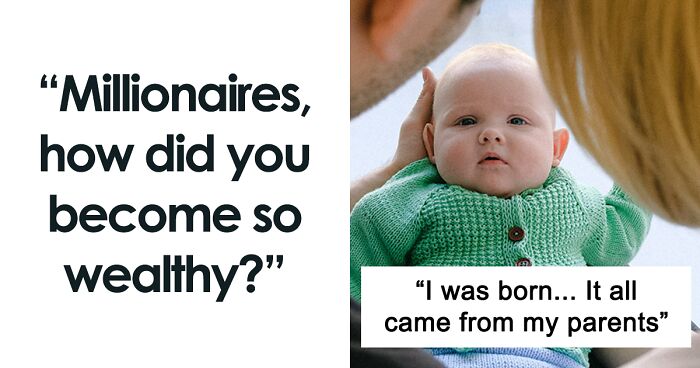

No matter how non-materialistic we may be, the thought of becoming a millionaire has crossed nearly everyone’s minds at least once or twice. I mean, then you could do pretty much anything you want, right? Start a business, splurge on vacations, and live out your days carefree. However, even when the American dream teaches us that with enough hard work and dedication, anyone can bootstrap their way to riches, many of us will never come even close to reaching that goal.

Except for these folks. You see, millions of millionaires out there overcame all odds or simply found themselves in a bit of luck. So when Redditor Goddammit_Vennie reached out to the Ask Reddit community and asked millionaires to reveal how they became so wealthy, they were eager to give everyone a glimpse into their journey.

Leveraging personal brands and diversifying income streams are common strategies among today’s wealthy individuals. For example, Kevin Hart, who has built a significant portion of his wealth through strategic brand partnerships and entertainment ventures, serves as an inspiring example of turning talent into financial success. Similarly, influencers like Kai Cenat demonstrate how leveraging social media can lead to incredible financial growth, showing that building wealth is not limited to traditional industries.

Hundreds of responses flooded the thread and proved there are plenty of ways to achieve this big milestone. We scoured the answers and picked out some of the most interesting ones for you to read, so check them out right below. Upvote the ones you liked most and be sure to share your thoughts with us in the comments!

This post may include affiliate links.

zfa reply

At last... my time to shine!

I was never too good in school, could read and write and do basic maths but nothing more. I did really enjoy woodworking though and anything using my hands.

I left school as soon as I could as I wanted to leave home. Lived in pretty s**tty places just scraping by on pretty much minimal wage working retail and hospitality until a mate of mine said I could probably make money on the side with my wood-working (he'd seen bits and pieces I'd made around the house).

There was no etsy back then so I had to do most of my stuff without any research as to what people would like and then try to hawk it via classifed and cards in local shops. I couldn't believe it when my first piece sold even though for the time I'd spent making it I hadn't even made minimum wage! However I kept at it and made a variety of ornaments which people liked and then started doing commissions. Thinks got bigger and bigger and I could quit my s**tty job to do it full time. Within a couple of years of selling my first piece I was getting more requests than I could fulfill but still only making an OK living out of it.

About 3 years to the day from my first-ever sale I actually had a motobike accident and lost the use of my left hand (fortunately not my dominant hand!). I decided to try and get a couple of the local homeless guys to help out and provide them with meals and a share of the sale prices. Obviously this meant we could make and I could sell many more pieces but I actually found I was making less money once stuff was split up. And to add insult to injury a couple of the guys ripped me off and stole a lot of my stuff. I was back at square one.

I decided to move back into making more basic pieces that would be quicker and simpler and that's when my mum passed away and left me a million dollars.

At last... my time to shine!

I was never too good in school, could read and write and do basic maths but nothing more. I did really enjoy woodworking though and anything using my hands.

I left school as soon as I could as I wanted to leave home. Lived in pretty s**tty places just scraping by on pretty much minimal wage working retail and hospitality until a mate of mine said I could probably make money on the side with my wood-working (he'd seen bits and pieces I'd made around the house).

There was no etsy back then so I had to do most of my stuff without any research as to what people would like and then try to hawk it via classifed and cards in local shops. I couldn't believe it when my first piece sold even though for the time I'd spent making it I hadn't even made minimum wage! However I kept at it and made a variety of ornaments which people liked and then started doing commissions. Thinks got bigger and bigger and I could quit my s**tty job to do it full time. Within a couple of years of selling my first piece I was getting more requests than I could fulfill but still only making an OK living out of it.

About 3 years to the day from my first-ever sale I actually had a motobike accident and lost the use of my left hand (fortunately not my dominant hand!). I decided to try and get a couple of the local homeless guys to help out and provide them with meals and a share of the sale prices. Obviously this meant we could make and I could sell many more pieces but I actually found I was making less money once stuff was split up. And to add insult to injury a couple of the guys ripped me off and stole a lot of my stuff. I was back at square one.

I decided to move back into making more basic pieces that would be quicker and simpler and that's when my mum passed away and left me a million dollars.

yanoJAL reply

In my 20s, I was a computer programmer just as the web started exploding in popularity. I could wire up websites and databases back when internet technologies were new, and tooling was still primitive. I never hit it big with a viral website like Facebook or Amazon, but I did charge a lot for programming services. And I used that money to buy houses at first, and ultimately an apartment building in coastal California.

In my 40s now. I don't feel very wealthy really. Oddly, I still check prices when shopping, and I plan to drive my old jeep until it dies. When I travel, I often pay to fly first class; and I do enjoy the nicer hotels. But, other than that, I live (and spend) rather simply.

In my 20s, I was a computer programmer just as the web started exploding in popularity. I could wire up websites and databases back when internet technologies were new, and tooling was still primitive. I never hit it big with a viral website like Facebook or Amazon, but I did charge a lot for programming services. And I used that money to buy houses at first, and ultimately an apartment building in coastal California.

In my 40s now. I don't feel very wealthy really. Oddly, I still check prices when shopping, and I plan to drive my old jeep until it dies. When I travel, I often pay to fly first class; and I do enjoy the nicer hotels. But, other than that, I live (and spend) rather simply.

NooJoisey reply

Not there yet but getting there. STEM degree for both wife and I I bag my lunch and drink from water fountain! I eat out with coworkers maybe once a month. Fill up my trusty klean kanteen bottle daily with the free ice from cafeteria and water from the water fountain. In my lower 30's right now.. Have a $500k house (bought 2 years ago) about 40% paid off.. Hope to pay it off completely well before I turn 40. Currently about $350k in Bank between liquid and stocks. Currently driving a 9 year old Scion.. Wife has a 13 year old Camry. Daughters toys are from the thrift store. Haven't had cable TV ever. Love Costco and Walmart. Love looking at deal sites. That doesn't mean we do not enjoy life. We've been backpacking in Europe.. Have visited Dubai.. Bahamas.. Bermuda.. Puerto Rico.. Vegas numerous times.. Canada numerous times..Going to Cali in less than a month. My philosophy is this: you get rich by acting poor in things that really don't please your heart. We like traveling.. So we do that. I like photography.. So I have a DSLR. Wife likes nail polish.. So she has like a big box full of them. I don't care much about food.. So I bag it and we rarely eat out. Same with our cars. Live simply.. Invest and spend wisely.. Love unconditionally..

For someone who ACTUALLY wants to put in the effort to be wealthy this is helpful! Thank you!

Virtually everybody in America is dreaming of becoming a member of the Millionaire Club and achieving financial freedom. And as it turns out, the number of people who reach this milestone is increasing. Global Wealth Report 2021 from the Credit Suisse Research Institute states that the number of millionaires in the US has reached nearly 22M. Worldwide, they estimated that there were 56.1M millionaires at the end of 2020, 5.2M more than a year earlier. The researchers stated that 2020 marks the year when more than 1% of all global adults are dollar millionaires for the first time ever.

To learn more about our fascination with seeking money, we reached out to Vicky Reynal, a psychotherapist and financial therapist based in the UK. "There is a widely held belief in our society (reinforced by the consumeristic culture that we live in) that money can buy happiness," she told Bored Panda. She explained that people seem to pursue wealth despite the evidence pointing to the contrary and that money can, at best, distract us from unhappiness.

"For some people, money equates with a sense of worth and so they chase financial success to reassure themselves and show others that they are valuable and worthy — these are people who seek an external measure of success which, in general, masks internal insecurities about lovability and worthiness," Reynal added.

concrete_isnt_cement reply

My grandparents invested a small amount of money in each of their grandchildrens' names when we were little kids.

The stocks they chose for me were Microsoft, Cisco, Starbucks, and most importantly Amazon.

I became a millionaire from those stocks shortly after my 21st birthday, last year. Honestly, I feel terribly guilty about it. I didn't do any work to deserve it, and frankly, my brother and my cousins haven't been nearly as fortunate with the investments made in their name.

My grandparents invested a small amount of money in each of their grandchildrens' names when we were little kids.

The stocks they chose for me were Microsoft, Cisco, Starbucks, and most importantly Amazon.

I became a millionaire from those stocks shortly after my 21st birthday, last year. Honestly, I feel terribly guilty about it. I didn't do any work to deserve it, and frankly, my brother and my cousins haven't been nearly as fortunate with the investments made in their name.

21 years ago Amazon stock was at $15, now it's at a little over 2000. So in order to make OP a millionaire the grandparents must have invested $7500 in random stocks for each grandchild. Basically what I'm saying is, despite what people will tell you, no-one gets rich by being good or lucky at playing the stock market. They started out rich and got richer by playing the stock market.

SisterofGandalf reply

I married an awesome businessman. :)

Disclaimer: He was broke when we met. I stood by him during the recession, when we had to put our house and everything we owned on the line. We were in danger of losing everything but got through it together.

I married an awesome businessman. :)

Disclaimer: He was broke when we met. I stood by him during the recession, when we had to put our house and everything we owned on the line. We were in danger of losing everything but got through it together.

rttr123 reply

I was born...

It all came from my parents. I get a lot of c**p from my friends in college lol.

My parents on the other hand went from living in lower middle class india (born in late 50s so basically studing hard and family bonds were what kept them going), came to California for masters and phd, and worked for massive tech companies for about 30 years. My dad went up to executive director or something. They invested a lot of money and bought houses in India and rented them out. The house they bought here in California went from $1.1m to about $3.5m.

I was born...

It all came from my parents. I get a lot of c**p from my friends in college lol.

My parents on the other hand went from living in lower middle class india (born in late 50s so basically studing hard and family bonds were what kept them going), came to California for masters and phd, and worked for massive tech companies for about 30 years. My dad went up to executive director or something. They invested a lot of money and bought houses in India and rented them out. The house they bought here in California went from $1.1m to about $3.5m.

However, it seems like many of us may have fallen for the myth that to become really wealthy you need a big income or a rich family. The National Study of Millionaires by Ramsey Solutions surveyed over 10,000 participants and found that accumulating wealth may be easier than you think. According to the report, the vast majority (79%) of millionaires in the US did not receive any inheritance at all. While 21% of the participants received some inheritance from their parents or other family members, only 3% received an inheritance of $1 million or more. The survey also found that 8 out of 10 millionaires came from at or below the middle-income level, and they built up their fortunes themselves.

udayserection reply

I enlisted in the army when I was 18. I liked it. I asked to become an officer, and they let me. The army sent me to college and I graduated. My officer pay was way higher and in the army, you don't have very many bills. I found I could save between 1k and 5k every month of my life.

After my second deployment, I was sitting on about 200k. I hired a financial manager, he did well for a few years.

I've bought and rented out a couple of houses.

I've got 17 years in the army. Creeping closer to a portfolio worth $2 million and a good pension in retirement. I'm about to make Lieutenant Colonel. I'm in my late 30s.

Just grind and save.

Edit: I should add that this job really sucks and I hate it a lot of the time. But due to the peaks and valleys of monetary motivation, I have to do it for a few more years.

I enlisted in the army when I was 18. I liked it. I asked to become an officer, and they let me. The army sent me to college and I graduated. My officer pay was way higher and in the army, you don't have very many bills. I found I could save between 1k and 5k every month of my life.

After my second deployment, I was sitting on about 200k. I hired a financial manager, he did well for a few years.

I've bought and rented out a couple of houses.

I've got 17 years in the army. Creeping closer to a portfolio worth $2 million and a good pension in retirement. I'm about to make Lieutenant Colonel. I'm in my late 30s.

Just grind and save.

Edit: I should add that this job really sucks and I hate it a lot of the time. But due to the peaks and valleys of monetary motivation, I have to do it for a few more years.

yoyoyo---- reply

Being frugal. Not buying new cars, not caring about what others think. Saving and investing and doing it again. Not making knee jerk investments. Letting them ride long term and not freaking out at every market correction. For me it was a slow game, but fun to watch it take off.

Being frugal. Not buying new cars, not caring about what others think. Saving and investing and doing it again. Not making knee jerk investments. Letting them ride long term and not freaking out at every market correction. For me it was a slow game, but fun to watch it take off.

TooManyMeds reply

Not me but my family. My Dad was p**s-poor as a kid because he was one of 5 kids to a single mother since my Grandpa died when dad was like 11 or 12. Moved out at 17 after getting his HSC (aussie SATs). Went to work. Worked a lot, my Dad's really smart so he was good at what he did. Mum and Dad weren't meant to be able to have kids, but when both of them were 40 they conceived me. Dad had just started his own business in the tech industry. But he believed in himself and the two mates he started the company with and it boomed. Mum hasn't worked since I was born because she was taking care of me. When I went to school she started doing a lot of charity work. She fell pregnant again with my little brother but he was stillborn when I was 3 years old so I stayed an only child. This year both my parents turned 60 and my Dad retired cuz his business is (and was) doing so well. We live in a nice house but most of our money goes to charity anyway, since Dad knows how it feels to have no money. What doesn't go to charity goes to family. I remember one year at Christmas Dad gave his Mum (my Nanna) and all four of his siblings $10 000 each, aka $50 000 in one year. I never asked for money, I got a job legally as soon as I could (14 and 9 months), and I've worked ever since while attending school. I think my Dad gave me good work ethics, they never spoiled me even though they could have. I'm 21 now, I still live at home (uni, and just started my first full-time job) but I plan to move out when I find a place I can take my dog with me. So technically my Mum and Dad are millionaires. I'm not, it's not my money, and when Mum and Dad pass I'll probably divide it up among the family/charity. Going to a private high school taught me money doesn't buy you happiness, so I don't have any interest in keeping more than enough to be comfortable. I wouldn't have even thought about inheritance but I was forced to cuz my Dad had two heart attacks this year and his dad, and his dad's dad both died of heart attacks in their 30s. Not that anyone cares, but he's doing way better now :) A few stents in and a lot of rehabilitation and he's almost back to normal. EDIT: I know I said I wasn't spoiled but they did give me a car when I got my full license. Well, they didn't get me a new car, they bought a new one for themselves and said I could drive the old one and take it with me if/when I move out. So basically I was an 18 year old driving a 3 year-old mid-range Lexus. I'm now a 21 year old driving a 6 year-old mid-range Lexus. Most of my friends come from pretty poor areas so I do get some looks when I'm in their neighbourhoods. Or gum. Twice now someone has stuck gum on the inside of my doorhandles. What a hard life I lead.

As you’re reading through these stories, you’ll notice that sometimes people hit the jackpot out of pure luck. When high emotions and excitement slowly fade away, finding your financial situation has shifted so drastically can be a bit much. "Quick changes to financial status can be overwhelming for some people, but not for all," Reynal said. "Some people manage to use the money in a way that is consistent with their values; they seek support (financial planners, financial therapists) to help them make choices that align with their beliefs and objectives."

But some individuals may have a hard time dealing with their fortunes. "Other people will struggle with feelings of guilt and undeservedness, which tends to happen in the face of material wealth that doesn't match up with an internal sense of worthiness. Or they might struggle to manage the (perceived or real) envy of others and will fear being exploited by others who, in their minds, are 'only interested in their money'," the psychotherapist said and noted this may set off a cycle of withdrawal and isolation.

synesthesiah reply

Well, last year my fiancé's grandparents won a stupid amount of money in the lotto (double-digit millions). They were generous enough to share with the family. (I grew up below the poverty line so my life is nuts rn)

Edit: I'm a girl, for one. Two, I am in fact choosing to do stuff with my life, as I'm not an idle person mooching off of a very lucky break. His money is placed in a trust and we have many financial advisors, we are not cleared to buy anything without approval, and what we don't use is invested by the bank that runs the trust. I don't really care for advice since I'm just reaping the rewards.

So far, we bought my fiancé's childhood home his father built, which is in one of the most sought-after neighbourhoods in my city, and we're loving the security we have as homeowners. We took an amazing trip in June, where he proposed right on the banks of the River Ness in Inverness, Scotland. It was pretty magical guys. (And no, my ring is not exorbitant)

Having the money hasn't changed us as a couple, as we spent a year and a half living in a bachelor suite the size of a one-car garage and still love each other. So, at this point it's a done deal, we're together for good, and are getting married next

Also, I signed a cohabitation agreement but we agreed that I am not signing a prenup, and my name will be added to the title of the house after marriage, and the cohabitation agreement nullifies, making everything BUT the trust, mine, so if in the highly unlikely case of divorce, I can go after him for half of everything but the trust, as it is owned by his grandparents, but he is beneficiary. Pretty nutty stuff and I'm genuinely surprised they didn't force me into a prenup

Well, last year my fiancé's grandparents won a stupid amount of money in the lotto (double-digit millions). They were generous enough to share with the family. (I grew up below the poverty line so my life is nuts rn)

Edit: I'm a girl, for one. Two, I am in fact choosing to do stuff with my life, as I'm not an idle person mooching off of a very lucky break. His money is placed in a trust and we have many financial advisors, we are not cleared to buy anything without approval, and what we don't use is invested by the bank that runs the trust. I don't really care for advice since I'm just reaping the rewards.

So far, we bought my fiancé's childhood home his father built, which is in one of the most sought-after neighbourhoods in my city, and we're loving the security we have as homeowners. We took an amazing trip in June, where he proposed right on the banks of the River Ness in Inverness, Scotland. It was pretty magical guys. (And no, my ring is not exorbitant)

Having the money hasn't changed us as a couple, as we spent a year and a half living in a bachelor suite the size of a one-car garage and still love each other. So, at this point it's a done deal, we're together for good, and are getting married next

Also, I signed a cohabitation agreement but we agreed that I am not signing a prenup, and my name will be added to the title of the house after marriage, and the cohabitation agreement nullifies, making everything BUT the trust, mine, so if in the highly unlikely case of divorce, I can go after him for half of everything but the trust, as it is owned by his grandparents, but he is beneficiary. Pretty nutty stuff and I'm genuinely surprised they didn't force me into a prenup

anon reply

A huge pipe fell on me and the company I was working for was a gong show. I got a little over a million in a settlement. 1/10 would not do again.

A huge pipe fell on me and the company I was working for was a gong show. I got a little over a million in a settlement. 1/10 would not do again.

millionaires-share-how-they-became-wealthy

I basically kept the same habits I had when my income was $12k a year for a family of three.

I make coffee at home, I still forage for food, I still shop at thrift shops for clothing, my car is 14 years old and I try not to use it if I can use my bicycle instead - including biking to work when I wasn't carpooling. Even when I was a single mom on $28k salary I put what I could in my 401k and every raise I got went to that til I at least got the full employer match.

When I got a new job and found out there was no similar retirement plan there, I met with the directors and a financial advisor and got one in place.

I make my own laundry detergent and use cloth wipes/napkins. I spend about $20 a week for two adults for food. Yesterday I really really wanted an orange but didn't take it from the fridge because I paid for those for my husband's packed lunches, and pears from the yard are free. Oranges travel better in his bicycle bag so they are for him. Pears from the yard have occasional spots that need to be cut out so they are for me because I retired last year and he has another year or two to go. It's easier to cut off bad spots when you are at home in your own kitchen. I am so tired of pears, though.

I have a million dollars but I won't eat an orange if I have a free pear. On the one hand, that's pathetic. On the other hand, that's why I have a million dollars and don't have to go to work anymore.

I basically kept the same habits I had when my income was $12k a year for a family of three.

I make coffee at home, I still forage for food, I still shop at thrift shops for clothing, my car is 14 years old and I try not to use it if I can use my bicycle instead - including biking to work when I wasn't carpooling. Even when I was a single mom on $28k salary I put what I could in my 401k and every raise I got went to that til I at least got the full employer match.

When I got a new job and found out there was no similar retirement plan there, I met with the directors and a financial advisor and got one in place.

I make my own laundry detergent and use cloth wipes/napkins. I spend about $20 a week for two adults for food. Yesterday I really really wanted an orange but didn't take it from the fridge because I paid for those for my husband's packed lunches, and pears from the yard are free. Oranges travel better in his bicycle bag so they are for him. Pears from the yard have occasional spots that need to be cut out so they are for me because I retired last year and he has another year or two to go. It's easier to cut off bad spots when you are at home in your own kitchen. I am so tired of pears, though.

I have a million dollars but I won't eat an orange if I have a free pear. On the one hand, that's pathetic. On the other hand, that's why I have a million dollars and don't have to go to work anymore.

When you find yourself going from rags to riches, there will be many opportunities to spend it all, and quick. We have long heard that people should put their thinking caps on when handling money and avoid giving in to temptations. The most common tip you hear from experts is that you need to quickly find a financial advisor who can help you steer clear of thoughtless decisions. However, choices become unhealthy when we make them without thinking of what's best for us, Reynal argued.

"A lottery winner donating all their money because they have thought through the pros and cons of keeping it because they have explored their desire to do good and be giving is very different from one that impulsively gives it all away out of an unexplored sense of guilt or fears that having money will 'spoil them' in some way. Some people do harbor beliefs that money is 'evil' or 'corrupting' because of the messages they heard growing up," she told us.

ilikeirony reply

Always saved up a lot of money (40% of my pay) and continually put it into stocks. Investment returns have outdone my savings for quite a while.

Always saved up a lot of money (40% of my pay) and continually put it into stocks. Investment returns have outdone my savings for quite a while.

5meterhammer reply

I actually hit big at a casino a while back. Not enough where I can afford to quit my job and buy a mansion, but I'm comfy and so will my son be.

I actually hit big at a casino a while back. Not enough where I can afford to quit my job and buy a mansion, but I'm comfy and so will my son be.

Hamoct reply

I live in Eastern Europe. In 1990 I took out a huge loan and bought 10 apartments and furnished them. I rent them out to people and with the money I earn from them I pay off the loan payments. I do this every 10 years. I have now 30 apartments and 1 employee who I pay to maintain them and make sure payments and maintenance is handled. The key is finding good tenants and maintaining a good relationship with them. It is not that hard but a key to this strategy.

I live in Eastern Europe. In 1990 I took out a huge loan and bought 10 apartments and furnished them. I rent them out to people and with the money I earn from them I pay off the loan payments. I do this every 10 years. I have now 30 apartments and 1 employee who I pay to maintain them and make sure payments and maintenance is handled. The key is finding good tenants and maintaining a good relationship with them. It is not that hard but a key to this strategy.

millionaires-share-how-they-became-wealthy

My dad [passed away], and my sister and I split a 1.6 million dollar estate down the middle. After court fees from an unrelated incident, taxes, realtor fees, balancing dad's bank debt, and paying off some of mom's debt, we brought home $720k each.

I've since turned it into around $950k, so I'm pretty close. My sister, meanwhile, pissed it away on brand new cars, cruises, extortionately priced weddings, and having children.

My dad [passed away], and my sister and I split a 1.6 million dollar estate down the middle. After court fees from an unrelated incident, taxes, realtor fees, balancing dad's bank debt, and paying off some of mom's debt, we brought home $720k each.

I've since turned it into around $950k, so I'm pretty close. My sister, meanwhile, pissed it away on brand new cars, cruises, extortionately priced weddings, and having children.

Some people value enjoying experiences more than having lots of money. I'm more of a "saver", I'm much wealthier than my sister, but she generally spends money as fast as she maked it, like she's traveled the world (often for months at a time), has 2 children, etc. Not sure who is really better off, I've got a financially secure retirement, while she'll be living on social security, but has a lifetime of experiences to reflect on.

lionalhutz reply

The old fashion way: great grandparents helped build a city

The old fashion way: great grandparents helped build a city

nerfezoriuq reply

I am on track of being a millionaire by just investing in my 401k. I started my career at 20 years old right after graduating from college and started investing the minimum to my 401k. Never really thought much of it until I did those calculators and realized that since I started so young the compound interest on any investment account with a decent return would be huge.

I would recommend you just put anything away, everyone tells you to max your investments but honestly not everyone can invest $18k a year. Do the math of how much $200 a month will grow in 30 years. This might not be the exact answer but this will easily get you to be a millionaire at some point.

I am on track of being a millionaire by just investing in my 401k. I started my career at 20 years old right after graduating from college and started investing the minimum to my 401k. Never really thought much of it until I did those calculators and realized that since I started so young the compound interest on any investment account with a decent return would be huge.

I would recommend you just put anything away, everyone tells you to max your investments but honestly not everyone can invest $18k a year. Do the math of how much $200 a month will grow in 30 years. This might not be the exact answer but this will easily get you to be a millionaire at some point.

200 dollar a month is still not feasible for all and I doubt it is going to get you to a million. (200= 2400 a year, 72k in 30 years so unless you have a really high interest like 15% it so, it ain't happening)

Yanman_be reply

I sell overpriced consultancy time to CTO's who don't know any beter.

I sell overpriced consultancy time to CTO's who don't know any beter.

hoesindifareacodes reply

Got a degree in finance, became a financial advisor, worked my butt off.

Edit: I should also add, being frugal with money. If you are under the age of 35 and are gainfully employed, it is entirely possible to become a millionaire at some point in life. Take 10% (or more) of your pay, put it in your 401k and invest in s&p500 etf. Don't carry bad debt, & keep 3-6 months of expenses as an emergency fund. Lastly, think of spending money in terms of hours worked: If something costs $10, think about how long it would take you to earn that $10 after tax. Is it worth it for you to work that time for that purchase?

Got a degree in finance, became a financial advisor, worked my butt off.

Edit: I should also add, being frugal with money. If you are under the age of 35 and are gainfully employed, it is entirely possible to become a millionaire at some point in life. Take 10% (or more) of your pay, put it in your 401k and invest in s&p500 etf. Don't carry bad debt, & keep 3-6 months of expenses as an emergency fund. Lastly, think of spending money in terms of hours worked: If something costs $10, think about how long it would take you to earn that $10 after tax. Is it worth it for you to work that time for that purchase?

Even making decent money these days, people cannot take 10% of their income away because their rent/mortgage is so high that even with a well paying job you're struggling. Every raise coincides with a hike in health care which in some states you are required to carry or you get a penalty, or your rent increases. A lot of the people on this list talk about making investments but there's no way for a lot of people to afford that. I wish I could afford to invest even just in my company's 401k to the max but I can't loose that much income. I make pretty good money, too, and have no debt other than student loans my regular electric/heat and utilities. I live frugally. It's rent. I live in a crappy apartment but it's 1700 a month. And that's CHEAP in this area. I can't move. I already drive over an hour each way to work. Gas is 6 dollars a gallon. It's just not feasible. You have to have a 2nd income in order to do it, unless you make over 130k.

Darth_Savage_Osrs reply

When I was 15, I started doing a lot of random jobs in my Hometown in Mexico. After a year, i accumulated about 40k, and decided to start flipping tractors and agricultural equipment. I'd try and make about 5k every machine, until I finally hit the 200k mark in 6 months. (I wasn't doing amazing in school but was making really decent money as you can tell). At that point, I bought a piece of land for really cheap. Story goes the owner was in seriously desperate to sell the land cause his wife or kids had been kidnapped, so I basically bought this land and instantly doubled my money. I couldn't buy all the land though, as it was a 1.2 million dollar total sale, so I begged my parents to sign so that the banks would lend me the other 800k. Once I bought the land, within the year the land was worth 2.5ish million as the violence in the region had died down a bit. Now I was a 17, almost 18 year old kid with a really big farm, which was bringing in about 200-250k in profit a year. I decided I wanted to go to college, and paid my way thru college and saved up as much as I could. I sold the land in Mexico at 2.4 M, and had about 3M in the bank, and I have now invested in more farm land and am looking into investing in an apartment complex or a start up bank. I wish I could say that I was amazing at business or some of the other cool things people have posted here, but honestly I've just been very lucky.

BlakeHighborn reply

This will be a boring, but hopefully honest answer. I am not a millionaire, but my mother is. The answer is simply hard-work. She was born in Chicago in the 1960's to a pair of Irish immigrants with less than $300 to their name when they came to this country. Neither of my grandparents had more than a high school education, but they worked damn hard for my mom to go to college. She got a degree from a very good school and went into journalism. Not a career that's usually associated with high earnings, but she busted her a*s in a time when women were really just getting into that field. She's also made the most of her money as a single parent as my father died of cancer when I was 11. She worked really hard and now, before taxes and after her bonus, is a managing editor at one of the most prestiegious newspapers in the world making close to 300k a year. Now, she makes great money, but she easily works between 60-80 hours a week. The other answer is investiments. My grandfather, although not edutcated, was always investing in the market and made a good deal of money and so did my mother. She has a guy who, despite a slip-up that cost her over 200k, has earned that for us many times over. So, I'm not trying to sound like a "Pull yourself up by your bootstraps" kind of guy, but, in my mother's case, she came from very little and is now very wealthy. I fully admit that a lot of that was luck; my grandparents were able to enter the country because my grandfather charmed the man who would sponsor them while he was a waiter on a cruise ship, but a lot of it is also hard work. Sure, there are people born into great wealthy and prestige, but a lot of them work damn hard for it Sorry for any formatting issues, I'm on my phone.

bicyclemom reply

Started work in IT at age 22. My manager told me to take some time on my first day to open a 401(K) and open an account at the local credit Union with its free checking and general lack of ripoff fees that most banks have. My husband did pretty much the same thing. Saved 15% off the top of my paycheck for 30+ years so far. My husband and I avoided debts other than a mortgage. We bought it home in 1995, a small house on a small property, borrowing way less than the bank wanted to lend us. We bought it for $255,500 (NYC 'burbs). It's worth around $550,000 today. We've always paid cash for our cars, and until our children came of driving age we only had 1 car. Today we're driving a 2003 Subaru Outback. Through all of this, we also set aside money for our kids' college education. They were able to get good scholarships and my son, at least, made it through debt free. I think my daughter will too, especially if her plan to graduate in 3 years works out. Between my husband and I we have about $1.7M in savings and cash and our home is all ours. I'm also fortunate enough to have a pension. If I work to age 65, that will be another $700K, but not sure I want to work that long. So that might be about half. The net is that we never spent a lot on a house or car. We took some vacations but even when we did that we went places where we cooked for ourselves. We just oversaved, underspent and underborrowed.

Kaden18356 reply

I sold 18% of my company for a large sum of money and we worked together to expand.

I sold 18% of my company for a large sum of money and we worked together to expand.

whitetrafficlight reply

Millionaire in my 20s here. A combination of things, but mostly number 4: * Working in software. This field tends to pay very well for good people. * Being frugal. I don't act like a pauper, but I don't have a cable subscription (I'm a gamer, TV doesn't interest me) and I prefer to cook my own meals than eat out. * Being single. Kids are expensive, or so I hear. * Stock options. I joined my company a couple of years before IPO, and at the time I felt they showed a lot of promise and could do really well in their market. I was right: the stock price has been rising steadily since IPO and the majority of my wealth is in stock options (on a steady diversification schedule). A million dollars was never my goal, I was actually surprised when I hit it a few months ago. I don't think it has really changed me though, it just means I don't have to worry about money and I can afford to take long distance flights business class (I got a free upgrade once and now I'm sold!) Still, most people will want to retire on at least a million... people live a long time now and if you're planning on taking 20 years retirement, that's $50k a year which is a fairly modest salary depending on where you live. The trick there is to save, invest, and not think yourself rich with that retirement account sitting there full of money.

SkinHead2 reply

Self made... Cracked the first $1m just after 33 sometime. Then the next few came quickly. The best advice is to build capital early. I scrimped and saved and had my first car till I was 30 and it totally shat itself. Didnt waste money on holidays or any expenditure that wasnt 100% necessary. Holidays consisted just of time of work and going to beach or doing fun free things So once I had a little nest egg $10K I got a house and everytime I had a spare $50 put it against the motgage. Then everytime I got a pay rise the difference went to the mortgage, not to increase in lifestyle. Im 45 now and saving becomes less of a priortity as the BASE capital is there. I can spend every sent I earn and my base will still increase. SUMMARY:- Get saving early. What Car and what clothes you wear dont change who you are.

nowhereman1280 reply

Started buying multifamily Real Estate in central Chicago in 2011. Have been selling since last year. At one point I had 15 buildings with 65 apartments in them. The few buildings I have left are worth about $2 million and I have over a third of a million in cash in my savings. Prices were so rediculous in the recession that I was able to turn $5,000 in savings and a lot of sweat equity into what I have now. I bought my first building with an FHA loans for $130k in Logan Square. It was 3 units and I put $5000 down. It's now worth $400k. Then is saved up the income from that property and bought a six unit for $50k that's now worth $350k. I then picked up another six flat for free because the city was going to force the bank to demolish it, borrowed against the equity in my other properties to do a total gut rehab of it, now the building is worth $1.1 million and generates $10,000 cash flow every month. I live frugally as well, when my old car died I bought a two year old Honda with 25,000 miles on it. I still live in the first property I bought. My hobbies are ones that are only expensive if you don't have the time to take advantage of them. I buy a ski pass and ski four weeks a year. The pass costs $600, but I can get thousands of dollars worth of skiing out of it since my "job" is mainly collecting passive income. I'm only 29 so my plan is to just slowly add to my portfolio while letting the few buildings I haven't sold off burn off principal. I'm basically semi retired and have been for three years.

anon reply

Well I'm 30. Landed a decent job during the recession right after college and committed 35% of my income to investment since then. I am very close to the million.

optiongeek reply

Through hard work and perseverance I established a reputation for honesty and competence. I was slowly promoted to increasing positions of responsibility and remuneration. I saved prodigiously and invested wisely. I married well to someone with similar values.

Through hard work and perseverance I established a reputation for honesty and competence. I was slowly promoted to increasing positions of responsibility and remuneration. I saved prodigiously and invested wisely. I married well to someone with similar values.

wuop reply

STEM degree + minimalism.

STEM degree + minimalism.

AnotherPint reply

Long game. Invested consistently since my mid-20s, and had a real estate move or two work out in my favor. During market crashes (2000, 2008) I did not pull the ripcord, just stuck to my guns, and that has made all the difference. Early start plus slow and steady wins the race. I used to think when I made it to this point I would live like Trump, but (A) being a millionaire ain't what it used to be, and (B) there's not that much material stuff I want anymore. I think expensive cars are stupid and I'll never own a $2,000 suit. I liked being able to put my kid through college and help him get set up without breaking a real sweat, and I like being able to pick up tabs and help other family members when needed, but that's about the extent of my profligacy.

2d_active reply

Is millionaire defined by assets? Because I just qualify based on the value of my property but I'm s**t-poor in terms of cash flow. I have always been very frugal and save significantly more than anyone else I know. Bought a property at the age of 23 which appreciated in value by a significant amount. However, I am just barely paying off the loan so I'm poor as f**k.

anon reply

You can always marry into it. Ugly rich boys or girls. Otherwise, hard work, fail fail then succeed. Also don't expect money to make you happy, all of us could learn to be happy with what we got. Compare yourself to yourself and not others and see how much you have grown over the years/months.

usually, i believe, you compare your insides to other's outsides - you're gonna' lose.

padmespadawan reply

Not me but my SO Attended the naval academy, left with one year before graduating and moved into finance. Started with selling cars at a dealership which led him to being a finance manager and "made 10k in my first month and never looked back". He's now worked his way up to a general sales manager at a high volume dealership and has recently gotten into investing in stocks. At 32 he makes a high six figure salary and is on track to become a partner in owning the dealership and inspires me everyday :)

Milkslinger reply

The power of compounding interest anyone can become a millionaire. Just put aside 10 to 20% of your salary in a account with compounding interest and give it a couple decades

Pmmeyourgat reply

A long time ago my great grandfather bought A good amount of land in Florida. My grandfather sold most of it in the 90s. But we still have some. I am in my 30s now and didn't know just how much money my family had until about 10 years ago. I knew we were well off, but I had no idea how well off. Although I do not have much of it personally yet (my mom still has it). My house was paid in full with it. Also my wife and I have a combined six figure income with decent retirement plans without it. So I havn't really felt a need for it. A good chunk of it is tied up in investments anyways. My wife and I have no intentions of using it. It will probably just continue to grow so future generations can enjoy the life and opportunities I have had.

bowhunter_fta reply

Didn't get into medical school on my first try. Went to graduate school. Had to work 3 jobs to pay for my education (I come from the upper end of the lower class....my parents didn't have money). Got into the financial business by accident (that's a story for another day). Fell in love with the financial biz. Got accepted into medical school. When it was time for me to go to med school, I was making so much money that I decided to stay in the financial biz (as you might imagine, my parents were none to pleased about that....but they've gotten over it). My first 10 years in the business (my 20's/early 30's), I worked 80+ hours per week. My friends all made fun of me because they were playing in 3 softball leagues every week and partying in Cancun (or some place like that) every few months. After 10 years of eating dirt and working my butt, I was able to cut down to 60 hours per week in my early 30's through my early 40's). All my friends weren't making fun of me anymore for not partying with them, they were all saying things like, "I wish I could have a house like yours). Somewhere in my mid-40's I was able to cut back to working only 3 - 4 days per week (when I did work, they were long.....12 hour +....days). And all my friends said, "I wish I only had to work 3 days per week". Now, in my early 50's, I work as often as I want, but I still put in 40 - 60 hours per week....because I like working and making money. But I take a lot of time off, do a lot of traveling, or just relaxing and doing what I want. I got where I'm because of hard work and training myself to find opportunities. Training oneself to find opportunities requires a lot of hard work and a LOT of failure. I got "rich", then almost went bankrupt. I got rich again, and then actually went bankrupt. Now, I'm rich again. I've been conned, swindled, I've had money stolen from me, I've had employees that have lied and cheated me. But in the end, I'm rich, my family is now rich and many of my loyal honest employees are rich, my loyal clientele is rich and my investors are rich. Work hard and become very good at something. Build a solid reputation as someone who knows what they are doing. Build a reputation as someone who can fight thru adversity and never give up. Locate opportunities in the market place. Find a way to profit from that opportunity. Learn how to build a business. Keep copious notes on the processes and procedures you followed (good and bad ones) that helped you build that business. Learn how to write a business plan. Seek out investors. Start out small and don't get greedy, i.e. don't get hung up on owning 51% of the company, (the goal is not about percentages, it's 1099's, K1's and building your net worth....as you get better and more experienced, you can demand a higher ownership share). Don't fall for the tripe the world tries to foist upon you. The government is NOT your friend. High taxes are not your friend. Government regulation is not your friend. And most of all, remember this: The world does NOT care about your intents, nor how "Noble" your project or idea is/was, nor does the world care about how hard you tried. And most of all the world does NOT care about your PLE (Perfectly Legitimate Excuse) to justify why you failed and why you lost money. The world ONLY cares about results and how much money you made them. There are no participation trophies in business. Now, go follow this formula and create your own wealth and success because my generation (the generation that is currently in power) is starting to retire and we need great people to step up and take over the leadership roles that we will gladly (eventually) relinquish so we can move onto the next stage of our lives....but we'll be here to advise and counsel whenever you need us!

He's right about quite a bit of that.... but the facts that he's right is also why the world is so f****d up. It very much sounds like the focus is on getting rich.... not caring how he gets rich.

anon reply

I have several million cents to my name... I just live within my means, easy! On a more serious note, if you're talking about being a millionaire in USD, I suppose I would be one if I inherit my parents' savings and house, because I am from Toronto where land is overvalued and our extremely modest house, bought in the 1980s, would easily sell for close to $1 million. Add in a few hundred thousand that my parents took decades to save, and then my net worth easily exceeds a million.

rydan reply

I earned a lot of money and then I turned around and used that money to become even wealthier. Then I stopped spending and let my bank account fill up.

kooknboo reply

Worked hard and made saving a priority from day one. Started at saving 10% of my gross and now I'm saving ~19%. Invested fairly conservatively. Never once in 30+ years have I dipped into my long term accounts. The result... home mortgage with about a $10k balance on it, not a single penny of consumer debt (car loan, credit card, etc) and I think it's been ~20 years since I've paid a penny of consumer debt interest, put two kids through 9+ years of college, nice house, frequent meaningful vacations, etc. $1.9M in the bank. I'm 53 and could retire in the next year or two if I wanted. Two inviolable rules - (1) save 10% minimum from day one of your first "real" job and increase that each year; and (2) never ever pull your credit card out of your pocket unless you can pay it off in full at the end of the month or it's a flat out, life changing emergency. I don't think my family has ever sacrificed once. It's not hard. Edit: Another Pro Tip - don't be a slave to your investments. I went through stretches where I was checking balances daily and stressing if they went down a bit. I eventually got in the mindset to check my balances at most once per month, keep the investments very conservative and just let it ride. Since I've been doing that, balances continue to go up with no stress or effort on my part. My 401K and IRA's have "goal year" investments. "I want to retire by 2025 so invest in a proper mix of risk for me" type of stuff. Probably 95% of my $$ is in those types of investments and up up up they go.

ok_calmdown reply

I was born. My dad’s dad was president of an investment group. Mom’s great grandpa imported/exported grain in Europe. Dad is one of the most driven, humble people I’ve ever met. As the youngest of 5, he didn’t get much from his father- neither in life nor death. He’s retired, but spent his entire life saving and planning. Worked at the same big company for 45 years, started in a basic sales job and eventually rose to a high managerial position. This guy would never waste a penny. When I asked for a desk to do my homework at as a little kid, dad taught me how to build a desk. Mom is extremely well educated, loving and generous. She raised my brother and me. Her family is so incredibly cool. We also own a fair amount of real estate in our home city / surrounding areas. Yeah, my parents have a few nice homes... But my apartment is a tiny studio and I don’t live off of handouts. I realize how lucky I am and despite how it might sound, we’re not bad people and we do work hard.

horses_for_courses reply

Two things: 1) develop and use a budget. Others have said this as well so I'll be brief, but record your purchases and know where your money is spent; and 2) understand the value of time. The 'get rich quick' strategies are either fraudulent or present such a high risk not to be worth it in the long run. Time is your friend when building wealth: invest wisely - don't chase the latest fads - and monitor your investments. Remember that in the stock market, you haven't lost money unless you sell; good stocks experience highs and lows, but increase in value over time.

roxasx12 reply

One of my cousins became a millionaire by investing in Bitcoin 5 years ago which was before a lot of people knew about it. He's only 22 right now.

ShowMeYourBunny reply

The same way most people do it - started a business and worked hard to grow it. Years of planning, growing connections within industry, hard work, and the willingness to take a risk and gamble on my own skill and ability. I'm not a miser. I make money so I can enjoy life.

HansHanson reply

Bought bitcoin at 170$ in 2013, bought from that ethereum last year. Initial investment was 8000$.

anon reply

Most millionaires are first-generation. The real way to become a millionaire is to work a decent job, save, invest. It's not complicated, it's not Magic. It just takes time. There's always the one percent that has some sort of special talent or ability. But it's hard to sell that to most people who don't.

Sciencebitchs reply

Not me but my stepfather grew up at the poverty line, worked his a*s of thru college to become a psychologist,never had kids, lived frugally, and invested in COD and such, nothing to risky, he now has about 1m +assets. (until he married my mother) Hard work and living wisely pays off.

whiskeyinmypants reply

Started 2 businesses - One, and investment firm, when I was 29 which became my full-time job and a second one whiskey distillery in the past two years. 34 now. I will say one thing about being a millionaire is that it does not mean you have a great cash flow all the time... for example most of my money is tied up in equity in my business.

Nspir3 reply

I'm not but my grandparents were. They become wealthy by saving money and investing you'd never know they were wealthy by what they drove or wore. It really isn't that complicated to become a millionaire. But being a millionaire nowadays isn't really that crazy. Just save and invest.

I'm not but my grandparents were. They become wealthy by saving money and investing you'd never know they were wealthy by what they drove or wore. It really isn't that complicated to become a millionaire. But being a millionaire nowadays isn't really that crazy. Just save and invest.

aussiecaveman reply

Being a millionaire does not necessarily mean having a million dollars worth of cash in the bank. It's all about nett worth. For example, I owe around $40,000 on my house. I have lived in it for over 20 years and it is now worth around $700,000. So I have $660,000 equity at this point in time. I am due to retire in 7 1/2 years and my superannuation is worth around $300,00. When my parents pass I will receive around $200,00 inheritance. When my wife retires she will receive about the same in superannuation and when her mother passes she will get around $150,000 inheritance. ( she has a lot more siblings than me). So, technically we are millionaires but oddly enough still have trouble making it from payday to payday.

Aristeros reply

*Not a millionaire.* Currently more than halfway there in terms of net worth (nearly $700k). I am a few years shy of forty. First in my family to go to college, worked my way through but still had about $40k in debt. Was struggling to find a job with my liberal arts degree so I joined the military as an officer, first as a way to pay for grad school, but I ended up staying. Paid off the debt very quickly because you have very few espenses in the military. I decided to never be in debt again and to always have a plan. Started saving with a Thrift Savings Plan (~401k) at 5% removed directly from my paycheck so you never miss the money, and once the debt was gone I put it to 10%, then 15%. My wife came to the relationship with a good car and no debt. About a year and a half in I started maxing a Roth IRA for me (S&P 500 index fund with Vanguard--very low expenses) and the wife (a growth fund with Vamguard) and kept maxing it even through the downturn. Maxing was easy through deployments--my wife is frugal and I wasn't spending. My IRA rebounded by 10-25% per year after the recession turned around until it was over $200k, hers nearly as well. TSP rebounded nearly as well. This formed the bulk of my current net worth--maxing these Roths and slowly increasing my TSP, each year, which is currently 17% of my base pay. Each time I deploy we make a fair bit because there is no income tax and you get a bit extra each month. This happened over 12 years, mind you. We have been on one expensive vacation in that time (our honeymoon), her car is over ten years old, mine is a used car purchased because we thought we would live overseas (military will ship one car not two) and I gave my car to my very-broke parents but the government changed its mind at the last minute. We don't spend a lot on clothes or electronics. Our peers have way nicer furniture than us, we have cleaned-up castoffs and the same stuff we have had for years. Once the new-to-you vehicle is paid off I will restart doing the Coverdells and UESP (college savings plans) for the kids. Hopefully one will go military so my GI Bill covers the other, ha ha. Deploying again next year, so we may bank another $30-40K because I am making $80k. Her folks have money enough to cover assisted living and then some, my folks have nothing and no plan, so we will break even there. Once both kids are in school the wife goes back to work. If we ever live in a good market to buy/sell a house at a profit we will (I keep getting stationed in not-that-place). Military offered a half-pay pension that doesn't exist to new folks, and I should get that, expect to 'retire' at fifty, find a job in government for a few years to sack away another $400k or so. Contractors who do what I do can get six figures, Best advice I can give is to have an emergency fund, live within your means, pay down the debt aggressively starting with the higher interest stuff like credit cards, and save in a way that it is automatic so you cannot spend it.

drwhite888 reply

I'm not a millionaire but if I was I'd say living under your means and getting over the idea that buying materialistic things will make you happier. Keep saving and building wealth.. Set a saving goal and once you've reached it don't go beneath it. I

Tawptuan reply

Not me but someone you all know of. About 20 years ago Bill Gates was already known as one of the richest men in the world and I lived in the same general community. One of my students worked at a Thai restaurant in a strip mall where Bill and his wife frequented on a regular basis. My student told me he regularly showed up in a modest older sports car which he drove himself, wearing a T-shirt and faded jeans. Melinda was simply dressed as well. Never anything flashy or pretentious. Regularly tipped 10 to 15%. That's the Pacific Northwest lifestyle of which Bill is the epitome. If you got it, you don't flaunt it.

FIREoManiac reply

In short, I have lived below my means, saved and invested, paid myself first, avoided most consumer debt, delayed lifestyle inflation, and gotten lucky with company stock and a frugal wife. That allowed me to invest in real estate which is now paying 2/3 of my paycheck in passive income. Net worth: About 2.9 M. I can provide more details if anyone is interested.

pf_throwaway_money reply

Late to the party, but whatever. It's important to note that being a barely-millionaire doesn't make you wealthy anymore. A million dollar in 2017 doesn't really do much for you. You can live like a robust lower middle class lifestyle on that amount for the rest of your life, unless you have a family to support, or you get sick. Great. Now take a time machine back to 1980. If you had a single million dollar back then, you could live a comfortable somewhat upper middle class lifestyle indefinitely. Or just middle class if you had a family to take care of. Money isn't what it used to be. In other countries nowadays, they build up they retirement plans through some government program, and they can end up retiring with a monthly income that exceeds what you can safely withdraw from your investment of a million dollars. Those people don't think of themselves as millionaires. Realistically, neither should we. Now back to the question of my fabulous wealth: I have a STEM degree, and have been working without interruptions for 20-ish years. I have not been particularly thrifty, I have no been especially lucky with startups or IPOs, I have no made any distinctive investments with it. In the end, I've managed to scrounge a million and a half. From an inheritance, I recently got another half a million, roughly. And then, there's bitcoin. I never really invested anything in it, but I got in early. Then I didn't do anything with it. That's worth a couple million dollars now, although with the little crash today, who knows where it'll end up. My deeply convoluted financial planning with it is that someday, I'll sell half. That'll happen when the price is high enough that it's enough to not have to work. None of this makes me feel wealthy still. To be in the 1% by wealth in the US, you need at least 8 millions, and I'm not sure I'll ever get to that number. But 5% is probably enough to live a quiet suburban life.

tamere2k reply

Started playing the stock market as an investment in college and basically got lucky. Now I work in an industry I love (hotel management) while my money makes more money for me because it is invested well and I live fairly modestly.

Jericho_Hill reply

Established good habits. Saved alot and invested in 00s. Bought a house. Kept lifestyle inflation low. Changed jobs / got promoted, saved and invested more each time. Now almost 40, millionaire a few times

jplevene reply

Worked hard and invested everything I could, especially into property. Working on my newest business, just under a year old, loads of working hours, but it has paid off again.

anon reply

I'm a book and art dealer. I have a 2mil book and art collection (pretty accurate figure I think) but usually only a few 000 in the bank. Started 20 years ago with 15,000 uk pounds after working as a designer specialising in servicing/advising left political parties in the UK. There was a scandal I was involved in and then I had to stop. I was interested in art so I thought "how hard could it be?". Had immediate success in buying a Warhol and selling it on. Then 18 months without another sale. But by buying and selling and buying more I have built up my stock. Some things I will not sell (at least not yet) but the end game is to put the entire stock up for auction when I am too old to work - but I'm about to hit 60 and I expect to work for at least another 10 years (it's fun) unless disaster or bad health intervenes.

vijay001xd reply

I live in India. It's not mine but my fathers story. He is a high school drop out. At the age 17 he worked in a textile mill for 3 years. After that he started a small cycle selling shop which ended up in loss. He was married at 25. He started a small ceramic tile retail shop with the pension fund provided by my grandfather. he used to be a miser. He also saves lot of money which lead him to expand his store. Now he has 8 different outlets which earns 10 million US dollars on average per year. He's always been a great inspiration for me.

anon reply

Stock trading. Depending on how good you are you can make a lot or a little money. Be careful though or you'll end up losing a lot or a little money.

anon reply

I'll be a millionaire when my grandparents pass away. I have no idea how much though, one million or several millions. They're in their 70s so who knows. I don't think about it ever oddly

i'll get some when my 90 year old mom goes - i continually tell her to go - spend it - have fun with it. she's content now though - plus she has been everywhere in the world she wants to go - she say's.

edentozion2030 reply

In just six years I have seen my net worth go from zero to $400k. I own a small business and have saved $50k per year the last few years now I'm investing it into real estate and other businesses. I should be worth a million within five years. So zero to one million in about ten years. Not bad. Dont work harder, work smarter! I have never worked more than 45 hrs per week and I didnt study much in college. I did learn to hear the voice of the Lord which I consider my best asset which helps me overcome fear. Fear is the biggest obstacle to success. I grew up with a single mom on food stamps and I realize that poverty is a mindset. Read "Rich Dad Poor Dad" to begin. Take calculated risks. Dont take the safe path hat everyone else is on.

Lol so literally almost everyone on this list is, like, invest money (most of us can't because rent or insurance is too high) or get married and have two incomes. I love the people saying 'live frugally' as if most people aren't doing that by default anyway. Most people are not making enough money to be able to take away any portion of it to go toward a 401k or investing. I make good money and have a good job but my rent is high an I can't save to buy property. Rent is high but mine is actually about as low as it gets in my area. Can't move because my job is here (i drive an hour each way but that's as close as I can get). The true key to getting wealthy is to have 2 incomes coming in. One that you live off of and one that you save. Don't let people think that your somehow lacking or work less hard because you can't do it on 1 income.

I notice that "Be born into poverty with little options" isn't on here much. It's very easy to invest when you have the means to do so. But, these days, the "just work hard and you'll make it!" isn't a viable means to wealth. Opportunities of the past aren't available to a lot of people now and money isn't getting to as far as it did. Stagnation is killing a lot of people's chances to live the American dream.

What's even worse is that other countries (Aus for example) are following the lead of the U.S (has a lot to do with Murdochs influence) in going out of their way to create the same issues the U.S has. Bafflingly, very few people seem to care about this. We have a federal election today, where both options aren't great (much like the U.S). Even the slightly less-s**t party doesnt plan on addressing the many glaring issues with social policies. Im very much hoping that they will have to negotiate with some independents to form government - but that's not looking likely.

Load More Replies...Given a few more years of high inflation, and about half of us will be millionaires, and yet not be rich.

I want to point out that "millionaire" doesn't mean "cash assets" ----- it's property, in many cases. There are also a lot of cute scams re: leases and gov't subsidies that people manipulate. But you can have $1M in assets .... and be in debt for more. Ask Donald Trump.

This is why "net worth" is more valuable information. Net worth = assets - liabilities.

Load More Replies...I notice that "Be born into poverty with little options" isn't on here much. It's very easy to invest when you have the means to do so. But, these days, the "just work hard and you'll make it!" isn't a viable means to wealth. Opportunities of the past aren't available to a lot of people now and money isn't getting to as far as it did. Stagnation is killing a lot of people's chances to live the American dream.

What's even worse is that other countries (Aus for example) are following the lead of the U.S (has a lot to do with Murdochs influence) in going out of their way to create the same issues the U.S has. Bafflingly, very few people seem to care about this. We have a federal election today, where both options aren't great (much like the U.S). Even the slightly less-s**t party doesnt plan on addressing the many glaring issues with social policies. Im very much hoping that they will have to negotiate with some independents to form government - but that's not looking likely.

Load More Replies...Given a few more years of high inflation, and about half of us will be millionaires, and yet not be rich.

I want to point out that "millionaire" doesn't mean "cash assets" ----- it's property, in many cases. There are also a lot of cute scams re: leases and gov't subsidies that people manipulate. But you can have $1M in assets .... and be in debt for more. Ask Donald Trump.

This is why "net worth" is more valuable information. Net worth = assets - liabilities.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime