Millennial Homeowners Are Sharing How Hard It Actually Was To Afford a House, And Their Posts Are A Good Reality Check

Interview With AuthorIt's no secret that millennials have a particularly challenging relationship with the housing market. And in that sense, not being able to afford one, they don’t really even have one. When baby boomers and Gen X hit their 30s, rapid construction and suburbanization were proliferating relatively affordable housing options. For them, part of the American Dream was buying a house.

Today, it’s estimated that millennials have 35% less wealth than previous generations and a whopping 70% say they can’t simply afford a house. Our prospect is frustrating, to say the least--always renting is the only option.

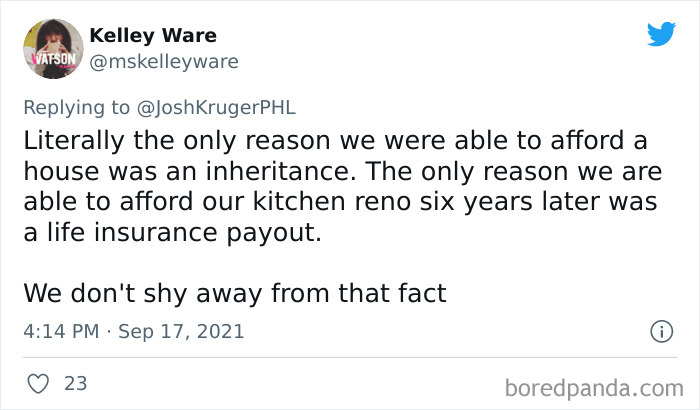

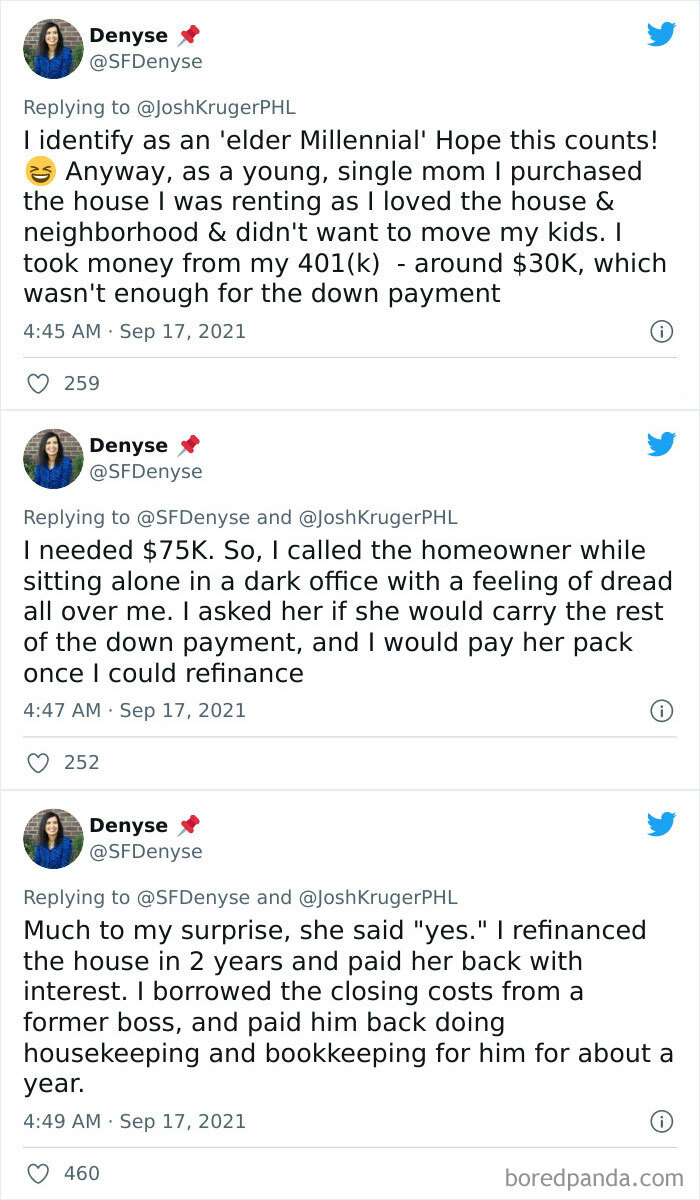

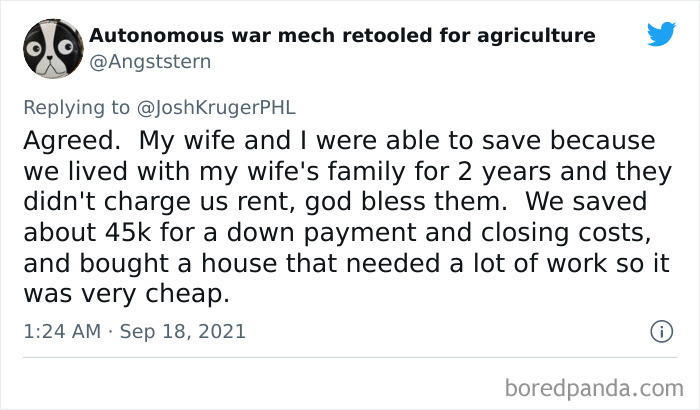

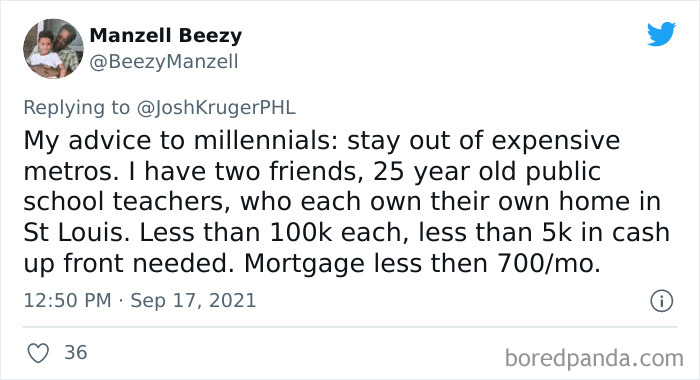

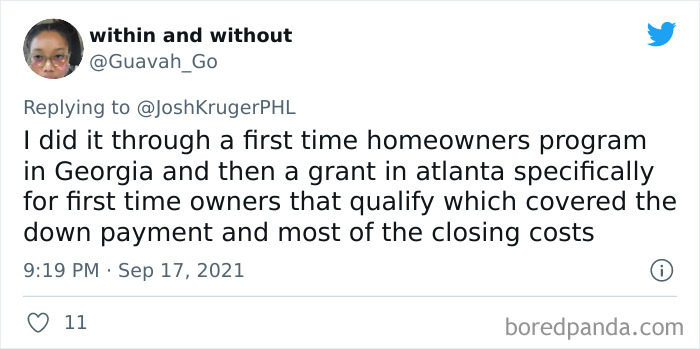

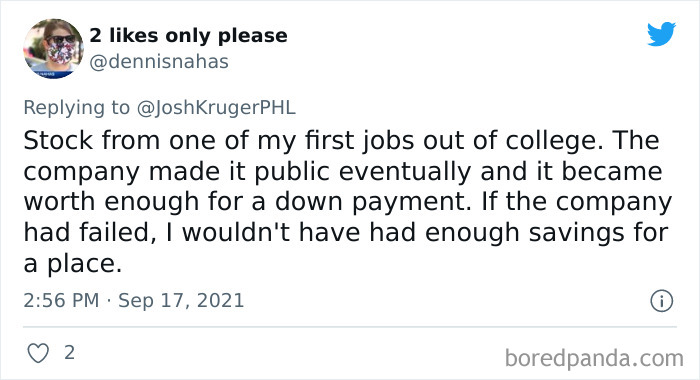

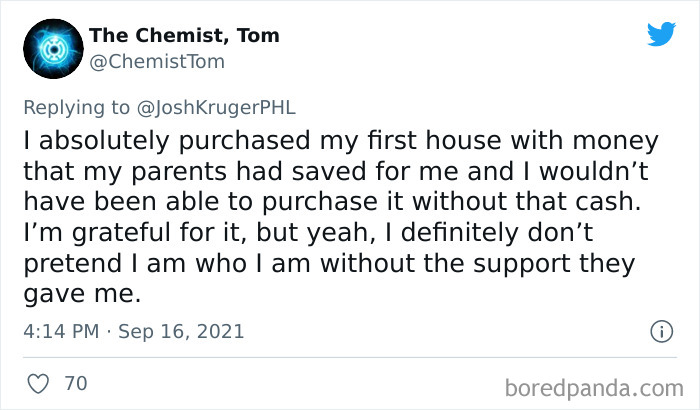

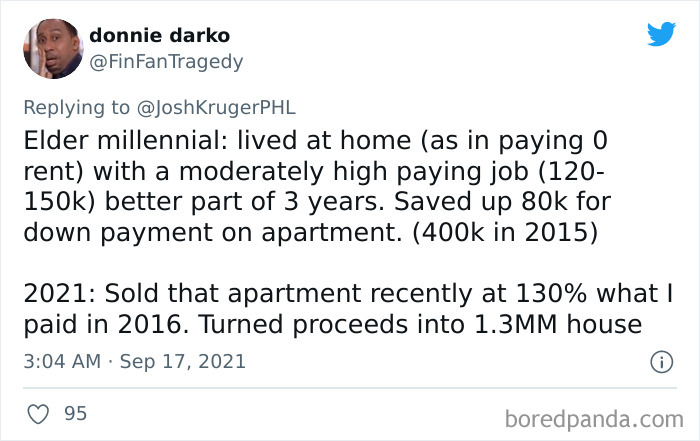

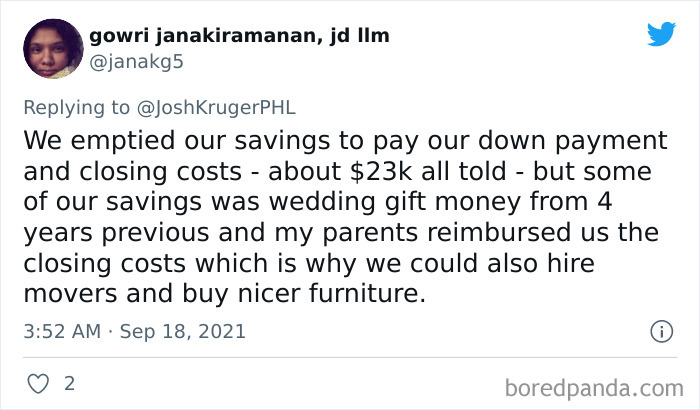

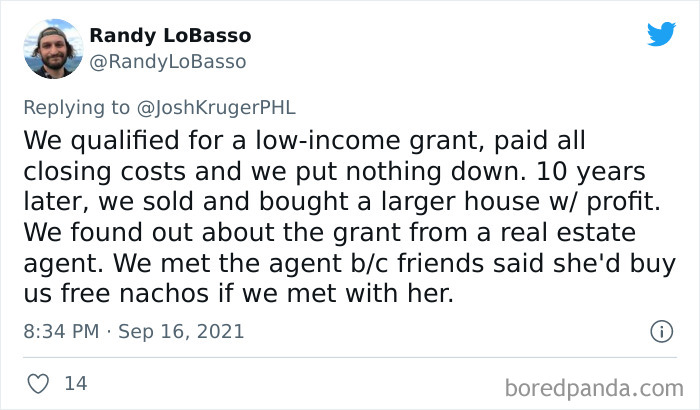

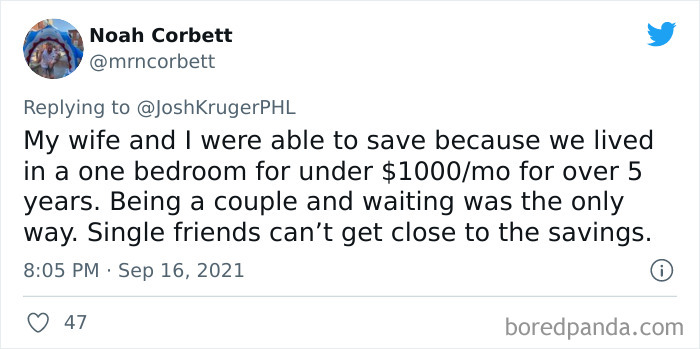

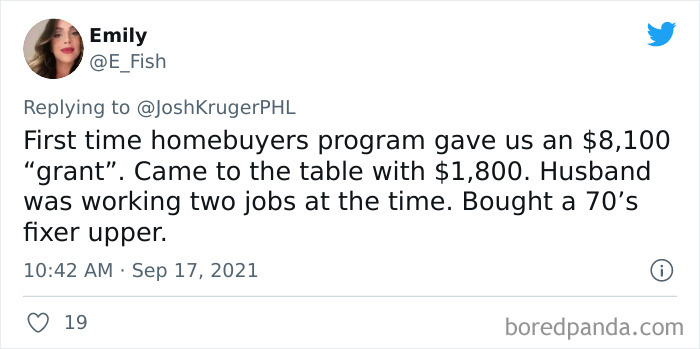

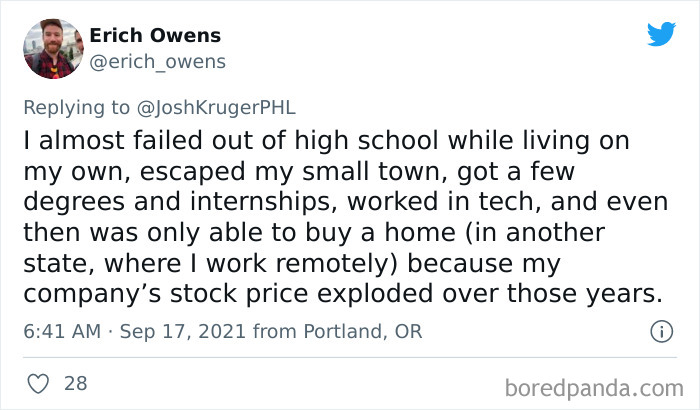

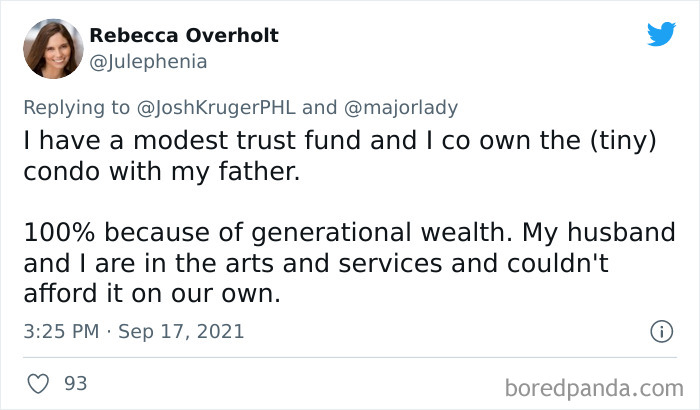

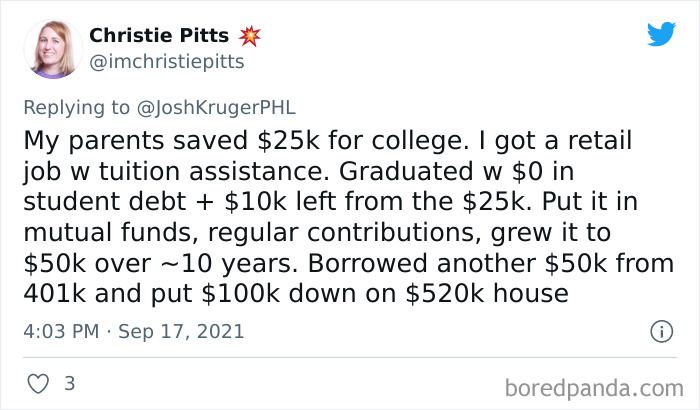

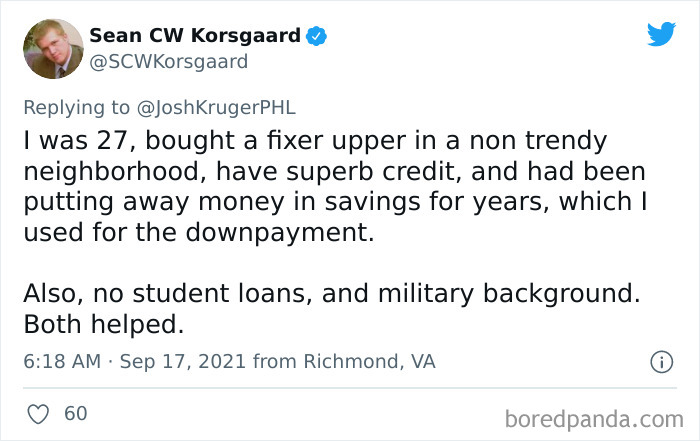

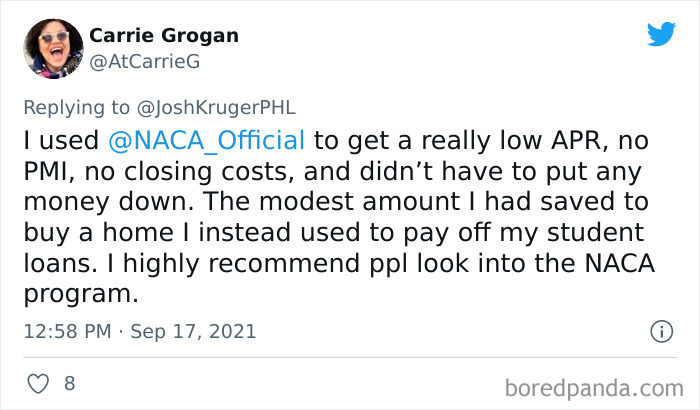

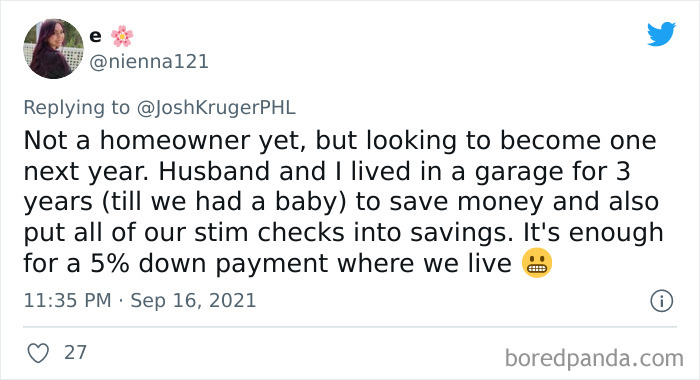

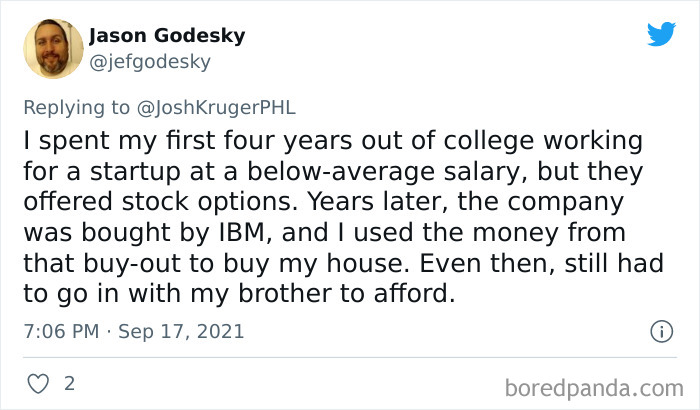

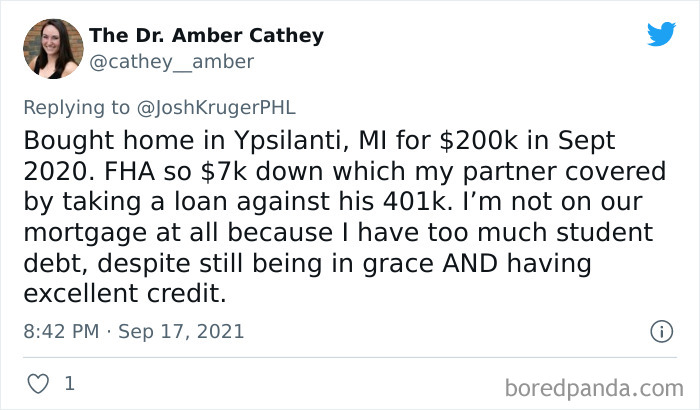

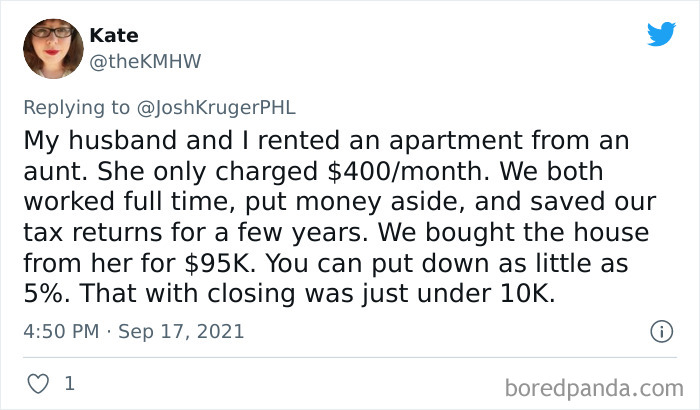

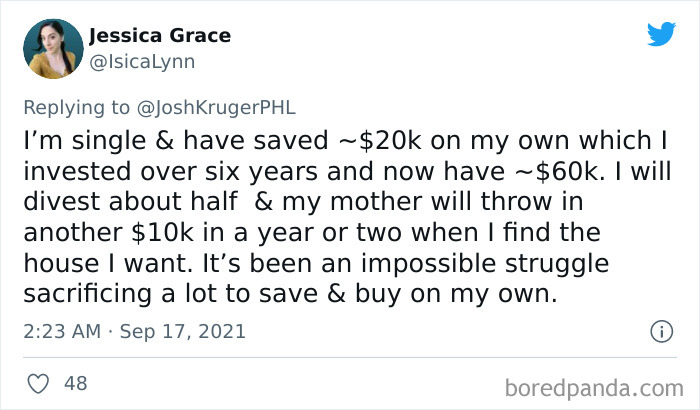

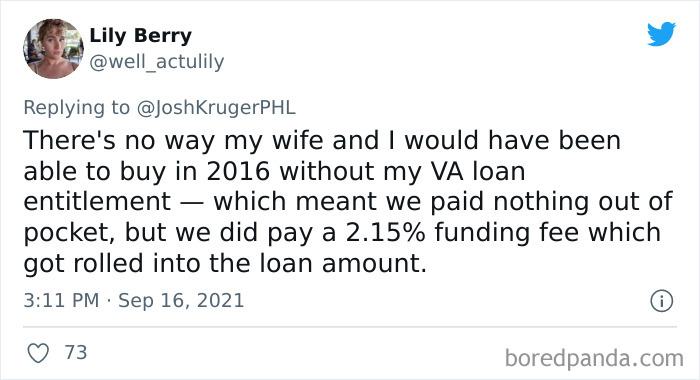

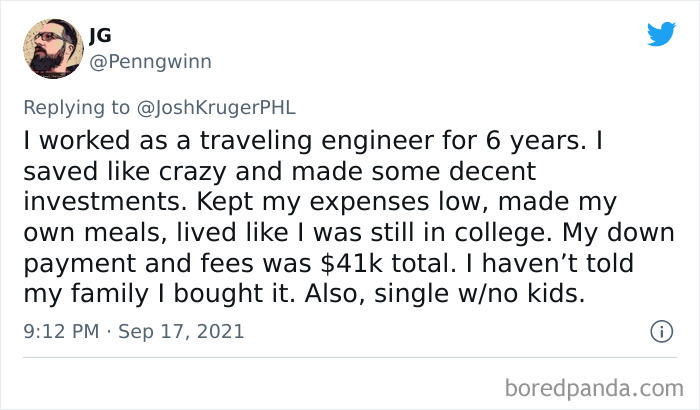

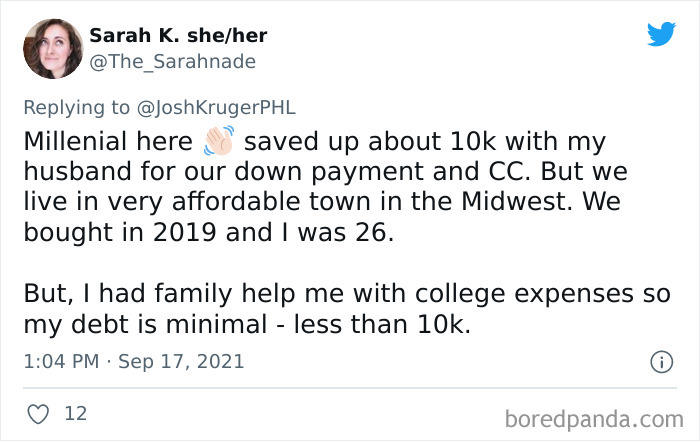

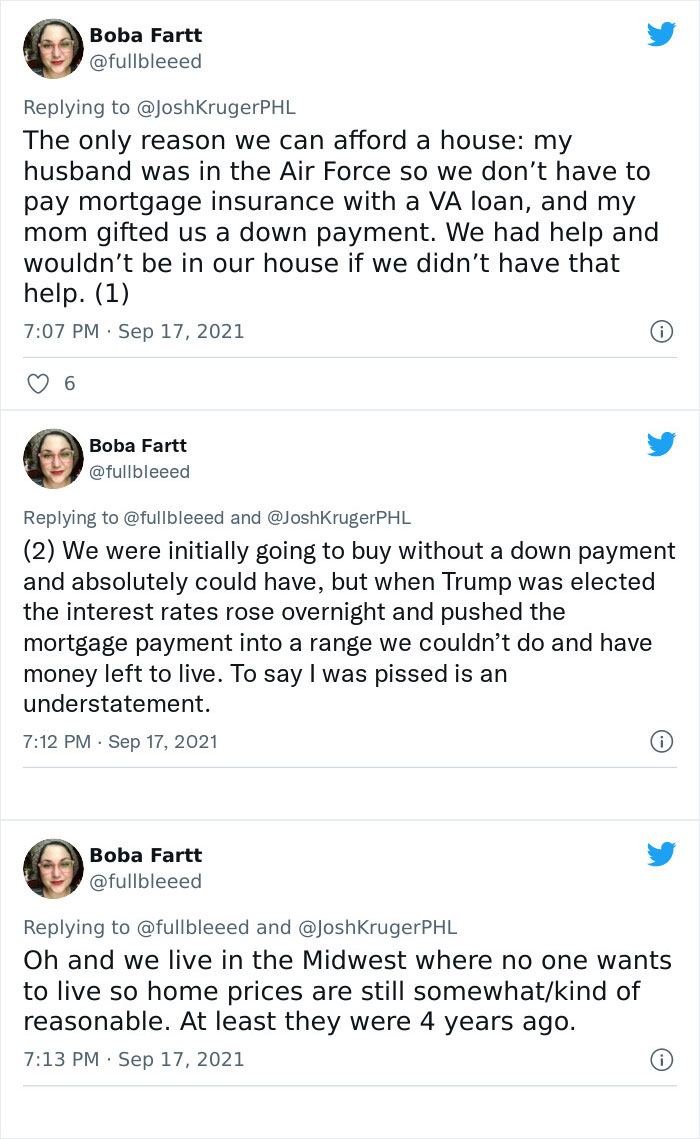

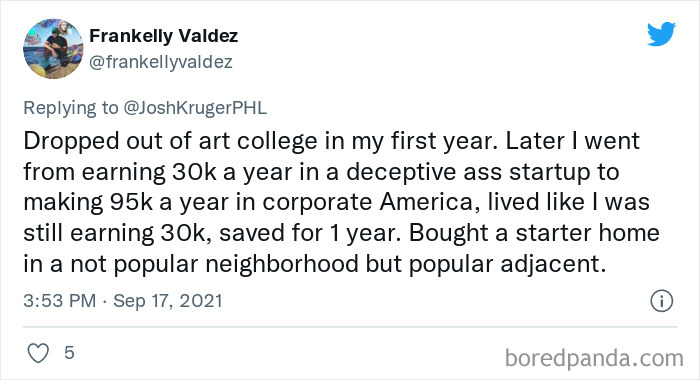

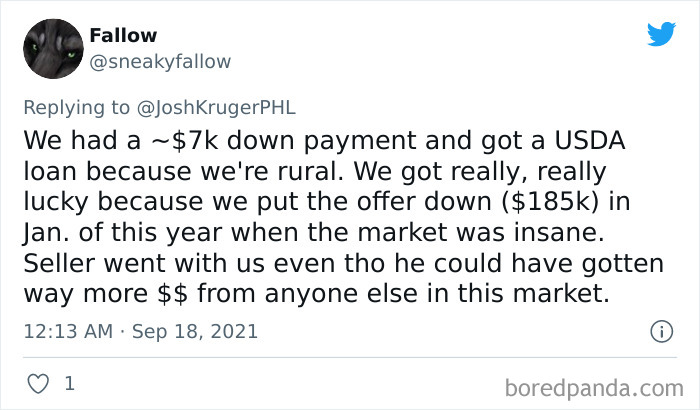

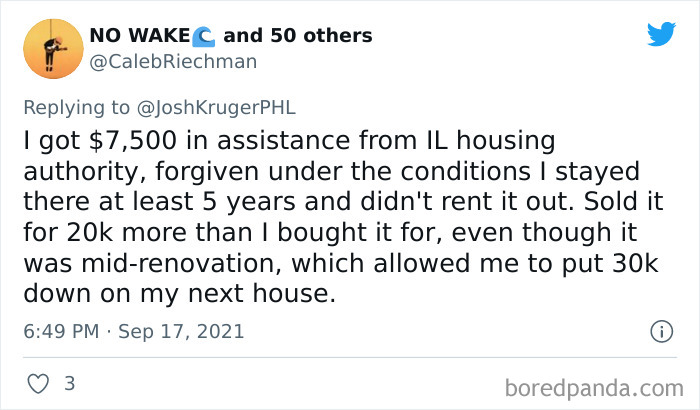

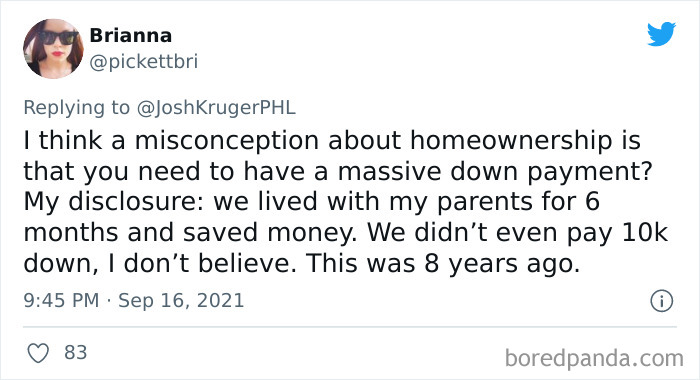

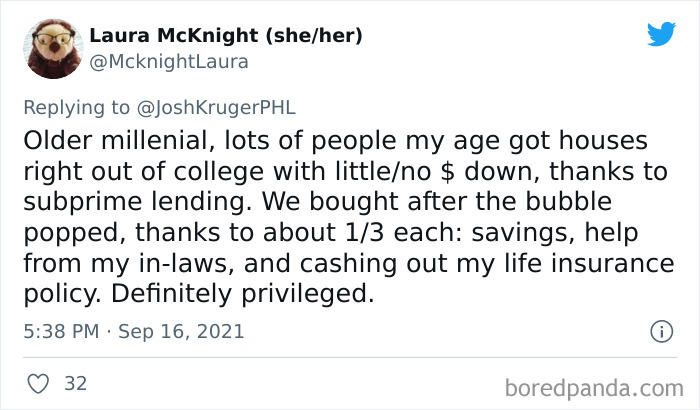

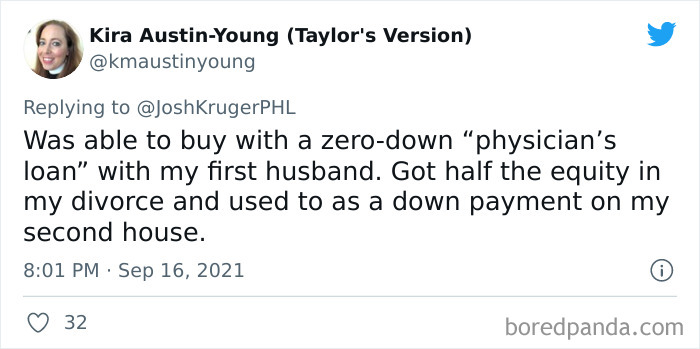

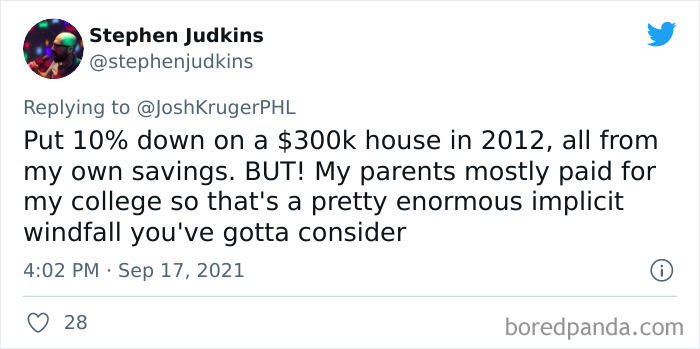

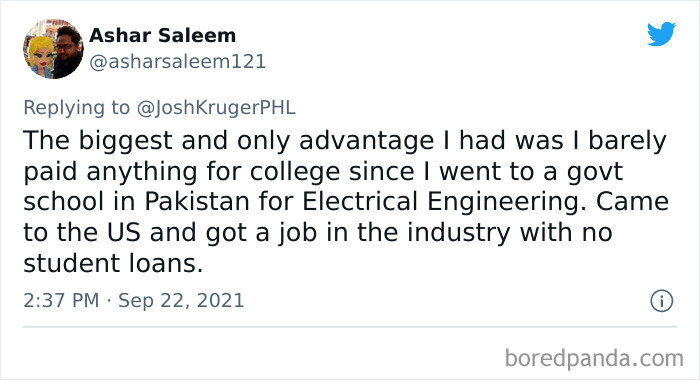

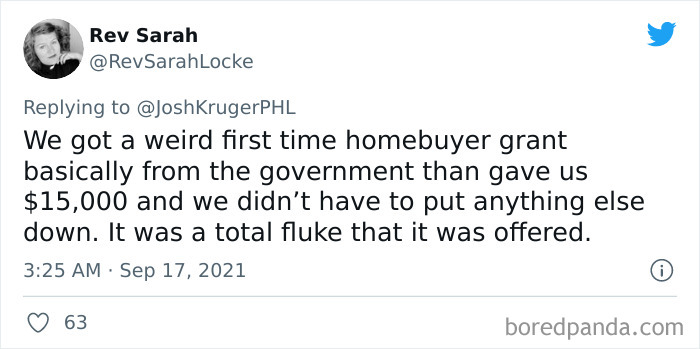

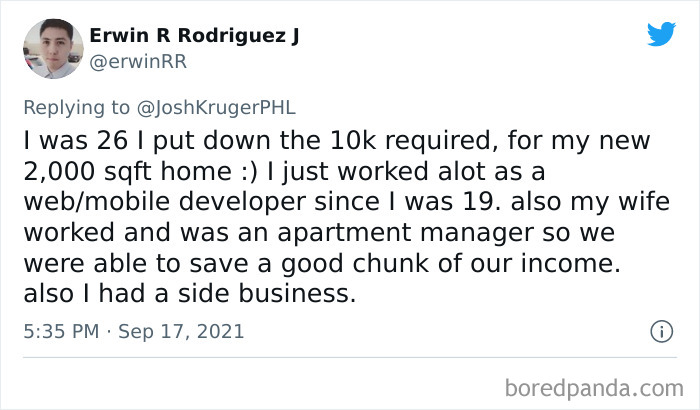

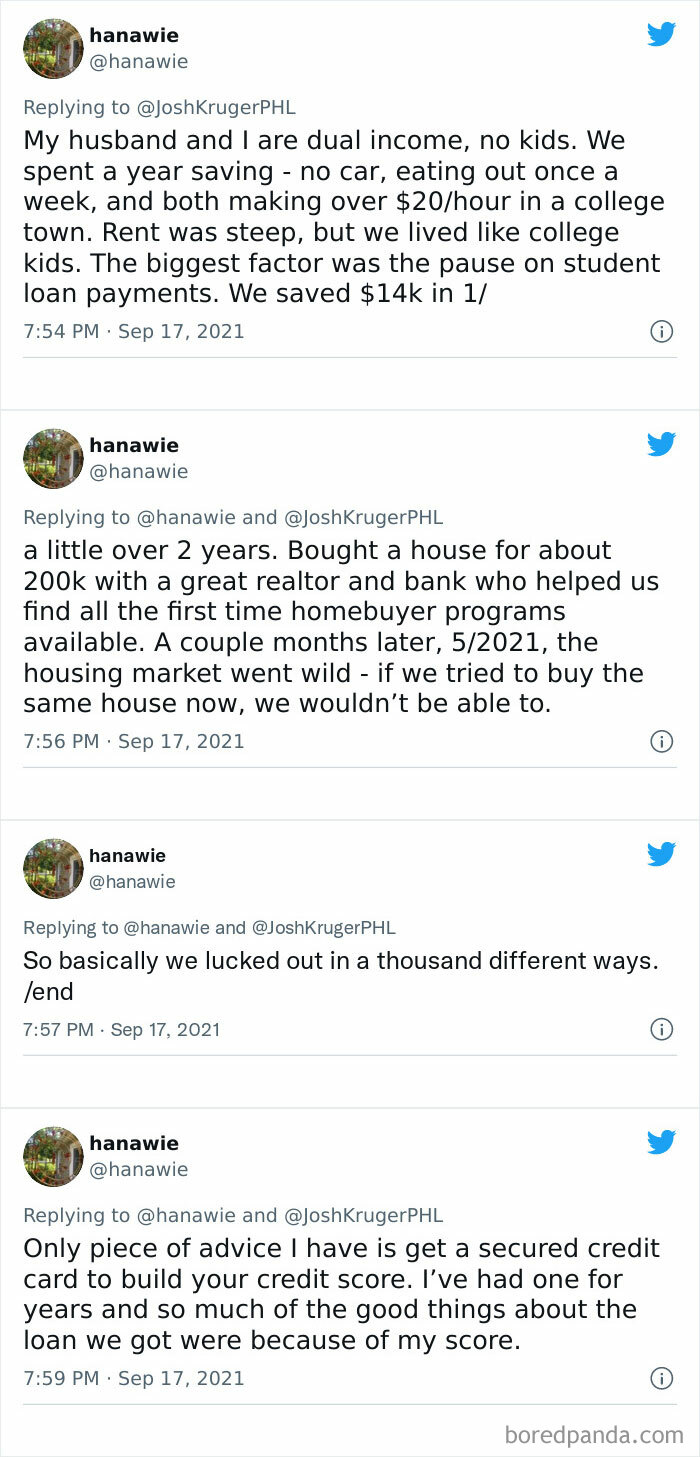

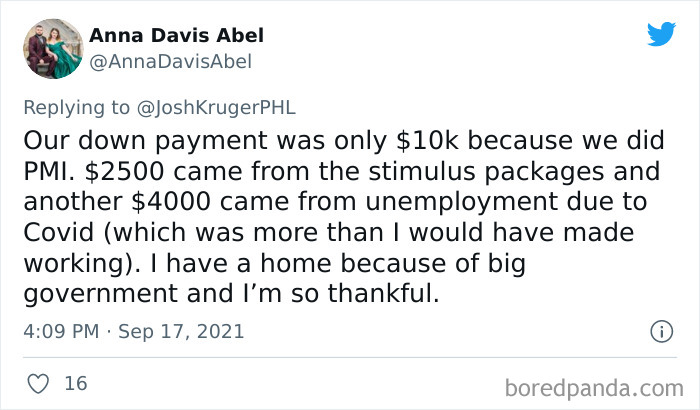

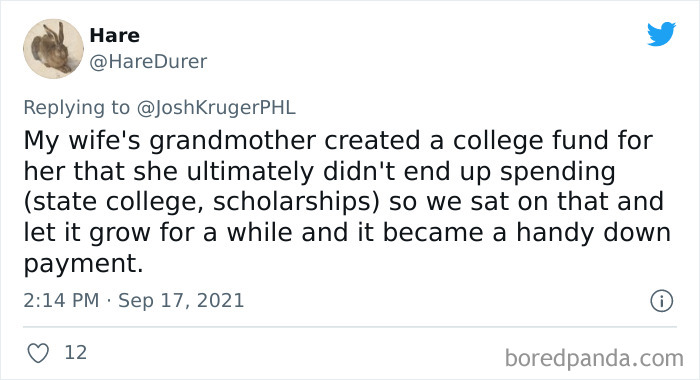

So in this uncertain economy, only very few millennials were able to afford a house. Often, thanks to very exceptional circumstances like heritage, stocks from college, and so on. Read this brutally honest thread where young people share what it took them to become rare millennial homeowners.

This post may include affiliate links.

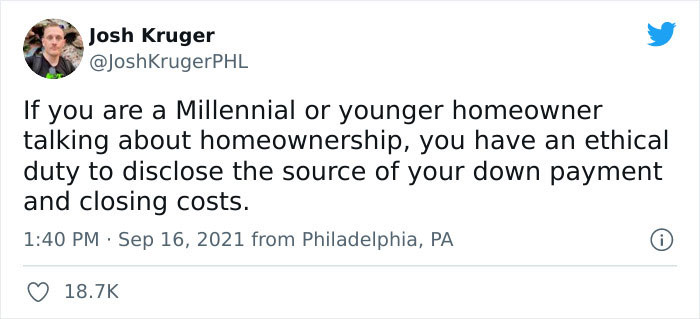

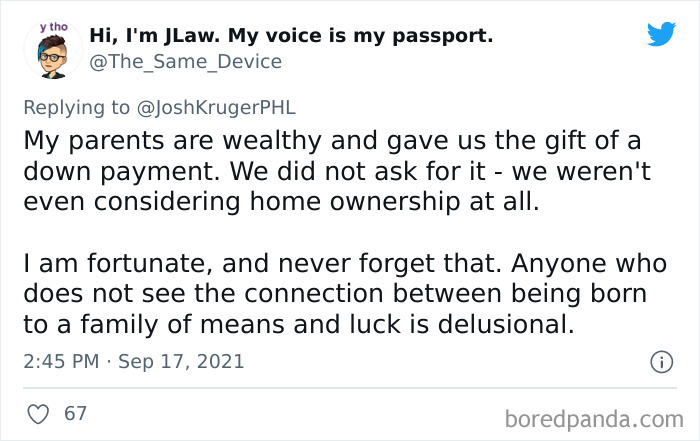

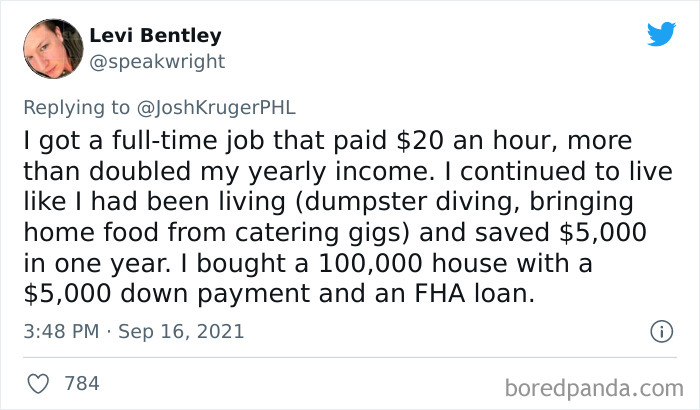

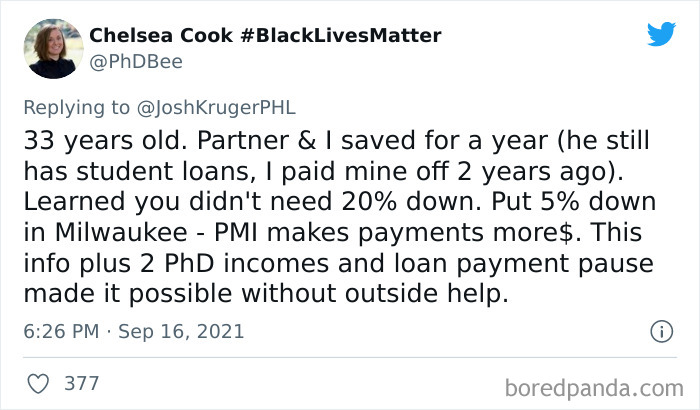

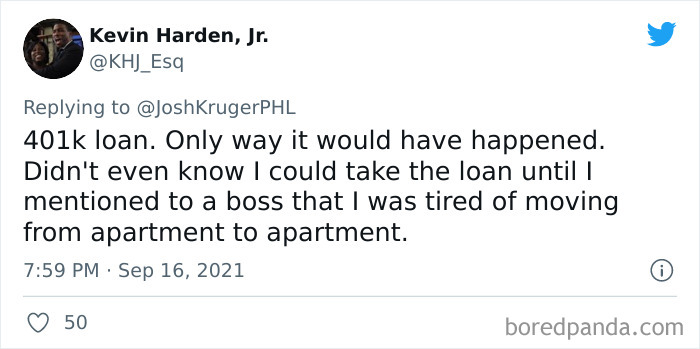

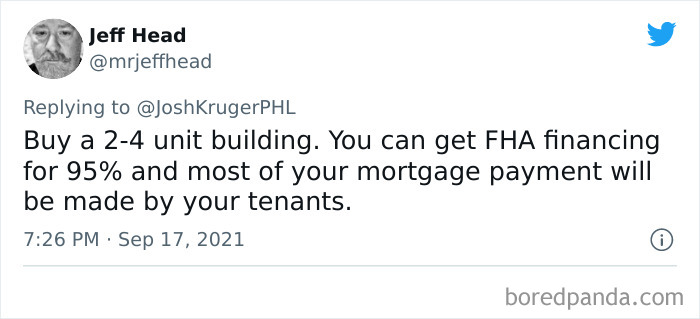

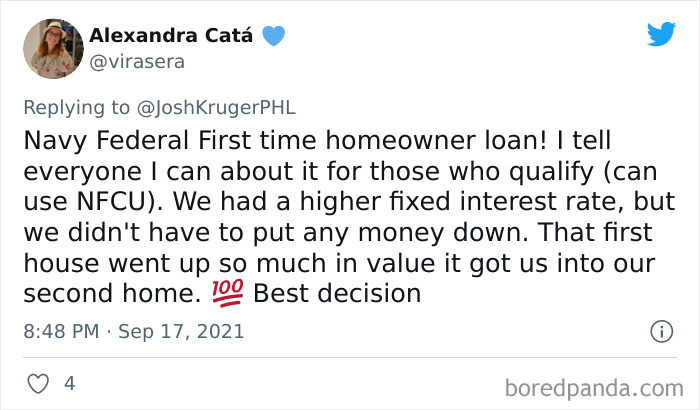

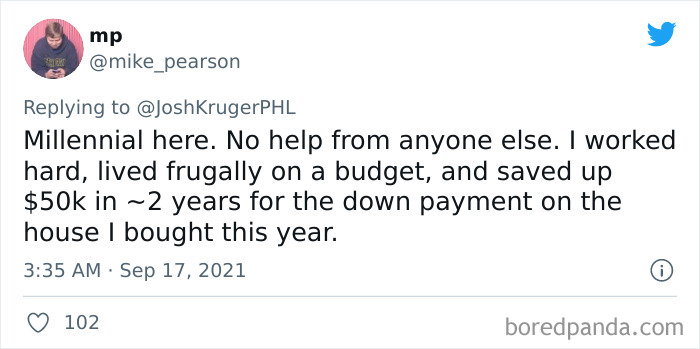

The thread started with a Twitter user named Josh Kruger, a Philadelphia-based writer and commentator. He asked homeowners to share how they were able to afford the down payment and closing costs for their homes.“If you are a Millennial or younger homeowner talking about homeownership, you have an ethical duty to disclose the source of your down payment and closing costs,” Josh tweeted on September 16.

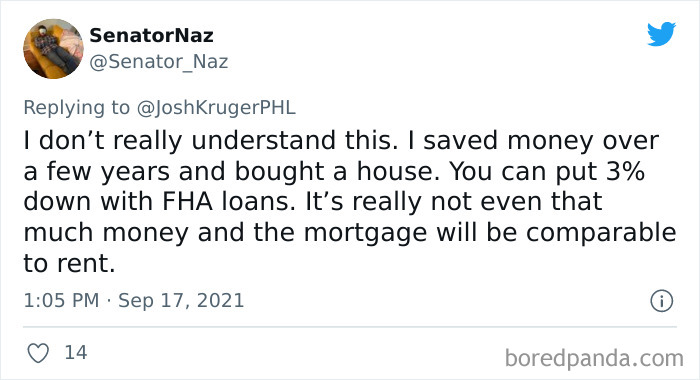

FHA is the way to go, I did it twice and yes you have the mortgage insurance, but you can actually afford a house this way, especially with the extremely high rent prices

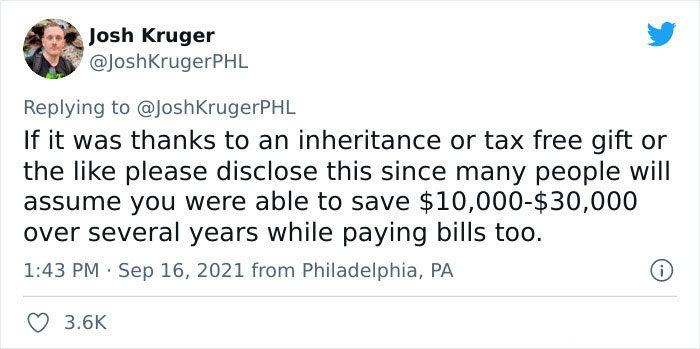

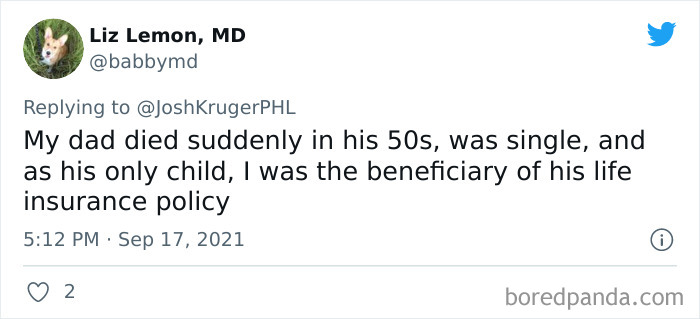

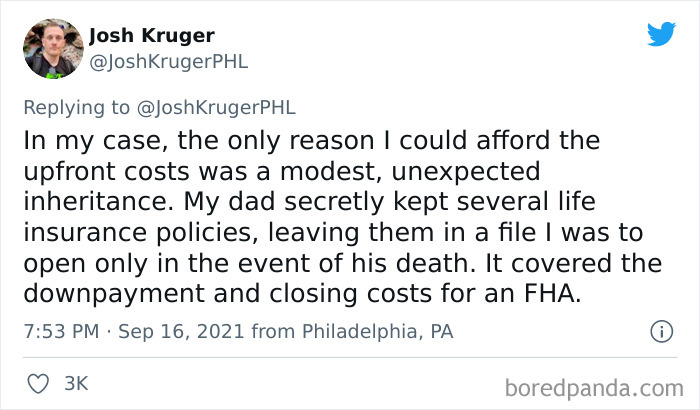

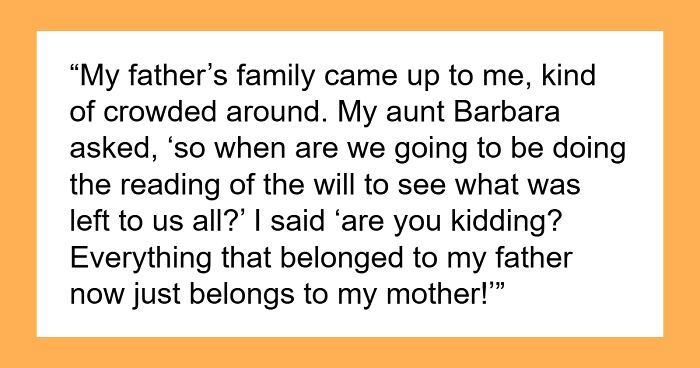

Josh added in another tweet: “If it was thanks to an inheritance or tax free gift or the like, please disclose this since many people will assume you were able to save $10,000-$30,000 over several years while paying bills too.” The author of the thread also shared that in his case, “the only reason I could afford the upfront costs was a modest, unexpected inheritance.”

He explained: “My dad secretly kept several life insurance policies, leaving them in a file I was to open only in the event of his death. It covered the downpayment and closing costs for an FHA.” Josh concluded in yet another post that “thanks to privilege, a few decisions made by my dad, and fate, I fell assbackwards into the ability to buy.” He then added that it was a “good decision but only possible due to unearned resources.”

Wait. Her down payment was supposed to be $75,000??!!?? That's more than my house cost.

This is how I got my house. got a short sale home for under 80k with a Federal home loan. probably the only reason I can live on a single income.

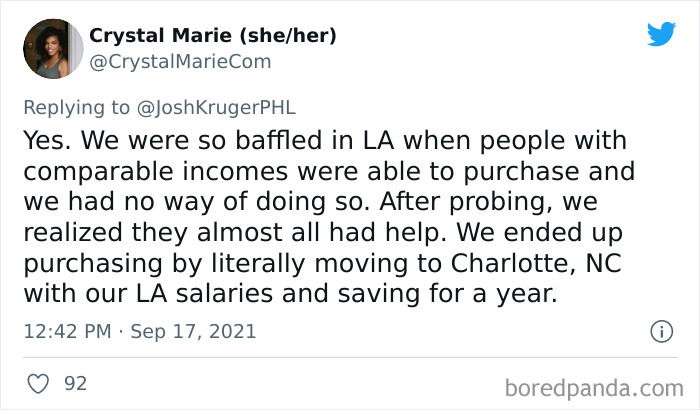

Bored Panda reached out to the author of this eye-opening Twitter thread Josh Kruger who is a Philadelphia-based writer and commentator. Josh told us he was totally unsurprised by the responses people shared in response to the thread. “My primary goal was to confirm my suspicion that, anecdotally, Id see a bunch of middle and upper-class white people and few people of color and even fewer people who saved up for their downpayment and closing costs while working,” he said.

“Sure enough, the vast majority of responses were from middle and upper-class white people who got a bailout from their parents, either by way of a loan, gift, or inheritance,” Josh added.

but where would they film tik-toks? LOL! true statement though...100%

When it comes to the current housing market, making it virtually unaffordable for most of the Americans to buy a house, Josh said that he blames it on Republican policies. “Personally, I blame Republican policies hostile to public programs and supply-side economics that have been debunked as junk economics repeatedly for 40 solid years. The Department of Housing and Urban Development's budget is, adjusted for inflation, about 25% what it was in 1978. What happened? Ronald Reagan.”

My uncle was a CFO of a manufacturing company. When the company was sold, his stock benefits made him a millionaire.

This was me as well (+1 sibling) and I bought his house from the estate. I would have been able to buy a house eventually with my job, but would have taken a couple more years.

Moreover, according to Josh, “we've transferred the cost of goods and services away from the bosses and consumers and put it onto the workers by artificially depressing wages.” He believes that housing costs wouldn't matter if we had an adequate wage structure in the US.

Having said that, Josh believes there’s hope “if they vote for Democrats.” He explained: “The responses lay bare, at least anecdotally, the fact that race and class-based privilege are tools used by their beneficiaries, which backs up data about the racial wealth gap amongst other things.”

“In the US, we have a mass delusion and perversion where we hobble people at the start of life with multiple barriers then blame them for not meeting or exceeding the performance of people who start life not with barriers but multiple helpful tools. This is why the work President Biden is doing must succeed. It helps remedy this.”

The author of the thread concluded by saying that “those who think both parties are the same, I'd question why you think giving working people money is the same thing as giving them COVID.”

I've lived in a one bedroom apartment with rent under $750/month for over 10 years, make $40k/year, have no kids, and have no debt. I've still only managed to save $2,600. If I was doing this with a partner, we'd most likely have a house by now. Being single and trying to save is HARD.

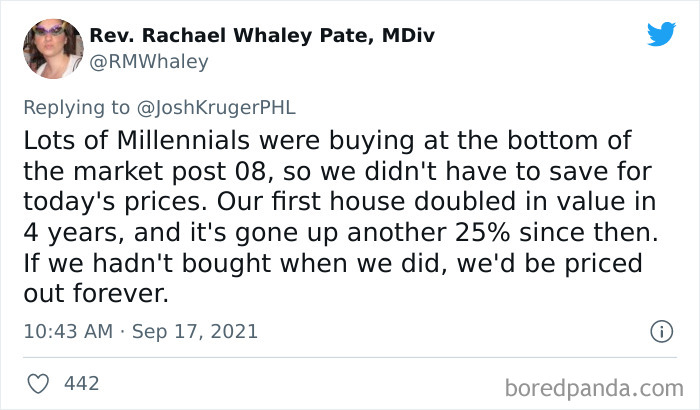

According to an extensive study by the rental firm Apartment List, affordability remains the biggest obstacle for millennials who want to own a home. This also means that they are forced to rent much later in life than previous generations. Many believe that millennial renters prefer this housing choice because they have more flexibility and they don’t have to deal with the hassle of home maintenance and unexpected housing costs. Many also claim that due to this reason, the renting lifestyle is much more attractive to millennials and this is why they are not so eager to become homeowners. This is not true.

The same study from Apartment List found that the lifestyle benefits of renting remain dwarfed by the burden of affordability. Only 30% of millennials claim that they’re not yet ready to settle down with homeownership while a vast majority of 70% say they cannot afford to buy a house. Among those who do not plan to buy a house, 69% say they will always be renting because they have no other option. Just 40% cite the benefits of a flexible lifestyle, proving that the vast majority of millennials rent not because they want to but because they simply have to.

The first sentence of this post is the truth. They dont understand. Do they think everyone qualifies for an FHA loan? If you are living paycheck to paycheck with a family to support, not everyone can "save money over a few years" either. Seems like they have not even tried to see this from any other perspective than their own.

I'm still not sure if I qualify as Gen X or Millennial - born 1980. But if I *am* a Millennial, I was gifted £2,000 by my parents at 21. I bought a flat for £28,000. My home ownership is entirely down to timing, because in 2001 £28,000 for a one bed flat was a piece of cake (mortgage was 2x my salary). Probably the other key factor is that at 21 I had already been in full employment for three years instead of going to university - no student debt. But, if it makes people feel better, I'll be Gen X and smug. Label me however you see fit.

In the Netherlands most people would have no problem buying a house. Only problem is that there are no houses, so prices are sky rocketing. They are exceeded the real value of the houses by 50k and up. Saddest part is that any house building project is immediately sold out to investors, so even before the houses are build they aren't available any more for people needing a house. And as fugitives/refugees and immigrants still get priority in housing over Dutch civilians who are waiting 10 years to rent a house, I'm afraid it won't be long before racism will rise and the Dutch tolerance will be replaced with xenophobia.

In Seattle, houses are selling for up to $250,000 over asking price/value. Or more.

Load More Replies...In the U$A, health privilege is almost as big of a luck factor as wealth privilege. If you were born with a genetic condition or defect, developed any serious condition or had a debilitating injury at any time, then that lowers your wealth ceiling significantly. An ambulance call, a lifetime medication or a cancer treatment can end up costing more than a college degree over time.

I'm still not sure if I qualify as Gen X or Millennial - born 1980. But if I *am* a Millennial, I was gifted £2,000 by my parents at 21. I bought a flat for £28,000. My home ownership is entirely down to timing, because in 2001 £28,000 for a one bed flat was a piece of cake (mortgage was 2x my salary). Probably the other key factor is that at 21 I had already been in full employment for three years instead of going to university - no student debt. But, if it makes people feel better, I'll be Gen X and smug. Label me however you see fit.

In the Netherlands most people would have no problem buying a house. Only problem is that there are no houses, so prices are sky rocketing. They are exceeded the real value of the houses by 50k and up. Saddest part is that any house building project is immediately sold out to investors, so even before the houses are build they aren't available any more for people needing a house. And as fugitives/refugees and immigrants still get priority in housing over Dutch civilians who are waiting 10 years to rent a house, I'm afraid it won't be long before racism will rise and the Dutch tolerance will be replaced with xenophobia.

In Seattle, houses are selling for up to $250,000 over asking price/value. Or more.

Load More Replies...In the U$A, health privilege is almost as big of a luck factor as wealth privilege. If you were born with a genetic condition or defect, developed any serious condition or had a debilitating injury at any time, then that lowers your wealth ceiling significantly. An ambulance call, a lifetime medication or a cancer treatment can end up costing more than a college degree over time.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime