You’d expect that grownups are better at handling money than their kids. Unfortunately, that’s not always the case. Just because someone is older doesn’t automatically make them wiser. Nor does it mean they’ll make good financial decisions. In some cases, adults even try to take advantage of their more naive or trusting family and friends.

Internet user u/Parental-problematic asked the r/CreditScore online community for help handling a tough situation at home. They revealed how their parents secretly took out a bunch of credit cards in their name, racking up a massive debt. Read on for the full story, as well as a captivating update about what the author did next.

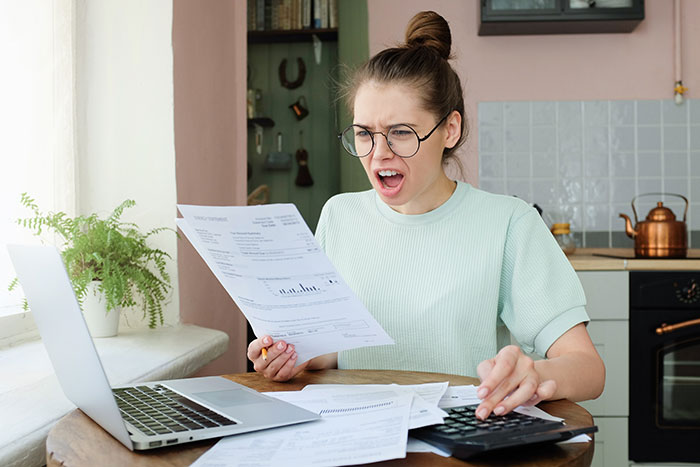

A bad credit score and massive debt can have a deeply negative impact on your future

Image credits: damirkhabirov (not the actual image)

An internet user opened up about how they found out that their parents stole their identity to open a few credit cards

Image credits: Prostock-studio (not the actual image)

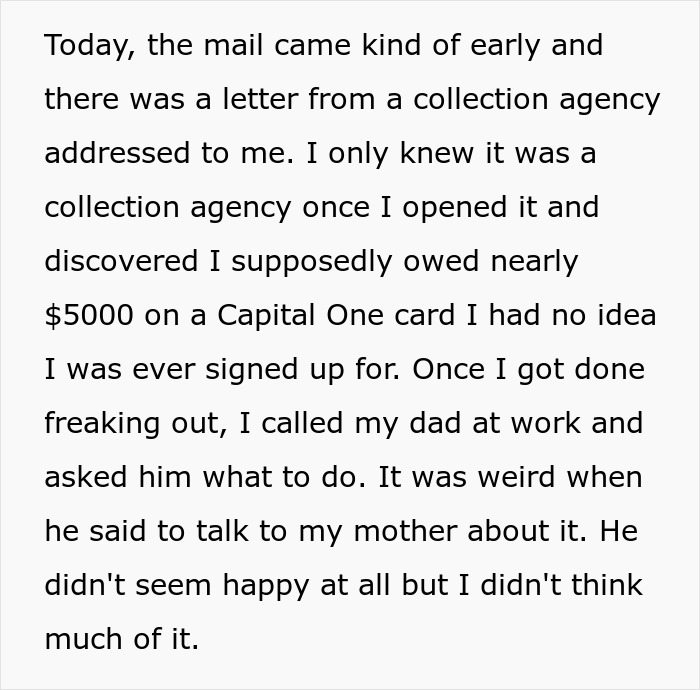

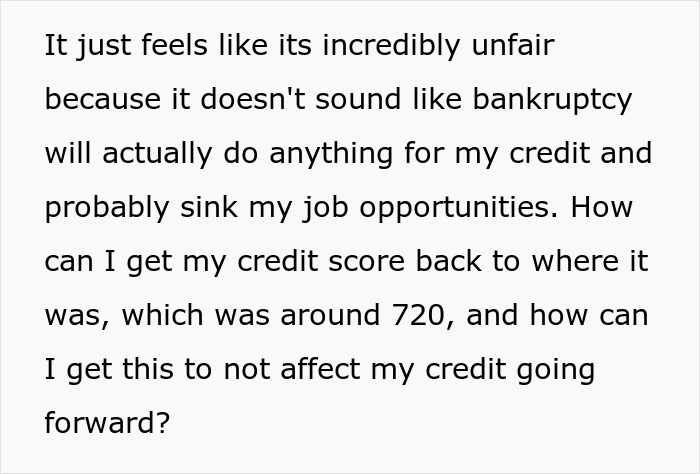

Image credits: Parental-problematic

It’s most often close family and friends who commit identity theft

According to the author of the viral story, they found out about the $15,000 debt in their name completely by accident. As it turns out, the two adults used their kid’s identity to open a few credit cards.

The parents’ “logic” was that their kid could simply declare bankruptcy and that the debt didn’t matter much because they wouldn’t be buying property any time soon. In other words, the couple felt entitled to their kid’s good credit score and identity to get access to more money.

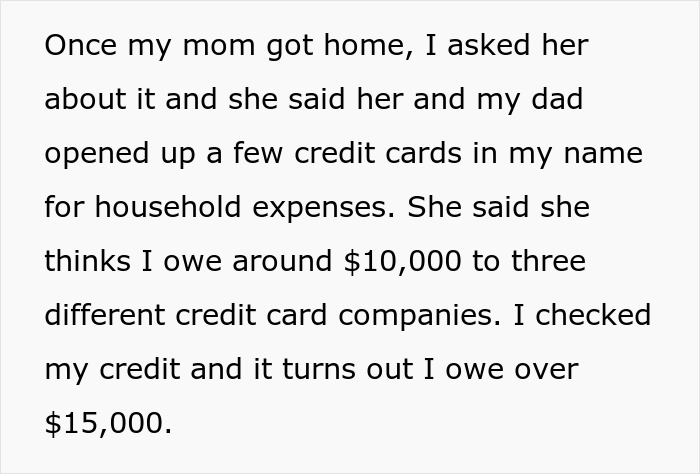

In response, the author filed a police report. They also got in touch with the authorities after they were unceremoniously kicked out of their parents’ house. It’s likely that the situation will only escalate from there.

“The state’s attorney’s office will be in contact in the next few weeks regarding identity theft charges. He said he believes they will likely prosecute, possibly as soon as this week,” they wrote. Unfortunately, u/Parental-problematic’s account was suspended, so we were unable to reach out to them for further comment.

According to SoFi Learn, it’s easier for a person’s relatives to commit identity theft because they have easier access to their personal information. Often, it’s someone who’s vulnerable who is the victim, like children or seniors.

In three-quarters of child identity fraud cases, the perpetrators are either family members or friends. Meanwhile, when it comes to senior identity fraud, nearly two-thirds of the time, it’s a family member who is at fault.

If you don’t solve the problem ASAP, your plans could get derailed

While ‘family is family’ rings true, it doesn’t give someone related to you by blood the right to do anything and everything they want with your identity or finances. Not only does it erode trust on a deeply personal level, but it can also throw a wrench into your future plans.

While a bad credit score isn’t the end of the world (you can recover from it), it does make life a heck of a lot harder than it has to be.

Investopedia points out that a bad credit score means that you’ll have a harder time taking out car and home loans and qualifying for a regular credit card in the future.

Even if you do get a loan, the odds are that you’ll get saddled with a high interest rate. In other words, you’ll end up paying more because your credit score shows you’re untrustworthy. You’ll also end up shelling out more for auto and homeowners insurance.

Meanwhile, your career prospects can suffer, too. If you’re applying for high-ranking positions, especially in organizations linked to finances, your low credit score can be a huge red flag to your prospective employers.

There’s another issue as well. If you don’t report the identity theft, the authorities might consider you an accessory to the crime. Getting a criminal record is also going to make it harder for you to get a good job in the future. So, the best course of action is to file reports with the authorities and the credit card issuers.

In the meantime, it’s probably best to distance yourself from the people who feel entitled to your good credit. Family members are supposed to support one another, not take advantage.

What would you have done if you were in the author’s shoes, dear Pandas? Has anyone ever stolen your identity or opened credit cards in your name? What did you do then? You can share your thoughts in the comments section.

The internet had a few suggestions to share with the author. Here’s what they told them

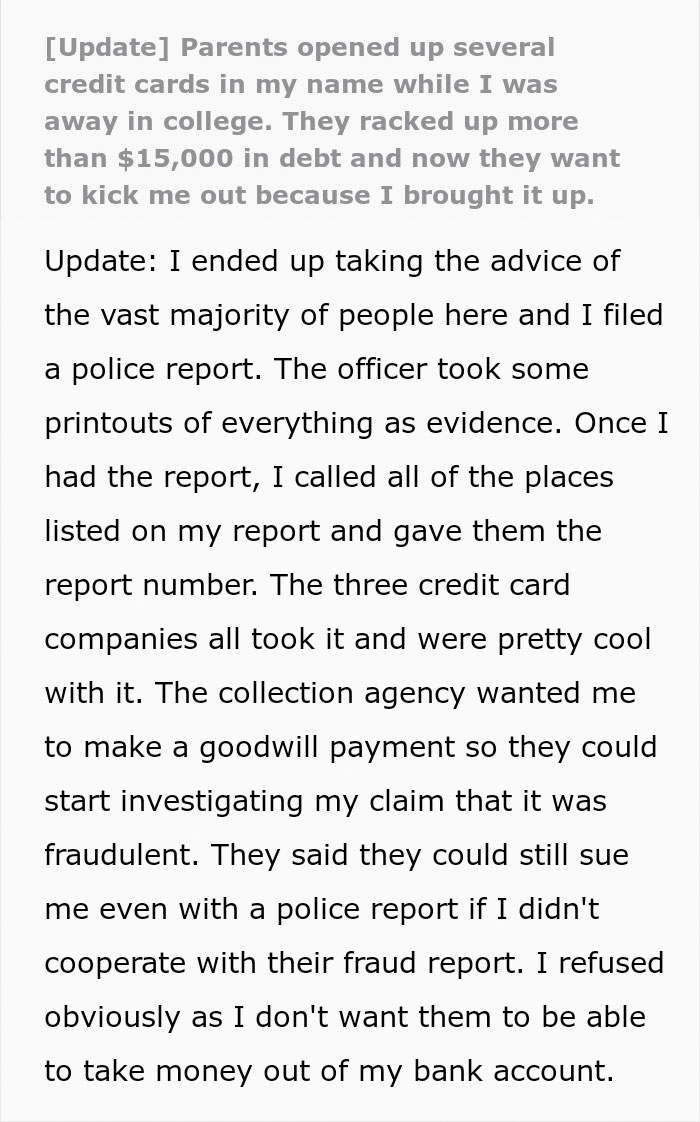

Later, the author shared an update about how they started solving the problem

Image credits: Kindel Media (not the actual image)

Image credits: Parental-problematic

Here’s how some folks reacted after they read the second half of the story

Poll Question

Thanks! Check out the results:

Can someone explain the legal situation here bc this could never happen in my country? To open a bank account or have a card issued you need to identify yourself in person or via a certified process. No way could I do that for my adult son.

In the US when you are born you are issued a special tax # called a social security. It is a number that is unique to you that the government uses to verify that you are who you are. Other agencies can also use that number to verify. When you sign up for a credit card you provide this #, it is connected to your overall credit score which banks use to determine if you're eligible for a loan and credit card companies use determine your limit. Unfortunately your parents have access to this # and some are scummy.

Load More Replies...All that feedback & I didn’t see anyone telling the kid he can apply to have a new SSN issued. One his parents WON’T know.

The Social Security Administration will rarely issue a person a new number, and it takes a lot of paperwork and hoops to prove that it is necessary. It's generally only in the case of massive, total identity theft (more than credit cards fraudulently issued by one or two people), or in cases where the person's life is in peril due to stalking or domestic violence.

Load More Replies...This is such a common story. My parents did this to me, but it was back in the days where credit cards sent you the “pre-approved” letters with a check to cash, that opened the account for you. I was away at college, so they opened at least 3 accounts in my name. Promised to pay, and they did until my Dad lost his job. I got married out of college to my husband who had just been commissioned in the military, where debt in collections was a no no. I graduated with college debt of $5000 (Pell Grant), then another $10,000 in CC debt. This was in the early 90s. There was a nonprofit business we went to that helped negotiate settlements with CC companies, then consolidated our debt into monthly payments. It so helped out. It wasn’t called identity theft back then. It was just parents being major a******s and committing fraud.

It was called identity theft back then, too. I'm sorry they did that to you.

Load More Replies...Can someone explain the legal situation here bc this could never happen in my country? To open a bank account or have a card issued you need to identify yourself in person or via a certified process. No way could I do that for my adult son.

In the US when you are born you are issued a special tax # called a social security. It is a number that is unique to you that the government uses to verify that you are who you are. Other agencies can also use that number to verify. When you sign up for a credit card you provide this #, it is connected to your overall credit score which banks use to determine if you're eligible for a loan and credit card companies use determine your limit. Unfortunately your parents have access to this # and some are scummy.

Load More Replies...All that feedback & I didn’t see anyone telling the kid he can apply to have a new SSN issued. One his parents WON’T know.

The Social Security Administration will rarely issue a person a new number, and it takes a lot of paperwork and hoops to prove that it is necessary. It's generally only in the case of massive, total identity theft (more than credit cards fraudulently issued by one or two people), or in cases where the person's life is in peril due to stalking or domestic violence.

Load More Replies...This is such a common story. My parents did this to me, but it was back in the days where credit cards sent you the “pre-approved” letters with a check to cash, that opened the account for you. I was away at college, so they opened at least 3 accounts in my name. Promised to pay, and they did until my Dad lost his job. I got married out of college to my husband who had just been commissioned in the military, where debt in collections was a no no. I graduated with college debt of $5000 (Pell Grant), then another $10,000 in CC debt. This was in the early 90s. There was a nonprofit business we went to that helped negotiate settlements with CC companies, then consolidated our debt into monthly payments. It so helped out. It wasn’t called identity theft back then. It was just parents being major a******s and committing fraud.

It was called identity theft back then, too. I'm sorry they did that to you.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

74

40