Why Millennials Are Struggling To Buy Homes, Explained By A Realtor

Today, everything from a movie ticket to college tuition is more expensive than it was a couple of decades ago. And the wages aren’t rising as fast as the prices.

Freddie Smith, a realtor from Orlando, Florida, says this is especially visible in the housing sector.

Earlier this month, Smith released a TikTok video where he breaks down the math of why Millennials have a harder time buying a home than Baby Boomers did.

The numbers look pretty grim, and the worst part is that you can’t really argue about them.

This realtor really feels for Millennials when it comes to housing

Image credits: fmsmith319

So he released a comprehensive video for other generations to get a better idea of how the current housing market differs from what it was a few decades ago

“Any time a millennial is trying to explain this to a boomer, they always use the same example. They go, ‘well, my interest rates were 15%, you have six and a half, you’re so lucky.’ Well, let’s look at it this way.”

Image credits: fmsmith319

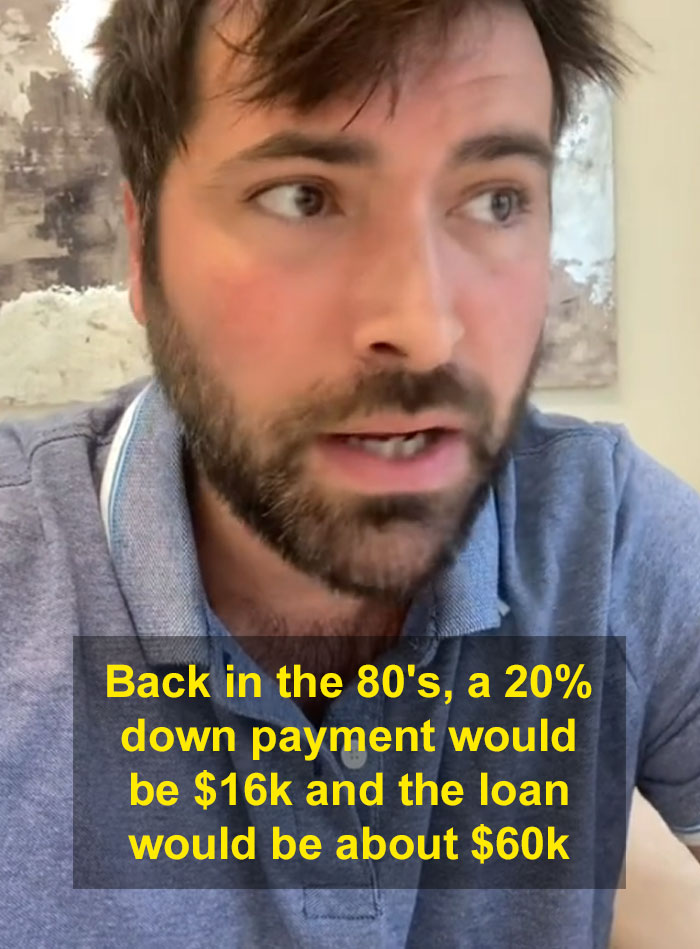

“If you bought a house for $80,000, back in the ‘80s, a 20% down payment would be 16 grand, and the average person was making around $30,000 back then. So your down payment was just half your yearly salary.”

“And then the loan you would have on it would be about $60,000. So in order to pay off the $60,000, if you really wanted to, it’s just two years of your salary, and you could have your house paid off.”

Image credits: fmsmith319

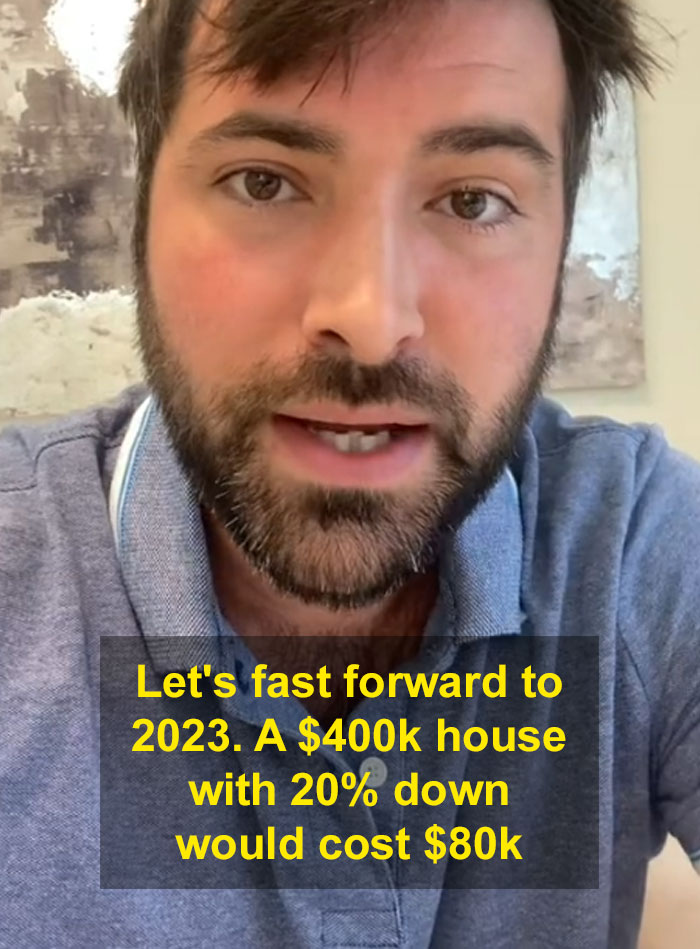

“Well, let’s fast forward to 2023 and I live in Orlando, so I’ll use this as an example. A $400,000 house with 20% down would cost $80,000. Just as the down payment. The average person makes $50,000.”

“So it’s almost twice their yearly salary just for the down payment, then they’ve got a $320,000 loan left that they have to look at.”

Image credits: fmsmith319

“That’s nearly seven times their salary to pay off the loan, regardless, and then you go ‘well, 15%, we had a higher payment.’ All the people buying houses right now, I’m a real estate agent here, so I see this all the time.”

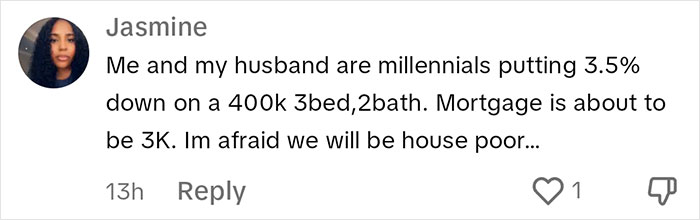

“It is incredibly rare that people are putting 20% down, people are putting three to 5% down, which is what the 6% interest rate is still shooting the mortgage through the roof. People’s payments on these homes are $3,300, $3,500 a month, on an average, simple, three-bed, two-bath home. So that’s the difference.”

Image credits: fmsmith319

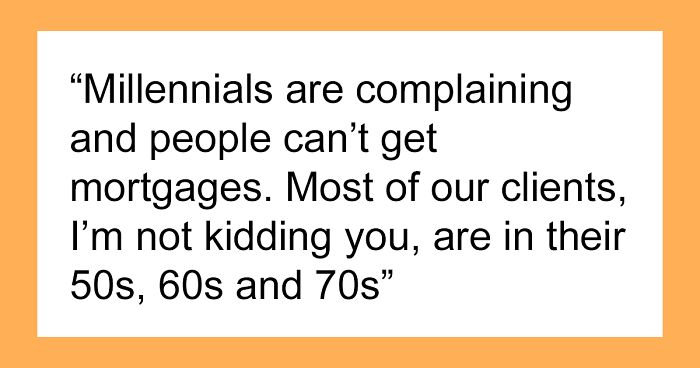

“Millennials are complaining and people can’t get mortgages. I don’t know the answer to it. But I’m in this stuff every single day and most of our clients, I’m not kidding you, are in their 50s, 60s and 70s.”

“It is so rare for us to see a millennial or especially anyone younger, except a couple the other day, and the agent pulled me aside and said ‘hey, they gotta send this video to their parents because they’re the ones paying for it.’ Good for them. That’s awesome. But that’s the situation that millennials are in.”

The video has been viewed over 4.8 million times

@fmsmith319 Replying to @JosiahFuerte ♬ original sound – Freddie Smith

Image credits: fmsmith319

The situation is even worse compared to what it was a few years ago

Smith has been working as a realtor for one and a half years.

“I’m seeing many Gen Xers buying their first home or upgrading to a second home. Boomers either buying a second vacation home (usually, in cash) or downsizing for retirement,” he told Bored Panda. “With many of our Gen X clients, they bought a home about 5 or 10 years ago, and are cashing in their equity for an upgrade. Putting down 30-40% is mitigating the high interest rates making the monthly payment manageable.”

“As far as my generation, Millennials, many are thriving and utilizing 3-5% down payments, for instance, and getting their foot in the door.”

“Others, if they are fortunate enough, are getting down payment or co-signing assistance from loved ones,” Smith added. “Lastly, I am in a very niche market here in Orlando, Florida, that we call the Disney Corridor. We work with a lot of cash investors, who are buying Airbnb properties near Disney with extravagant themed rooms.”

Image credits: Mikhail Nilov (not the actual photo)

Millennials have been renting a lot

Some people point to a study by RentCafe, which found that in 2022, Millennial homeowner households became a majority among the generation, at 51.5 percent.

And it’s true, over the past five years, about seven million have joined the ranks, bringing the total to about 18 million — that’s more than triple the gains of Gen X (born 1965 to 1980), which added two million new homeowner households, for a total of about 24 million.

However, Millennials still own fewer homes than older generations do. Baby boomers (born 1946 to 1964) are still leading the rankings, with about 32 million homeowners among them.

And that’s quite telling, when you consider the fact that Millennials were the largest generation group in the U.S. in 2022, with an estimated population of 72.24 million.

No wonder that a survey from Apartment List found that in 2022, 24.7% of Millennials said they plan to “always rent” rather than buy a house.

Image credits: Kindel Media (not the actual photo)

Sometimes, especially when it comes to discussions on the economy, Millennials and older generations seem to be looking at issues from totally different perspectives

As Freddie Smith pointed out, when it comes to work and cost of living, the Boomers vs. Millennials debate is one for the centuries.

“What I’ve learned from reading thousands of comments on my TikTok videos is that Millennials feel a bit let down,” the realtor said. “However, it’s not the Boomers’ fault.”

“Society and the general narrative in the ’80s and ’90s was [said that you have to] go to school, get good grades, go to college, get a degree and work your way up. Our parents’ generation was giving the best advice they could for the information they had at the time. No one knew that social media would revolutionize the world so fast and we didn’t know the cost of living would rise at an unprecedented level.”

“So here we are in 2023, where Millennials are left holding the bag. Many of them are in their 30s, renting, holding massive college debt and making $65K a year, wondering why they are living paycheck to paycheck,” Smith said. “Where the butting of heads comes from, generally, is when Boomers give advice to ‘work harder’, ‘stop buying Starbucks’, and ‘stop whining’, not taking into consideration that most Millennials are working 40 hours a week at a job and [have] two side hustles just to get by”

“They are struggling to save [and] invest, let alone purchase a house. We don’t want a handout and we aren’t blaming the Boomers. All we are asking for is a little understanding that the struggle is real and we want to fix it, so that our generation and future generations don’t end up in a perpetual renter’s economy.”

The realtor said that Millennials, just like other people who are planning to buy their first home, have to sit down and map out a very strict, well-planned road map if they want to get a piece of the pie.

“It may take 6 months, a year, or two years to get their ducks in a row, but it’ll be worth it in the end,” Smith said. “I know that it may sound impossible to so many, but at the moment, this is our best option. Could the government step in and help in some way? I hear they are trying to help with down payment assistance, which is nice, but in my personal opinion, the down payment isn’t really the issue.”

Smith gave an example to illustrate the big picture. “In 2020, you could get a house for $300K and put down 3%, which was $9K. You’d also have to pay approximately another $9k in closing costs. Total out of pocket would be roughly $20K cash to get in that house. Today, that same house is $500K and at a 3% down payment you are looking at $15K, but in today’s market it is more likely to have the seller pay some closing costs, so both examples are costing the buyer about $20K cash to get in. So where does the problem lie?”

“Interest rates and housing costs combine,” he highlighted. “In 2020, the $300K house at 3% interest rate would run you about $1,000 for principal and interest. In 2023, that $500K house at 7% interest rate runs you about $2,600 a month for principal and interest for the same house. Now, that individual homeowner has to have doubled or even tripled their salary from 2020 to 2023 just to be considered for the same home.”

Smith said that there is a way for a government policy to implement a 2 or 3% interest rate for first-time home buyers only, and that would open the door for millions of first-time home buyers in today’s market.

However, if there’s anyone who can clean up this mess, it’s Millennials. They certainly seem like the ones who know how to deal with hardship. After all, the oldest of the cohort became adults facing the housing crisis and the Great Recession of the late ’00s, and the youngest graduated from college right into the pandemic.

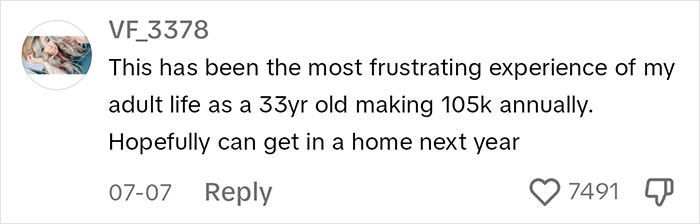

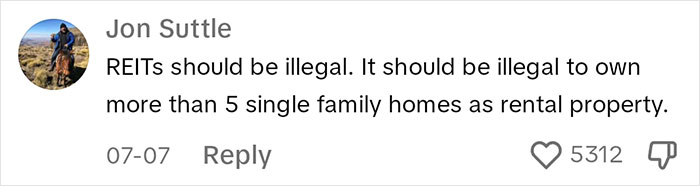

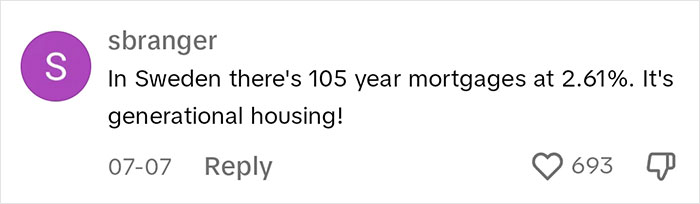

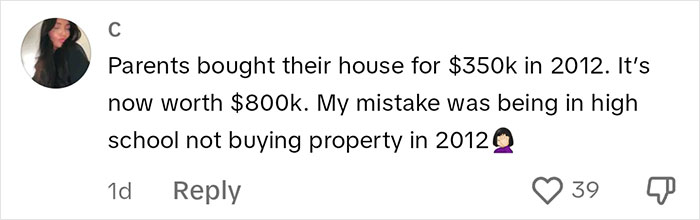

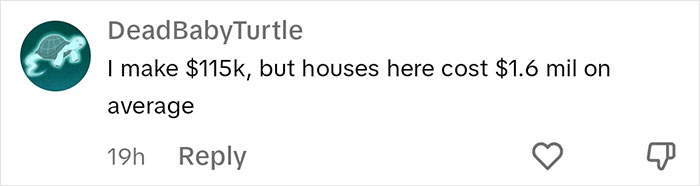

Smith’s video really resonated with people, and inspired many to share their personal stories

Let's do some more math. Since 1950 Rent up 300% Medical costs up 300% Jobs requiring degree up 300% Cost of degree up 300% Productivity up 300% Average wage up 10% Ceo compensation up 13,000%

If we use rent and medical in the inflation calculation. Workers create 3 times more value while making less than half as much.

Load More Replies...The only reasons I will ever be able to afford a home are that 1) being in the military means I can apply for VA loans (which do not require a down payment and generally have more favorable interest rates), and 2) my father's premature death leading me to inherit a trust fund. The fact that half of that is down to pure luck (good or bad, depending on your view) is atrocious.

Also, do to the area you're wanting to live in! I bought my home with 4 bedrooms and 3 baths in 2020 for $160 with 10 acres of land with it. Yet I'm out in the country nearest Walmart is 25 miles away nearest large city is 3.5 hours away.

Load More Replies...one issue I've seen in many places is that the expectation now is that property values will rise and people are using that as their retirement or get rich quick scheme. That's fine as an expectation, but when people take steps to protect their value against things that they perceive as threats to it, that's when real solutions get thrown out the window. Cities everywhere need sustainable, cheaper housing in mass quantities. But try to find a neighborhood willing to have a development of cheaper housing built next door. No one will say out loud "cheaper housing will make my house less valuable," but they'll say things like "a taller building doesn't match the height of the single family homes around here" or "a bigger development will cause traffic problems" or "the architecture doesn't fit well with our neighborhood." These are all arguments I've heard at city council meetings in my area and I'm sure they happen everywhere. It's incredibly frustrating.

Perfext example of Nimby (not in my neighborhood .

Load More Replies...Let's do some more math. Since 1950 Rent up 300% Medical costs up 300% Jobs requiring degree up 300% Cost of degree up 300% Productivity up 300% Average wage up 10% Ceo compensation up 13,000%

If we use rent and medical in the inflation calculation. Workers create 3 times more value while making less than half as much.

Load More Replies...The only reasons I will ever be able to afford a home are that 1) being in the military means I can apply for VA loans (which do not require a down payment and generally have more favorable interest rates), and 2) my father's premature death leading me to inherit a trust fund. The fact that half of that is down to pure luck (good or bad, depending on your view) is atrocious.

Also, do to the area you're wanting to live in! I bought my home with 4 bedrooms and 3 baths in 2020 for $160 with 10 acres of land with it. Yet I'm out in the country nearest Walmart is 25 miles away nearest large city is 3.5 hours away.

Load More Replies...one issue I've seen in many places is that the expectation now is that property values will rise and people are using that as their retirement or get rich quick scheme. That's fine as an expectation, but when people take steps to protect their value against things that they perceive as threats to it, that's when real solutions get thrown out the window. Cities everywhere need sustainable, cheaper housing in mass quantities. But try to find a neighborhood willing to have a development of cheaper housing built next door. No one will say out loud "cheaper housing will make my house less valuable," but they'll say things like "a taller building doesn't match the height of the single family homes around here" or "a bigger development will cause traffic problems" or "the architecture doesn't fit well with our neighborhood." These are all arguments I've heard at city council meetings in my area and I'm sure they happen everywhere. It's incredibly frustrating.

Perfext example of Nimby (not in my neighborhood .

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

33

36