“Am I The Jerk For Telling My Boyfriend He Isn’t Entitled To My Inheritance?”

In most partnerships, money is one of the stickiest subjects. Who makes what, how to split the bills, and is there a way to have more?

But as this story shows, answering some of these tough questions can actually increase tensions within the relationship, not reduce it.

After her grandfather passed away, Reddit user throw_709236 inherited a significant amount of money from his estate. She took the opportunity to quit a job that made her miserable and pursue the passions that gave her the most joy.

The situation, however, got more complicated because the woman’s boyfriend, who she was living with, expressed that he would like her to step up with their bills and use some of her wealth to cover their rent.

After refusing, the woman started having second thoughts and turned to the platform’s “Am I the [Jerk]?” community for advice.

This woman’s life was turned upside down after she inherited a big portion of her grandpa’s estate

Image credits: Ketut Subiyanto (not the actual photo)

But her boyfriend thought she also needed to step up with their bills

Image credits: cottonbro (not the actual photo)

It’s not exactly obvious what the right course of action for this couple is. Experts at the National Bank of Canada, for instance, say that the 50/50 split works when both people are making more or less the same. But if there is a significant salary gap between them, the distribution of expenses is more balanced if each contributes proportionally to their income.

The equation is really simple: all you have to do is calculate what percentage of total household income is earned by each person and then apply this percentage to the total monthly budget.

Let’s take this hypothetical situation as an example: one of the spouses earns $75,000 per year and the other $25,000. The monthly household budget is $5,000. How do they allocate the expenses? The spouse who earns $75,000 transfers $3,750 to the joint account (or 75% of $5,000) and the other transfers the remaining $1,250 (25% of $5,000). Thus, each partner is contributing to shared expenses in relation to their financial capacity.

But since this is an inheritance and the woman is no longer working, determining her yearly base can be a bit trickier.

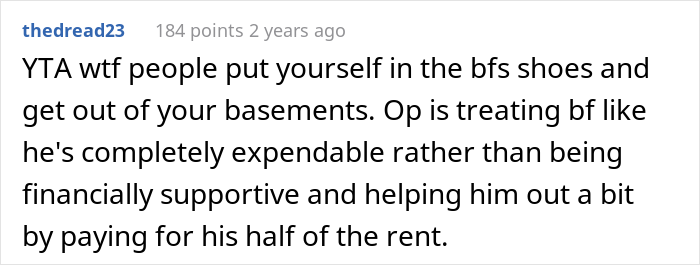

People’s opinions were split; one group sided with the woman

When you’re in a committed relationship, these things are important. 48% of Americans who are married or living with a partner say they argue with the person over money, according to a survey by The Cashlorette. Most of those fights are about spending habits: 60% said that one person spends too much or the other is too cheap.

Such conflicts can have serious consequences. In many cases, they are the number one predictor of whether or not you’ll end up divorced, according to a study of more than 4,500 couples. “Financial disagreements did predict divorce more strongly than other common problem areas like disagreements over household tasks or spending time together,” the people behind the research concluded.

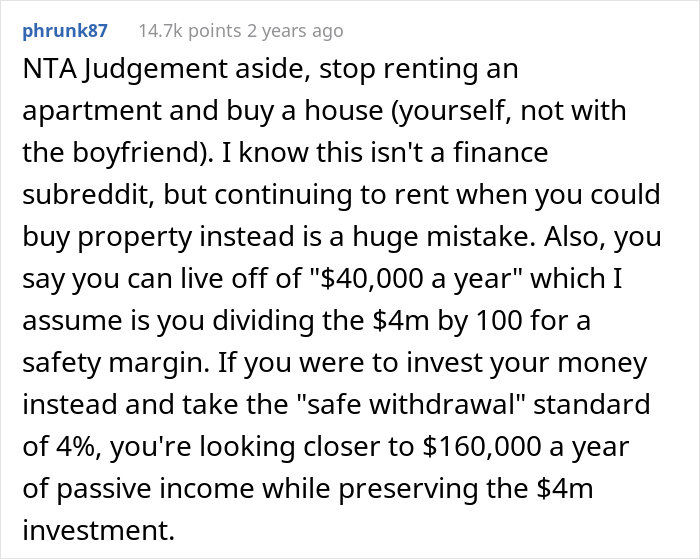

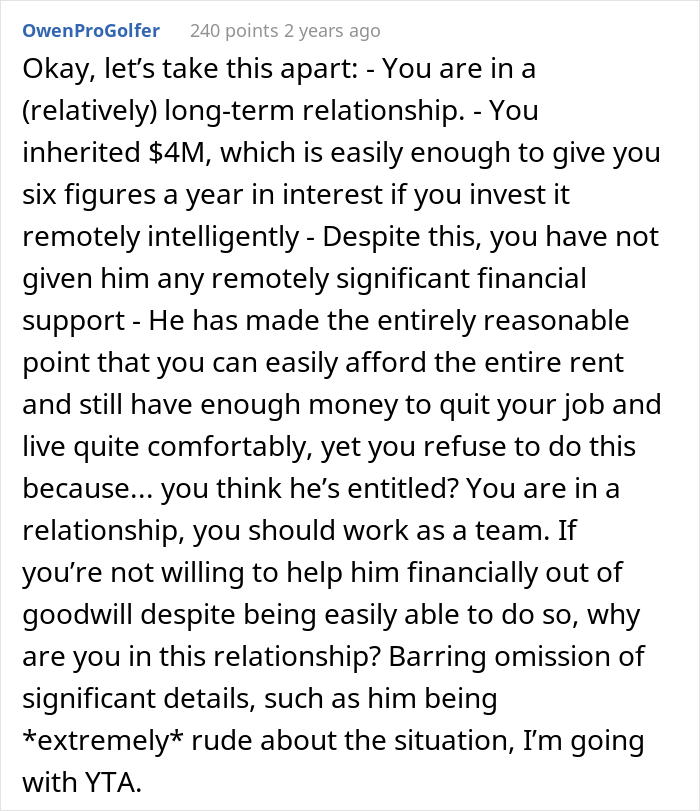

While another believed she was in the wrong

What often makes matters even worse, according to data from a 2021 study of 1,713 couples conducted by Fidelity, is that roughly 40% of people in a serious relationship don’t know how much their partner makes.

These results came despite 71% of respondents saying they communicate “very well” with their significant other, and 25% saying they communicate about money “exceptionally well.”

Many couples are simply too hesitant to have full, honest discussions about money. “Life is busy and people don’t necessarily take the time to talk about their finances,” Stacey Watson, senior vice president of Life Event Planning at Fidelity, told CNBC Make It. “Money can be an uncomfortable topic.”

Yes, you can ask random strangers on the internet for advice, but they don’t have the full picture as you do. Instead of running away from making an important decision, it’s probably best to stop treating Reddit like a Magic 8 Ball and sit down with your partner for a one-on-one instead.

When it comes to couples’ finances, there’s no one answer for everyone. As corny as it sounds, you have to find what works for you.

There were also some who thought that the couple were both being unreasonable

To help pave the road to better marital finances and relationships, experts at Investopedia put together some of the most common issues and challenges to look out for:

1. What’s Mine, Yours, Ours. Sometimes, when each spouse works and they can’t agree on financial nuances or find the time to talk about them, they decide to split the bills down the middle or allocate them in some other fair and equitable manner. When the bills have been covered, each spouse can spend what they have left as they want. It sounds like a reasonable plan, but it can build resentment over the individual purchases made. It also divides spending power, eliminating much of the financial value of marriage, as well as the ability to plan for long-term goals such as buying a home or securing retirement. Plus, it can lead to relationship-ruining behavior like financial infidelity, wherein one spouse hides money from the other.

Bill splitting also pushes down the road any planning and consensus-building about how financial burdens will be handled if one spouse loses a job; decides to cut back on hours or take a pay cut to try out a new career; leaves the workforce to raise children, go back to school, or care for a parent; or if there’s any other situation in which one partner may have to financially support the other. Couples owe it to themselves to have a conversation about such contingencies well before any of them happen.

2. Debt. From school and car loans to credit cards and even gambling habits, most people come to the altar with financial baggage. If one partner has more debt than the other—or if one partner is debt-free—the sparks can start to fly when discussions about income, spending, and debt servicing come up.

People in such situations may take some solace in knowing that debts brought into a marriage stay with the person who incurred them and are not extended to a spouse. It won’t hurt your credit rating, which is linked to Social Security numbers and tracked individually. That said, in most states (those that operate under what is called common law), debts incurred after marriage jointly are owed by both spouses.

Note that there are nine states in which all property (and debts) are shared after marriage regardless of individual or joint account status. They are Arizona, California, Nevada, Idaho, Washington, New Mexico, Texas, Louisiana, and Wisconsin. In these community-property states, you are not liable for most of your spouse’s debt that was incurred before marriage, but any debt incurred after the wedding is automatically shared—even when applied for individually.

3. Personality. Personality can play a big role in discussions and habits about money. Even if both partners are debt-free, the age-old conflict between spenders and savers can play out in multiple ways. It is important to know what your money personality is—as well as that of your partner—and to discuss these differences openly.

Briefly, some people are natural savers who may be viewed as cheapskates and risk-averse, some are big spenders and like to make a statement, and others take pleasure in shopping and buying. Others rack up debt—often mindlessly—while some are natural investors who delay satisfaction for future self-sufficiency. Many of us may display more than one of these characteristics at a given time, but will usually revert to one main type. Whichever profile you and your spouse most closely fit, it’s best to recognize bad habits, address them, and moderate them.

4. Power Plays. Power plays often occur in the following scenarios:

- One partner has a paid job and the other does not;

- Both partners would like to be working but one is unemployed;

- One spouse earns considerably more than the other;

- One partner comes from a family that has money and the other doesn’t.

When one or more of these situations is present, the money earner (or the one who makes or has the most money) often wants to dictate the couple’s spending priorities. Although there may be some rationale behind this idea, it is still important that both partners cooperate as a team. Keep in mind that while a joint account offers greater transparency and access, it is not in itself a solution to an unbalanced power/money dynamic in a marriage.

5. Children. To have or not to have? That’s usually the first question. Food, clothing, shelter, Little League, ballet, designer jeans, prom gowns, minivans, and college are all part of a long list of child-related expenses. These don’t include expenses for offspring who have already left the nest. That’s assuming your kids will leave the nest. Some never do.

Of course, having kids isn’t just about the cost. If one partner cuts their hours, works from home, or leaves a career to raise children, couples should address how that changes marriage dynamics, assumptions about retirement, lifestyle, and more.

6. Extended Family. Co-managing finances and respecting the goals, needs, and expectations each spouse has regarding their extended family can be especially tricky.

Take, for example, her mom—she wants a vacation in Vegas. His parents need a new car. Her brother can’t make the rent. His sister’s husband lost his job. Now one spouse is writing a check and the other wants to know why that money wasn’t used to address needs at home or fund a vacation for “us.” When a serious crisis arises—illness, a major storm, an unexpected death—the pressure can be magnified.

Family money dynamics work the other way, too. His mom will pay to fly him home for the holidays. Her mom will fund a new car because the one she’s driving is a Honda, not a Lexus. Her mom buys the grandkids extravagant gifts and his mom can’t afford to match that kind of spending. The joys of a family often extend right into your wallet (pardon the sarcasm).

Of course, it’s impossible for two people to agree on every single thing. But by talking to each other, they can at least set boundaries, compromise, and find a lesser evil than falling apart.

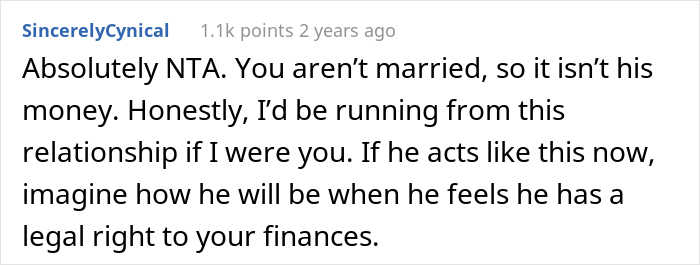

And a few who said that no one is to blame and it’s upto the couple to work things out

233Kviews

Share on FacebookExplore more of these tags

NTA, and I seriously have no idea why everyone is saying YTA??? She inherited money from her grandfather passing. That money is hers, and has nothing to do with her boyfriend.. She’s paying her half of the rent. His half is his problem. Also a year is still a fairly new relationship, and they could absolutely break up. Then what if she gets into another year long relationship? Should she pay their half of the rent, too. She shouldn’t have even told him the full amount. Then again, now she knows that he feels entitled to her money!

I agree with you. They're not married, and their relationship is still new. I've had relationships that were 5 years long and ended badly. And I've helped out partners when I've had more money than they did, and I've always gotten screwed for it (never paid back). She has an opportunity to seriously improve her life and the lives of any children she might have in the future, which might not be with this partner. Also, the fact that he asked bothers me. What's next? "I need a new car. Let's go on this expensive vacation. I've always wanted a Rolex."

Load More Replies...Wow, bunch of money grubbers on the YTA bandwagon. If SHE decided to pay his bills/rent/whatever, that's one thing. If HE is pressuring her to do so, that's something entirely different. She's definetly NTA

Yeah they would be the type to say she's a gold digger if the roles were reversed.

Load More Replies...With that kind of money, I agree with another post from above; buy a home.

That actually depends on whether she wants to stay in one location or not. With the amount of money she inherited, she can easily afford to "travel the world", so to speak, if she invests wisely. One of the commentators was right, with just 4% return and never touching the main capital, she is guaranteed $160K/year for life, so she doesn't have to tie herself to a particular place unless she wants to.

Load More Replies...NTA, and I seriously have no idea why everyone is saying YTA??? She inherited money from her grandfather passing. That money is hers, and has nothing to do with her boyfriend.. She’s paying her half of the rent. His half is his problem. Also a year is still a fairly new relationship, and they could absolutely break up. Then what if she gets into another year long relationship? Should she pay their half of the rent, too. She shouldn’t have even told him the full amount. Then again, now she knows that he feels entitled to her money!

I agree with you. They're not married, and their relationship is still new. I've had relationships that were 5 years long and ended badly. And I've helped out partners when I've had more money than they did, and I've always gotten screwed for it (never paid back). She has an opportunity to seriously improve her life and the lives of any children she might have in the future, which might not be with this partner. Also, the fact that he asked bothers me. What's next? "I need a new car. Let's go on this expensive vacation. I've always wanted a Rolex."

Load More Replies...Wow, bunch of money grubbers on the YTA bandwagon. If SHE decided to pay his bills/rent/whatever, that's one thing. If HE is pressuring her to do so, that's something entirely different. She's definetly NTA

Yeah they would be the type to say she's a gold digger if the roles were reversed.

Load More Replies...With that kind of money, I agree with another post from above; buy a home.

That actually depends on whether she wants to stay in one location or not. With the amount of money she inherited, she can easily afford to "travel the world", so to speak, if she invests wisely. One of the commentators was right, with just 4% return and never touching the main capital, she is guaranteed $160K/year for life, so she doesn't have to tie herself to a particular place unless she wants to.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

90

106