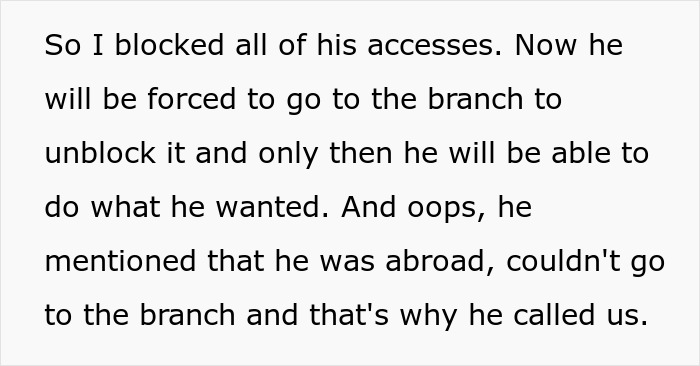

“Enjoy Not Being Able To Use Your Money”: Bank Employee Gets Revenge Against Entitled Customer

No, the customer is not always right! Customers need to understand that being rude to staff isn’t just horrible—it can also backfire immensely. Sometimes, raising your voice at others is about the worst thing you can do.

Especially if they work at a bank call center like redditor u/Antek_Ash. She shared how she used company policy to knock an extremely entitled customer down a few pegs. Scroll down for a reminder that treating the people who handle your money with politeness is probably a good idea.

Many banks have strict security protocols in place to protect their clients’ funds from scams

Image credits: Pavel Danilyuk (not the actual photo)

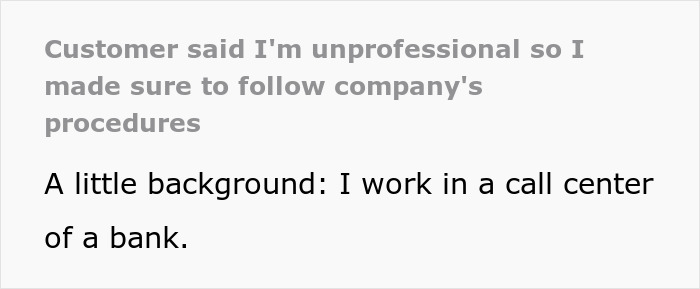

One bank call center employee shared how she dealt with someone incredibly rude on the phone

Image credits: Jonathan Cooper (not the actual photo)

Image credits: Antek_Ash

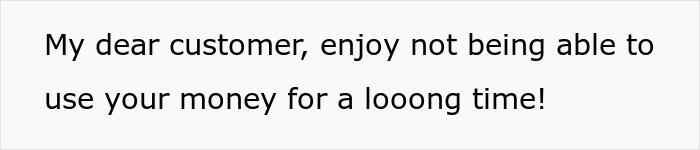

Nobody deserves to be yelled at in their place of work

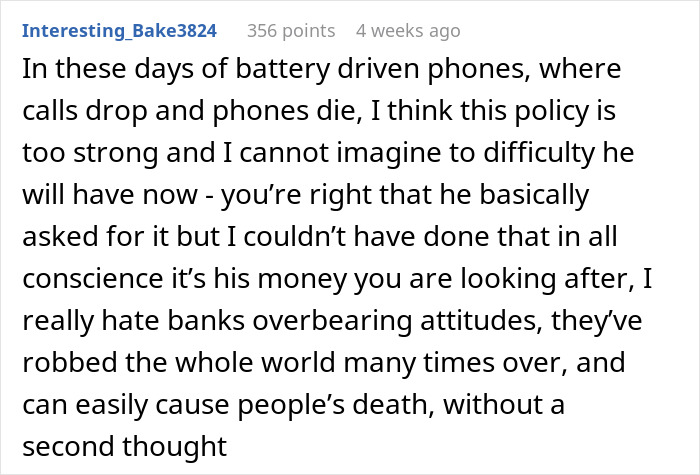

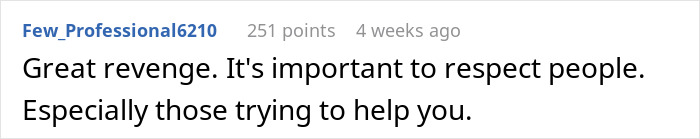

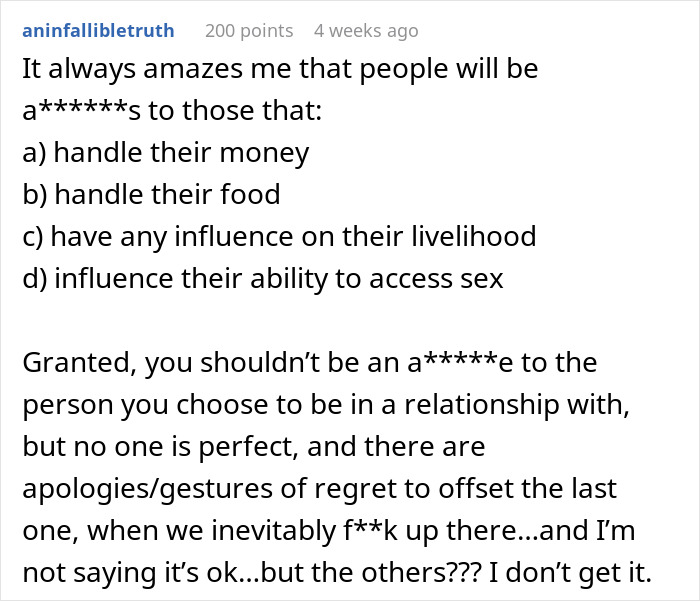

Many redditors who read the story on r/pettyrevenge felt that the OP was perfectly within her rights to block the customer. Someone who’s yelling at you, telling you that you’re unprofessional even though you’re trying to help them, needs to understand that they’ve crossed the line.

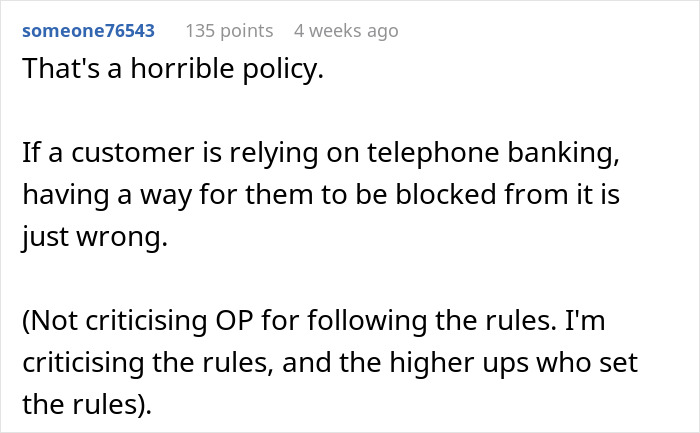

Some readers, however, considered whether the security policies that banks have are too strict. Some shared instances where they were blocked from their accounts due to ridiculous misunderstandings. Others felt uncomfortable that banks have the power to block them even when they’re polite and communicative.

So it seems like there’s an issue on both sides of the aisle. Some customers definitely need to learn to keep their tempers in check. On the flip side, banks also need to ensure that their customer service is at the top of its game so that mistakes happen less often.

Yelling shouldn’t be anyone’s go-to response. But even the most patient, kindest people have limits for their patience. There needs to be empathy on both sides of the phone.

The best customer service and call center employees will know how to differentiate between someone who’s entitled (and thinks they can get away with it), someone who’s simply having a bad day, and someone who’s polite but extremely frustrated.

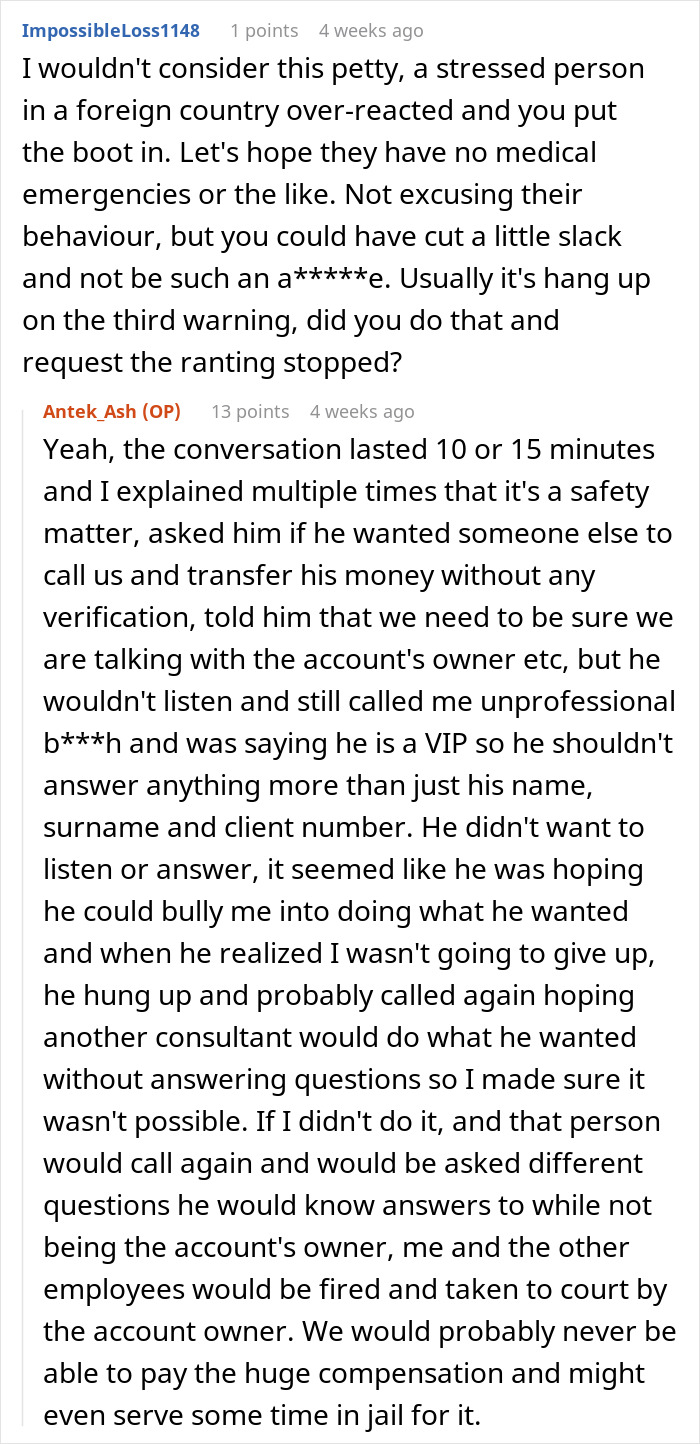

Employees need to know that management has their backs

Image credits: Pixabay (not the actual photo)

Bored Panda recently covered why it’s so important that managers support employees when they have to deal with rude customers.

“Employees must feel assured that their company doesn’t tolerate abusive clientele, for example. In this situation, the more training the better. There are many varieties of challenging customers, and each one often requires a different response,” workplace expert Lynn Taylor, the author of ‘Tame Your Terrible Office Tyrant,’ told us during an interview, earlier.

“With many customer conflicts going viral today, companies must do their utmost to define what is and isn’t acceptable… how to take the highroad, unless it’s abuse. One internal litmus test to live by is to consider how the scenario would be perceived by an objective person—or the outside world,” Taylor told Bored Panda.

“The key in many training programs is for employees to understand where to draw the line. What are the boundaries? How do you provide a service in a friendly manner, but let the customers know there are limits? This is where role-playing is invaluable. Being in a customer-facing business does not mean being a punching bag; in this case, the customer is ‘not always right.'”

Dealing with customers correctly means finding the balance between empathy and healthy boundaries

Image credits: Yan Krukau (not the actual photo)

Many unhappy customers and clients simply want to be heard. Often, their complaints aren’t personal.

“After witnessing a meltdown, let the perpetrator know they’ve been heard, but set boundaries to bad behavior. Also:

- Reiterate what their beef is, to offer some validation.

- Be the voice of reason in a way that they know benefits them.

- You just can’t fight fire with fire whether it’s an irate customer or an out of control toddler who is running amok.

- Show patience and understanding, but also some solid boundary setting is in order.

- Diplomacy is critical… as in many contentious situations, it’s how you package your information. Your delivery matters.

- You may need to repeat yourself in a polite way, using varying phrases to get your message across.

- Use a little levity to defuse tension when you feel you are turning the situation around.”

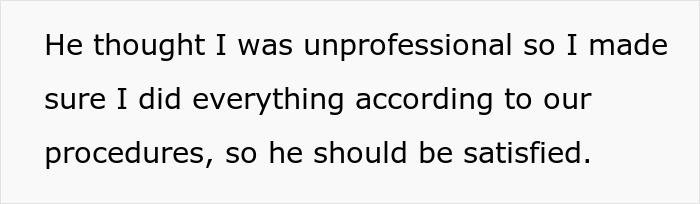

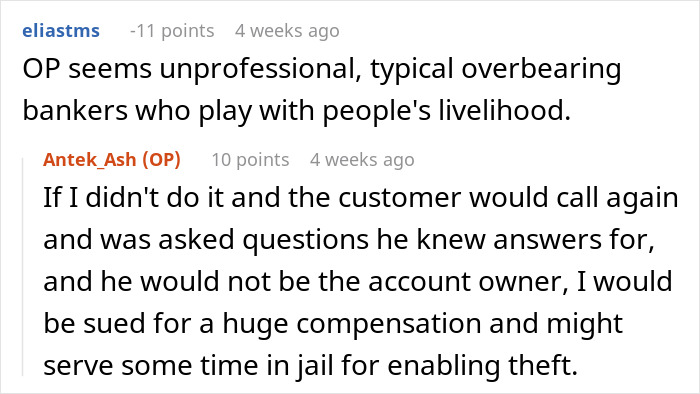

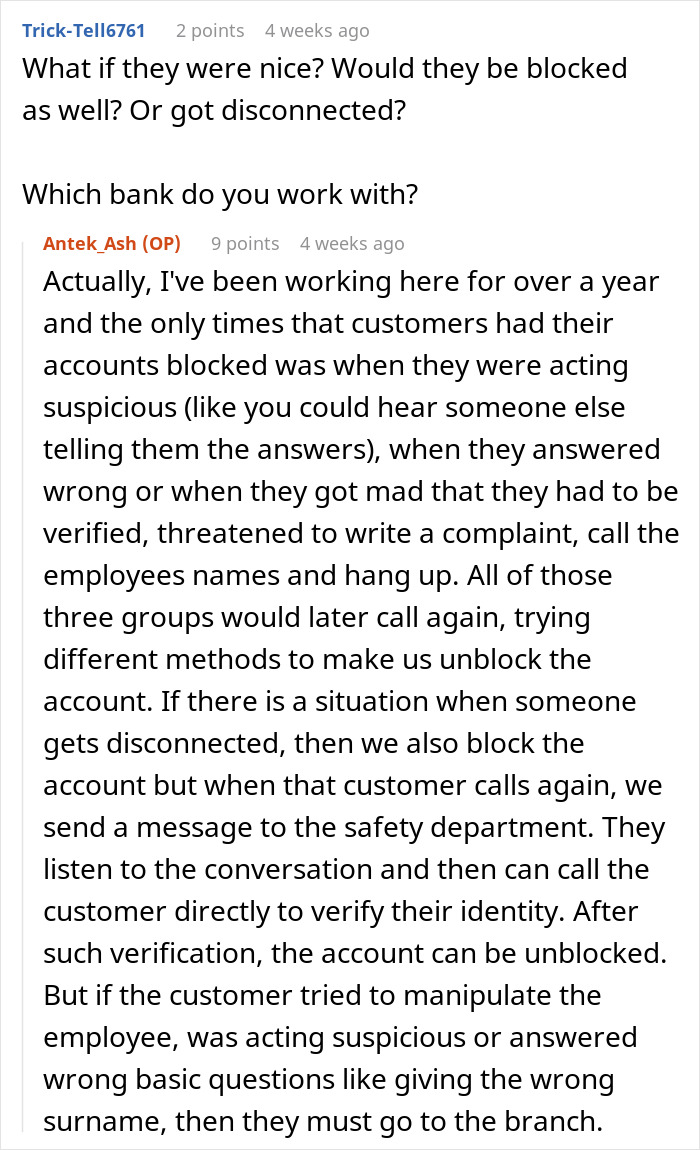

The author revealed some more information about what happened in the comments of her post

Here’s what some readers had to say after reading the viral story. There were mixed reactions

The story inspired people to share similar experiences

I worked in retail banking for over 7 years and can confirm (in my experience) that money really can bring out the worst in people, just like the cliché says.

Interestingly, people trying to scam or get access to accounts will use the tactic of trying to intimidate the employee as this caller did. It was actually a red flag for them to say they were in a foreign country, which is where a lot of scams originate. If it truly was the account holder calling, he was being an idiot. I thank everyone who verifies my information or asks for my I.D. when necessary.

All the people going "but it's his money!" are missing the point. The dude refused to verify his ID. There was no real way to know if it was his money. Just because OP enjoyed following protocol doesn't mean it was an a hole thing to do.

Seriously. People are stuck a******s about their own money being protected from them. I used to get screamed at for avoiding people that if they ordered large orders over the phone then they had to come in with ID and that credit card to pick up the product. Not my rule, but also one I'm happy to enforce SO YOU DON'T LOSE YOUR MONEY TO A SCREAMING A*****E THAT WASN'T YOU, FOR ONCE. She did her job, he refused to do his (answer simple questions), so yes, the money is locked up for the protection of the owner, which may or may not be him. Adding a sense of urgency to the matter and escalating and getting angry are super common tactics of scammers. Don't act like a scammer and you won't be treated like one.

Load More Replies...I worked in retail banking for over 7 years and can confirm (in my experience) that money really can bring out the worst in people, just like the cliché says.

Interestingly, people trying to scam or get access to accounts will use the tactic of trying to intimidate the employee as this caller did. It was actually a red flag for them to say they were in a foreign country, which is where a lot of scams originate. If it truly was the account holder calling, he was being an idiot. I thank everyone who verifies my information or asks for my I.D. when necessary.

All the people going "but it's his money!" are missing the point. The dude refused to verify his ID. There was no real way to know if it was his money. Just because OP enjoyed following protocol doesn't mean it was an a hole thing to do.

Seriously. People are stuck a******s about their own money being protected from them. I used to get screamed at for avoiding people that if they ordered large orders over the phone then they had to come in with ID and that credit card to pick up the product. Not my rule, but also one I'm happy to enforce SO YOU DON'T LOSE YOUR MONEY TO A SCREAMING A*****E THAT WASN'T YOU, FOR ONCE. She did her job, he refused to do his (answer simple questions), so yes, the money is locked up for the protection of the owner, which may or may not be him. Adding a sense of urgency to the matter and escalating and getting angry are super common tactics of scammers. Don't act like a scammer and you won't be treated like one.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

31

17