Bank Sends This Person An Ambiguous “Super Predatory” Letter About An Unpaid Debt From 2 Decades Ago, Luckily They Read It Carefully

Usually, getting mail is great. You might open up your mailbox to find a postcard from a long-forgotten friend or an invitation to support a local cause you care about deeply. However, right at the back of your mailbox you might find a bill or… a debt collection letter.

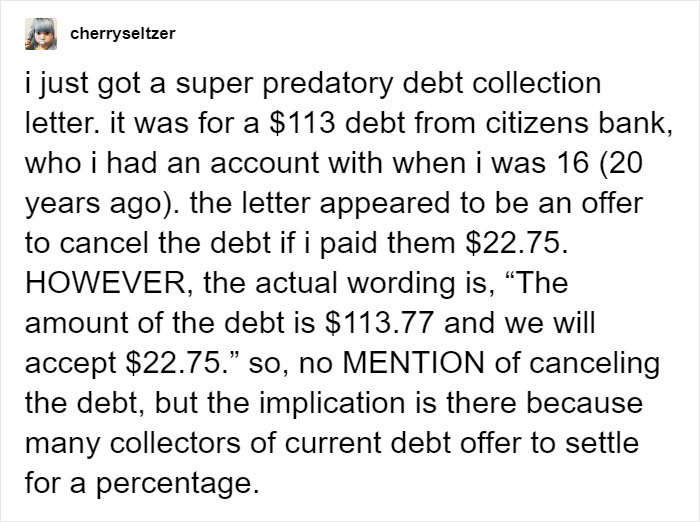

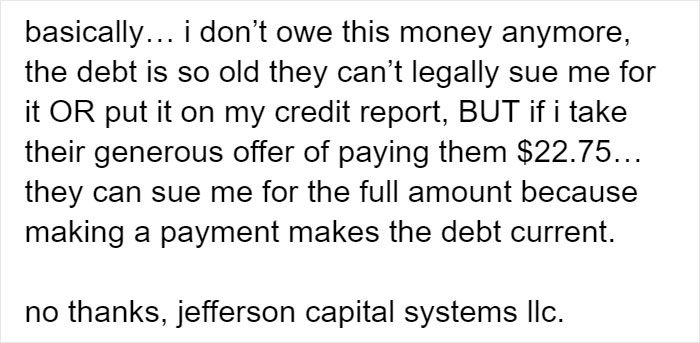

A Tumblr user, who goes by the name of Cherryseltzer, shared their story about a weird and “super predatory” debt collection letter they got. And it got their alarm bells ringing. The letter’s full of ambiguity and it’s bound to make anyone want to complain about getting something like this.

Scroll down, have a read, and let us know what you think, dear Pandas. Have you gotten anything like this yourselves? What’s the best thing to do in a situation like this? Share your thoughts in the comment section.

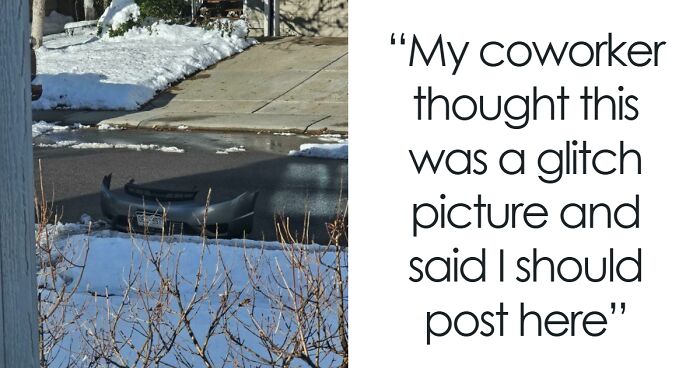

Someone shared their negative experience with a bank letter and it’s a warning about how you should read everything very carefully

Image credits: Daniel Arauz (not the actual photo)

Image credits: cherryseltzer

Image credits: feetlips

Paying off your debts and honoring your agreements is important. However, letters about a minuscule debt from over 2 decades ago that make you wish you had a lawyer on retainer don’t exactly help improve a company’s reputation.

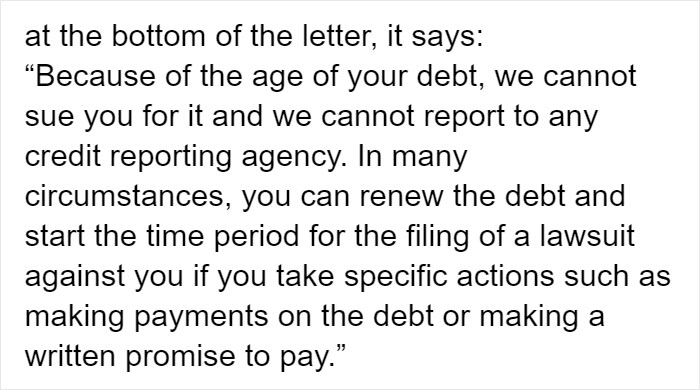

And what makes my head spin the most is that actually making any repayments toward the debt (even though you don’t have to) would make it possible for the bank to sue you for the full amount. I might be old-fashioned, but aren’t things that are legal supposed to be connected to the spirit of justice (just a tiny bit)?

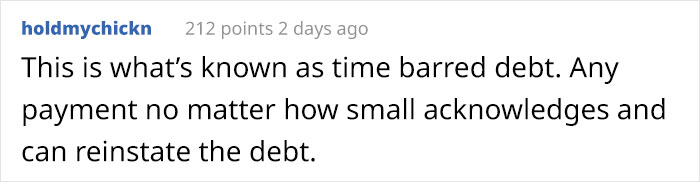

Cherryseltzer’s story got nearly 122k notes on Tumblr. The story made a resurgence in popularity on Imgur recently, too, with nearly 5.9k upvotes. Naturally, the people who read the story online were shocked and suggested that everyone read all letters and contracts very carefully. And one commenter took the cake when they summed up the entire situation in a single sentence: “Pay us so we can sue you.”

Debt collection laws vary country to country and state to state, so you’ll need to do some research and read up on what is and isn’t allowed if you get any similar letters. And if you’re confused, there are always people and organizations who offer pro bono advice about legal matters. Just make sure to always, always, always read the fine print.

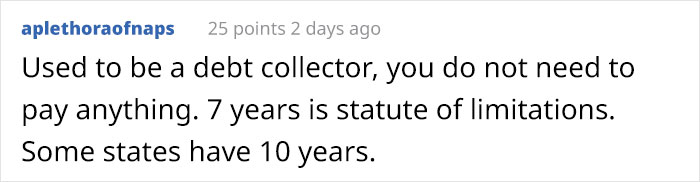

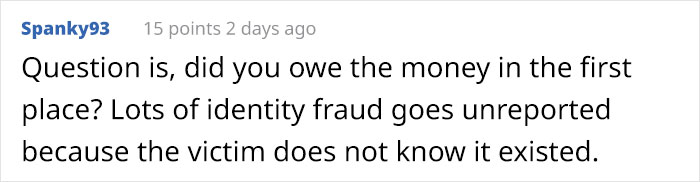

Here’s what people said when they read about what happened

Fun story - I once had a crown put in by a dentist who screwed up my insurance paperwork so I ended up having to pay for the whole massive bill out of pocket. It wiped out my meager savings, but I paid it completely. A couple months later, I start getting harassing and threatening phone calls at home and at work from a debt collection agency acting on behalf of the dentist. The debt in question? One cent. Let me repeat that. ONE. CENT. The icing on this particular crud cake was that when I went directly to the dentist to have it out with them, it turns out HE owed ME.

Should have turned it over to a debt collection agency so they could harass him. Unbelievable. I'm sure that was the last time you ever used that dentist.

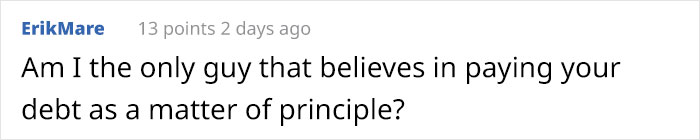

Load More Replies...The comment inside the article by ErikMare, "Am I the only person that believes in paying your debts?": I don't think this applies. This is a tiny debt from almost a generation ago to Citizens Bank, likely from a banking error (say $6 for being 24h in unauthorised overdraft); paying $6--$10 I would agree is "paying your debts". HOWEVER, Citizens Bank has recently sold this for a similar amount (say $2--$5) to this predatory company; so CB has effectively made its money back (you being 24h in red doesn't actually cost them anything; it's all paperwork). Paying this $23 to this vulturine third party however will oblige to paying the rest of the $113 PLUS COSTS --- non of which is "debts"... So NO paying this is NOT PAYING DEBTS --- you don't OWE them anything. They are professional gamblers in essence, they "bought" the debt and are gambling with it (if 1 in 10 is scared enough for their credit rating then they're making money). Banks are really an essential service, these aren't.

I always pay my debts with the caveat that they must be my legitimate debts to pay. I once took my kids to a clinic for their annual maintenance exams, which are fully covered by our insurance. The clinic billed the exams as sports physicals, which insurance does not cover, and sent me a bill for just under $400. I pleaded with them for months to bill the insurance properly, but they refused and ended up sending the debt to collections. I fought collections for several years until they finally just stopped sending me a bill. I had a huge sigh of relief when seven years passed without any further mention of it and I knew I was free of it. It's been about 12 years now and my daughter got dehydrated one night and our options were that clinic for urgent care or the ER which would cost much more. They said they wouldn't treat my daughter unless I paid over $900 "towards the unpaid bill". I have no idea what total they have ballooned it to, but I never owed it in the first place.

Load More Replies...You'd have to be real careful... not only could you wind up owing the $113... but can you imagine if those bastards tried to hook on 20 some years worth of interest?

Fun story - I once had a crown put in by a dentist who screwed up my insurance paperwork so I ended up having to pay for the whole massive bill out of pocket. It wiped out my meager savings, but I paid it completely. A couple months later, I start getting harassing and threatening phone calls at home and at work from a debt collection agency acting on behalf of the dentist. The debt in question? One cent. Let me repeat that. ONE. CENT. The icing on this particular crud cake was that when I went directly to the dentist to have it out with them, it turns out HE owed ME.

Should have turned it over to a debt collection agency so they could harass him. Unbelievable. I'm sure that was the last time you ever used that dentist.

Load More Replies...The comment inside the article by ErikMare, "Am I the only person that believes in paying your debts?": I don't think this applies. This is a tiny debt from almost a generation ago to Citizens Bank, likely from a banking error (say $6 for being 24h in unauthorised overdraft); paying $6--$10 I would agree is "paying your debts". HOWEVER, Citizens Bank has recently sold this for a similar amount (say $2--$5) to this predatory company; so CB has effectively made its money back (you being 24h in red doesn't actually cost them anything; it's all paperwork). Paying this $23 to this vulturine third party however will oblige to paying the rest of the $113 PLUS COSTS --- non of which is "debts"... So NO paying this is NOT PAYING DEBTS --- you don't OWE them anything. They are professional gamblers in essence, they "bought" the debt and are gambling with it (if 1 in 10 is scared enough for their credit rating then they're making money). Banks are really an essential service, these aren't.

I always pay my debts with the caveat that they must be my legitimate debts to pay. I once took my kids to a clinic for their annual maintenance exams, which are fully covered by our insurance. The clinic billed the exams as sports physicals, which insurance does not cover, and sent me a bill for just under $400. I pleaded with them for months to bill the insurance properly, but they refused and ended up sending the debt to collections. I fought collections for several years until they finally just stopped sending me a bill. I had a huge sigh of relief when seven years passed without any further mention of it and I knew I was free of it. It's been about 12 years now and my daughter got dehydrated one night and our options were that clinic for urgent care or the ER which would cost much more. They said they wouldn't treat my daughter unless I paid over $900 "towards the unpaid bill". I have no idea what total they have ballooned it to, but I never owed it in the first place.

Load More Replies...You'd have to be real careful... not only could you wind up owing the $113... but can you imagine if those bastards tried to hook on 20 some years worth of interest?

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

152

45