Woman Furious After Internet Turns The Tables On Her And Says She’s Financially Controlling Her BF

Interview With ExpertIt’s safe to say that reaching financial independence is a common goal for a lot of adults. However, many factors can interfere with it or keep people from achieving it, such as health issues, job losses, failing businesses, and other various personal difficulties.

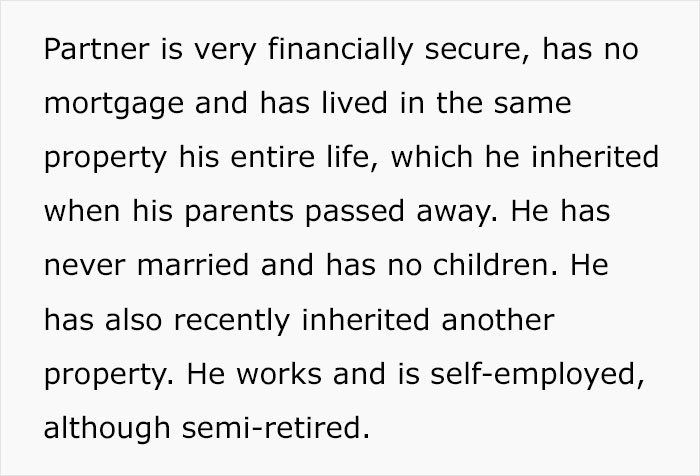

One forum user, nicknamed Mochachoc, shared that she had successfully reached financial independence. That is, until her health declined and she was forced to start from scratch. During such a difficult time, she turned to her long-distance boyfriend for help. For a while, his aid was sufficient, but over time she needed more, which he refused to give. Helpless, she turned to netizens, asking if she was being unreasonable.

Scroll down to find the full story and a conversation with Adam Kol, a couples financial coach, and Emily Blain, a financial coach from “Dream Big Financial Coaching,” who kindly agreed to tell us more about financial independence in relationships.

People who reached financial independence might lose it for various reasons

Image credits: Liza Summer / pexels (not the actual photo)

For this woman, it was her health that pushed her to lean on her boyfriend for support, who overtime became hesitant to give her money

Image credits: Karolina Grabowska / pexels (not the actual photo)

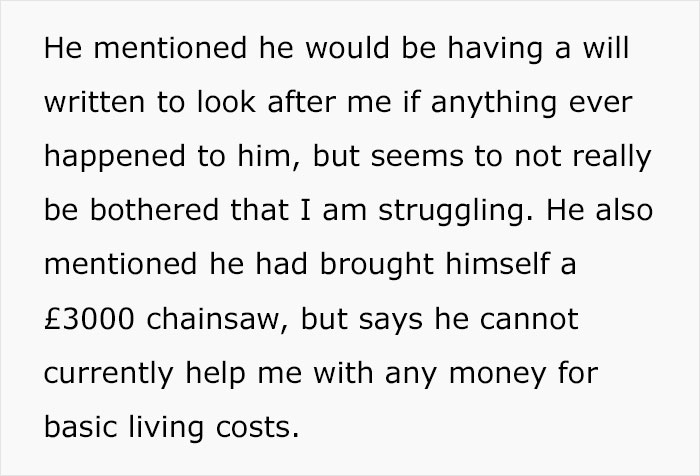

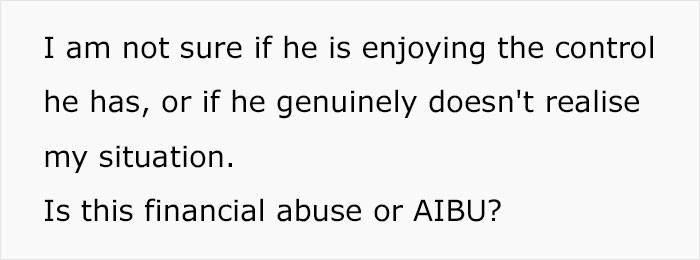

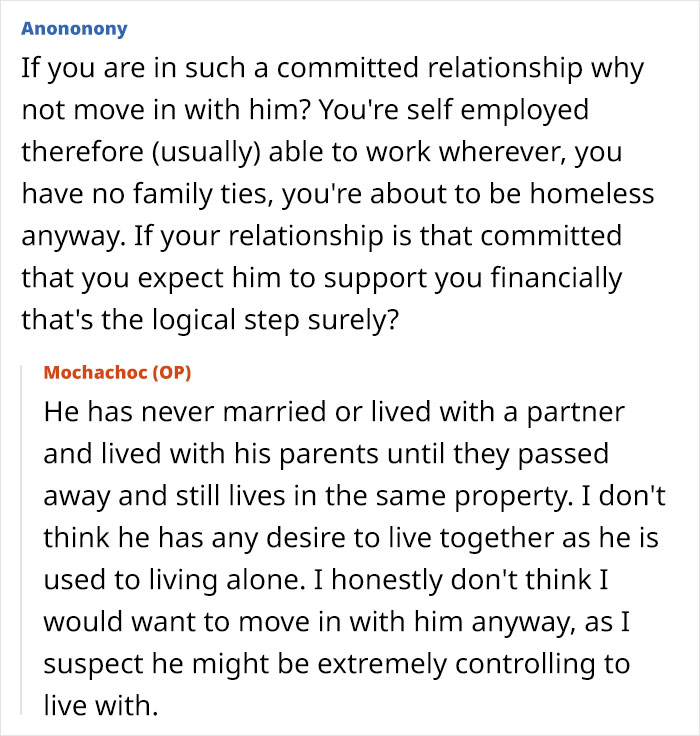

Image credits: Mochachoc

A third of all women rely on their partner financially

YouGov data in 2021 showed that in many couples, around a third of all women rely on their partner financially, even if they work full-time. Meanwhile, only 11% of men are completely reliant on their other half, meaning that money issues strike less often in the male population.

As females are more financially dependent, this also means they’re more likely to be in a worse position with money if their marriage or relationship ends. 35% of women with a partner say that they wouldn’t manage well if they suddenly split up. This number rises to 59% for women who are already financially dependent on their significant other.

To avoid this, financial coaches advise having at least some level of financial independence so a person can have more freedom outside and inside the relationship. “If you’re financially independent, your partner knows you aren’t with them because you don’t have other options,” notes financial coach Emily Blain.

Meanwhile, couples financial coach Adam Kol says, “Couples should strive for interdependence, relying on each other in healthy and appropriate ways. You may want to both continue working or set aside a certain amount of individual funds and as long as you’re deciding as a team, then it can work out well.”

One of the reasons why a person becomes money-reliant on their other half is when they step into the role of a stay-at-home parent who takes care of children and their home in exchange for financial support from their partner. The dependent individual may also have a physical disability that prevents them from working. In addition, the partner might have been encouraged to quit their job when their significant other is in a good enough financial situation where they don’t have to be employed.

Dependence can bring up resentment in a relationship

As long as this situation doesn’t become a source of power, guilt, or disagreement, the relationship shouldn’t suffer. However, such arrangements are often viewed in a negative light. “Financial dependence creates an unhealthy power dynamic and the potential for control or even financial abuse. Instead, even if one partner is the sole breadwinner, you can work to ensure both are equal stakeholders in the household, including financial decision-making,” explains Kol.

Blain also mentions that “financial dependence can lead to resentment. As with anything in a relationship, good communication is important. It’s very important for both members of a couple to have their own spending money that they don’t have to justify.”

If you aren’t dissatisfied with your relationship, it’s the perfect time to make positive changes and strengthen your personal finances for the future. For this, Blain recommends trying to look into taking on a larger role in managing household expenses. “Part of financial independence is building the skills to support yourself both income-wise and knowledge-wise. If you don’t know how much it would cost to support yourself or the skills around managing a budget, start there!”

Meanwhile, Kol urges people to keep in mind that achieving financial independence won’t happen overnight. “Get support for emotional healing, and keep taking the next right step to improve your financial situation. Try to manage your expenses, boost your income, and strengthen your credit so you can get your own place to live and move forward in your life,” he advises.

In cases where financial dependency is a concern in a partnership, it’s important for couples to openly communicate any feelings surrounding it. This can help build trust and create more supportive and understanding relationships with a partner and finances as well. As a result, they might be even more motivated to help each other’s financial situation.

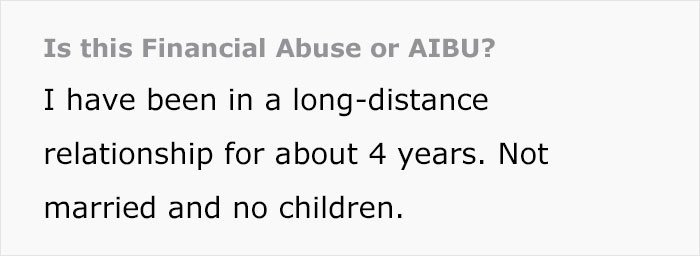

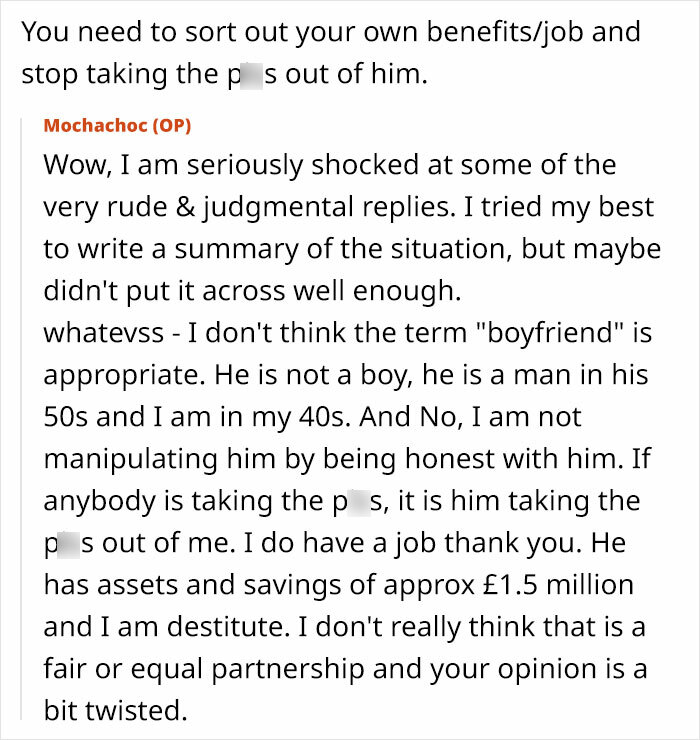

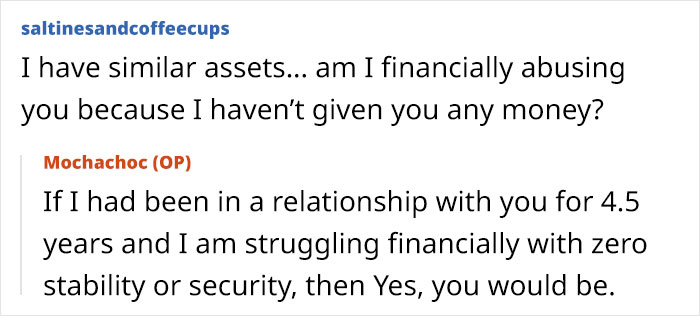

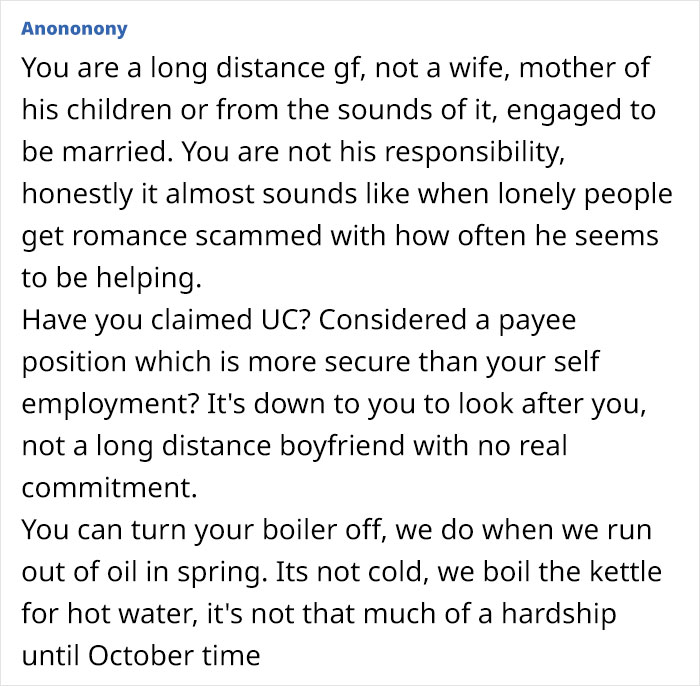

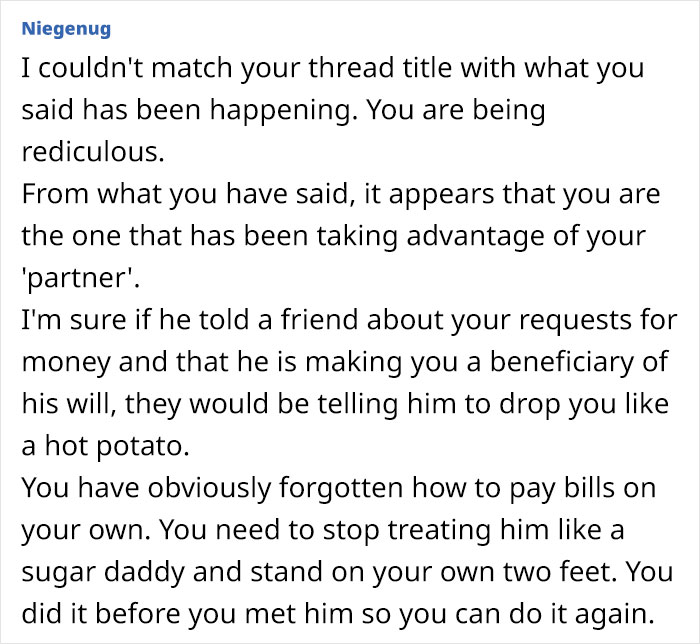

Readers thought the woman was wrong to accuse her boyfriend of financial abuse

•

Not Quite Done Yet!

Discover Your Competitive Edge

Subscribe Premium to Compare Your Stats with Others

More Premium features:

How did you score compared to others?

Your general stats:

| User | Result | Reward |

|---|---|---|

| / 7 | |

| / 7 | |

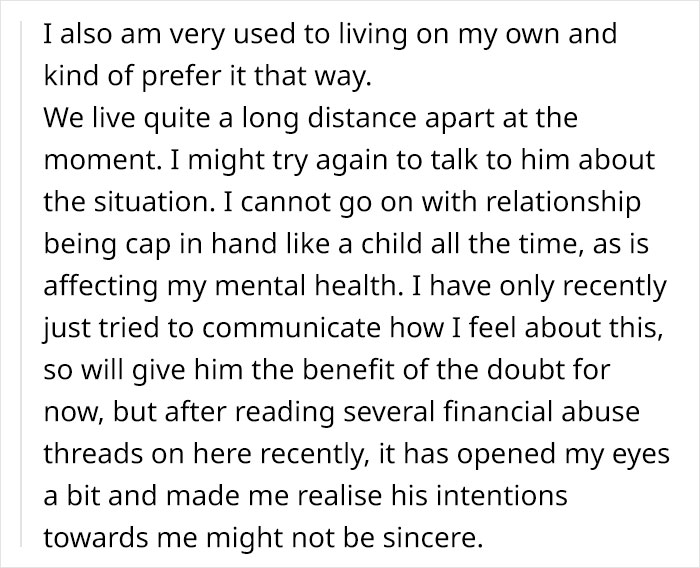

Please tell me if I'm right or wrong, but I will only listen to the answers that tell me im right.

It seems like she was chasing online support to stick it to him with a "see, everybody agrees with me" and is not even remotely interested in anything where she is at fault. The manipulation, just in the text is amazing, a real professional grifter if ever I saw one.

Load More Replies...So, I fail to find the part where she is explaining what she is bringing to the relationship. She says she sees the relationship as a partnership/team. So what exactly is her contribution?

I also don't see how someone can financially control her (like she claims) when you have a job and don't live with that person.

Load More Replies...They’ve been dating for four years; her money problems started “a few years ago.” Sounds like she has been slowly bleeding this fellow since early on in the relationship. Also, she never mentions ever feeling like any of this money is a loan. Just gifted to her with no expectation of repayment down the road. I kind of wonder what he’s even getting out of it? A few phone calls, and a depletion of his savings? He’s like one of those women who marry death row inmates.

Please tell me if I'm right or wrong, but I will only listen to the answers that tell me im right.

It seems like she was chasing online support to stick it to him with a "see, everybody agrees with me" and is not even remotely interested in anything where she is at fault. The manipulation, just in the text is amazing, a real professional grifter if ever I saw one.

Load More Replies...So, I fail to find the part where she is explaining what she is bringing to the relationship. She says she sees the relationship as a partnership/team. So what exactly is her contribution?

I also don't see how someone can financially control her (like she claims) when you have a job and don't live with that person.

Load More Replies...They’ve been dating for four years; her money problems started “a few years ago.” Sounds like she has been slowly bleeding this fellow since early on in the relationship. Also, she never mentions ever feeling like any of this money is a loan. Just gifted to her with no expectation of repayment down the road. I kind of wonder what he’s even getting out of it? A few phone calls, and a depletion of his savings? He’s like one of those women who marry death row inmates.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

19

67