Millennial Homeowners Are Sharing How Hard It Actually Was To Afford a House, And Their Posts Are A Good Reality Check

Interview With AuthorIt's no secret that millennials have a particularly challenging relationship with the housing market. And in that sense, not being able to afford one, they don’t really even have one. When baby boomers and Gen X hit their 30s, rapid construction and suburbanization were proliferating relatively affordable housing options. For them, part of the American Dream was buying a house.

Today, it’s estimated that millennials have 35% less wealth than previous generations and a whopping 70% say they can’t simply afford a house. Our prospect is frustrating, to say the least--always renting is the only option.

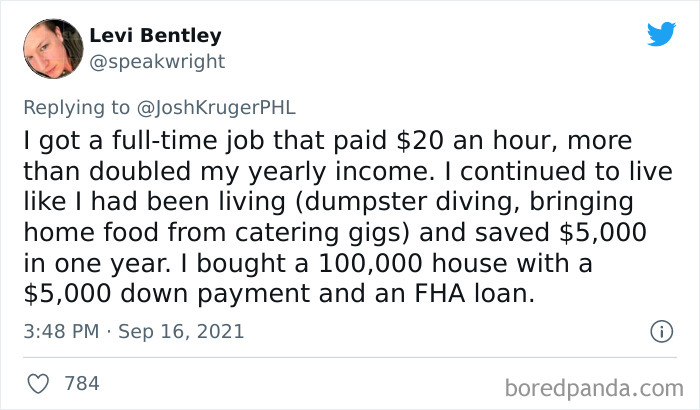

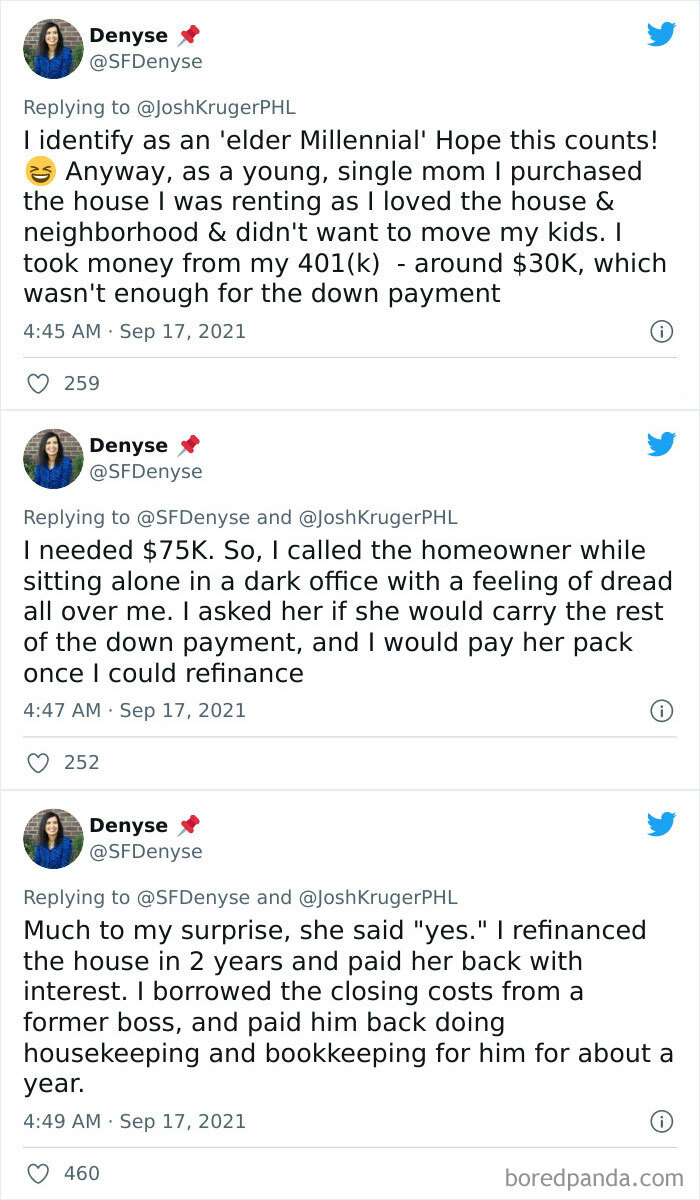

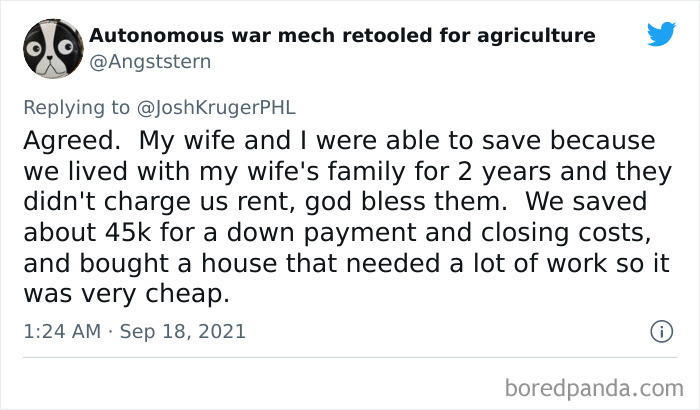

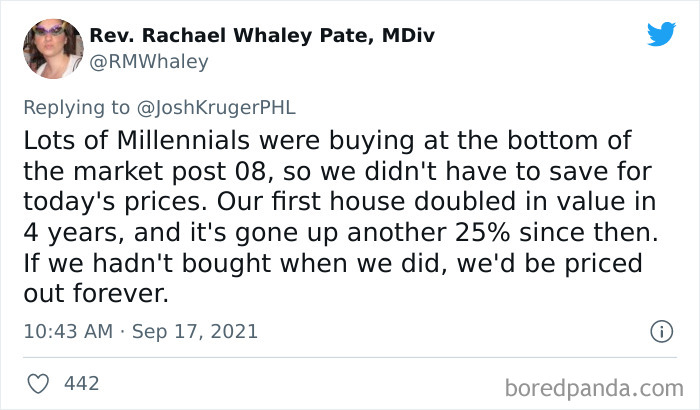

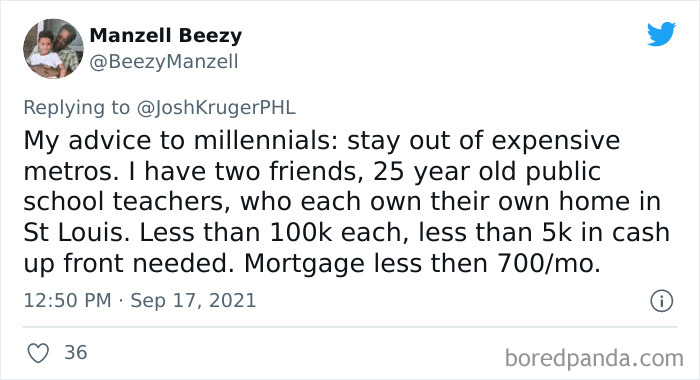

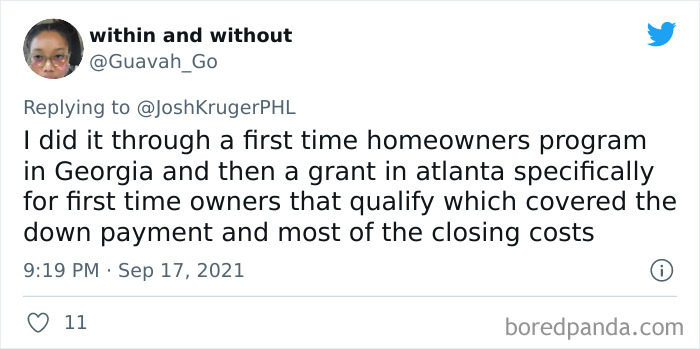

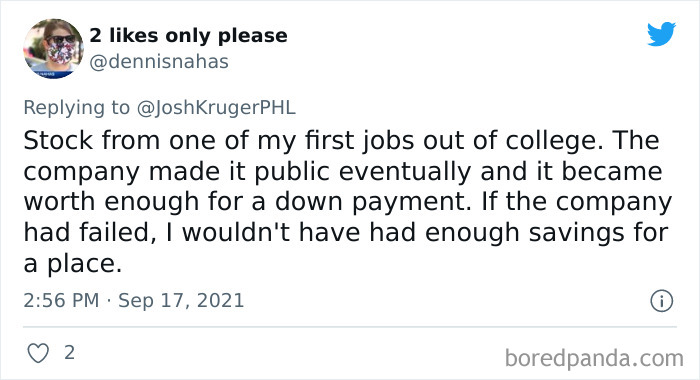

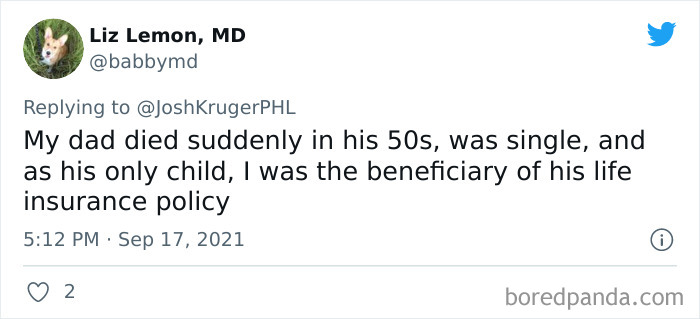

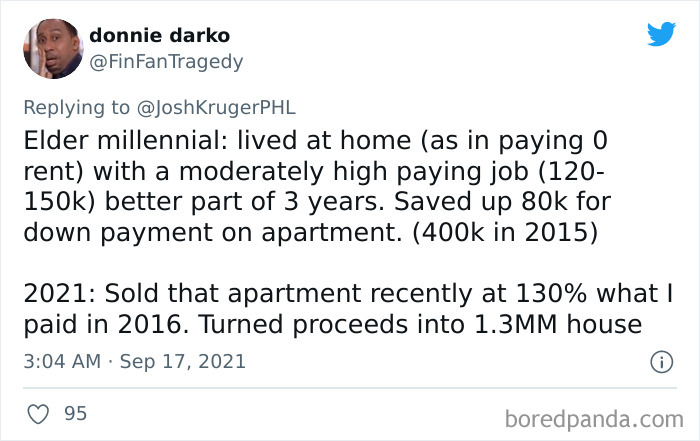

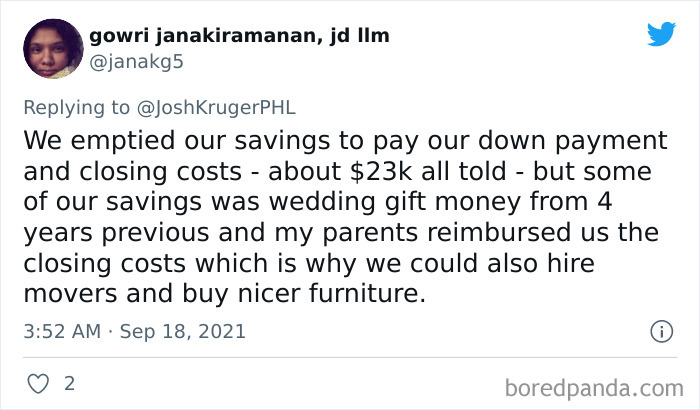

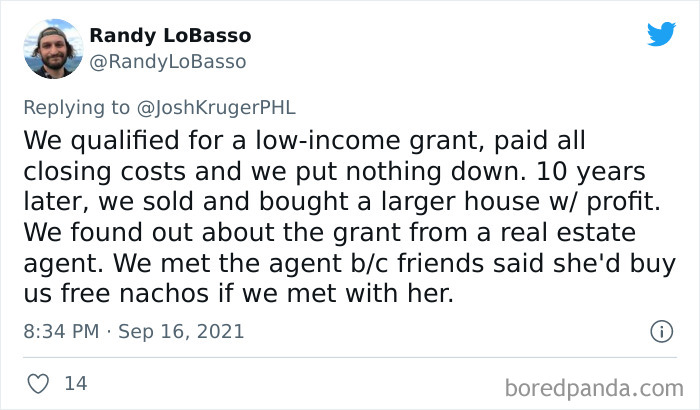

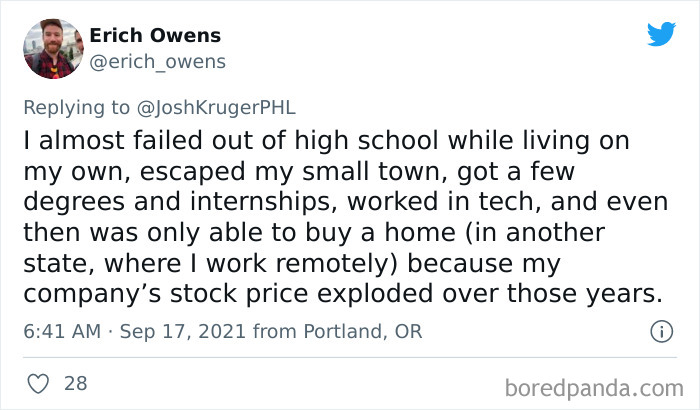

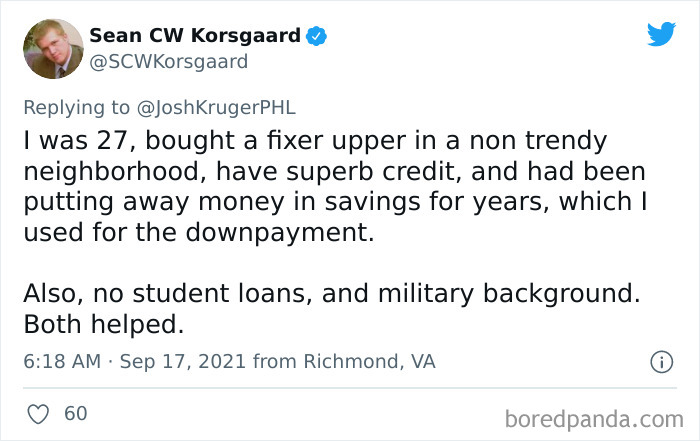

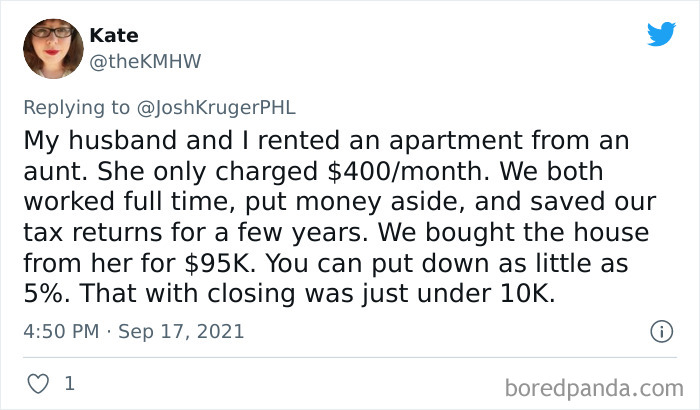

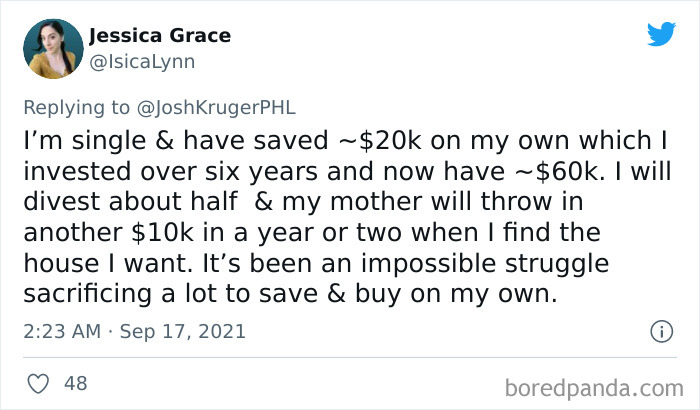

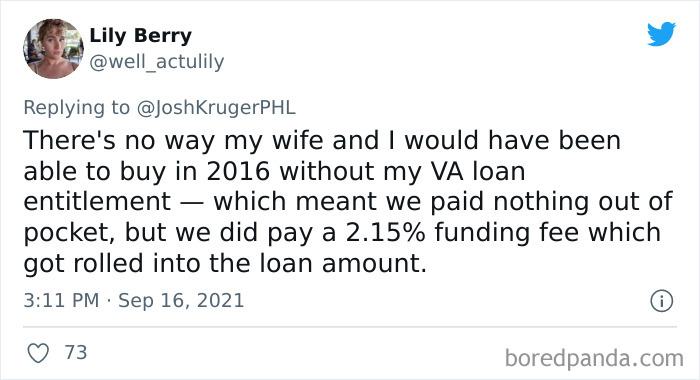

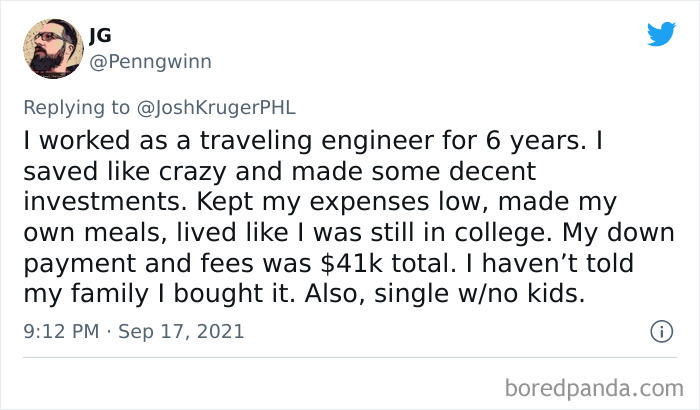

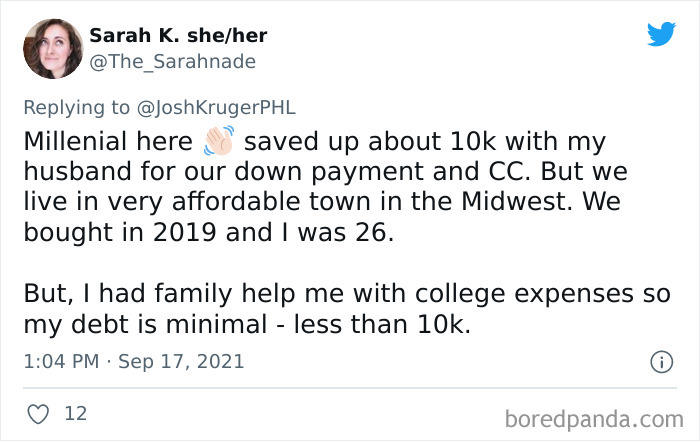

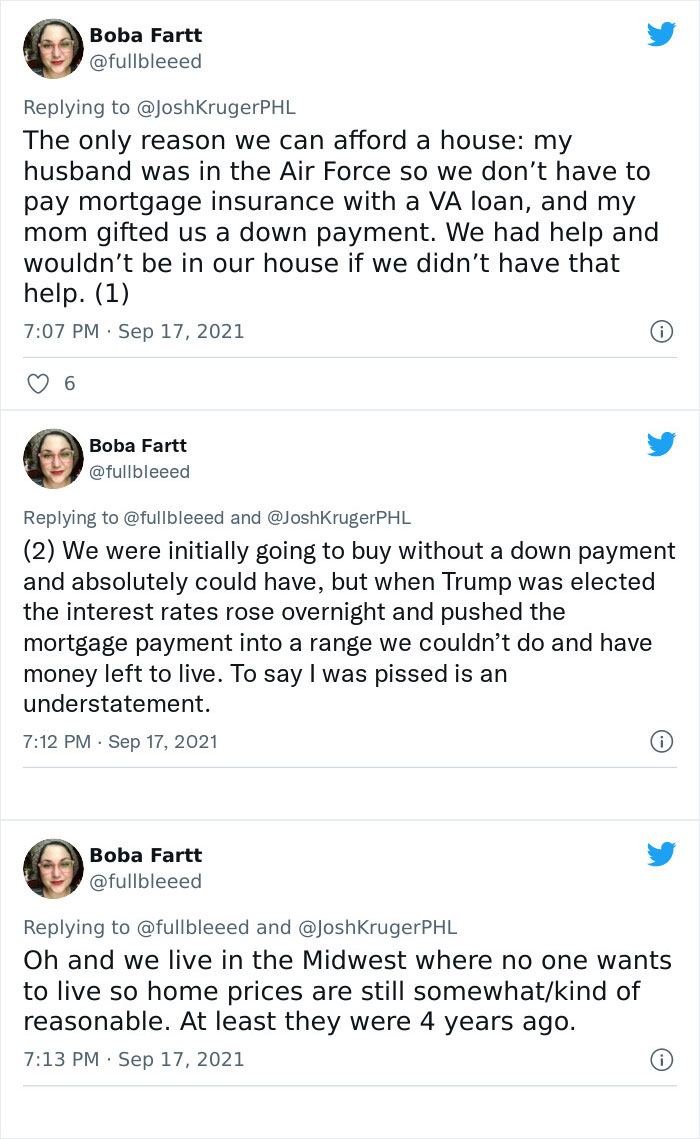

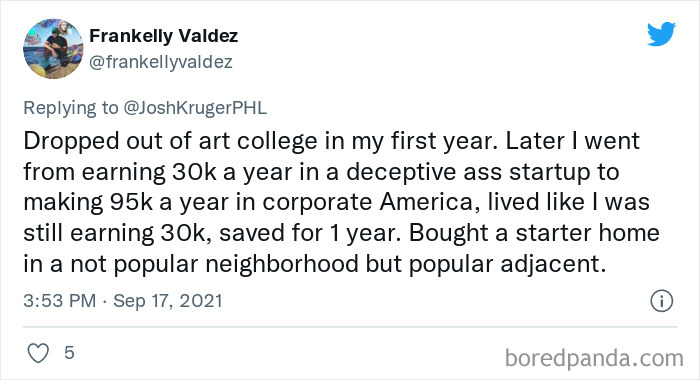

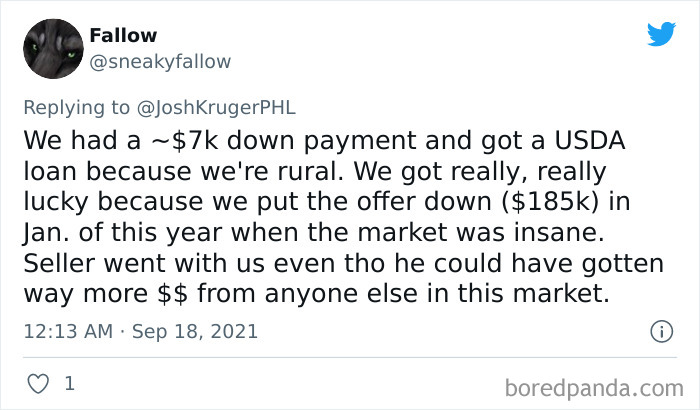

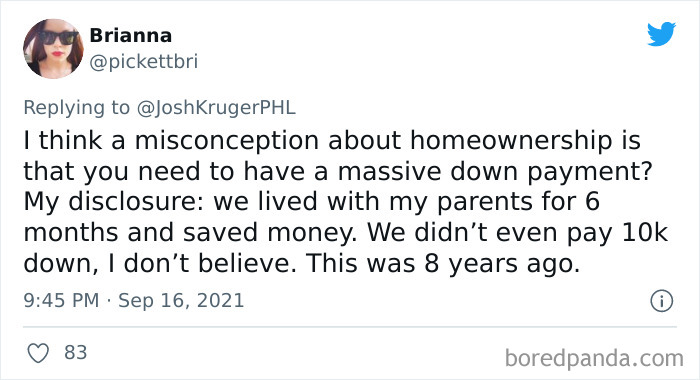

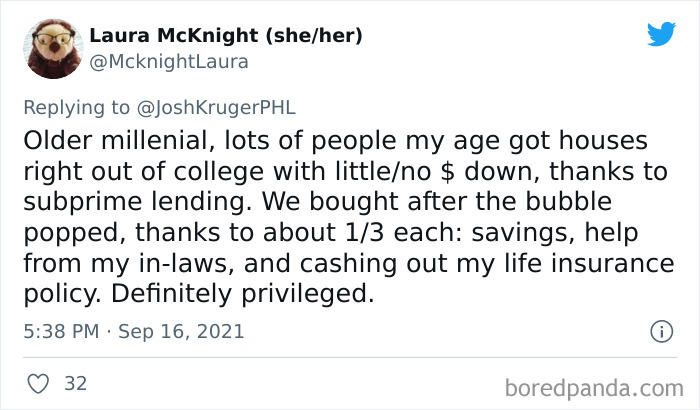

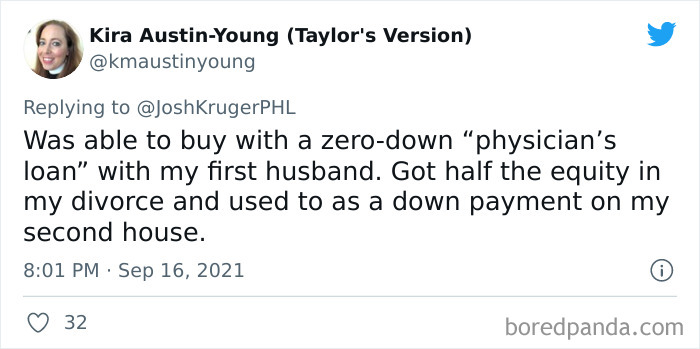

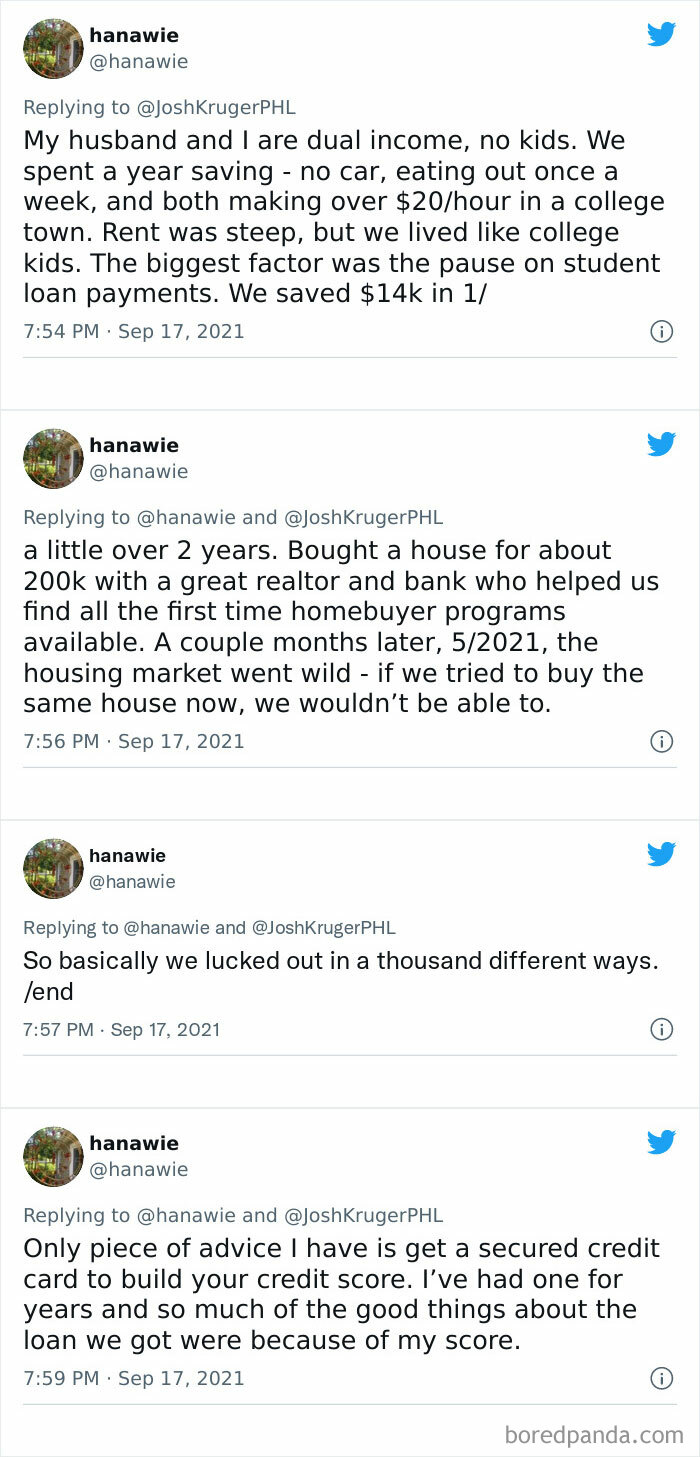

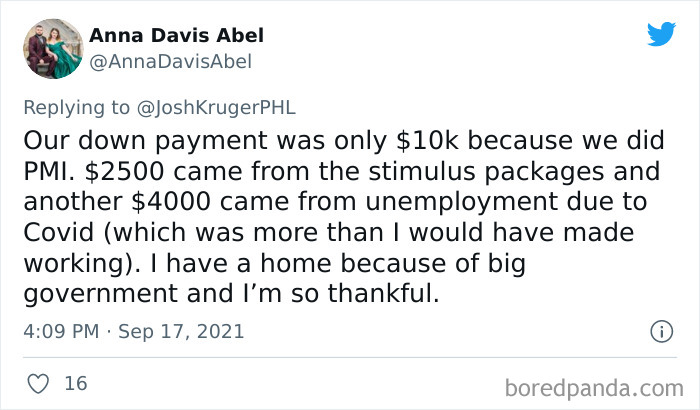

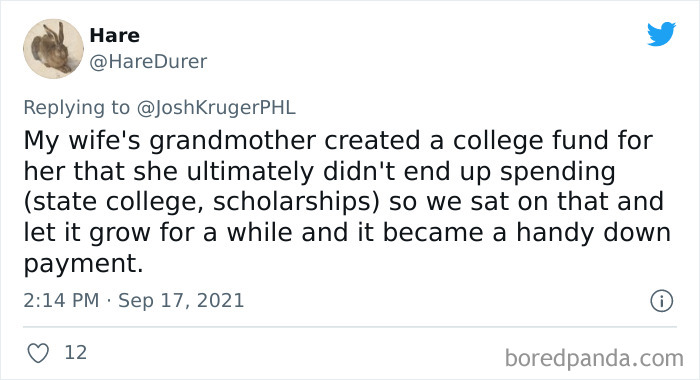

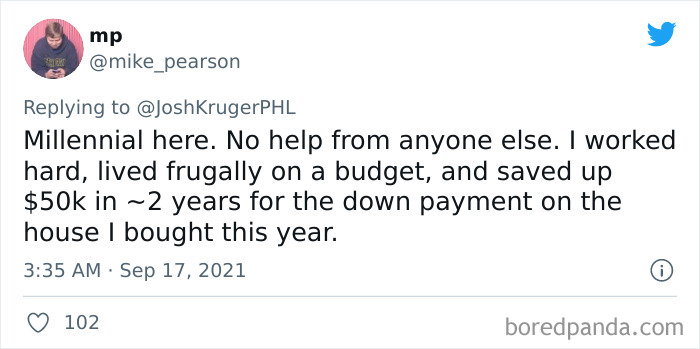

So in this uncertain economy, only very few millennials were able to afford a house. Often, thanks to very exceptional circumstances like heritage, stocks from college, and so on. Read this brutally honest thread where young people share what it took them to become rare millennial homeowners.

This post may include affiliate links.

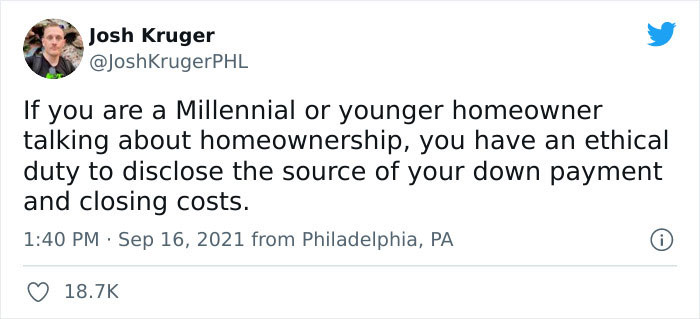

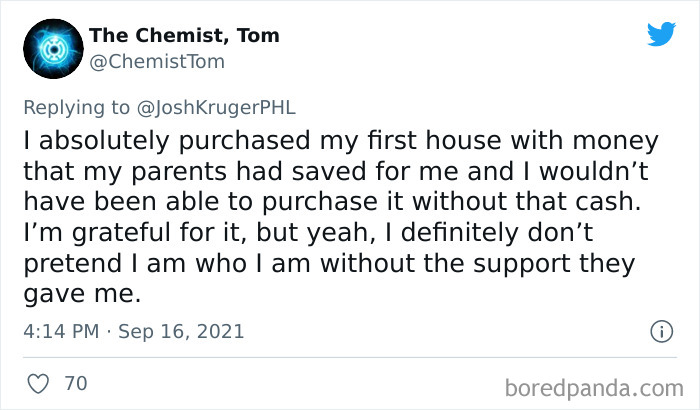

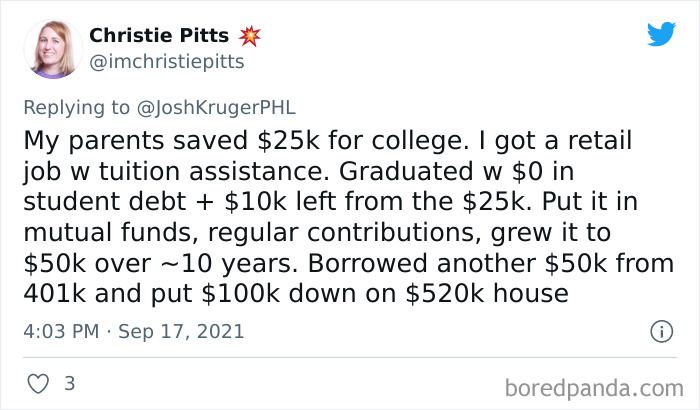

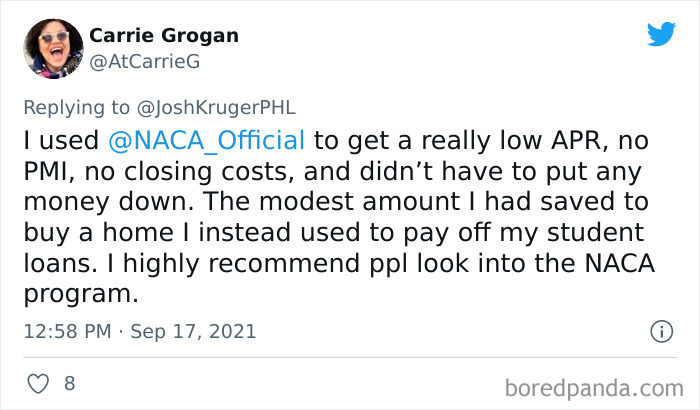

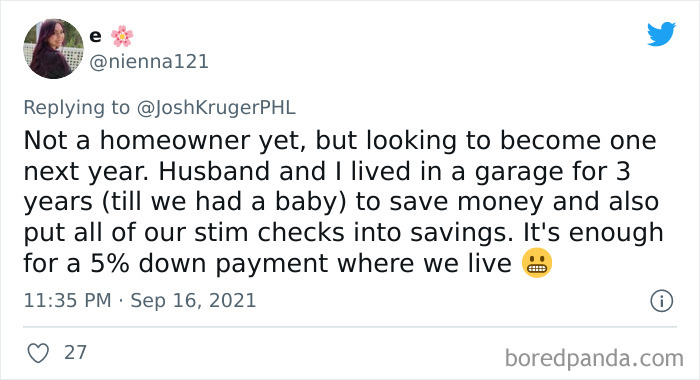

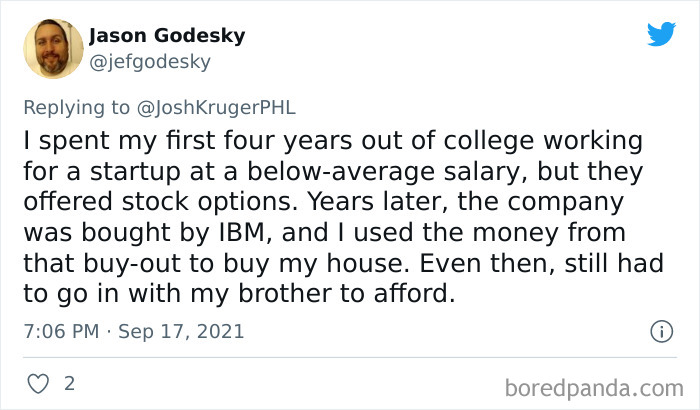

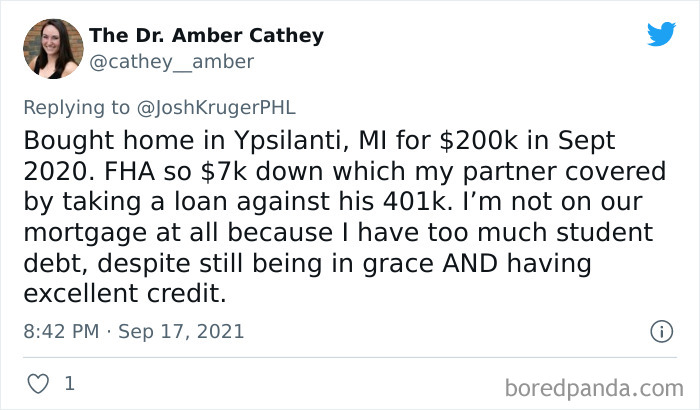

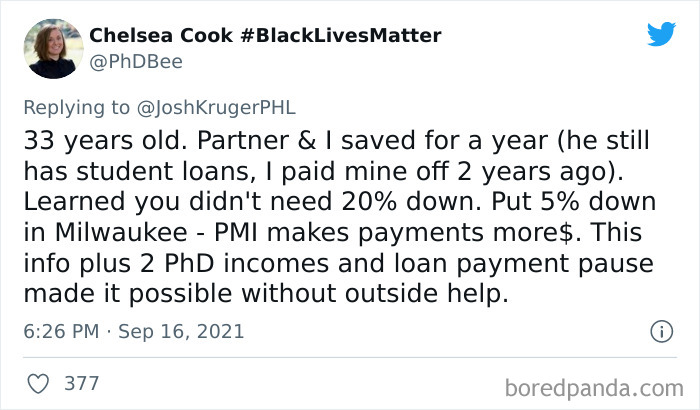

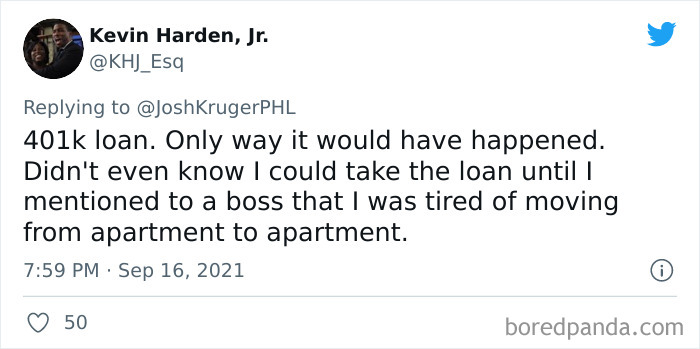

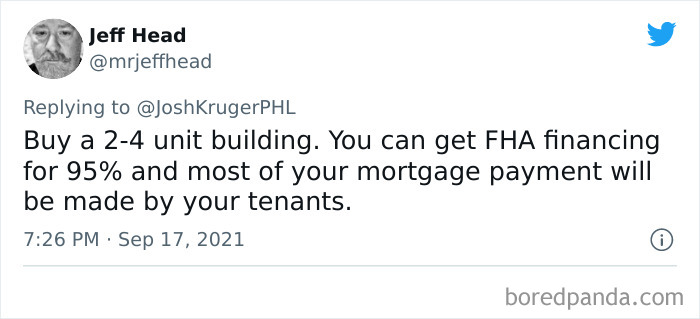

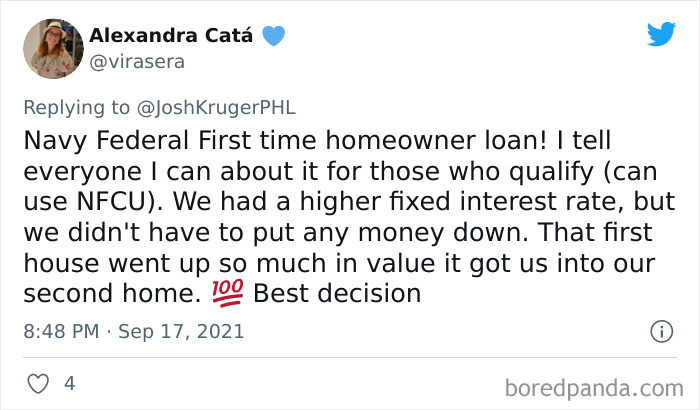

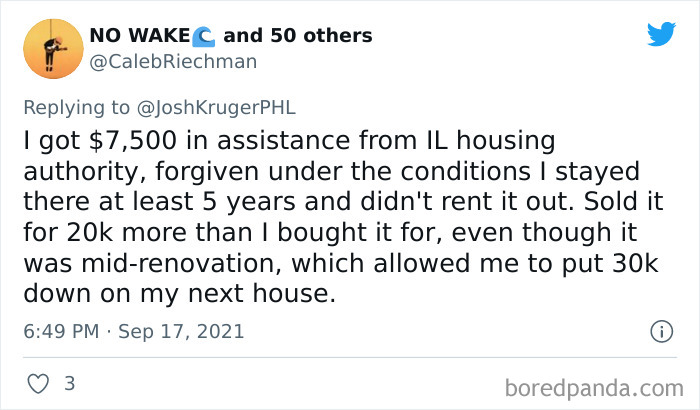

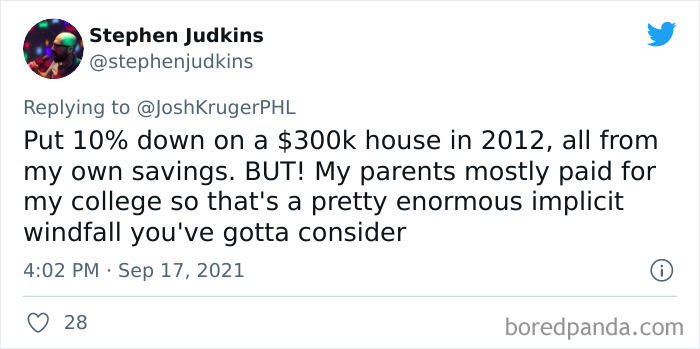

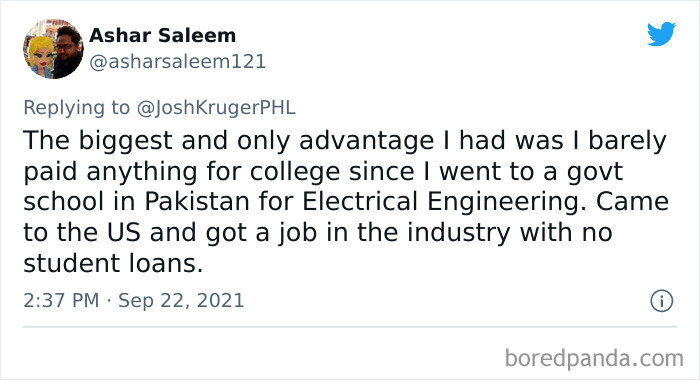

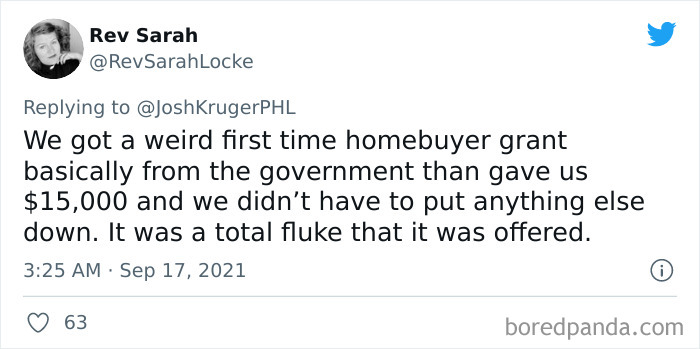

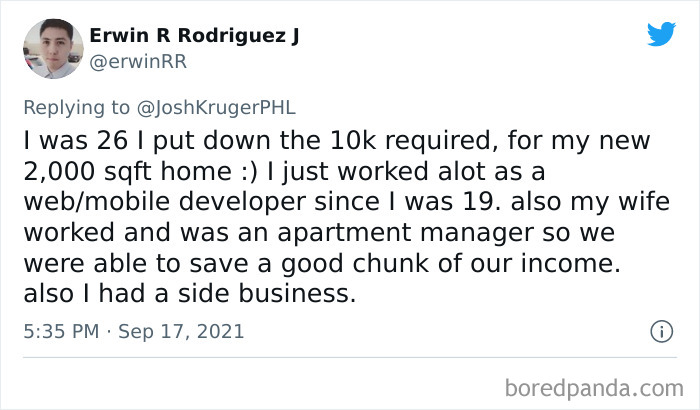

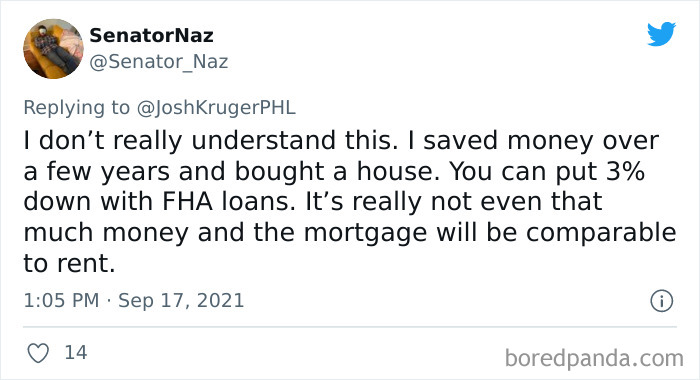

The thread started with a Twitter user named Josh Kruger, a Philadelphia-based writer and commentator. He asked homeowners to share how they were able to afford the down payment and closing costs for their homes.“If you are a Millennial or younger homeowner talking about homeownership, you have an ethical duty to disclose the source of your down payment and closing costs,” Josh tweeted on September 16.

FHA is the way to go, I did it twice and yes you have the mortgage insurance, but you can actually afford a house this way, especially with the extremely high rent prices

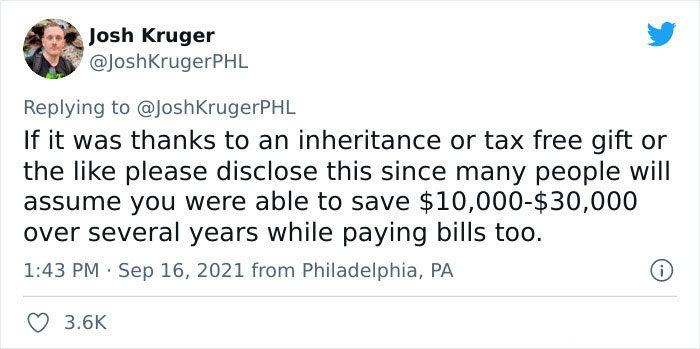

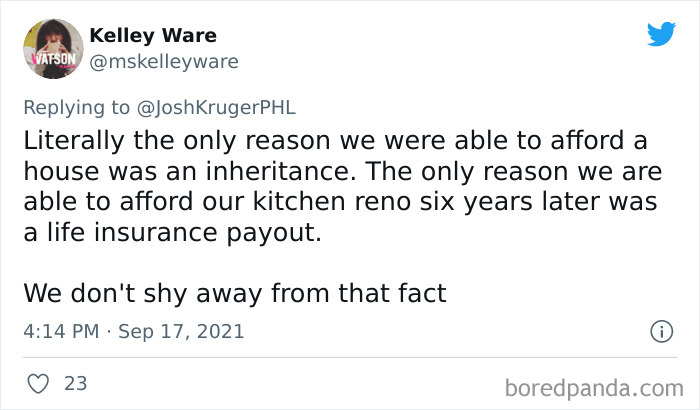

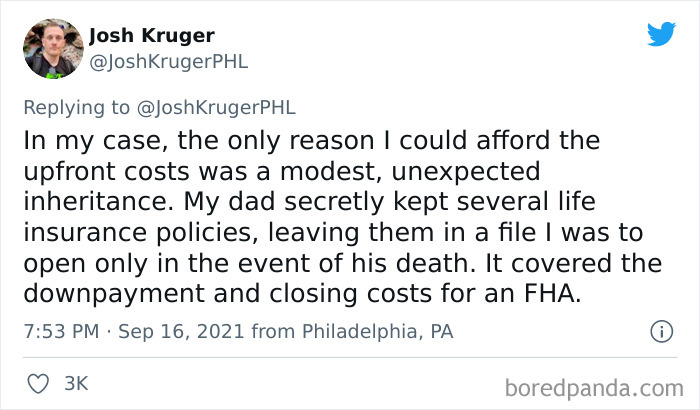

Josh added in another tweet: “If it was thanks to an inheritance or tax free gift or the like, please disclose this since many people will assume you were able to save $10,000-$30,000 over several years while paying bills too.” The author of the thread also shared that in his case, “the only reason I could afford the upfront costs was a modest, unexpected inheritance.”

He explained: “My dad secretly kept several life insurance policies, leaving them in a file I was to open only in the event of his death. It covered the downpayment and closing costs for an FHA.” Josh concluded in yet another post that “thanks to privilege, a few decisions made by my dad, and fate, I fell assbackwards into the ability to buy.” He then added that it was a “good decision but only possible due to unearned resources.”

Wait. Her down payment was supposed to be $75,000??!!?? That's more than my house cost.

This is how I got my house. got a short sale home for under 80k with a Federal home loan. probably the only reason I can live on a single income.

80k? is that for the house? Median house prices here in New Zealand have just surpassed $1 million

Load More Replies...In 2021most housing in NSW Australia is unaffordable for the average couple, even with two working. We are in WA Aust, where houses are starting to get up to the $500K, most people are finding they can't afford them. Our daughter in NSW is earning $39 an hour, she has saved over $130kand still cannot afford to get into the market as the average prices of housing in NSW are $800K

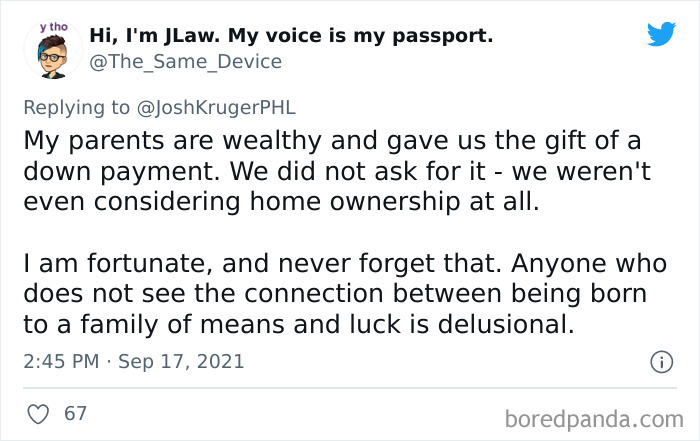

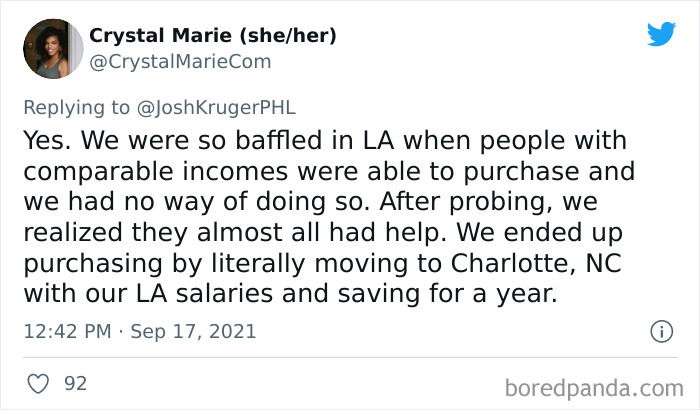

Bored Panda reached out to the author of this eye-opening Twitter thread Josh Kruger who is a Philadelphia-based writer and commentator. Josh told us he was totally unsurprised by the responses people shared in response to the thread. “My primary goal was to confirm my suspicion that, anecdotally, Id see a bunch of middle and upper-class white people and few people of color and even fewer people who saved up for their downpayment and closing costs while working,” he said.

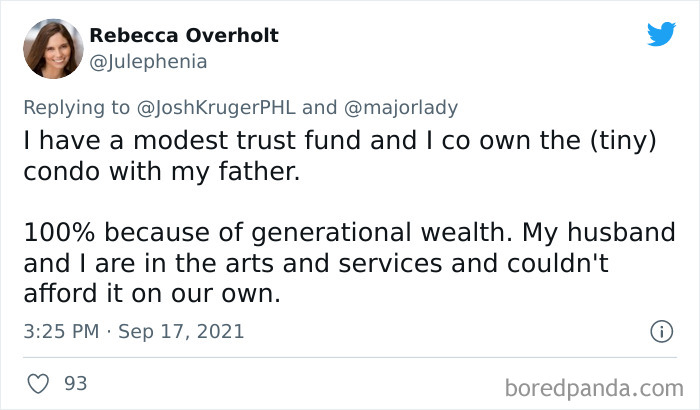

“Sure enough, the vast majority of responses were from middle and upper-class white people who got a bailout from their parents, either by way of a loan, gift, or inheritance,” Josh added.

but where would they film tik-toks? LOL! true statement though...100%

When it comes to the current housing market, making it virtually unaffordable for most of the Americans to buy a house, Josh said that he blames it on Republican policies. “Personally, I blame Republican policies hostile to public programs and supply-side economics that have been debunked as junk economics repeatedly for 40 solid years. The Department of Housing and Urban Development's budget is, adjusted for inflation, about 25% what it was in 1978. What happened? Ronald Reagan.”

My uncle was a CFO of a manufacturing company. When the company was sold, his stock benefits made him a millionaire.

This was me as well (+1 sibling) and I bought his house from the estate. I would have been able to buy a house eventually with my job, but would have taken a couple more years.

Moreover, according to Josh, “we've transferred the cost of goods and services away from the bosses and consumers and put it onto the workers by artificially depressing wages.” He believes that housing costs wouldn't matter if we had an adequate wage structure in the US.

Having said that, Josh believes there’s hope “if they vote for Democrats.” He explained: “The responses lay bare, at least anecdotally, the fact that race and class-based privilege are tools used by their beneficiaries, which backs up data about the racial wealth gap amongst other things.”

“In the US, we have a mass delusion and perversion where we hobble people at the start of life with multiple barriers then blame them for not meeting or exceeding the performance of people who start life not with barriers but multiple helpful tools. This is why the work President Biden is doing must succeed. It helps remedy this.”

The author of the thread concluded by saying that “those who think both parties are the same, I'd question why you think giving working people money is the same thing as giving them COVID.”

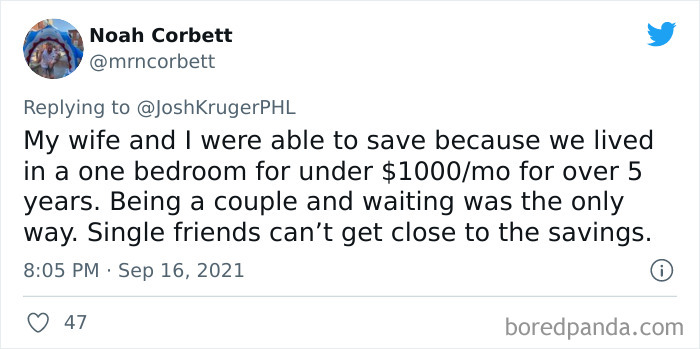

I've lived in a one bedroom apartment with rent under $750/month for over 10 years, make $40k/year, have no kids, and have no debt. I've still only managed to save $2,600. If I was doing this with a partner, we'd most likely have a house by now. Being single and trying to save is HARD.

According to an extensive study by the rental firm Apartment List, affordability remains the biggest obstacle for millennials who want to own a home. This also means that they are forced to rent much later in life than previous generations. Many believe that millennial renters prefer this housing choice because they have more flexibility and they don’t have to deal with the hassle of home maintenance and unexpected housing costs. Many also claim that due to this reason, the renting lifestyle is much more attractive to millennials and this is why they are not so eager to become homeowners. This is not true.

The same study from Apartment List found that the lifestyle benefits of renting remain dwarfed by the burden of affordability. Only 30% of millennials claim that they’re not yet ready to settle down with homeownership while a vast majority of 70% say they cannot afford to buy a house. Among those who do not plan to buy a house, 69% say they will always be renting because they have no other option. Just 40% cite the benefits of a flexible lifestyle, proving that the vast majority of millennials rent not because they want to but because they simply have to.

I'm still not sure if I qualify as Gen X or Millennial - born 1980. But if I *am* a Millennial, I was gifted £2,000 by my parents at 21. I bought a flat for £28,000. My home ownership is entirely down to timing, because in 2001 £28,000 for a one bed flat was a piece of cake (mortgage was 2x my salary). Probably the other key factor is that at 21 I had already been in full employment for three years instead of going to university - no student debt. But, if it makes people feel better, I'll be Gen X and smug. Label me however you see fit.

In the Netherlands most people would have no problem buying a house. Only problem is that there are no houses, so prices are sky rocketing. They are exceeded the real value of the houses by 50k and up. Saddest part is that any house building project is immediately sold out to investors, so even before the houses are build they aren't available any more for people needing a house. And as fugitives/refugees and immigrants still get priority in housing over Dutch civilians who are waiting 10 years to rent a house, I'm afraid it won't be long before racism will rise and the Dutch tolerance will be replaced with xenophobia.

In Seattle, houses are selling for up to $250,000 over asking price/value. Or more.

Load More Replies...In the U$A, health privilege is almost as big of a luck factor as wealth privilege. If you were born with a genetic condition or defect, developed any serious condition or had a debilitating injury at any time, then that lowers your wealth ceiling significantly. An ambulance call, a lifetime medication or a cancer treatment can end up costing more than a college degree over time.

It is really easy: move to Germany and enjoy having no student loans, 1-2% mortgage taxes/year, fair loans, not paying with your own kidney if you use health services 😊

Hey US Millennials.... if you like to work with your hands and can do your own carpentry & plumbing, look into buying an FHA or VA repo on your next house purchase. If you know how to bid, you can get a house for 10-20% below the market for a similar property. All are sold "as-is". All will need some work, which is fine if you can do this for yourself. The advantage goes away if you have to contract out all the work to skilled contractors. The last time I looked into it, the VA had a sweat-equity program where they would escrow some of the money pending your completion of repairs. This amounts to the government paying you to fix your own house. The VA also offers good deals on raw land if you want to buy repo'd land and build a house from scratch on the property. You do not have to be a veteran to buy any VA repos. You will have to find a broker that works with these agencies, not all of them do...

Two things to add to this: 1) Buying a fixer-upper as a first home is generally great advice, especially if you're moving in with a spouse so you can share duties and also enjoy building something together. Just make sure to get a good grasp on what are achievable repairs. Youtube will carry you far! 2) Lifehack: If you want hands-on experience with home repair at zero risk and costing only time, volunteer with your local Habitat for Humanity. No need to commit to long term, you can basically just call them and ask when and where they will need a hand in the next few days, then show up to a job site and get a little basic training and supervision on either a new build or restoration, and the jobs are totally random based on what needs to be done. Oh and you help needy people get a leg up in life, so that's nice, too.

Load More Replies...I'm a unicorn, I bought a down town house in a beautiful town just a few minute walk to two of my jobs. I bought it 3~ years ago when I was 20-22 for 190k. I am single and paid for it myself, because of my frugality. I lived with my parents didn't pay for rent, food, laundry or transportation. My biggest expense in the year was Christmas which I tried to keep under 100. As a result I saved up 17k over two years. I have friends who will never own a home, the spend their money traveling and doing things and I am jealous and sad that we live in a world where we can't have both.

Started working earlier (12) and lived at home longer (late 20s) than my peers, and got a practical STEM degree. Got a credit card as soon as I turned 18 and never used it if I didn't already have the money to pay it off (simple rule to a high credit score). Generous grades-based scholarship paid by state lottery (aka voluntary tax) + mom with 2-3 jobs pre-paying for college meant I graduated with no debt. Overall very frugal living (ramen and instant meals into late 20s). Always bought 15-20 year old cars (best advice I can offer anyone) and second hand everything, plus learned some basic DIY to avoid ever having to go to repair shops. Ended up getting a great deal on a foreclosure for my first home at 27. I have a decent paying job and some great bonuses over the years, but can't imagine what my life would look like if I had to pay for college, or if I was kicked out of the house at 18 like some people.

One thing people often don't even point out is that my parent's generation, most middle class people had wives stay at home. Not all, but the majority of couples trying to save for a house now have both spouses working and and yet the relative cost of a house has gone up so much that it is far more difficult. My Dad was lower middle class. My Mom didn't work after they got married. They bought their house in their late 20s, maybe 2-4 years after they got married.

Gen X, it is hard to be able to afford a house for us too, being broke, especially when young and starting out, is not a millennials only affliction.

I live in Kansas, so the cost of living is cheap. My husband and I bought our 4br/3 car garage home for just over $100k in 2009. Decent neighborhood. We have excellent credit, but at the time, no savings. Got a mortgage loan through our credit union, no down payment. Our mortgage is $620 a month. All of these people living in trendy places with high cost of living, I can see why it’s nearly impossible to own a home!

I have been saving up since I graduated from high school, and it took me 10 f*cking years to be able to even start thinking about buying a flat (all this with working all throughout my university years, earning multiple scholarships, and landing a great IT job after finishing my Masters). Finally, at the age of 28, I took the money and bought a 30 square meter apartment. Oh no, wait, cause my father took a loan (because I wouldn't be granted one...), and we agreed that I would pay him back little by little. I live in Romania, and I'm still considered lucky, because only those are able to afford their own places who inherit a grand fortune or have extremely rich parents.

I bought a house, I'm 27, on a single income 3 1/2 years ago. I had zero problems and zero help from relatives or inheritance. I got a double lot for 140k with an unfinished apartment/mother in law suite and a 3 section shed. It's not hard, you just have to stop looking for the newest or "best". My house was built in the 90's. 2 bedroom, 2 bath with a lot of land and room to grow. Stop looking for perfect and make your own perfect..

My boyfriend bought a house at a really good price when he was 25, about 8 years ago. We sold the house this year for LITERALLY double what he paid for it. The equity went directly to the down payment for our new house. Also, his mom is in real estate so we saved on agent fees, she was able to get a lower interest rate for us, and she gave us a cash gift from selling one of her rental properties. No way in hell we could have afforded this house on our own.

Start small. Bought $130k condo with 5% down at 25. Sold and made $30k. Used that as a down payment on a townhouse. Sold in 2021 at height of the market, made $160k and bought (unfortunately still at the height of the market) my dream home. Start small in your twenties and build up from there. Dont expect to buy your dream house right away. Dont live in the expensive trendy neighborhood outside of your means out of college. Live more affordably and save money early.

Last of the millennials, me and my hubby ('95 and '96) both have well paid jobs, I have £40,000 from an inheritance, my parents have offered to lend us 100,000 from an inheritance they recently recieved and we currently don't pay rent (for various reasons) and we still cannot borrow enough money to afford a house in the city we live and work.... If we'd been able to buy last year even, it would be a completely different story. The UK house prices have tripled in the last couple of years. £140,000 deposit available and still can't afford a house with the mortgage we can borrow. The only way we can get a house now is to just wait for someone we love to die and move into theirs....

I'm an old Millenial. We bought our house at 22 years old. No down payment, we benefited from a first time home buyer rule at the time, where we didn't need a down payment and our closing costs were added into our home loan. We bought a house for 80K. We haven't renovated it, which we NEED to, because I was a SAHM, so 3 on 1 income was hard. Now that kids are old enough to take care of themselves, I'm making $15 an hour and saving for a kitchen

Worked my tail off and always lived under my salary. Hardly any fancy vacays on my own, not much eating out and if so eating the cheapest thing on the menu. Bought a condo, parents did give me 10k for closing costs. Rented it out and moved into a small 1 bedroom outside of the city. Got married to someone in finance. We live the same under salary life style, sold the condo, and was able to buy a nice house close to the city.

$120-150k is only moderately high income? For a millennial? I have a masters degree in a lucrative technical field and I didn’t expect to retire with that kind of salary; that person’s income is pretty good for someone still so young.

Hubby and I saved for 5 years, last 2 years living at my parents house int he basement and they charged us rent $800 a month and harassed us for extra constantly. We managed to save $65000, husbands dad stepped up and gave us $50,000 when he found out we were moving out of my parents house and just going to rent a big place and give up on owning (my parents were horrid landlords we couldn't take it anymore)

My grandma died. The proceeds from her house was split three ways between my dad and my uncles. My dad (still living) then split the money he received two ways between me and my sister. He gifted it to us - in the UK if you gift someone more than your £3k gift allowance, if you stay alive more than 7 years after the gift, your giftee doesn't have to pay tax on the gift.

In my town, house flippers are coming in, paying cash for old houses, and selling the homes with a huge markup to Bay Area commuters.

Back in the early 90's, as newlyweds, my husband and i made a deal with his parents to buy one of his family's homes. We agreed to pay rent with a percentage going into an escrow account to fund a down payment for the house and the parents would assist with financing. Sounded like a good plan at first. One day his parents wanted to buy a boat, a fancy sport cruiser, so, they wanted us to start the mortgage process before the "Spring Season". LSS, my husband had bad credit, less than 2 years at his job and I didn't have enough income to qualify for a mortgage alone. So, they kicked us out on the street, we had a weekend to find a new place and move out before the next weekend when showings were to begin to sell the house. Needless to say, I never had anything further to say to them and now own my own home, free and clear, almost 1,000 miles away from them all. (My husband's siblings both live in the other family homes which were gifted to them for a token sum and no mortgage).

Where I am house prices have risen, but interest rates have dropped. Using an inflation calculator and what I paid years ago means supposedly you could get about an equal house for an equal payment today. Not to say it's easy now, just it definitely wasn't easy then. We got no money from anyone, all had to be saved over years.

I was on my way to home ownership at 32. I budgeted like crazy and moved in with family for 2 years to save for the downpayment. One month away from my target to start shopping we went into lockdown for COVID. Now housing prices are so ridiculously high it will be years more saving before I have my own place

My fiance and I each took out a help-to-buy ISA a couple of years ago, which has an upper limit on how much you can put into it each month, and will pay out 25% of whatever is in it up to £12000 when we apply for a mortgage. We calculated this would be a 3 1/2 year time limit on being able to save to get the maximum return from the ISA (£30,000 total between us, with each of us saving £12000 into the ISA and getting £3000 from the government on top) to apply for a mortgage, and in that time we received an early inheritance which I have not had to dip into my share of and I am building up each month with the same amount I am paying into the ISA to give us as much as possible to cover our deposit, plus £5000-£10000 to cover any legal fees. Being first time buyers there's a possibility that we could get a smaller percentage deposit as well which would mean we could afford a higher mortgage. It has taken until my early 30s to reach a position where this feels like it could be a reality.

I was lucky, bought my first flat right before the market went sky high around 2003, sold it about 18 months later for double what we paid, which paid off all our debt from uni. I then got divorced and my parents let me stay in a flat they owned just covering my expenses and then eventually moved into a 4 bedroom house in a small town in Ayrshire with my now husband and our 4 kids for an incredible low price - my brother is just in process of buying a new built home, about a third the size of our home, much smaller garden but it's 3 times what we paid. But we were lucky and circumstances worked in our favour - no way we could afford this size of house back in Glasgow

Perhaps this younger generation should spend less on miscellaneous toys, gaming devices, and electronics and more saving. Older generations have more wealth because at younger ages they didn't waste money on take-out and frivolous items.

I'm a late GenX but much of this resonates with me. It's interesting to compare to what my parents had at a similar age. By 35 (for example) they were married with a child and owned a condo (later a house). Both had High School educations and were able to own a home and support a family with one income. I had an advanced degree and a decent paying job but could only afford a smaller condo thanks to a legal settlement and help from my parents (or I'd still be living at home)

All of these posters are white. I am happy for their good fortune, but these stories all made want to barf. Seems I'll ever own my home, let alone sell one for profit.

What is the point of this? It's not "easy" for most people to save money and purchase a home. That's not a recent development. Yet people have been doing for many generations

I think the point is that Millennials have been called lazy and some older generations have heavily implied that they waste their money...of course that's nothing new either, every generation since the beginning of time has people from the previous generation calling them lazy or wild or entitled. It's the circle of life I suppose...

Load More Replies...Priced out of my home town and where I work. Was gifted £60,000, just enough for a deposit for a 1 bedroom house within a commutable distance from work. Prior to 2001, it was easy but when the Labour government opened the flood gates to Eastern Europe, the population exploded. Demand for housing outweighed the supply and it got worse and worse.

It was Edward Heath, leader of the Conservative Party, who joined the EU in 1972. And it was John Major, leader of the Conservative Party, who signed the Treaty of Maastricht in 1992. And it was also John Major, Conservative, who in 1997 negotiated on behalf of the UK to sign the Treaty of Amsterdam, although it was Tony Blair who was Prime Minister when it was actually signed shortly after he was elected.

Load More Replies...I'm still not sure if I qualify as Gen X or Millennial - born 1980. But if I *am* a Millennial, I was gifted £2,000 by my parents at 21. I bought a flat for £28,000. My home ownership is entirely down to timing, because in 2001 £28,000 for a one bed flat was a piece of cake (mortgage was 2x my salary). Probably the other key factor is that at 21 I had already been in full employment for three years instead of going to university - no student debt. But, if it makes people feel better, I'll be Gen X and smug. Label me however you see fit.

In the Netherlands most people would have no problem buying a house. Only problem is that there are no houses, so prices are sky rocketing. They are exceeded the real value of the houses by 50k and up. Saddest part is that any house building project is immediately sold out to investors, so even before the houses are build they aren't available any more for people needing a house. And as fugitives/refugees and immigrants still get priority in housing over Dutch civilians who are waiting 10 years to rent a house, I'm afraid it won't be long before racism will rise and the Dutch tolerance will be replaced with xenophobia.

In Seattle, houses are selling for up to $250,000 over asking price/value. Or more.

Load More Replies...In the U$A, health privilege is almost as big of a luck factor as wealth privilege. If you were born with a genetic condition or defect, developed any serious condition or had a debilitating injury at any time, then that lowers your wealth ceiling significantly. An ambulance call, a lifetime medication or a cancer treatment can end up costing more than a college degree over time.

It is really easy: move to Germany and enjoy having no student loans, 1-2% mortgage taxes/year, fair loans, not paying with your own kidney if you use health services 😊

Hey US Millennials.... if you like to work with your hands and can do your own carpentry & plumbing, look into buying an FHA or VA repo on your next house purchase. If you know how to bid, you can get a house for 10-20% below the market for a similar property. All are sold "as-is". All will need some work, which is fine if you can do this for yourself. The advantage goes away if you have to contract out all the work to skilled contractors. The last time I looked into it, the VA had a sweat-equity program where they would escrow some of the money pending your completion of repairs. This amounts to the government paying you to fix your own house. The VA also offers good deals on raw land if you want to buy repo'd land and build a house from scratch on the property. You do not have to be a veteran to buy any VA repos. You will have to find a broker that works with these agencies, not all of them do...

Two things to add to this: 1) Buying a fixer-upper as a first home is generally great advice, especially if you're moving in with a spouse so you can share duties and also enjoy building something together. Just make sure to get a good grasp on what are achievable repairs. Youtube will carry you far! 2) Lifehack: If you want hands-on experience with home repair at zero risk and costing only time, volunteer with your local Habitat for Humanity. No need to commit to long term, you can basically just call them and ask when and where they will need a hand in the next few days, then show up to a job site and get a little basic training and supervision on either a new build or restoration, and the jobs are totally random based on what needs to be done. Oh and you help needy people get a leg up in life, so that's nice, too.

Load More Replies...I'm a unicorn, I bought a down town house in a beautiful town just a few minute walk to two of my jobs. I bought it 3~ years ago when I was 20-22 for 190k. I am single and paid for it myself, because of my frugality. I lived with my parents didn't pay for rent, food, laundry or transportation. My biggest expense in the year was Christmas which I tried to keep under 100. As a result I saved up 17k over two years. I have friends who will never own a home, the spend their money traveling and doing things and I am jealous and sad that we live in a world where we can't have both.

Started working earlier (12) and lived at home longer (late 20s) than my peers, and got a practical STEM degree. Got a credit card as soon as I turned 18 and never used it if I didn't already have the money to pay it off (simple rule to a high credit score). Generous grades-based scholarship paid by state lottery (aka voluntary tax) + mom with 2-3 jobs pre-paying for college meant I graduated with no debt. Overall very frugal living (ramen and instant meals into late 20s). Always bought 15-20 year old cars (best advice I can offer anyone) and second hand everything, plus learned some basic DIY to avoid ever having to go to repair shops. Ended up getting a great deal on a foreclosure for my first home at 27. I have a decent paying job and some great bonuses over the years, but can't imagine what my life would look like if I had to pay for college, or if I was kicked out of the house at 18 like some people.

One thing people often don't even point out is that my parent's generation, most middle class people had wives stay at home. Not all, but the majority of couples trying to save for a house now have both spouses working and and yet the relative cost of a house has gone up so much that it is far more difficult. My Dad was lower middle class. My Mom didn't work after they got married. They bought their house in their late 20s, maybe 2-4 years after they got married.

Gen X, it is hard to be able to afford a house for us too, being broke, especially when young and starting out, is not a millennials only affliction.

I live in Kansas, so the cost of living is cheap. My husband and I bought our 4br/3 car garage home for just over $100k in 2009. Decent neighborhood. We have excellent credit, but at the time, no savings. Got a mortgage loan through our credit union, no down payment. Our mortgage is $620 a month. All of these people living in trendy places with high cost of living, I can see why it’s nearly impossible to own a home!

I have been saving up since I graduated from high school, and it took me 10 f*cking years to be able to even start thinking about buying a flat (all this with working all throughout my university years, earning multiple scholarships, and landing a great IT job after finishing my Masters). Finally, at the age of 28, I took the money and bought a 30 square meter apartment. Oh no, wait, cause my father took a loan (because I wouldn't be granted one...), and we agreed that I would pay him back little by little. I live in Romania, and I'm still considered lucky, because only those are able to afford their own places who inherit a grand fortune or have extremely rich parents.

I bought a house, I'm 27, on a single income 3 1/2 years ago. I had zero problems and zero help from relatives or inheritance. I got a double lot for 140k with an unfinished apartment/mother in law suite and a 3 section shed. It's not hard, you just have to stop looking for the newest or "best". My house was built in the 90's. 2 bedroom, 2 bath with a lot of land and room to grow. Stop looking for perfect and make your own perfect..

My boyfriend bought a house at a really good price when he was 25, about 8 years ago. We sold the house this year for LITERALLY double what he paid for it. The equity went directly to the down payment for our new house. Also, his mom is in real estate so we saved on agent fees, she was able to get a lower interest rate for us, and she gave us a cash gift from selling one of her rental properties. No way in hell we could have afforded this house on our own.

Start small. Bought $130k condo with 5% down at 25. Sold and made $30k. Used that as a down payment on a townhouse. Sold in 2021 at height of the market, made $160k and bought (unfortunately still at the height of the market) my dream home. Start small in your twenties and build up from there. Dont expect to buy your dream house right away. Dont live in the expensive trendy neighborhood outside of your means out of college. Live more affordably and save money early.

Last of the millennials, me and my hubby ('95 and '96) both have well paid jobs, I have £40,000 from an inheritance, my parents have offered to lend us 100,000 from an inheritance they recently recieved and we currently don't pay rent (for various reasons) and we still cannot borrow enough money to afford a house in the city we live and work.... If we'd been able to buy last year even, it would be a completely different story. The UK house prices have tripled in the last couple of years. £140,000 deposit available and still can't afford a house with the mortgage we can borrow. The only way we can get a house now is to just wait for someone we love to die and move into theirs....

I'm an old Millenial. We bought our house at 22 years old. No down payment, we benefited from a first time home buyer rule at the time, where we didn't need a down payment and our closing costs were added into our home loan. We bought a house for 80K. We haven't renovated it, which we NEED to, because I was a SAHM, so 3 on 1 income was hard. Now that kids are old enough to take care of themselves, I'm making $15 an hour and saving for a kitchen

Worked my tail off and always lived under my salary. Hardly any fancy vacays on my own, not much eating out and if so eating the cheapest thing on the menu. Bought a condo, parents did give me 10k for closing costs. Rented it out and moved into a small 1 bedroom outside of the city. Got married to someone in finance. We live the same under salary life style, sold the condo, and was able to buy a nice house close to the city.

$120-150k is only moderately high income? For a millennial? I have a masters degree in a lucrative technical field and I didn’t expect to retire with that kind of salary; that person’s income is pretty good for someone still so young.

Hubby and I saved for 5 years, last 2 years living at my parents house int he basement and they charged us rent $800 a month and harassed us for extra constantly. We managed to save $65000, husbands dad stepped up and gave us $50,000 when he found out we were moving out of my parents house and just going to rent a big place and give up on owning (my parents were horrid landlords we couldn't take it anymore)

My grandma died. The proceeds from her house was split three ways between my dad and my uncles. My dad (still living) then split the money he received two ways between me and my sister. He gifted it to us - in the UK if you gift someone more than your £3k gift allowance, if you stay alive more than 7 years after the gift, your giftee doesn't have to pay tax on the gift.

In my town, house flippers are coming in, paying cash for old houses, and selling the homes with a huge markup to Bay Area commuters.

Back in the early 90's, as newlyweds, my husband and i made a deal with his parents to buy one of his family's homes. We agreed to pay rent with a percentage going into an escrow account to fund a down payment for the house and the parents would assist with financing. Sounded like a good plan at first. One day his parents wanted to buy a boat, a fancy sport cruiser, so, they wanted us to start the mortgage process before the "Spring Season". LSS, my husband had bad credit, less than 2 years at his job and I didn't have enough income to qualify for a mortgage alone. So, they kicked us out on the street, we had a weekend to find a new place and move out before the next weekend when showings were to begin to sell the house. Needless to say, I never had anything further to say to them and now own my own home, free and clear, almost 1,000 miles away from them all. (My husband's siblings both live in the other family homes which were gifted to them for a token sum and no mortgage).

Where I am house prices have risen, but interest rates have dropped. Using an inflation calculator and what I paid years ago means supposedly you could get about an equal house for an equal payment today. Not to say it's easy now, just it definitely wasn't easy then. We got no money from anyone, all had to be saved over years.

I was on my way to home ownership at 32. I budgeted like crazy and moved in with family for 2 years to save for the downpayment. One month away from my target to start shopping we went into lockdown for COVID. Now housing prices are so ridiculously high it will be years more saving before I have my own place

My fiance and I each took out a help-to-buy ISA a couple of years ago, which has an upper limit on how much you can put into it each month, and will pay out 25% of whatever is in it up to £12000 when we apply for a mortgage. We calculated this would be a 3 1/2 year time limit on being able to save to get the maximum return from the ISA (£30,000 total between us, with each of us saving £12000 into the ISA and getting £3000 from the government on top) to apply for a mortgage, and in that time we received an early inheritance which I have not had to dip into my share of and I am building up each month with the same amount I am paying into the ISA to give us as much as possible to cover our deposit, plus £5000-£10000 to cover any legal fees. Being first time buyers there's a possibility that we could get a smaller percentage deposit as well which would mean we could afford a higher mortgage. It has taken until my early 30s to reach a position where this feels like it could be a reality.

I was lucky, bought my first flat right before the market went sky high around 2003, sold it about 18 months later for double what we paid, which paid off all our debt from uni. I then got divorced and my parents let me stay in a flat they owned just covering my expenses and then eventually moved into a 4 bedroom house in a small town in Ayrshire with my now husband and our 4 kids for an incredible low price - my brother is just in process of buying a new built home, about a third the size of our home, much smaller garden but it's 3 times what we paid. But we were lucky and circumstances worked in our favour - no way we could afford this size of house back in Glasgow

Perhaps this younger generation should spend less on miscellaneous toys, gaming devices, and electronics and more saving. Older generations have more wealth because at younger ages they didn't waste money on take-out and frivolous items.

I'm a late GenX but much of this resonates with me. It's interesting to compare to what my parents had at a similar age. By 35 (for example) they were married with a child and owned a condo (later a house). Both had High School educations and were able to own a home and support a family with one income. I had an advanced degree and a decent paying job but could only afford a smaller condo thanks to a legal settlement and help from my parents (or I'd still be living at home)

All of these posters are white. I am happy for their good fortune, but these stories all made want to barf. Seems I'll ever own my home, let alone sell one for profit.

What is the point of this? It's not "easy" for most people to save money and purchase a home. That's not a recent development. Yet people have been doing for many generations

I think the point is that Millennials have been called lazy and some older generations have heavily implied that they waste their money...of course that's nothing new either, every generation since the beginning of time has people from the previous generation calling them lazy or wild or entitled. It's the circle of life I suppose...

Load More Replies...Priced out of my home town and where I work. Was gifted £60,000, just enough for a deposit for a 1 bedroom house within a commutable distance from work. Prior to 2001, it was easy but when the Labour government opened the flood gates to Eastern Europe, the population exploded. Demand for housing outweighed the supply and it got worse and worse.

It was Edward Heath, leader of the Conservative Party, who joined the EU in 1972. And it was John Major, leader of the Conservative Party, who signed the Treaty of Maastricht in 1992. And it was also John Major, Conservative, who in 1997 negotiated on behalf of the UK to sign the Treaty of Amsterdam, although it was Tony Blair who was Prime Minister when it was actually signed shortly after he was elected.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime