“It’s Been My Lifesaver”: Woman Shares She Paid Off $19k In Debt With Her ‘No-Buy’ Method

Interview With AuthorAs 2023 is nearing its end, many people are rushing to make their resolutions for 2024. Some decide to finally make use of that gym membership, others take up a new hobby, like knitting. There’s also a chance to get your finances in order. Starting from the new year, people make a budget and resolve to stick to it for the entire year.

One woman successfully did it in 2023. She decided to make 2023 a no-buy year. TikToker vomitgrocery, aka Angela Szot, shared her no-buy journey online. Angela monitored her finances throughout the year and was able to pay off $19k in debt on a baker’s salary of $45k. To help others do the same, she shared her methods in a couple of videos. Check them out below.

Bored Panda reached out to Angela and she was kind enough to have a short chat with us about the feedback she received from others on TikTok. We also asked her if she’s planning to continue her no-buy streak for 2024. Read our conversation below!

Many people struggle to come up with effective methods on how to get out of financial debt

Image credits: Pixabay (not the actual photo)

This woman challenged herself to a ‘no-buy’ year to pay off debt

Image credits: vomitgrocery

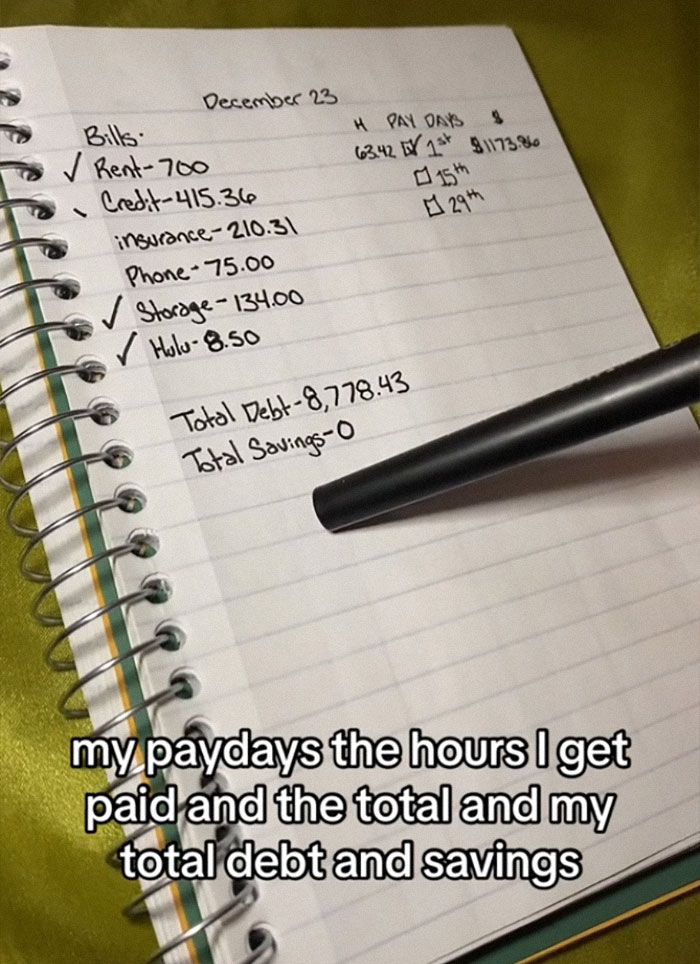

“Hi, my name is Angela and I have been on a debt-free “no-buy year” journey all of 2023 and I’ve paid off a little over $19,000 in debt. And this is my exact method.

I am not a smart finance girlie. I do not know how to use spreadsheets. I got this $2 notebook from Walmart. And it’s been my lifesaver.”

Image credits: vomitgrocery

“I dedicate three pages to a month. So the first page is just all of my bills, my pay days, the hours I get paid and the total and my total debt and savings. Any time I pay off something, I give it a checkmark. And that’s perfect.”

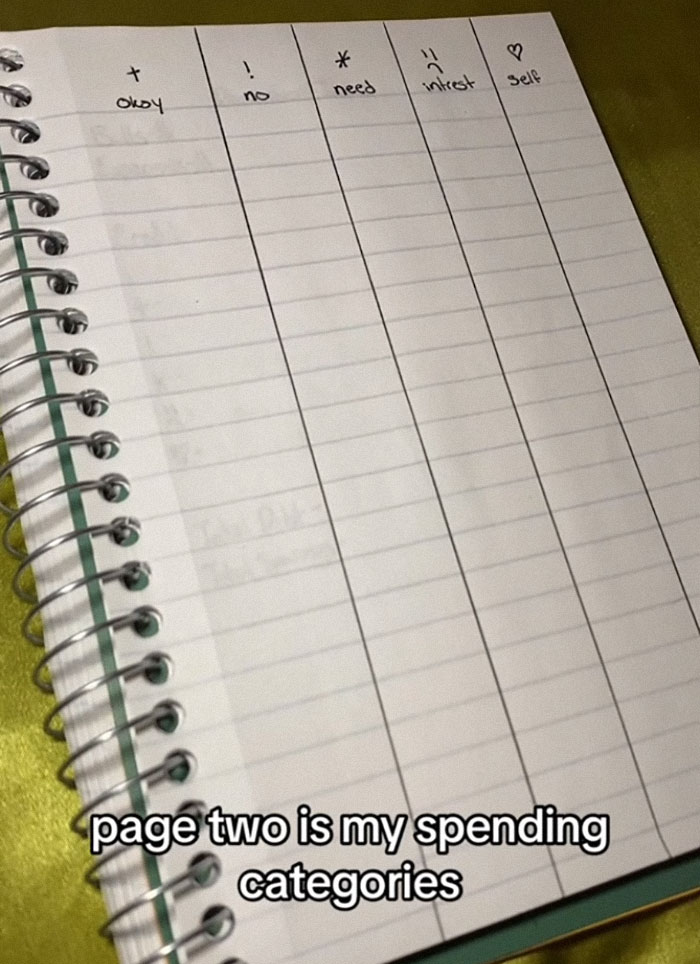

Image credits: vomitgrocery

“Page two is my spending categories. And you can make up whatever categories you want. But anytime I make a purchase, I write down what the total was. And I just put it into whatever category I think it fits in.”

Image credits: vomitgrocery

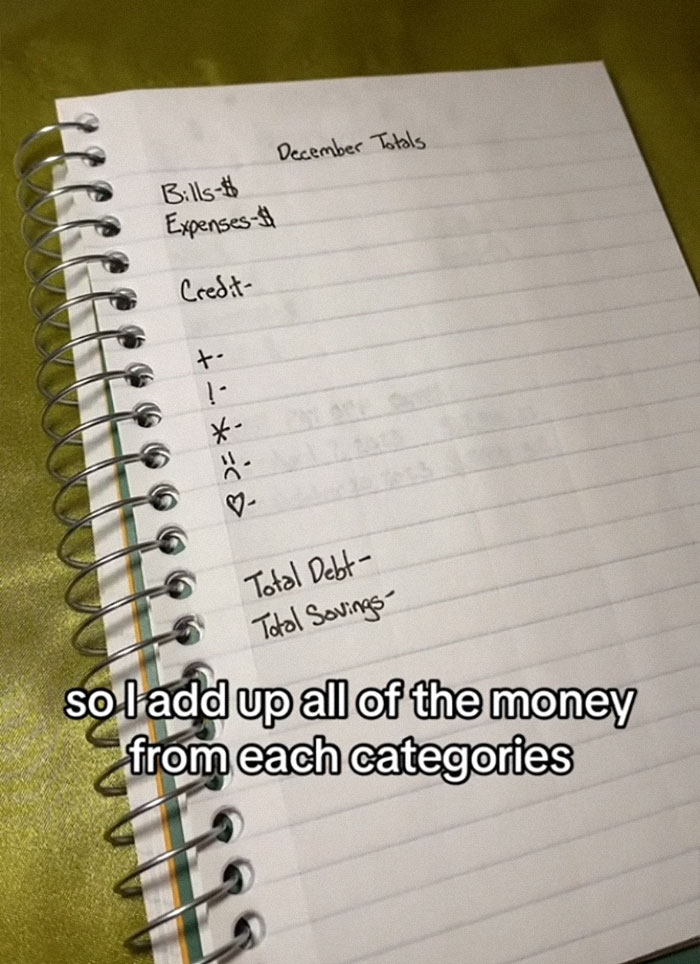

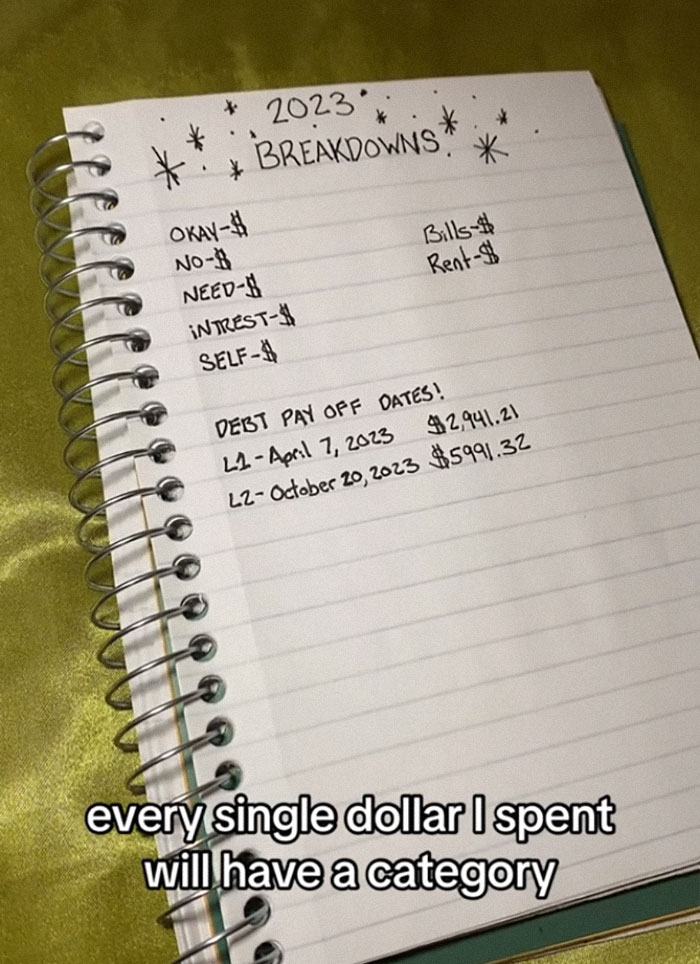

“For the third page, it’s just the end-of-the-month total. So I add up all of the money from each category and put them into their finals page. And that’s the whole month.”

Image credits: vomitgrocery

“And so at the end of December, I will be able to find out all the money I spent on every single category I put it into. Every single dollar I spent will have a category. I can’t wait.”

Image credits: vomitgrocery

Over 300K people viewed Angela’s video on TikTok

@vomitgrocery Replying to @Ana Hartnett Reichardt Author I’m just a girl😫😩 #debtpayoff#debtpayoffjourney#justagirl#creditcarddebt#justagirlintheworld#mymethod♬ original sound – Angela Szot

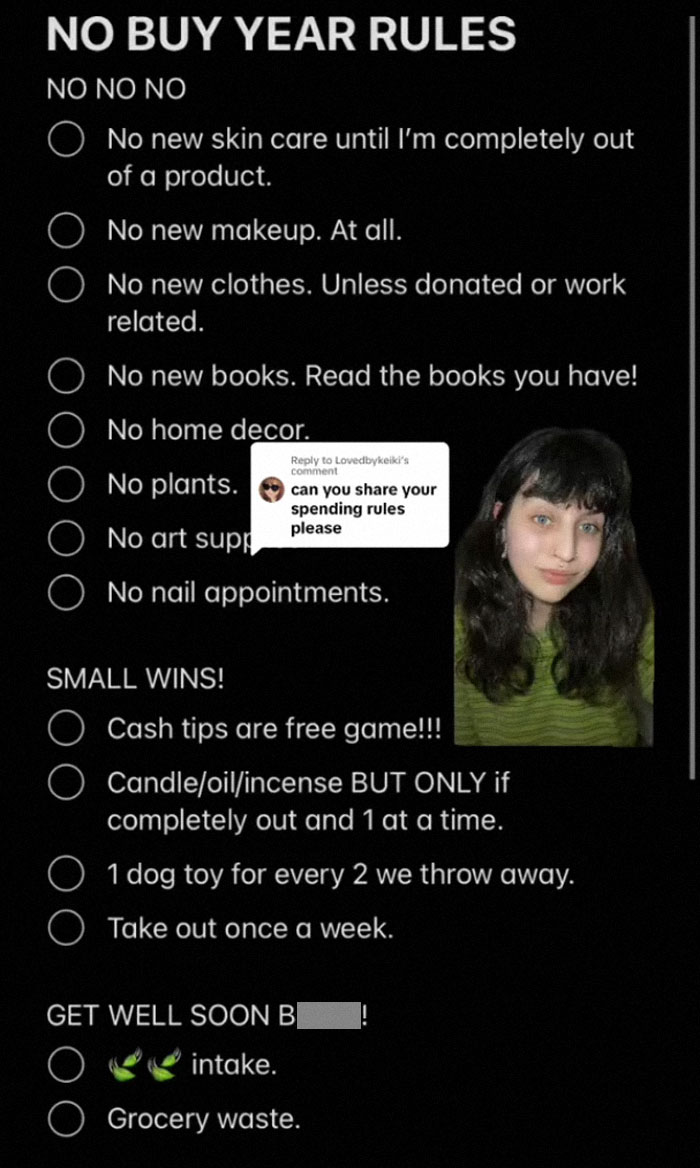

The TikToker later shared the rules she set for herself during the no-buy year

Image credits: vomitgrocery

@vomitgrocery Replying to @Lovedbykeiki #greenscreen RULES AND REGULATIONS #nobuyyear#nobuyyearrules#debtfreejourney#creditcarddebt#debtpayoff♬ original sound – Angela Szot

The young woman told Bored Panda she plans to continue her no-buy streak into 2024, but with a twist

This video is the most popular one on Angela’s account. Bored Panda asked her what the reactions from people have been like. “The feedback has been almost nothing but absolute kindness!” Angela says. “Strangers are leaving the most sincere comments I’ve ever read and it’s not lost on me one bit!”

The creator says she wanted to celebrate her victory with others. “I only have a handful of people in my life to share my wins from this journey with,” the woman says. “And I was so proud of myself [that] I decided to make a video about it to treasure this time.”

However, the positive reaction surprised her. “I had no idea so many others would connect and want to follow along for my journey.” She got reactions from people who aren’t even in debt and got inspired to start their own journey just because they found her relatable.

“I’m a baker who works about 40 hours a week and makes just under $45k a year. To be honest, all this feedback at once is quite overwhelming,” Angela admits. She says that making videos so late into the journey is perhaps even more impactful. “People are going to know that this method can work because I’m living proof.”

The woman shares a milestone with us: “In late February or early March, I will be completely debt-free!” Angela gushes. “My 2024 plan is to do what I’m going to call a ‘Low Buy-No Buy’ and it’s going to be a year of focusing on self-care and self-love.”

Angela says she’ll tweak her method a little bit for the new year. “My no-buy rules will stay the same and I will build in my new “self-love” rules around them. My overall goal is to buy my dream home in 2025,” the creator shares.

The woman has a positive message for those who might still be in doubt about trying out the ‘no-buy’ method. “Making sacrifices and staying dedicated is not easy and the gratification won’t be instantaneous. But I promise you your mindset shifts and the gratification will become everything to you,” Angela is positive.

Image credits: Lukas (not the actual photo)

The woman says she was looking for ways to change her wasteful spending habits

Angela also previously spoke with Buzzfeed and told them why she decided to share her no-buy year journey. She started noticing her spending habits and realized she wanted something to change.

“I was noticing that I was getting cranky and annoyed with myself about the same things over and over,” the woman said. She then named some of the things that frustrated her: “Food waste, buying art supplies and never touching them once I got home, my plants constantly dying and me retrying.”

“I was sick of myself, and it was time to do something about it,” the woman said. And she certainly did. Angela monitored her spending for a whole year and was able to pay off $19k in debt. I, for one, envy her the willpower and the self-control not to buy new books and pretty candles on random occasions.

Admittedly, Angela told Buzzfeed that this was the most challenging part of her year. “The hardest part of this challenge for me is not buying trinkets and home decor. I’m a homebody, and adding new elements and pieces to my space brought me a lot of serotonin,” the creator said.

Angela also had some advice for people who she might inspire to try something similar. “Make realistic achievable goals and come up with your plan,” the woman said in an interview with Buzzfeed. “Write all of your rules down, make your final purchases that will help you stay true and on track, and then start immediately. But remember that gratification isn’t always instant,” she also added.

Image credits: picjumbo.com (not the actual photo)

Doing a no-buy year can help change your spending habits

Doing a no-buy year is not a breaking new idea. Some personal finance and minimalist living bloggers have shared their experiences with the challenge before. For those who are considering doing it, here is some more advice and opinions from the people who have tried it.

People can tweak their rules and shift some items from the ‘no’ list to the ‘yes’ list. The Happy Philosopher, for example, decided that eating at restaurants, streaming service subscriptions and a few other areas are okay. Aimee Rebecca chose to limit some purchases instead of getting rid of them completely. These included beauty products, takeout and alcohol.

Another participant, Ryan from the Tiny Life blog, found a way to still read tons of books without buying them. He either downloaded audiobooks on his phone or used the library to check out physical ones.

Former fashion designer and Danish YouTuber Signe says her no-buy challenge changed into a low-buy challenge. She couldn’t commit to a strictly no-buy plan because her body was changing considerably after her pregnancy. Therefore, she found that she had to buy at least 2 pieces of clothing each month.

However, most of the people that have shared their journeys online agree on one thing – a no-buy year can significantly change the way you spend your money. People start prioritizing repairing their houses, furniture, and clothing. When the next Black Friday comes around, they find themselves not wanting anything that’s advertised to them.

Image credits: David Gomes (not the actual photo)

People in the comments praised Angela for her simple but effective method

Poll Question

Thanks! Check out the results:

"Woman Pays Off $19K Debt On A $45K Salary, Shares The Simple Method She Used"" yes just pay the money. this lady makes more than she has in debt. it's fairly simple. Now try doing in with a minimum wage job. Not so easy now, is it?

No nails, no kew clothes etc starting to sound like avocado sandwich trope. I wouldnt be able to use her list at all since I already dont buy skincare, do nails, buy kew clothes etc. But I guess effective on those who has had money to spend on such but want to use money on something else.

You were downvoted for this, not sure why. But yes, cutting back in unnecessary expenditure to remove debts caused by excessive spending is not much use if you don't have anything to cut back on.

Load More Replies..."Woman Pays Off $19K Debt On A $45K Salary, Shares The Simple Method She Used"" yes just pay the money. this lady makes more than she has in debt. it's fairly simple. Now try doing in with a minimum wage job. Not so easy now, is it?

No nails, no kew clothes etc starting to sound like avocado sandwich trope. I wouldnt be able to use her list at all since I already dont buy skincare, do nails, buy kew clothes etc. But I guess effective on those who has had money to spend on such but want to use money on something else.

You were downvoted for this, not sure why. But yes, cutting back in unnecessary expenditure to remove debts caused by excessive spending is not much use if you don't have anything to cut back on.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

-10

12