Ex Says He Can’t Afford To Pay Back His Debt, Woman Locks Him Out Of PlayStation Account

Finances in a relationship are a tricky thing. Most of the time you are not thinking that you may break up or any worst-case scenarios, so giving money to your partner, helping them financially or paying for something doesn’t look like a big deal. It’s nice that you can help a person that you love! Well, until you break up. Then all the loans and shared things don’t come back to you as easily as they were borrowed.

More info: Reddit

Trusting your partner too much on their word that they will pay back a ‘loan’ may hurt you in case of a breakup

Image credits: Ketut Subiyanto (not the actual photo)

Woman shares her revenge on ex by locking him out of his Playstation account right after he renewed his subscription

Image credits: u/McDonaldsCrewBoi

Image credits: Pavel Danilyuk (not the actual photo)

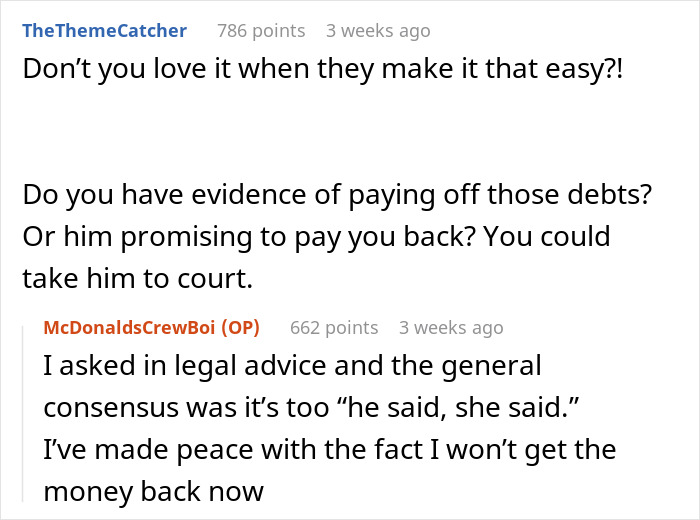

She shares that when they broke up, he owed her around $1900, which he had agreed to pay back, but after the breakup, he ‘couldn’t afford’ to give her anything

Image credits: u/McDonaldsCrewBoi

Also, all their shared things became his, which he kept, and returned the woman’s TV broken and without any cables

Image credits: u/McDonaldsCrewBoi

Image credits: JESHOOTS (not the actual photo)

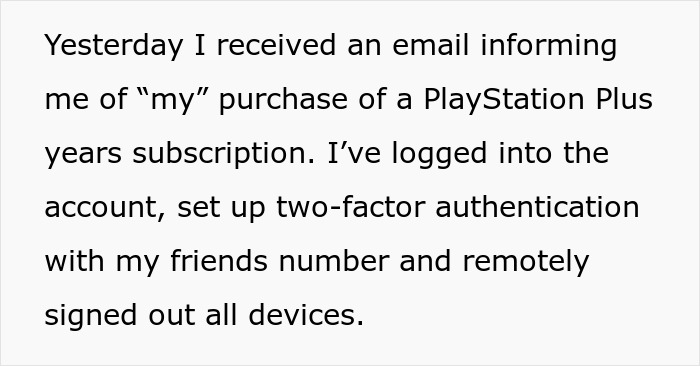

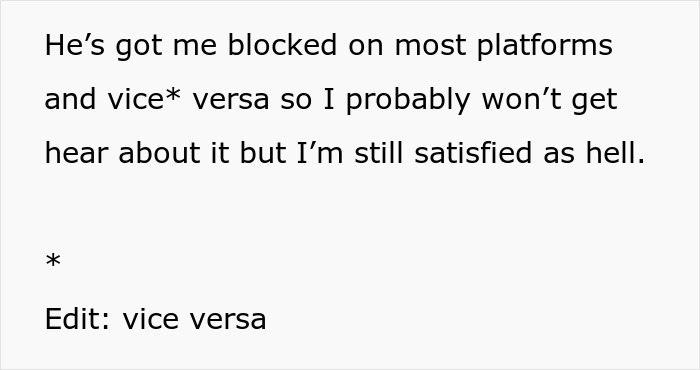

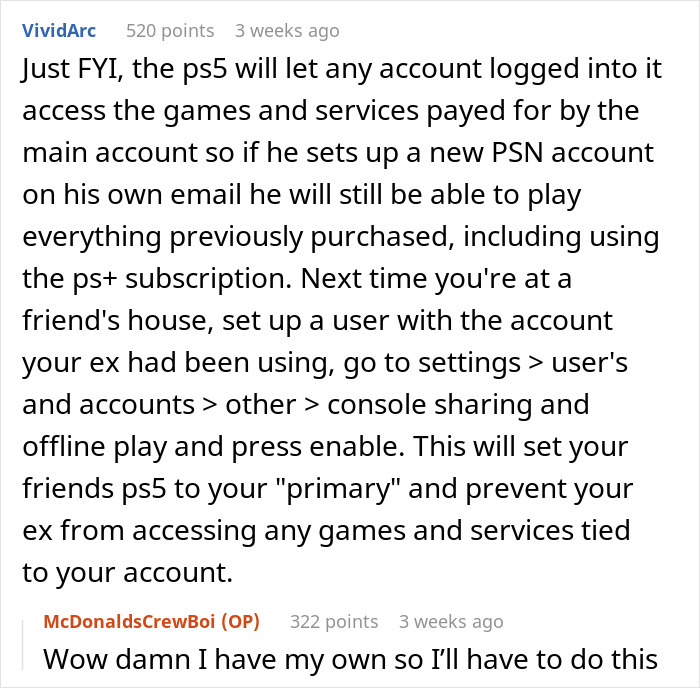

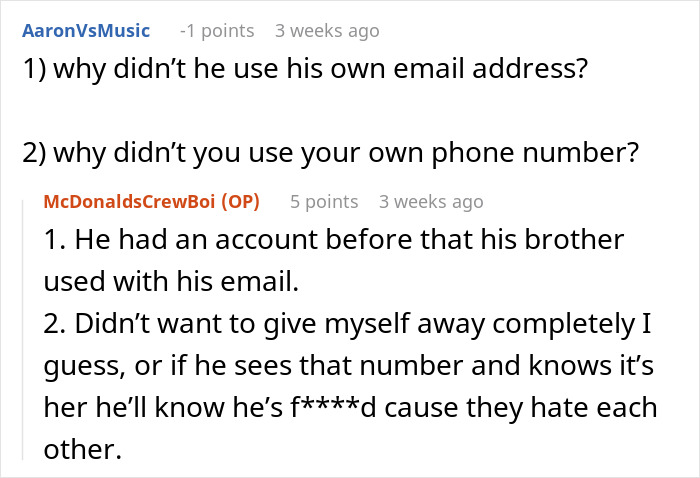

His PlayStation was set up using the woman’s email, to which she got a confirmation about renewal of subscription and she simply decided to sign out of all devices

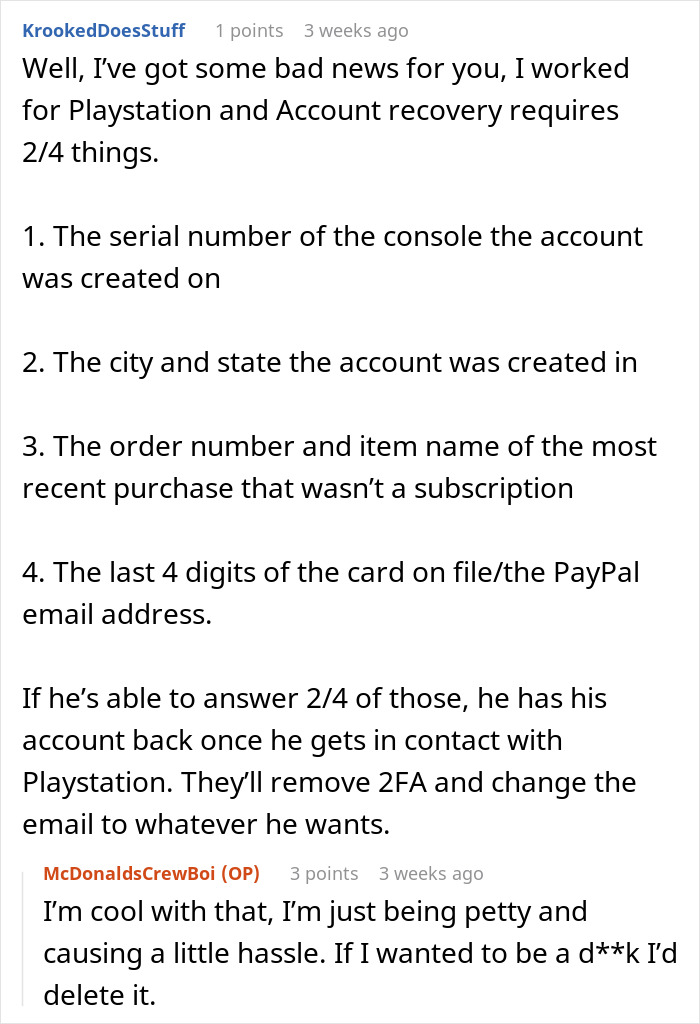

One Reddit user decided to share her small victory with petty revenge community members. The author shared how she executed her revenge plan on her ex after he failed to pay back $1900 that she lent him, locking him out of his PlayStation account right after he renewed his subscription. The post received 8.5K upvotes and 366 comments.

The author started the story by sharing that when she and her ex broke up, he owed her money as she paid back his credit card debt. However, it was agreed that it would be paid no matter what happened with the relationship. However, once they broke up, he explained that he couldn’t afford to give her anything, thus he kept almost all their shared things and returned her TV broken without any cables.

However, OP highlighted that her ex had a PlayStation which was a gift from her. To set up an account, he used her email and nobody really thought about it. Just when she received a confirmation that he had renewed the subscription, she decided to log in to the account, set up authentication with a friend’s number and sign out of all devices. Despite knowing that she won’t hear from her ex again, OP shares that it was satisfying.

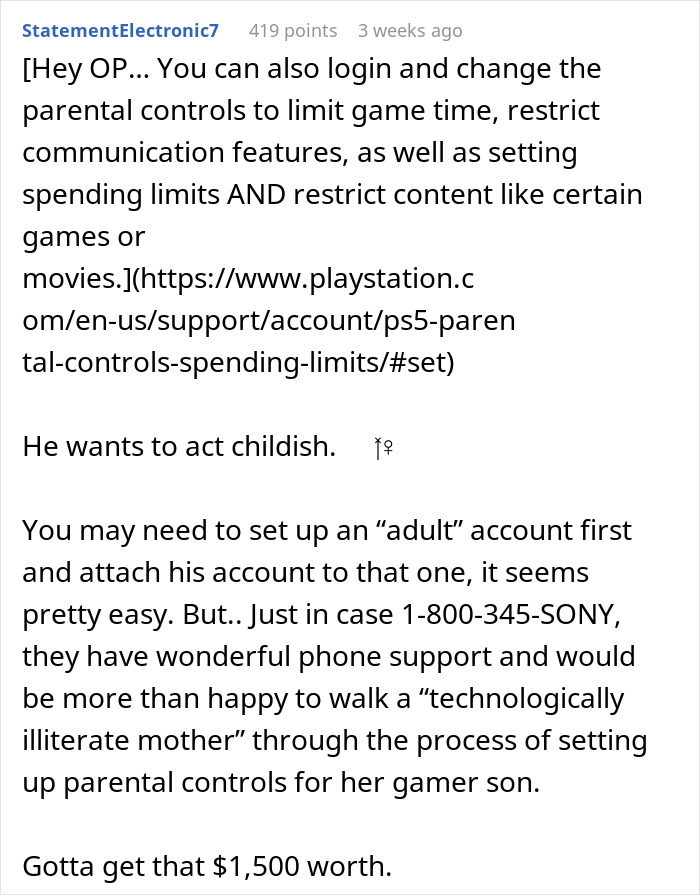

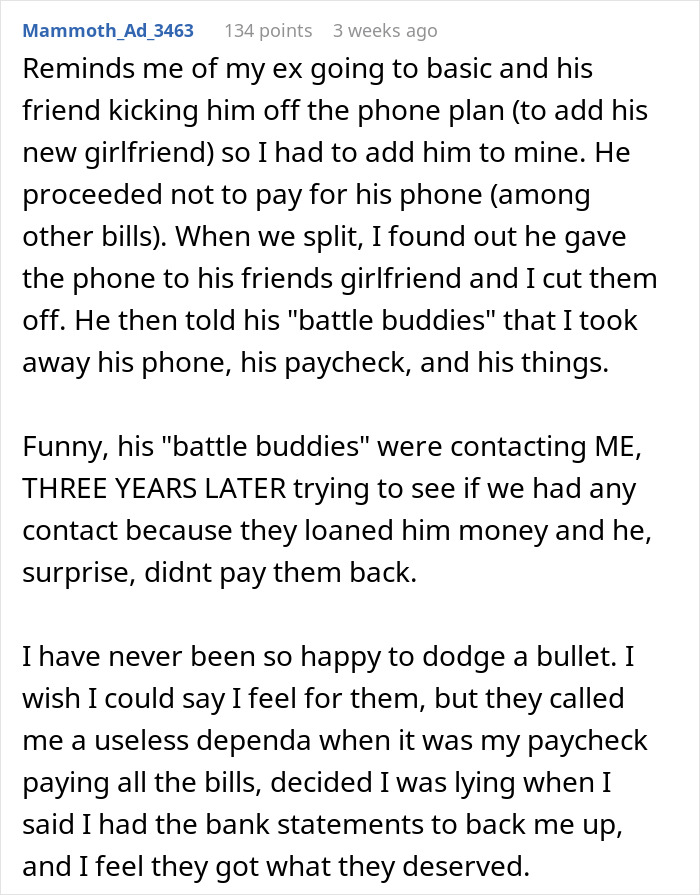

Community members liked this revenge and also shared a few tips on how to prevent him from getting back his account easily, as well as similar personal stories. “I had a buddy who waited until he saw that his ex was halfway through a season of a show, then canceled it. Talking about thinking two steps ahead,” one user shared. “I’d leverage this account against the money he owes you and any shared furniture or things you want back,” another person suggested.

Image credits: Andrea Piacquadio (not the actual photo)

For context, let’s look at a little bit of statistics about lending money to family members or friends. According to Bankrate’s latest survey of 2490 U.S. adults, 60% of them have helped a friend or family member by lending money with the idea that it will be reimbursed, while 17% have lent a credit card, and 21% have co-signed for a financial instrument such as a loan or rental.

However, more than a third (35%) of those who engaged in at least one of these activities suffered a negative outcome, such as financial loss, a lowered credit score, or a strained relationship.

To avoid disappointment or harming relationships with close people, CNBC lists 3 rules of thumb for making personal loans that you should follow. To begin with, when lending money, it’s important to make sure that it’s money that you can afford to lend. The second rule is to put everything in writing. It’s not necessary to have it written by a lawyer, “just a simple promissory note.”

And finally, the third rule is to communicate early. It’s important to be as upfront as possible about the amount of money you hope to recover. 39% of Americans said they would choose to let a $100 debt from a friend or family member go unpaid rather than making an effort to recover it.

So, folks, it’s important to follow promises that you made, especially if it’s about paying back money that you borrowed, despite the change in your relationship with that person.

Anyway, what do you think about this revenge? Was it too harsh or too soft? Have you ever been in a similar situation? Share your thoughts in the comments below!

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

39

5