“I’m Stuck Living With My Parents Because I Can’t Afford Anything”: Online Discussion Ensues After Guy Rants About Absurd Housing Prices

There are certain milestones in life that everyone achieves as they come naturally walking the path of life, like finishing school and getting your first job. Many people would say that another one of their goals is owning a home, regardless of whether it would be meant for starting a family or living on your own.

However, the complaints of not being able to afford property are getting louder and louder. Young people are forced to live with their parents because they can’t afford either a mortgage or rent. They compare what their parents earned and what they paid for their homes and they feel complete despair.

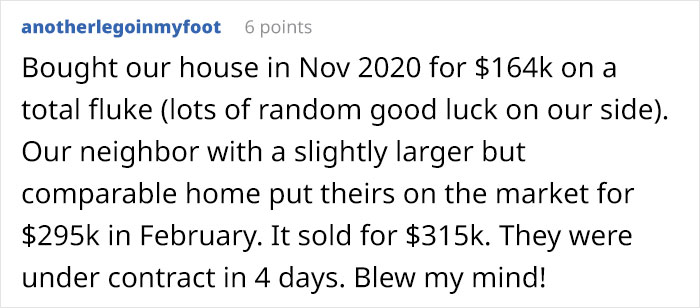

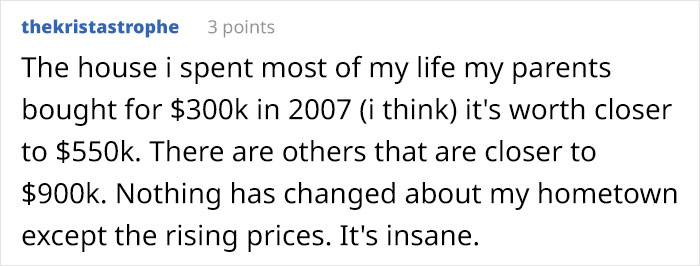

One of those young people who has lost hope of becoming a homeowner is a Reddit user named _TYFSM. The realization came after seeing a house that was worth $185k in 2014 go up in price 5 times in a span of 8 years. And the comments under the post prove that this wasn’t an isolated incident and actually a lot of people share the same frustration.

More info: Reddit

A 26-year-old man who was dreaming of owning a house is now in despair seeing the prices and doesn’t believe he could ever afford one

Image credits: tkoch (not the actual photo)

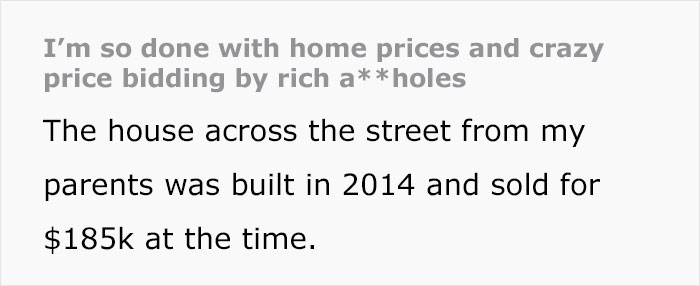

The Original Poster (OP) is a 26-year-old man who now lives with his parents in a suburb of Dallas, Texas and he doesn’t think that he could ever buy a house. He explained that in 2014, when he had just entered college, there was a house built across the street from his parents. Then the property was sold for $185k.

As _TYFSM was getting an education, he dreamt of owning such a small simple home like the one he witnessed being bought. His plan was to work really hard until he was 30 and with the help of his spouse, his young family would be able to afford to get a loan and own a house.

This same house was up for sale again and this time it was priced at $540k. And when it was sold 4 days later, the new owners paid $935k.

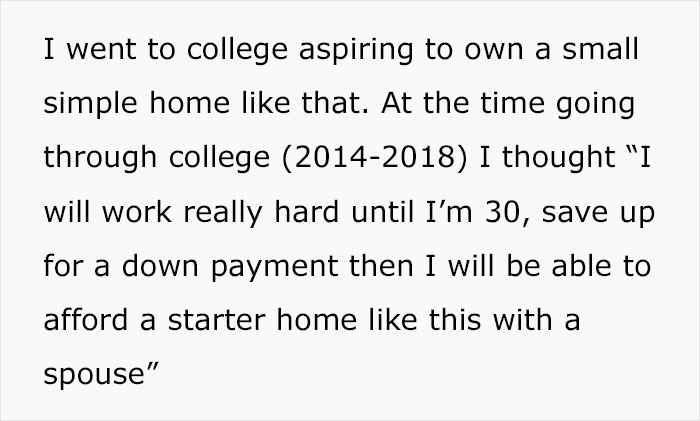

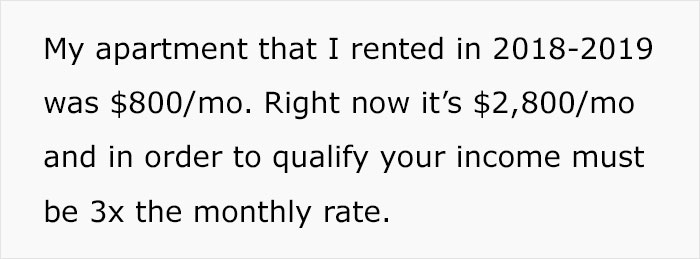

The situation with rent isn’t more consoling either. A few years ago the man was renting and his monthly payments were $800. Paying that much, he managed to save up some money and buy a car. Now, if he were to rent in the same place, he would have to pay $2,800 and the landlord only allows tenants who earn 3 times more than the monthly rate.

The realization came when he remembered how much a house across the street from his parents cost in 2014 and for how much it was sold just recently

Image credits: _TYFSM

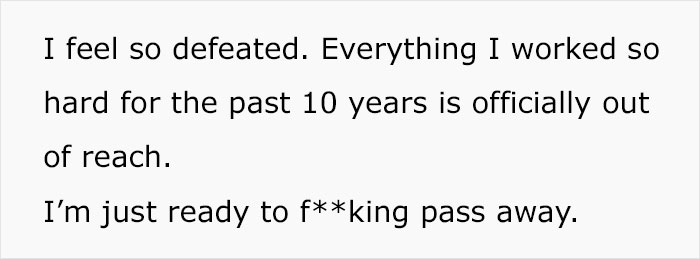

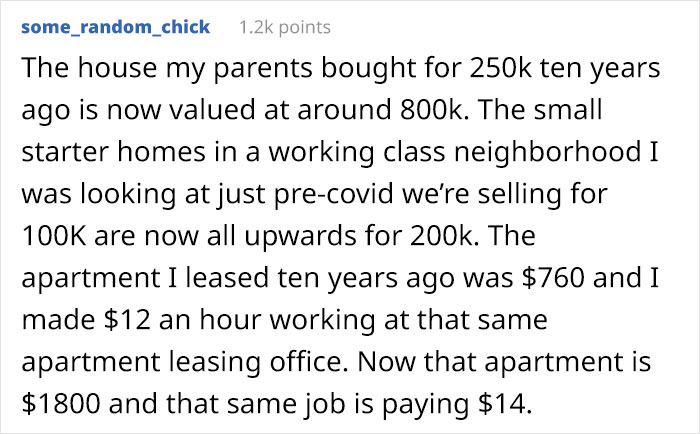

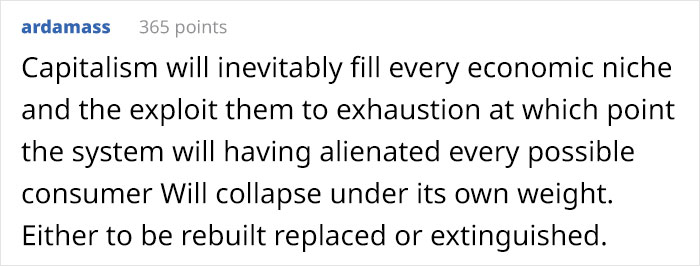

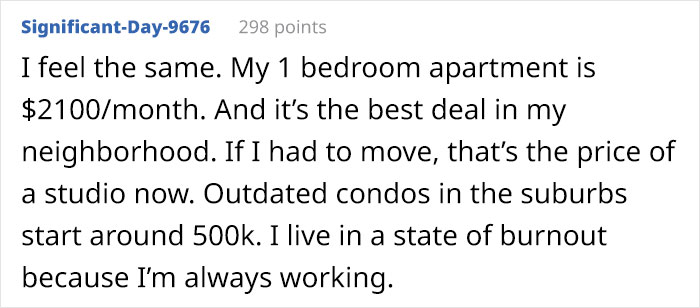

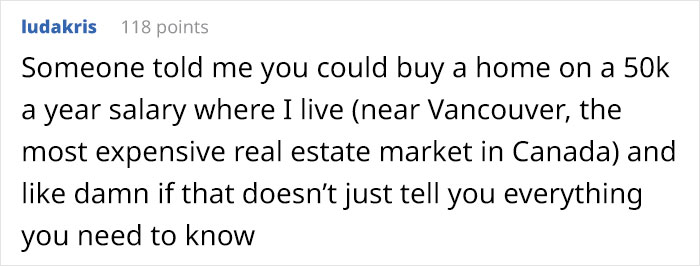

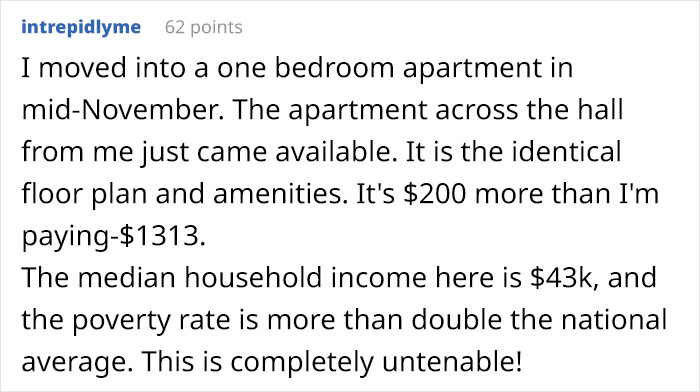

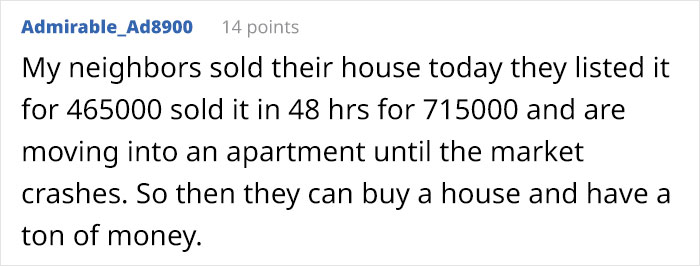

The numbers are depressing and not being able to afford anything when you worked so hard is frustrating. What is more, this is not just _TYFSM’s problem as many people in the comments related and shared their own observations of house and rent prices increasing at astronomical rates.

What is even scarier is that the people who agreed with _TYFSM shared that they earn $70k or under $100k a year, which seems like a solid salary, but they also live with their parents just to save money, because if they were renting, they wouldn’t have any money to put into savings.

The problem of not being able to afford to buy a house is the first reason Investopedia, an online source educating people about finances and economics, mentioned while listing why Millennials aren’t buying homes.

Millennials are also still paying their student debts and banks are requiring a 20% down payment, which steadily rises as house prices increase.

They also point out a couple of reasons that are less related to finances, like preferring living in urban areas and not getting married or having children, which often are reasons why people buy houses.

He is already living with his parents as he can’t afford anything because rent prices are increasing at the same pace as property prices

Image credits: _TYFSM

Advice like stop buying avocados and $4 coffee, which became a meme thanks to Australian millionaire Tim Gurner, doesn’t help and just fuels the frustration Millennials feel. Even if you take this advice seriously, it would take years for you to save up for a down payment as you would be saving a couple of hundred dollars a month, and that’s if you usually treated yourself with that coffee every day and ate the avocado toast at least a few times a week.

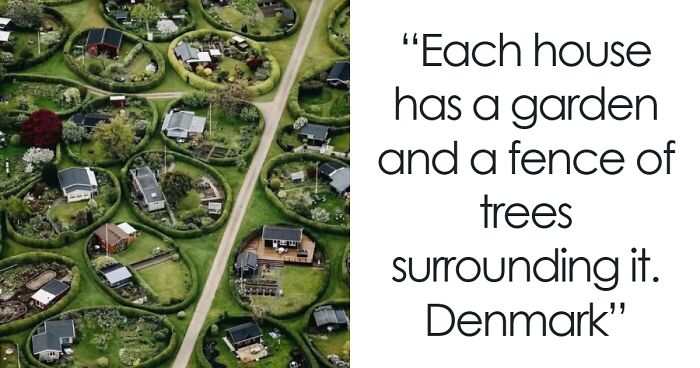

While older people like to accuse Millennials of not working and earning enough, young people tend to blame house prices, which are increasing more rapidly than people’s wages. According to The Organisation For Economic Co-Operation And Development, the average wage in the US in 2000 was $38,968 in today’s currency and it increased to $69,329 in 2020. So it grew about 78 percent.

By the S&P/Case Shiller U.S. National Home Price Index, which tracks the change in value of single-family homes, the index value in January 2000 was 100 and in 2021 it amounted to 278.69, which means there was a 178 percent increase in house prices in the last two decades.

And it’s hard to deny the numbers which show that salaries don’t grow as fast as prices, which doesn’t give any consolation

Image credits: _TYFSM

Image credits: Gadini (not the actual photo)

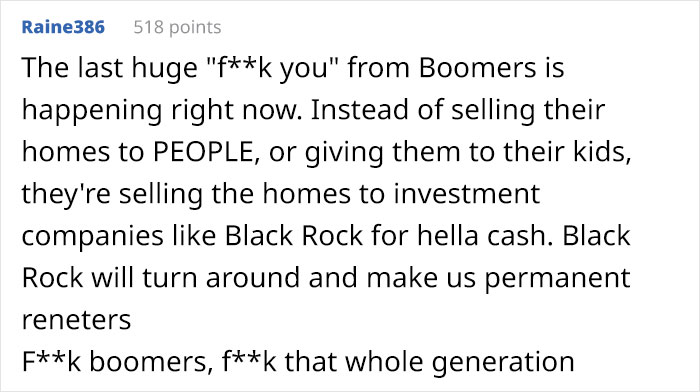

As Forbes Advisor explains, house prices are increasing because there is high demand and not that much supply. And according to the law of demand, that leads to higher prices as buyers will then demand less of that good.

The supply is low because after building a lot of houses in the early 2000s, the bubble burst and that is when the financial crisis began. Some builders went out of business, construction workers lost their jobs and people were reluctant to start building again. What is more, current home owners are not willing to sell their houses even though they can’t take care of them.

The issue is complex and there is no simple solution. But even if _TYFSM doesn’t see any hope, after his post was shared on Twitter by @JoshuaPotash, it actually went viral and got over 200k likes. People in the comments were more hopeful and advised people to consider moving to less populated places and avoid metropolises.

Are you more on _TYFSM’s side and think that only the rich will be able to own homes in the future? Or do you agree with some of the Twitter users who still think it’s possible, but you would have to broaden your geographical options? Let us know in the comments!

People in the comments didn’t give hope either because many of them are in the same situation as the OP

Navigating the challenges of the housing market today can feel overwhelming, especially for those trying to make sense of skyrocketing prices alongside stagnant wages. However, wisdom from those who’ve experienced life’s ebb and flow can offer some clarity. Discussions about the financial hurdles young people face can benefit from exploring insights shared by seasoned individuals, offering a refreshing perspective on handling life’s obstacles.

Consider delving deeper into the life lessons shared by experienced seniors for some unconventional yet thought-provoking guidance.

207Kviews

Share on FacebookIt is not only boomers who are selling their houses for ridiculous above market prices; it's everybody and anybody. Investors are not only buying up homes and apartments with cash, but also the properties where mobile homes sit and then raising the rents. This is NOT a generation issue, it's a rich investor vs nearly everyone else issue. I suspect that in time, this housing bubble will burst. Hang in there!

Many of the 'boomers' I know are staying put, because their mortgages are paid or very low, and they know if they sell and have to buy another place, the price will be prohibitive. Or if they sell, they usually have good reasons like medical bills, aging and needing extended care, gifting the money to children. I don't know why so many want to blame boomers when wall street and their kind are young people. The housing prices are insane and feel immoral to me. I had a little house once that I paid $64000. That same house is currently listed for over $900,000. Same house, exterior looks the same, some updates on the inside, but that's all..

Load More Replies...It's not fair to always blame the boomers for all the troubles in the lives of the young adults today. These same boomers are still very much supporting their adult children out of necessity too, and its effecting their own ability to retire and have any $ left for their own needs in that stage of their lives. Its a scary strange uncertain time for everyone

And not all boomers are rich and have a house. It's not old versus young, but rich versus poor.

Load More Replies...I’m admittedly from that bubble of privilege, because I grew up in San Francisco. When my grandparents retired, they moved to Mtn. View, in what is now known as Silicon Valley. They bought their SF home for $60K and it’s now valued at $3.7M, but stilled owned & lived in by family. Their Mtn. View “golden years” home was $80K. They paid off their mortgage in the early 90s. I inherited it in 2001 and sold it for $880K which allowed me to buy my SF home, for just under $1M. It’s now valued at triple. If I hadn’t been absolutely blessed with family that invested in home ownership in the right places, I’d never own one. No one had any idea the peninsula would become what it is nor did anyone think old homes in random neighborhoods of SF would ever increase in value so drastically.

I am peanut butter AND jealous. I grew up on the peninsula, just south of SF for those who are reading and don’t know. Have never owned my own place, only rent. Now I’m renting in Santa Rosa. But I actually love it up here… not as crowded, people are remarkably friendlier. I would love to own my property but given that I’m 39, that ship has probably sailed at this point.

Load More Replies...It is not only boomers who are selling their houses for ridiculous above market prices; it's everybody and anybody. Investors are not only buying up homes and apartments with cash, but also the properties where mobile homes sit and then raising the rents. This is NOT a generation issue, it's a rich investor vs nearly everyone else issue. I suspect that in time, this housing bubble will burst. Hang in there!

Many of the 'boomers' I know are staying put, because their mortgages are paid or very low, and they know if they sell and have to buy another place, the price will be prohibitive. Or if they sell, they usually have good reasons like medical bills, aging and needing extended care, gifting the money to children. I don't know why so many want to blame boomers when wall street and their kind are young people. The housing prices are insane and feel immoral to me. I had a little house once that I paid $64000. That same house is currently listed for over $900,000. Same house, exterior looks the same, some updates on the inside, but that's all..

Load More Replies...It's not fair to always blame the boomers for all the troubles in the lives of the young adults today. These same boomers are still very much supporting their adult children out of necessity too, and its effecting their own ability to retire and have any $ left for their own needs in that stage of their lives. Its a scary strange uncertain time for everyone

And not all boomers are rich and have a house. It's not old versus young, but rich versus poor.

Load More Replies...I’m admittedly from that bubble of privilege, because I grew up in San Francisco. When my grandparents retired, they moved to Mtn. View, in what is now known as Silicon Valley. They bought their SF home for $60K and it’s now valued at $3.7M, but stilled owned & lived in by family. Their Mtn. View “golden years” home was $80K. They paid off their mortgage in the early 90s. I inherited it in 2001 and sold it for $880K which allowed me to buy my SF home, for just under $1M. It’s now valued at triple. If I hadn’t been absolutely blessed with family that invested in home ownership in the right places, I’d never own one. No one had any idea the peninsula would become what it is nor did anyone think old homes in random neighborhoods of SF would ever increase in value so drastically.

I am peanut butter AND jealous. I grew up on the peninsula, just south of SF for those who are reading and don’t know. Have never owned my own place, only rent. Now I’m renting in Santa Rosa. But I actually love it up here… not as crowded, people are remarkably friendlier. I would love to own my property but given that I’m 39, that ship has probably sailed at this point.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

95

125