Family Are Furious With Daughter After She Sues Them For Stealing Her College Fund So Their Son Could Have A Grand Wedding

InterviewRecently, a woman went on the AITA community for a moral judgement regarding the drama in her family.

“My great-aunt set up savings accounts for all of her female relatives,” the Redditor explained. She was one of them, ready to have her future college covered.

But when the author was ready to enroll in college, she found out that the great-aunt’s fund was almost all gone.

A woman wonders if she was wrong to sue her parents for spending her college money without asking

Image credits: Alina555 (not the actual photo)

Image credits: dolgachov (not the actual photo)

Image credits: Accomplished_Bar5656

“It’s important that we don’t allow others – even if it’s our own family – to take away that which rightfully belongs to us,” an expert says

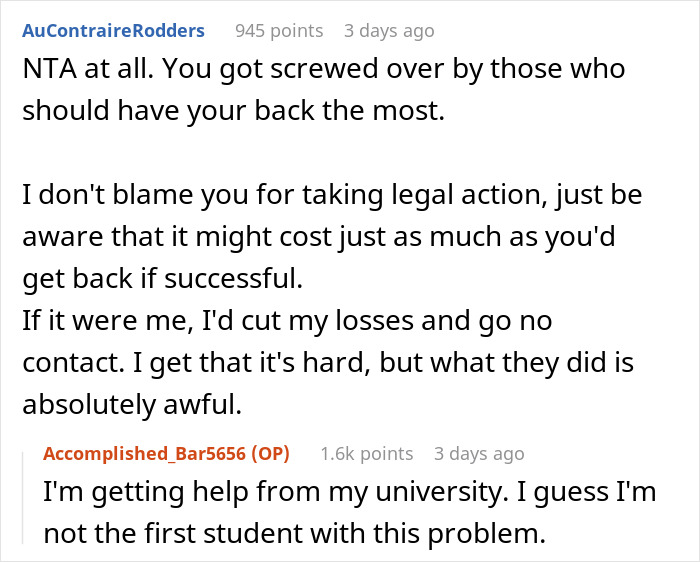

To find out an expert’s take on this case, we reached out to Susan DeCou, a certified divorce coach and the creator of “The Quiet Zone Coaching,” who teaches women how to stop feeling overwhelmed and start waking up happy in the morning again.

“Sometimes the culture we’re raised in makes this type of behavior an acceptable thing. She doesn’t say which culture her family is part of, but I’m guessing it’s one that still puts an emphasis on the boys of the family before the girls. Her aunt had become ‘Americanized,’ and her parents apparently felt that it wasn’t necessary to provide an education for their daughters,” Susan commented.

However, Susan argues that if the relationship is already that damaged, then she would have no problem advising her to sue her parents. “It’s important that we don’t allow others – even if it’s our own family – to take away that which rightfully belongs to us.”

“She can still have a ‘relationship’ that includes keeping them at arm’s length”

Image credits: Andrea Piacquadio (not the actual photo)

The good news is that it’s still possible to repair the relationship with her parents. “There needs to be some open and clear communication between this woman and her parents if she wants to reconcile. However, her parents may not feel like they’ve done anything wrong, based on the culture they were raised in and still follow,” Susan explained.

Moreover, Susan argues that if that’s the case, “the author can still have a ‘relationship’ that includes keeping them at arm’s length, especially in situations where their value systems will be at odds with each other.”

Otherwise, she may decide to cut all ties. “That would be even more sad if she decides to have children someday. That kind of decision is up to each individual to make, based on their own situation; there is no ‘right’ answer.”

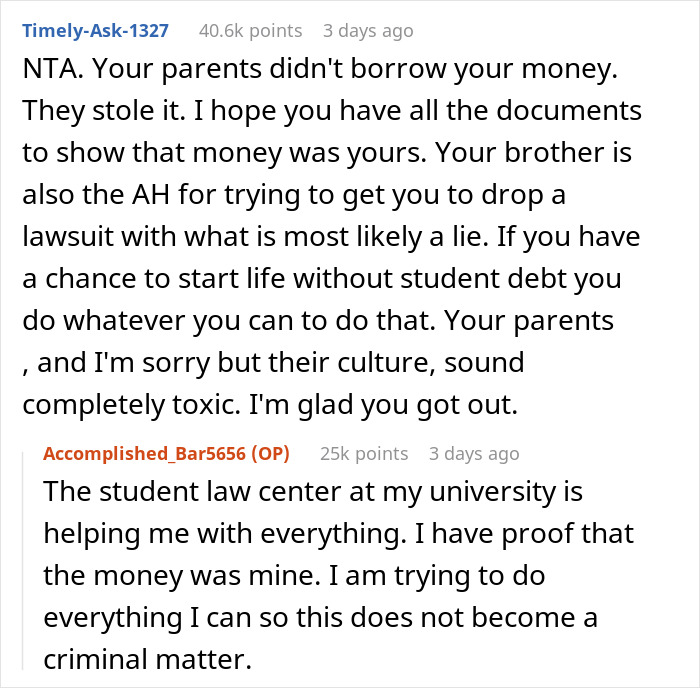

The author later shared more information about the whole situation

It’s estimated that in 2023, more than half of students leave school already in debt in the US

The cost of college has been steadily increasing in the past thirty years. And with rising education fees, more and more people have found themselves in desperate need of student loans, as well as other financial aid. It’s estimated that in 2023, student loan debt, including federal and private loans, reaches $1.75 trillion in total, with $28,950 owed per borrower on average.

Forbesreports that younger people hold the majority of student loan debt. Borrowers between the ages of 25 and 34 carry about $500 billion in federal student loans—the majority of people in this age group owe between $10,000 and $40,000.

That doesn’t stop just there. A big amount of borrowers carry their education debt well into middle age and beyond. In fact, people aged 35-49 owe more than $620 billion in student loans. This cohort has the highest number of borrowers who owe more than $100,000 in loans. Similarly, 2.4 million retired people right now feel the burden of owing an astonishing $98 billion in student loans.

A few lucky ones, 10,776 borrowers, to be precise, had their federal loans forgiven thanks to the Public Service Loan Forgiveness (PSLF) program. According to a Forbes report, already more than $1 billion has been forgiven, with the average applicant discharging about $95,000 in debt.

“Having a student loan debt can give you a lot less to play with in terms of getting a mortgage on a house, or saving for a deposit,” the savings expert explains

Image credits: Joslyn Pickens (not the actual photo)

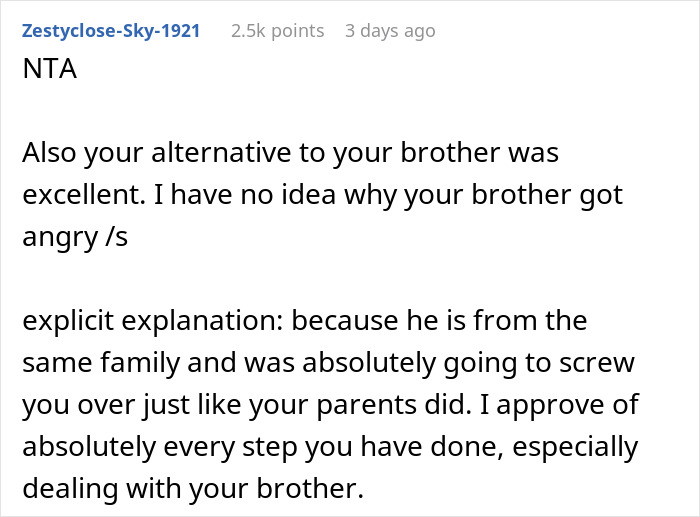

Lucinda O’Brien, the savings expert from Money.co.uk told Bored Panda in an interview via email that having a student loan debt can often feel like a huge chunk of money going out of your account every month, “leaving a lot less disposable income, and giving you a lot less to play with in terms of getting a mortgage on a house, or saving for a deposit.”

“The only way this would affect your credit score is if you couldn’t afford the loan repayments, and therefore weren’t able to keep up,” she added.

For student loan borrowers in England and Wales, it’s crucial to do their research before repaying the loans

Image credits: Andrea Piacquadio (not the actual photo)

We also wondered how having student loan debt affects people’s spending habits in England And Wales. “Often you hear former graduates wondering: ‘If I’ve got extra cash, should I pay off my student loan?’ This is a complicated question as it depends on interest rates and the time of taking out the loan, so you’ll need to understand these factors before making a decision,” Lucinda explained.

According to the savings expert, it’s important to do your research about your student loan. For example, for English and Welsh students who started university in 2012 or after, this is a Plan 2 loan, and it works differently from the loans pre and post 1998.

Meanwhile, “for post-1998 student loans, it can be more beneficial to use your extra cash to invest, say in property or put into a high-interest savings account. This is because it’s one of the cheapest loans in the market, so it doesn’t make sense to pay it off quickly,” Lucinda explained.

“If you could earn more from savings than the loan is costing you, it’s better to save the cash”

It’s also worth calculating, Lucinda argues, whether you could earn more from savings than the loan is costing you. And if so, it’s better to save the cash. “Plus, remember that the loan is written off after 30 years (so many people won’t pay off their student loans in full), and if you don’t earn enough money you won’t need to pay it back,” she concluded.

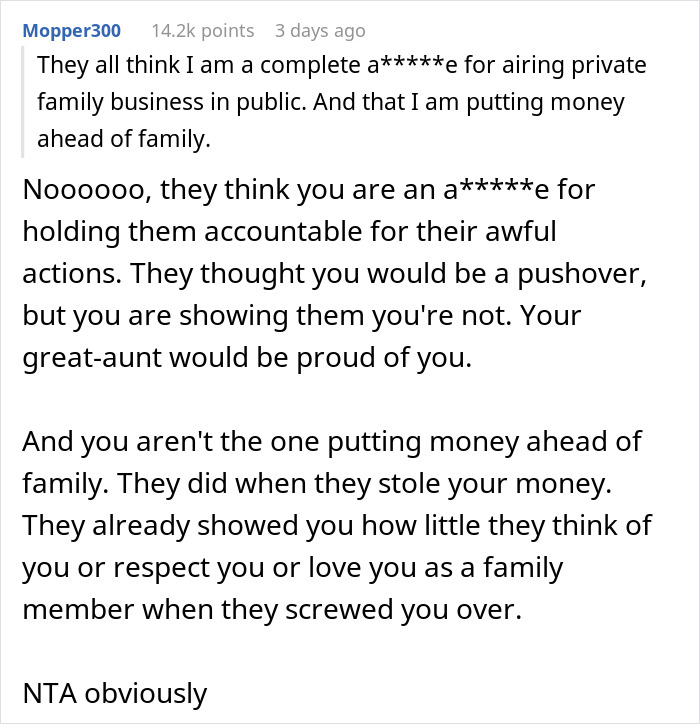

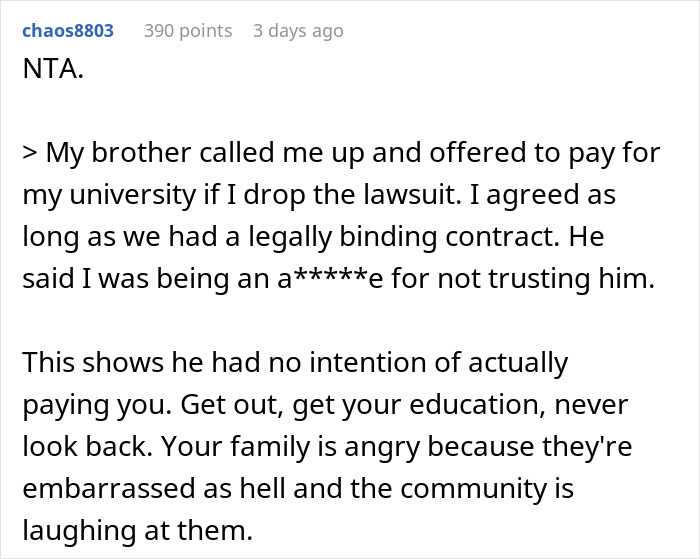

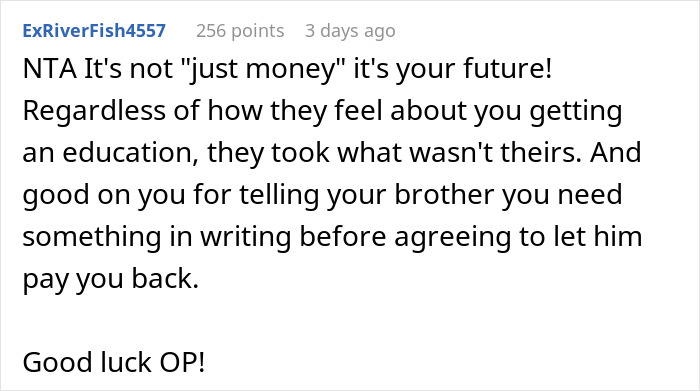

Many people expressed their support for the author

Explore more of these tags

Really like to know what culture it is. Because there are several cultures that believe that women don’t need education, however most if not all of those cultures, come down waaaay hard of theft

@marcelo depends on the definition of theft and ownership for that matter. If women can’t own anything they can’t be stolen from….

Load More Replies...In our will, we have left money for both our kids that they get in a lump sum at age 30, with the exception of tuition and living expenses associated with college, which would be available to them right away. If something happens to the both of us, that money is held in trust and overseen by our lawyer. We have heard of too many cases where the money is entrusted to a friend or relative and a large portion of it vanishes.

As long as it's a trusted lawyer. Unfortunately, there are unscrupulous lawyers as well. Sad that there are always lousy people in every group.

Load More Replies...Really like to know what culture it is. Because there are several cultures that believe that women don’t need education, however most if not all of those cultures, come down waaaay hard of theft

@marcelo depends on the definition of theft and ownership for that matter. If women can’t own anything they can’t be stolen from….

Load More Replies...In our will, we have left money for both our kids that they get in a lump sum at age 30, with the exception of tuition and living expenses associated with college, which would be available to them right away. If something happens to the both of us, that money is held in trust and overseen by our lawyer. We have heard of too many cases where the money is entrusted to a friend or relative and a large portion of it vanishes.

As long as it's a trusted lawyer. Unfortunately, there are unscrupulous lawyers as well. Sad that there are always lousy people in every group.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

141

96