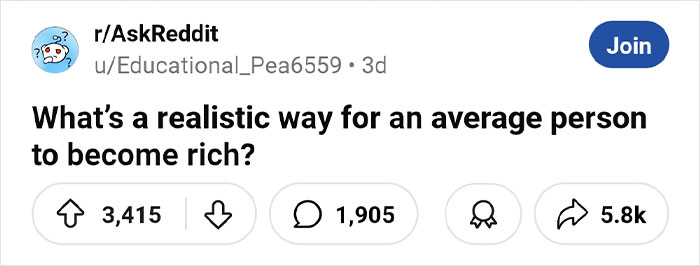

The idea of being rich is something that many of us dreamed about as kids. If you work hard, do well in school and in your career, you’ll certainly end up wealthy! Right? Well, adulthood often confronts us with harsh realities, one of which being the fact that getting rich is not easy for the vast majority of us. Today, I simply aspire to be able to provide a comfortable life for my cat, forget about owning a home or driving a fancy car.

But according to some, it is possible to accumulate wealth if you take the right advice. Redditors have recently been sharing tips for realistic ways that the average person can become rich, so we’ve gathered some of their insights below. Enjoy reading through, and be sure to upvote all of the financial tips that you plan to try for yourself!

This post may include affiliate links.

Well I got hit by a semi truck, lost a leg, and got a multimillion dollar settlement. Your experience may vary.

Well I got hit by a semi truck, lost a leg, and got a multimillion dollar settlement. Your experience may vary.

The best advice I ever received in my life:

The best advice I ever received in my life:

"Get good at doing something wealthy people need, and you will always have work."

The guy who told me this fixed air conditioning on yachts. No one who can afford a yacht is going to put up with the a/c not working on it, no matter what the current economic situation is like.

Pretty much by definition, an "average" person can't be rich.

Pretty much by definition, an "average" person can't be rich.

A small percentage of people get rich by being exceptionally good at, say, music or sports or salesmanship. What's far more common is that rich people had some kind of considerable head start that isn't available to average people.

The most "realistic" way would be to pursue some sort of high-demand and well-compensated career such as cardiology or plumbing, then being unusually scrupulous about saving and investing, and then marry a partner doing exactly the same thing.

If you get training in one of the trades (plumbing, electrician, HVAC, mechanic, etc.), you are pretty much guaranteed a comfortable income. No need to be unusually scrupulous......just be smart about saving. And invest your money, don't just save it.

Find a job that nobody wants to do and then make a business out of it.

Find a job that nobody wants to do and then make a business out of it.

Start a course telling others the secret to success.

Start a course telling others the secret to success.

For $10 I will teach you my secret to make 5 figures a month by working as little as 1 hour a week.

Inheritance.

Inheritance.

Two bugs: 1) I like my parents. A LOT. I might even go so far as to say I love them, and I sure do love having them around. 2) They don't have money, so there isn't anything to inherit. 🤷 I do realize it's my fault, as both issues could have been solved by choosing different parents, but I'm told the right of return has expired.

Right place right time.

Right place right time.

Everyone gets 2-3 chances to become super rich in their life time. In my time, it was Bitcoin. After that it was Dogecoin. After that it was Nividia.

I missed every single one of them.

Will there be more? Probably. Do we know what they are? Probably not.

I missed eBay, Microsoft, and Yahoo. But I didn't have any money then, either.

Winning the biggest jackpot at the lottery is genuinely the most realistic way for most people.

Winning the biggest jackpot at the lottery is genuinely the most realistic way for most people.

Earning and investing will get you, at best, a comfortable middle-class lifestyle.

Pretty much what I was thinking of saying. Nothing wrong with sensible financial advice as in the other postings, but if you want to be really rich as opposed to comfortably off, you really need a multi million windfall, or get into something at the ground floor (e.g. bitcoin) assuming you are astute enough to guess where things might head. I regret not having the imagination to see in the mid 90s where opportunities lay in the burgeoning internet

Marry a rich person or someone from a rich family.

Marry a rich person or someone from a rich family.

It’s the most important financial decision you can make.

Reinvest earnings from investments.

Reinvest earnings from investments.

Just make sure you set aside enough of those earnings to pay taxes on the capital gains.

I have a family friend who was a child of a single Mom during the Depression. i.e. raised in extreme poverty. He became a multi-millionaire. A friend who always wanted to be rich kept asking me "his secret". So I told him.

I have a family friend who was a child of a single Mom during the Depression. i.e. raised in extreme poverty. He became a multi-millionaire. A friend who always wanted to be rich kept asking me "his secret". So I told him.

After serving in WW2 he did nothing with his life then he was recalled for Korea. After two wars as a combat Rifleman he told himself he had to do something with his life so got a degree in a business field(dont want to say for privacy reasons). He worked that field living a pretty good middle class lifestyle for the next 20 years when the company he worked for was forced to sell. He risked his middle class lifestyle mortgaged everything he had along with a couple of partners and brought the business.

20 more years of putting every penny back into the business, having the wife complain about giving up her nice middle class lifestyle for "this" and driving old cars while his employees had better and finally the business takes off, they are brought out by a Mega-Corp and he comes out with tens of millions which he proceeds to invest carefully, still driving used Cars. Today in his 90's he is worth North of 100 million.

So the answer I gave my friend was learn a skill, get a job that pays the bills, take a risk when opportuntity presents itself, keep investing in yourself, your business and in the Economy and if you are lucky a mere 50 YEARS later you might be wealthy. It was not answer he wanted to hear. Only the very few become wealthy in their youth i.e. win it, inherit it or are super genius., without decades of effort. Time, investment, patience are the way to do it. Not as easy as it sounds since must of us can't do that.

Embrace frugality. Reducing unnecessary spending can help increase savings.

Embrace frugality. Reducing unnecessary spending can help increase savings.

Realistically it takes a long time. You’re gonna need a job that allows you to make more money than you spend. Invest at least 20% of that money into index funds, high-interest savings accounts, certificates, etc. consistently and frequently and let it grow over decades. If you do this and max out your 401k contributions you’ll eventually become a millionaire and have enough to retire.

Realistically it takes a long time. You’re gonna need a job that allows you to make more money than you spend. Invest at least 20% of that money into index funds, high-interest savings accounts, certificates, etc. consistently and frequently and let it grow over decades. If you do this and max out your 401k contributions you’ll eventually become a millionaire and have enough to retire.

How do you become rich sooner as an average person with an average job? Have rich parents that pass away.

Realistically it takes a long time. At least five generations (all with good strategy and will to follow)

Explore opportunities in emerging markets.

Explore opportunities in emerging markets.

Set clear boundaries with finances.

Set clear boundaries with finances.

Finances, listen up! We are going to save $100 every month! *landlord raises rent $150 a month* S**t.

Stay consistent with your financial strategy. Regularly reviewing goals can help keep you on track.

Stay consistent with your financial strategy. Regularly reviewing goals can help keep you on track.

"Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn't, pays it."

"Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn't, pays it."

- Ben Franklin

Edit: This comment got some traction and I'm seeing a lot of people disagree or downplay compounding in the thread so I want to address some of what I'm seeing -

1. Compound interest alone won't make you wealthy, it's just one of the tools (arguably the most important one) that helps along the way. You need to continually save and contribute to the investment and do it over a long time span of 30-40 years. It's important to start as early as possible and keep doing it consistently.

2. "Interest" in this quote can be interchanged with "returns". There are very few fixed interest rate investments these days that will give you proper returns. Low cost index and bond funds while reinvesting your dividends provide compound returns which gives you the same benefit. The "compound" is the important part of the quote, not "interest"

3. Take advantage of tax advantage. Tax advantaged accounts are some of the best tools available to the everyman to help grow your balance. IRAs, 401k, 403b, HSAs, learn about all of them and which you can leverage to help you get to your goals

4. Diversify your investments so nothing will totally wipe you out. You will have up years and down years but the most important thing is always being able to play.

5. Pay attention to and control your expenses. The two components of being able to save is your earnings rate and your expenses. The net of that is your possible savings rate. It's much more difficult to control and grow your earnings rate than it is to simply lower your expenses. Learning to live off less than you make and controlling your expenses will help you with every aspect of your life

6. Avoid debt as much as you can. Don't finance a car, don't use credit cards if you can't pay off the balance in full every month, don't use any BNPL services, pay off your mortgage as fast as you can

If you do all of this and **CONSISTENTLY SAVE** over a decades long time frame, compounding will take care of the rest, I promise. This is all stuff the average person has access to and can use that will get you wealthy in your life.

That quote is usually attributed to Albert Einstein. Because he said it. I have always tried to save (it wasn’t always possible), because the safety net allows you to take advantage of opportunities as they arise. Identify the right opportunity, and you may succeed financially.

It depends on how you define being rich.

It depends on how you define being rich.

If you’re looking at it from being financially secure where you’re comfortable, you have to earn more than you spend.

If you’re looking at it from becoming financially independent, then you’ll need to save, invest, and work.

If you’re looking for FU money, start a business.

What if my job doesn't pay enough to let me earn more than I spend?

Share financial tips with friends. Teaching others reinforces your knowledge and may open opportunities.

Share financial tips with friends. Teaching others reinforces your knowledge and may open opportunities.

Evaluate your risk tolerance. Understanding your comfort level can guide investment choices.

Evaluate your risk tolerance. Understanding your comfort level can guide investment choices.

Stay disciplined with savings. Regularly contributing to your savings can lead to financial stability.

Stay disciplined with savings. Regularly contributing to your savings can lead to financial stability.

Be proactive about financial planning. Creating a budget can help guide your spending and saving.

Be proactive about financial planning. Creating a budget can help guide your spending and saving.

Unfortunately, housing, food, and utilities guide my spending (and there ain't no saving).

Get involved in your community. Local connections can lead to business collaborations and job opportunities.

Get involved in your community. Local connections can lead to business collaborations and job opportunities.

Live below your means. Keeping expenses low allows you to save more and invest in your future.

Live below your means. Keeping expenses low allows you to save more and invest in your future.

In general, the most likely path looks something like this:

1. Identify a lucrative career path relative to the amount of training investment (college, trade school, apprenticeship, etc) required to become proficient, and identify it EARLY. In the US, Software Engineering USED to be a slam dunk, now the trades are very in demand. Plumber, HVAC technician, electrician, things like that.

2. Work hard to excel in the training needed to become proficient. Study hard in college, work hard and learn well in an apprenticeship. These are years of investment—don’t spend too much time not investing in yourself (that being said, you can still have lots of fun when you’re young). I’ll talk a little bit about debt later, but if you can avoid going into too much student debt, do so. Don’t go to an Ivy League if a state school will get the job done too. Get as many scholarships as you can (and there are a LOT of random ones out there!).

3. Spend a good amount of time trying to shop around for a good job or position for your skills—solid wage, good benefits, ESPECIALLY a good retirement program. Learn some negotiation skills so you can try and haggle your way into a little more during interviews. Learn how to interview so you become comfortable doing it (as you’ll want to do it often to see if any better prospects come through).

4. Work hard at your job, but don’t be married to it. Leveraging your current position and experience to launch you to a better (higher paying, better hours, better benefits, what have you) position is a big part of wage and career growth. Interview even when you’re comfortable, just to see what comes up and whether you could reasonably switch. My FIL in law is a very successful software engineer and project manager, and he interviews for jobs as a hobby. Frightens me… but he also has had a very successful career and went from basically average wealth to being decently wealthy around retirement age.

5. Save. Save way more than you think. Go all out on your 401(k), as much as you’re allowed or as much as your company matches. The more money you save in growth areas, the more will come in from interest. Maintain a sizable emergency fund for months of expenses if something happens, but keep it in something that can grow (but still be fairly liquid) so you can get a return on it.

6. Budget religiously. Know exactly where your money comes from and where it goes. If it seems like something is eating up too much of your budget, fight to reduce it. Like getting in shape, you need to measure exactly what your inflows and outflows are so that you can control them and use them to your advantage, not the other way around.

7. Be okay with used and subpar goods for a while. We all want the newest model of the hottest car or what have you, but if taking the more run down but ultra reliable used car that will last you another ten years means you can save more and not be saddled with hefty new car loans and leases. This can even translate to getting off brand cereal instead of name brand, or shopping a sale instead of just getting the best thing. Is it a huge difference? Of course not—your choice to get a Starbucks latte or get fresh avocados for your toast almost certainly isn’t going to make or break your chances at wealth, but a lot of little things like that can add up (part of why budgeting is so important). Identify what you can reasonably do without or make do with a substitute, and do so.

8. Be patient. For the majority of people, wealth growth is slow. It’s entirely possible for most average citizens to become wealthy, but in virtually all cases it’s not going to be fast. Asset growth over long time horizons is what we’re aiming for, which is also why the guy driving next to you in a shiny Corvette looks like your old uncle from the Midwest. It is extremely difficult (and requires insane luck or wealthy, pushover parents) to become wealthy when you’re young.

9. Don’t take on debt if you don’t have to. Student loans, for example, is a useful debt—if you’re using it to become a doctor, that’s an awesome investment. But taking in a loan for a new car when an older but reliable Honda will do is not a good choice and could take away from your saving power. Use debt as a tool, but treat it like a very sharp knife. Can cut through some problems easily, but can also hurt you.

That’s the basic path. It’s also the ideal. The corollary to this is that the reality for a lot of people is sometimes wrenches are thrown into the works—layoffs, health crises, family crises. Part of my belief in a social safety net is that it should serve as a way to hoist people back onto this path if life pushes them off. But for the average person, this is the path to wealth—slow, steady, and disciplined.

Invest 25% of your income in broad stock market index funds and wait 30 years.

Invest 25% of your income in broad stock market index funds and wait 30 years.

I'm not saying this isn't good advice, but it won't make you rich. The Dow Jones has increased by a factor of 5 over the last 30 years. Inflation has effectively halved the value of a dollar over the same period, so that's really a 2.5 times increase in your saving (assuming no fees on your investments). If you invested 25% of your income then, you can now withdraw about 62% of your income.

Explore entrepreneurship. Starting your own business can be risky, but it also has the potential for high rewards.

Explore entrepreneurship. Starting your own business can be risky, but it also has the potential for high rewards.

Read personal finance books. Knowledge can empower you to make better financial choices.

Read personal finance books. Knowledge can empower you to make better financial choices.

Seek multiple income streams.

Seek multiple income streams.

I don't think the people who give this kind of advice know what an average person is and how much they earn. Do they really think people who spend most of their income on basic necessities can reduce "extra" spending? Or that they can invest/save 20% of their income?

Like the man said, when I was young I was poor. Now, after forty years of hard work, I am no longer young.

Majority of these aren't ways to get rich, they're general advice for financial prosperity over a long period of time, but still not making you rich. Garbage post.

I don't think the people who give this kind of advice know what an average person is and how much they earn. Do they really think people who spend most of their income on basic necessities can reduce "extra" spending? Or that they can invest/save 20% of their income?

Like the man said, when I was young I was poor. Now, after forty years of hard work, I am no longer young.

Majority of these aren't ways to get rich, they're general advice for financial prosperity over a long period of time, but still not making you rich. Garbage post.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime