‘He Insisted I Pay’: Husband Loses It When Wife Only Pays For Her Own Meal After Big Family Celebratory Dinner That He Organized

Long-term relationships are hard. It can be really difficult to live with someone day in, day out. If you don’t want your bond to disintegrate, the both of you have to cooperate, negotiate, communicate, and connect every single day. Add a kid or two into the mix and things get even more interesting.

Studies show that aside from sex, money is the next big thing married couples fight about. And sadly, Reddit user Valley-Mountains3453 has just got a taste of it.

Even though she and her husband were clear on keeping their finances separate, a big fight broke out between the two after the woman refused to pay for her partner’s and his family’s bills at a restaurant.

What you want to spend money on (and when) reveals critical things about your values and priorities, so a conflict like this doesn’t sound too crazy. If you’ve just started dating. But Valley-Mountains3453 thought she and her husband were past that.

After they couldn’t work it out, she turned to the “Am I the A***ole?” community, asking them for an outsider’s opinion on what had happened.

A couple who lived with separate finances for years have just had a huge fight over a restaurant bill

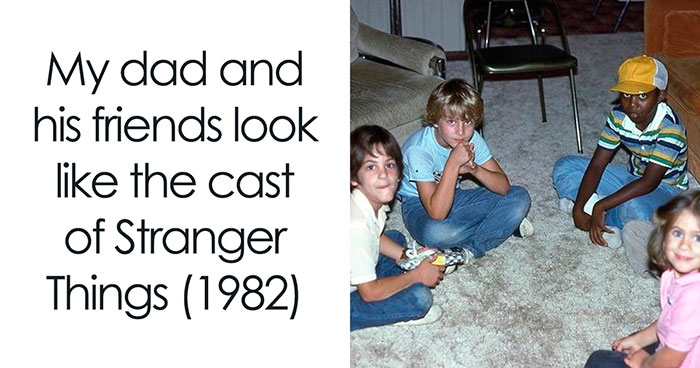

Image credits: Davey Gravy (not the actual photo)

And it looks like they aren’t resolving the issue any time soon

According to data from a 2021 study of 1,713 couples conducted by Fidelity, roughly 40% of couples who live together don’t know how much their partner makes.

These results came despite 71% of respondents saying they communicate “very well” with their other half, and 25% saying they communicate about money “exceptionally well.”

So it seems that many couples are hesitant to have full, honest discussions about money. “Life is busy and people don’t necessarily take the time to talk about their finances,” Stacey Watson, senior vice president of Life Event Planning at Fidelity, told CNBC Make It. “Money can be an uncomfortable topic.”

And it is to many. 44% of participants reported that they argue about money with their spouse occasionally, while 20% said money is actually their biggest relationship challenge.

According to Shannon McLay, founder and CEO of The Financial Gym, shame is often the factor that keeps people from being forthcoming with their partner, whether it be about how much money they make or the amount of debt they have.

“People are more comfortable getting physically naked with somebody than financially naked,” McLay noted. “We’ve seen couples who have been married for years, who have children, and don’t know about each [other’s finances].” If that is the case, it’s usually just a matter of time before they end up in a similar situation.

Experts at the National Bank of Canada agree. The 50/50 split works when both people are making more or less the same. But if there is a significant salary gap between them, the distribution of expenses is more balanced if each contributes proportionally to their income.

The equation is really simple too: all you have to do is calculate what percentage of total household income is earned by each person and then apply this percentage to the total monthly budget.

Let’s take this hypothetical situation as an example: one of the spouses earns $75,000 per year and the other $25,000. The monthly household budget is $5,000. How do they allocate the expenses? The spouse who earns $75,000 transfers $3,750 to the joint account (or 75% of $5,000) and the other transfers the remaining $1,250 (25% of $5,000). Thus, each partner is contributing to shared expenses in relation to their financial capacity.

There are many different kinds of conversations couples can have about money, but many limit themselves to only discussing basic financial decisions like how much they spend on vacations or their children’s education. But it’s all about context. The bigger picture.

“There’s a difference between making financial purchase decisions and sharing financial details,” McLay highlighted. “It’s great that you can have those conversations about purchases, but if you don’t know the digits, then you’re making decisions from a flawed perspective.”

As a starting point, McLay recommends that couples talk about their respective salaries, savings, credit scores, investments, and debt. She believes it’s crucial for couples to share information because it could be a major factor in larger decisions, such as taking out a loan or, like in our story, buying a house.

People thought the husband was out of his depth

Anyone can write on Bored Panda. Start writing!

Follow Bored Panda on Google News!

Follow us on Flipboard.com/@boredpanda!

Rokas is a writer at Bored Panda with a BA in Communication. After working for a sculptor, he fell in love with visual storytelling and enjoys covering everything from TV shows (any Sopranos fans out there?) to photography. Throughout his years in Bored Panda, over 300 million people have read the posts he's written, which is probably more than he could count to.

Read less »

Rokas Laurinavičius

Writer, BoredPanda staff

Rokas is a writer at Bored Panda with a BA in Communication. After working for a sculptor, he fell in love with visual storytelling and enjoys covering everything from TV shows (any Sopranos fans out there?) to photography. Throughout his years in Bored Panda, over 300 million people have read the posts he's written, which is probably more than he could count to.

Read more »

I'm a Visual Editor at Bored Panda since 2017. I've searched through a multitude of images to create over 2000 diverse posts on a wide range of topics. I love memes, funny, and cute stuff, but I'm also into social issues topics. Despite my background in communication, my heart belongs to visual media, especially photography. When I'm not at my desk, you're likely to find me in the streets with my camera, checking out cool exhibitions, watching a movie at the cinema or just chilling with a coffee in a cozy place

Read less »

Ilona Baliūnaitė

Author, BoredPanda staff

I'm a Visual Editor at Bored Panda since 2017. I've searched through a multitude of images to create over 2000 diverse posts on a wide range of topics. I love memes, funny, and cute stuff, but I'm also into social issues topics. Despite my background in communication, my heart belongs to visual media, especially photography. When I'm not at my desk, you're likely to find me in the streets with my camera, checking out cool exhibitions, watching a movie at the cinema or just chilling with a coffee in a cozy place

And here I always thought that it was the role of the person making the invitation to pay. If I invite you to a meal I'm going to pay for it, if you invite me then you're going to pay for it. The exceptions are discussed ahead of time because we're adults capable of talking to one another.

You, that's how I was raised. Yet I've been leiving in San Antonio, TX for the planned 20 years and I've learnt to tell people who invite me out, "oh I can't make it, I do not have enough funds to.attend", because in more than one occasion that I've been invited to a gathering and believed I was covered for my meal, it turned out I wasn't. Not sure if it's a Texas thing or what... very strange.

Hi from San Antonio!!!! Your way seems to work well. If only more people just asked, "so who's going to pay this time?"

The whole situation is idiotic. Using his logic, why didn't his parents pay?

Because they were guests... Just like wife, but he forgot that part.

Load More Replies...I have never read a positive story on couples who unite every part of their lives except finances. Either be all in, or don't bother, because it just doesn't work.

It does not have to be black and white. Two partners have an account each to which they receive their salary and and a 3rd for bills, rent, mortgage, eating out cinema... It is important to be financially independent to some degree in case something happens (doesn't have to be separation, any event where one partner is suddenly no longer legally competend, but certain monetary decision or transactions still need the two parties).

Load More Replies...My husband and I have been together for 17 years and our finances are only somewhat together. We file joint taxes and have a joint investment account, but our own “regular” bank accounts and credit cards. We never fight over money.

Same situation with my wife and I. It's easy to do for adults that talk about things lol

With me and my husband, we have separate accounts because he's a spender, and I'm a saver. Plus he's retired and takes care of our son, and I work full time. So I pay most of our bills out of my account (which he did, before he retired, while I took care of our son-we just switched roles, really, lol). But he still carries my card sometimes, for grocery trips (if I'm at work) or whatever. He takes money from my account occasionally, if he needs a little running money. We file a joint return, too. And every financial decision we make, we make together. But physically having the money in my own account helps me keep better control over the budget. So that's why we do it. And it works just fine for us.

My step father was forced to take an early retirement but he still takes care of all the expences... mind you there hasn't been a mortgage payment in over 7 years so their bills are minimal but they also lived well under their budget. My mom, who died just one month ago, hated giving her money away to the big companies, so she would pay in cash, no interest charges, no late fees due, no gifting their hard earned money to the mega rich. If I was as controlled as her, I would've paid off my home years ago. 😅

@miri Could not have said this Better. I really appreciate this independence since first my relationship in my 20s (nearly broke me in several ways). You can never know, what will happen and i definetly never though of His betrayal! So, keep the finances save has nothing to do with trust. Because people like yourself change! Things happen! Circumstances change!

OMG STFU already. You literally just came on here to "try" and correct people's grammar within their comments, like wtf? The fact that this is the only reason you are here is pathetic in itself, but what's worse is that your grammar/spelling is incorrect even though you are attempting to correct other people. Gtfoh.

My parents were married for 60 years until dad died and that's how they did it, seems entirely sensible to me.

That does not make sense. When finances are combined, the 2 party necessity is still there and if one party becomes incompetent, the other simply carries on due to joint survivorship. This separate stuff appears to be a poor person's idea of prepping for a potential divorce but forgoing the pre nup. It is rather cynical but sort of makes sense. There is a certain level of self centeredness and defensiveness here in pretending to join together while essentially remaining separate. I presume the marriage part is just for the tax breaks

Well then these "partners" are not fully committed. They are creating a means for escape and/or hiding money. Usually, it's the woman objecting because they find the idea of supporting a man repulsive. If/when the husband starts making significant amounts of money then the woman needs to step in and at a minimum have unrestricted inspection of said store of money. Call me sexist if you want, but that is reality. OTOH, when a high earning man wants to maintain separate finances it's usually to hide the expenditures of his dalliances. No good comes from it either way.

I need you to get in better relationships, buddy. You can be fully committed and not share a bank account. Women typically want to keep finances separate because they've been in a relationship where the man had all the control and they had none. When the relationship ended they were left to rebuild while he rode off with all she owns.

With me and my husband, it's because he's a spender, and I'm a saver. Plus he's retired and takes care of our son, and I work full time. So I pay most of our bills out of my account. But he still carries my card sometimes, for grocery trips (if I'm at work) or whatever. He takes money from my account occasionally, if he needs a little running money. But having it in my own account helps me keep better control over the budget. So that's why we do it. And it works just fine for us.

Talk about bad relationships, if you have to keep your finances separate because fear of being controlled you are in a bad relationship. Again, the only way a woman wants to keep finances separate is because she makes a significant amount and her husband makes less. In marriages where hubby makes more, accounts are joint and both have full access to $$$ are usually more stable, happy relationships. Also in divorce there is something called financial discovery. You don't get away with emptying accounts - and it's not like women don't do it too when it happens.

I don't think it matters which spouse makes more money, really I've always made more than my husband, but our money all goes into one joint account. We've been married for almost 30 years. We don't fight over money. It's just not that important to either of us.

Married childhood boyfriend, shared everything including joint account where everything went in and out. Except he had a "private" account from where he hid the costs of his infidelities. My entire salary went on the family, some of his. He also liked "booking up to account" expensive items for his sole benefit but questioned my simple expenses like a haircut. I would always have to find the "joint $" to foot his purchases bill. So no, its not only women there are lots 9f juvenile, spoilt and entitled men as well.

This comment is hidden. Click here to view.

Seperate from each other. Yo are toxic.

That’s an unfair thing to say. Two people who are committed to their life together can simultaneously maintain some of their own independence as well. My husband and I don’t share finances. We have separate bank accounts, credit card accounts, etc. we use my savings account that I had before we got married as our “joint” saving’s account that we use for home repairs and vacations and things, and we split the mortgage and home bills right down the middle. For us, it works very well. We make almost the same, so neither of us is getting the short end of the stick. We discuss any big purchases with each other even if we use our own money, because we value each other’s opinions. I think the key maturity and transparency. I never have to feel guilty if i treat myself to something!

This comment is hidden. Click here to view.

He gets to spend his money on whatever he wants without your oversight? I mean outside those "big purchases"? Let me guess, he doesn't make more money that you - or if he does, not much more. If he out earns you by a notable degree you are either a kind wife or a fool, maybe a bit of both - especially if you can't log into his account online and review his transactions . Sorry for my saying so. Most wives I know have an eagle eye on what hubby spends money on.

You seem to be a very jaded person. I literally say that we make about the same. He isn't a child, he is my equal partner and I have no desire or need to "monitor" him. We both pay shared expenses equally, we both contribute to a savings account equally, so why shouldn't we both be able to do what we want with what is left over? If we ever need access to each other's finances (which we do sometimes, as we have shared loans and things) we have no problem doing that. We just honestly don't care after the necessities are taken care of. We trust each other. And furthermore, if either of us ever needs money we have no problem helping each other out because at the end of the day we are a team. It's really not that complicated. Thank you for assuming I am a fool, but I assure you neither my husband or I are fools. It makes me sad your view is so bleak.

This comment is hidden. Click here to view.

So you won't keep a joint account because you make as much as he does. The idea of him having free access to "your" money rankles you. If he doubled his income your view would change. You would want access to that money. Funny because marital law sees all money as co-owned and separate accounts are a relationship power play. You see separate accounts as adult autonomy. Men don't think in those terms. Autonomy is intrinsic. We are expected to provide. Sharing with our wives is an expression of love, duty and devotion. I guarantee you are the one demanding separate finances and your husband would agree happily if you changed your mind and wanted joint accounts.

Boy it must be exhausting to be you, thinking everything in a relationship is some diabolical power play, and that you must always be playing defense against the person you chose to build a life with. The last thing I will say is that we have never one time argued about money, and we are both very happy in our marriage. You seem to think very poorly of women, in particular, as all of your comments have made clear. I hope for your sake that changes one day.

Having been bitten over a lengthy marriage by an entitled and spoilt man I can guarantee I will never share an account with anyone ever again and I would advise same to anyone. Not all men are devoted to their wife and family. Some turn out to be spoilt, entitled little boys who think it is their right to everything: my monies ours and his is his.

My husband and I have been together for 30 years and our finances are separate. Of course, he would never put me in a situation like that and we do loan each other money when needed - neither one of us would let the other go without. I pay some bills and he pays others. We each can do whatever we want with what is left over. We have never argued about finances in at least 20 years. Also, he's 16 years older than I am and we knew each other for 3 months before getting married, so I guess nothing about our relationship was supposed to last.

No relationship is supposed to last by that logic unless you both die at the same time.

Well people who are happy with their lives don't post on AITA now do they. Seriously, most people only write stuff on the internet to complain. It goves a very very skewed view of how people live and what "everyone" thinks is normal and/or accepable. I've worked with people and their finances for many years and I can assure you, most people make that work perfectly

Not all, some husbands/wives burden their spouses with all or most of the household expenses, a kind of power play. Where kids are involved usually the mum is left struggling to feed, cloth them as hubby makes technical appearances to change clothes/shirts

My husband and I also have a joint account for family expenses and separate finances for each of our own personal expenses, like things we don't need but want for ourselves. We decide together what kinds of things are from which pot of money, and how much we are allotted personally each month for our own use. We love it, and it works for us because needs are not fought over, and we each get to use our own bit for whatever without feeling like we have to worry or feel guilty or whatever. Every couple must agree together on what works for them. Sometimes you might need to adjust it a bit, or get down and discuss with full honesty where the priorities and expectations lie and both parties might need to compromise if it's going to work out.

This comment is hidden. Click here to view.

You make more money than him lol. Just like every other woman in this thread who supports separate finances. The idea of supporting a man repulses you - even the man you married and fathered your children.

I'm a broke ass woamn and absolutely keep separate finances from my husband. Calm down.

This comment is hidden. Click here to view.

Are you both broke? My mother kept a separate account too, but my father paid all the bills. That account was her spending money. Oh and she full access to his accounts too just in case. If your husband makes good money and you are broke yet you have separate accounts and equally share bills then your husband has some concerns or is not acting in good faith. Could be the marriage is a little new. Then it's understandable. Takes a little time to grow into some trust. When you have kids the husband and father has to take on the provider role, especially if he has the means to do so. Expecting a very pregnant or new mom to share financial responsibility is poor form. You should not tolerate that. If no kids then it doesn't matter because you are just playing house. Separate finances is a reflection of the lack of commitment inherent in childless marriages.

Disagree. I've been with my partner for ten years. We put 50% of our finances into a shared acct and it works wonderfully. It covers all our bills, rent, vacations..etc.

I'd prefer such an arrangement rather than the all eggs in one joint account, approach.

I agree. I think that people should keep their separate bank accounts because of independence and salary differences. But a commited couple needs to have at least a joined account. It gets ridiculous to talk about who is paying the groceries this week.

Yes this seems the best way to go. My husband and I have been together 24 yrs our money has always been together though. We own a business together too. Can't imagine constantly worrying about whose paying their half of a loaf of bread every week. Neither of us go wo what we need and neither does our daughter. I understood having your own money but not to the detriment of a partnership so weird.

Count your blessings; many have had joint accounts cleaned out without their knowledge. A friend's daughter had one with a long term boyfriend to, among other things, finance their future wedding. One weekend she meets a friend who asked her why she wasn't at the said boyfriend's wedding. Needless to say, he had cleaned out the account

This comment is hidden. Click here to view.

IT'S I AGREE. I THINK THAT PEOPLE SHOULD KEEP THEIR BANK ACCOUNTS SEPARATE BECAUSE OF THEIR INDEPENDENCE AND THEIR SALARY DIFFERENCES. BUT A COMMITTED COUPLE NEEDS TO HAVE AT LEAST ONE JOINED ACCOUNT. IT GETS RIDICULOUS TO TALK ABOUT WHO IS PAYING FOR THE GROCERIES THIS WEEK. THEY CAN TAKE TURNS PAYING FOR THE GROCERIES EVERY WEEK ETC OR THEY CAN EACH PAY FOR HALF OF THE GROCERIES EVERY WEEK OR SO.

We have always kept our money separate. He does the grocery shopping. I would give him my debit card and tell him to stay within $100/wk. No arguing, just a budget.

We have two joint accounts: one I use the majority of the time and one he uses the majority of the time. He gives me a portion of his check whenever he gets paid. I use my account to pay the household bills. He uses his account for stuff he buys and I use my account for stuff I buy. Works for us.

Me and my partners finances are separate but we discuss what needs to be done they pay xyz, I pay abc but if I have an issue with something I speak up and we devise a plan. I admit they are not good at the speaking up if they have a problem because of their pride but we’re working on that.

I don't know, my husband and I have separate finances- I have two sons I share custody of and when they're with my ex, I send child support money, which I don't think is fair to have my husband pay. Plus, we base it off who makes more (he does) and so I pay for things like groceries, internet, streaming, etc. Works for us

This is an acceptable rationale for separate bank accounts. I was in this situation myself for a time. When I no longer had to pay child support - there was no reason to keep finances separate. Co-mingling money means ex can subpoena those accounts. That is an unwanted thing to happen - and yes if the ex sniffs out you have a joint account they will probably subpoena it as it will change the support formula results.

My Partner and i are together for nearly half of our lifes now and lived together for that amount of time exept for one year. We both have our own money and pay our Bills together. But not 50/50. It is orientated on our income. Very simple, absolute fair and we have both the freedom to buy with our own money, whatever we want. The only Times when an argument could come up is, when the stuff, someone wants to buy, would take much space. Because we Share this space.

I disagree. Sure, it's nice if everything is shared, but doesn't have to be. Most marriage arguments are about finances anyways. Maybe you live in an odd place, because I know several long term married couples who have independent finances. Should you share underwear with your partner too? You said every part.

I feel like uniting finances could be a bad idea just in case it doesn't work out or the spouse turns out to be abusive. If they take control of the money then you can't leave. If I'm going to be with someone I want my own source of money, and if they love me then they'll understand and be okay with that.

Nah dude no way. I'd NEVER intertwine all my finances with my husband. That's how u end up in a cycle of abuse you cant get out of if the guy ends up being even remotely abusive or cruel and 90% of guys ive dated were plus tons of people end up being that way after yrs of marriage. If u wanna have a small amount of shared money 4 household expenses then that's fine but 4 the most part id never share. Not that it matters, ive been broke my entire adult life anyway even when I was making over twice the min wage cuz NJ housing costs r insane and a studio apt is like $1200 a mnth but yea if I had any $$ id never let any1 touch it. Wen I did have $$ like a tax return id love spending it on my bf anyway so if he still complained id kno he was just greedy

I live a positive story like this. We do not mix finances. It works, I promise.

And here I always thought that it was the role of the person making the invitation to pay. If I invite you to a meal I'm going to pay for it, if you invite me then you're going to pay for it. The exceptions are discussed ahead of time because we're adults capable of talking to one another.

You, that's how I was raised. Yet I've been leiving in San Antonio, TX for the planned 20 years and I've learnt to tell people who invite me out, "oh I can't make it, I do not have enough funds to.attend", because in more than one occasion that I've been invited to a gathering and believed I was covered for my meal, it turned out I wasn't. Not sure if it's a Texas thing or what... very strange.

Hi from San Antonio!!!! Your way seems to work well. If only more people just asked, "so who's going to pay this time?"

The whole situation is idiotic. Using his logic, why didn't his parents pay?

Because they were guests... Just like wife, but he forgot that part.

Load More Replies...I have never read a positive story on couples who unite every part of their lives except finances. Either be all in, or don't bother, because it just doesn't work.

It does not have to be black and white. Two partners have an account each to which they receive their salary and and a 3rd for bills, rent, mortgage, eating out cinema... It is important to be financially independent to some degree in case something happens (doesn't have to be separation, any event where one partner is suddenly no longer legally competend, but certain monetary decision or transactions still need the two parties).

Load More Replies...My husband and I have been together for 17 years and our finances are only somewhat together. We file joint taxes and have a joint investment account, but our own “regular” bank accounts and credit cards. We never fight over money.

Same situation with my wife and I. It's easy to do for adults that talk about things lol

With me and my husband, we have separate accounts because he's a spender, and I'm a saver. Plus he's retired and takes care of our son, and I work full time. So I pay most of our bills out of my account (which he did, before he retired, while I took care of our son-we just switched roles, really, lol). But he still carries my card sometimes, for grocery trips (if I'm at work) or whatever. He takes money from my account occasionally, if he needs a little running money. We file a joint return, too. And every financial decision we make, we make together. But physically having the money in my own account helps me keep better control over the budget. So that's why we do it. And it works just fine for us.

My step father was forced to take an early retirement but he still takes care of all the expences... mind you there hasn't been a mortgage payment in over 7 years so their bills are minimal but they also lived well under their budget. My mom, who died just one month ago, hated giving her money away to the big companies, so she would pay in cash, no interest charges, no late fees due, no gifting their hard earned money to the mega rich. If I was as controlled as her, I would've paid off my home years ago. 😅

@miri Could not have said this Better. I really appreciate this independence since first my relationship in my 20s (nearly broke me in several ways). You can never know, what will happen and i definetly never though of His betrayal! So, keep the finances save has nothing to do with trust. Because people like yourself change! Things happen! Circumstances change!

OMG STFU already. You literally just came on here to "try" and correct people's grammar within their comments, like wtf? The fact that this is the only reason you are here is pathetic in itself, but what's worse is that your grammar/spelling is incorrect even though you are attempting to correct other people. Gtfoh.

My parents were married for 60 years until dad died and that's how they did it, seems entirely sensible to me.

That does not make sense. When finances are combined, the 2 party necessity is still there and if one party becomes incompetent, the other simply carries on due to joint survivorship. This separate stuff appears to be a poor person's idea of prepping for a potential divorce but forgoing the pre nup. It is rather cynical but sort of makes sense. There is a certain level of self centeredness and defensiveness here in pretending to join together while essentially remaining separate. I presume the marriage part is just for the tax breaks

Well then these "partners" are not fully committed. They are creating a means for escape and/or hiding money. Usually, it's the woman objecting because they find the idea of supporting a man repulsive. If/when the husband starts making significant amounts of money then the woman needs to step in and at a minimum have unrestricted inspection of said store of money. Call me sexist if you want, but that is reality. OTOH, when a high earning man wants to maintain separate finances it's usually to hide the expenditures of his dalliances. No good comes from it either way.

I need you to get in better relationships, buddy. You can be fully committed and not share a bank account. Women typically want to keep finances separate because they've been in a relationship where the man had all the control and they had none. When the relationship ended they were left to rebuild while he rode off with all she owns.

With me and my husband, it's because he's a spender, and I'm a saver. Plus he's retired and takes care of our son, and I work full time. So I pay most of our bills out of my account. But he still carries my card sometimes, for grocery trips (if I'm at work) or whatever. He takes money from my account occasionally, if he needs a little running money. But having it in my own account helps me keep better control over the budget. So that's why we do it. And it works just fine for us.

Talk about bad relationships, if you have to keep your finances separate because fear of being controlled you are in a bad relationship. Again, the only way a woman wants to keep finances separate is because she makes a significant amount and her husband makes less. In marriages where hubby makes more, accounts are joint and both have full access to $$$ are usually more stable, happy relationships. Also in divorce there is something called financial discovery. You don't get away with emptying accounts - and it's not like women don't do it too when it happens.

I don't think it matters which spouse makes more money, really I've always made more than my husband, but our money all goes into one joint account. We've been married for almost 30 years. We don't fight over money. It's just not that important to either of us.

Married childhood boyfriend, shared everything including joint account where everything went in and out. Except he had a "private" account from where he hid the costs of his infidelities. My entire salary went on the family, some of his. He also liked "booking up to account" expensive items for his sole benefit but questioned my simple expenses like a haircut. I would always have to find the "joint $" to foot his purchases bill. So no, its not only women there are lots 9f juvenile, spoilt and entitled men as well.

This comment is hidden. Click here to view.

Seperate from each other. Yo are toxic.

That’s an unfair thing to say. Two people who are committed to their life together can simultaneously maintain some of their own independence as well. My husband and I don’t share finances. We have separate bank accounts, credit card accounts, etc. we use my savings account that I had before we got married as our “joint” saving’s account that we use for home repairs and vacations and things, and we split the mortgage and home bills right down the middle. For us, it works very well. We make almost the same, so neither of us is getting the short end of the stick. We discuss any big purchases with each other even if we use our own money, because we value each other’s opinions. I think the key maturity and transparency. I never have to feel guilty if i treat myself to something!

This comment is hidden. Click here to view.

He gets to spend his money on whatever he wants without your oversight? I mean outside those "big purchases"? Let me guess, he doesn't make more money that you - or if he does, not much more. If he out earns you by a notable degree you are either a kind wife or a fool, maybe a bit of both - especially if you can't log into his account online and review his transactions . Sorry for my saying so. Most wives I know have an eagle eye on what hubby spends money on.

You seem to be a very jaded person. I literally say that we make about the same. He isn't a child, he is my equal partner and I have no desire or need to "monitor" him. We both pay shared expenses equally, we both contribute to a savings account equally, so why shouldn't we both be able to do what we want with what is left over? If we ever need access to each other's finances (which we do sometimes, as we have shared loans and things) we have no problem doing that. We just honestly don't care after the necessities are taken care of. We trust each other. And furthermore, if either of us ever needs money we have no problem helping each other out because at the end of the day we are a team. It's really not that complicated. Thank you for assuming I am a fool, but I assure you neither my husband or I are fools. It makes me sad your view is so bleak.

This comment is hidden. Click here to view.

So you won't keep a joint account because you make as much as he does. The idea of him having free access to "your" money rankles you. If he doubled his income your view would change. You would want access to that money. Funny because marital law sees all money as co-owned and separate accounts are a relationship power play. You see separate accounts as adult autonomy. Men don't think in those terms. Autonomy is intrinsic. We are expected to provide. Sharing with our wives is an expression of love, duty and devotion. I guarantee you are the one demanding separate finances and your husband would agree happily if you changed your mind and wanted joint accounts.

Boy it must be exhausting to be you, thinking everything in a relationship is some diabolical power play, and that you must always be playing defense against the person you chose to build a life with. The last thing I will say is that we have never one time argued about money, and we are both very happy in our marriage. You seem to think very poorly of women, in particular, as all of your comments have made clear. I hope for your sake that changes one day.

Having been bitten over a lengthy marriage by an entitled and spoilt man I can guarantee I will never share an account with anyone ever again and I would advise same to anyone. Not all men are devoted to their wife and family. Some turn out to be spoilt, entitled little boys who think it is their right to everything: my monies ours and his is his.

My husband and I have been together for 30 years and our finances are separate. Of course, he would never put me in a situation like that and we do loan each other money when needed - neither one of us would let the other go without. I pay some bills and he pays others. We each can do whatever we want with what is left over. We have never argued about finances in at least 20 years. Also, he's 16 years older than I am and we knew each other for 3 months before getting married, so I guess nothing about our relationship was supposed to last.

No relationship is supposed to last by that logic unless you both die at the same time.

Well people who are happy with their lives don't post on AITA now do they. Seriously, most people only write stuff on the internet to complain. It goves a very very skewed view of how people live and what "everyone" thinks is normal and/or accepable. I've worked with people and their finances for many years and I can assure you, most people make that work perfectly

Not all, some husbands/wives burden their spouses with all or most of the household expenses, a kind of power play. Where kids are involved usually the mum is left struggling to feed, cloth them as hubby makes technical appearances to change clothes/shirts

My husband and I also have a joint account for family expenses and separate finances for each of our own personal expenses, like things we don't need but want for ourselves. We decide together what kinds of things are from which pot of money, and how much we are allotted personally each month for our own use. We love it, and it works for us because needs are not fought over, and we each get to use our own bit for whatever without feeling like we have to worry or feel guilty or whatever. Every couple must agree together on what works for them. Sometimes you might need to adjust it a bit, or get down and discuss with full honesty where the priorities and expectations lie and both parties might need to compromise if it's going to work out.

This comment is hidden. Click here to view.

You make more money than him lol. Just like every other woman in this thread who supports separate finances. The idea of supporting a man repulses you - even the man you married and fathered your children.

I'm a broke ass woamn and absolutely keep separate finances from my husband. Calm down.

This comment is hidden. Click here to view.

Are you both broke? My mother kept a separate account too, but my father paid all the bills. That account was her spending money. Oh and she full access to his accounts too just in case. If your husband makes good money and you are broke yet you have separate accounts and equally share bills then your husband has some concerns or is not acting in good faith. Could be the marriage is a little new. Then it's understandable. Takes a little time to grow into some trust. When you have kids the husband and father has to take on the provider role, especially if he has the means to do so. Expecting a very pregnant or new mom to share financial responsibility is poor form. You should not tolerate that. If no kids then it doesn't matter because you are just playing house. Separate finances is a reflection of the lack of commitment inherent in childless marriages.

Disagree. I've been with my partner for ten years. We put 50% of our finances into a shared acct and it works wonderfully. It covers all our bills, rent, vacations..etc.

I'd prefer such an arrangement rather than the all eggs in one joint account, approach.

I agree. I think that people should keep their separate bank accounts because of independence and salary differences. But a commited couple needs to have at least a joined account. It gets ridiculous to talk about who is paying the groceries this week.

Yes this seems the best way to go. My husband and I have been together 24 yrs our money has always been together though. We own a business together too. Can't imagine constantly worrying about whose paying their half of a loaf of bread every week. Neither of us go wo what we need and neither does our daughter. I understood having your own money but not to the detriment of a partnership so weird.

Count your blessings; many have had joint accounts cleaned out without their knowledge. A friend's daughter had one with a long term boyfriend to, among other things, finance their future wedding. One weekend she meets a friend who asked her why she wasn't at the said boyfriend's wedding. Needless to say, he had cleaned out the account

This comment is hidden. Click here to view.

IT'S I AGREE. I THINK THAT PEOPLE SHOULD KEEP THEIR BANK ACCOUNTS SEPARATE BECAUSE OF THEIR INDEPENDENCE AND THEIR SALARY DIFFERENCES. BUT A COMMITTED COUPLE NEEDS TO HAVE AT LEAST ONE JOINED ACCOUNT. IT GETS RIDICULOUS TO TALK ABOUT WHO IS PAYING FOR THE GROCERIES THIS WEEK. THEY CAN TAKE TURNS PAYING FOR THE GROCERIES EVERY WEEK ETC OR THEY CAN EACH PAY FOR HALF OF THE GROCERIES EVERY WEEK OR SO.

We have always kept our money separate. He does the grocery shopping. I would give him my debit card and tell him to stay within $100/wk. No arguing, just a budget.

We have two joint accounts: one I use the majority of the time and one he uses the majority of the time. He gives me a portion of his check whenever he gets paid. I use my account to pay the household bills. He uses his account for stuff he buys and I use my account for stuff I buy. Works for us.

Me and my partners finances are separate but we discuss what needs to be done they pay xyz, I pay abc but if I have an issue with something I speak up and we devise a plan. I admit they are not good at the speaking up if they have a problem because of their pride but we’re working on that.

I don't know, my husband and I have separate finances- I have two sons I share custody of and when they're with my ex, I send child support money, which I don't think is fair to have my husband pay. Plus, we base it off who makes more (he does) and so I pay for things like groceries, internet, streaming, etc. Works for us

This is an acceptable rationale for separate bank accounts. I was in this situation myself for a time. When I no longer had to pay child support - there was no reason to keep finances separate. Co-mingling money means ex can subpoena those accounts. That is an unwanted thing to happen - and yes if the ex sniffs out you have a joint account they will probably subpoena it as it will change the support formula results.

My Partner and i are together for nearly half of our lifes now and lived together for that amount of time exept for one year. We both have our own money and pay our Bills together. But not 50/50. It is orientated on our income. Very simple, absolute fair and we have both the freedom to buy with our own money, whatever we want. The only Times when an argument could come up is, when the stuff, someone wants to buy, would take much space. Because we Share this space.

I disagree. Sure, it's nice if everything is shared, but doesn't have to be. Most marriage arguments are about finances anyways. Maybe you live in an odd place, because I know several long term married couples who have independent finances. Should you share underwear with your partner too? You said every part.

I feel like uniting finances could be a bad idea just in case it doesn't work out or the spouse turns out to be abusive. If they take control of the money then you can't leave. If I'm going to be with someone I want my own source of money, and if they love me then they'll understand and be okay with that.

Nah dude no way. I'd NEVER intertwine all my finances with my husband. That's how u end up in a cycle of abuse you cant get out of if the guy ends up being even remotely abusive or cruel and 90% of guys ive dated were plus tons of people end up being that way after yrs of marriage. If u wanna have a small amount of shared money 4 household expenses then that's fine but 4 the most part id never share. Not that it matters, ive been broke my entire adult life anyway even when I was making over twice the min wage cuz NJ housing costs r insane and a studio apt is like $1200 a mnth but yea if I had any $$ id never let any1 touch it. Wen I did have $$ like a tax return id love spending it on my bf anyway so if he still complained id kno he was just greedy

I live a positive story like this. We do not mix finances. It works, I promise.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

135

285