Even though the votes are still being counted and the US presidential election results aren’t final, some Americans are already celebrating what seems to be former Vice-President Joe Biden’s victory. Now, they’re taking a closer look at the politician’s policies. And one of them is increasing taxes. Naturally, when people hear about tax increases, they tend to panic (and blame 2020). But in this case, Biden pledged not to raise taxes on anyone earning less than 400k dollars per year. In other words, around 90 percent of taxpayers would be safe from the tax hike.

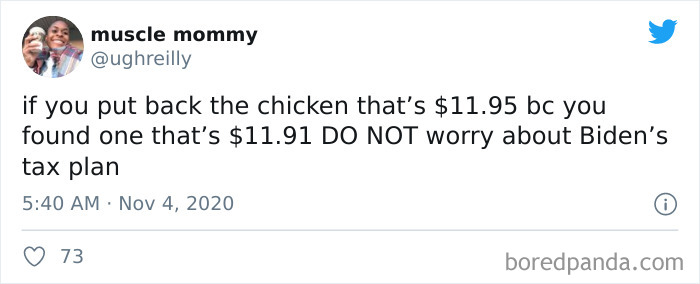

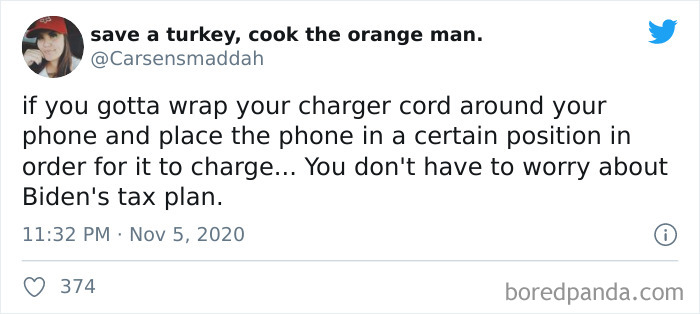

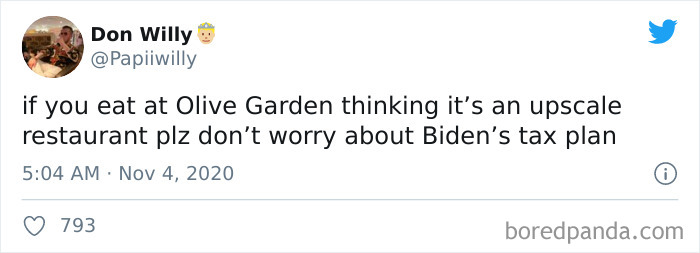

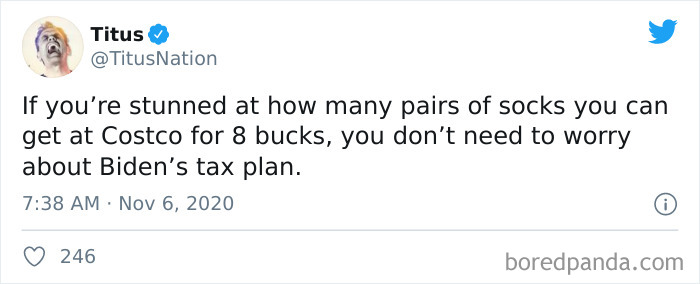

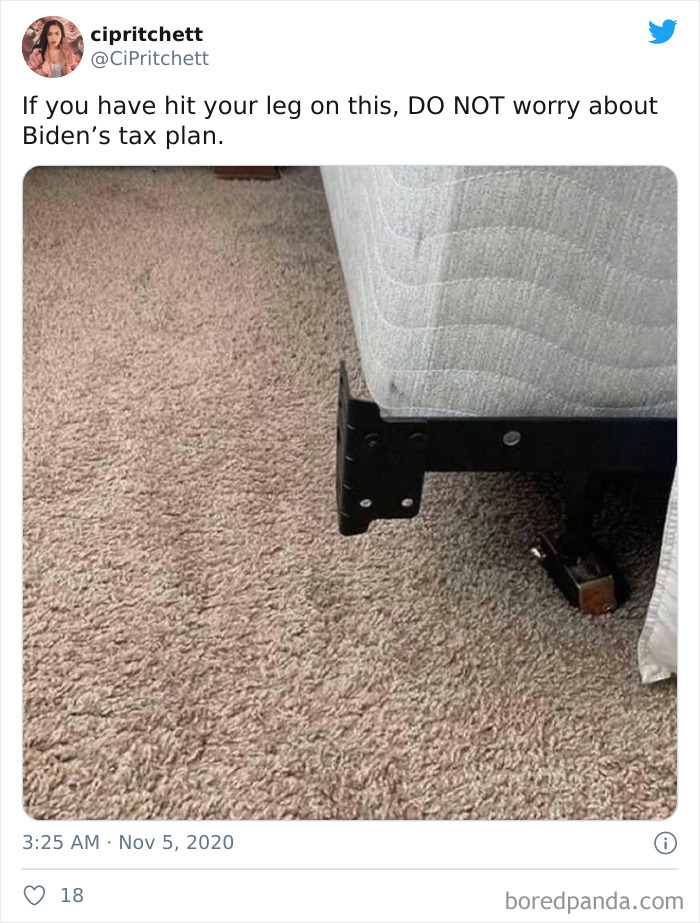

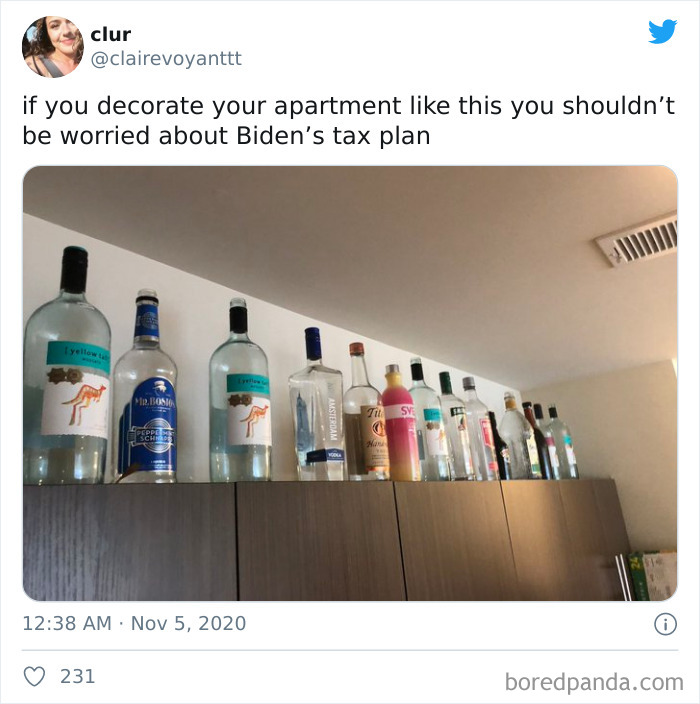

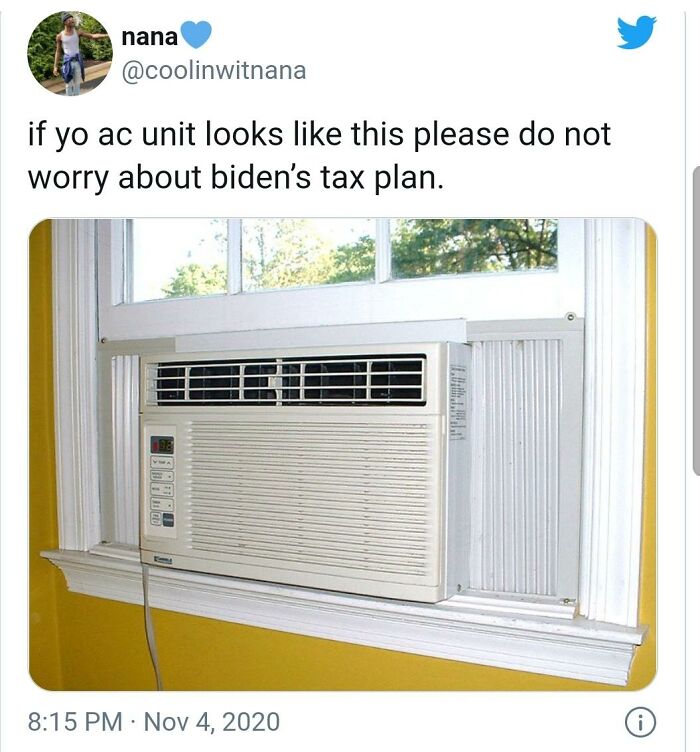

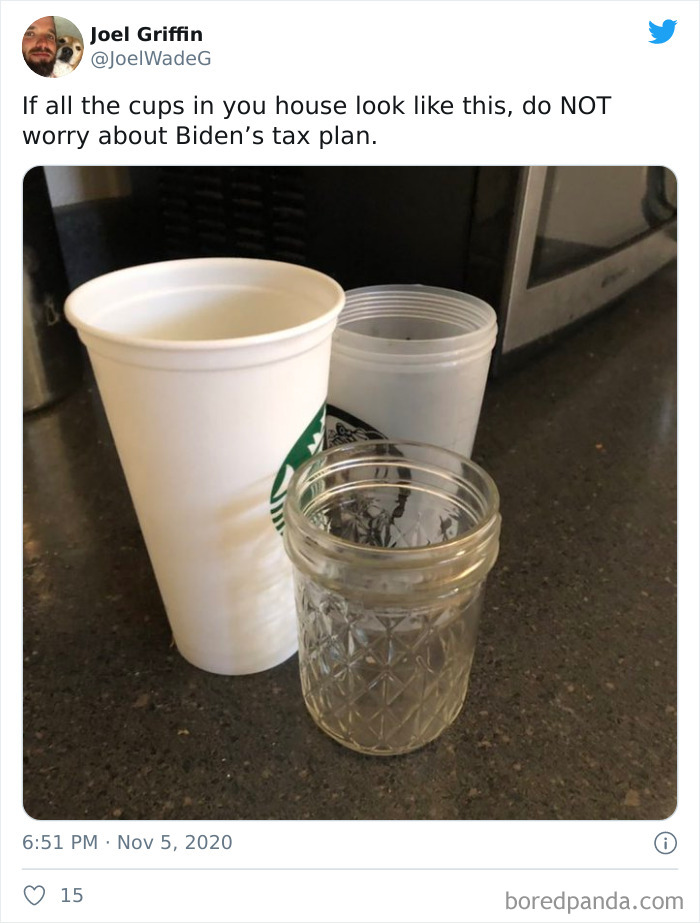

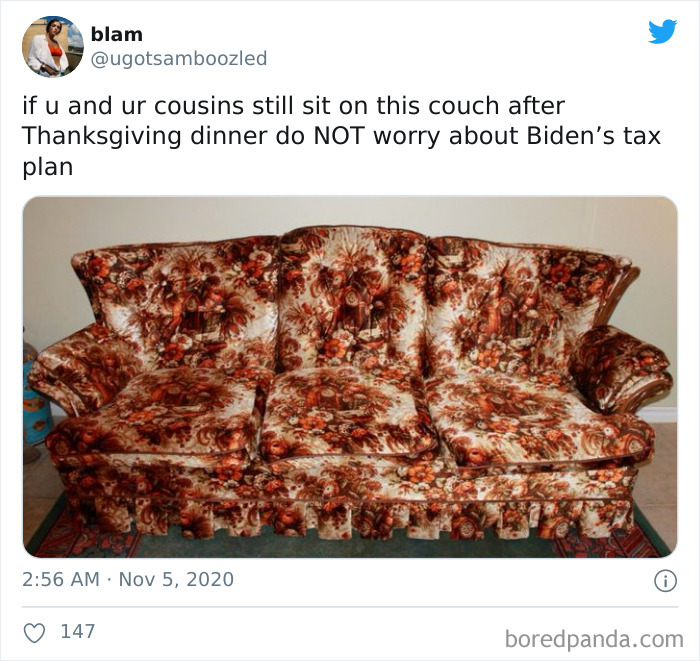

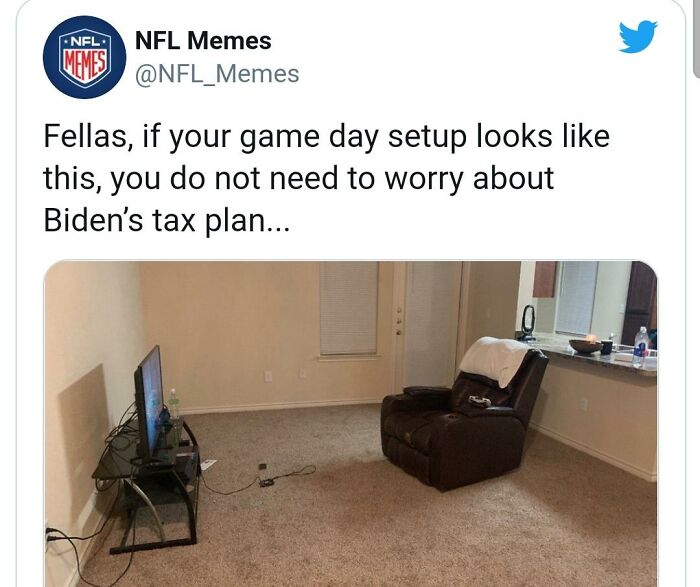

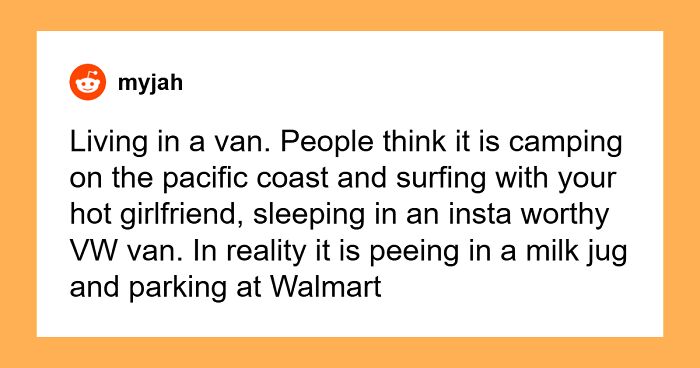

Twitter users had a lot of fun showing that the vast majority of Americans had nothing to worry about by posting examples from their lives and how you can tell that Biden’s tax hike won’t affect you. Scroll down to check out the funniest ones and remember to upvote your fave tweets. Let us know in the comment section which of these tweets you relate to the most.

David Alexander Bateman, the Director of Undergraduate Studies at the Department of Government at Cornell University, told Bored Panda that almost all presidents try to make changes to the US tax system. "After all, Trump supported the far-right tax plans of Paul Ryan, which amounted to one of the largest upward redistributions in American history. Obama tried and succeeded in very slightly raising taxes. Bush presided over several tax cuts, and Clinton and G. H. W. Bush both presided over modest increases in taxes." Read on for Bateman's full insights and the fact that it's almost guaranteed that Biden is the winner of the elections.

Joe Biden plans to increase taxes for the wealthy and for corporations. However, some Americans were still worried

Image credits: Joe Biden

Image credits: DKEvanoff

This post may include affiliate links.

"Every single president in my lifetime has tried to revise tax rates and at least suggested broader reforms to the tax system. Right now, wealthy Americans are ludicrously under-taxed, paying effective rates well below their 20th-century historical norms and well-below what is necessary to sustain the public services upon which wealth creation and productivity rely upon," Bateman from Cornell University said.

He added that Biden's plans might actually be criticized as not sufficiently aggressive and not aiming to raise top tax rates enough, limiting the raise to the already "extremely wealthy," instead of the "broader affluent middle classes." Bateman highlighted that many economists estimate that the "optimal rate" for high earners would be around 70 percent which is still below the 90 percent top rate that existed during the mid-20th century. "There is a lot of pushback against this by conservative and industry-backed think tanks, but the logic is sound," Bateman said.

"Even Obama, after all, sought to raise taxes on those making over 250,000 dollars which at the time was seen by many as insufficient to finance the public services a productive country requires," Bateman told Bored Panda.

We were also interested to get Bateman's take on when we'll be getting the final count for the US presidential elections. He pointed out that the final count will most likely be weeks. However, this doesn't mean we won't know the winner by then (and some news media outlets are already celebrating Biden's victory after more and more votes are counted in Pennsylvania).

"The norm in US national elections is that it takes a few weeks before all the votes are counted, largely because there are so many jurisdictions doing the counting, so many different ways in which ballots can be cast—including provisional ballots, which aren't even touched for days after the election—and because most jurisdictions are under-funded relative to the demands that are placed upon them," Bateman explained.

"It seems now extremely likely that Biden has won. I expect some media outlets to call the election once Biden takes a clear lead in Pennsylvania," Bateman commented. "The reason it's taking longer this year than most is simply that there was so much voting by mail, with one party much more likely to vote by mail than the other, and because many jurisdictions—including the most pivotal ones—were prohibited by state law from processing these ballots early."

However, the results in some states can still take a while to process. "But even if the election is called later today, we won't know close states such as Georgia for a while, in part because in many states ballots are still arriving—military ballots can arrive in Georgia, for example, up to 9 days after the election."

CNN explains that Biden plans to reverse some of the tax cuts that President Donald Trump signed into law in 2017 and will raise taxes on the wealthy and on corporations.

However, because of how interconnected economic systems are, those earning less than 400k dollars per year could still see an average decrease in after-tax income of 0.9 percent. Compare that to around a 17.7 percent decrease of after-tax income for those earning more than 400k dollars.

So it's not technically true that the tax changes won't affect all Americans, but the changes vary greatly depending on how much you earn. But like with most things, we won't know how the entire system is affected until after the changes have already been made (if Biden's proposed changes will go through).

If I haven't reached the dizzy heights of iphone 6 at all yet, I guess that counts, right?

What Biden plans to do is raise the top federal tax rate from 37 percent to 39.6 percent, subject earnings over 400k dollars to the Social Security payroll tax (which is right now limited to 137.7k dollars of earnings), and raise the corporate tax rate from 21 percent to 28 percent.

Overall, these and other changes to the tax system could raise the United States anywhere from 2.4 trillion dollars and 4 trillion dollars over 10 years. What’s then done with this money is a whole other issue altogether.

WRONG! In my area, you get up there and take down the shoes and see if they fit, b/c hey, free shoes. No joke.

Someone put my shampoo bottle in the bin, thinking it was empty. I was furious. Got it out of the bin and got 2 more washes from it. Also the empty bottle needed to be recycled, not put in general rubbish.

What about hanging coffee mugs from hooks off of your kitchen cabinet? Does that count too? F817EDA2-8...a-jpeg.jpg

I love those ac's. They get super cold and they the noise at night I love too. Plus I have a box fan in almost every room. I hate hearing house noises like conversations my kids are having in the other room.

I am obsessed with kitchen cups and plates from yard sales and thrift stores. Always have been. It's like I need this random mug from some lawyers office I've never heard of! For $.10!

Wrong, Ive been in a mansion with a Lambo out front and the bathroom was like this. Wasnt an old mansion either

It also can be habitual lying for any perceived short-term advantage, like Trumpy did. Come to think of it, he's such a poor business man his real income probably dips below $400K unless he redirects state money to his pocket (like have the FBI rent entire floors in Trump Towers, or make security pay for accessing his golf club, and giving posts to his family).

yeah... the rich people are the more stingy. they don't have problem with healtcare because they can affort it. poor people can't

Life is less expensive if you have money. You can afford to buy in bulk. Cash back or 0% interest deals when buying a car. Forgiveness on utilities and other some other payments. My phone is not cut off if payment is not received before midnight the day it is due. I don't pay cut off and reconnect fees. And so on. It is amazing, how can you escape poverty, the system is rigged. Health care -- no insurance, expect to pay full price in most circumstances. Our insurance companies pay a fraction of this.

Load More Replies...If the Senate remains in Republican control, do not worry about Biden's tax plan.

Those morons don't realize the rich won't pay this tax. YOU will pay it! Rich people are rich not because they pay taxes! They make poor people pay taxes in products, services, etc.

Once upon a time, a long, long time ago, in 1972, those who earned $100,000 were taxed about 70%, yearly income of $2,000 paid about 14%. (www.tax-brackets.org) Add a zero to income level. Make $1,000,000 pay %70 in taxes, $20,000 taxed at 14%. Today, $20,000 year income still pays about 14%. The highest tax bracket, about half a million dollars a year pay 37% of their income --- if they paid taxes. I don't remember hearing people complain about unfair taxes growing up. Taxes = services. I think people understood what taxes paid for back then. Today? Nope.

Load More Replies...yeah... the rich people are the more stingy. they don't have problem with healtcare because they can affort it. poor people can't

Life is less expensive if you have money. You can afford to buy in bulk. Cash back or 0% interest deals when buying a car. Forgiveness on utilities and other some other payments. My phone is not cut off if payment is not received before midnight the day it is due. I don't pay cut off and reconnect fees. And so on. It is amazing, how can you escape poverty, the system is rigged. Health care -- no insurance, expect to pay full price in most circumstances. Our insurance companies pay a fraction of this.

Load More Replies...If the Senate remains in Republican control, do not worry about Biden's tax plan.

Those morons don't realize the rich won't pay this tax. YOU will pay it! Rich people are rich not because they pay taxes! They make poor people pay taxes in products, services, etc.

Once upon a time, a long, long time ago, in 1972, those who earned $100,000 were taxed about 70%, yearly income of $2,000 paid about 14%. (www.tax-brackets.org) Add a zero to income level. Make $1,000,000 pay %70 in taxes, $20,000 taxed at 14%. Today, $20,000 year income still pays about 14%. The highest tax bracket, about half a million dollars a year pay 37% of their income --- if they paid taxes. I don't remember hearing people complain about unfair taxes growing up. Taxes = services. I think people understood what taxes paid for back then. Today? Nope.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime