Lotto Winner Tries To “Stop People From Falling Into Same Trap” After His Pension Is Cut Off

A widower who won $60,000 AUS ($40,890 USD) in the lotto had his pension cut off as the winnings were considered income, highlighting the dark side of winning a fortune.

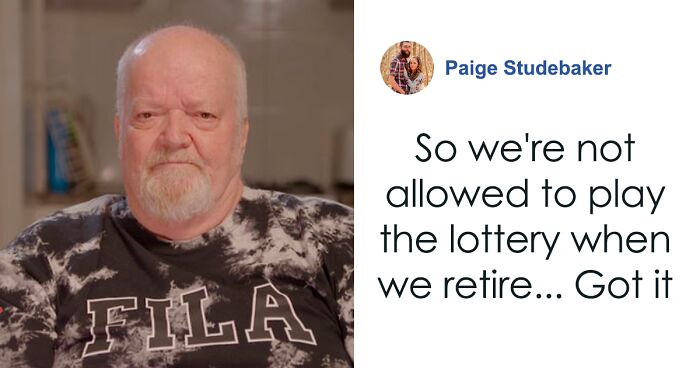

Frank Kemmler, a 70-year-old man from Adelaide, Australia, informed his family that they were all going on an exciting holiday after news came that he had just scored the lottery luck, earning thousands of Australian dollars.

“It was certainly a nice feeling when I checked me numbers,” he told A Current Affair on Friday (December 29). The widower added: “I rang the family. I said, ‘pack up, we’re going on a holiday!’”

Frank Kemmler, a 70-year-old widower from Australia, had his pension cut off after winning $60,000 AUS in the lotto because the prize was considered income

Image credits: A Current Affair

Image credits: A Current Affair

But the joy of finally having some significant financial relief collapsed like a house of cards after a visit to the local Centrelink, the Australian authority in charge of delivering social security payments.

There, Frank was told access to his pension would be cut as his lotto winnings, paid out every month, were considered a form of income, the New York Post reported.

Frank tried to convey to the authorities that he was willing to take his prize as a lump sum, but he wasn’t given the option

Image credits: Erik Mclean

The disappointed man recalled: “[It] was a bit of a disillusionment. You think you win on the one hand, but they take it away with the other hand.

“It was so unexpected, it took me a couple of days to realize I had just been cut off for no reason at all. So much for being lucky.”

Frank tried to convey to the authorities that he was willing to take his prize as a lump sum, but he wasn’t given the option.

Image credits: dylan nolte

As a result, the defeated man was left to reportedly pay full price for doctor appointments and medication which were previously covered under his pension. His monthly payments have also reportedly now dried up.

As per the publication, upon reapplying to receive the pension on December 1, Frank was informed that “they were so busy” and that he could wait for up to six months to receive the benefits.

He deplored: “Anybody would think I grew younger; I grew a year older, not a year younger.”

Frank went on to warn other Australians about the pension and to be careful if they’re lucky enough to win the lotto as they too could have their benefits cut.

The defeated man was left to reportedly pay full price for doctor appointments and medication which were previously covered under his pension

Image credits: Waldemar

He urged: “The pension is not really my main worry, because I’m just trying to stop other people from falling into the same trap.

“These people that are buying these [lottery] tickets, there’s no warning anywhere … to say that you’re going to lose your pension.

“If I’d known then what I know now, I would’ve given the win to my daughter and kept the pension for myself.”

A spokesperson from Services Australia told News.com.au they “extended an offer to work directly with Mr. Kemmler to ensure he’s getting the support he is eligible for”.

“It’s so wrong,” a reader commented

125Kviews

Share on FacebookExplore more of these tags

This is misleading at best. He's living on state benefits, not a pension that he's worked to build up. Yes, maybe it sucks that he's gonna be worse off for a while, but if your only income is from a means-tested social security benefit then of course it will be removed if you no longer meet the criteria for receiving it.

Just googled to make sure. It seems he is on "disabilty" and not his "retirement pension. So you are right

Load More Replies...would not happen in the USA. The Social Security Administration considers gambling winnings, lottery winnings and other such prizes as "Unearned income" and it does not effect your Social Security or your Medicare benefits. , , , The IRS, on the other hand, will want to talk to you about it.

If he took a one-time lump sum payment, then yes. However, he took an annuity.

Load More Replies...That's really rotten. As said earlier, he "won" his pension rather than a prize.

Why should taxpayers continue to shell out for a man who has income of his own?

Load More Replies...This is misleading at best. He's living on state benefits, not a pension that he's worked to build up. Yes, maybe it sucks that he's gonna be worse off for a while, but if your only income is from a means-tested social security benefit then of course it will be removed if you no longer meet the criteria for receiving it.

Just googled to make sure. It seems he is on "disabilty" and not his "retirement pension. So you are right

Load More Replies...would not happen in the USA. The Social Security Administration considers gambling winnings, lottery winnings and other such prizes as "Unearned income" and it does not effect your Social Security or your Medicare benefits. , , , The IRS, on the other hand, will want to talk to you about it.

If he took a one-time lump sum payment, then yes. However, he took an annuity.

Load More Replies...That's really rotten. As said earlier, he "won" his pension rather than a prize.

Why should taxpayers continue to shell out for a man who has income of his own?

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

44

21