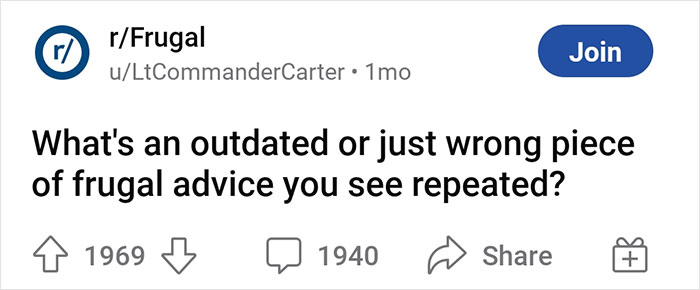

“Don’t Use Credit Cards, Use Cash For Everything”: 30 People Debunk Frugal Hacks That Just Don’t Work

Many folks are looking for additional ways to save money. And in times like this, the easiest thing to do is to fall back on the advice you’ve been hearing all of your life. However, those frugality tips might save you a tiny sliver of cash, at the expense of massive chunks of your time and energy. Which isn’t all that great of a bargain now, is it?

Redditor u/LtCommanderCarter started an interesting and useful discussion on r/Frugal, asking people to share all the savings hacks that they personally think are either totally outdated or just plain wrong. And some of them might make you see how you budget things and spend your (very limited) time in a fresh new light. Check them out below.

Meanwhile, Bored Panda reached out to personal finance expert and best-selling author Rick Orford who was kind enough to shed some light on what someone could do if they find that their expenses are outweighing their income. You'll find our interview with him as you read on.

This post may include affiliate links.

I'm in a high cost of living area and the "thrift stores" sell noticably worn t-shirts for $13.99.

I'm in a high cost of living area and the "thrift stores" sell noticably worn t-shirts for $13.99.

They haven't been thrifty for more than 8 years in my area.

“Don’t use credit cards, use cash for everything.” - easy way to not have a great credit score when you need a loan. Use the cards and pay it off monthly.

“Don’t use credit cards, use cash for everything.” - easy way to not have a great credit score when you need a loan. Use the cards and pay it off monthly.

"it's cheaper to buy in bulk"

"it's cheaper to buy in bulk"

then half of the item goes to waste because of spoilage or freshness.

It depends **WHAT** you buy in bulk. Toilet paper in bulk? That's awesome. That's why my spouse and I weren't panicking like everyone else during "The great TP crisis of 2020". We were/are regular Costco shoppers.

We probably all know that money won’t make you happy on its own—health, an active social life, and finding purpose in life will help you with that. However, a bigger income can boost your happiness as you find more and more financial stability… to a certain extent.

Research conducted by Daniel Kahneman and Matthew Killingsworth, arbitrated by Barbara Mellers found that happiness rises up to $100,000 per year, and then plateaus. Greater income increased the emotional well-being of those who were the unhappiest the most. However, those people who are already very happy with their lives saw their happiness grow even beyond earning $100,000 per year.

“In the simplest terms, this suggests that for most people larger incomes are associated with greater happiness. The exception is people who are financially well-off but unhappy. For instance, if you’re rich and miserable, more money won’t help. For everyone else, more money was associated with higher happiness to somewhat varying degrees,” Killingsworth, the lead paper author and a senior fellow at Wharton, said.

Almost none of these comments are actually things that are blatantly wrong they may just not apply to some people. DIY, buying in bulk, Black Friday deals, finding quality items at thrift stores, are all things that tons and tons of people have had success with.

Delivery services. I do Walmart delivery all the time. I save on impulse purchases, it’s free, and the $10 tip saves me so much time and energy. Plus I can examine the price/weight in more detail.

Delivery services. I do Walmart delivery all the time. I save on impulse purchases, it’s free, and the $10 tip saves me so much time and energy. Plus I can examine the price/weight in more detail.

Oh, and my kids can’t beg for stuff or sneak things in the cart.

Nah in my country the delivery fee costs much more than the petrol to drive to the store. Furthermore, the store will always "substitute" items that aren't in stock with a hated alternative, or an utterly irrelevant alternative ("Oh you ordered a toothbrush, sorry no stock, but here's a toilet brush."). Lastly, the quality they ship is whatever they pull off the shelf, with perishables I like to study the goods and see which is the best one. Oh and I forgot: the worst part. They take a few hours to deliver and when they do eventually rock up, they yell outside your gate (because we have 6ft walls with razorwire), so you have to endure like five minutes of yelling and missed calls from random unknown numbers while you try find your keys and eventually realise what the ruckus is about. My god I hate it. Far rather just go to the store like an old fart. Newfangled delivery apps. In my day we had to go kill a bear to harvest our grain growin' in Apache territoreh. Them days was tough!

Latte factor!

Latte factor!

It's like "okay I need to make my money go further somehow' and people are like "stop buying coffee!" It's like you really think that wasn't the first thing to go? Really? It's like when thin people tell me I could lose so much weight if I stopped drinking soda and are stunned or flat out don't believe me when I say I don't drink soda (and if I do it's usually coke zero which isn't great for you but isn't the calorie bomb they're imagining).

Okay, so you already took the advice before someone gave it. But many people DO buy coffees all the time. I grind my beans, make espresso, use half and half - and I used to use quality syrup but quit for the calories) for PENNIES. When my friend gets a 16 ounce mocha with hazelnut it is $6.50. So the advice is sound and some folks need to hear it even if that someone isn't you.

According to personal finance expert Rick, there are two main strategies for building a surplus of income. The first one is increasing our income, such as "by asking for a raise, getting a higher paying job, or even a side hustle." The second approach is decreasing our expenses.

"Increasing income could be as simple as approaching one's boss and explaining why you're valuable, the extra work you provide over and above what's expected, and the current going rate for an experienced role such as yours," the expert told Bored Panda.

"If that doesn't work, there are other options. Thanks to the strong jobs market, now is a great time to dust off the resume and start looking for a higher-paying job."

There are always good opportunities available if someone has the patience to search for them and the courage to act.

Wash your dishes by hand. Yeah my dishwasher uses less power to heat the water and run a load than the hot water cylinder uses just to heat the water. It uses less water than a sink full and can do more dishes in that amount of water than I can. So saves me money there too as I have to pay for water.

Wash your dishes by hand. Yeah my dishwasher uses less power to heat the water and run a load than the hot water cylinder uses just to heat the water. It uses less water than a sink full and can do more dishes in that amount of water than I can. So saves me money there too as I have to pay for water.

Actual handy frugal tip incoming, scrape food off your dishes and then just load into the dishwasher. Do not rinse your dishes. Add dishwasher powder to the prerinse section as well as the normal wash section. Select a cycle with a prerinse start. Dishes come out perfectly clean. Use powder, not tablets. Powder is generally about the same price as tablets but will get you twice the amount of loads.

Not really. Pretty much all household dishwashers use less water and energy per load than hand washing, sometimes excessively so. Unless the dishwasher is really old, like decades old, that is.

Load More Replies...I'm single and I would run out of dishes before I got a full load and the dishes would just sit in there getting really gross.

You can do a low cost rinse program so that doesn't happen. Plus the dishwasher will clean them far more effectively than most humans can.

Load More Replies...Dishwasher is a sizable upfront investment not everyone can afford. It's not bad advice, it's a case of poverty tax.

That's a fair point. The cheaper ones in the UK are about £200. Could probably find one second hand if you were that determined to have one.

Load More Replies...In most apartments here cold and hot water is included in the rent, so since the dishwasher uses electricity it would save money to wash it by hand. But I do feel that I have better use for my time.

I've been telling my husband for years. Dishwasher uses less water. He still cleans by hand, w/o his glasses. He uses more water and dishes still have food all over!

This is true! Dishwashes, when properly used, are more efficient than washing by hand. Only problem for me, personally, is that I don't have space for a dishwasher. I have quite limited cabinet *and* counter space, so washing by hand it is.

Considering the electricity prices, i would not. i see this as a waste of money. In India, it is easier to wash dishes honestly. also we can have a maid do the work

If I was to use the dishwasher for washing, all the stuff I store in there would get soggy....

For me, it's easier and faster to wash by hand as I cook. The Hubs can wash up after. If he cooks; I wash up once he's done, because he's like a mad chef and destroys the kitchen. We usually leave the dishwasher for the weekend when neither of us want to do any chores as we hang out. It really depends on several variables. .

Depends, if you are living alone it's not more frugal because you have one plate, one cup, etc.

So, I will start the dishwasher every 3 day, problem solved

Load More Replies...With the high cost of dishwasher detergent/pods, we never run it until full. I would not dream of not rinsing dishes first - letting all that those food tidbits just go into the dishwasher drain seems like a maintenance problem in the making

Scrape, don't rinse. Dishwashers are less efficient if the dishes are pre-cleaned.

Load More Replies...Why do you still have a hot water tank? A combi boiler heats only the water you need when you need it.

Lots of older properties still have hot water tanks. Not everyone can afford the upgrade, even with grants.

Load More Replies...Dishwasher sanitizes better because it gets the dishes / water super hot - hotter than you can do by hand. I hand wash most of my dishes since it is just me but I do both. Most of the time though my dishwasher is just a drying rack.

Before my husband moved in with me I used the dishwasher once a month and hand washed cups as needed. Now I am grateful for the dishwasher. I didn't realize how much more cooking for two would be, especially with him loving coffee! (Why does autocorrect want to change coffee to cousin?)

Load More Replies...If you don’t have a dishwasher, take dirty dishes into the bath/shower with you, and wash yourself (and the dishes) with washing up liquid. You will save on both water and bubble bath.

Pretty sure this is a joke but I’ve seen on extreme savers people saving the “cold water” you have to start with in a shower for doing the dishes/flushing toilets etc.

Load More Replies...Dishwasher is always more efficient. Keep handwashing to knives, wooden boards and utensils and such.

To me the „scraping off food of your dishes“ is the wierd part? Why aren’t the plates empty? Here‘s a money saving tip: finish your dämn meals!

this depends on the number of dishes. In my house hold everyone has their own dishes and own utensils. The kids each wash their own stuff and me and the hubby wash ours. We use our dishwasher for all the pots and pans and stuff like that. It may not be a big savings in the water bill but it's a big savings in our time!

Clip grocery store name brand coupons to save money.

Clip grocery store name brand coupons to save money.

Except most of the things that have manufacturer's coupons are high markup processed foods. Often another brand was a better buy than the coupon item. Sometimes a different size of the same product by the same manufacturer that didn't qualify for the discount was a better buy.

Buying generic and cooking from scratch are usually cheaper.

A lot of coupons require you to buy two or more of an item, so you end up having to spend more to use the coupon.

Higher quality cost more. The cost tells you nothing about the quality, it’s better to look at the materials and how something was made.

Higher quality cost more. The cost tells you nothing about the quality, it’s better to look at the materials and how something was made.

Reviews by other people with experience with the products helps, as well.

At the same time, knowing how to control your expenses can be an invaluable skill, too. Rick pointed out that part of making ends meet also means cutting expenses as well as creating and sticking to a budget.

"To start a budget, divide expenses between needs and wants. Needs are necessities that you need to live, like rent, insurance, food, etc. Wants are things that are nice to have, e.g. subscriptions, restaurants, shopping, etc.," the personal finance expert said.

"For many Americans, interest payments are also a big portion of one's budget. As a result, prioritizing paying down debt will result in instant savings (less interest to pay monthly), thereby increasing one's monthly surplus of income," he explained.

"Putting it all together, cutting back means reducing expenses and increasing income at the same time so that you can spend less than you earn and save the rest." For some more great personal finance advice, feel free to check out Rick's blog, as well as his book, 'The Financially Independent Millennial.'

People don’t account for quality or time at all. Yes I can clean my own house, mow my own lawn, fix whatever is broken, but all of that takes time to do it and it won’t be as good as some who does it for a living. You can always make more money so be frugal with time than money.

People don’t account for quality or time at all. Yes I can clean my own house, mow my own lawn, fix whatever is broken, but all of that takes time to do it and it won’t be as good as some who does it for a living. You can always make more money so be frugal with time than money.

"tell the dealership you have cash in hand. They'll give you an amazing out-the-door price!"

Haven't seen this to be true for the past 10 years. Dealerships make their money off of loans and the APR they can rake you over the coals for. They don't care if you have cash in hand. The point is to sell a loan, warranties, and future service

Going cheap on everything. You are not doing yourselves any favors by buying cheap appliances. Cheap appliances break easy and need to be replaced. When you buy something, make sure it lasts and your not throwing money away to replace it every couple of months.

Going cheap on everything. You are not doing yourselves any favors by buying cheap appliances. Cheap appliances break easy and need to be replaced. When you buy something, make sure it lasts and your not throwing money away to replace it every couple of months.

It makes sense for anyone and everyone to manage their finances well. Ideally, you want to have an income that’s greater than your monthly expenses. That way, you can pay for everything that you need, slowly get rid of any debt that you might have, and even have money left over to drop into your savings account or invest where you see fit.

A good approach to managing your expenses is to sit down and create a detailed list of all of your monthly expenses. Then, be honest with yourself about where you can cut back. For instance, you might be paying for a few streaming services but never find the time or energy to actually use them. It’d be a no-brainer to (temporarily) suspend those accounts.

Or you might realize that you’re spending an incredible amount of money on sneakers you never wear or on video games you don’t even enjoy anymore. This will look different for everyone. If money is tight, you need to get rid of all the superfluous expenses first before moving on to the stuff that will really feel bad to sacrifice.

My pet peeve is "you need to save 3 months of expenses in an emergency fund." You actually need way more than that. Eight months to a year is recommended to sustain yourself during a recession. And anytime I look for a new job, it takes two months at least before I find something. I wouldn't want to lie awake at night worrying that the last month is going to escape me before my paycheck arrives.

My pet peeve is "you need to save 3 months of expenses in an emergency fund." You actually need way more than that. Eight months to a year is recommended to sustain yourself during a recession. And anytime I look for a new job, it takes two months at least before I find something. I wouldn't want to lie awake at night worrying that the last month is going to escape me before my paycheck arrives.

It's cheaper to diy/if you want something done right, do it yourself.

My family always said this. I was in my 30s when i finally realized how wrong they were. While trying to plumb in a new bath tub. It took me a week to fail at it. It took a plumber an hour to do it right.

DIY. Not everyone has thousands of dollars worth of equipment around and the skills to build something cheap.

DIY. Not everyone has thousands of dollars worth of equipment around and the skills to build something cheap.

People reusing plastic containers for food. No, that is not designed to be reused for ten years

Tool hiring or borrowing (I mean from a tool library, not a neighbour!) saves a lot of money and storage space!

One major area where you can really cut back is food. For instance, if you’re a big fan of dining out, eating fast food, ordering takeaway, or buying tons of snacks every single day, you can save a ton by choosing to cook at home. You can make inexpensive, nutritious meals very quickly by shopping around for good deals and planning ahead.

You could, for instance, buy certain ingredients at a discount and then freeze them for future use. Meanwhile, when you’re cooking, you can make bigger batches of chili or stir-fry or chicken and broccoli with rice, and then freeze the portions for the rest of the week. This way, you’re saving your time, energy, and money.

So long as you’re focusing on nutrition, you should be perfectly fine. And it’s no sin to dine out somewhere fancy from time to time—good food is good for the soul. But it really does have to be ‘from time to time,’ not daily.

Eating out is just as expensive as grocery shopping these days. It varies , but the price per meal of cooking at home is much cheaper

Eating out is just as expensive as grocery shopping these days. It varies , but the price per meal of cooking at home is much cheaper

Driving for miles to save 2-5 cents on gas. I still see this done today and I don't think it helps at all. But to each their own.

Driving for miles to save 2-5 cents on gas. I still see this done today and I don't think it helps at all. But to each their own.

Thanks to another reddit user, I will add and point out that the saving 2-5 cents is meant for those who use unleaded or diesel. There are those who use other forms of gas that I was not meaning for this to apply to because they may not have that option. My apologies.

Ironic they pictured a Shell station. One of the most over priced stations in my area. I pass a shell station on my way home and it is typically 45 to 65 cents more a gallon than what I had just paid in town. It's become a game to check on the days I fill up. But really, who drives "miles" to save "2 cents"? I save a LOT more than that on my Costco gas and I drive (effectively 0 miles to get there because I wait until I am there anyway for shopping.

People still parrot the “buy a cheap laser printer from Brother” talking point like it’s 2005. You don’t need a printer at all, just go to a copy shop and spend the 30 cents the one time in a decade you’ll actually need to print something.

People still parrot the “buy a cheap laser printer from Brother” talking point like it’s 2005. You don’t need a printer at all, just go to a copy shop and spend the 30 cents the one time in a decade you’ll actually need to print something.

LOL at only needing to print something once every 10 years. I have a Brother laser printer. About 10 years old now I think. Works great. Costs me nothing to have it around because powdered toner doesn't dry out. It is a printer / scanner / copier. I would have paid more at the copy store even not counting my gas and time to drive there. YMMV

That earning more money means you lose all the gains to taxes. Nope, you always will take home more money if you get a raise. Where a raise does adversely affect a person is if the extra income tips them out of a government benefit, such as below x income receive this tax credit or that assistance program. But you have to usually be pretty low income to get those anyway.

That earning more money means you lose all the gains to taxes. Nope, you always will take home more money if you get a raise. Where a raise does adversely affect a person is if the extra income tips them out of a government benefit, such as below x income receive this tax credit or that assistance program. But you have to usually be pretty low income to get those anyway.

Related: NO, you do not need to spend extra on your small business because you "need the tax write off" (quoting a relative). Business expense tax write offs are only a win if you had to spend that money anyway. If you are inventing business expenses for the write off you are losing every time.

People say that a plant based diet is too expensive. That's only true if you are constantly buying all the plant based substitutes. If you're just getting normal basic food like legumes and grains and veggies and stuff like that, it's a lot cheaper than buying meat.

Not true everywhere, an avacardo costs the same as a chicken at the moment where I am.

The people who insist credit and debit cards are bad.

No, they aren’t. YOU lacked the self control to understand how to manage one efficiently. They are extremely useful if you use it responsibly. They warn everyone else because of their failures. it’s quite comical.

Different strokes for different folks. Some people need to see the contents of their wallet shrink in order to control spending. There is nothing wrong with that. There is something wrong with needing to look down on someone, anyone who isn't like you, in order to feel good about yourself. It's quite pathetic.

Making your own laundry detergent. It's performative frugality and a tremendous waste of time. Powdered detergent is cheap.

Making your own laundry detergent. It's performative frugality and a tremendous waste of time. Powdered detergent is cheap.

This one is just wrong. I spend a grand total of maybe $25 on ingredients and can make over a year's worth of laundry detergent (plus have leftover soap for personal hygiene for the year as well). That detergent is dye free, fragrance free, unpronounceable chemical free and works better than most commercial products I've used. It only takes about 10 minutes to make a batch (it's just grating plain soap and mixing with 2 other ingredients in a blender) and each batch lasts 3-4 months. I don't see how 30-40 minutes out of an entire year is a "tremendous waste of time".

My mother will drive around to 2 or 3 different grocery stores to take advantage of various deals, but I'm certain that the time and gas burnt driving around cancels out any savings on groceries. (This may be less true with grocery prices skyrocketing recently)

My mother will drive around to 2 or 3 different grocery stores to take advantage of various deals, but I'm certain that the time and gas burnt driving around cancels out any savings on groceries. (This may be less true with grocery prices skyrocketing recently)

I do this, but I'm very fortunate. The store that is the farthest from my home is only 2 miles away. The other stores are even closer. I check the sales and compare prices on line. In one day, going to three different stores, I've saved up to $15 only buying items I need and using the digital store coupons. That's the trick though. Only buying the items you need.

A lot of people don't save the amounts of money they believe they are saving. Pointing this out to them, even using numbers and math, can even make them angry.

A lot of people don't save the amounts of money they believe they are saving. Pointing this out to them, even using numbers and math, can even make them angry.

Cleaning products. Sometimes baking soda and vinegar doesn’t cut it. Save your body soreness, frustration, and wasted time. Buy yourself some soft scrub!

Cleaning products. Sometimes baking soda and vinegar doesn’t cut it. Save your body soreness, frustration, and wasted time. Buy yourself some soft scrub!

This is one of those"use when appropriate" situations. Vinegar is great for cleaning windows or mirrors; really any glass surface. That's about it. You can't scrub your stove with it, so don't try. Use the commercial products there and only there. You still save money because you probably already have vinegar on hand and your Soft Scrub lasts longer because you aren't using it where you don't need it.

The general idea that you should keep everything for as long as possible and only replace something when it breaks.

The general idea that you should keep everything for as long as possible and only replace something when it breaks.

For older electric items, especially things like heaters and refrigerators, the energy consumption of an older appliance can be 4-5x higher or more than a new model. Depending on how much your energy costs the cost of that extra energy can be the equivalent of buying a new appliance every few years.

Same with cars. With the amount you spend on repairs/maintenance and the general poorer fuel consumption you're often better off financially buying a newer one sooner rather than "driving until the wheels fall off".

We drove the first new car we ever bought for 15 years. 1999 VW Passat. No car payments for 10 years, changed the oil religiously, drove it for 180,000 miles, 30mpg at 70 mph with the air on, paid less than a total of 5k worth of repairs, tires, etc, after payments were done/warranty expired, sold it used while still running well. Way cheaper than buying anything new. Nothing necessarily or inherently bad about old or used cars, a bit of knowledge and maintenance pay big dividends.

Dollar stores.

Dollar stores.

Usually not cheaper *per unit* —they’re just packaged in smaller quantities to price cheaper.

B******T. I have purchased exact same items at Dollar Tree I have seen in other stores for 2 or 3 X price. Obviously you have to pay attention and not all items are great deals. I do agree some things are smaller package. But not all and some smaller package is still a better deal. Just be aware and be a conscientious shopper - like you should be in any store.

Just because it didn't cost money, doesn't mean you saved. Your time is worth money. Professionals have insurance and offer warranties, you don't get those if you do it yourself. It's important to factor those in when you're trying to save

Just because it didn't cost money, doesn't mean you saved. Your time is worth money. Professionals have insurance and offer warranties, you don't get those if you do it yourself. It's important to factor those in when you're trying to save

Thrift stores are cheaper for quality, if you enjoy the search as a hobby.

Thrift stores are cheaper for quality, if you enjoy the search as a hobby.

Black Friday has always been a performative consumption marketing ploy.

Wrong frugality is maybe just doing anything that is time consuming and unfulfilling to save a few dollars.

EDIT: And I feel like this will answer a bunch of downthread comments, Black Friday is a Q4 retail nonsense holiday that attempts to put books in the black for new year. SKUs are invented for it specifically. It's cool if you, individually, get nice deals for your family, however the entire idea is nonsense.

1) "Black Friday, Boxing day etc are all scams and spending to money is the frugal option." : There is some truth to this but people miss it entirely. using these kind of sales for big purchases if the price is better or comparable to the recent price history of the item. Last year alone i got a new microwave for %50/$150 off let alone cutting my cellphone and internet bills in half. In the past i got much needed furniture, other appliances and general house hold items i really needed on these sales

1) "Black Friday, Boxing day etc are all scams and spending to money is the frugal option." : There is some truth to this but people miss it entirely. using these kind of sales for big purchases if the price is better or comparable to the recent price history of the item. Last year alone i got a new microwave for %50/$150 off let alone cutting my cellphone and internet bills in half. In the past i got much needed furniture, other appliances and general house hold items i really needed on these sales

2) " When moving random boxes are free!" : This is my biggest gripe. I will maintain that buying proper moving boxes saves you money and time in the long run. Firstly Random boxes are difficult to stack and move, since you're now playing tetris with them to make it fit. Driving around trying to find boxes wastes time and money in gas, plus transporting the ever popular alcohol boxes means you are now transporting air since they are glued together. Buying flat moving boxes are fairly cheap and you can pick up a bunch at once and go home with them. Every time I've helped people move, when they used uniform moving boxes everything went so much faster.

3) "Costco is a waste of money": Simply put you just don't know how to Costco. People end up buying more then they can consume and throw it out, or they over consume because they buy in bulk. The other problem is people impulse shop. Find what you need and comparison shop, more often then not you'll save a ton of money. Recently I pick up an instant pot for $60 cheaper then anywhere else, that alone is the cost of a membership. In my last trip i picked up printer paper saving about $3-4 over staples, bath soap saving $3-4 over walmart, Shampoo saving $4, mens Deoderant saving about $10, womens deoderant saving $12-15, chicken legs/drumsticks saving about $1 a pound and so forth. Even big purchases like clothes is far better quality then other stores at the same price point.

4) "That costs too much that isn't frugal" This is a personal one. Some people think being frugal means being as cheap as possible. Recently I made a post of some containers i used to clean up my pantry, i spent less then $4 per container which is cheaper then any other option out there except re-using crappy plastic ones and a lot of people jumped on me for it. I also see a lot of frugal things people do and it's either a mess, an eyesore, takes way to much time for what you're saving or all 3. Spending a few extra dollars can alleviate these problems. Remember time is money and value your time as well.

A lot of these operate on the assumption that people have the time/energy/ability to do all of these tips. None of them are disability-friendly, which I hate.

i went from earning a good income to being on permanent disability which was a big change in income as i had used most of my savings/small portfolio to pay off all my medical bills since didn't want them to haunt me after i stopped working and refused to declare bankruptcy. it took a while to adjust but i figured it out. had the county kind of hound me to file for food assistance but i didn't want or need it. i do buy in bulk and on sale. invested in a small freezer, put in a small garden that my disabilty allows me to tend, shop in summer at open market and learned how to can and dehydrate. it was a learning curve. once a month a mobile food pantry comes through and maybe if things are a bit tight i will go. it is not the same as SNAP but basically farmers getting rid of excess instead of destroying it. originally went there because when they did the pilot program they needed to find out if people would use so went to support the program.

A lot of these finance "tips" people believe only because of the Dave Ramsey personal finance course. Ive had to take his outdated course built mainly for the middle class 2 times (highschool and college)

I have to disagree with the one about making your own laundry detergent. I can make 3 gallons of laundry detergent for less than $2. That's a lot cheaper than buying commercial products. And the detergent I make is better for the environment and works just as well. While it takes a few minutes to make because I have to boil water and dissolve a bar of Ivory soap, I can easily do that while I'm doing other stuff in the kitchen like unloading the diswasher. So it's a much better bet to make your own.

Complete bullpucky. If you use a rewards card responsibly and pay it off fully ever month it basically functions as a sales discount

So many people say it's cheaper to pay someone else to fix things and that is true, but everyone should learn to do the basics in maintenance. If I can do it and I'm stuck in a wheelchair and can do most jobs then the majority of others should be able to. Biggest thing I'd say to being frugal is to think carefully how you want to spend your money. Do you really need that? I found that 80% of the time it's want not need

Calgon is a waste. Let's say you do four loads of laundry a week, your £300 washing machine will last 5 years without it, and generously say Calgon doubles its lifespan. After 10 years without it your total spend is £600 on two washing machines, after 10 years with it you've spent £300 on the original washing machine and £800 on Calgon...

A lot of these operate on the assumption that people have the time/energy/ability to do all of these tips. None of them are disability-friendly, which I hate.

i went from earning a good income to being on permanent disability which was a big change in income as i had used most of my savings/small portfolio to pay off all my medical bills since didn't want them to haunt me after i stopped working and refused to declare bankruptcy. it took a while to adjust but i figured it out. had the county kind of hound me to file for food assistance but i didn't want or need it. i do buy in bulk and on sale. invested in a small freezer, put in a small garden that my disabilty allows me to tend, shop in summer at open market and learned how to can and dehydrate. it was a learning curve. once a month a mobile food pantry comes through and maybe if things are a bit tight i will go. it is not the same as SNAP but basically farmers getting rid of excess instead of destroying it. originally went there because when they did the pilot program they needed to find out if people would use so went to support the program.

A lot of these finance "tips" people believe only because of the Dave Ramsey personal finance course. Ive had to take his outdated course built mainly for the middle class 2 times (highschool and college)

I have to disagree with the one about making your own laundry detergent. I can make 3 gallons of laundry detergent for less than $2. That's a lot cheaper than buying commercial products. And the detergent I make is better for the environment and works just as well. While it takes a few minutes to make because I have to boil water and dissolve a bar of Ivory soap, I can easily do that while I'm doing other stuff in the kitchen like unloading the diswasher. So it's a much better bet to make your own.

Complete bullpucky. If you use a rewards card responsibly and pay it off fully ever month it basically functions as a sales discount

So many people say it's cheaper to pay someone else to fix things and that is true, but everyone should learn to do the basics in maintenance. If I can do it and I'm stuck in a wheelchair and can do most jobs then the majority of others should be able to. Biggest thing I'd say to being frugal is to think carefully how you want to spend your money. Do you really need that? I found that 80% of the time it's want not need

Calgon is a waste. Let's say you do four loads of laundry a week, your £300 washing machine will last 5 years without it, and generously say Calgon doubles its lifespan. After 10 years without it your total spend is £600 on two washing machines, after 10 years with it you've spent £300 on the original washing machine and £800 on Calgon...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime