This 8-Item List Of Requirements For Being Able To Rent This House Went Viral Because Of Its Ridiculousness

Future tenants must always be careful and watch out for scammers who just want to take their money. But landlords also need to take their own precautions to not be left without a tenant when they told every other applicant the place is no longer available and from messy people who can destroy their property.

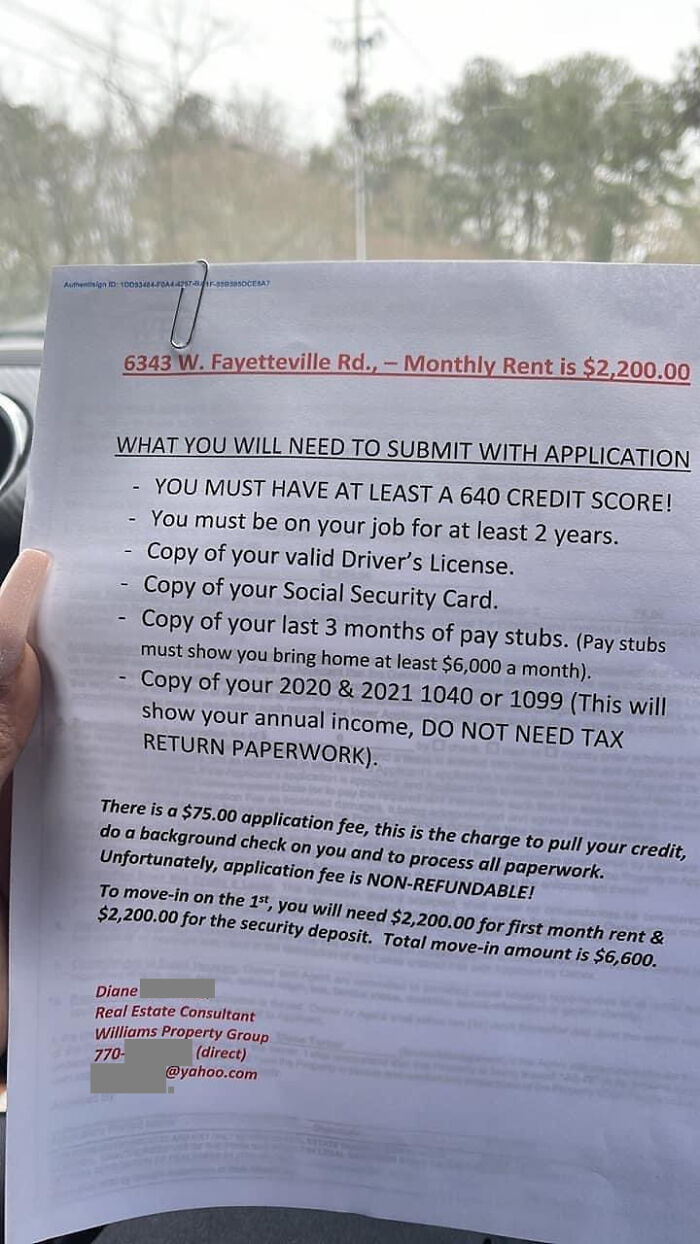

There is a saying ‘better safe than sorry,’ but usually there is a line when it’s too much. A person online shared a photo of a list of requirements a tenant must meet to be able to rent a 1,568-square-foot (145 square meters) house in Georgia, USA and they look like someone’s buying the property and not renting it.

More info: imgur

Finding a place to live is hard as it is, but landlords tend to make the task even more difficult

Image credits: David Baron (not the actual photo)

The photo of the requirements was posted on imgur by the user Mostlywibbly alongside a Google Maps photo for reference as to how the house looks from the outside.

It seems that the landlord wanted to make sure that the person they would be renting the property to was a financially stable, working person with a car.

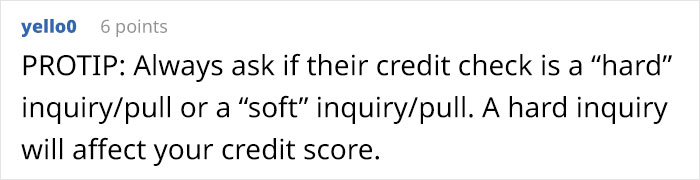

The first thing on the list was to have a 640 credit score. For those who aren’t familiar, a credit score shows how likely a person is to pay back credit. The number ranges from 300 to 850 and the higher the number, the bigger the chance the person will be able to pay off their debts, so 640 is kind of high.

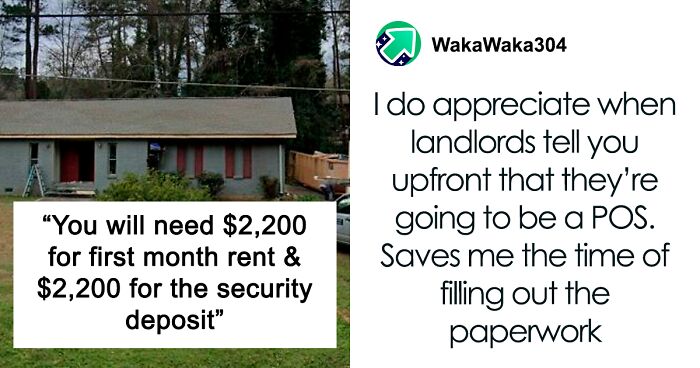

An Imgur user shared a list of requirements this landlord has for a person to be able to apply

Image credits: Mostlywibbly

Image credits: Mostlywibbly

The first thing written in all caps indicates that it is very important that the future tenant have a good credit score

Image credits: Zillow

Then the landlord wanted the tenant to not only have a job, but have been in it for 2 years. Which presumably shows responsibility and stability, but the weird part is that this is not common practice with rent. Background checks and credit scores are required when people are buying homes as it is a long-term investment and commitment, but renting is a lot more simple.

On top of having a long-term job, the tenant must have a driver’s license and provide a copy of it with the application. So logically, anyone who doesn’t have a car automatically isn’t eligible to rent the house.

Image credits: Zillow

Image credits: Zillow

Image credits: Zillow

There are more copies of documents the landlord wanted to have. One of them is the tenant’s social security card, which is understandable as it is used for identification. Another thing that the landlord asked to provide were pay stubs for the last 3 months, and the tenant must be earning $6,000 a month, which is $72,000 yearly.

According to the information on World Data, the average yearly income in the US for full-time employees in 2020 was $69,392 or around $5,783. So the landlord expects their tenants to earn a little bit more than the national average.

The landlord wanted the person to have a stable job of 2 years, a car and a salary of at least $6,000 a month

The landlord wanted not only to see the monthly payments but also the copies of form 1040, which is the U.S. Individual Tax Return form or form 1099 which shows non-employment income.

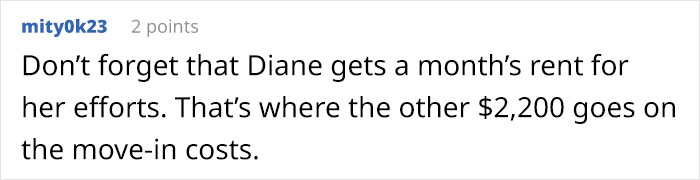

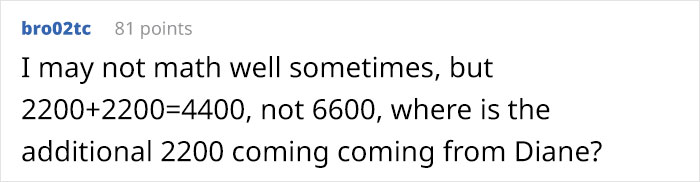

To be able to apply for this house, a person must pay a $75 application fee which is non-refundable. The rent is $2,200 and the deposit is one month’s payment. So in total it should be $4,400, but for some reason the paper states that the total move-in amount is $6,600, which is a whole month’s rent more.

They also wanted to see forms 1040 or 1099 submitted with the application

Many people in the comments found it suspicious that there is an application fee and they advised to never even look at such listings because it is a scam to lure money from people. They also noticed that the total move-in amount was quite a bit bigger than it should be if you do the math correctly.

People in the comments were also pointing out that the place was not worth $2,200 a month because it is in Riverdale, which is a small city with a population of 15,129 people and it is 12 miles (19 km) south of downtown Atlanta, the capital of the state of Georgia.

Many people pointed out how ridiculous those requirements are

First of all, the math didn’t make sense as the total move-in amount didn’t match up with the prices of the first month and security deposit

The listing of this property is still visible on Zillow even though the house isn’t up for sale or for rent. It is hard to say if the landlord just changed their mind or there was a person who moved in, but there are a lot of things that you can see in the description.

First of all, it was built in 1972 and first sold in 1995 for $69,900. Zillow estimates that now it has a value of $203,800. The last time the property was sold was in 2008 for $40,000. After that, it was listed for rent only on February 2nd of this year. The price was $2,200 in the papers, as Mostlywibbly had said, but the same day, it was lowered to $2,000. Then it was lowered again just two days later to $1,800 but removed the same day.

They also immediately were warded off by the application fee as it is just easy money for the companies

We can only guess what prompted the landlord to change the price so quickly and remove the listing only after 2 days it was put up. Maybe it was actually rented out, because it is a 3-bedroom house with 2 bathrooms that has a fireplace and hardwood floor.

The photos show that it probably was renovated, but looking at them closer, it is evidence that the job was done sloppily and it could be that applicants pointed it out, so the landlord decided to fix the problems to be able to ask for a bigger rent price. It’s up for speculation but it is definitely suspicious.

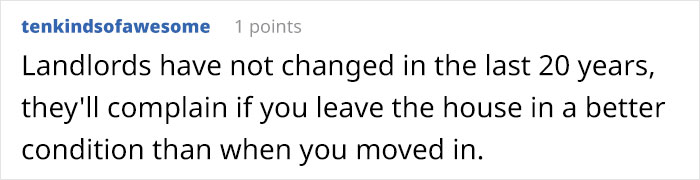

Finally, they suggested that it might be a scam and that landlords are greedy people in general

What do you think of the requirements to be able to apply for the rent of this property? Do you think it is common for landlords to ask for these things and do you think that the price is fair for what the tenant would be getting? Let us know your opinion in the comments!

491Kviews

Share on FacebookIf somebody is CLEARING $6,000 a month, they won't need to rent that shitty little shed conversion way outside of Atlanta. They will own their own place and it won't be that. The price is about 2.5 - 3 times the cost of similar properties in that area. Obviously the landlord has been burned by bad tenants (I mean, it's the perfect location for a meth lab), but the valuation is ridiculous. I can understand how horrible it is to have someone default on rent (possibly due to COVID?) and/or trash your property, but he's dreaming if he thinks he will get any of these requirements fulfilled.

Likely an investment property scheme for tax write offs. Anybody with those quals can get a mortgage no problem for a better house for less $ and the property owner knows it. I've seen this many times.

Load More Replies...Ok, as a landlady I have to say this is freaking ridiculous! We don’t do credit score checks because they are NOT indicative of someone’s ability to be a good tenant. We do require one year employment. The tax thing? BS. Also, APPLICATION FEES ARE A SCAM! I go on our state’s judicial case search site, which is free and public information, and look for any landlord/tenant actions or evictions (w/ithe past 4 years). I speak to bosses and supervisors and former landlords. For free. However, if I do find that someone has lied (about employment or rental history) that is a big red flag. But this is nonsense, no matter how badly he has been burned before.

You can do what you want but credit checks DO say something about the applicant. Too many bad renters out there to merely trust them with a $200k asset.

Load More Replies...Um, if your credit score is 640, and you can produce that much documentation at that income level? Unless you're in a huge metro area like NYC/LA? You'll get a mortgage. Also, that much rent on that house if it's in a rural area? LOL, no. Someone bought that house to "flip it" (cosmetic fix-up, re-sell fat) and got into a financial hole they want a tenant to fill in for them. Hubby sees this in his work all the time, and he can rant for hours about "flippers" and their traits as landlords. (None of his rant is poite!)

If somebody is CLEARING $6,000 a month, they won't need to rent that shitty little shed conversion way outside of Atlanta. They will own their own place and it won't be that. The price is about 2.5 - 3 times the cost of similar properties in that area. Obviously the landlord has been burned by bad tenants (I mean, it's the perfect location for a meth lab), but the valuation is ridiculous. I can understand how horrible it is to have someone default on rent (possibly due to COVID?) and/or trash your property, but he's dreaming if he thinks he will get any of these requirements fulfilled.

Likely an investment property scheme for tax write offs. Anybody with those quals can get a mortgage no problem for a better house for less $ and the property owner knows it. I've seen this many times.

Load More Replies...Ok, as a landlady I have to say this is freaking ridiculous! We don’t do credit score checks because they are NOT indicative of someone’s ability to be a good tenant. We do require one year employment. The tax thing? BS. Also, APPLICATION FEES ARE A SCAM! I go on our state’s judicial case search site, which is free and public information, and look for any landlord/tenant actions or evictions (w/ithe past 4 years). I speak to bosses and supervisors and former landlords. For free. However, if I do find that someone has lied (about employment or rental history) that is a big red flag. But this is nonsense, no matter how badly he has been burned before.

You can do what you want but credit checks DO say something about the applicant. Too many bad renters out there to merely trust them with a $200k asset.

Load More Replies...Um, if your credit score is 640, and you can produce that much documentation at that income level? Unless you're in a huge metro area like NYC/LA? You'll get a mortgage. Also, that much rent on that house if it's in a rural area? LOL, no. Someone bought that house to "flip it" (cosmetic fix-up, re-sell fat) and got into a financial hole they want a tenant to fill in for them. Hubby sees this in his work all the time, and he can rant for hours about "flippers" and their traits as landlords. (None of his rant is poite!)

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

98

125