I am very thankful for the financial habits my parents taught me: balancing a checkbook, the importance of saving, and how to budget. It was after I was out of their house, I was introduced to the idea of investment after a few attacks from people who would zealously spout off financial theories. For the most part, I tried to steer clear of those conversations. If a conversation was sprung on me, my tactic was to stand as still as possible (and not blink) and hope the attacker would walk away. Each conversation made me like I could never understand the wasteland of financial and investment theories. Finally, a friend came alongside me and showed me how he was handling his family’s finances. He actually took the time to explain how he was trying do the most with his income to provide for his family, now and in the future, by wisely investing his money. I became slightly obsessed with his strategy on investments and with an ironic and unforeseen career change, I am now a financial advisor.

Needless to say, I want to teach my kids how to not only save money, but also learn investment strategies at a young age. My wife and I are firm believers that it is never too soon to begin training your kids. We communicate what we are doing and why we are doing it, to sometimes an absurd degree. We hold both of our daughters to high expectations and support those expectations with a whole lot of love, communication, and intentional training and direction.

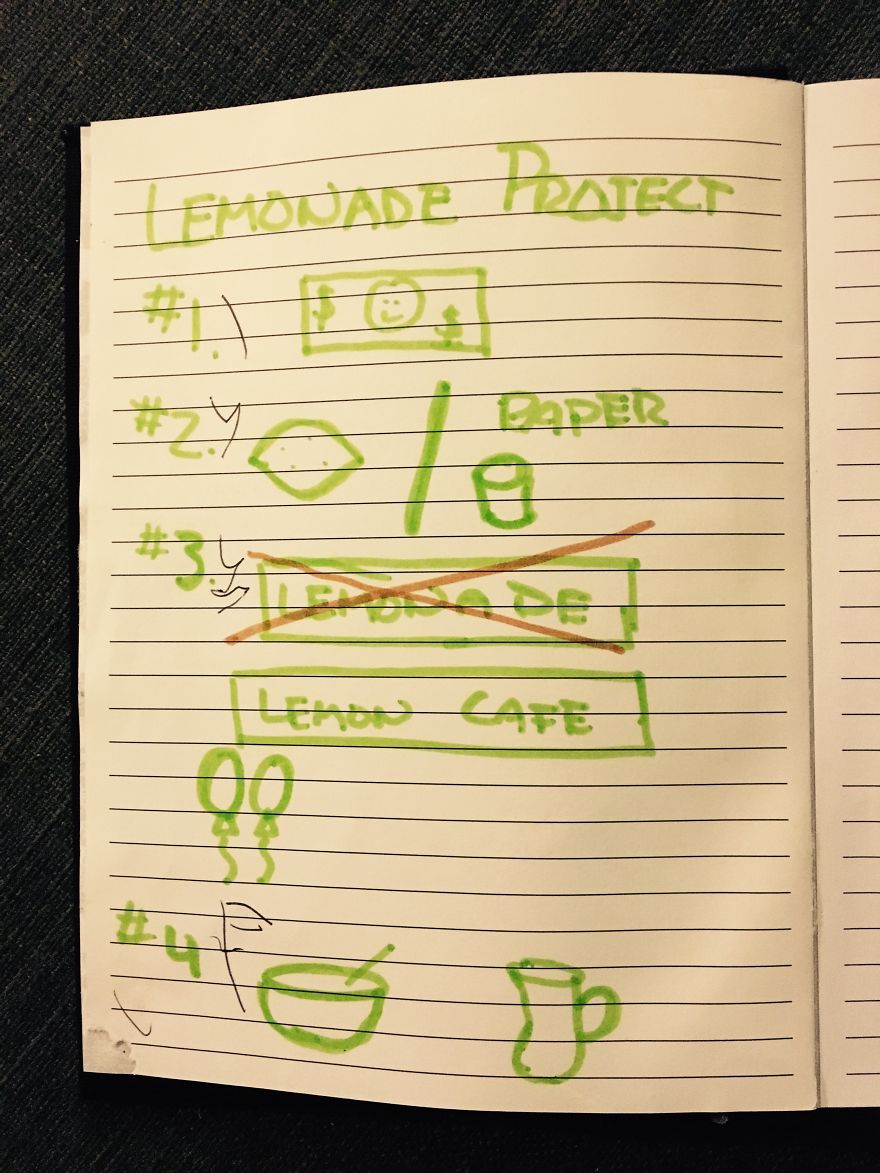

The other day, I was having a little time alone with my thoughts (I was probably in the shower, since I don’t get much other time alone) trying to decide how to introduce what I do for other people to my three year old. As a financial advisor, I only use strategies where you will not lose your money and are not subject to any fees. I firmly believe that your money should stay your money with the potential to grow only, not diminish. One of the best investment strategies I want to pass on to my kids, is learning how to set up a life insurance plan to become, essentially, a family bank. To be able to use this strategy, my kids need to understand the following concepts (not in any particular order):

1. How to save money

2. The idea that you can invest and spend the same dollar at the same time

3. How to take out a loan and pay it back

4. How compounding interest works

To start off, I randomly decided we would work on how to take out a loan and pay it back. I figured this concept can easily be built into one of the oldest of American traditions… the good old-fashioned lemonade stand. This also gave me the ability to teach my sweet, energetic, up-for-anything-three-year-old the main concept of loans and obviously, a ton of little lessons on the way. Here is our story…

Step 1: Making the plan

As parents we are goofy, silly, and spontaneous, but we try to emphasis the importance of making a plan. We planned out our day and then my daughter helped draw pictures of each step.

Step 2: Taking out a loan

This step was key. I wanted my daughter to see the money coming out of our bank account. She told the cashier how much money we needed (in $1 bills), then we counted the money out together. We talked about how we were borrowing the money and we would need to give it back.

Step 3: Buying supplies

As we collected our supplies, we would stop periodically to count our money (just the $1 bills). I wanted her to see the money we borrowed was slowly dwindling.

Step 4: All the hard work

We squeezed a whole lot of lemons and limes. Add some sugar, water, and a sprig of rosemary (let it sit overnight) and we were set to go.

Step 5: Selling in the shade

The next day we set up our stand and put the cuteness factor to the test. Due to state regulations, we needed to do a suggested tip instead of an actual cost. Thankfully no one took advantage of that and kept to our suggested tip.

Step 6: Paying back our loan

After we were done for the day, we went straight to the bank to repay our loan. It worked out perfectly. My daughter was a little sad, so we were able to talk about how we borrowed the money and now we were returning it. In the end she understood, but the reality hurt a little.

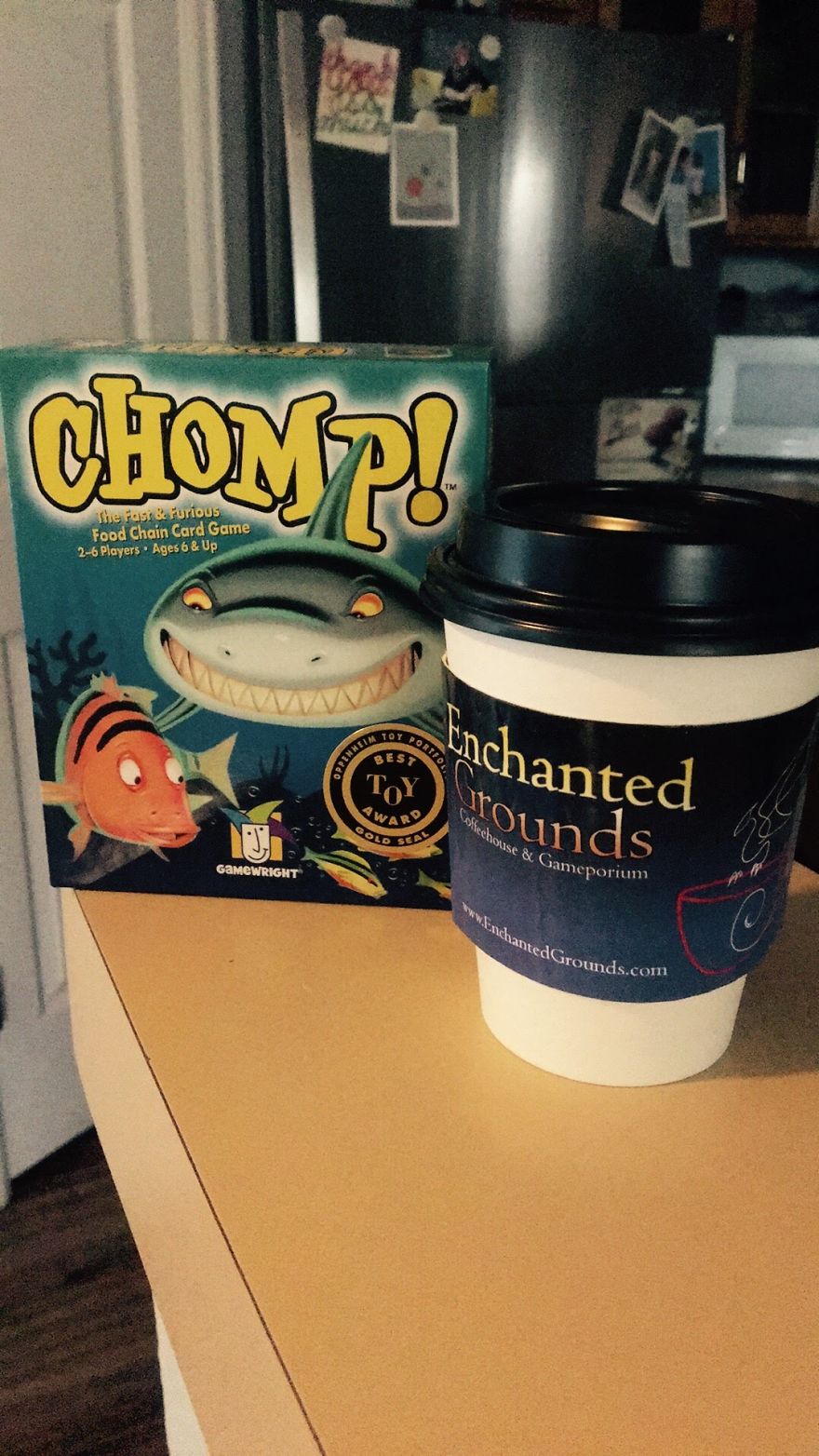

Step 7: Reaping the reward

Right after the bank, we enjoyed our reward, she bought herself a steamer and a game. The day was done and the lesson learned. Next step, now I have to figure out how to teach her that you can use the same dollar for investment and spending at the same time.

16Kviews

Share on FacebookYou almost made me cry! I applaud you and your efforts. I think the BEST step is the part where you said that you take the time to explain 'why'. Once a child understands the 'why' part, the rest will come much easier. PLEASE update us with a "Part II"

While I agree that starting to teach about what matters in life can never be started to early, I am a bit doubtful regarding financial advisory for toddlers. After all, the things that matter most – particularly for children – do not require money, or at least not a lot of it and not usually. And why would you teach about loans, whereas lending money should be prevented as much as possible? Please do not take this as harsh criticism, it is just that when I see a 3-year old with a stack of bank notes I wonder if a colouring book would not be more joyful.

I truly do respect what you said, so here is a little context. I think that intentionality is the best thing we can give to our kids. I can assure you that all of our coloring books are full, our Legos are well used, and our playdough has all dried out. The best part of our day was that it was a project that we did together. She ended the day 10x more proud of herself then I have ever seen. She won't open up a policy with me today, but we learned about borrowing (which applies to toys now and more later). As for adults, I agree that loans generally should be avoided, unless you are borrowing something that is yours, which is what I encourage through life insurance policies. It allows you to maximize the potential of your money.

Load More Replies...The idea is brilliant but I think 10 years old is a better age to start learning about money. At 3 years old the main problem should be eat-sleep-have fun ^^

Most kids have pocket money given to them before 10, it's a good thing to start very early, so they understand the value of money and why mom and dad can't buy everything they want. In this case I think it was done in a playful way and the child had fun along the way. But in the end, you teach your kids about money when you think it's right for them to learn - you're the parent, you decide.

Load More Replies...Kids need to know what hard work is needed to earn money..You really did a great job!

How about teaching your daughter to be more polite, compassionate, a better person, to respect the nature and to think about the others.... The way she is admired the money in this Foto scares me!

She is curious about what it is. She loves learning about new things and is a smart little thing. She loves spending time with her daddy too. It was a great thing they did together! Our daughter is the sweetest, most polite, kind, silly, passionate, caring, and wonderful little girl. You'd just have to meet her someday and listen to her giggles and silly stories to see. She would ask you what your name is and your favorite color and she would tell you, "It's so nice to meet you!". You'd just have to meet her. There is no other way to convince you, otherwise.

Load More Replies...You almost made me cry! I applaud you and your efforts. I think the BEST step is the part where you said that you take the time to explain 'why'. Once a child understands the 'why' part, the rest will come much easier. PLEASE update us with a "Part II"

While I agree that starting to teach about what matters in life can never be started to early, I am a bit doubtful regarding financial advisory for toddlers. After all, the things that matter most – particularly for children – do not require money, or at least not a lot of it and not usually. And why would you teach about loans, whereas lending money should be prevented as much as possible? Please do not take this as harsh criticism, it is just that when I see a 3-year old with a stack of bank notes I wonder if a colouring book would not be more joyful.

I truly do respect what you said, so here is a little context. I think that intentionality is the best thing we can give to our kids. I can assure you that all of our coloring books are full, our Legos are well used, and our playdough has all dried out. The best part of our day was that it was a project that we did together. She ended the day 10x more proud of herself then I have ever seen. She won't open up a policy with me today, but we learned about borrowing (which applies to toys now and more later). As for adults, I agree that loans generally should be avoided, unless you are borrowing something that is yours, which is what I encourage through life insurance policies. It allows you to maximize the potential of your money.

Load More Replies...The idea is brilliant but I think 10 years old is a better age to start learning about money. At 3 years old the main problem should be eat-sleep-have fun ^^

Most kids have pocket money given to them before 10, it's a good thing to start very early, so they understand the value of money and why mom and dad can't buy everything they want. In this case I think it was done in a playful way and the child had fun along the way. But in the end, you teach your kids about money when you think it's right for them to learn - you're the parent, you decide.

Load More Replies...Kids need to know what hard work is needed to earn money..You really did a great job!

How about teaching your daughter to be more polite, compassionate, a better person, to respect the nature and to think about the others.... The way she is admired the money in this Foto scares me!

She is curious about what it is. She loves learning about new things and is a smart little thing. She loves spending time with her daddy too. It was a great thing they did together! Our daughter is the sweetest, most polite, kind, silly, passionate, caring, and wonderful little girl. You'd just have to meet her someday and listen to her giggles and silly stories to see. She would ask you what your name is and your favorite color and she would tell you, "It's so nice to meet you!". You'd just have to meet her. There is no other way to convince you, otherwise.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

207

20