“It’s Just Sitting There”: Family Demands Woman Give Her College Savings To Dropout Cousin

In some places of the world, education is not cheap. That’s why many parents start saving up for their child’s schooling way before they even apply for it.

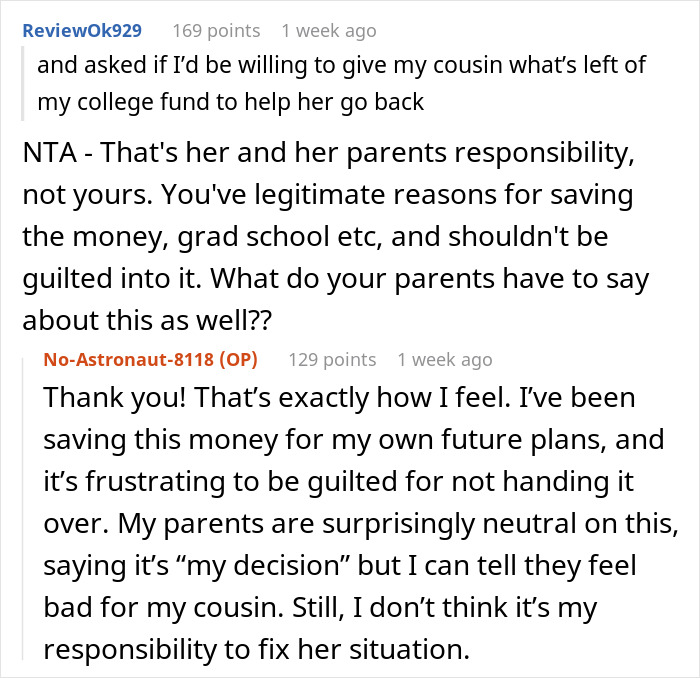

That was the case with this redditor, whose parents started saving for her to go to college when she was little. However, the young woman got a scholarship in her last year, leaving her with some money on her hands. That caught the attention of her family members, her aunt and uncle, who asked her to give the leftover college fund to their daughter—the OP’s cousin—saying that she needed it more.

Scroll down to find the full story in the woman’s own words below, where you will also find Bored Panda’s interview with a financial aid expert and author of How to Appeal for More College Financial Aid, Mark Kantrowitz, who was kind enough to answer a few of our questions.

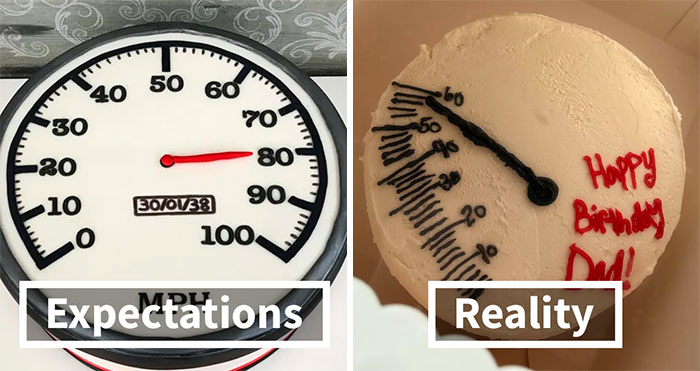

Finding a way to pay for a child’s education is a headache many families experience

Image credits: gpointstudio/Envato (not the actual photo)

This young woman’s family asked her to give her leftover college fund to her cousin, saying that “she needed it more”

Image credits: Tatiana_Mara/Envato (not the actual photo)

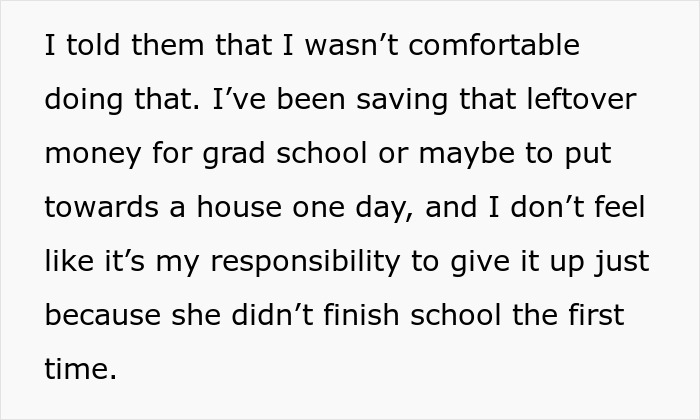

Image credits: No-Astronaut-8118

Many parents start saving for their children’s education quite early in their lives

When they become parents, people might have no idea what their child will want to do in life. But chances are, they will want to get an education, which can get quite costly in some places. According to the International Schools Database, the US and China are the two countries that top the list of such costly places. But whether it’s one of the top two that you choose or something lower on the list, you might have to open up your wallet quite wide nevertheless.

Bearing in mind how expensive getting an education can be, it might be best to start saving up as early as possible. And many people seemingly do. According to Statista, in around the decade preceding 2018, 48-62% of American parents were saving for the college education of their children. As of 2022, the heads of more than a quarter of households that were saving for college were under 35 years old, suggesting that people start saving quite young.

A survey of parents of recent high school graduates found that despite saving up for the occasion, not all parents feel equally ready to take the first step – cover their child’s first tuition bill. The survey revealed that close to nine-in-ten parents believed that a degree was important for their child’s future, yet only roughly four-in-ten were ready to cover said bill.

Image credits: Alexander Grey/Unsplash (not the actual photo)

Most families struggle financially putting their young through college

Discussing the topic of saving for college with Bored Panda, the financial aid expert Mark Kantrowitz pointed out that most families struggle with covering such expenses. “Low-income families struggle more than middle-income families, who struggle more than high-income families, but very few families can afford to pay for college out of pocket change,” he said.

“Less than 18% of children under 18 years old have a 529 plan. More than two-thirds of Bachelor’s degree recipients graduate with student loan debt. If total student loan debt at graduation is less than annual income, the borrower should be able to afford to repay the student loans in ten years or less. If total debt exceeds annual income, they will need an alternate repayment plan, like extended repayment or income-driven repayment, which means they will still be in debt when their children enroll in college.

“But, we don’t really have a student loan debt problem, so much as a college completion problem. Most students who graduate are able to repay their debt. Undergraduate students who drop out of college are four times more likely to default and represent three quarters of the default. Among students in Bachelor’s degree programs, college dropouts are 95 times more likely to default. They have the debt but not the degree that can help them repay the debt,” Kantrowitz explained.

Image credits: ManuelTheLensman/Unsplash (not the actual photo)

There are many ways leftover college money can be used

According to the aforementioned survey, three in four parents have set aside some money to cover the costs of their child’s schooling. It seems that the OP’s parents, too, were determined to help their daughter carry the financial load of schooling since quite early in her life. But that didn’t mean that the young woman didn’t have to work hard for the degree, which she did, consequently earning a scholarship for the last year.

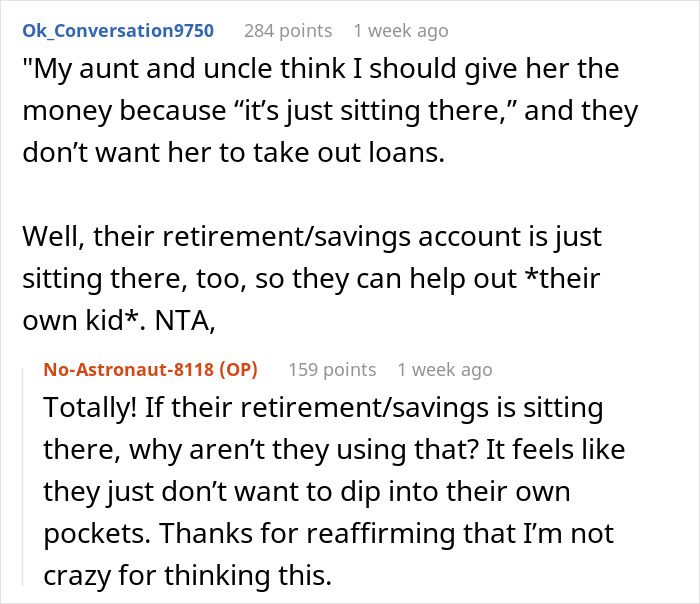

Because of the scholarship, the OP’s college fund was not entirely empty after graduating. And the young woman’s aunt and uncle seemingly knew about it, as they asked their niece to give the money to her cousin. According to them, it was “just sitting there” either way. But even if the graduate is left with no student debt, they can still encounter money-related issues when starting their lives, which is when savings can really come in handy.

“A leftover college fund is not just ‘money lying there’ any more than money in a bank account is available to pay for someone else’s needs and wants,” Kantrowitz noted. “The niece might need it to pay for her own education if she decides to go to graduate school, or might use it to pay for her own children’s education. She could roll it over into a Roth IRA to get a head start on saving for retirement. Or, she could take a non-qualified distribution, paying taxes on the earnings portion of the distribution, for her other needs.”

According to the financial aid expert, the owner of a 529 college savings plan account controls the account and can change the beneficiary to a relative of the old beneficiary, including a cousin. “If the niece [the OP] is both the account owner and beneficiary of a 529 plan account, a custodial 529 plan account, the beneficiary cannot be changed,” he noted.

The expert continued to suggest that there are several options for leftover money in a 529 plan account, aside from changing the beneficiary:

- “Keep the money in the 529 plan for the beneficiary’s future college costs, including graduate school and continuing education.

- Use the money to repay qualified education loans. Up to $10,000 each for the beneficiary and the beneficiary’s siblings can be used to make a qualified distribution to repay qualified education loans. It can also be used to repay parent loans by changing the beneficiary. Note that the $10,000 limit is a lifetime limit per borrower.

- Save the 529 plan for a grandchild.

- Rollover up to $35,000 to a Roth IRA in the name of the beneficiary. The 529 plan account must have existed for at least 15 years. Contributions made within the last five years, including their earnings, may not be rolled over. The rollover is subject to annual Roth IRA contributions limits, currently $7,000 per year ($8,000 for those age 50 and older).

- Take a non-qualified distribution. The earnings portion of a non-qualified distribution is taxed at the recipient’s rate, plus a 10% tax penalty. The tax penalty can be waived if the distribution is due to receipt of a scholarship, AOTC, military academies, or other educational benefits, up to the amount of the benefit. It is best to have the distribution go to the person (beneficiary or account owner) who has the lowest tax bracket. If there are multiple 529 plans, one can choose the plan with the lowest percentage earnings to minimize the tax bite. The tax penalty is also waived in cases involving death or disability of the beneficiary.”

Kantrowitz added that “There is no requirement that the money in a 529 plan be spent. There are no age limits. So, the niece could just keep the money in the 529 plan and decide what to do with it later.”

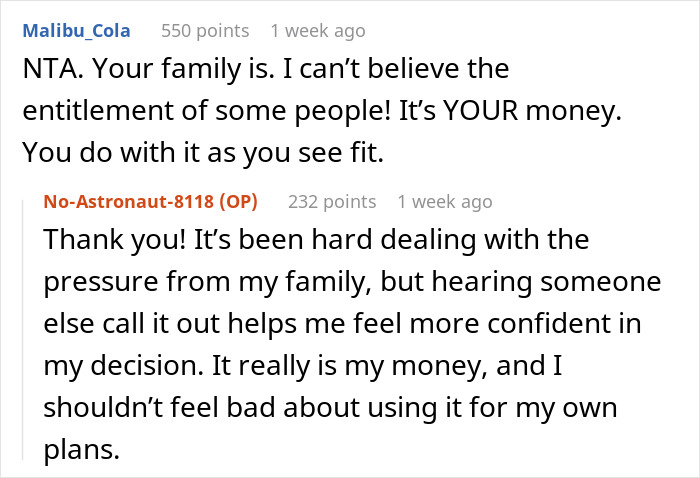

The OP shared that she might put the leftover money towards a house someday; or maybe use it for grad school, which is exactly what she told her aunt and uncle. And while they didn’t take it well, fellow netizens in the comments assured the redditor that refusing to give her money to her cousin didn’t make her a jerk.

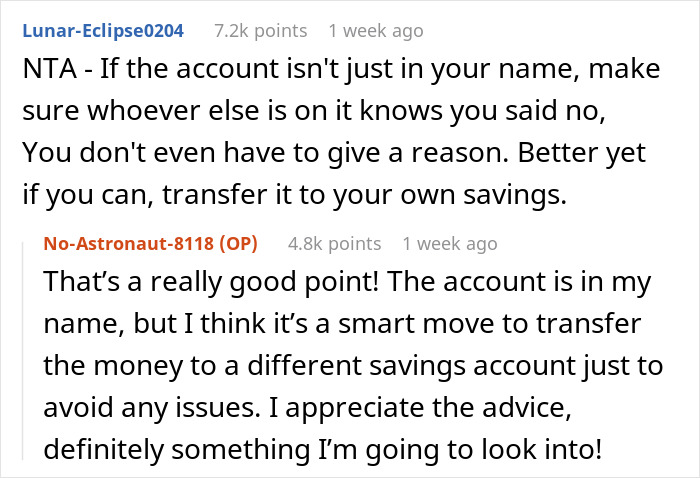

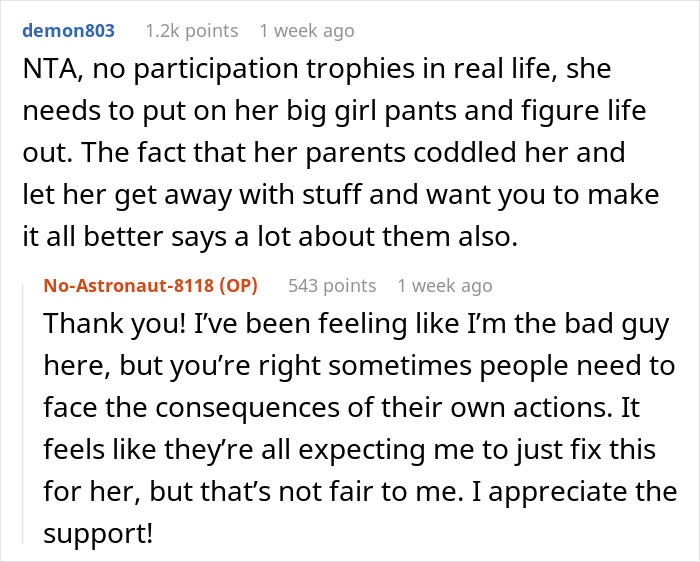

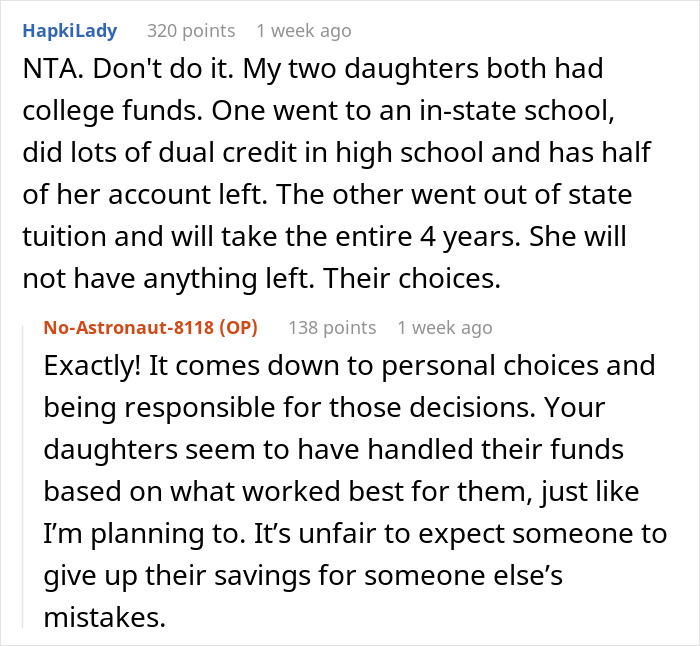

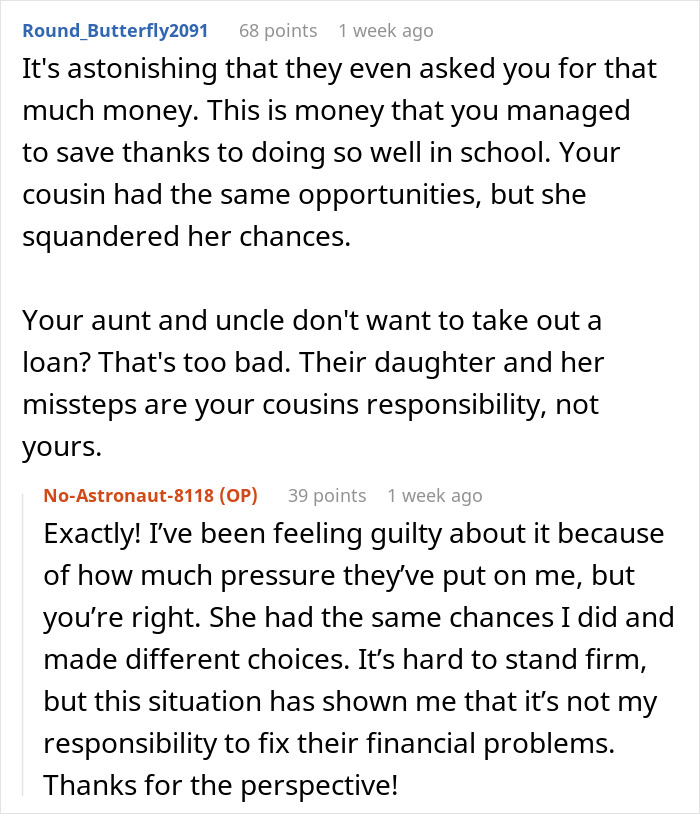

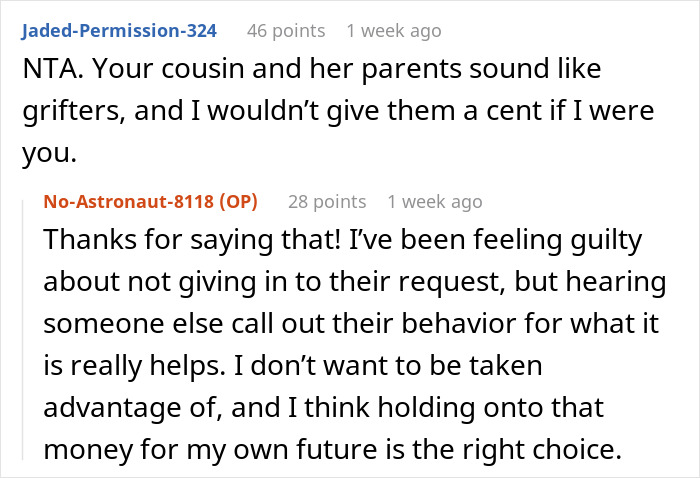

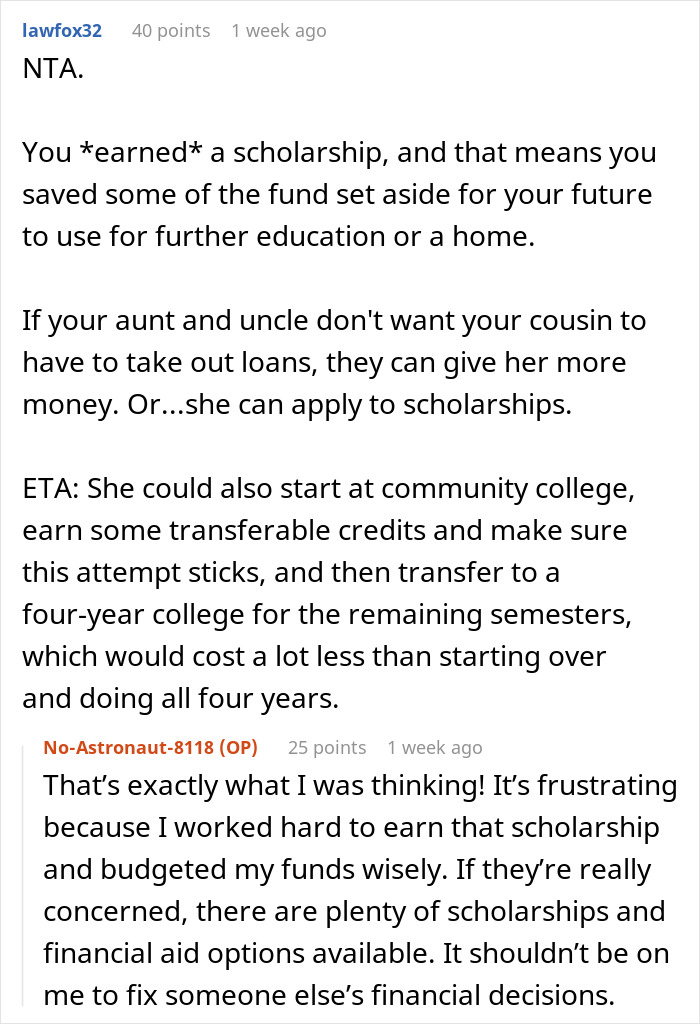

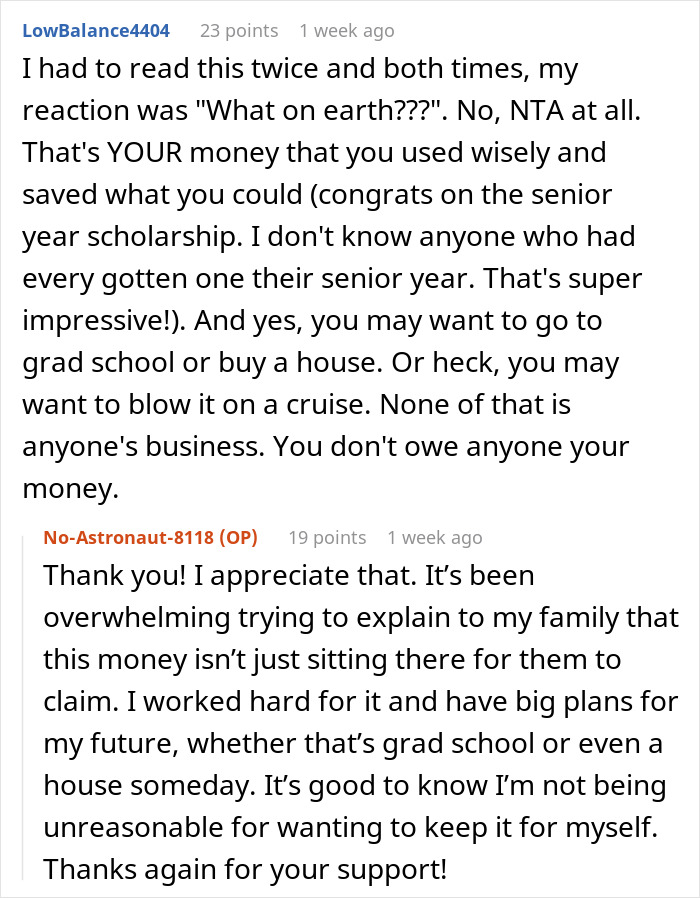

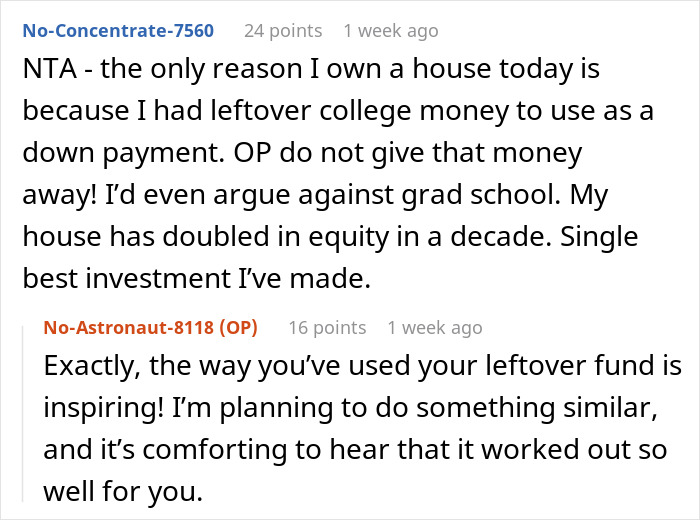

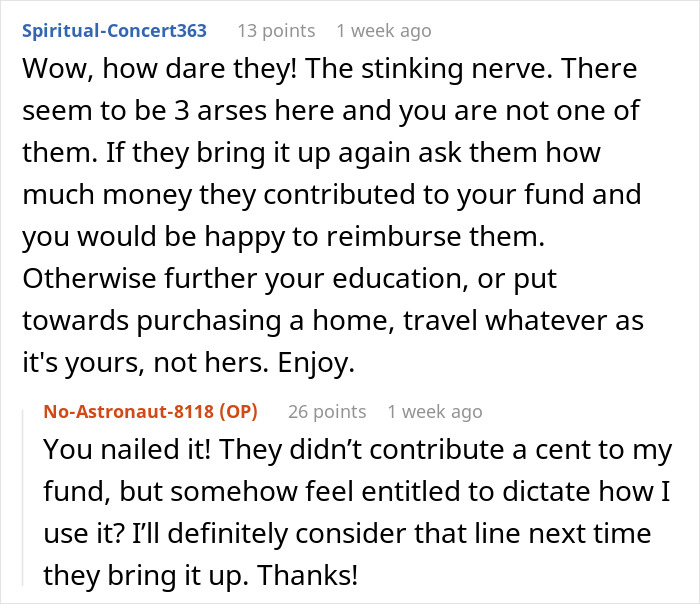

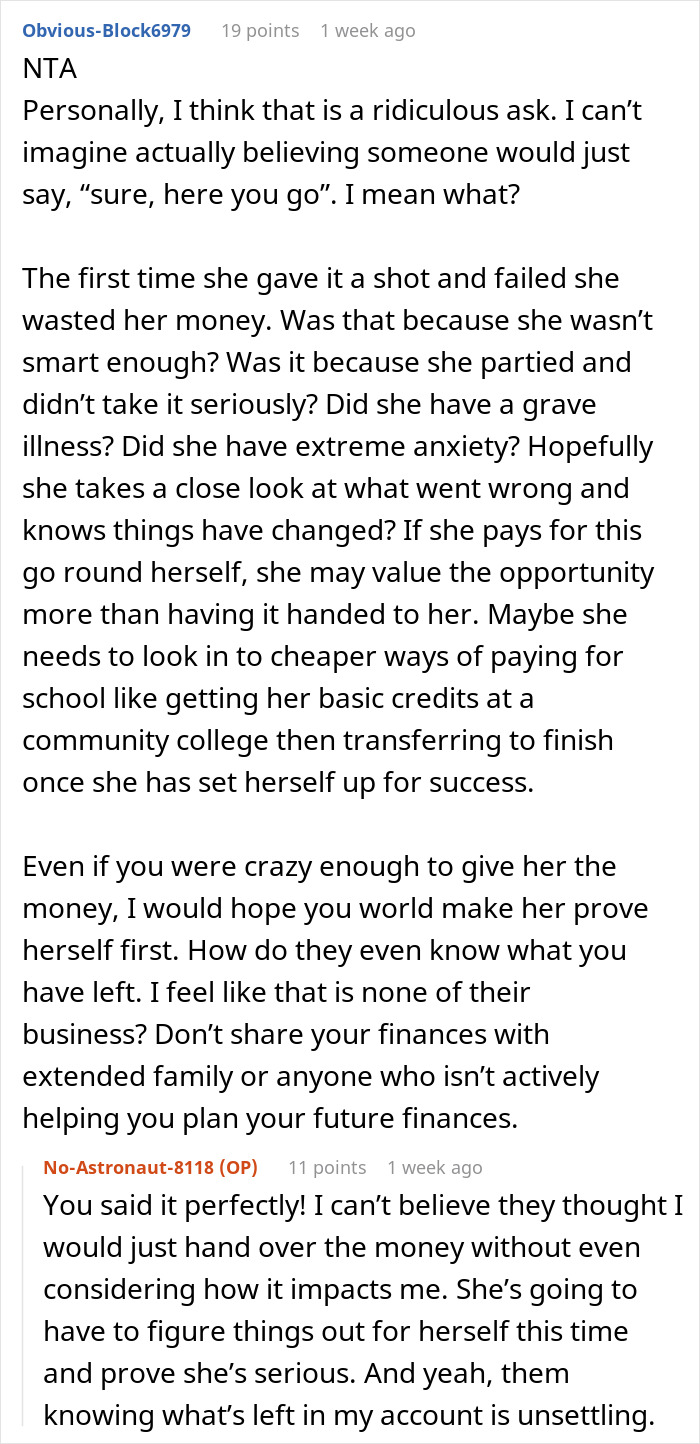

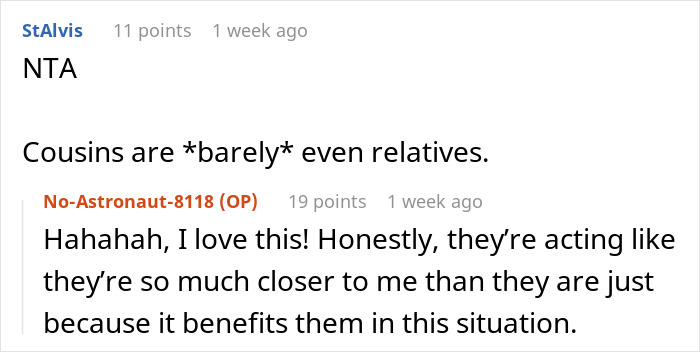

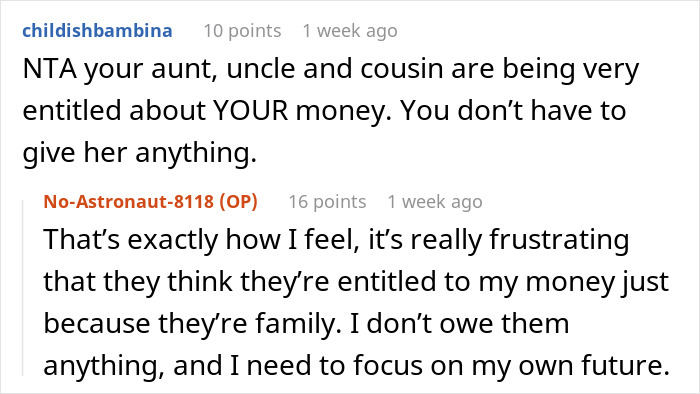

Fellow netizens didn’t think that the woman was a jerk for refusing to give money to her cousin

Poll Question

Thanks! Check out the results:

Explore more of these tags

I've always wondered about the whole "I need it more" argument. How does one even measure need?

Also "it's just sitting there", as though money in savings is useless because it's not being immediately spent. If OP was so rich that she couldn't spend all of her money in her lifetime, sure, then it's just sitting there. She clearly has a use for it, though.

Load More Replies...Funny how that "family supports family" trope only ever seems to work in one direction. I wonder how quickly Aunt and Uncle would offer to finance OP's second college attempt if the situation were reversed? (Actually, I don't wonder that--I know EXACTLY what the answer would be in that case.)

Exactly! OP would never see a cent. She would be wise to transfer every cent of her leftover college fund into a checking/savings account that no one but her can access. I wouldn't put it past those grifters to try and guilt-trip the parents into forking over the cash. But OP needs to brace herself; that toxic trio may attempt something illegal.

Load More Replies...I've always wondered about the whole "I need it more" argument. How does one even measure need?

Also "it's just sitting there", as though money in savings is useless because it's not being immediately spent. If OP was so rich that she couldn't spend all of her money in her lifetime, sure, then it's just sitting there. She clearly has a use for it, though.

Load More Replies...Funny how that "family supports family" trope only ever seems to work in one direction. I wonder how quickly Aunt and Uncle would offer to finance OP's second college attempt if the situation were reversed? (Actually, I don't wonder that--I know EXACTLY what the answer would be in that case.)

Exactly! OP would never see a cent. She would be wise to transfer every cent of her leftover college fund into a checking/savings account that no one but her can access. I wouldn't put it past those grifters to try and guilt-trip the parents into forking over the cash. But OP needs to brace herself; that toxic trio may attempt something illegal.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

38

40