“Not My Money”: Man Starts A Fight After Stay-At-Home Wife Spends $950 On Groceries

Married life comes with its fair share of ups and downs, and the occasional quarrel is to be expected. Usually, a sincere apology and a hug can patch things up, but sometimes, a disagreement cuts deep enough to make you want to get a little petty.

That’s what one woman on Reddit resorted to after her husband accused her of being wasteful when she spent $950 on their monthly grocery run. In response, she decided to stop using and wearing all his gifts to show she was done with his complaints about money. Now, she’s left wondering if she went too far.

The man accused his wife of being wasteful after she spent $950 on groceries

Image credits: mstandret / Envato Elements (not the actual photo)

In response, she decided to stop using and wearing all his gifts

Image credits: pvproductions / Freepik (not the actual photo)

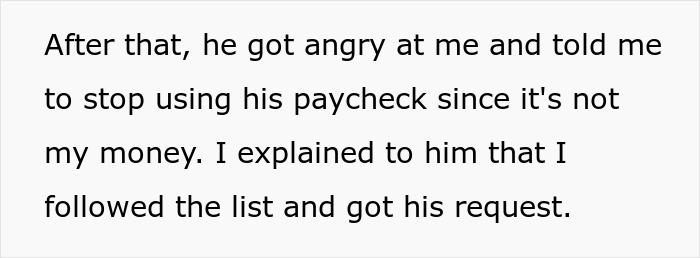

Image credits: swirledletters

Image credits: wayhomestudio / Freepik (not the actual photo)

The missteps couples make when they talk about money

Marriage is often seen as a declaration of love, but it comes with a lot of practicalities—one of the biggest being how to handle money together. From managing a household budget to planning for the future, finances are a delicate subject that many couples struggle to discuss, even before they tie the knot.

According to a survey by NerdWallet and Zola.com, over two-thirds of engaged Americans find it hard to have serious financial conversations with their partner, and more than half don’t agree on financial goals. This can create misunderstandings and tension down the road, especially if certain topics are avoided before getting married.

“It’s really hard to feel comfortable starting these conversations,” says Jillian Knight, a licensed marriage and family therapist who specializes in financial therapy. “Because a lot of the time, people have the belief that you shouldn’t talk about money or that they’re not good with money.”

A common mistake couples make is assuming they share the same values and views about money without ever actually addressing them. “This leads to sometimes vicious fights, arguing over whose perspective is the ‘right’ one,” says Lisa Marie Bobby, a licensed marriage and family therapist. Instead, Stephanie Zepeda, a licensed marriage and family therapist in Houston, suggests starting with open-ended questions like, “What money lessons did you learn growing up?” This can help you understand where your partner is coming from and why they manage finances the way they do.

Many couples also overlook the importance of regularly checking in on their financial situation, particularly when one person becomes the default money manager. While it’s fine for one partner to take the lead, both should have a basic understanding of their finances, believes Knight. How much is coming in? How much is going out? What are the big financial goals? Without this shared knowledge, unexpected issues can arise and cause unnecessary stress.

Things can get even more complicated when there’s a power imbalance, with one partner earning most or all of the household income. This can make the breadwinner feel in control of financial decisions, leaving the other partner vulnerable. “The downside is that the non-earning partner can easily begin to feel—or become—powerless in this arrangement,” says Meredith Moore, Founder & CEO of Artisan Financial Strategies LLC. As a result, feelings can get hurt, like in the Reddit story where the wife, despite having a small income of her own, felt sidelined in financial matters.

If arguments about money are left unresolved because they’re uncomfortable to talk about, they’re likely to resurface again and again. “It becomes this cycle that couples sometimes get stuck in,” says LaQueshia Clemons, a licensed clinical social worker. She recommends revisiting the topic within 24 hours and starting the conversation by acknowledging something positive about how your partner takes care of money. It’s a simple way to keep the atmosphere positive and prevent any lingering bitterness.

Lastly, financial discussions often revolve around budgeting or saving, which can make them feel like a chore. Megan McCoy, an assistant professor at Kansas State University, suggests adding a little fun to the mix. For example, she and her husband buy a Powerball ticket twice a year and spend a date night dreaming about what they would do if they won. “I really think it’s a huge mistake to only talk about scarcity—where we should cut, how we should budget,” she says. “You can learn so much from having those positive, playful conversations.”

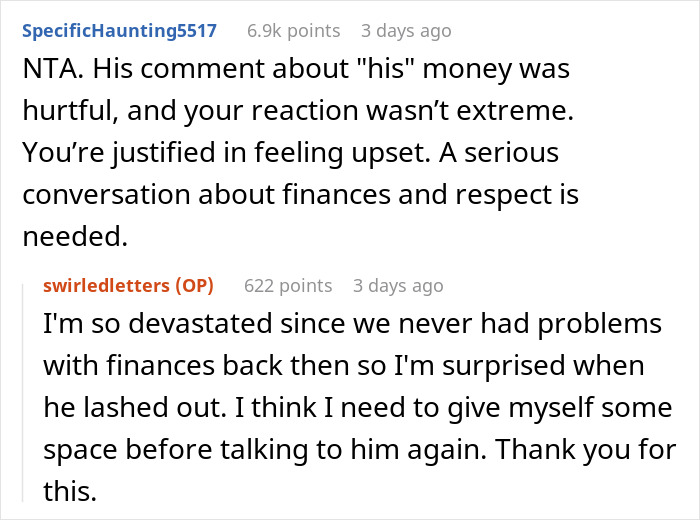

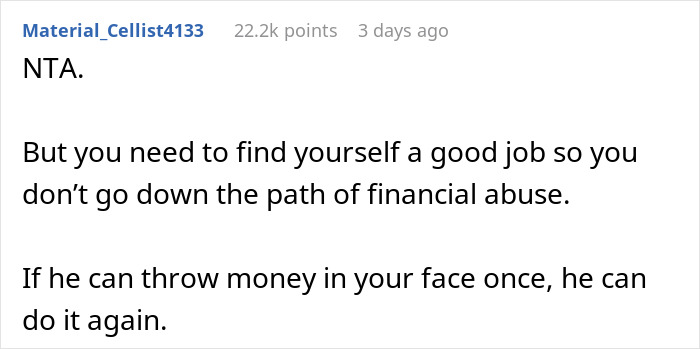

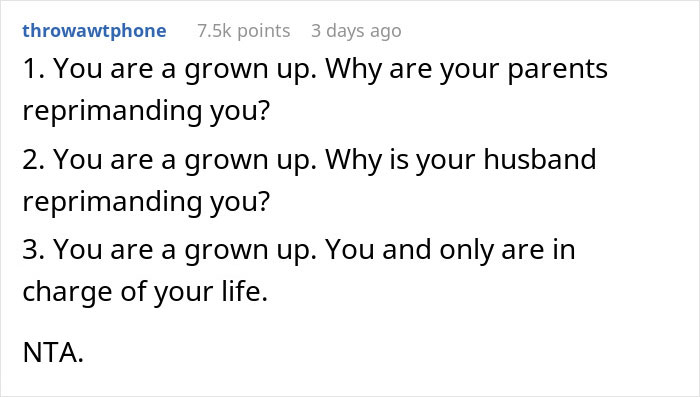

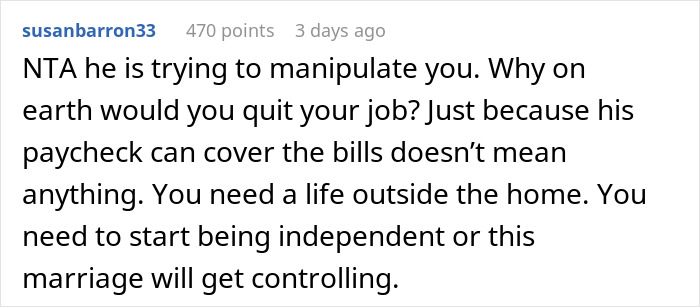

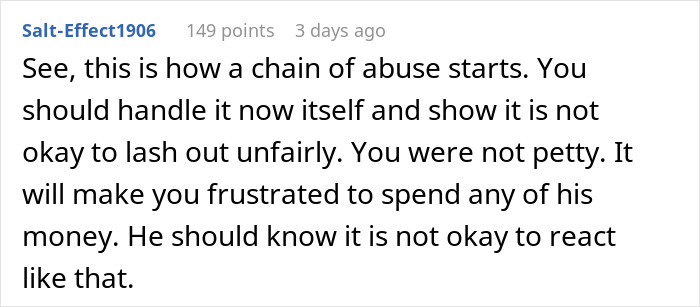

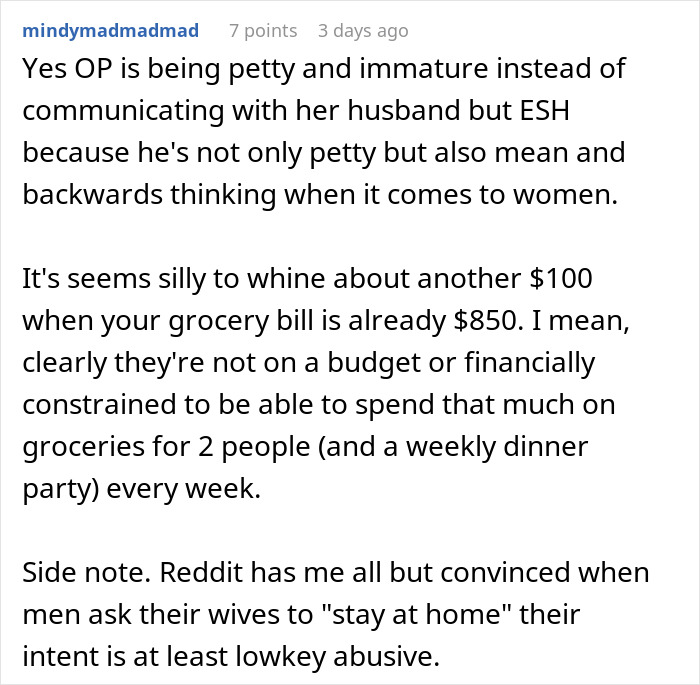

Many commenters sided with the woman, suggesting her husband might be trying to manipulate her

Others pointed out that they both could have handled the situation better through proper communication

Poll Question

Thanks! Check out the results:

Insists that wife stays home and gives up her career after marriage, gets angry when she spends his money. Being a SAHW is a really bad deal for women everywhere and this is just one example of why.

I read some of these things and think half the US lives in 1920’s, not the 2020’s.

LMAO. NO. It’s not. There are plenty of SAH moms, wives and even husbands who are not abused. Making this claim is so irresponsible to people who are ACTUALLY abused.

Load More Replies...Insists that wife stays home and gives up her career after marriage, gets angry when she spends his money. Being a SAHW is a really bad deal for women everywhere and this is just one example of why.

I read some of these things and think half the US lives in 1920’s, not the 2020’s.

LMAO. NO. It’s not. There are plenty of SAH moms, wives and even husbands who are not abused. Making this claim is so irresponsible to people who are ACTUALLY abused.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

23

41