Insurance Guy Begs Couple To Go Back To Their Original Price After Their Malicious Compliance

Despite the premiums we all pay them month after month, insurance companies can be shockingly stingy when it comes to actually helping us. They will wheel and deal, nitpick and obfuscate, in the hope that we simply give up or take the crumbs they offer us.

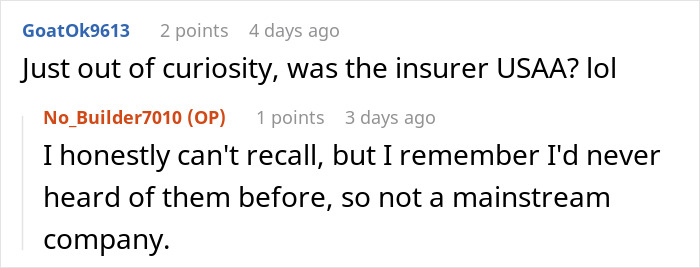

But one netizen had the chance to flip the script and make the insurance company eat its own word when they were told to come back with another quote. OP maliciously complied and did exactly as asked. Readers shared their enjoyment of someone sticking it to a hostile insurance agent and really getting their money’s worth.

Insurance companies will bend over backwards to try and limit the payouts we are entitled to

Image credits: Enver GÜLMEZ (not the actual photo)

So one netizen saw an opportunity for malicious compliance and decided to take it

Image credits: Karolina Grabowska (not the actual photo)

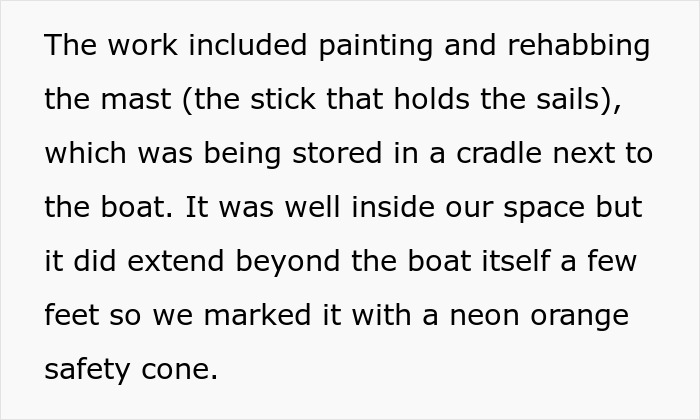

Image credits: u/No_Builder7010

Insurance and boats have a long history together

Image credits: Scott Graham (not the actual photo)

OP isn’t the first and won’t be the last person to have to deal with an insurance agent that will go out of their way to prevent a claim from being honored. Often, insurance companies will maintain somewhat confusing policies or complex contracts in order to limit their own risk, often at the cost of providing good services to their customers. Even if one is using a reputable broker, it’s important to remember that most brokers get the majority of their fees from the insurance provider, not the client that they ostensibly represent. It’s not hard to see the conflict of interest here.

It’s symbolic that OP’s case involved a boat, as many of humanity’s earliest laws around risk prevention and insurance started with ships. For example, one of the oldest law codes in the world, the Codex Hammurabi, had multiple stipulations around the responsibility of ship captains and cargo losses. The Corpus Juris Civilis, which was commissioned by Justinian to codify a thousand years of Roman law, references marine insurance principles written by the city-state of Rhodes and even the Phoenicians around 1000 BCE.

Indeed, until the 14th century, most insurance laws, policies, and concepts were all tied up in ships and cargo, as the sea was still a dangerous, fickle place. No doubt ancient shipowners could relate to OP’s misfortune to have their vessel damaged while at shore. While it’s a modern misconception that contracts are a relatively recent development, it’s quite likely that OP’s story had its own versions even two thousand years ago. While unfortunately, we do not know, arguing with an insurance agent might be more of a time-honored human tradition than we might think.

Insurance companies are often too paranoid about fraud

Image credits: René Ranisch (not the actual photo)

To play the devil’s advocate, vehicle insurance fraud is still quite commonplace. Between 1999 and 2006, there were over 20,000 suspected fraudulent accidents in the UK, where people staged collisions to get overcharged for repairs. This is a shockingly high number, given the amount of cameras and general car knowledge that the average person has. These sorts of scams are perhaps why the agent in OP’s story demands two quotes, as it’s pretty easy to see how a person may collude with a mechanic or boatyard.

Given that the average person doesn’t own a boat and repair facilities are significantly less common than mechanic shops, it may seem that OP was attempting to scam this insurance company. After all, the one thing most of us know about boats is the frequent expenses they incur on their owners. As the saying goes, the two happiest days in a boat owner’s life are the days they buy it and the day they sell it. It may not be that hard to stage an exaggerated claim with a boat, but the agent went overboard by calling a client a scammer without a shred of evidence.

However, the agent should have considered the facts. The US has pretty heavy laws around insurance fraud, including prison sentences of up to twenty years in extreme cases, as well as fines and other punishments. It seems a bit strange for a person with no previous history of scams to risk all that over $2500.

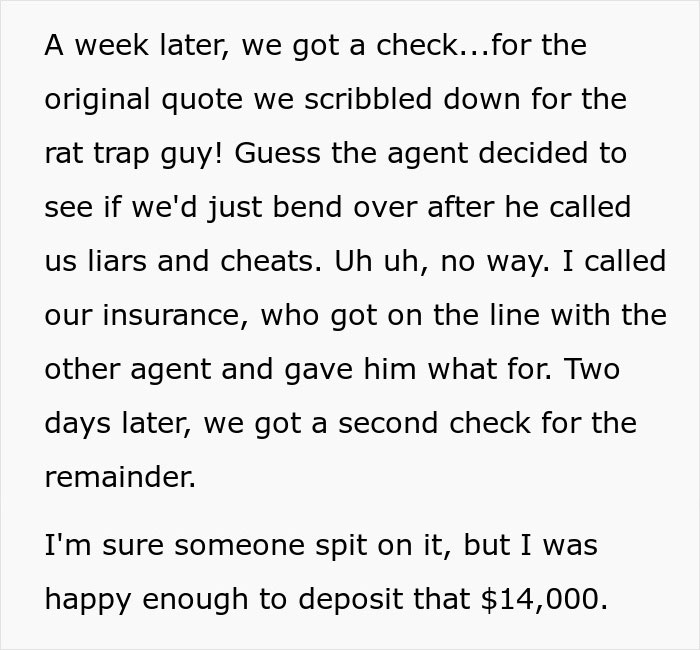

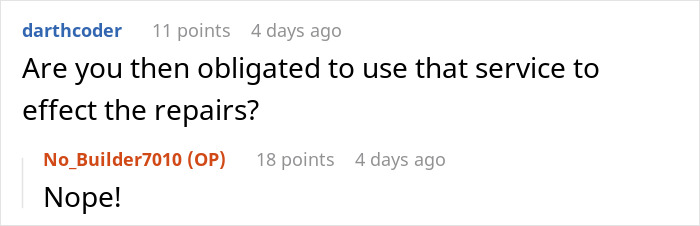

OP answered some reader questions

Other commenters shared similar stories

Explore more of these tags

I've seen this very thing multiple times. First time was my own claim. Lightning ran in on an expensive ($1500)VCR I had (late 80's) Agent insisted I find one as close as possible to the fried one. I tried to get him to just give me $100 so I could just buy one from Wart-Mal but nooo, has to be apples for apples. MC, closest thing I could find was $800. Suddenly he says "but they're $100 at Wart-Mal". But rules are rules so they cut me a check. Next was a guy whose 4 wheeler was stolen by some kids and returned. It was white and they got it dirty (Virginia red clay doesn't really come off), so he wanted all new body panels and some other things that got scratched. I worked for the dealer and had to spend 2 hours writing up the estimate. In the end the guy wanted us to endorse the check over because suddenly he didn't want it repaired. So we charged him 2 hours labor for our trouble and he blew a gasket. Owner let him go without paying so the service manager called the insurance company

Called to report him for fraud and the insurance company told him they didn't care what he does with the money. I've encountered other cases but these 2 always stand out as absurd.

Load More Replies...Had Nationwide adjuster who never viewed property say they would only pay $5200. for: 8' lattice fence blown to smitherines, brick garage wall collapsed with emergency structural support installed and wall rebuilt, 8 custom shutters blown apart, 3 architectural windows and wood frames destroyed, twisted gutters, 2 chimneys damaged, floor to ceiling crack in brick wall on second floor. The guy in another city had a reason why each thing wasn't covered. Contacted public adjuster who said it was too small for him to take on; state ins. department said the insurance wasn't going to cover it because they didn't want to. Repairs cost me close to $35,000.

I'm surprised the insurance company didn't submit the check directly to the company supplying the quote. Usually they want to make sure the money they are paying out goes into what they are paying for.

I've seen this very thing multiple times. First time was my own claim. Lightning ran in on an expensive ($1500)VCR I had (late 80's) Agent insisted I find one as close as possible to the fried one. I tried to get him to just give me $100 so I could just buy one from Wart-Mal but nooo, has to be apples for apples. MC, closest thing I could find was $800. Suddenly he says "but they're $100 at Wart-Mal". But rules are rules so they cut me a check. Next was a guy whose 4 wheeler was stolen by some kids and returned. It was white and they got it dirty (Virginia red clay doesn't really come off), so he wanted all new body panels and some other things that got scratched. I worked for the dealer and had to spend 2 hours writing up the estimate. In the end the guy wanted us to endorse the check over because suddenly he didn't want it repaired. So we charged him 2 hours labor for our trouble and he blew a gasket. Owner let him go without paying so the service manager called the insurance company

Called to report him for fraud and the insurance company told him they didn't care what he does with the money. I've encountered other cases but these 2 always stand out as absurd.

Load More Replies...Had Nationwide adjuster who never viewed property say they would only pay $5200. for: 8' lattice fence blown to smitherines, brick garage wall collapsed with emergency structural support installed and wall rebuilt, 8 custom shutters blown apart, 3 architectural windows and wood frames destroyed, twisted gutters, 2 chimneys damaged, floor to ceiling crack in brick wall on second floor. The guy in another city had a reason why each thing wasn't covered. Contacted public adjuster who said it was too small for him to take on; state ins. department said the insurance wasn't going to cover it because they didn't want to. Repairs cost me close to $35,000.

I'm surprised the insurance company didn't submit the check directly to the company supplying the quote. Usually they want to make sure the money they are paying out goes into what they are paying for.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

53

7