Woman Causes Family Drama By Refusing To Forgive Late Mom’s Debt And Demanding That Sister Pay It

When someone you know, like a family member, is in a financially tough spot, it might feel natural to help them out. This can bring people closer together when times get hard. But when it comes to loaning the money, things get slightly more complicated as the chance of seeing it ever again plummets.

Reddit user AmIGreedy12 found herself at risk of losing the $37K that she loaned her now-late mother. To try and save it, she pushed her sister to repay it, even though it meant leaving her without a home. This stirred quite the drama amongst the family, which led the Redditor to turn online, asking if she was acting greedy.

When a family member is in a financially tough spot, it might feel natural to help them out

Image credits: Prostock-studio / envatoelements (not the actual photo)

However, after helping out and not being repaid, this woman was set on taking extreme measures

Image credits: demopicture / envatoelements (not the actual photo)

Image credits: wutzkoh / envatoelements (not the actual photo)

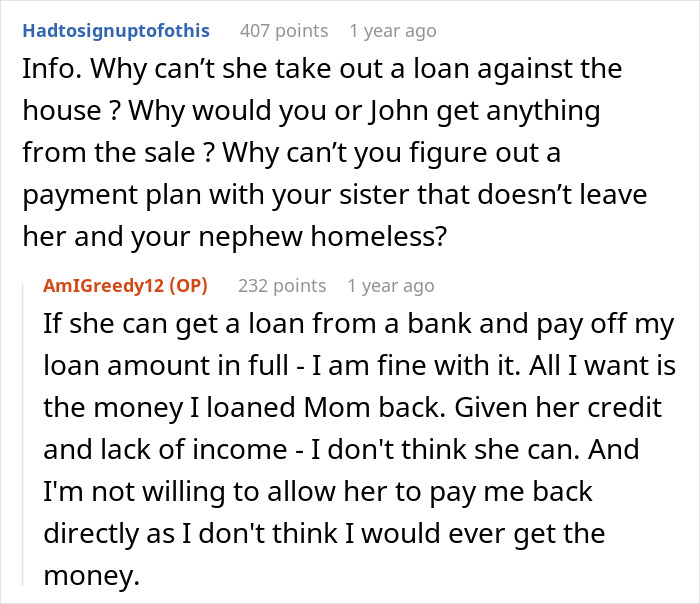

Image credits: AmIGreedy12

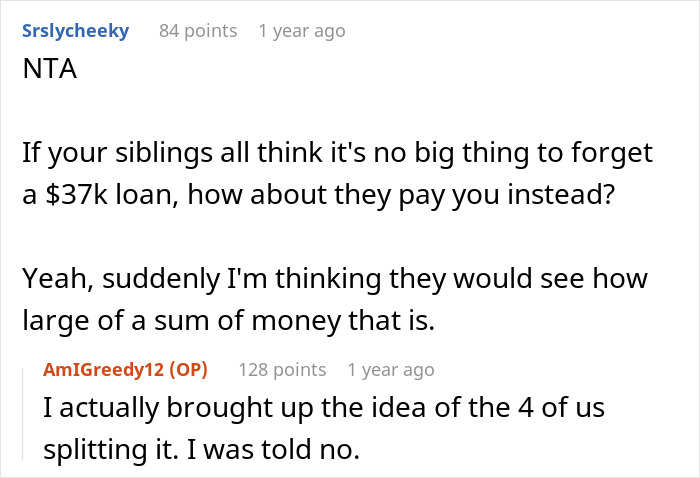

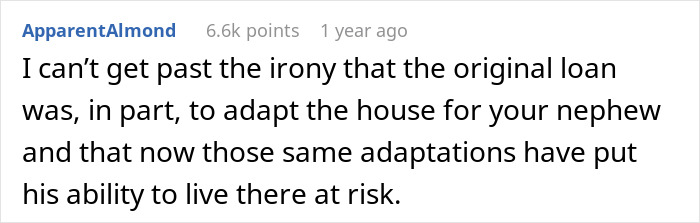

42% of people reported losing money through loans made to friends and family members

Image credits: Beachbumledford / envatoelements (not the actual photo)

According to the 2022 CreditCards.com survey, 42% of participants reported losing money through loans made to friends and family members. Due to the high risk of not seeing the borrowed sum ever again, many experts urge people to very thoroughly think before lending the funds to family and friends.

When a loved one asks to borrow money, the first thing a person should consider is their own financial situation. “Ask yourself: Am I really in a position to be gifting money right now?” says Wendy De La Rosa Wendy De La Rosa, assistant professor of marketing.

If the person has the extra money, they can consider sharing it. However, if they have to pull the funds from their necessary expenditures like rent, car payments, or tax money, they are at risk of jeopardizing themselves. It can also put them in an even more vulnerable position if the borrower fails to pay back.

“I’m not a big fan of lending money to family and friends because of the strong likelihood that something will go wrong,” says Ted Rossman, senior industry analyst at CreditCards.com. “If you want to do this, don’t lend more than you can afford to lose.”

Lending money should be left to financial institutions

Image credits: Joyseulay / envatoelements (not the actual photo)

Meanwhile, financial author Michelle Singletary believes that lending money should be left to appropriate institutions. “As individuals, we are not in the business of lending money. We don’t know how to do it because there are a lot of feelings involved,” she says. “That’s why it should be left up to financial institutions.”

If a person has the money the family member needs and doesn’t feel a negative effect from parting away with it, they might consider gifting it. “If I’m giving money, I’m assuming it’s a gift. It’s not going to get paid back. So from my end, I know it’s money I’m willing to lose,” says financial educator Berna Anat.

In cases when that’s not possible, there are other ways to help a struggling loved one out. It may simply be enough to provide some guidance, as someone who is in a financially tough position often doesn’t see another way out. Instead of giving them the money, think about helping the person with their budget or setting up an action plan to get them out of the tough situation.

Or offer to assist them with their groceries, or suggest taking care of their little ones so they could pick a few more shifts at work or focus a bit more on their side hustle. Providing support shows that you’re willing to be there for them, which will be greatly appreciated.

So, dear Pandas, what are your thoughts on lending money? Have you done it before? If so, how did it go? Be sure to let us know in the comments below!

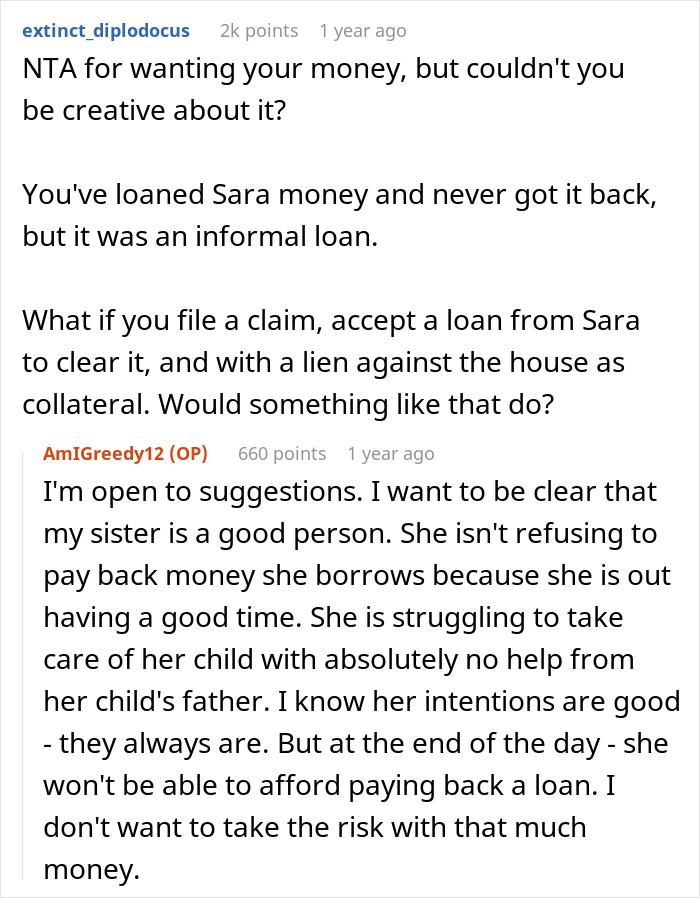

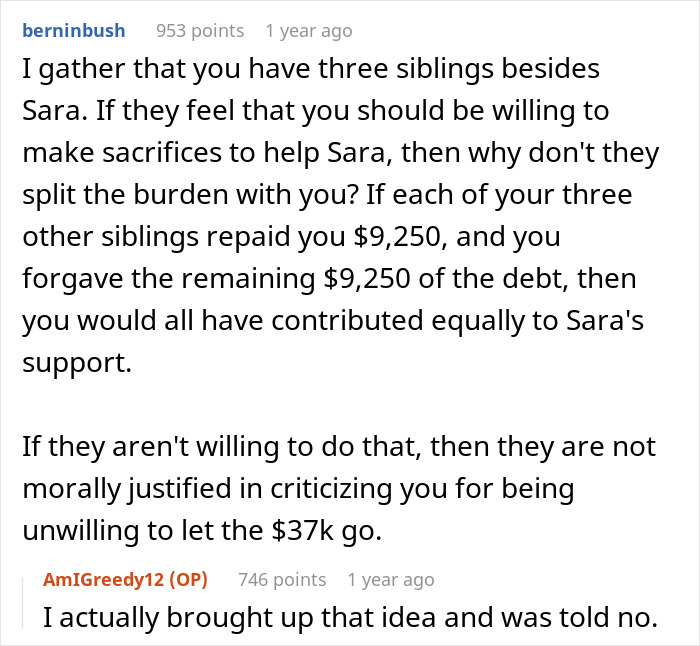

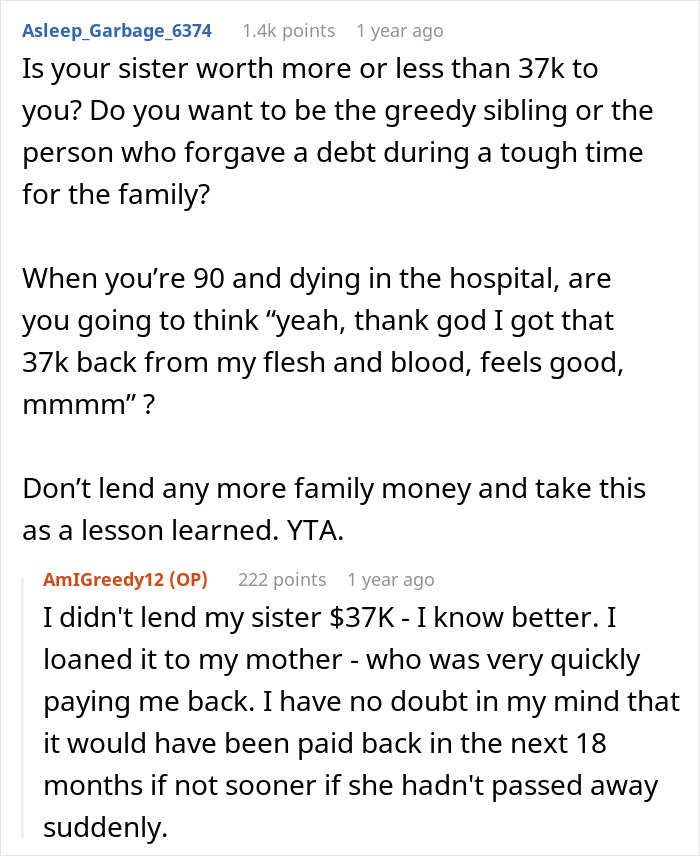

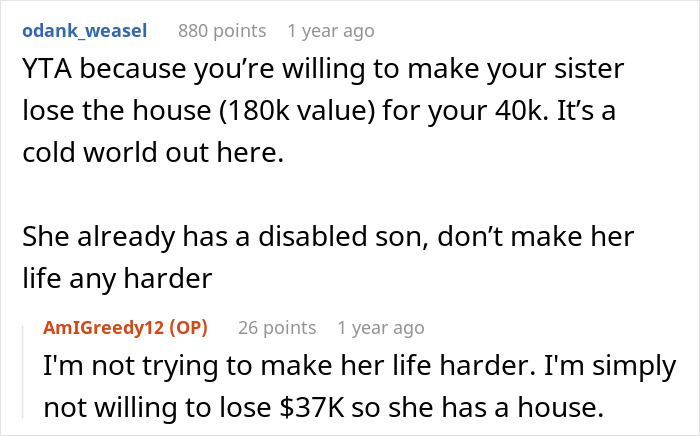

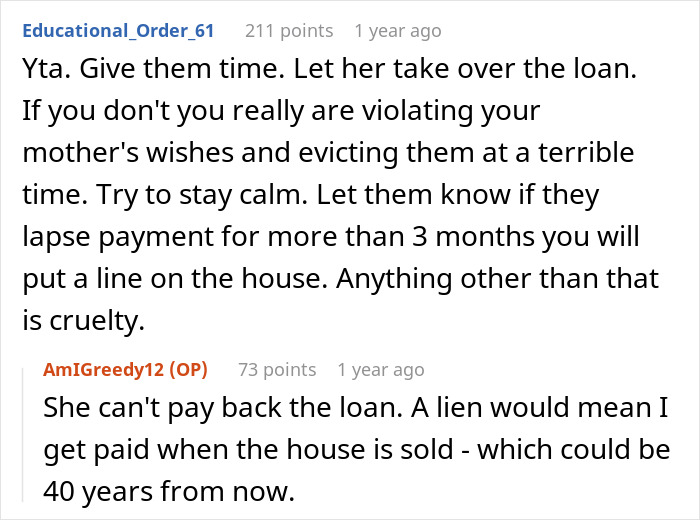

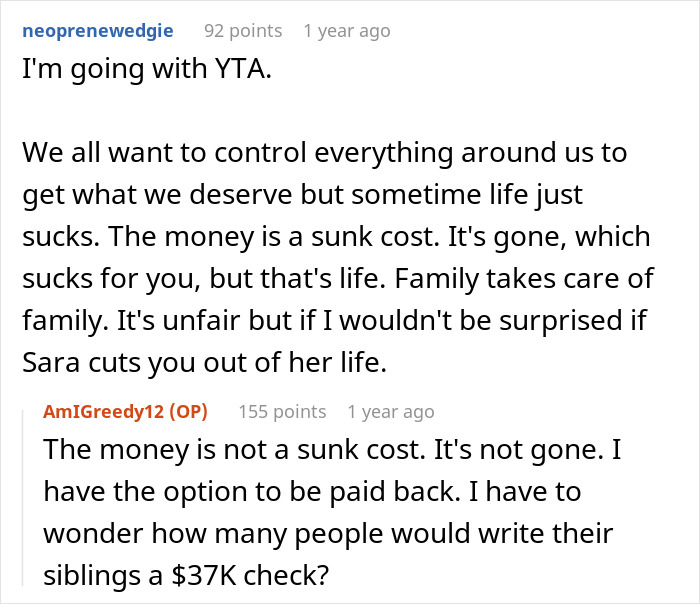

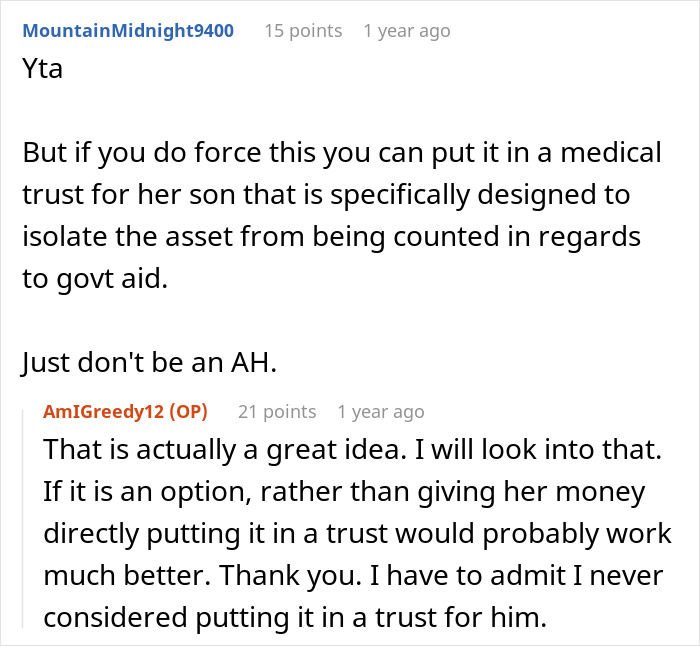

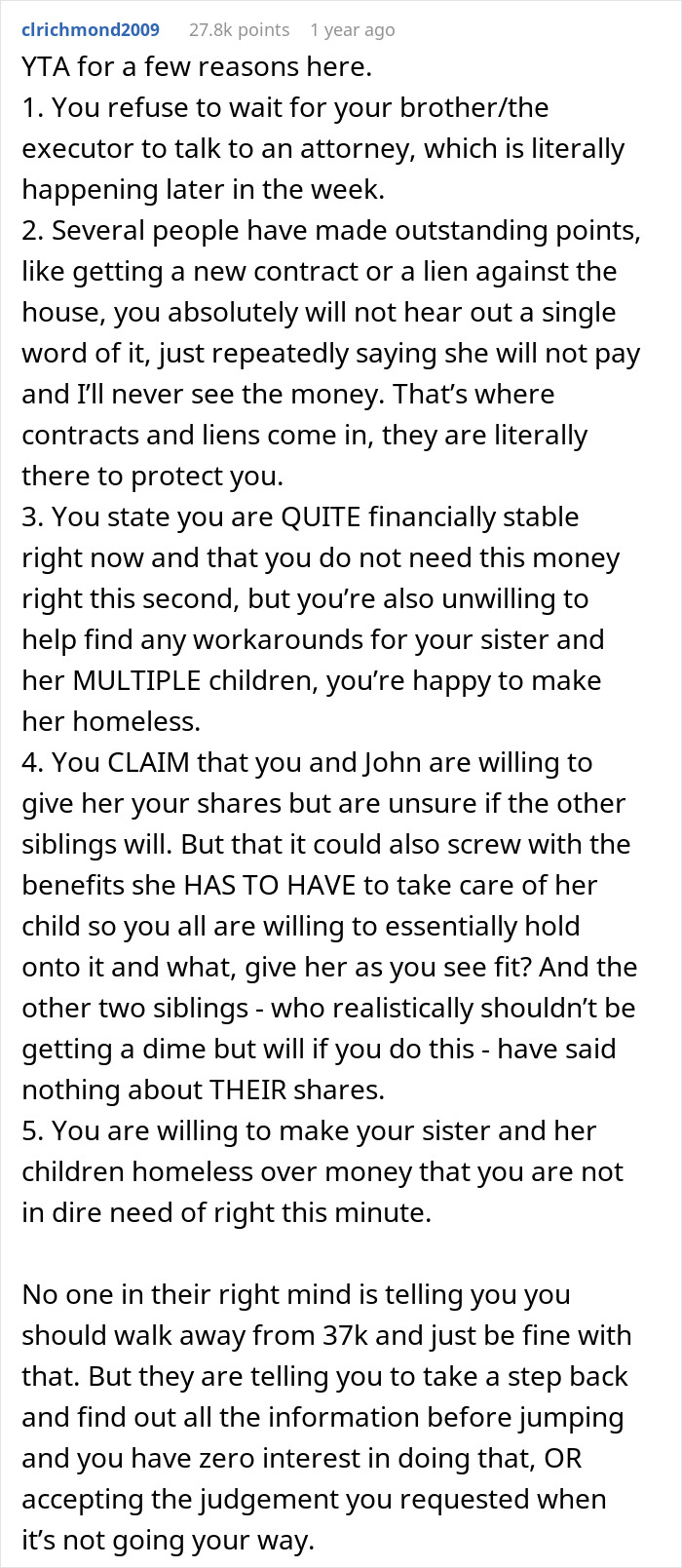

The author’s post stirred up a heated discussion in the comments

Poll Question

Thanks! Check out the results:

66Kviews

Share on FacebookExplore more of these tags

Wow I guess people just regularly lose $37K seeing as how many people think she should just forget getting paid back what she loaned

It’s easy to give away somebody else’s money. The fact that the OP gave her sister nearly $10K, and the other siblings who are calling her greedy won’t give the sister the same amount say everything you need to know.

Load More Replies...She’s not the AH. She’s looking at it quite logically. If her sister can’t get a loan from a bank, she likely will never be able to pay her back this money owed and will eventually also lose the house at which point the siblings will incur additional expenses because I doubt they’d let them go homeless. The mom is the only AH. She put one child ahead of others. When she took out that loan she should have also taken out a life insurance policy. How was the mom paying her back? Is the reason she only left like $1k because she was using her savings to pay back the loan and soon enough was going to run out of money herself? The financially responsible thing to do is request the debt be paid which means sale of the house. She gets her $37k back making her whole. Any proceeds would then either be split amongst the remaining siblings or if they feel generous, used towards a smaller home for the sister and nephew.

The mother should have just gotten a home equity loan and kept the daughter out of it. She was probably getting SSI and/or pension and paying her daughter back with that. If one of her own children were disabled they may have been eligible for benefits, but not a grandchild.

Load More Replies...The sister is just going to lose the house eventually anyway and then she will have to go through the whole mess of getting the money from the foreclosure sale. Not an expert, but it seems to make a lot more sense to get the money now and for the sister to put the rest of it aside in the trust like the lawyer suggested.

That's the part that isn't really being addressed in the responses. Everything in this post suggests that the sister with the disabled child is well-meaning but completely overwhelmed and unable to meet the obligation which doesn't bode well for her ability to keep a house that would still need insurance, taxes paid, and upkeep. The OP has even offered to gift her sibling 1/4 if the other siblings follow suit. There's one other thing, her sister may qualify for a form of HUD or Section 8 housing through the social security administration because she has a permanently disabled child, so owning that house may not even be in her best interest.

Load More Replies...Wow I guess people just regularly lose $37K seeing as how many people think she should just forget getting paid back what she loaned

It’s easy to give away somebody else’s money. The fact that the OP gave her sister nearly $10K, and the other siblings who are calling her greedy won’t give the sister the same amount say everything you need to know.

Load More Replies...She’s not the AH. She’s looking at it quite logically. If her sister can’t get a loan from a bank, she likely will never be able to pay her back this money owed and will eventually also lose the house at which point the siblings will incur additional expenses because I doubt they’d let them go homeless. The mom is the only AH. She put one child ahead of others. When she took out that loan she should have also taken out a life insurance policy. How was the mom paying her back? Is the reason she only left like $1k because she was using her savings to pay back the loan and soon enough was going to run out of money herself? The financially responsible thing to do is request the debt be paid which means sale of the house. She gets her $37k back making her whole. Any proceeds would then either be split amongst the remaining siblings or if they feel generous, used towards a smaller home for the sister and nephew.

The mother should have just gotten a home equity loan and kept the daughter out of it. She was probably getting SSI and/or pension and paying her daughter back with that. If one of her own children were disabled they may have been eligible for benefits, but not a grandchild.

Load More Replies...The sister is just going to lose the house eventually anyway and then she will have to go through the whole mess of getting the money from the foreclosure sale. Not an expert, but it seems to make a lot more sense to get the money now and for the sister to put the rest of it aside in the trust like the lawyer suggested.

That's the part that isn't really being addressed in the responses. Everything in this post suggests that the sister with the disabled child is well-meaning but completely overwhelmed and unable to meet the obligation which doesn't bode well for her ability to keep a house that would still need insurance, taxes paid, and upkeep. The OP has even offered to gift her sibling 1/4 if the other siblings follow suit. There's one other thing, her sister may qualify for a form of HUD or Section 8 housing through the social security administration because she has a permanently disabled child, so owning that house may not even be in her best interest.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

22

43