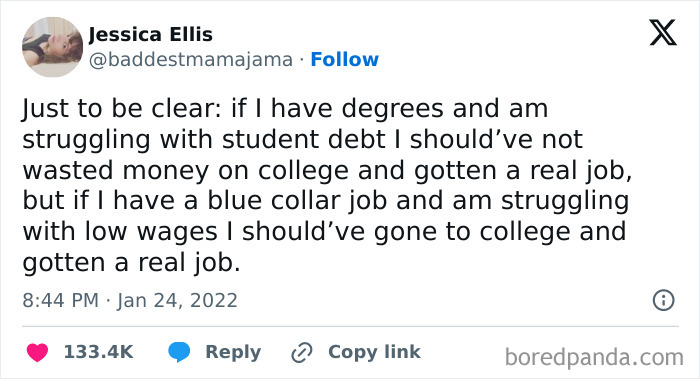

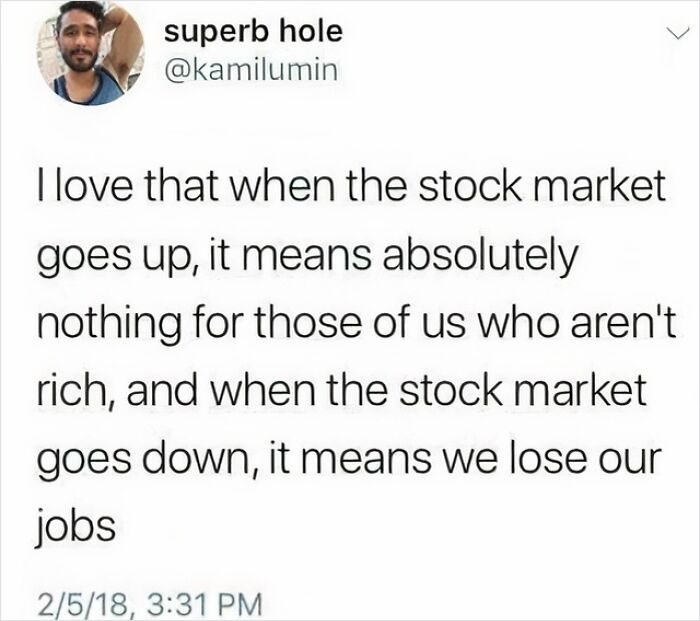

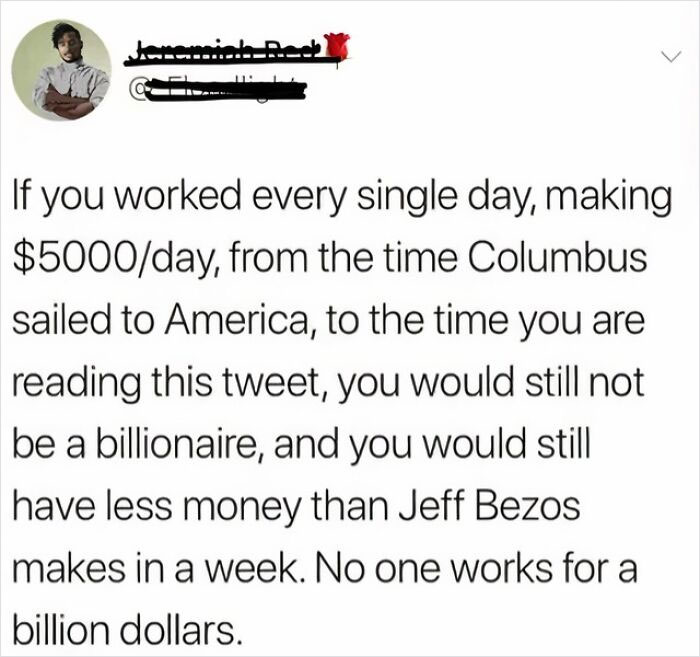

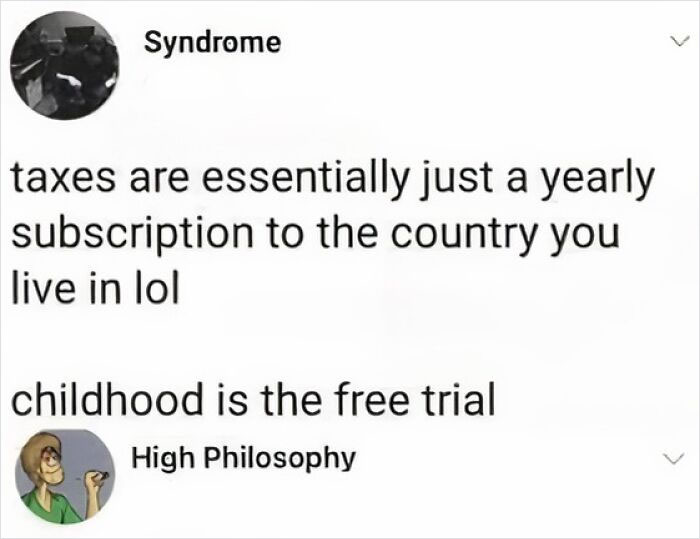

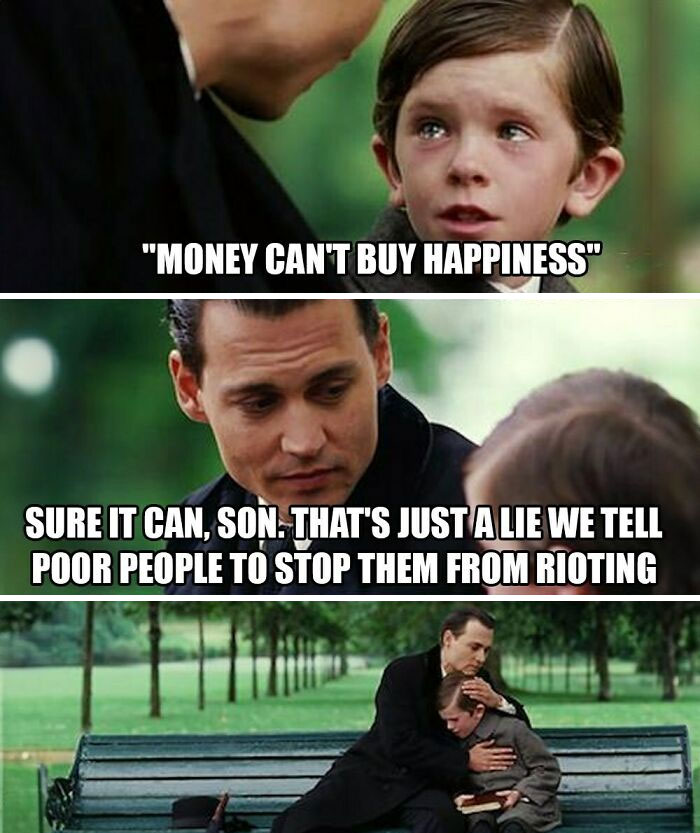

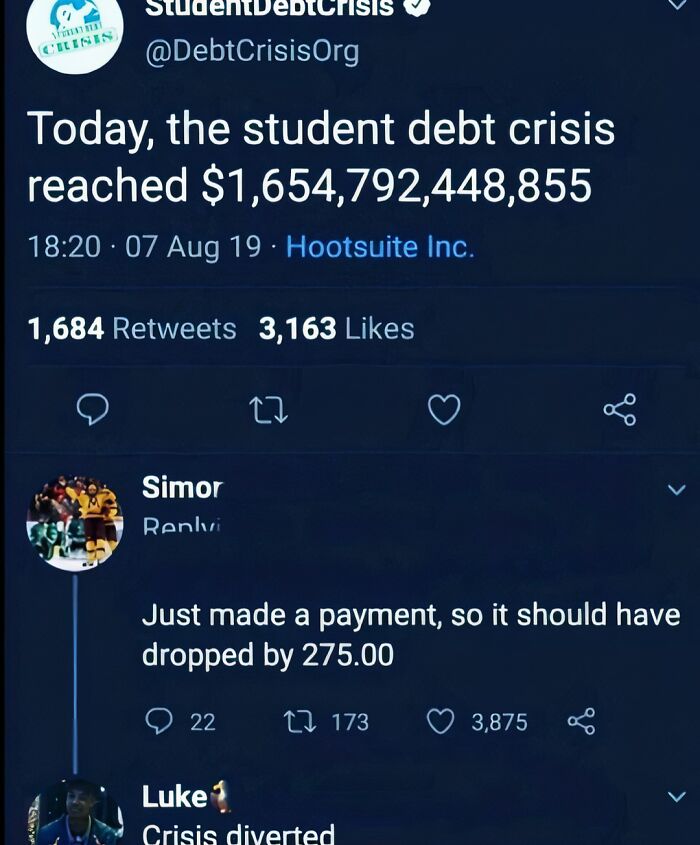

50 Funny Memes Mocking The Absurdity Of Today’s Economy, Shared By This Instagram Account

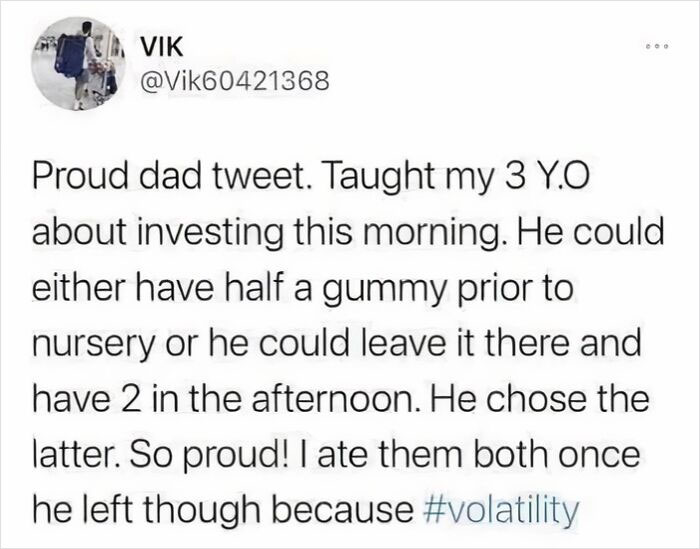

Some might argue that memes are the currency of the internet, but a more accurate assessment is that they are like stocks, with rising and falling value based on just how many people think they are a good choice. At the end of the day, digital content currency isn’t what pays the bills, but we can still get a solid laugh out of it.

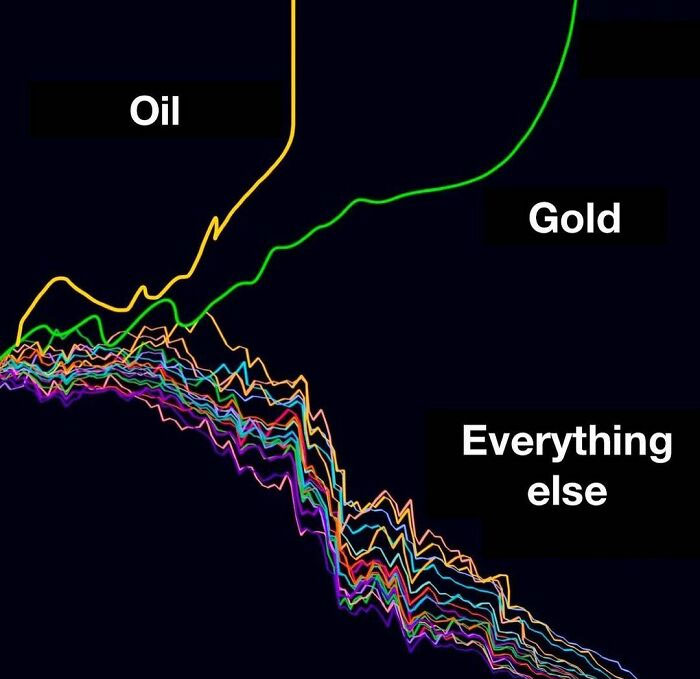

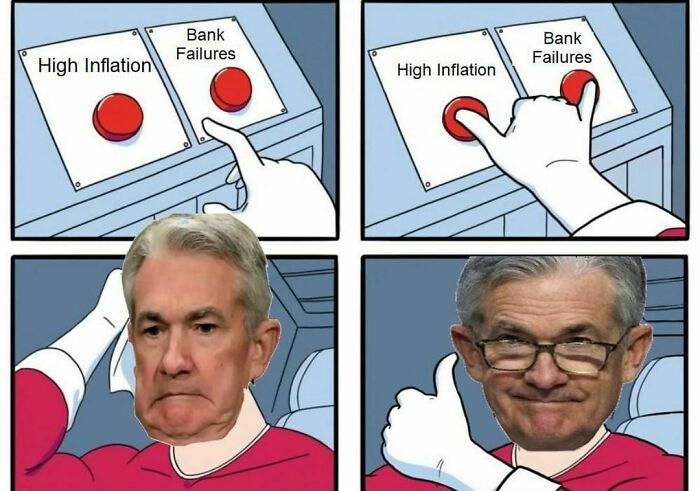

The “Wall Street Memes” IG page is all about the funny and often painfully relatable reality of money. So get comfortable as you scroll through, diversify your snack portfolio, upvote your favorites and be sure to share your thoughts in the comments below.

More info: Instagram

This post may include affiliate links.

And when Trump takes over, you will lose your jobs if you are a Federal employee.

As often as some folks might see all this talk of debt, finances and financial instruments as overwhelmingly modern, the truth is that ever since we’ve started putting seeds in the ground, we’ve had a need to do more than just barter. Money, in the shape of a useful commodity, is multiple thousands of years old, which naturally means that laws around debt, contracts and payments are nearly as old as well.

The law code of Hammurabi, often considered the first codified legal system around, has multiple examples of property laws, including provisions for limiting debt collections from drought-hit farmers.

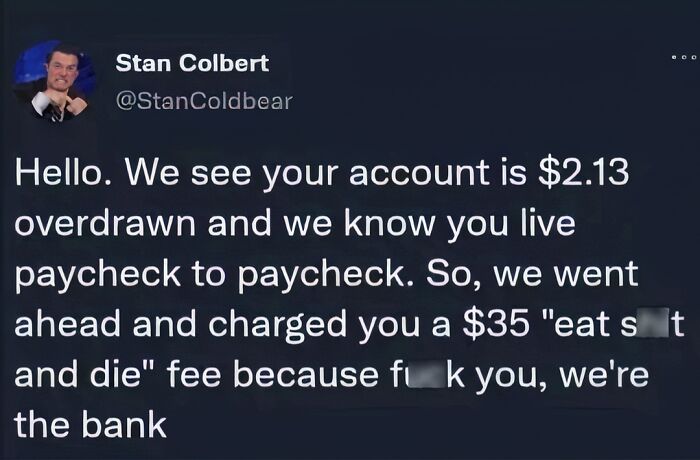

I'd argue there should be some sort of deterrent otherwise everyone would be thousands overdraft, but it should be proportional to whatever amount you're overdrawn

Load More Replies...There are so many fees that are only charged to the people that can least afford them. Overdraft fees are just one of then. It's expensive to be poor.

Ancient history, but had a "the check is in the mail" incident. It was going to cover my expenses while waiting to be paid. Except it wasn't sent when they said it would be.And it was just over half of what it was supposed to be. And I'd written 17 checks in the meantime. And the bank cashed the biggest one, even though it was written next to last, and bounced 13 of the others. At their base fee of $25, and individual store fees of $15-$35. Wiped out that next paycheck entirely. Living paycheck to paycheck for years on end erodes ones nerves and self-confidence. Realizing one day that you aren't any longer is like seeing a double-rainbow at dawn.

Already started. During covid, i had to dip into savings. Noticed a $12 fee. Below minimun balance. Closed my account.

Load More Replies...They not only kick you when you're down, they kick you twice! While some twit has almost three hundred billion dollars, and wants more! Yay capitalism.

We've used a credit union for decades. When we moved out of state and had to open a new account, we thought we'd try a bank. Turns out the credit rating earned in a credit union is not acknowledged by or reported to any bank system. All of a sudden there were minimum balances and fees just to give them our money. We took our dough to a local credit union, who were happy to see us and very helpful.

My credit union no longer has overdraft or low balance fees.

Load More Replies...I bank at a bank where is if you are overdrawn by $5 or less, they don't charge a late fee. I did this either by accident or on purpose because I knew that I would get paid in a day or two.

I've been with a credit union for years that automatically covers 3 overdrafts with an "instant loan" up to a pre-calculated limit, based on your normal pay and balance. Once thought I'd bounced a rent payment. Nope. Covered. Aside from an email letting me know, it cost me some adrenaline and around $1.30 interest.

Load More Replies...This EXACT thing happened to me!! I was overdrawn by $4:13…. It cost me an extra $48!!! 🤬

Back in the late 70's, I worked at a credit union that offered overdraft protection. The CU would cover your bad check up to a limit for a small interest rate saving you the fee the Payee would charge on top of an overdraft. That this feature isn't universally used is another way the wealthy keep low-wage earners down and controllable.

Back around 2000 (so before smart phones and I believe even texting) I overdrafted because I had a substantial deposit into my checking account get clawed back (long story...) and was not notified, so I thought I had plenty of money... So every swipe of my debit card, +$35 overdraft fee - $1 soda, now $36 soda, etc... Never noticed until I went to an ATM to get cash (which I never usually carried, then or now) and saw my balance was negative $5k+! I went to my bank and asked, "WTF?! How far in the hole were you going to let me get?!", they said something like, "At $10k you should get a letter..." I was an unemployed student, lol! From then on, I turn "overdraft protection" off (so if my balance can't cover the debit, it gets straight declined) on all my debit cards! Not that I ever use debit cards anymore except at the one mom&pop that doesn't accept credit. Yikes, good times.

Why is it that the corporate megabank I use gives me until 8pm to make things right, but the community credit union that I also use will put a $30 zap on me if the paycheck comes in 5 minutes after the premature bill comes out? I thought it was supposed to be the other way around? Grrr!

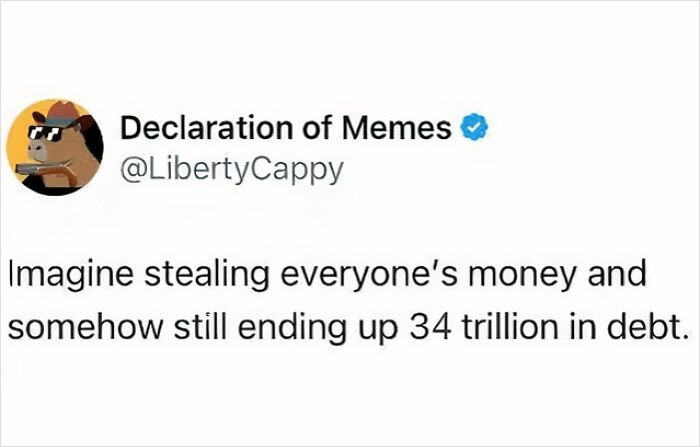

In 1980, the federal deficit was less than a billion dollars. After Reagan's trickle down policy, by the end of his second term, it was over three billion dollars, and it's gone up exponentially ever since.

And, instead of sharing, they want even more. As the French would say " off with their heads!"

It even specifies that the draught-victim would be immune from both debt repayment and interest repayment for a year. One has to imagine that this specificity was needed as folks interested in making money however they can have been around since the conception of civilization itself.

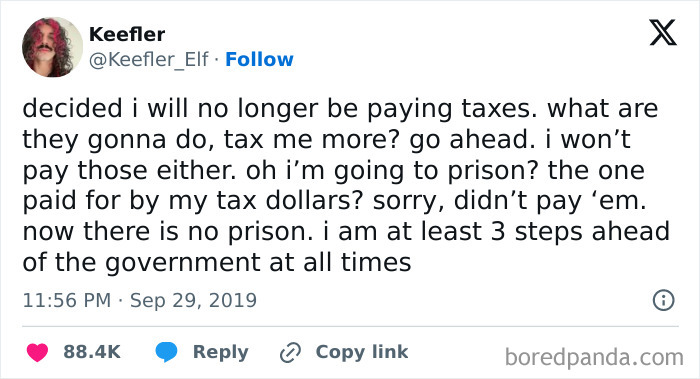

I don't mind paying taxes. It's getting my money ripped off by billionaire grifters and corporations that not only don't pay taxes, they get government subsidies, while I drive on pot holed streets.

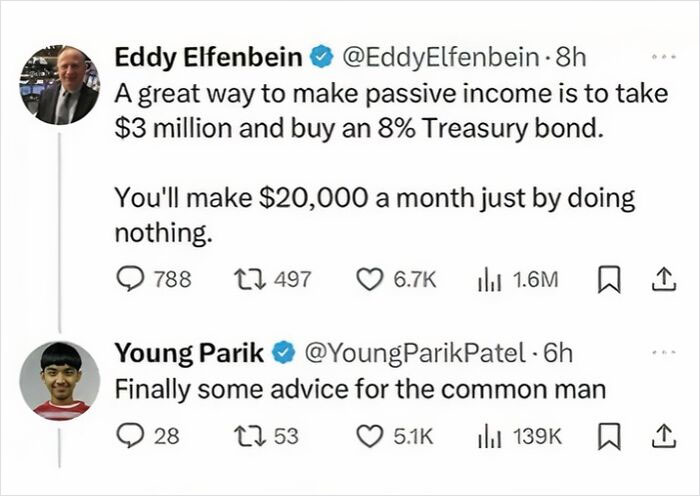

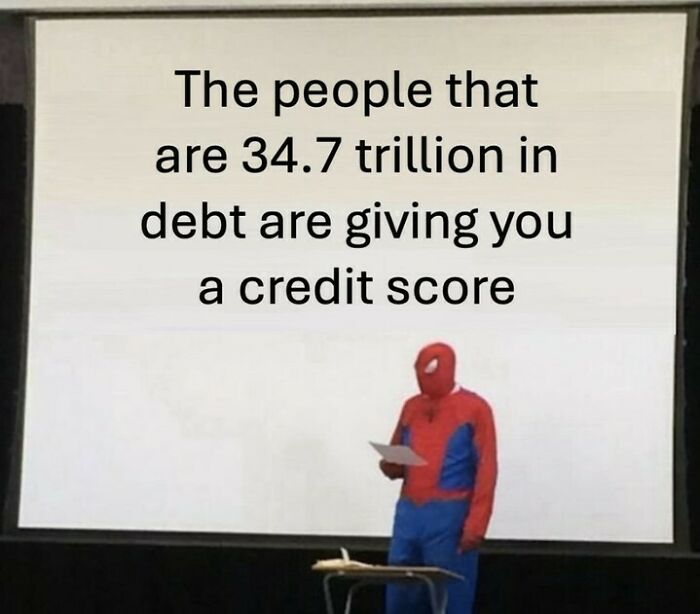

There were even rules about investments, “If a merchant should give silver to a trading agent for an investment venture, and he [the trading agent] incurs a loss on his journeys, he shall return silver to the merchant in the amount of the capital sum,” which would fit right in with any amount of “Wall street memes,” given that, like the titular Wall street of old, these were used in places with actual walls.

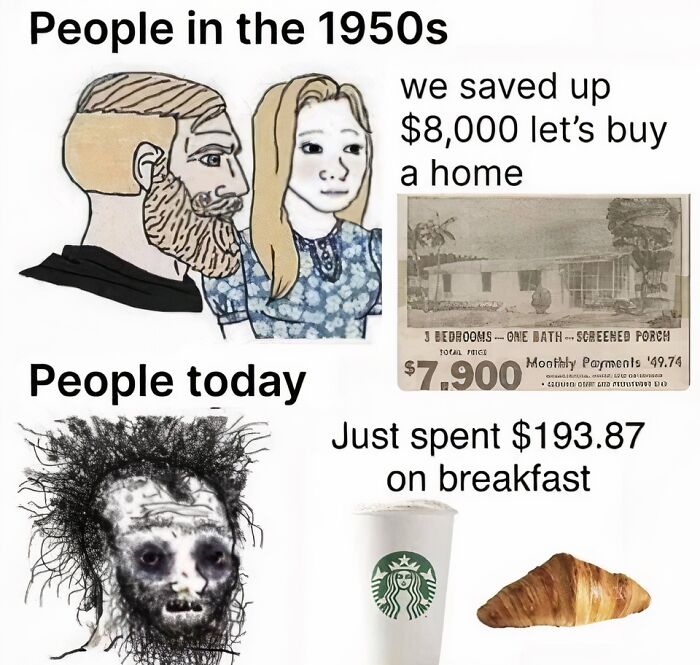

Here your income must be three times your rent to qualify. Rents start at $1,000/month. Minimum wage, $15, works out to less than $3,000.

Incidentally, that is the actual origin of Wall street’s name, it was quite literally the street adjacent to the city wall in 17th century New Amsterdam. It was also a place where early merchants and traders would sell shares and bonds, unaware that this action would continue in this exact same place for the next three hundred years at a scale they could never have imagined.

He is not streaking. Streaking is running with no clothes on. So he shouldn't get any money.

Me at age 33 I don't want to wake up and pay for a place to sleep at. Life is better asleep.

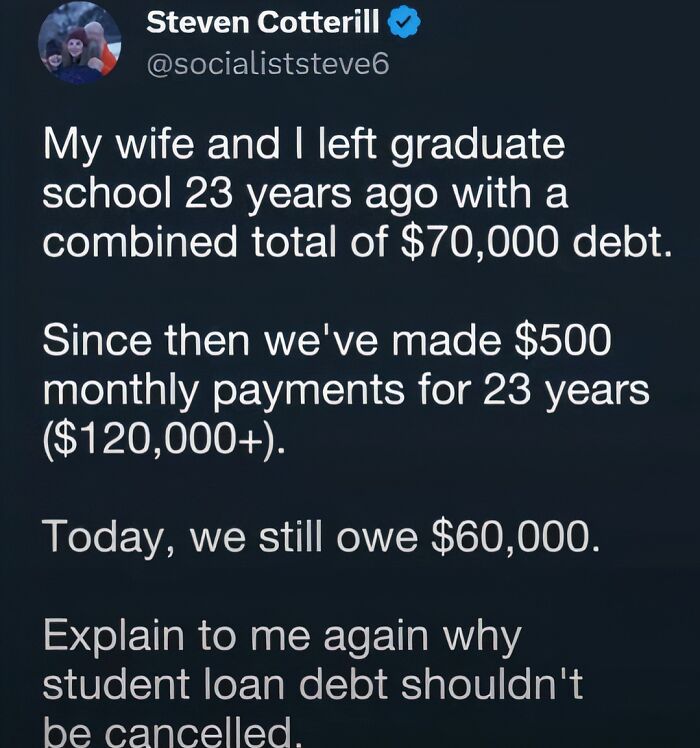

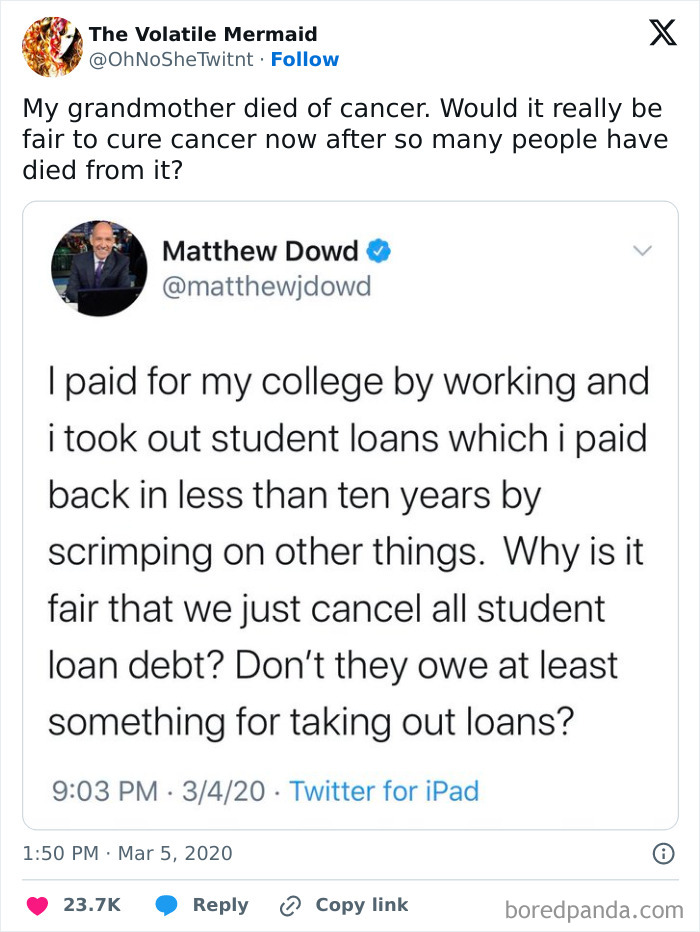

I paid my student loans off after 16 years. But, I have no animosity toward people who had their loans forgiven. People should not have to suffer because they want to better themselves.

Money tends to attract money, which goes both for compound interest and financial institutions and business to flourish together. While recently Silicone valley has given it a run for its money, no pun intended, as far as gatherings of massive capital go, the name Wall street remains synonymous with money. And, as with nearly everything, humans take these ideas and hammer them down into memes.

Pay the loan, ditch the crazy fee structure and high interest rate. People who have been making their payments, but now owe more need help. A $30,000 loan that is now$100,000 is NOT the same loan you paid.

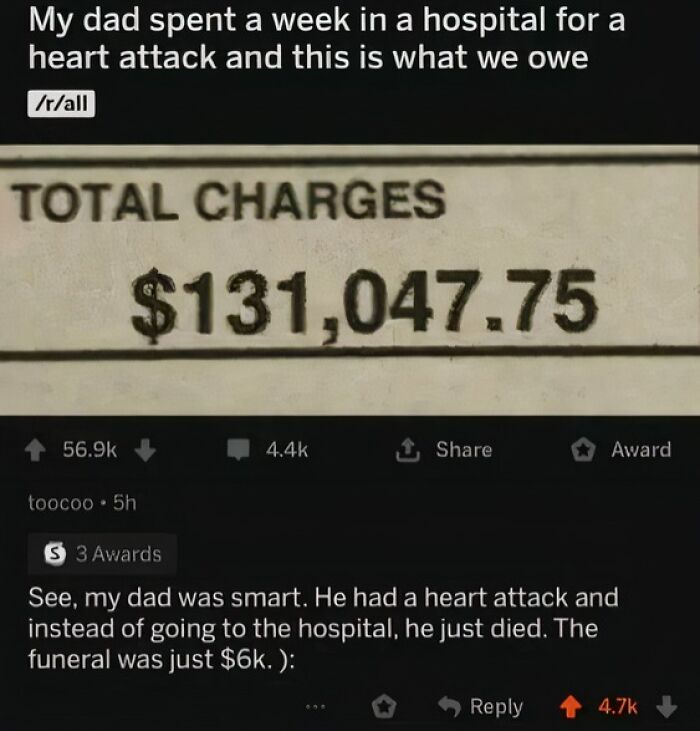

Except in the US, for-profit prisons make a lot of money for everyone except the taxpayers.

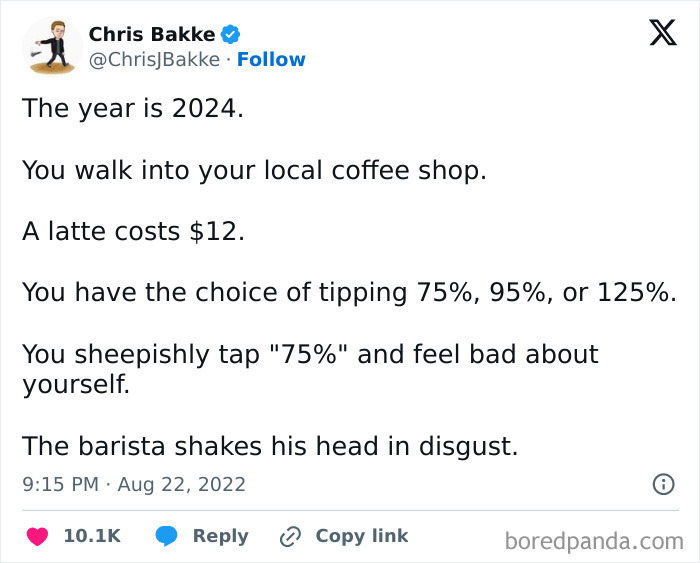

Tipping is out of control. I'm sorry, but I'm not tipping you for doing what you already get paid for and aren't doing anything to make my experience better.

Old fashioned boss. He wants to see his company succeed without huge debt, take care of his employees, and foster a safe, pleasant workplace.

Not gonna lie, I'm going to have to blame us the electorate for putting up with this nonsense.

In the 1950s, $8000 was a huge amount of money. Like two to four years' salary.

Gotta get that money to hand to the billionaires that have perfected regulatory capture.

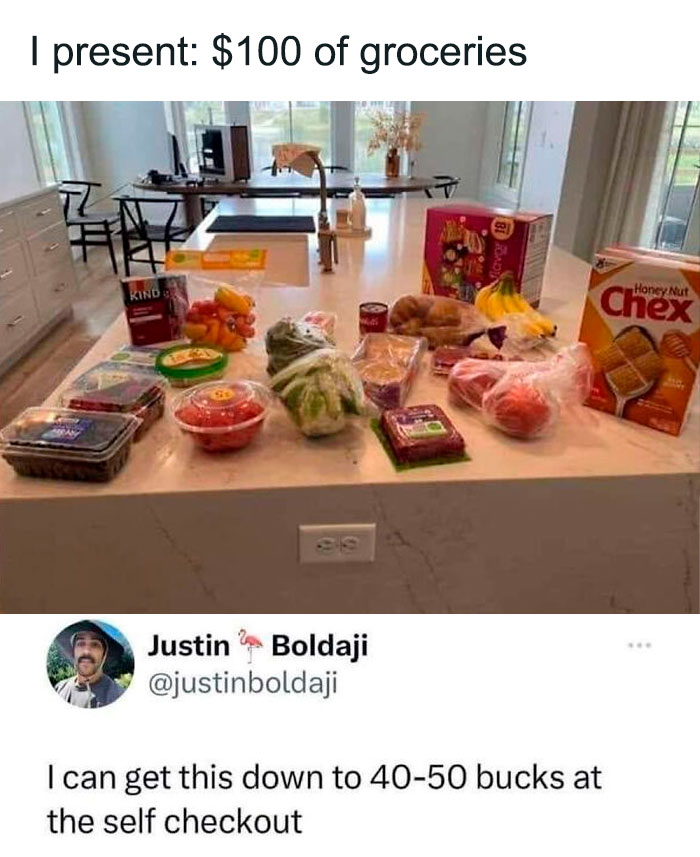

i can cook 5 good meals for that money that will taste good. I cant afford delivery meals.

Some people got lucky. A colleague got into BTC back when it was below $400. Didn't buy a lot, but last time I checked he hadn't worked in the last 6 years. No, I didn't listen to him.

I have a spread sheet on my home computer that I keep all of my expenses.

I'm pretty old. I can remember 1968. Gas briefly dropped all the way to $0.23. Most of the time it was more like $0.30. With inflation today those numbers would be $2.09 and 2.72. Which is right about where gas is right now. (That's in Texas. If your gas is a lot higher it's mostly state taxes)

I don't think many people on this app voted for trump

But you shouldn't be working more than one job...that's not a good thing my friend.

Load More Replies...I don't think many people on this app voted for trump

But you shouldn't be working more than one job...that's not a good thing my friend.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime