Mom Insists 24YO Daughter Share Her Savings Account ‘Just In Case’, Drama Ensues When She Refuses

Many people from older generations today complain that young folks, unlike them, have absolutely no business acumen and don’t actually know how to earn money. Well, let’s leave this controversial thesis but note that many people in their twenties today not only know how to earn well but also have the skill to save money. A skill that is not inherent to everyone.

Why go far for examples? By the age of 24, the user u/ComprehensiveWin82, the author of today’s story, had managed to save a hefty amount in her account. However, she has yet to master the skill of saying “No” to close relatives about money issues.

More info: Reddit

The author of the post is 24 years old, but she had built up a fairly decent emergency fund for herself, aspiring to buy a house one day

Image credits: SHVETS production / Pexels (not the actual photo)

However, recently, the woman’s mom asked her to share full access to her savings account with her

Image credits: ComprehensiveWin82

Image credits: Kampus Production / Pexels (not the actual photo)

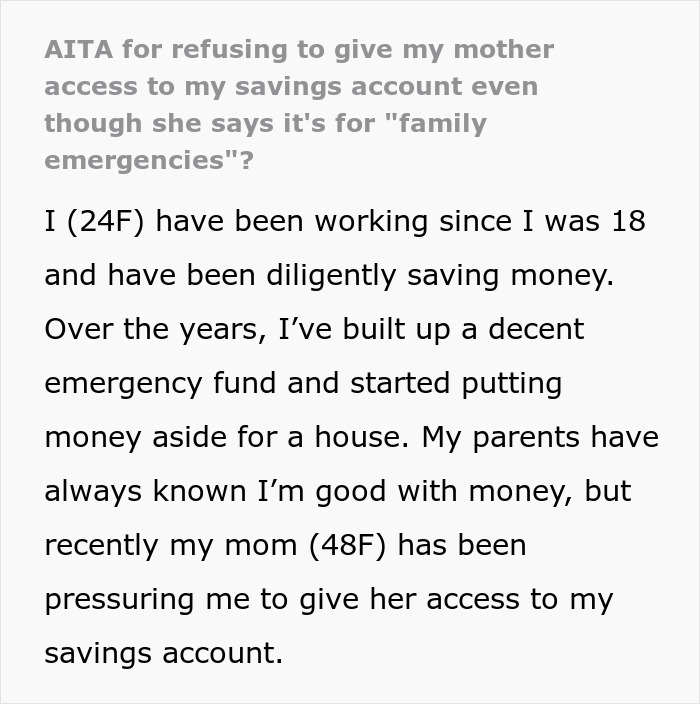

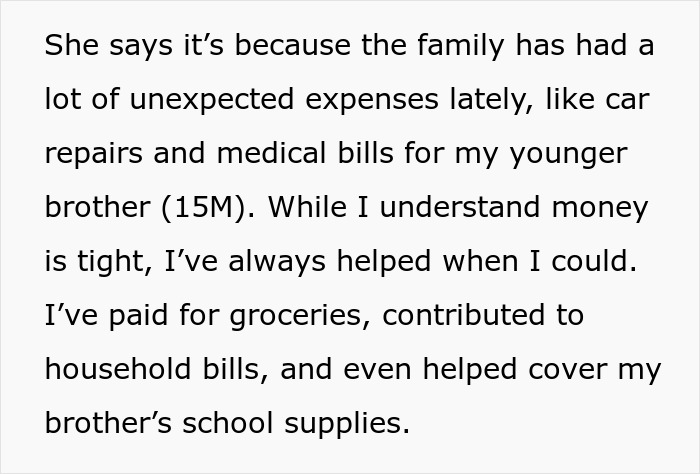

The author was always very financially supportive of her relatives, but nevertheless, she didn’t want to share control over her savings

Image credits: ComprehensiveWin82

The mom dubbed the daughter “selfish” for this refusal, and her elder sis noted that she’s overreacting here

So, the Original Poster (OP) is 24 years old; however, despite her fairly young age, she has already managed to save up a fairly decent emergency fund and is counting on buying a house in the future. The author has a good job and earns well, and thanks to her ability to save money (a skill that is greatly underestimated these days), she now has a tidy sum in her savings account.

And recently, she had a dispute with her own mother over this money. The lady asked her daughter for full access to her account. No, our heroine has never refused any financial assistance to her relatives – especially since her younger brother needs medical treatment. But to give her the opportunity to fully manage her savings account with all the money in it?

The author tried to avoid a direct refusal by offering her mother a certain amount of money at any time – but this was obviously not enough for the mom. Moreover, she accused her daughter of “being selfish” and said that she needed access to the account “just in case something big happens.” In turn, the OP understood perfectly well that if something happened, she would hardly get the money back…

The original poster tried to ask other family members for advice, but her dad refrained from saying anything, and the older sis suggested that our heroine was simply overreacting, and that she needed to give mom this opportunity. And in general, according to the sister, “What’s the point of saving if you’re not going to help your family?”

And now the woman is thinking and experiencing mental anguish – ‘what to do?’ To refuse means to offend her mother, who will definitely say that the daughter doesn’t trust her. To agree means to risk her hard-earned money – because there are actually plenty of examples of parents overusing the trust of their adult children…

Image credits: Yan Krukau / Pexels (not the actual photo)

Well, technically, it’s actually quite easy to give another person the opportunity to manage your bank account – and you don’t even necessarily need to tell them your credentials. But the risk of someone else, even your own mother, having full access to your finances is also damn high. After all, it’s not even because your mom will steal all the money.

The thing is, no one guarantees that your relatives will be able to resist possible phishing and data breaches. “If you lose your savings, you might never get your money back. Dealing with the fallout of identity theft and financial fraud could take a toll on your life for a long time,” this dedicated post on Aura.com claims.

“As for the moral aspects of this situation, this is a classic attempt to manipulate the mind of another person. For this woman’s mother, refusal immediately meant that her daughter didn’t trust her, and she said so directly,” says Irina Matveeva, a psychologist and certified NLP specialist, who Bored Panda asked for a comment here.

According to the expert, the specifics of relationships in many families are such that even if the mother spends this money, any claim from the daughter will subsequently turn against her. And she will be dubbed “selfish and rude” more than once – regardless of whether she shares access to her account or not. “And in today’s unstable world, the risk of a financial emergency increases, doesn’t it?” Irina adds.

“In other words, this woman has already found herself in a lose-lose situation, and she should just try to delicately and firmly explain to her mother the actual reason for her refusal. And if she doesn’t understand – or, more precisely, doesn’t want to understand, then she should still refuse. In the end, it’s easier to mend the fences than to return the lost money,” Irina Matveeva concludes.

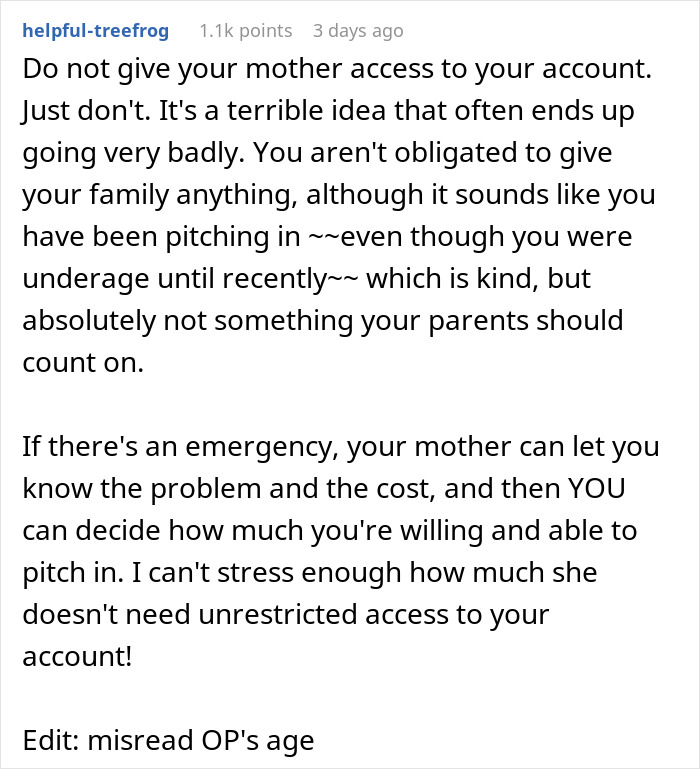

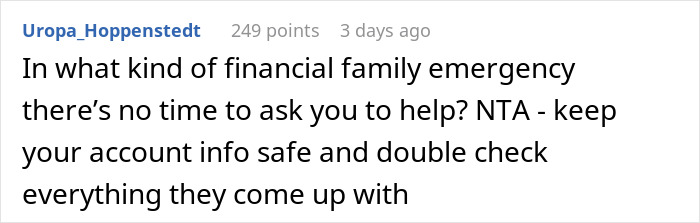

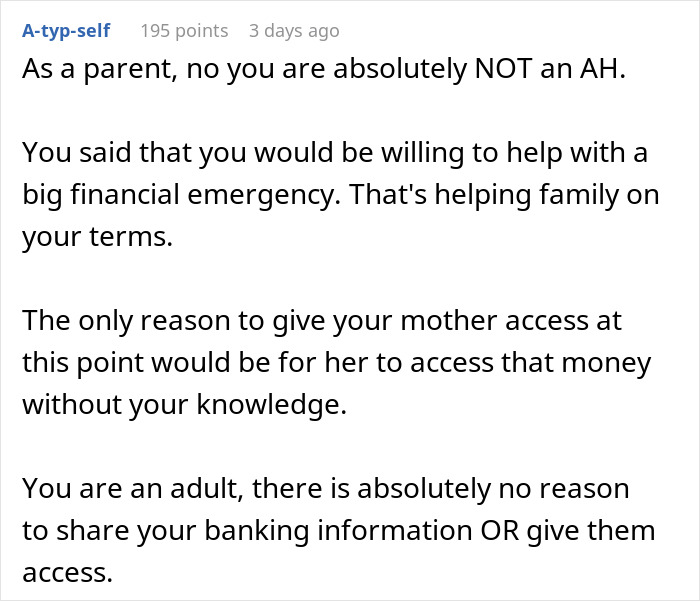

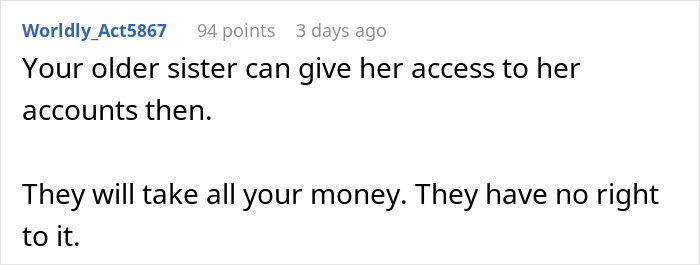

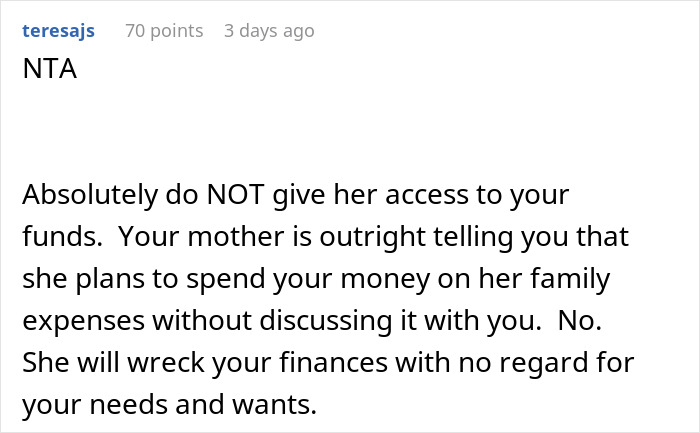

People in the comments completely agreed with our heroine that she should flatly refuse here – and not succumb to all sorts of tricks and provocations. Moreover, even many parents of adult children in the comments also noted that the original poster is completely right in her unwillingness to share access to her savings account.

If you help the family, then do it on your own terms, the respondents summarized. “They will take all your money. They have no right to it,” someone wisely wrote in the comments to the original post. And what do you, our dear readers, think about this story? Please feel free to share your opinions in the comments below as well.

Most of the commenters, however, claimed that the author was right and urged her not to share the access to her money anyway

Image credits: ComprehensiveWin82

Image credits: RDNE Stock project / Pexels (not the actual photo)

Poll Question

Thanks! Check out the results:

Just open another account at a different bank for your money. Keep a token amount in the old one and give her access. If she questions just say you developed a gambling problem or something and ask if you can borrow some money.

"Dear Mum, Haaaaahaahahahahaha. Thank you for the warning. You're now never getting a house key either."

I agree with Ray Bolen. Also put a lock on your credit access to be sure no has any access to opening cards or other accounts.

Just open another account at a different bank for your money. Keep a token amount in the old one and give her access. If she questions just say you developed a gambling problem or something and ask if you can borrow some money.

"Dear Mum, Haaaaahaahahahahaha. Thank you for the warning. You're now never getting a house key either."

I agree with Ray Bolen. Also put a lock on your credit access to be sure no has any access to opening cards or other accounts.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

38

72