Family Man With Good Credit Score Reveals What The Only House Available In His Budget Range Looks Like, And The Internet Is Horrified

InterviewEveryone has something that motivates them to strive for greatness at work. We want to have a positive impact on the world while also providing stability for our loved ones. One common goal that people have is wanting to own property. After all, who doesn’t want a quality home for their spouse and kids, a quiet corner of the world to truly call your own?

However, it can be disheartening to realize that all of your effort at work, your endless saving, struggles, and sacrifices might not be enough for you to afford to buy your dream home in the United States. That’s the frustration that one family man with good credit, TikToker @averagejoegam3, shared in a video that has gone massively viral. He revealed what the house within his budget looks like and shocked the internet. Scroll down to watch the full video.

Bored Panda reached out to @averagejoegam3, and he was kind enough to answer a few of our questions. “Sometimes, it gives me anxiety when I think about how many people my video has reached. I never thought it would get this many views and I almost didn’t post it!” he opened up to us, adding that the last thing he wanted to do was to discourage people. “Now more than ever, we have to focus on the things that make us the happiest. Family, friends, hobbies, and passions.” Read on for the full interview.

This TikToker’s rant went viral after he shared his honest feelings about the housing market

Image credits: averagejoegam3

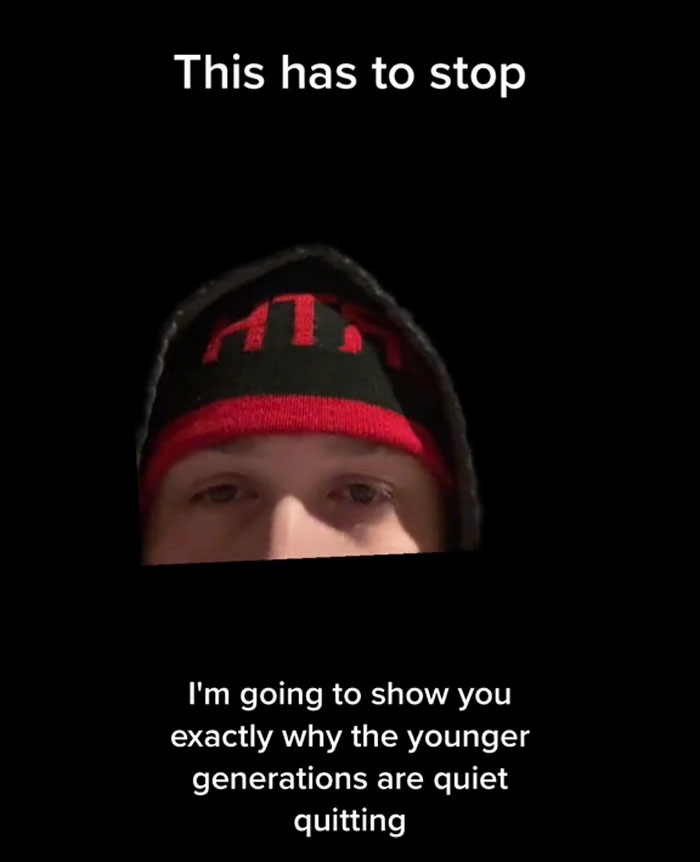

“I am going to show you exactly why the younger generations are quiet-quitting”

“Saying careers are dead, nobody wants to work anymore. All that s**t that you hear, I’m going to show you exactly why that’s happening. My wife and I have been together for seven years. And in those seven years, we came up the old fashioned way. We have two kids. We really struggled for a long time. And we, just now, after seven years of struggling and sacrificing, got to a point where we’re no longer paycheck to paycheck. She finished school, I worked my way up at my job, where we make $120,000 a year in combined household income.”

Image credits: Patricia Prudente (not the actual photo)

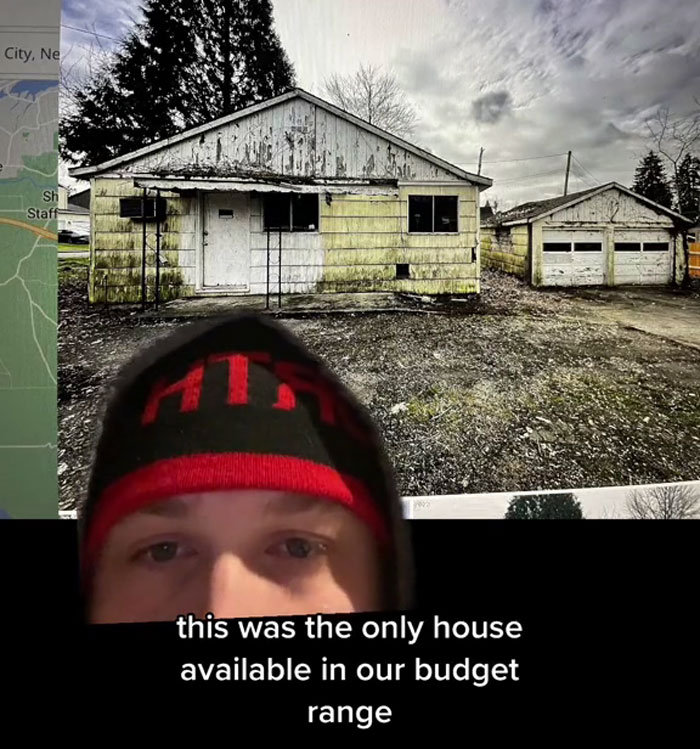

The man revealed what an affordable house looks like in his area

“And in two years, we financed and budgeted things out, we can probably save around $40,000 for a downpayment for a house. After seven years of struggling and working our a***s off, we built ourselves up in this country to buy a house. Let me show you what $120,000 a year, $40,000 downpayment, with good credit gets you. This was the only house available in our budget range, in our location where we live. There was one house for sale and it was this one right here.”

Image credits: averagejoegam3

He was frustrated by how unfair the situation is for the younger generation

“This is what we can afford with $120,000 combined income and a $40,000 downpayment with good credit. Our cars are paid off, we sacrificed, we worked hard. We worked our way up in this country to get to a point where we’re no longer paycheck to paycheck and we can save money. This is what we can get. Everybody that is in the older generations saying, ‘Oh, I guess you better go to college and do your best. Guess you better go get a degree, find a trade, something that makes you more valuable to community,’ was it always like that? Is that how it always was?”

Image credits: Alexander Mils (not the actual photo)

“Did you have to be a doctor, a lawyer, an architect, an engineer to get a livable house with a very substantial income? My mom worked at Michaels. My dad was a pressman in a printing company. They both bought a house which nowadays is probably $600,000. At the age of 23, my mom worked just over minimum wage at Michaels, and my dad worked for a little bit more than that in a printing company. This is what’s going on.”

You can watch the video in full right over here

@averagejoegam3 This has to change. #quietquitting#inflation#truth#millennial#genz#boomer#genx#debate#housingmarket#greenscreen♬ original sound – Average Joe

The message resonated with a ton of people around the internet

Image credits: Vojtech Okenka (not the actual photo)

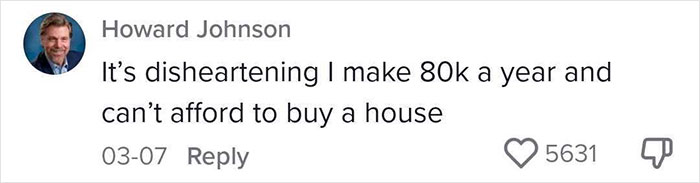

TikToker @averagejoegam3 told Bored Panda that he’s glad that his video reached so many people around the world. “My story is just one of millions of other families and people in the same position,” he said.

“It resonates with so many people because there’s so many honest, hardworking adults just doing their best to provide for themselves and everyone around them.”

According to the video creator, there are various reasons why buying a house has become unaffordable for many young professionals.

“The one [reason] that bothers me the most is investment companies buying up single-family homes and using them for Airbnbs or just renting them out permanently. Which at some point should be illegal,” he shared his thoughts.

There are no easy fixes to the current situation, and @averagejoegam3 doesn’t have any instant solutions to the problem either. However, he pointed out that starting to have real conversations about the housing market and asking questions “is a good place to start.”

“Eventually, younger generations are going to start holding political office and I have high hopes for big changes in our future.”

Despite everything, @averagejoegam3 remains optimistic about the future and hopes that others will, too.

“For everyone that watched my video and got discouraged, or lost hope, or it negatively impacted them or their motivation, please don’t let your happiness or success be judged by what you can buy. Yes, it is frustrating. But the last thing I wanted was to discourage people or make people feel depressed. Now, more than ever, we have to focus on the things that make us the happiest. Family, friends, hobbies, and passions.”

Buying a house really has become more expensive than in the past

Image credits: Towfiqu barbhuiya (not the actual photo)

TikToker @averagejoegam3’s video made a huge splash online. It was viewed a jaw-dropping 4.6 million times on the video-sharing platform. Meanwhile, it caused such a buzz that other internet users started posting it elsewhere online. One person who reshared the video on Reddit got over 53k upvotes.

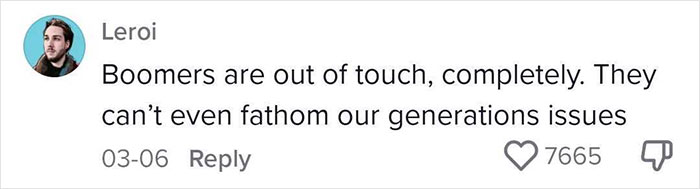

The TikTok really resonated with a lot of people who feel powerless and as though they’re not in charge of their destinies. One common thorn in gen Z and millennials’ sides is talking about housing with members of the older generations who have the idea that having a run-of-the-mill job and saving a bit of money every single month is enough to afford a decent, livable home.

Stereotypically, this is expressed as something along the lines of, ‘Well, maybe if you ate less avocado toast and drank less coffee, you could save enough money to buy a house.’ We’re all for good saving habits and being less reliant on caffeine, but these are small potatoes compared to how inflated property prices have become.

According to the Federal Reserve Bank of St. Louis, the average sales price of houses sold in the United States was $535,800 in the final quarter of 2022. The average price peaked in the third quarter of 2022 at $547,800. Just a few years ago, in Q2 of 2020, the average was $374,500. Now compare that to Q4 of 2011 when the price stood at 259,700.

There was another peak right before the great economic crash ($322,100 at the start of 2007), but otherwise, the costs of houses are far lower the further you go back in time. An average home went for around $210,000 in 2001. You could nab a house for around $150,000 in 1991. While in 1981, buying a house would cost you around $84,000. What this means, essentially, is that property prices have been rising rather disproportionally. In short, you need to save more to buy an average home that your parents and grandparents could afford far more easily in their time. That’s awesome for them! But pretty bad for those of us who don’t own property yet.

The market might be correcting for the better, but it’s too soon to tell

Image credits: Karolina Grabowska (not the actual photo)

However, there are some signs that the housing market might potentially be cooling (ever so slightly). CNN reports that rising interest rates “slowed the frenzied sales activity.” However, home prices are still at a record high. The median price for which a home sold in 2022 was $386,000 according to the National Association of Realtors. That represented a 10.2% increase from the median in 2021. However, home sales last year have dropped by 17.8% compared to 2021. In this case, the term ‘homes’ refers not just to houses but also to townhomes, condos, and co-ops.

Meanwhile, Statista reports that, actually, the homeownership rate in the US rose a bit in 2022. “In 2022, the proportion of households which are occupied by owners stood at 65.9 percent. The U.S. homeownership rate was the highest in 2004 before the 2007-2009 recession hit and decimated the housing market. The rate continued to fall until 2016, but has begun to increase again since then.”

This means that more and more Americans have become homeowners since 2016. In short, things aren’t completely black-and-white for absolutely everyone in the US. More and more millennials who are currently renting are planning to buy homes in the near future.

Planning and actually buying, however, are two entirely different things. Investopedia notes that millennials aren’t buying homes as readily as previous generations. Many millennials are delaying getting married and having kids. Instead, some of them choose to live at home with their parents, as they shoulder huge student debts and can’t save up for down payments.

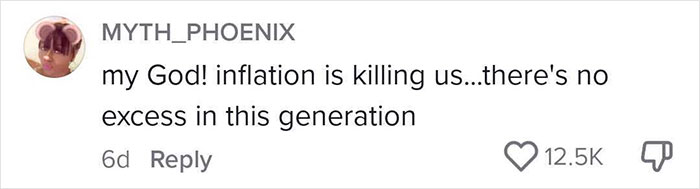

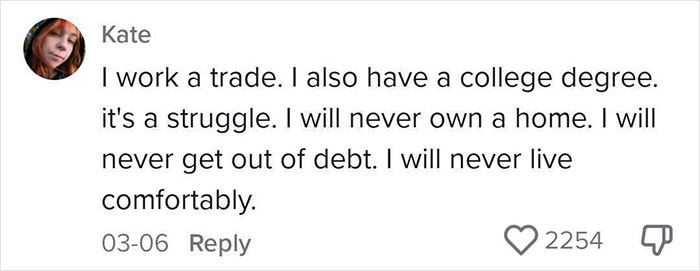

Here’s how people reacted to the candid TikTok

Explore more of these tags

Man, if only I could quit eating avocado toast, I'd be able to afford a house :(

Everything he says is true. I'm a boomer and part time Realtor in Greater Boston and I can't imagine buying a place now. I was able to buy something 25 years ago and that is the only way that I can own today. We even sold and moved to a cheaper town because property taxes are out of control. And some people think that owning a condo might be a better alternative, but HOA fees are astronomical now as well.... $500-1200/month depending upon the cost and amenities. It's not sustainable.

How much are short term rentals hurting the housing market? I just bought a tiny house for $400K. And it seems to me that I was competing with a lot of people who owned multiple properties. Many of the folks buying were paying $500K cash and site unseen. Many of them were out of state. Are they flippers? Or is this AirBnB? What's driving the prices so high? I know interest rates were insanely low, but honestly I'd rather buy low with a higher rate, then do what I did. You can always refinance when the rates go down.

Load More Replies...Man, if only I could quit eating avocado toast, I'd be able to afford a house :(

Everything he says is true. I'm a boomer and part time Realtor in Greater Boston and I can't imagine buying a place now. I was able to buy something 25 years ago and that is the only way that I can own today. We even sold and moved to a cheaper town because property taxes are out of control. And some people think that owning a condo might be a better alternative, but HOA fees are astronomical now as well.... $500-1200/month depending upon the cost and amenities. It's not sustainable.

How much are short term rentals hurting the housing market? I just bought a tiny house for $400K. And it seems to me that I was competing with a lot of people who owned multiple properties. Many of the folks buying were paying $500K cash and site unseen. Many of them were out of state. Are they flippers? Or is this AirBnB? What's driving the prices so high? I know interest rates were insanely low, but honestly I'd rather buy low with a higher rate, then do what I did. You can always refinance when the rates go down.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

77

76