“Am I A Jerk For Refusing To Loan My Boyfriend $5,000?”: Woman Defends Her Decision To Get Plastic Surgery Instead Of Giving Money To New BF

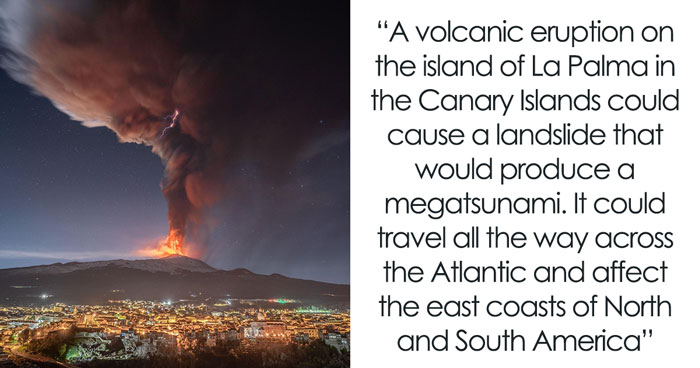

It can be comforting to have a partner or spouse to rely on when times get tough. Times of crisis or financial troubles always reinforce the old cliche that no person is an island. So helping a loved one with money should seem like a no-brainer. But life is often more complicated than that, as this story demonstrates.

A woman asked the internet if she was in the wrong for spending her own money on plastic surgery and not loaning it to her boyfriend. On the surface, maybe it sounds selfish, but they had been dating for less than four months and he wanted a whooping 5000$. Commenters sided with the woman and shared similar experiences with demands from supposed loved ones.

Money can be a touchy subject particularly when one partner has a lot more than the other

Image credits: Nicola Barts (not the actual photo)

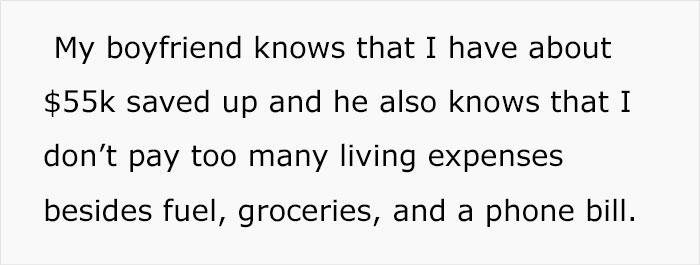

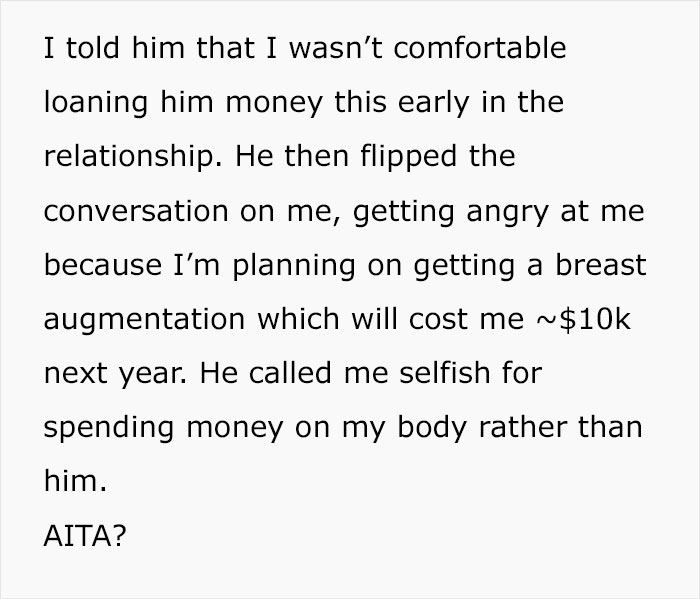

A woman wanted to know if she was wrong to spend her money on herself instead of loaning 5000$ to her new boyfriend

Image credits: Mikhail Nilov (not the actual photo)

Image source: throwaway6644227

Loaning money to people close to you is inadvisable, but quite common

Image credits: Karolina Grabowska (not the actual photo)

It’s pretty common to hear advice regarding lending money to friends and family. One can risk losing both the money and the relationship in one go. The issue can become more complex when there is a spouse or long-term partner involved. Unless you get a prenup, your husband or wife will have some rights to property and money regardless of who actually earned it. Many long-term couples see their finances similarly, spending money on both partners without always keeping track of who spent what and in what amounts. There is also a cultural question, as some groups see inter-familial loans or borrowing among friends as normal and considerably preferable to banks.

In fact, despite this often asserted warning against loaning to family or friends, these groups are the second most common line of credit in the US, UK, and Australia, after traditional banks. That being said, these loans generally didn’t exceed 400$ and the most common variants were under 100$. So the woman in the story was right to be wary of losing nearly ten times more to a person who she met only relatively recently. Even in high-income countries, like the US, UK, and Australia, less than 10% of loans to family members were over 2000$. Many respondents indicated that their emotional ties to the other person made them more likely to repay. A bank might not know that you are on vacation while in debt, but a family member would and might judge you accordingly.

Manipulative family members and partners might start to feel like they are entitled to your money

Even if they prefer to borrow money from friends and family, many said they would prefer to still use a bank in the future. They acknowledge that there is a moral hazard in loaning money since a family member might struggle to make another repay the funds. Banks are at least “fair,” with set repayment dates and pretty clear punishments for what happens if you can’t make them. People understood that there are risks of resentment, exploitation, and enablement when it comes to taking and giving money to family members. But in most of these cases, it’s at least family, who you tend to know for longer periods of time. A three-month-old relationship is about as financially trustworthy as a literal three-year-old.

The relational issue that often comes up in regard to money is entitlement. Greed has a way of clouding common sense, decency, and empathy, as a person begins to see their family member or partner as a sort of complex ATM that is standing in the way of “their” income. Setting aside that this was a relationship in its early stages, it’s not necessarily unacceptable to ask for a loan from your partner. As a student, getting it from a bank will either be impossible or so expensive so as to almost permanently tie the person down in debt. But this question must be asked with the expectation that the answer might be no. This is not a conditional no, OP was well within her rights to spend her own cash however she pleased. Her boyfriend’s reaction should be enough to warrant rethinking if he should remain her boyfriend at all.

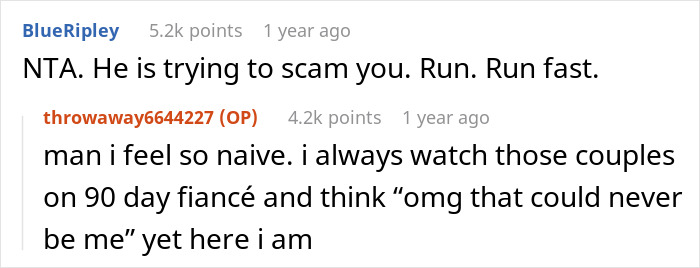

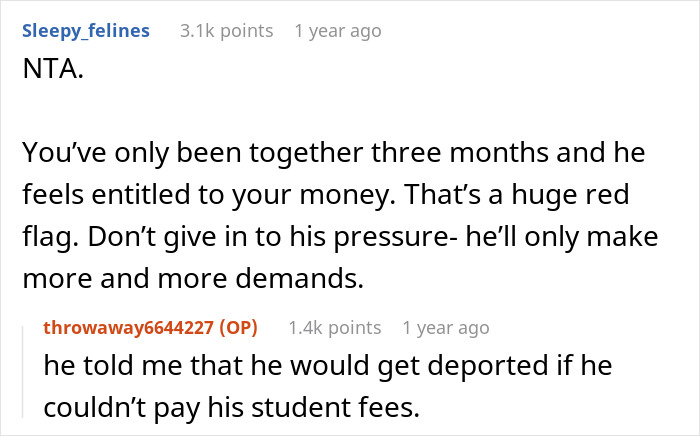

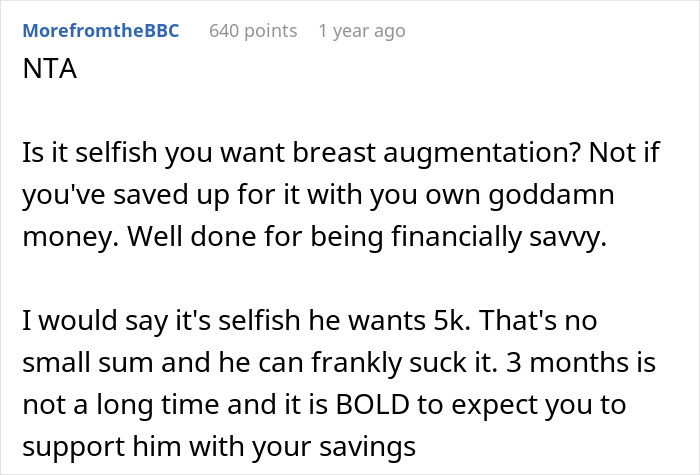

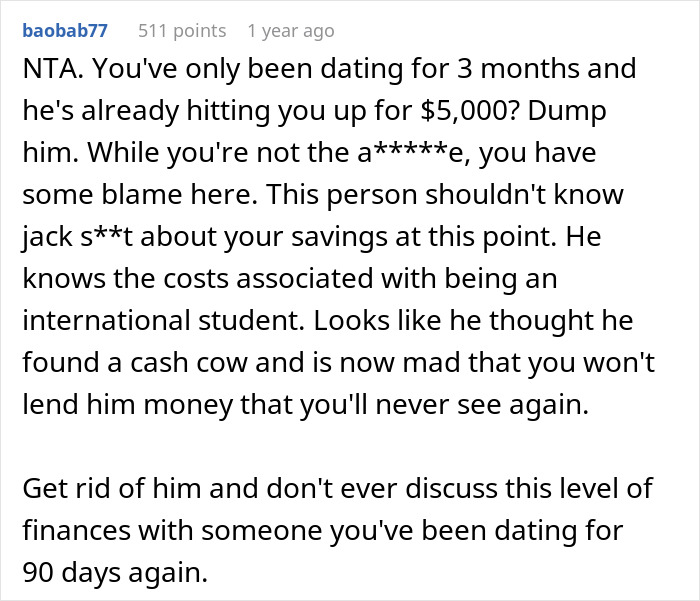

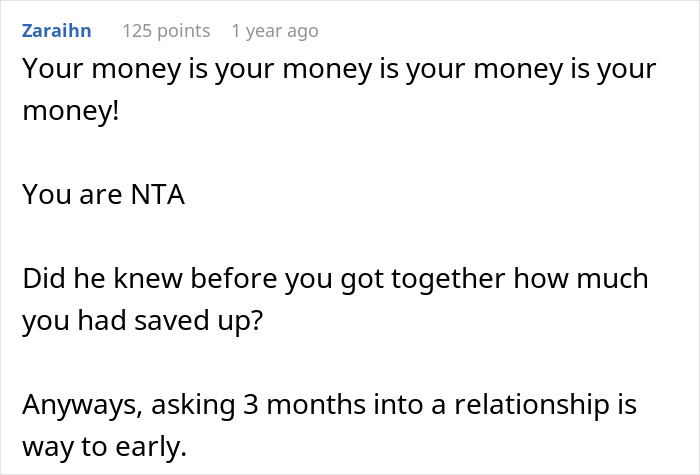

Many commenters sided with OP and warned her against partners who thought themselves entitled to her money

Some shared similar experiences with greedy partners and the risks involved

"It's so confusing, because he paid for everything at the start". Classic tactic to engender guilt when they start siphoning off you, its starts off small and then the stories and drama get wilder and the need for more financial help becomes more desperate aka: he claims he will be deported if he can't pay his student fees. He may not have "known" she had significant savings specifically but these types read between the lines really well. EG well paying job, low over heads, not a big spender = yeh cash savings are building up somewhere. Or a "feeler" like can you spot me $50. Then, s**t need $100 do you mind? If the reaction is low key and sure "here ya go" they get the idea real quick, been there done that, have the survivor scars for life.

You absolutely don't have to lend your money to anyone. Especially a person you know for 3 months. Especially if it's quite a big sum. Especially if he asks you for a big favor, but acts like you owe him something. Don't lend him any money and better dump him asap.

3 months in and he already asking for money? Jeez, what a scammer.

Asking for a lot of money. Three months would be the period I'd be willing to loan out much smaller amounts of money that I am willing and able to write off if it doesn't get paid back. If it doesn't get paid back without a very good reason I'm never loaning that person anything again. If I have to keep reminding them to pay back the loan before it gets paid back then I'm never loaning them money again even if after they pay me back. If they give me grief and are salty when paying back the money instead of being appreciative I'm never loaning them anything again. Most of these will move the person from friend to acquaintance that I tolerate in our friend group if I have to. More than likely we'll be done

Load More Replies...Please, OP, take the advice of all these people. We've been though it before, and know how it always ends up.

I’d love to know the follow up with these, the last few have been more than a year old!

I'm assuming from that one reply where the OP mentions that she always judges people on 90 day fiancee and now almost fell for it herself that she wizened up. Hopefully.

Load More Replies...Big NTA. For a bf of 3 months? Hell no lmao $5,000 is a lot of money. Amazing she’s been able to save up $55K. Getchu those boobies girl and enjoy them 🧡

Even asking for 500$ would be too much. Also, did he pile up that amount of debt in three months? Even it wasn't a scam, he would be horribly irresponsible and she wouldn't want spend the rest of her life with someone like that.

I wouldn't be surprised if he was working to get off his student visa for something more permanent

"It's so confusing, because he paid for everything at the start". Classic tactic to engender guilt when they start siphoning off you, its starts off small and then the stories and drama get wilder and the need for more financial help becomes more desperate aka: he claims he will be deported if he can't pay his student fees. He may not have "known" she had significant savings specifically but these types read between the lines really well. EG well paying job, low over heads, not a big spender = yeh cash savings are building up somewhere. Or a "feeler" like can you spot me $50. Then, s**t need $100 do you mind? If the reaction is low key and sure "here ya go" they get the idea real quick, been there done that, have the survivor scars for life.

You absolutely don't have to lend your money to anyone. Especially a person you know for 3 months. Especially if it's quite a big sum. Especially if he asks you for a big favor, but acts like you owe him something. Don't lend him any money and better dump him asap.

3 months in and he already asking for money? Jeez, what a scammer.

Asking for a lot of money. Three months would be the period I'd be willing to loan out much smaller amounts of money that I am willing and able to write off if it doesn't get paid back. If it doesn't get paid back without a very good reason I'm never loaning that person anything again. If I have to keep reminding them to pay back the loan before it gets paid back then I'm never loaning them money again even if after they pay me back. If they give me grief and are salty when paying back the money instead of being appreciative I'm never loaning them anything again. Most of these will move the person from friend to acquaintance that I tolerate in our friend group if I have to. More than likely we'll be done

Load More Replies...Please, OP, take the advice of all these people. We've been though it before, and know how it always ends up.

I’d love to know the follow up with these, the last few have been more than a year old!

I'm assuming from that one reply where the OP mentions that she always judges people on 90 day fiancee and now almost fell for it herself that she wizened up. Hopefully.

Load More Replies...Big NTA. For a bf of 3 months? Hell no lmao $5,000 is a lot of money. Amazing she’s been able to save up $55K. Getchu those boobies girl and enjoy them 🧡

Even asking for 500$ would be too much. Also, did he pile up that amount of debt in three months? Even it wasn't a scam, he would be horribly irresponsible and she wouldn't want spend the rest of her life with someone like that.

I wouldn't be surprised if he was working to get off his student visa for something more permanent

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

72

35