Husband Won’t Give His Wife A Penny From His Inheritance, Gets Mad When She Does The Same After Inheriting A Small Fortune

When they work together, couples can achieve more than singles. So if you’re in a serious commitment, you and your partner should have a calm and honest talk about each other’s financial habits, goals, and fears. Because when people skip it and enter discussions about money only when there’s a problem, their ego can take control of the situation and seriously damage the relationship. Even a marriage.

A few days ago, Reddit user Zealousideal_Fly4786 submitted a post to the “Am I The [Jerk]?” community that perfectly illustrates this tricky and dangerous predicament. In it, the woman describes how her partner used her savings and inheritance against her, bending the rules he himself had established. The story serves as a reminder that communication is key to understanding one another and that having a policy agreed upon in advance is way more effective than trying to put it together on the go.

A woman who inherited a small fortune got into a huge fight with her partner over money

Image credits: Timur Weber

So she asked the internet to evaluate her decisions

To help pave the road to better marital finances and relationships, experts at Investopedia put together some of the most common issues and challenges to look out for:

1. What’s Mine, Yours, Ours. Sometimes, when each spouse works and they can’t agree on financial nuances or find the time to talk about them, they decide to split the bills down the middle or allocate them in some other fair and equitable manner. When the bills have been covered, each spouse can spend what they have left as they want. It sounds like a reasonable plan, but it can build resentment over the individual purchases made. It also divides spending power, eliminating much of the financial value of marriage, as well as the ability to plan for long-term goals such as buying a home or securing retirement. Plus, it can lead to relationship-ruining behavior like financial infidelity, wherein one spouse hides money from the other.

Bill splitting also pushes down the road any planning and consensus-building about how financial burdens will be handled if one spouse loses a job; decides to cut back on hours or take a pay cut to try out a new career; leaves the workforce to raise children, go back to school, or care for a parent; or if there’s any other situation in which one partner may have to financially support the other. Couples owe it to themselves to have a conversation about such contingencies well before any of them happen.

2. Debt. From school and car loans to credit cards and even gambling habits, most people come to the altar with financial baggage. If one partner has more debt than the other—or if one partner is debt-free—the sparks can start to fly when discussions about income, spending, and debt servicing come up.

People in such situations may take some solace in knowing that debts brought into a marriage stay with the person who incurred them and are not extended to a spouse. It won’t hurt your credit rating, which is linked to Social Security numbers and tracked individually. That said, in most states (those that operate under what is called common law), debts incurred after marriage jointly are owed by both spouses.

Note that there are nine states in which all property (and debts) are shared after marriage regardless of individual or joint account status. They are Arizona, California, Nevada, Idaho, Washington, New Mexico, Texas, Louisiana, and Wisconsin. In these community-property states, you are not liable for most of your spouse’s debt that was incurred before marriage, but any debt incurred after the wedding is automatically shared—even when applied for individually.

3. Personality. Personality can play a big role in discussions and habits about money. Even if both partners are debt-free, the age-old conflict between spenders and savers can play out in multiple ways. It is important to know what your money personality is—as well as that of your partner—and to discuss these differences openly.

Briefly, some people are natural savers who may be viewed as cheapskates and risk-averse, some are big spenders and like to make a statement, and others take pleasure in shopping and buying. Others rack up debt—often mindlessly—while some are natural investors who delay satisfaction for future self-sufficiency. Many of us may display more than one of these characteristics at a given time, but will usually revert to one main type. Whichever profile you and your spouse most closely fit, it’s best to recognize bad habits, address them, and moderate them.

4. Power Plays. Power plays often occur in the following scenarios:

- One partner has a paid job and the other does not;

- Both partners would like to be working but one is unemployed;

- One spouse earns considerably more than the other;

- One partner comes from a family that has money and the other doesn’t.

When one or more of these situations is present, the money earner (or the one who makes or has the most money) often wants to dictate the couple’s spending priorities. Although there may be some rationale behind this idea, it is still important that both partners cooperate as a team. Keep in mind that while a joint account offers greater transparency and access, it is not in itself a solution to an unbalanced power/money dynamic in a marriage.

5. Children. To have or not to have? That’s usually the first question. Food, clothing, shelter, Little League, ballet, designer jeans, prom gowns, minivans, and college are all part of a long list of child-related expenses. These don’t include expenses for offspring who have already left the nest. That’s assuming your kids will leave the nest. Some never do.

Of course, having kids isn’t just about the cost. If one partner cuts their hours, works from home, or leaves a career to raise children, couples should address how that changes marriage dynamics, assumptions about retirement, lifestyle, and more.

6. Extended Family. Co-managing finances and respecting the goals, needs, and expectations each spouse has regarding their extended family can be especially tricky.

Take, for example, her mom—she wants a vacation in Vegas. His parents need a new car. Her brother can’t make the rent. His sister’s husband lost his job. Now one spouse is writing a check and the other wants to know why that money wasn’t used to address needs at home or fund a vacation for “us.” When a serious crisis arises—illness, a major storm, an unexpected death—the pressure can be magnified.

Family money dynamics work the other way, too. His mom will pay to fly him home for the holidays. Her mom will fund a new car because the one she’s driving is a Honda, not a Lexus. Her mom buys the grandkids extravagant gifts and his mom can’t afford to match that kind of spending. The joys of a family often extend right into your wallet (pardon the sarcasm).

Of course, it’s impossible for two people to agree on every single thing. But by talking to each other, they can at least set boundaries, compromise, and find a lesser evil than falling apart.

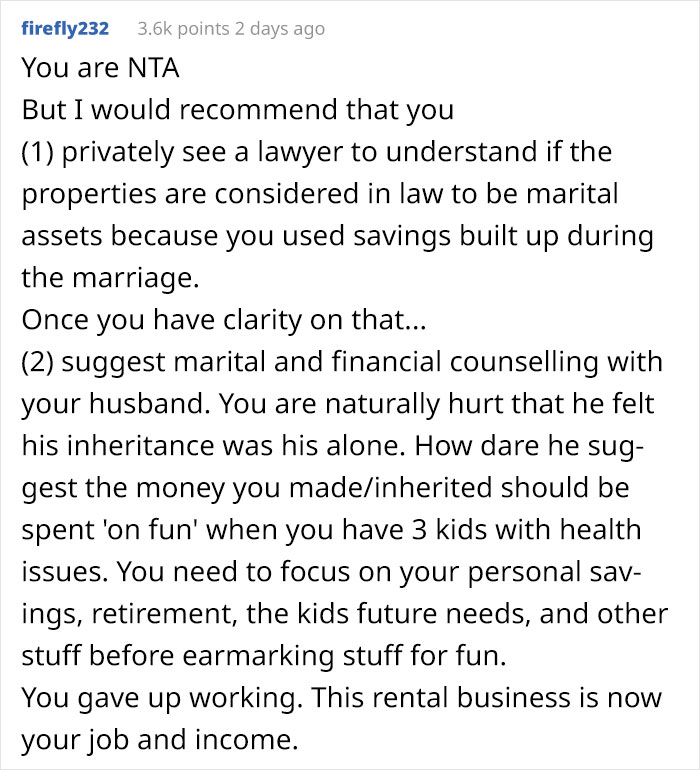

People think there’s nothing wrong with the way the woman handled the situation

According to data from a 2021 study of 1,713 couples conducted by Fidelity, roughly 40% of couples who live together don’t know how much their partner makes.

These results came despite 71% of respondents saying they communicate “very well” with their other half, and 25% saying they communicate about money “exceptionally well.”

So it seems that many couples are hesitant to have full, honest discussions about money. “Life is busy and people don’t necessarily take the time to talk about their finances,” Stacey Watson, senior vice president of Life Event Planning at Fidelity, told CNBC Make It. “Money can be an uncomfortable topic.”

And it is to many. 44% of participants reported that they argue about money with their spouse occasionally, while 20% said money is actually their biggest relationship challenge.

According to Shannon McLay, founder and CEO of The Financial Gym, shame is often the factor that keeps people from being forthcoming with their partner, whether it be about how much money they make or the amount of debt they have.

“People are more comfortable getting physically naked with somebody than financially naked,” McLay noted. “We’ve seen couples who have been married for years, who have children, and don’t know about each [other’s finances].” So sadly, Zealousideal_Fly4786’s case isn’t a standalone example.

There are many different kinds of conversations couples can have about money, but many limit themselves to only discussing basic financial decisions like how much they spend on vacations or their children’s education. But it’s all about context. The bigger picture.

“There’s a difference between making financial purchase decisions and sharing financial details,” McLay highlighted. “It’s great that you can have those conversations about purchases, but if you don’t know the digits, then you’re making decisions from a flawed perspective.”

As a starting point, McLay recommends that couples talk about their respective salaries, savings, credit scores, investments, and debt. She believes it’s crucial for couples to share information because it could be a major factor in larger decisions, such as taking out a loan or, like in our story, buying a house.

For couples wondering how to begin, Fidelity’s Stacey Watson suggests arranging a monthly date night where partners agree to discuss financial topics completely judgment-free. But if one partner still feels uncomfortable, she said that bringing in an expert, like a financial planner, could be helpful. “Both partners being involved in the decisions is going to lead to a better financial future,” Watson said.

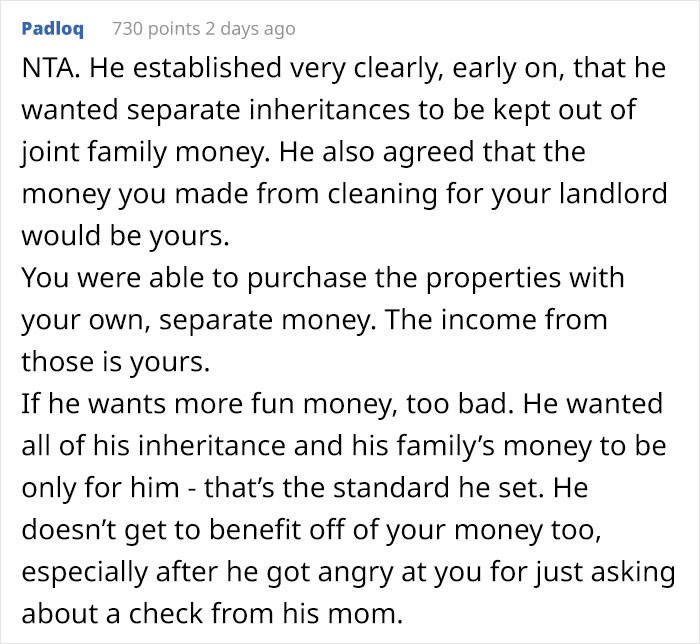

After her story went viral, she posted an update, sharing the latest developments

468Kviews

Share on Facebook"He can help with the house and kids when he gets off work" - excuse me? So he doesn't do any of this right now? How these people find each other and get married I'll never know...

They get too far down the line qnd think there's no other alternative

Load More Replies...Definitely. It seems to me that he wanted to keep her from having money. Not wanting that she works, later only allowing a small job for a bit of cash and not sharing the insurance. It seems that he,as many abusive men, wants her to be financially dependent on him.

Load More Replies..."He can help with the house and kids when he gets off work" - excuse me? So he doesn't do any of this right now? How these people find each other and get married I'll never know...

They get too far down the line qnd think there's no other alternative

Load More Replies...Definitely. It seems to me that he wanted to keep her from having money. Not wanting that she works, later only allowing a small job for a bit of cash and not sharing the insurance. It seems that he,as many abusive men, wants her to be financially dependent on him.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

![“[Am I The Jerk] For Telling My Mom I Won’t Help With Sister’s Wedding Prep After Giving Birth?”](https://www.boredpanda.com/blog/wp-content/uploads/2025/01/refusing-help-preparing-wedding-baby-coverimage.jpg)

130

75