Family Man With Good Credit Score Reveals What The Only House Available In His Budget Range Looks Like, And The Internet Is Horrified

InterviewEveryone has something that motivates them to strive for greatness at work. We want to have a positive impact on the world while also providing stability for our loved ones. One common goal that people have is wanting to own property. After all, who doesn’t want a quality home for their spouse and kids, a quiet corner of the world to truly call your own?

However, it can be disheartening to realize that all of your effort at work, your endless saving, struggles, and sacrifices might not be enough for you to afford to buy your dream home in the United States. That’s the frustration that one family man with good credit, TikToker @averagejoegam3, shared in a video that has gone massively viral. He revealed what the house within his budget looks like and shocked the internet. Scroll down to watch the full video.

Bored Panda reached out to @averagejoegam3, and he was kind enough to answer a few of our questions. “Sometimes, it gives me anxiety when I think about how many people my video has reached. I never thought it would get this many views and I almost didn’t post it!” he opened up to us, adding that the last thing he wanted to do was to discourage people. “Now more than ever, we have to focus on the things that make us the happiest. Family, friends, hobbies, and passions.” Read on for the full interview.

This TikToker’s rant went viral after he shared his honest feelings about the housing market

Image credits: averagejoegam3

“I am going to show you exactly why the younger generations are quiet-quitting”

“Saying careers are dead, nobody wants to work anymore. All that s**t that you hear, I’m going to show you exactly why that’s happening. My wife and I have been together for seven years. And in those seven years, we came up the old fashioned way. We have two kids. We really struggled for a long time. And we, just now, after seven years of struggling and sacrificing, got to a point where we’re no longer paycheck to paycheck. She finished school, I worked my way up at my job, where we make $120,000 a year in combined household income.”

Image credits: Patricia Prudente (not the actual photo)

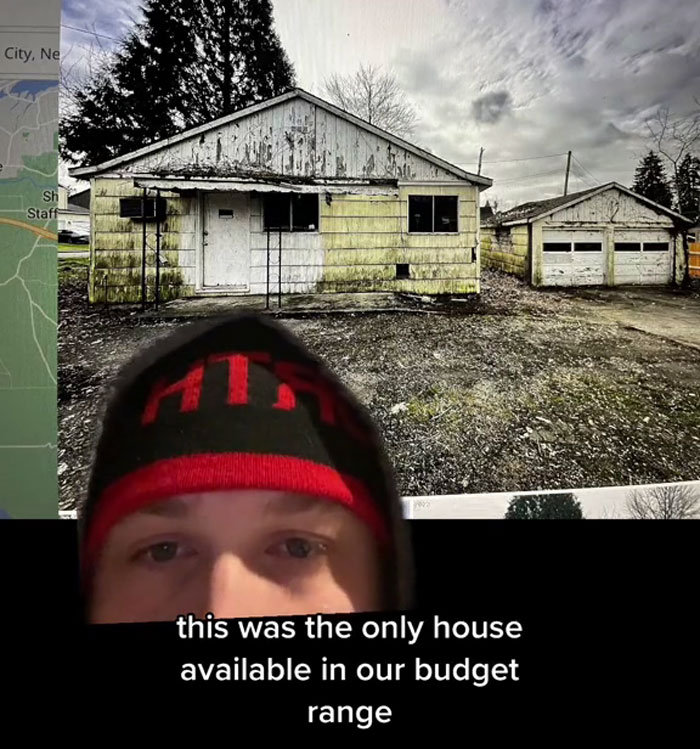

The man revealed what an affordable house looks like in his area

“And in two years, we financed and budgeted things out, we can probably save around $40,000 for a downpayment for a house. After seven years of struggling and working our a***s off, we built ourselves up in this country to buy a house. Let me show you what $120,000 a year, $40,000 downpayment, with good credit gets you. This was the only house available in our budget range, in our location where we live. There was one house for sale and it was this one right here.”

Image credits: averagejoegam3

He was frustrated by how unfair the situation is for the younger generation

“This is what we can afford with $120,000 combined income and a $40,000 downpayment with good credit. Our cars are paid off, we sacrificed, we worked hard. We worked our way up in this country to get to a point where we’re no longer paycheck to paycheck and we can save money. This is what we can get. Everybody that is in the older generations saying, ‘Oh, I guess you better go to college and do your best. Guess you better go get a degree, find a trade, something that makes you more valuable to community,’ was it always like that? Is that how it always was?”

Image credits: Alexander Mils (not the actual photo)

“Did you have to be a doctor, a lawyer, an architect, an engineer to get a livable house with a very substantial income? My mom worked at Michaels. My dad was a pressman in a printing company. They both bought a house which nowadays is probably $600,000. At the age of 23, my mom worked just over minimum wage at Michaels, and my dad worked for a little bit more than that in a printing company. This is what’s going on.”

You can watch the video in full right over here

@averagejoegam3 This has to change. #quietquitting #inflation #truth #millennial #genz #boomer #genx #debate #housingmarket #greenscreen ♬ original sound – Average Joe

The message resonated with a ton of people around the internet

Image credits: Vojtech Okenka (not the actual photo)

TikToker @averagejoegam3 told Bored Panda that he’s glad that his video reached so many people around the world. “My story is just one of millions of other families and people in the same position,” he said.

“It resonates with so many people because there’s so many honest, hardworking adults just doing their best to provide for themselves and everyone around them.”

According to the video creator, there are various reasons why buying a house has become unaffordable for many young professionals.

“The one [reason] that bothers me the most is investment companies buying up single-family homes and using them for Airbnbs or just renting them out permanently. Which at some point should be illegal,” he shared his thoughts.

There are no easy fixes to the current situation, and @averagejoegam3 doesn’t have any instant solutions to the problem either. However, he pointed out that starting to have real conversations about the housing market and asking questions “is a good place to start.”

“Eventually, younger generations are going to start holding political office and I have high hopes for big changes in our future.”

Despite everything, @averagejoegam3 remains optimistic about the future and hopes that others will, too.

“For everyone that watched my video and got discouraged, or lost hope, or it negatively impacted them or their motivation, please don’t let your happiness or success be judged by what you can buy. Yes, it is frustrating. But the last thing I wanted was to discourage people or make people feel depressed. Now, more than ever, we have to focus on the things that make us the happiest. Family, friends, hobbies, and passions.”

Buying a house really has become more expensive than in the past

Image credits: Towfiqu barbhuiya (not the actual photo)

TikToker @averagejoegam3’s video made a huge splash online. It was viewed a jaw-dropping 4.6 million times on the video-sharing platform. Meanwhile, it caused such a buzz that other internet users started posting it elsewhere online. One person who reshared the video on Reddit got over 53k upvotes.

The TikTok really resonated with a lot of people who feel powerless and as though they’re not in charge of their destinies. One common thorn in gen Z and millennials’ sides is talking about housing with members of the older generations who have the idea that having a run-of-the-mill job and saving a bit of money every single month is enough to afford a decent, livable home.

Stereotypically, this is expressed as something along the lines of, ‘Well, maybe if you ate less avocado toast and drank less coffee, you could save enough money to buy a house.’ We’re all for good saving habits and being less reliant on caffeine, but these are small potatoes compared to how inflated property prices have become.

According to the Federal Reserve Bank of St. Louis, the average sales price of houses sold in the United States was $535,800 in the final quarter of 2022. The average price peaked in the third quarter of 2022 at $547,800. Just a few years ago, in Q2 of 2020, the average was $374,500. Now compare that to Q4 of 2011 when the price stood at 259,700.

There was another peak right before the great economic crash ($322,100 at the start of 2007), but otherwise, the costs of houses are far lower the further you go back in time. An average home went for around $210,000 in 2001. You could nab a house for around $150,000 in 1991. While in 1981, buying a house would cost you around $84,000. What this means, essentially, is that property prices have been rising rather disproportionally. In short, you need to save more to buy an average home that your parents and grandparents could afford far more easily in their time. That’s awesome for them! But pretty bad for those of us who don’t own property yet.

The market might be correcting for the better, but it’s too soon to tell

Image credits: Karolina Grabowska (not the actual photo)

However, there are some signs that the housing market might potentially be cooling (ever so slightly). CNN reports that rising interest rates “slowed the frenzied sales activity.” However, home prices are still at a record high. The median price for which a home sold in 2022 was $386,000 according to the National Association of Realtors. That represented a 10.2% increase from the median in 2021. However, home sales last year have dropped by 17.8% compared to 2021. In this case, the term ‘homes’ refers not just to houses but also to townhomes, condos, and co-ops.

Meanwhile, Statista reports that, actually, the homeownership rate in the US rose a bit in 2022. “In 2022, the proportion of households which are occupied by owners stood at 65.9 percent. The U.S. homeownership rate was the highest in 2004 before the 2007-2009 recession hit and decimated the housing market. The rate continued to fall until 2016, but has begun to increase again since then.”

This means that more and more Americans have become homeowners since 2016. In short, things aren’t completely black-and-white for absolutely everyone in the US. More and more millennials who are currently renting are planning to buy homes in the near future.

Planning and actually buying, however, are two entirely different things. Investopedia notes that millennials aren’t buying homes as readily as previous generations. Many millennials are delaying getting married and having kids. Instead, some of them choose to live at home with their parents, as they shoulder huge student debts and can’t save up for down payments.

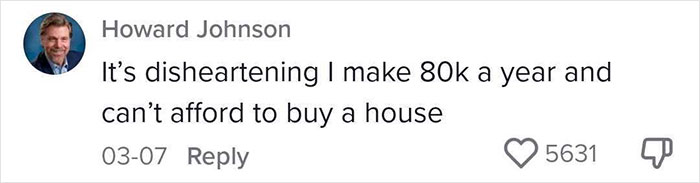

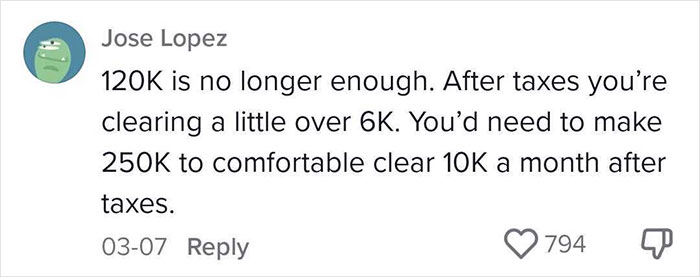

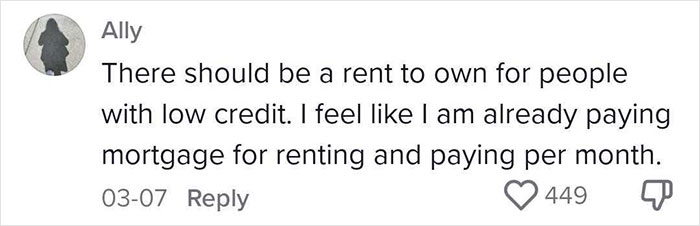

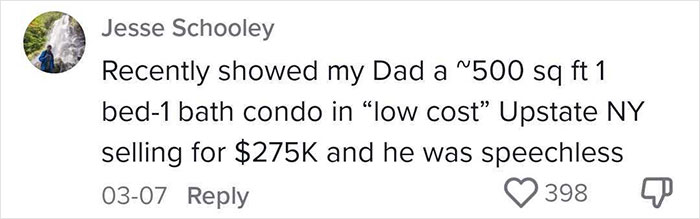

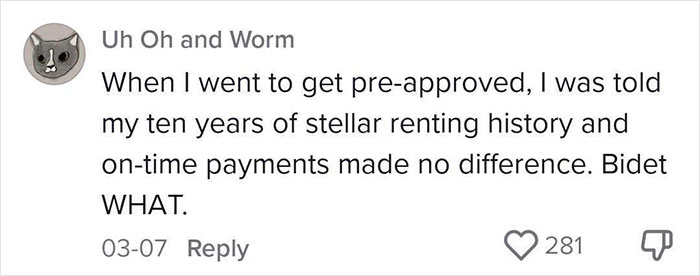

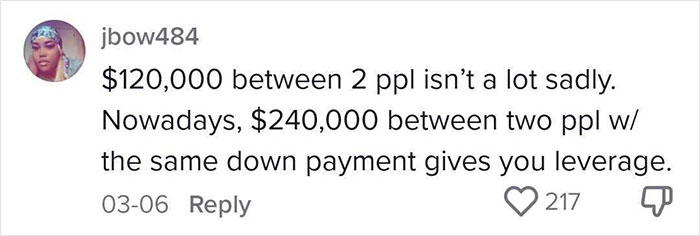

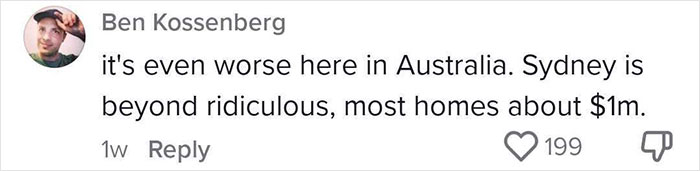

Here’s how people reacted to the candid TikTok

Man, if only I could quit eating avocado toast, I'd be able to afford a house :(

Everything he says is true. I'm a boomer and part time Realtor in Greater Boston and I can't imagine buying a place now. I was able to buy something 25 years ago and that is the only way that I can own today. We even sold and moved to a cheaper town because property taxes are out of control. And some people think that owning a condo might be a better alternative, but HOA fees are astronomical now as well.... $500-1200/month depending upon the cost and amenities. It's not sustainable.

How much are short term rentals hurting the housing market? I just bought a tiny house for $400K. And it seems to me that I was competing with a lot of people who owned multiple properties. Many of the folks buying were paying $500K cash and site unseen. Many of them were out of state. Are they flippers? Or is this AirBnB? What's driving the prices so high? I know interest rates were insanely low, but honestly I'd rather buy low with a higher rate, then do what I did. You can always refinance when the rates go down.

Load More Replies...There was no college education amount my mom's seven siblings. Yet they bought a modest house. They all did it with a partner but most had a stay at home mom, in the kids early year. (Yeah, remember when one income could do it) My heart breaks for the people like this.

Found out about this amazing hacker that helped increase my credit score. I wanted buying a new home but my credit scores weren't good enough but guess I was finally able to purchase my home after this dude helped me. He raised my score to 780 and deleted all negative item off my credit report, it worked like magic. You can reach him on Remedyhacker1 @ gmail. com just wanted to share incase anyone needs this service too because he really helped me a lot.

The housing market really has gone insane tge last couple of years. My husband and I were able to buy a house in 2008 for $265,000. We spent the next decade lamenting how we way overpaid, as we watched tge housing market continue to drop and then fluctuate up and down. As well as slowing realizing that our house, which was built at the height of the early '00s housing boom, was built with every cheap short cut imaginable. It wasn't until 2020 that our house was valued at $300,000. Then the pandemic hit, our boring little town suddenly became a hot real-estate market. Our house is now supposedly worth over $450,000. Meanwhile I've received a 3% raise at my job in the last 5 years. There is no way we'd be able to afford our house now as 1st time homebuyers.

I told my parents recently that a studio in a new-build apartment building in mt town costs $2000/month. They were visibly shocked. And in the very next breath they were doubling down on how "kids these days" live with their parents and don't want to work. Like... my college-edicated, fully-employed single friends rent single bedrooms, not full apartments. I

Man, that has to be one of the nicest houses I've ever seen. Sure, it needs a scrape and a paint job, but look past first looks. It's a cottage, likely two or three bedrooms, has a yard with two trees, needs sod, has a full driveway with a detached two car garage. The yard looks to be at least a quarter acre. That's huge by todays standards. Here in Salt Lake City the lot itself would easily go for $300,000. With the house and garage it would be around $500,000. With a 30 year mortgage that's only $16,000 a year. Plus $4000 interest.

It has potential... But if the exterior hasn't been kept up, it's less likely that the rest of the maintenance is up to date. It would seem that the previous owners didn't care for it and it will need a lot of renovation. A fixer upper is one thing, but a house with major foundation, plumbing, and electric problems is even more expensive and difficult to get up to code.

Load More Replies...Yeah... that's what's going on in my world. Husband and I NEED a house - rent has gone up enough I won't be able to afford another year at this stupid apartment. I don't make as much as this guy and my husband isn't working now due to medical reasons. My credit score is over 800. There are houses, but most have been dumps. The ones that are okay get snatched up before we can react. I refuse to forgo an inspection, and apparently everybody else has cash to throw at these homes, inspection-free. I truly despise investors.

The people with "cash to throw at these homes" are likely banks reselling the homes for a quick profit.

Load More Replies...Yes, everything is bloated right now but the math here still doesn't add up. With good credit and low debt they'd get a better loan and first time buyer incentives. Its never been easy or guaranteed. For most, living with parents or years of roommates, renting, commuting and budgets are the only way to a home investment.

My father bought a 4 bedroom house at 25, four years out of college, for three times a professional salary. My brother bought a one bedroom flat for four times his professional salary at the same age. My nephew, with the benefit of an inheritance, has just bought a one room studio for EIGHT times his professional salary with a 50% down payment.

Curious where this was (did I miss that?) and what his budget was (did I miss that also). Sadly that house wasn't likely on the market to be bought and lived in but, rather, to be bought and torn down and a McMansion shoehorned into it. There is no financial incentive in the US for builders to make smaller home, just to maximize profit. Much of the US's housing stock was post WW2 GI Bill Capes built with an incentive from the government to provide affordable housing for veterans. As each one of these homes gets torn down and replace with a huge one. the class disparity widens.

Even if you went for it, you’d have to spend another $250,000 - $300,000 to either renovate it or better yet, tear it down and build new. Whoever listed this broken down shack for an outrageous price sure has some gall. I would be ashamed to ask more than what the land alone is worth—-and we don’t even know what the neighborhood is like since it looks like a f*****g crack house—-because that house is uninhabitable and not worth a dime.

If you look to the left side of the house you can see the neighbors’ house is quite nice. And without going in I can’t tell what condition the house is in other than dirty and needing a power wash and a paint job. I know the housing market is high but I was told location was a huge part of the price so my very small first house was quite a distance from where I really wanted to live. Over time I moved to slightly bigger housing nearer where I wanted to live. It took me 30 years to live in my dream home in the location I wanted. :)

Load More Replies...I live in Poland, in Cracow. I'm making twice more than average, still I can only dream about renting or buying a house. I'm currently paying half of my payroll to live in 30sq m flat, quite far from city center.... And I'm f****** depressed about the reality

I was really lucky to "buy" apartment 5 years ago for 6000/m2. This year my friend paid 11000/m2. We didn't loved the apartment and idea of paying for ot for 30 yeara but it was cheep even for 5ya and I told my husband that we need to get it or in a few years we wont be able to live in Kraków. Unfortunately (for all people buying now) I was right.

Load More Replies...I just bought my house this past fall. I have a 4 br/2story double lot with a barn on it. I live in a small town in Ohio and am retired. My house was built in 1900 and is in great shape for being so old. (It's been well taken care of) I paid $72,000 for it which is not to bad. So there are places where a home can be purchased for a decent price but you have to look outside of the big cities and highly populated areas. In central Ohio, say Columbus, Cincinatti or Cleveland this same house would cost minimum $100,000 and probably closer to $150,000.

If you're raising kids and need decent childcare, you need to stay near family and friends. Most people can't afford to move that far away from their 'village ' . I know when our teens were small daycare cost more than a mortgage and if we ever wanted to retire or help kids pay for college we both needed to work. You're unrealistic.

Load More Replies...A lot of it depends on where you choose to live and work. We (62M, 60F) left a $ 2,600-a-month, 1-bed apartment in a Los Angeles suburb in December 2019. We could not touch a house like the one in the photo above anywhere in the county for less than $700k. In Feb 2020, we bought a new construction home in Brevard County (Space Coast, NASA, etc) Florida for $247k. If I could pick this house up and put it anywhere in SoCal it would be worth north of 1.4 Million. Do you know what else? Wages here are only about 30% lower. The timing was everything for us because the same model home 3/2/2 1756 sq ft on a 1/4 acre are now selling for $350k in 2023. We will never be able to sell because our mortgage rate is only 2.6% and could not afford to buy the same house at today's interest rates anyplace else. Everyone else that got 3% or under interest rate is in the exact same boat, and that is a major reason for the current housing shortage. Wages are the problem.

They are the problem because in 2000 I was earning $24 per hour at my trade job. That same job 23 years later only tops out at about $30 to $40 per hour, depending on where you are in the country. If wages had kept pace with inflation, ALL wages would be at least 250% higher than in 2000. The federal min wage has not been raised since 2008 and still sits at $7.25 if it had kept pace with inflation it should be at $15 today.

Load More Replies...I wish people would stop blaming the boomers for everything that has gone wrong. The only place the blame can be placed is the government. THEY are the ones who are wildly overspending the people's money and they control the dollar supply and the interest rates. They, and they alone, are in control of the money. Many boomers are struggling too, especially the ones who have now retired. Their retirement funds, which, a couple of decades ago, would have seen them live comfortably, are now barely giving them a living because of inflation. Blame your government for the state of the nation - not the people who have worked hard all their lives, same as you.

You are quite correct. Unfortunately, like the cost of housing, the "blame game" has spiraled out of control on this website. Very sad.

Load More Replies...Couple of things from the comments: 1, rent to own does exists in parts of the southwest. You sign a 'lease' agreement that you payments go to owning the property after so many years. Payments are higher than normal rent, but not by a huge amount. If you leave, the money is forfeited. 2, van life is not what sexy man-bun/bikini girl make it look like on their instagram. It's actually quite expensive-on par with an apartment. Things you have to think about like buying food every day and single serve items- usually more expensive- because you can't store it, charging electronics, washing clothes, showering and getting water, upkeep on the van and gas... the costs offset the lack of rent. You can't always find a parking lot to sleep in so you're stuck paying for campgrounds or you can try and get lucky parking at a hotel or something. The cost of the van itself is almost 50-60K, even if you do the work you. Plus, living in a van costs a whole lot more in insurance.

I'm a boomer and I agree that too many boomers are completely out of touch. In the mid-70s I made $15,000/year and my husband made $30,000. We were able to buy a 2/2 home in a nice, quiet neighborhood in San Antonio. The house was $25,000. Even adjusted for inflation, those two salaries would not be a able to buy that same house. I looked it up. A 3/1 on that same street is $215,000. Salary growth has nowhere near kept up with inflation. Gas in 1976 was .17/gallon. A huge paper bag of groceries was $10. My health insurance was free to me -- paid 100% by my company. None of that is true anymore

I love the generalization that all people my age think younger people need to buck up, stop being lazy, save, etc., and they should be able to buy a house like people my age did. That's ludicrous! I couldn't afford to buy a home in the county and or town I grew up in now, or any place around it, because housing is so out of sight. The teachers and cops who work there wouldn't think of buying a home unless they're married to someone who makes 6 figures, and then it's a townhouse or condo at best. They live in the surrounding counties or state, and even those areas are becoming too expensive. When I was young, that county was mostly middle class people, and the town I grew up in had more minority home ownership than any other place in the county. When they tried to build affordable homes a few years ago at the site of an old motel, the residents next to it put up such a stink the project was stopped because it would bring down their property values. The place I knew is dead.

It's funny (not really) because when the housing crisis happened, so many people were angry about how many people were buying homes they couldn't afford. So many people were getting foreclosed upon because their payments went from 1K to 4K overnight. And so many rich people were like 'that's what you get for buying a 300k home you know you couldn't afford.' Meanwhile, now they get angry at us for NOT buying homes or having kids because we can't afford them -and we're told we're hurting the fabric of America and we're all just lazy. It's like you can't win. More and more people are getting into trades after years of being lambasted for going to college and not being able to get a good job afterward, and now you're starting to hear people complain about that, too. Saying we're flooding the job market making it harder to get those jobs. Yeah, same thing happened to us after college. Welcome to our world.

I'm all for a nice, high, well-enforced minimum wage. But it was never enough to live well on. Relative to inflation, the highest it ever was, at $1.60/hr, was $12.40/hr in 2023 money. That enough to keep you off of the bread lines and lying in the streets and instead eating boiled rice and beans for dinner living in a youth group home.

Y'all shouldn't be downvoting Full Name. He's correct... through the first part, anyway. It's not ALL true that say, doubling the minimum wage would mean that the prices of a hamburger would double. Maybe up 10%? The reason we need a minimum wage is because without one, taxpayers are subsidizing businesses which don't pay a living wage; they find people willing to work those wages, because for some people, the amount of slack government picks up is fine. Business owners think they're being failed by society when they don't find people to work minimum wage, so they demand we import cheap laborers who will. And of course, that government-funded slack is not available to married people, and pretty much anyone else the government decides to disfavor.

Load More Replies...Even renting an apartment is getting too expensive. Forget buying a house. My husband and I both have good jobs in a fairly low cost of living area, and our rent is insane. It keeps going up, too, yet the quality of our living space isn't improving to make up for it. We aren't happy, but can't afford to move.

BP filled with whiners complaining about this, yet 95% of you fools vote Democrat.

Housing prices have nothing to do with "Boomers" though. It's corporations buying up the cheaper houses and putting them on the market for double the price. Also, those "flipper" shows... buy it for rock bottom, do a crappy renovation job, and put it on the market for 4x what it's worth.

It's not just houses. It's EVERYTHING. My husband and I are looking for a new car, as our old one finally gave up the ghost. He is on disability. I do work. But together we only make a little over $28,000 a year. Fortunately, our insurance covered our own car, and gave us a good amount. But the only car we can find, that fits us, that we really like and is good shape without a rebuilt title, is over $11,000. And that's for a 6 year old car. A house? Fugghettaboutit. The only reason we're surviving is because we lucked into our trailer at the right time. It's tiny, but it's all we need. It's home. It scares me to live here, when it storms. But our rent here is super cheap. Like, we couldn't even afford an apartment, on our income. It terrifies me to think of ever having to move out. And groceries are through the roof, too. It's like they're actively TRYING to keep peoole down, isn't it?

We (I) looked at some absolute dumps in and around the Springfield/Eugene, OR area. I'm talking DUMPS - one that looked a lot like the picture above. We finally found a decent condo, which I really didn't want because of the HOA fees, but it was literally the only thing we could afford that didn't make me want to hurl. It was listed at $275K, but there were no other condos in the area for comparison and FHA would only finance $240k, so we ended up paying almost $14k in closing costs instead of the $5k we were expecting. This is the first time either of us have bought a home. We're in our 60's.

OK, I know the market is crazy. But my son, 25, in the Army, just bought a $230k house, with 10% down. Sure it is in Kansas, but it is still a $230k house. And trust me in the army with his wife working they don't make anywhere close to a $100k a year.

Right after buying my house in 2010 (3 bed 1 bath 100+yo for $70k!) both my husband and I lost our jobs. Thank god for unemployment! Our house payment was first paid, then car insurance, then car payment. After that we did what we could. Eventually had creditors calling us. They all said I should sell my house and rent instead. I said if they could find me someplace less than my $500 mortgage that I would gladly do so. All replied with shock. When you get approved for a $250k mortgage you don't have to buy a $250k house.

Move, many places have artificially elevated housing costs. I live in a rural area, you could buy a house here for that 40 thousand. I have seen it happen. Not nice,...would need fixed up, but you could buy one.

Did it say where that house was? Did it say what the selling price was? I call b******t.

Im a boomer. I bought my house 15 years ago, with a down payment if 15K. At the time I was working in retail with good pay and a great credit score. I will never go back to Apt living. ,,, Cost is astronomical ! Also would never buy another house these days. The housing market is ridiculous! Just so glad that I got my house before all the bad stuff went down.

Location is clearly the issue here. Many might not know this but a mortgage company will typically lend 3x salary for a 30 year loan. With a FHA loan you only need a 3% down payment + closing costs. In my area plenty of homes available for less then 200k and I live in the richest County in Michigan. I personally would suggest to hold off if you can and see how the interest rates and housing market plays out. But if your currently renting look into FHA. Create equity for yourself not someone else.

This isn't caused by boomers. We bought our houses and are still in them. How is this boomers' fault?

The actual issue is that wages have not kept up with the cost of living. We're regularly discussing billionaires where we used to discuss millionaires. That is a 1000% difference. Minimum wage is unchanged. The part that shocks and annoys me is how many people who will never be billionaires loudly defend this system of resource management.

Work three jobs to barely afford an apartment/house/condo that you can never come home to. How far America has fallen.

Housing prices are criminal these days. An average middle class 2 story home can go for over $1 mill. What? As far as I’m concerned that’s legal theft. My nephew and his wife are looking for their first house. Daughter due to be born this summer. She’s a Nurse Practitioner and he works in refrigerator repair and he makes very good money. They’ve saved like crazy. Very responsible with money. They’re getting nowhere. They keep losing out to people having sold their houses and now have lots of money to put in large offers. I don’t know what the answer is, but young people and young families see no hope of homeownership. It’s horrible. And then the banks also won’t approve a monthly mortgage payment that is LESS than your rent. WHAT?

My spouse and I both work two full time, well paying jobs, just to be COMFORTABLE…meaning not living paycheck to paycheck. If one of us loses one of our jobs, it’ll be paycheck to paycheck. Thank goodness for remote jobs, so we’re about to stack them.

I'd love to know where that is. Is it a VHCOL city? I bet it is, especially with him saying his parents' house is worth 600k now. You move to where you can afford to live, not where you *want* to live. I live within an hour of NYC and have gorgeous lake views from my living room windows and watch the sun rise over the lake with my coffee every morning. I haven't had to lock my car doors in 20 years. This person could very easily afford my house with their salary and have lots left over to save/invest. Could I or they afford the same house in the heart of NYC, Seattle, Toronto or Silicon Valley? Of course not. Not saying the housing market doesn't suck rn, but there are affordable and nice places to live. This guy's parents just happened to buy in an area that became HCOL over time, which he'll benefit from eventually anyway.

I feel for everyone in this situation. And I feel like I just missed this hardship by the skin of my teeth! Back in 2005 I'd just graduated college, 2 degrees, making like $40-$50k a year to start. I made raises quickly and was up near $80k-$90k in just a few years. But back in 2005, My dad (a very poor, often homeless native American boy who worked very hard to grow up to run his own construction business and invest in a few rental properties), knew my future might hinge in buying then, just a few tears before the bubble and eventual housing crash. He planned ingeniously, to help me buy a small one bedroom condo in Seattle ($240k at the tine, but overlooking the lake and city, gorgeous views). His plan was he'd put down $70k he'd saved for another rental property, I'd pay the monthly mortgage (just $1,500 at the time), and whenever I sold, we'd split the equity, and id pay back his $70k down payment. When he passed away, he absolved me of any debt, saying keep it for your next place.

Continued: I was married and had 1 chikd by then, still in that 1 bed condo. When my 2nd child came along, it was time to move. With the housing market on fire, we sold for almost double what we paid, about $430, and put the equity down on our next place, a 4 bed 4 bath 3 story home farther from the city, for just $530. It was new construction no previous owners. Flash forward Just 2 years later, and our place was valued at $990k, just under a million! While the markets cooled, and its mire like high $800s now, the point is, had we waited, not had help from my dad, not bought before the bubble, or not chosen properties that doubled in value wach time, I would never have been able to afford the house I have now. I never could even afford to re-purchase the 1 bed condo I sold, as it's at around $600k now. It's insanity. I feel like we made it into a market that most people I know could never. Our neighbors are doctors and lawyers (we're in construction), we really lucked out. It's sad!

Load More Replies...My wife and I keep looking to try to move closer to her family, but there's just no way. Anything we find is like this and all gutted out inside so you're looking to spend a lot more than the asking price of the house. We're very much just stuck here for now. So many things would be easier if we had family nearby but sadly, it just can't happen.

It's really becoming time for a revolution over here. I say eat the rich! On a positive note, I'm pleasantly surprised that there's no dumb spam bot comments on making $12000/mo or whatever on this one!

My parents (Silent Gen/Boomer cusp) had an 8-room Colonial custom-built in 1974. It cost them $40,000. In 1997, I (GenX) bought a 5-room dilapidated ranch that hadn't been updated since it was built 40 years earlier. It cost me $99,000, and I could barely afford it after 6 months of working 12-16 hour days, 6-7 days a week AND it was the peak of the buyer's market. I'm just now able to afford an equity loan to update the house so my daughter (Millennial) will have a home. Oh, and as is, my house is worth nearly 3 times what I paid.

Asking this because I want to learn: how much of this is expectations? For example, I grew up in a poor household. My father worked 2 jobs for 10 years just to get the down payment for a house. I saw him at dinner for an hour each day. Parents went out to eat once a year for anniversary. Every penny was saved. As a result I did not expect to have a home, two cars and eating out twice a week. My point is have we been sold on an image of what our lives should be but not the reality of what it used to take to get it?

I'm middle age, but I DEFINITELY think housing is out of control!! I live outside Nashville and if you want to live in just a decent area with a 2000 sq ft home, it will absolutely be no less than 400k. The town I *want* to live in, there isn't anything available under 700k. My two daughters are 20 and 23, and I'm so angry that it is so difficult for them (and everyone in this age group) to just get by. That's why either adult kids have to stay WITH their parents or move away to a city where they can *hopefully* afford something. But then they don't have a close family support system. Then they end up having kids and grandparents can't even help out, because grandparents can't just quit their jobs to move close to their kids!

When my father bought a house back in 1977, it was around $140k in our neighborhood. Over the years, it's had plumbing issues, wood rot and not to mention the look becoming hugely outdated. The deck on the back was falling apart and the garage had a rat infestation due to the neighbors burning trash in their backyard. But when the house went on the market in 2020, the first day of being available, we had 32 bids, with the highest cash bid being 35-40% over the asking price. We were floored. No way we could afford it today.

Where I live in the Midwest, between myself and my husband, we don't even make half of what OP does. And yes, we currently own a house. But because people from the coasts (East or West) where houses are A LOT more expensive are moving here, I can't afford to move into a smaller house or a decent apartment (for a lower mortgage/rent than what I'm paying now) because these people are causing our local housing/rental market to put listing prices at $250K for a 2 bedroom, 1 1/2 bathroom house or apartment ($1,200/month minimum without pet fees). I can't afford that. So, forgive me if I have no sympathy for OP, since I am in my 50's and have worse problems than his family.

I was considering buying a studio flat in London in 2010. I liked it and it was good area. It cost £ 97k. I did not get mortgage as a single person even though mortgage was lower than rent. I later met my husband and moved in with him, otherwise I would be stuck renting forever and probably have to go back to houseshare. That studio flat was for sale again 3 years ago for £ 275k.

I have a decent full time job, but I will literally never be able to afford to buy a house.

According to the article, average USA house price is 0,5m USD. That's about ZAR10m here. Here's what ZAR 10m gets you: a mansion. https://www.property24.com/articles/high-end-buyers-snapping-up-sas-luxury-properties-at-bargain-prices/30303

Man, if only I could quit eating avocado toast, I'd be able to afford a house :(

Everything he says is true. I'm a boomer and part time Realtor in Greater Boston and I can't imagine buying a place now. I was able to buy something 25 years ago and that is the only way that I can own today. We even sold and moved to a cheaper town because property taxes are out of control. And some people think that owning a condo might be a better alternative, but HOA fees are astronomical now as well.... $500-1200/month depending upon the cost and amenities. It's not sustainable.

How much are short term rentals hurting the housing market? I just bought a tiny house for $400K. And it seems to me that I was competing with a lot of people who owned multiple properties. Many of the folks buying were paying $500K cash and site unseen. Many of them were out of state. Are they flippers? Or is this AirBnB? What's driving the prices so high? I know interest rates were insanely low, but honestly I'd rather buy low with a higher rate, then do what I did. You can always refinance when the rates go down.

Load More Replies...There was no college education amount my mom's seven siblings. Yet they bought a modest house. They all did it with a partner but most had a stay at home mom, in the kids early year. (Yeah, remember when one income could do it) My heart breaks for the people like this.

Found out about this amazing hacker that helped increase my credit score. I wanted buying a new home but my credit scores weren't good enough but guess I was finally able to purchase my home after this dude helped me. He raised my score to 780 and deleted all negative item off my credit report, it worked like magic. You can reach him on Remedyhacker1 @ gmail. com just wanted to share incase anyone needs this service too because he really helped me a lot.

The housing market really has gone insane tge last couple of years. My husband and I were able to buy a house in 2008 for $265,000. We spent the next decade lamenting how we way overpaid, as we watched tge housing market continue to drop and then fluctuate up and down. As well as slowing realizing that our house, which was built at the height of the early '00s housing boom, was built with every cheap short cut imaginable. It wasn't until 2020 that our house was valued at $300,000. Then the pandemic hit, our boring little town suddenly became a hot real-estate market. Our house is now supposedly worth over $450,000. Meanwhile I've received a 3% raise at my job in the last 5 years. There is no way we'd be able to afford our house now as 1st time homebuyers.

I told my parents recently that a studio in a new-build apartment building in mt town costs $2000/month. They were visibly shocked. And in the very next breath they were doubling down on how "kids these days" live with their parents and don't want to work. Like... my college-edicated, fully-employed single friends rent single bedrooms, not full apartments. I

Man, that has to be one of the nicest houses I've ever seen. Sure, it needs a scrape and a paint job, but look past first looks. It's a cottage, likely two or three bedrooms, has a yard with two trees, needs sod, has a full driveway with a detached two car garage. The yard looks to be at least a quarter acre. That's huge by todays standards. Here in Salt Lake City the lot itself would easily go for $300,000. With the house and garage it would be around $500,000. With a 30 year mortgage that's only $16,000 a year. Plus $4000 interest.

It has potential... But if the exterior hasn't been kept up, it's less likely that the rest of the maintenance is up to date. It would seem that the previous owners didn't care for it and it will need a lot of renovation. A fixer upper is one thing, but a house with major foundation, plumbing, and electric problems is even more expensive and difficult to get up to code.

Load More Replies...Yeah... that's what's going on in my world. Husband and I NEED a house - rent has gone up enough I won't be able to afford another year at this stupid apartment. I don't make as much as this guy and my husband isn't working now due to medical reasons. My credit score is over 800. There are houses, but most have been dumps. The ones that are okay get snatched up before we can react. I refuse to forgo an inspection, and apparently everybody else has cash to throw at these homes, inspection-free. I truly despise investors.

The people with "cash to throw at these homes" are likely banks reselling the homes for a quick profit.

Load More Replies...Yes, everything is bloated right now but the math here still doesn't add up. With good credit and low debt they'd get a better loan and first time buyer incentives. Its never been easy or guaranteed. For most, living with parents or years of roommates, renting, commuting and budgets are the only way to a home investment.

My father bought a 4 bedroom house at 25, four years out of college, for three times a professional salary. My brother bought a one bedroom flat for four times his professional salary at the same age. My nephew, with the benefit of an inheritance, has just bought a one room studio for EIGHT times his professional salary with a 50% down payment.

Curious where this was (did I miss that?) and what his budget was (did I miss that also). Sadly that house wasn't likely on the market to be bought and lived in but, rather, to be bought and torn down and a McMansion shoehorned into it. There is no financial incentive in the US for builders to make smaller home, just to maximize profit. Much of the US's housing stock was post WW2 GI Bill Capes built with an incentive from the government to provide affordable housing for veterans. As each one of these homes gets torn down and replace with a huge one. the class disparity widens.

Even if you went for it, you’d have to spend another $250,000 - $300,000 to either renovate it or better yet, tear it down and build new. Whoever listed this broken down shack for an outrageous price sure has some gall. I would be ashamed to ask more than what the land alone is worth—-and we don’t even know what the neighborhood is like since it looks like a f*****g crack house—-because that house is uninhabitable and not worth a dime.

If you look to the left side of the house you can see the neighbors’ house is quite nice. And without going in I can’t tell what condition the house is in other than dirty and needing a power wash and a paint job. I know the housing market is high but I was told location was a huge part of the price so my very small first house was quite a distance from where I really wanted to live. Over time I moved to slightly bigger housing nearer where I wanted to live. It took me 30 years to live in my dream home in the location I wanted. :)

Load More Replies...I live in Poland, in Cracow. I'm making twice more than average, still I can only dream about renting or buying a house. I'm currently paying half of my payroll to live in 30sq m flat, quite far from city center.... And I'm f****** depressed about the reality

I was really lucky to "buy" apartment 5 years ago for 6000/m2. This year my friend paid 11000/m2. We didn't loved the apartment and idea of paying for ot for 30 yeara but it was cheep even for 5ya and I told my husband that we need to get it or in a few years we wont be able to live in Kraków. Unfortunately (for all people buying now) I was right.

Load More Replies...I just bought my house this past fall. I have a 4 br/2story double lot with a barn on it. I live in a small town in Ohio and am retired. My house was built in 1900 and is in great shape for being so old. (It's been well taken care of) I paid $72,000 for it which is not to bad. So there are places where a home can be purchased for a decent price but you have to look outside of the big cities and highly populated areas. In central Ohio, say Columbus, Cincinatti or Cleveland this same house would cost minimum $100,000 and probably closer to $150,000.

If you're raising kids and need decent childcare, you need to stay near family and friends. Most people can't afford to move that far away from their 'village ' . I know when our teens were small daycare cost more than a mortgage and if we ever wanted to retire or help kids pay for college we both needed to work. You're unrealistic.

Load More Replies...A lot of it depends on where you choose to live and work. We (62M, 60F) left a $ 2,600-a-month, 1-bed apartment in a Los Angeles suburb in December 2019. We could not touch a house like the one in the photo above anywhere in the county for less than $700k. In Feb 2020, we bought a new construction home in Brevard County (Space Coast, NASA, etc) Florida for $247k. If I could pick this house up and put it anywhere in SoCal it would be worth north of 1.4 Million. Do you know what else? Wages here are only about 30% lower. The timing was everything for us because the same model home 3/2/2 1756 sq ft on a 1/4 acre are now selling for $350k in 2023. We will never be able to sell because our mortgage rate is only 2.6% and could not afford to buy the same house at today's interest rates anyplace else. Everyone else that got 3% or under interest rate is in the exact same boat, and that is a major reason for the current housing shortage. Wages are the problem.

They are the problem because in 2000 I was earning $24 per hour at my trade job. That same job 23 years later only tops out at about $30 to $40 per hour, depending on where you are in the country. If wages had kept pace with inflation, ALL wages would be at least 250% higher than in 2000. The federal min wage has not been raised since 2008 and still sits at $7.25 if it had kept pace with inflation it should be at $15 today.

Load More Replies...I wish people would stop blaming the boomers for everything that has gone wrong. The only place the blame can be placed is the government. THEY are the ones who are wildly overspending the people's money and they control the dollar supply and the interest rates. They, and they alone, are in control of the money. Many boomers are struggling too, especially the ones who have now retired. Their retirement funds, which, a couple of decades ago, would have seen them live comfortably, are now barely giving them a living because of inflation. Blame your government for the state of the nation - not the people who have worked hard all their lives, same as you.

You are quite correct. Unfortunately, like the cost of housing, the "blame game" has spiraled out of control on this website. Very sad.

Load More Replies...Couple of things from the comments: 1, rent to own does exists in parts of the southwest. You sign a 'lease' agreement that you payments go to owning the property after so many years. Payments are higher than normal rent, but not by a huge amount. If you leave, the money is forfeited. 2, van life is not what sexy man-bun/bikini girl make it look like on their instagram. It's actually quite expensive-on par with an apartment. Things you have to think about like buying food every day and single serve items- usually more expensive- because you can't store it, charging electronics, washing clothes, showering and getting water, upkeep on the van and gas... the costs offset the lack of rent. You can't always find a parking lot to sleep in so you're stuck paying for campgrounds or you can try and get lucky parking at a hotel or something. The cost of the van itself is almost 50-60K, even if you do the work you. Plus, living in a van costs a whole lot more in insurance.

I'm a boomer and I agree that too many boomers are completely out of touch. In the mid-70s I made $15,000/year and my husband made $30,000. We were able to buy a 2/2 home in a nice, quiet neighborhood in San Antonio. The house was $25,000. Even adjusted for inflation, those two salaries would not be a able to buy that same house. I looked it up. A 3/1 on that same street is $215,000. Salary growth has nowhere near kept up with inflation. Gas in 1976 was .17/gallon. A huge paper bag of groceries was $10. My health insurance was free to me -- paid 100% by my company. None of that is true anymore

I love the generalization that all people my age think younger people need to buck up, stop being lazy, save, etc., and they should be able to buy a house like people my age did. That's ludicrous! I couldn't afford to buy a home in the county and or town I grew up in now, or any place around it, because housing is so out of sight. The teachers and cops who work there wouldn't think of buying a home unless they're married to someone who makes 6 figures, and then it's a townhouse or condo at best. They live in the surrounding counties or state, and even those areas are becoming too expensive. When I was young, that county was mostly middle class people, and the town I grew up in had more minority home ownership than any other place in the county. When they tried to build affordable homes a few years ago at the site of an old motel, the residents next to it put up such a stink the project was stopped because it would bring down their property values. The place I knew is dead.

It's funny (not really) because when the housing crisis happened, so many people were angry about how many people were buying homes they couldn't afford. So many people were getting foreclosed upon because their payments went from 1K to 4K overnight. And so many rich people were like 'that's what you get for buying a 300k home you know you couldn't afford.' Meanwhile, now they get angry at us for NOT buying homes or having kids because we can't afford them -and we're told we're hurting the fabric of America and we're all just lazy. It's like you can't win. More and more people are getting into trades after years of being lambasted for going to college and not being able to get a good job afterward, and now you're starting to hear people complain about that, too. Saying we're flooding the job market making it harder to get those jobs. Yeah, same thing happened to us after college. Welcome to our world.

I'm all for a nice, high, well-enforced minimum wage. But it was never enough to live well on. Relative to inflation, the highest it ever was, at $1.60/hr, was $12.40/hr in 2023 money. That enough to keep you off of the bread lines and lying in the streets and instead eating boiled rice and beans for dinner living in a youth group home.

Y'all shouldn't be downvoting Full Name. He's correct... through the first part, anyway. It's not ALL true that say, doubling the minimum wage would mean that the prices of a hamburger would double. Maybe up 10%? The reason we need a minimum wage is because without one, taxpayers are subsidizing businesses which don't pay a living wage; they find people willing to work those wages, because for some people, the amount of slack government picks up is fine. Business owners think they're being failed by society when they don't find people to work minimum wage, so they demand we import cheap laborers who will. And of course, that government-funded slack is not available to married people, and pretty much anyone else the government decides to disfavor.

Load More Replies...Even renting an apartment is getting too expensive. Forget buying a house. My husband and I both have good jobs in a fairly low cost of living area, and our rent is insane. It keeps going up, too, yet the quality of our living space isn't improving to make up for it. We aren't happy, but can't afford to move.

BP filled with whiners complaining about this, yet 95% of you fools vote Democrat.

Housing prices have nothing to do with "Boomers" though. It's corporations buying up the cheaper houses and putting them on the market for double the price. Also, those "flipper" shows... buy it for rock bottom, do a crappy renovation job, and put it on the market for 4x what it's worth.

It's not just houses. It's EVERYTHING. My husband and I are looking for a new car, as our old one finally gave up the ghost. He is on disability. I do work. But together we only make a little over $28,000 a year. Fortunately, our insurance covered our own car, and gave us a good amount. But the only car we can find, that fits us, that we really like and is good shape without a rebuilt title, is over $11,000. And that's for a 6 year old car. A house? Fugghettaboutit. The only reason we're surviving is because we lucked into our trailer at the right time. It's tiny, but it's all we need. It's home. It scares me to live here, when it storms. But our rent here is super cheap. Like, we couldn't even afford an apartment, on our income. It terrifies me to think of ever having to move out. And groceries are through the roof, too. It's like they're actively TRYING to keep peoole down, isn't it?

We (I) looked at some absolute dumps in and around the Springfield/Eugene, OR area. I'm talking DUMPS - one that looked a lot like the picture above. We finally found a decent condo, which I really didn't want because of the HOA fees, but it was literally the only thing we could afford that didn't make me want to hurl. It was listed at $275K, but there were no other condos in the area for comparison and FHA would only finance $240k, so we ended up paying almost $14k in closing costs instead of the $5k we were expecting. This is the first time either of us have bought a home. We're in our 60's.

OK, I know the market is crazy. But my son, 25, in the Army, just bought a $230k house, with 10% down. Sure it is in Kansas, but it is still a $230k house. And trust me in the army with his wife working they don't make anywhere close to a $100k a year.

Right after buying my house in 2010 (3 bed 1 bath 100+yo for $70k!) both my husband and I lost our jobs. Thank god for unemployment! Our house payment was first paid, then car insurance, then car payment. After that we did what we could. Eventually had creditors calling us. They all said I should sell my house and rent instead. I said if they could find me someplace less than my $500 mortgage that I would gladly do so. All replied with shock. When you get approved for a $250k mortgage you don't have to buy a $250k house.

Move, many places have artificially elevated housing costs. I live in a rural area, you could buy a house here for that 40 thousand. I have seen it happen. Not nice,...would need fixed up, but you could buy one.

Did it say where that house was? Did it say what the selling price was? I call b******t.

Im a boomer. I bought my house 15 years ago, with a down payment if 15K. At the time I was working in retail with good pay and a great credit score. I will never go back to Apt living. ,,, Cost is astronomical ! Also would never buy another house these days. The housing market is ridiculous! Just so glad that I got my house before all the bad stuff went down.

Location is clearly the issue here. Many might not know this but a mortgage company will typically lend 3x salary for a 30 year loan. With a FHA loan you only need a 3% down payment + closing costs. In my area plenty of homes available for less then 200k and I live in the richest County in Michigan. I personally would suggest to hold off if you can and see how the interest rates and housing market plays out. But if your currently renting look into FHA. Create equity for yourself not someone else.

This isn't caused by boomers. We bought our houses and are still in them. How is this boomers' fault?

The actual issue is that wages have not kept up with the cost of living. We're regularly discussing billionaires where we used to discuss millionaires. That is a 1000% difference. Minimum wage is unchanged. The part that shocks and annoys me is how many people who will never be billionaires loudly defend this system of resource management.

Work three jobs to barely afford an apartment/house/condo that you can never come home to. How far America has fallen.

Housing prices are criminal these days. An average middle class 2 story home can go for over $1 mill. What? As far as I’m concerned that’s legal theft. My nephew and his wife are looking for their first house. Daughter due to be born this summer. She’s a Nurse Practitioner and he works in refrigerator repair and he makes very good money. They’ve saved like crazy. Very responsible with money. They’re getting nowhere. They keep losing out to people having sold their houses and now have lots of money to put in large offers. I don’t know what the answer is, but young people and young families see no hope of homeownership. It’s horrible. And then the banks also won’t approve a monthly mortgage payment that is LESS than your rent. WHAT?

My spouse and I both work two full time, well paying jobs, just to be COMFORTABLE…meaning not living paycheck to paycheck. If one of us loses one of our jobs, it’ll be paycheck to paycheck. Thank goodness for remote jobs, so we’re about to stack them.

I'd love to know where that is. Is it a VHCOL city? I bet it is, especially with him saying his parents' house is worth 600k now. You move to where you can afford to live, not where you *want* to live. I live within an hour of NYC and have gorgeous lake views from my living room windows and watch the sun rise over the lake with my coffee every morning. I haven't had to lock my car doors in 20 years. This person could very easily afford my house with their salary and have lots left over to save/invest. Could I or they afford the same house in the heart of NYC, Seattle, Toronto or Silicon Valley? Of course not. Not saying the housing market doesn't suck rn, but there are affordable and nice places to live. This guy's parents just happened to buy in an area that became HCOL over time, which he'll benefit from eventually anyway.

I feel for everyone in this situation. And I feel like I just missed this hardship by the skin of my teeth! Back in 2005 I'd just graduated college, 2 degrees, making like $40-$50k a year to start. I made raises quickly and was up near $80k-$90k in just a few years. But back in 2005, My dad (a very poor, often homeless native American boy who worked very hard to grow up to run his own construction business and invest in a few rental properties), knew my future might hinge in buying then, just a few tears before the bubble and eventual housing crash. He planned ingeniously, to help me buy a small one bedroom condo in Seattle ($240k at the tine, but overlooking the lake and city, gorgeous views). His plan was he'd put down $70k he'd saved for another rental property, I'd pay the monthly mortgage (just $1,500 at the time), and whenever I sold, we'd split the equity, and id pay back his $70k down payment. When he passed away, he absolved me of any debt, saying keep it for your next place.

Continued: I was married and had 1 chikd by then, still in that 1 bed condo. When my 2nd child came along, it was time to move. With the housing market on fire, we sold for almost double what we paid, about $430, and put the equity down on our next place, a 4 bed 4 bath 3 story home farther from the city, for just $530. It was new construction no previous owners. Flash forward Just 2 years later, and our place was valued at $990k, just under a million! While the markets cooled, and its mire like high $800s now, the point is, had we waited, not had help from my dad, not bought before the bubble, or not chosen properties that doubled in value wach time, I would never have been able to afford the house I have now. I never could even afford to re-purchase the 1 bed condo I sold, as it's at around $600k now. It's insanity. I feel like we made it into a market that most people I know could never. Our neighbors are doctors and lawyers (we're in construction), we really lucked out. It's sad!

Load More Replies...My wife and I keep looking to try to move closer to her family, but there's just no way. Anything we find is like this and all gutted out inside so you're looking to spend a lot more than the asking price of the house. We're very much just stuck here for now. So many things would be easier if we had family nearby but sadly, it just can't happen.

It's really becoming time for a revolution over here. I say eat the rich! On a positive note, I'm pleasantly surprised that there's no dumb spam bot comments on making $12000/mo or whatever on this one!

My parents (Silent Gen/Boomer cusp) had an 8-room Colonial custom-built in 1974. It cost them $40,000. In 1997, I (GenX) bought a 5-room dilapidated ranch that hadn't been updated since it was built 40 years earlier. It cost me $99,000, and I could barely afford it after 6 months of working 12-16 hour days, 6-7 days a week AND it was the peak of the buyer's market. I'm just now able to afford an equity loan to update the house so my daughter (Millennial) will have a home. Oh, and as is, my house is worth nearly 3 times what I paid.

Asking this because I want to learn: how much of this is expectations? For example, I grew up in a poor household. My father worked 2 jobs for 10 years just to get the down payment for a house. I saw him at dinner for an hour each day. Parents went out to eat once a year for anniversary. Every penny was saved. As a result I did not expect to have a home, two cars and eating out twice a week. My point is have we been sold on an image of what our lives should be but not the reality of what it used to take to get it?

I'm middle age, but I DEFINITELY think housing is out of control!! I live outside Nashville and if you want to live in just a decent area with a 2000 sq ft home, it will absolutely be no less than 400k. The town I *want* to live in, there isn't anything available under 700k. My two daughters are 20 and 23, and I'm so angry that it is so difficult for them (and everyone in this age group) to just get by. That's why either adult kids have to stay WITH their parents or move away to a city where they can *hopefully* afford something. But then they don't have a close family support system. Then they end up having kids and grandparents can't even help out, because grandparents can't just quit their jobs to move close to their kids!

When my father bought a house back in 1977, it was around $140k in our neighborhood. Over the years, it's had plumbing issues, wood rot and not to mention the look becoming hugely outdated. The deck on the back was falling apart and the garage had a rat infestation due to the neighbors burning trash in their backyard. But when the house went on the market in 2020, the first day of being available, we had 32 bids, with the highest cash bid being 35-40% over the asking price. We were floored. No way we could afford it today.

Where I live in the Midwest, between myself and my husband, we don't even make half of what OP does. And yes, we currently own a house. But because people from the coasts (East or West) where houses are A LOT more expensive are moving here, I can't afford to move into a smaller house or a decent apartment (for a lower mortgage/rent than what I'm paying now) because these people are causing our local housing/rental market to put listing prices at $250K for a 2 bedroom, 1 1/2 bathroom house or apartment ($1,200/month minimum without pet fees). I can't afford that. So, forgive me if I have no sympathy for OP, since I am in my 50's and have worse problems than his family.

I was considering buying a studio flat in London in 2010. I liked it and it was good area. It cost £ 97k. I did not get mortgage as a single person even though mortgage was lower than rent. I later met my husband and moved in with him, otherwise I would be stuck renting forever and probably have to go back to houseshare. That studio flat was for sale again 3 years ago for £ 275k.

I have a decent full time job, but I will literally never be able to afford to buy a house.

According to the article, average USA house price is 0,5m USD. That's about ZAR10m here. Here's what ZAR 10m gets you: a mansion. https://www.property24.com/articles/high-end-buyers-snapping-up-sas-luxury-properties-at-bargain-prices/30303

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

77

75