TikToker Explains Why Making $25 An Hour In The US Is Not Enough, Sparks Important Discussion

InterviewPretty much everyone’s feeling their wallets getting lighter. (Economic) winter is (definitely) coming, and many folks are looking worried. Some people suddenly feel that what they make at their current jobs might no longer be enough to cover all of their expenses, as the price of, well, pretty much everything continues to rise.

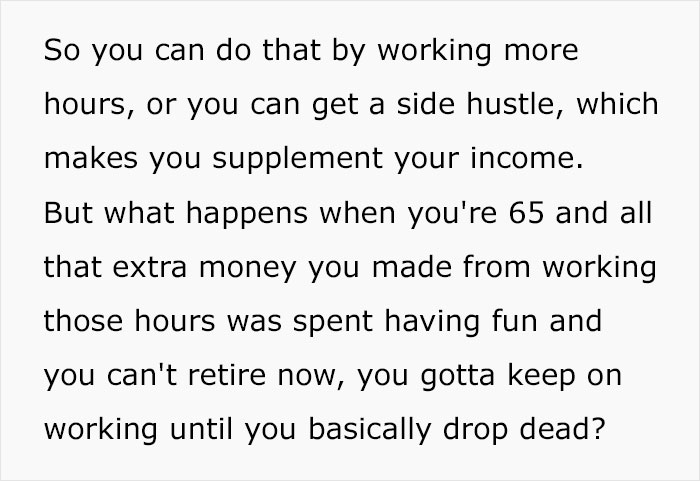

And while one side of the coin is learning how to budget and living within your means, the other side is all about finding new sources of income. Whether that’s a new job, a part-time side hustle, or some other way to make some extra income.

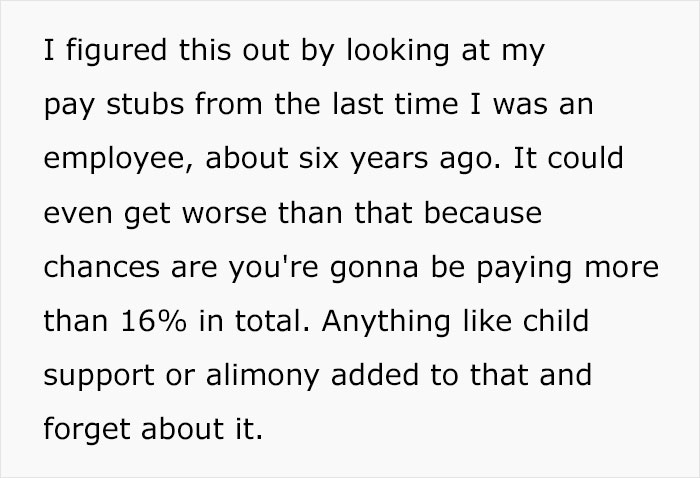

TikToker Ryan Halbert, aka @digitalsolutionss, a financial independence advocate, went viral after sharing a video on TikTok about how anyone living in the United States who’s getting paid less than $25 an hour “should be terrified.” Check out the full video and the internet’s reactions to it below, Pandas. Let us know what you think about Ryan’s analysis in the comments, and share your own tips for surviving these financially tough times in the comments.

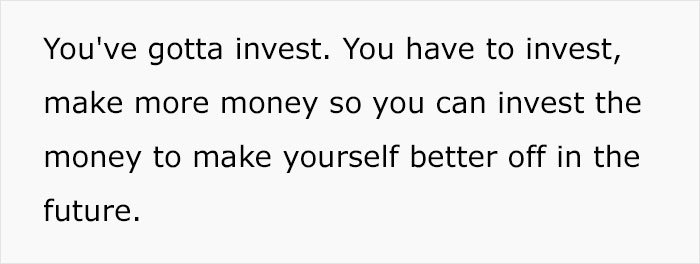

Ryan’s philosophy isn’t about pinching pennies (though, obviously, he says that everyone has to try and live within their means)—he advocates working really hard to create sources of passive income and to start investing so that you not only survive but also thrive. And while your capacity to save money has a very clear ceiling, your ability to earn more money isn’t as limited.

Bored Panda got in touch with Ryan and we had a friendly chat about his viral video, getting a better wage at work, as well as how to handle side hustles if someone’s feeling utterly exhausted. Check out the full interview below.

More info: TikTok | Instagram | YouTube | Website

Ryan Halbert went viral on TikTok after explaining why anyone who’s earning less than $25 an hour should be incredibly worried

Image credits: digitalsolutionss

Image credits: Yan Krukov (not the actual photo)

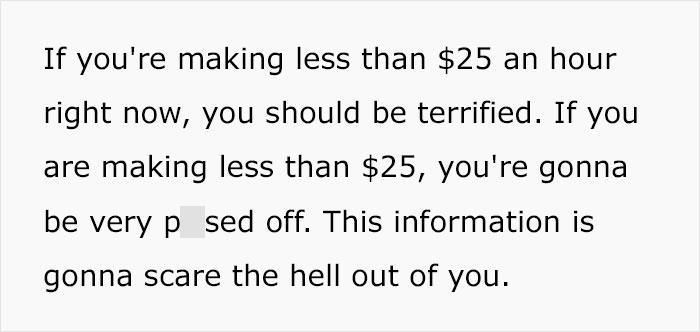

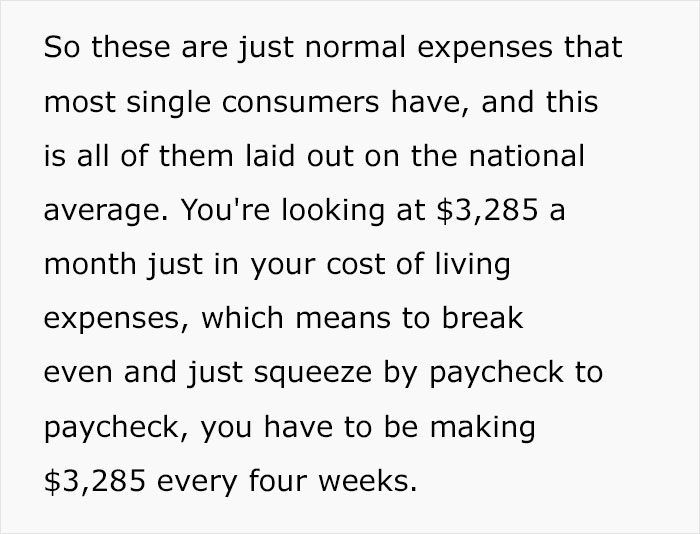

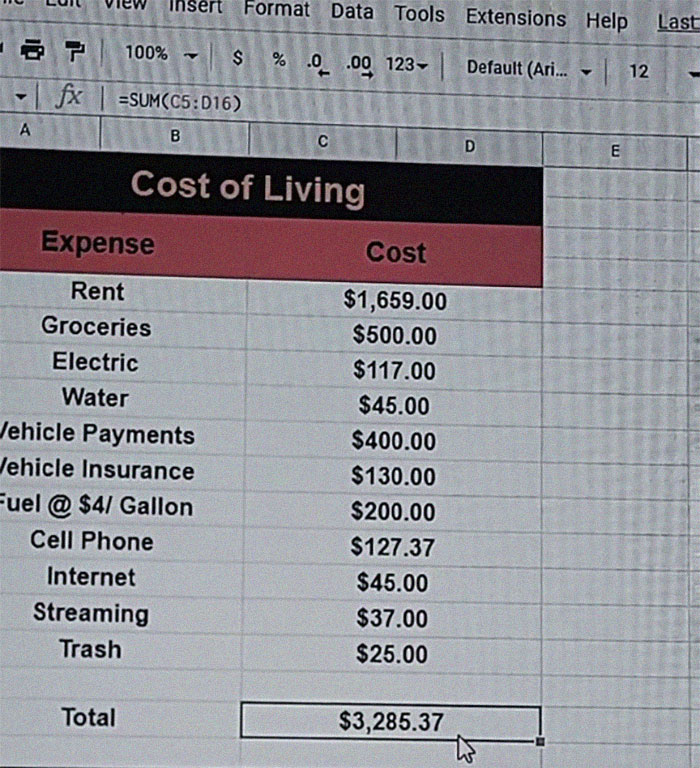

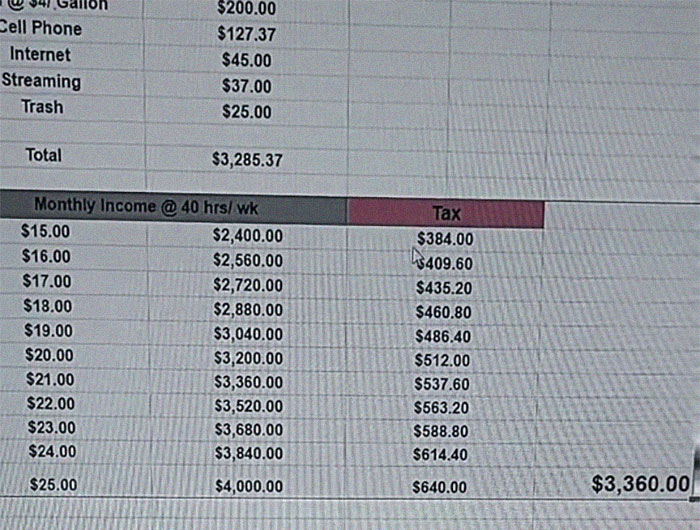

In the video, he broke down the monthly basic expenses an average American might have, and the cost of living situation is, frankly, terrifying

Image credits: digitalsolutionss

Image credits: digitalsolutionss

Image credits: digitalsolutionss

According to Ryan, if someone’s looking to get a pay raise at work, it’s important to weigh how happy they are at their job. “If they love the job and people but just need extra income then I would advise them to put in 100%+ and formally ask for that increase and tell the person in charge of giving them the increase EXACTLY how much more they need, not just ask for a raise and hope they get a good number,” he told Bored Panda.

“You have to TELL the boss, ‘I need $x.xx more money per hour.’ If they can’t do it, negotiate.”

Meanwhile, someone who has no emotional attachment to their position ought to hunt for another job with more pay. However, Ryan noted that “you’ll always be capped on pay with a 9-5.”

“If you’re looking to side hustle but are too exhausted from the hours you’re putting in, then downgrade your lifestyle and work less hours. Side hustles and entrepreneurship isn’t for people looking for easy money. If you’re too exhausted and that’s the reason you won’t put the extra effort in and work to make more, then you don’t want it bad enough and your pains aren’t that painful yet,” he said.

You can watch the full TikTok video right over here

@digitalsolutionssif you aren’t struggling from this yet, you will. don’t wait until that happens. take action now♬ original sound – Ryan Halbert | Business Growth

Ryan also told us more about what he does, as well as going viral on TikTok. It’s not the first time this has happened.

“What I do is help ordinary people become informed and learn about the potential of earning money and monetizing through social media using marketing avenues. Furthermore, I work 1-on-1 with folks who are ready to take this seriously and just need to learn the skills to get results. The content I make is intended to create awareness about particular opportunities and also to educate how to make money with social media,” he explained.

“I think the biggest driving force behind it is when I get messages from people that I’ve worked with to tell me that they’ve earned their first commission, had their first $1,000 day or their first $10,000 month. If I didn’t get those then I would just do something else.”

Ryan said that he has a few videos on his TikTok account with over a million views, as well as a video with over 10 million views. “I immediately begin to look at the engagement that the video is getting once that type of momentum begins. If I do not like the reaction from the audience or too many people are twisting the message and contaminating it, I will take the videos down before they get too much attention,” he explained his process.

“In the case of my ‘Cost of Living’ video, my comment section was filling with the harsh reality that is many people’s daily experience. These people are rarely heard and often overlooked. For the most part, the politics remained absent in the majority of comment conversations, which was also a breath of fresh air. Folks were able to communicate their feelings about the subject as well as share their different ways of handling the situation.”

In a follow-up video, Ryan addressed some misconceptions that people had after watching his other TikTok

@digitalsolutionss#stitch with @Ryan Halbert | Business Growth ♬ original sound – Ryan Halbert | Business Growth

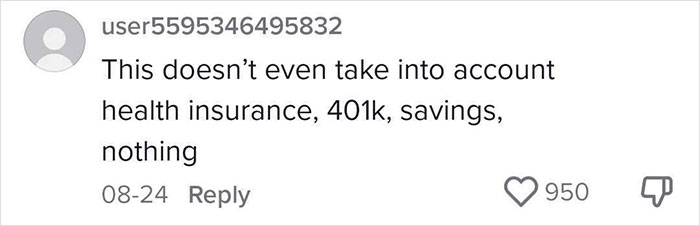

According to Ryan, in the viral video, the monthly expenses he lists don’t include going out for a meal or dealing with unforeseen circumstances.

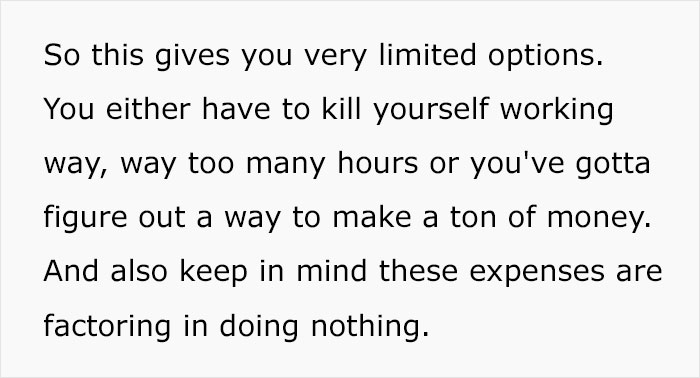

After the media got wind of Ryan’s video, he made a couple of follow-up TikToks explaining that some people have been taking his ideas out of context. For him, it’s finding new sources of income that paves the path to financial independence.

He believes that it’s far better to spend your time and energy doing that than constricting your already limited budget even further. That’s not to say that people should be spending their hard-earned cash left, right, and center at a whim. Like Ryan notes, it’s not your boss’ fault that you can’t budget.

Ryan’s aim is to use “hard work and dedication to achieve the results you desire.” He’s even written an e-book about affiliate marketing that might be one way forward for some people hoping to have a side hustle.

Each and every single one of us is responsible for setting the boundaries that we’re willing to tolerate at work, whether it’s regarding workplace culture, coworker behavior, growth opportunities, or financial stability.

Management has to clearly know what your ambitions are, and you have to constantly remind them of your job performance (e.g. twice each year). Nobody else will fight for a better wage for you, so it falls on your shoulder to convince your boss that you’re worth the pay bump. Are you outperforming your colleagues? Are you consistently getting good results? Awesome!

While it’s hardly ever fun to chat with your superiors about money, at the same time, no one else will do it for you. So you’ve got to find a professional and diplomatic way to broach these financial topics while reminding them of your value.

And though hardly anyone likes someone who’s arrogant and boastful, it’s important not to be too shy during job interviews. You’ve gotta be your number one supporter. Try to find the right balance where you’re proud of your achievements without sounding overly self-important.

At the same time, we here at Bored Panda have covered the importance of learning to cut back and save money. Frugality isn’t just getting rid of a few unwanted monthly streaming subscriptions. It’s an entire lifestyle. You start to realize that you really don’t need a lot of the things that you think you do. Perhaps you start fixing and making your own clothes. Or you decide to buy food in bulk with your family, friends, or neighbors, and freeze a large part of it. Ways to budget better certainly do exist. But, naturally, they work best while you’re also looking for ways to earn more.

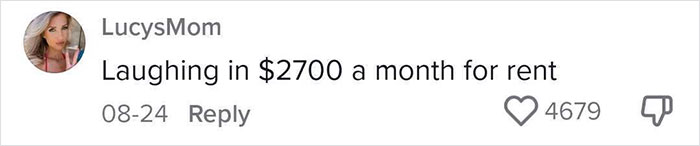

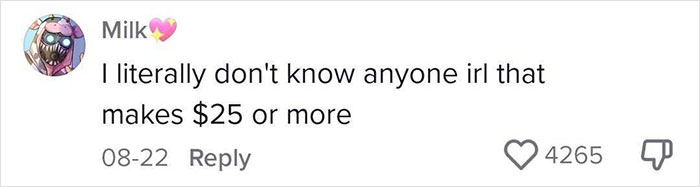

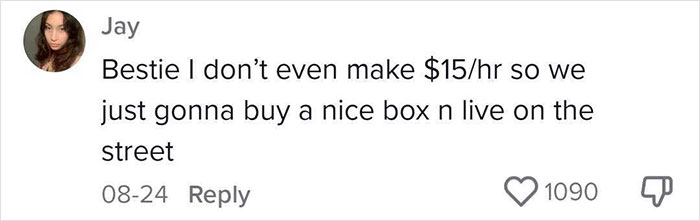

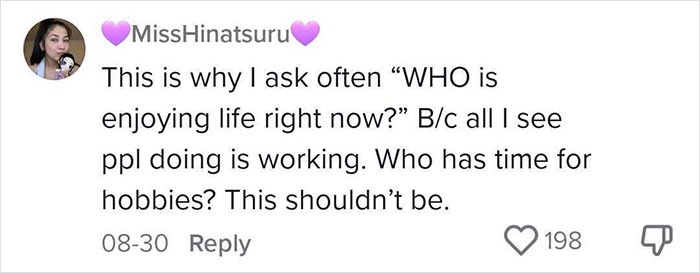

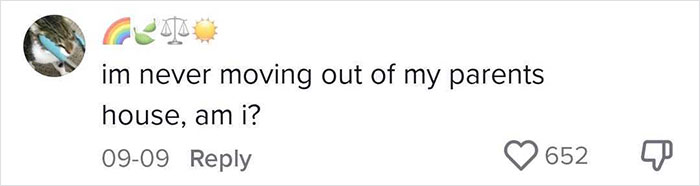

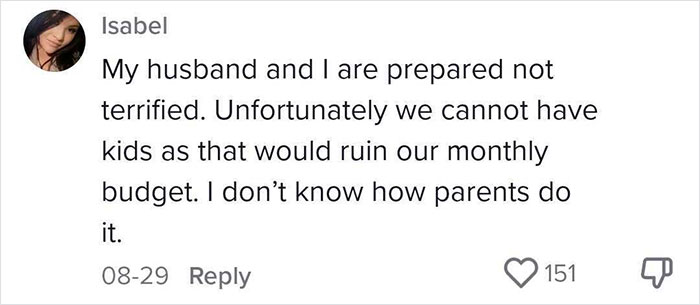

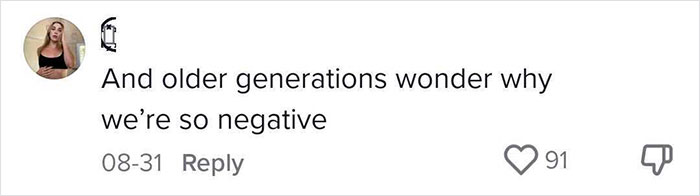

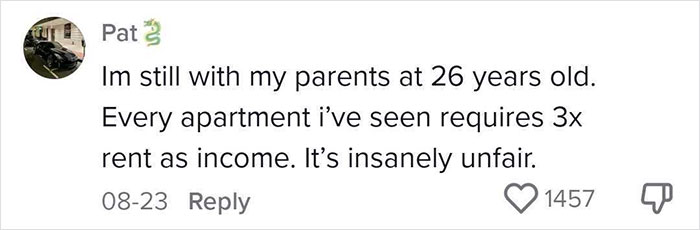

Here’s how some people reacted to Ryan’s viral video

I really, really, really wish that Bored Panda would stop regurgitating Tik Tok videos.

If you stop reading them, they'll get less traffic, and that will get them to post fewer of them. Reading the post then commenting on it indicates you're interested, so they'll keep making them.

Load More Replies...130 usd a month for your cellphone plan?! I pay 10 euros for unlimited 5G. Is there anything in the us that is not a corporate scam?

The vehicle insurance seems also ridiculously expensive.

Load More Replies...These numbers aren't even remotely accurate for a single person. Why does one person need $500/mo in groceries? Why is their cell phone $130? I know rent prices are high, but that depends on location. I was renting until last year in NC for $850/mo. Why do you have a $400 car payment if you can't afford it? I agree, wages should be higher, but these are numbers for someone that either can't budget or is making enough to afford it.

Exactly what I thought! $500 a MO for groceries?! I have a 4 person family and I don't pay $500 a mo for groceries. Cell phone is $50 for unlimited and you get a free tip of the line iPhone or pixel for free. Rent varies a lot and buying a house can currently be very challenging. Even gas isn't that on spot. $200 at $4 a gal is 50 gallons. Standard fill is usually around 12 gallons unless you drive a big truck or SUV. Which if you are single and in a budget why are you driving a gas guzzler? That's a little over 1 fill per week. Which depending on how far work is and what you drive that could be true. BUT being you are on a budget you should have a car that is known for great gas mileage. When I was driving an hour to work I purchased a diesel Jetta that got 50 miles/gallon. My car payment wasn't $400. My current car payment is $250. If your car payment is $400 you are spending outside of your budget. You won't be rich at $25 an hour but it's not bad. I started at $21.

Load More Replies...I really, really, really wish that Bored Panda would stop regurgitating Tik Tok videos.

If you stop reading them, they'll get less traffic, and that will get them to post fewer of them. Reading the post then commenting on it indicates you're interested, so they'll keep making them.

Load More Replies...130 usd a month for your cellphone plan?! I pay 10 euros for unlimited 5G. Is there anything in the us that is not a corporate scam?

The vehicle insurance seems also ridiculously expensive.

Load More Replies...These numbers aren't even remotely accurate for a single person. Why does one person need $500/mo in groceries? Why is their cell phone $130? I know rent prices are high, but that depends on location. I was renting until last year in NC for $850/mo. Why do you have a $400 car payment if you can't afford it? I agree, wages should be higher, but these are numbers for someone that either can't budget or is making enough to afford it.

Exactly what I thought! $500 a MO for groceries?! I have a 4 person family and I don't pay $500 a mo for groceries. Cell phone is $50 for unlimited and you get a free tip of the line iPhone or pixel for free. Rent varies a lot and buying a house can currently be very challenging. Even gas isn't that on spot. $200 at $4 a gal is 50 gallons. Standard fill is usually around 12 gallons unless you drive a big truck or SUV. Which if you are single and in a budget why are you driving a gas guzzler? That's a little over 1 fill per week. Which depending on how far work is and what you drive that could be true. BUT being you are on a budget you should have a car that is known for great gas mileage. When I was driving an hour to work I purchased a diesel Jetta that got 50 miles/gallon. My car payment wasn't $400. My current car payment is $250. If your car payment is $400 you are spending outside of your budget. You won't be rich at $25 an hour but it's not bad. I started at $21.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

31

39