Man Gets A Harsh Reality Check Online After Venting About GF Using Him To Fund Her Trip

Interview With ExpertIt’s natural to want to go above and beyond for the people we care about. But even the most generous hearts have their limits.

This Redditor paid $5K for his girlfriend and her son’s vacation, hoping they’d have a memorable trip together. However, when she later asked for another $2.5K, he refused, feeling he had already contributed more than enough. She’s been giving him the cold shoulder ever since, so now he’s asking the internet for help.

The man paid $5K for his girlfriend and her son’s vacation, hoping they’d have a memorable trip together

Image credits: anastasya_1995 (not the actual photo)

But when she later asked for another $2.5K, he refused—and now she’s cut off all contact

Image credits: sedrik2007 (not the actual photo)

Image credits: triplebogeyking

Nearly a quarter of couples break up over finances

Whether we like it or not, money plays a major role in our lives—and by extension, our relationships. So when couples disagree about finances, it can become a serious dealbreaker.

In fact, according to a Wealth of Geeks and Credit.com study, nearly a quarter of all couples break up over financial issues. The numbers climb even higher among those between the ages of 35 and 49, with 30% calling it quits over money, while 28% of those aged 25 to 34 report the same. For younger (18-24) and older (50-64) pairs, it seems to be less of a concern, with 13% and 15% ending their relationships for similar reasons, respectively.

Financial conflicts don’t always lead to breakups, but they can create tension—especially among younger generations. More than 40% of millennials and Gen Z respondents in last year’s Credit Karma survey say they argue about money on a monthly basis. For millennial couples, money is the most common source of arguments, even more than issues related to quality time, chores, or intimacy.

“Finances are a leading cause of relationship breakdowns because they combine a lack of education with poor communication,” personal finance expert and educator Hannah Rein, CPA, told Bored Panda. “Most education systems don’t teach personal finance, and many parents shy away from the topic—either because they see it as taboo or never learned about money themselves. As a result, people often enter adulthood figuring it out as they go, which can lead to costly mistakes and financial stress.”

Rein notes that handling your own finances is hard enough, but it becomes even more complicated when shared with a partner. “A significant source of tension often stems from not understanding why your partner behaves the way they do with money,” she said. “For instance, someone who grew up in a household where money was tight may value a large emergency fund and frugality as adults because it gives them a sense of security they lacked in childhood.”

“On the other hand, someone raised in financial abundance may feel more comfortable spending and not see a big savings cushion as necessary. When these two people come together, it’s easy to see how their financial habits and priorities could clash,” she added.

This is why open communication is so important. “Asking questions about each other’s money habits and early experiences with money can provide crucial insights,” Rein said. “These conversations early in a relationship can help you determine if you’re financially compatible—and, more importantly, how to work together toward shared goals.”

Image credits: Vera Arsic (not the actual photo)

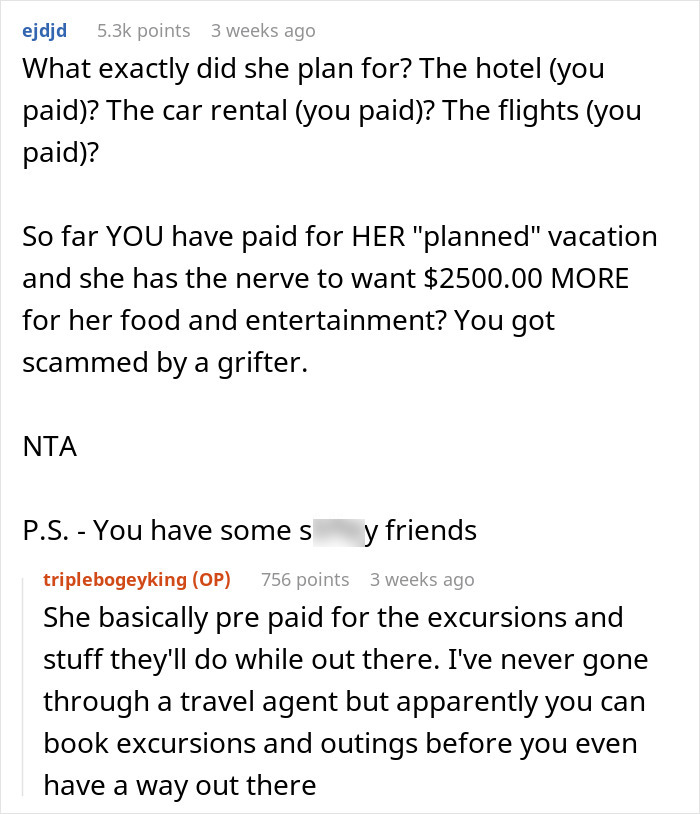

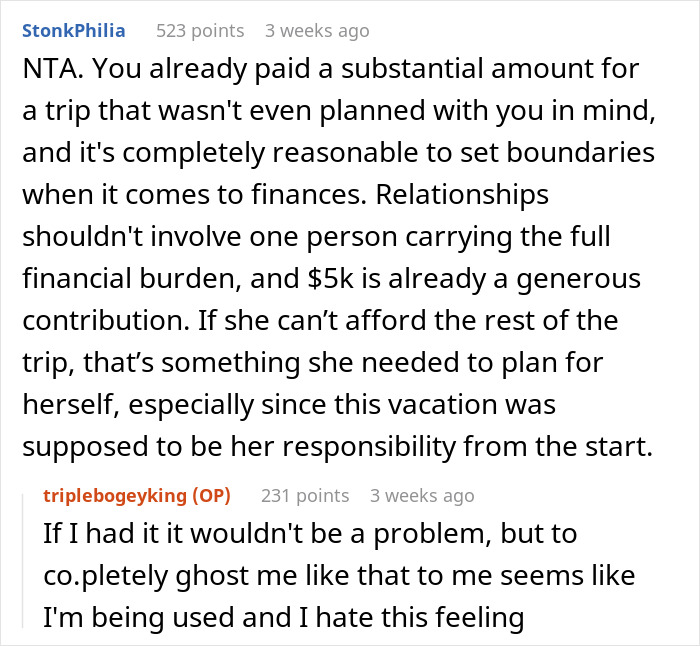

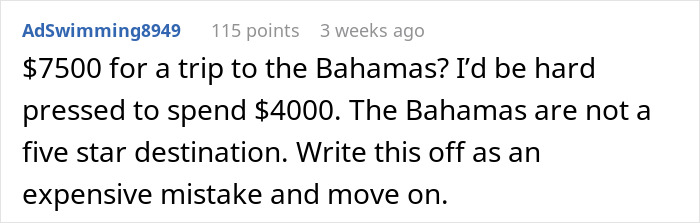

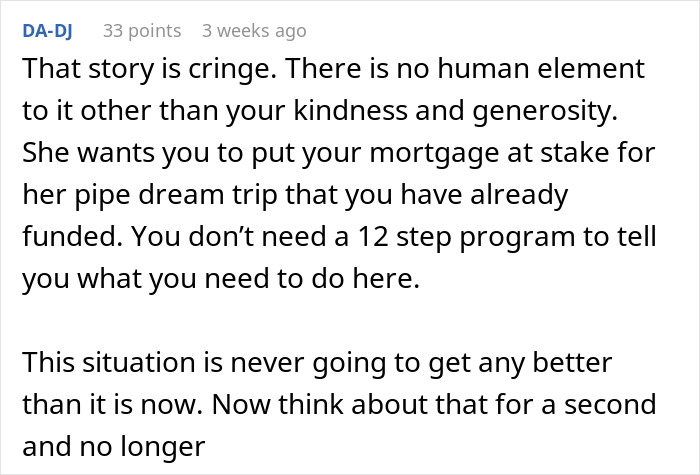

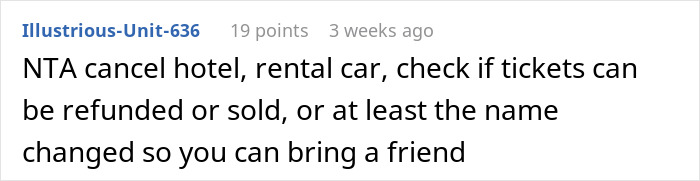

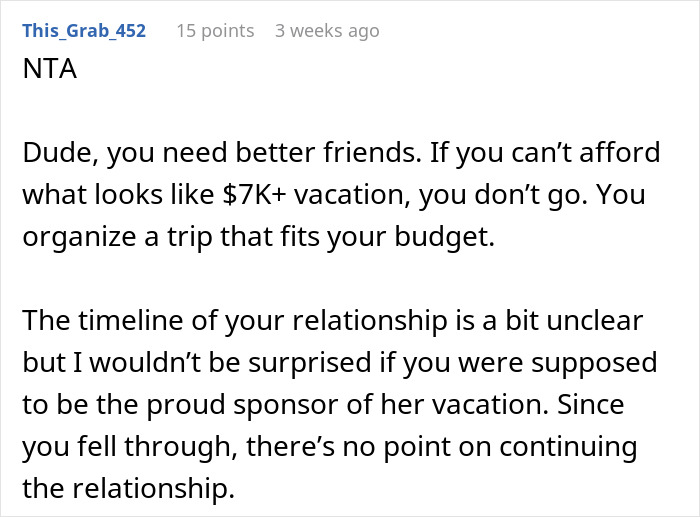

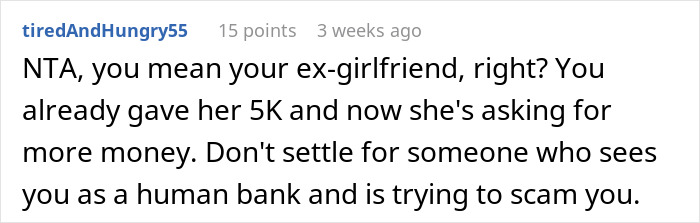

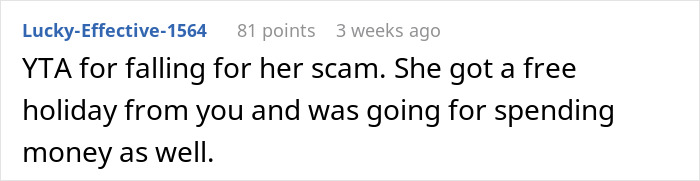

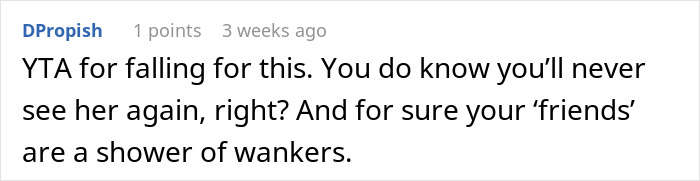

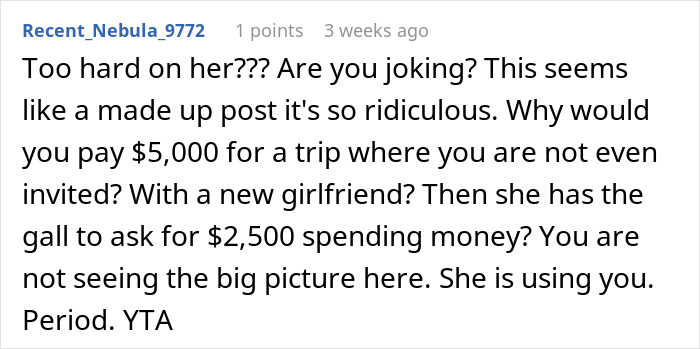

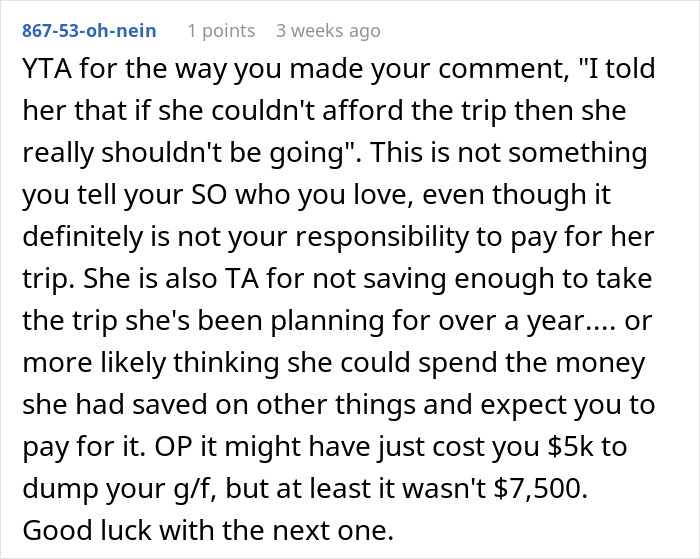

Most readers felt bad for the author, claiming his girlfriend was taking advantage of him

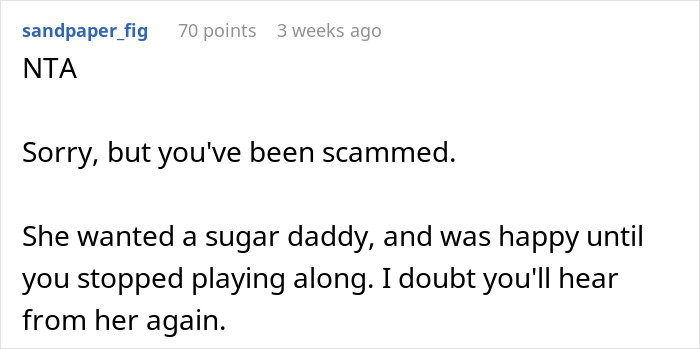

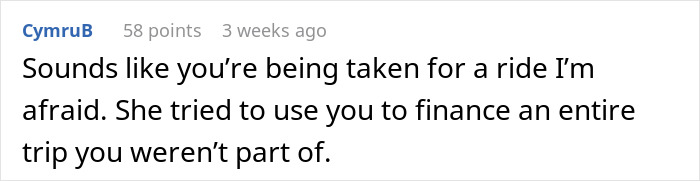

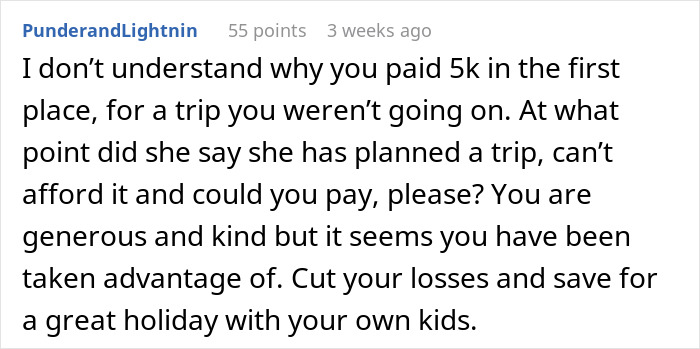

Some, however, argued he brought it on himself by falling for what they described as a “scam”

Poll Question

Thanks! Check out the results:

What do you want to bet her REAL boyfriend/husband (her son’s baby daddy) is sitting on the beach laughing their asses off at OP’s naïveté?

Some of the commenters seem naïve, too: “You already gave her $5000; what more could you give?” $2500, apparently. I’m worried those people who don’t see what happened will be parted from *their* money soon, too. (It breaks my heart when nice guys don’t see what’s happening to ‘em, and pretty much hand over their wallets. 😰)

Load More Replies...Another post with no resolution. Maaan, I need to stop reading these half-efforts.

I agree. I checked the reddit post and the OP hasn't updated or posted in 24 days. BP should only post stories where we find out what happens in the end

Load More Replies...What do you want to bet her REAL boyfriend/husband (her son’s baby daddy) is sitting on the beach laughing their asses off at OP’s naïveté?

Some of the commenters seem naïve, too: “You already gave her $5000; what more could you give?” $2500, apparently. I’m worried those people who don’t see what happened will be parted from *their* money soon, too. (It breaks my heart when nice guys don’t see what’s happening to ‘em, and pretty much hand over their wallets. 😰)

Load More Replies...Another post with no resolution. Maaan, I need to stop reading these half-efforts.

I agree. I checked the reddit post and the OP hasn't updated or posted in 24 days. BP should only post stories where we find out what happens in the end

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

13

25