“I Don’t Think I’ll Ever Get A Job Again”: High Schooler’s Realization About Taxes Goes Viral

Amber Marie is a 23-year-old high school English teacher who just witnessed one of her students get a lesson on the economy.

Recently, she noticed the teen was clearly going through a rough patch, so she struck up a conversation and realized it was because of the girl’s job. More specifically, her very first paycheck.

After receiving it, the student realized the difference between the amount the employer was paying for her work and the sum that was reaching her pocket, due to taxes.

In one way or another, taxes follow us throughout our entire lives, and this teacher just shared a video, explaining how one of her students had realized it

Image credits: Mikhail Nilov (not the actual photo)

“I had a student walk into my class today and she was so angry. I could tell right off the bat she was not in a good mood”

“I’m like, ‘Hey, girl, what’s up?’ And she’s like, ‘I can’t even today, this is the worst day of my life. Nothing is worth anything anymore.’ And I’m like, ‘What do you mean, what happened?’ She’s like, ‘Well, I got my first job last week and I worked 32 hours.’ I’m like, ‘Wow, 32 hours is a lot for a high school student, but that’s good.’ And she’s like, ‘I finally got my first check. And I’m supposed to be getting paid $17 an hour, for 32 hours. I did the math, I know how much money I was supposed to make. And then I got my check. And it was way less.'”

Image credits: amber.marie44

“‘The taxes took up almost half of my entire check. I knew that people hate taxes, But I didn’t realize that they were taking hundreds of dollars out of every paycheck.’ I was like, ‘Oh yes girl, welcome to America.’ And then she was saying how it doesn’t even make it worth it to work anymore, because the amount of work that she’s putting in does not correlate to the amount of money that she’s getting. And she asked me, ‘Do they do this to your check too?’ And I said, ‘Yeah, they do to everybody’s check. Everyone gets taxed.'”

Image credits: amber.marie44

“She was like, ‘I think I’m going to quit my job and I don’t think I’ll ever get a job again because that’s insane. Why am I working to only get half of the money I made?’ Girl, preach it because I get it. It made my heart so sad for her because I knew how excited she was to get this job and knew all the things that she wanted to buy when she finally got her first paycheck, and how excited she was to finally have her own money. And then to realize that she’s not going to be getting paid what she thought she was getting paid. It hurts. I remember my first check, I remember the heartbreak.”

Image credits: amber.marie44

Image credits: amber.marie44

The clip has since gone viral

@amber.marie44 Why we need to be teaching high schoolers ab taxes 😪 #teacher #teachersoftiktok #teachertok #teachersbelike #teacherlife #teachertiktok #taxes ♬ original sound – amber

Image credits: Lukas (not the actual photo)

Speaking globally, the taxes in the US are low

According to data collected by the Organisation for Economic Co-operation and Development (OECD), the tax-to-GDP ratio in the United States did increase by 0.8 percentage points from 25.8% in 2020 to 26.6% in 2021, but if we zoom out and look at a wider time scale, the same measurement in the country has decreased from 28.3% in 2000 to 26.6% in 2021.

The US ranked 32nd out of 38 OECD countries in terms of the tax-to-GDP ratio in 2021, with the average standing at 34.1%.

The income tax system in the U.S. is considered a progressive system (although it has been flattening a bit in recent decades). For 2023 and 2024, there are seven tax brackets with rates of 10%, 12%, 22%, 24%, 32%, 35%, and 37%. (There were 16 tax brackets in 1985.)

The student mentioned in the video couldn’t have given away half of her hard-earned money, since the top individual tax rate stands at 37%, which, when you put things into perspective, isn’t a high number either. This figure is lower than that in 17 out of 27 European Union countries.

For comparison, the countries with the highest tax rates there are Denmark (56%) and Austria (55%).

Outside of Europe, Israel (50%), Australia (45%), China (45%), and South Africa (45%) all have higher top rates than the U.S. Countries with lower top tax rates included Guatemala (7%), Norway (22%), Brazil (27.5%), and Canada (33%).

Governments use taxes to help fund public works and services, and to build and maintain their infrastructure, including the roads we travel on to the schools we attend.

However, this can be a great learning opportunity for the teen, since a person who enters the workforce needs to understand the impact of having taxes withheld from their pay.

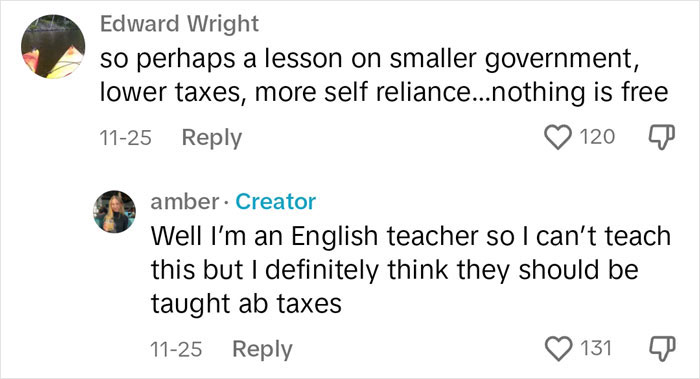

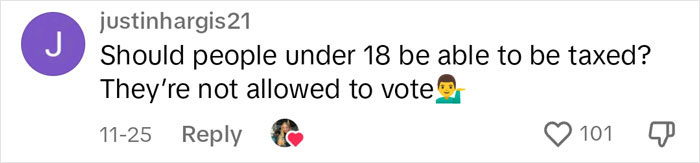

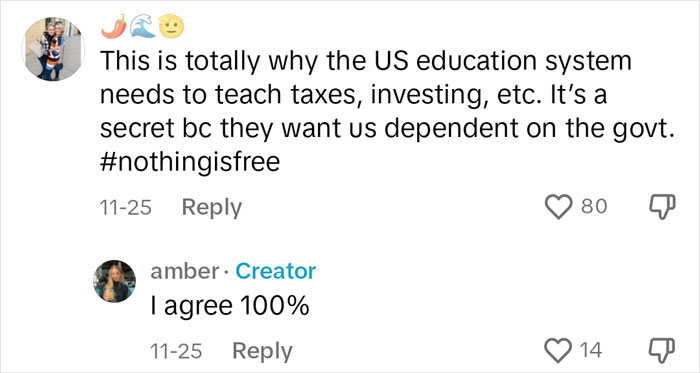

And it ignited a heated discussion on TikTok

It's a BS story. The federal and state tax due on a 28,800 annual salary is about $4500 in California, a high income tax state. That figure includes state and federal income tax, social secuity, and medicare. Unless they royally screwed up her payroll deductions this is a c**p story. In California, you'd get to a 50% tax rate on a $2,500,000 annual income. No high school kid is paying 50% on a part-time job.

She'll get some back when she files, but yes with the first job people don't understand deductions and the paycheck can show a 50% tax rate. She'll learn after filing

Load More Replies...I’d like to know what the people who say, “Have a conversation about smaller government, more self-reliance, blah, blah, blah,” think happens when we have to pay for everything ourselves out of pocket. Like, do they think it’s going to cost less? I’d like to see someone actually crunch the numbers because it sounds like an ideological position rather than anything fact-based. And, sorry, but a kid isn’t paying half her income to taxes. That just isn’t possible; she needs a lesson in how to fill out a W-2, what withholding and dependents are, etc. Her tax rate should be less than $25%. Rather than just whining about how “taxes suck,” maybe actually teach about tax brackets, marginal tax rates, what taxes pay for and the like. Also, who is going to finance the lifestyle she very likely envisions for herself is she isn’t going to work just because she has to pay some taxes? There are definitely some topics for discussion rather than moaning about taxes.

It's amusing -- she's in high school, so she's getting benefits from the government right there, has been for ten or twelve years already. Things cost money.

Load More Replies...I don't know how taxes work in the US but shouldn't she be getting back most, if not all of it, after a tax declaration? There must be a tax-free amount for low earners, which a kid surely is, since she can't work full time all year (and shouldn't be allowed to).

She filled out her tax withholding form wrong somehow. $17 x 32 = $544/week. $544 x 4 weeks = $2,176/month. $2,176 x 12 = 26,112. Her tax rate should put her in the neighborhood of $1,876 per month. That's $300/month in federal taxes. Figure another $100/month in state tax (on average at that payrate). She should see a deduction of roughly $400 per month, at most. She either filled out her tax withholding form very wrong, or she's full of it for a viral internet story.

Load More Replies...It's a BS story. The federal and state tax due on a 28,800 annual salary is about $4500 in California, a high income tax state. That figure includes state and federal income tax, social secuity, and medicare. Unless they royally screwed up her payroll deductions this is a c**p story. In California, you'd get to a 50% tax rate on a $2,500,000 annual income. No high school kid is paying 50% on a part-time job.

She'll get some back when she files, but yes with the first job people don't understand deductions and the paycheck can show a 50% tax rate. She'll learn after filing

Load More Replies...I’d like to know what the people who say, “Have a conversation about smaller government, more self-reliance, blah, blah, blah,” think happens when we have to pay for everything ourselves out of pocket. Like, do they think it’s going to cost less? I’d like to see someone actually crunch the numbers because it sounds like an ideological position rather than anything fact-based. And, sorry, but a kid isn’t paying half her income to taxes. That just isn’t possible; she needs a lesson in how to fill out a W-2, what withholding and dependents are, etc. Her tax rate should be less than $25%. Rather than just whining about how “taxes suck,” maybe actually teach about tax brackets, marginal tax rates, what taxes pay for and the like. Also, who is going to finance the lifestyle she very likely envisions for herself is she isn’t going to work just because she has to pay some taxes? There are definitely some topics for discussion rather than moaning about taxes.

It's amusing -- she's in high school, so she's getting benefits from the government right there, has been for ten or twelve years already. Things cost money.

Load More Replies...I don't know how taxes work in the US but shouldn't she be getting back most, if not all of it, after a tax declaration? There must be a tax-free amount for low earners, which a kid surely is, since she can't work full time all year (and shouldn't be allowed to).

She filled out her tax withholding form wrong somehow. $17 x 32 = $544/week. $544 x 4 weeks = $2,176/month. $2,176 x 12 = 26,112. Her tax rate should put her in the neighborhood of $1,876 per month. That's $300/month in federal taxes. Figure another $100/month in state tax (on average at that payrate). She should see a deduction of roughly $400 per month, at most. She either filled out her tax withholding form very wrong, or she's full of it for a viral internet story.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

-6

56