Frugal living isn’t about being cheap and getting the cheapest (or free) of anything. Instead, it’s about getting the most value from your resources and developing better money habits while not depriving yourself of living comfortably. It’s wrong to think that by following frugal living tips, one deters himself from living a joyful, pleasure-filled life. Instead, frugal tips often guide you to compromise and find the best solution that will fill both your pockets and your heart.

Thus, if you have big goals for the future or want to save up for an emergency fund, or have a financial cushion, it might be time to give frugal tips and tricks a go. No matter how big or small your goals and aspirations are, whether you want to buy a rental property or save for a family trip overseas, frugal tips to save money can help accelerate your savings. While these tips on how to save money range from "mild" to quite intense, a healthy balance between the two will help you power through and prevent you from getting too burned out on your frugal journey.

Below, we've compiled some great, easy tips to save money every day and tricks on how to live frugally and actually enjoy it. Hint: stealing is NOT an option! Found a frugal tip you will try to apply in your life? Let us know by giving it an upvote! Any more frugal tips on saving money that you would add to the list? Let us know by leaving a comment!

This post may include affiliate links.

Eat Before You Go Shopping

Have a proper meal before shopping, and never go grocery shopping when hungry. According to studies, a growling stomach will tempt you to buy more food than you actually need!

Let Items Sit In Your Shopping Cart

Making an online purchase? Keep the item in your shopping basket for at least one day before checking out. This helps lessen impulsive purchases made online. If it was a spur-of-a-moment addition to your cart, it would likely lose its allure after a few days.

Pay Attention To Grocery Prices

Always compare the "unit price" tags on products at the grocery store to see if you may save money. Even though a product's overall cost could be higher, buying the more expensive version might result in you getting more of it.

This can show you how the supermarkets sometimes dupe shoppers into spending more

Stop Wasting Food

Be aware of your expiration dates, and don't throw away food before it has gone bad. As long as they are stored properly, perishables are often still safe to consume after their "sell by" and "use by" dates.

Look sniff & squish. If the food passes these tests then it's good. Avoid green meat, lumpy milk and hairy anything

Freeze Everything

A long-lasting meal doesn't necessarily have to be instant food packed with preservatives. When kept in a freezer, fresh foods like meat, bread, and vegetables can stay fresh for up to two years.

I used to work for the Facility Management department at a College. Some students moved out and left a large, 8 foot long, chest freezer. Instead of taking it to the dump it was given to me. I've had it for more than 25 years. I can fit so much frozen things in it.

Buy Second-Hand

When purchasing something used is an option, be sure to take it. The price of gently used products might be significantly lower than brand-new ones. To get what you need at a much better price, shop at second-hand stores in your neighborhood.

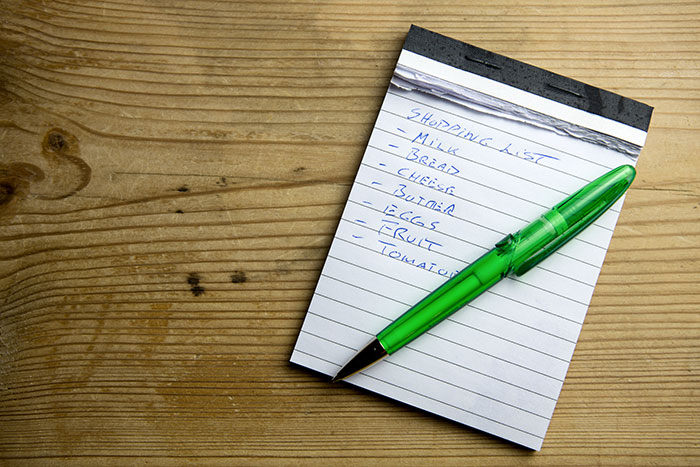

Make A List Before You Go Shopping

Making a list before shopping will help you avoid impulsive or unnecessary purchases; just ensure you stick to it. No exceptions are allowed!

I do that too, and it does help. Shopping without my husband also helps.

Plan Your Meals

List the meals you'll consume for the entire week every Sunday. By preparing your meals in advance, you can spend your money wisely at the grocery store because you won't buy food that will eventually go bad and be binned later.

That's exactly what I do, I don't prep, but make a meal plan spread out for two weeks. My grocery bill is usually between $150-180 for the two weeks.

Shop Post-Holidays

You can take advantage of post-holiday sales by purchasing gifts and Christmas décor a few days after the holidays. Most people only do this at Christmas; however, it can be done for any celebratory event!

Skip Brands, Buy Generic

Purchase generic versions of foods, cosmetics, and pharmaceuticals. They are just as good as the name brand, and the few cents you'll save will soon add up to considerable amounts of money.

Stick To Water

Instead of purchasing sugary, pricey beverages like sodas, juices, and beers, opt for water. Your money, waistline, and health will all benefit from it. Also, use a reusable water bottle rather than a disposable one to further reduce costs.

Don’t Pay For Things You Don’t Use

Cancel any memberships you don't use, such as magazine subscriptions, internet subscriptions, and gym memberships. The money you save can now be spent on things you actually need or be put into your savings account!

I rotate subscription tv apps, I'll have one for a month or two and then swap. You can only watch one at a time and the cost soon adds up.

Grow Your Own Vegetables

Whether you live in an apartment or have a yard, you can save money by growing your own veggies and herbs. Growing your own food is not only one of the more exciting strategies for inexpensive living, but it is also fun and enjoyable!

Encourage kids to grow vegetables - mine were always excited to eat when they'd grown. Even a window sill can be used to grow cherry tomatoes or radishes or herbs.

Bring Your Own Bag

Here's some practical advice for cutting grocery costs and being more sustainable: bring your own bag. A bag tax, a 5-cent fee to place your items in one of the store's brown paper bags, is in place in many states. Although it might seem like little money, it can add up over time.

Use Halves

You probably won't notice much difference if you use half as much soap, toothpaste, shampoo, or detergent. Your clothing should still feel just as fluffy with just a quarter of a dryer sheet.

Take Advantage Of Your Library

A cheap getaway to wherever your heart desires can be delivered through reading. Even better, you can borrow books from your local library, costing you nothing! Free adventure? Yes, please!

Reading fiction has been linked to increased empathy so it makes us nicer!

Sell Things You No Longer Use

Most of us are guilty of having unnecessary clutter lying about the house. It might be time to downsize if you have a sizable collection of designer purses, too many Lululemon leggings, clothes your children have outgrown, or a bookshelf bursting with books you no longer reach out for.

Stop Impulse Buying

E-commerce has made it simpler than ever to make impulsive purchases. At the press of a button, you can find anything and everything, and before you know it, your late-night shopping binges have cost you hundreds to thousands of dollars. One essential piece of frugal living advice to help you save money is learning to quit impulse buying.

Make Your Own Coffee

You can save four to five dollars daily if you skip buying coffee which you can make at home. This can add to significant savings in just one month! Also, consider purchasing your coffee beans in bulk; that is more cost-effective and sustainable.

I’ve said it many times before, and I’ll say it again: Buying an espresso machine is 💯 worth it. At Starbucks you spend $8 on coffe, and home you spend $8 a month on milk, 3 syrups a year ($6) and $15 every 6 months for coffee grounds (unless you buy bulk, which I do). That's $144 a year, compared to a daily Starbucks that would be $2,920. And don't get me wrong every once in a while I do swing by Starbucks for a drink I'm not good at making but the espresso machine has saved me so much money. ($2,776 to be exact) EDIT: ok so where I live Starbucks costs more and beans are cheaper and my espresso machine uses less grounds then. Average so that’s why I don’t use as much beans and only re supply six months. Sorry about that. Yours might cost $5-10 more but still cheaper than Starbucks and takes less time Lmaoo

Switch Off Unnecessary Lights

While this should be obvious, many of us are guilty of leaving the lights in the room while going to the toilet or running some quick errands. And then we totally forget that we've left the lights on. Hence, make it a habit to turn off the lights when leaving a room. Leaving them on wastes energy and drives up your monthly energy bill.

Shop At Farmers Markets Late In The Day

Farmers' market vendors frequently offer their stock at discounted prices just before the market closes because they don't want to transport unsold food home. Up to 80% in savings might be yours for the grab.

Cancel Your Cable And TV Service

You can now watch practically anything instantly and at a fraction of the price of cable TV, thanks to services like Hulu, Netflix, and Amazon Prime. Besides, you won't see any advertisements for products you don't need!

Watching ads is so disconcerting anymore. I like to rotate through the streaming services and catch up on shows. The only thing I keep consistently at the moment is Disney Plus, Curiosity and PBS, which are all fairly cheap. Prime I have only because I already pay for the shipping. That way I can do AMC, Hulu, Netflix, HBO or whatever for a month or two at a time and cancel.

Cook In Bulk

Make double, triple, or even four times as many servings of your go-to dish and freeze it. Simply reheat one when you need a quick meal. Also, buying food in bulk will ultimately end up costing you less.

This is a good way to save money and it makes it easy to have a ready meal in a hurry. Ping cooking

Consume Less Meat

Meat is expensive, so reduce your consumption and choose cheaper per-ounce protein-rich foods like beans, eggs, or almonds.

I just stopped eating meat altogether to save money. It's really helped my grocery bill and has been encouraging healthy eating for my family.

Pay Down Your Debt First

If you have debt, you will keep depleting your resources. Make paying off your debts a top priority. You won't want to return to debt once you've struggled to eliminate it from your life.

Buy Ugly Produce

Did you know that a third of the produce farmed in the United States is not sold because it does not look appealing enough? That less-than-cute tomato that Misfits Market saves from the trash and sells for up to 40% discount is still delicious.

Return Things You Don’t Need

Look over your most recent purchases. Is there anything you don't need at all? Get your money back by returning the item in person or by shipping it back.

Write Down Every Expenditure

Everything. Put it in writing. Any kind of journal or notebook will do. When you make a payment, purchase sour cream, or buy socks, note it down. To start saving, one must first determine where all the money is going.

I need to start doing this. The amount I spend on candy is probably what's giving me finances cavities.

Shop The Sales

Adjust your menu to what is on offer at your local grocery shop, and in just a few months, you'll significantly reduce your spending on food.

Eat At Home

If you compare the price of ingredients to a restaurant bill, you'll notice the savings right away. When opposed to eating out, consuming nutritious home-cooked food over time will result in fewer medical costs and less financial hardship. Also, compared to restaurants, you'll use less oil, salt, and sugar when cooking.

Home cooking has gotten just as expensive as eating out (at least where I live.)

Eat What’s In Season

This is one easy approach to reducing your grocery bill. Produce in season is less expensive since it is easier to obtain. Also, it is richer in nutrients and much tastier!

Bring Your Own Lunch

Eating out and getting takeaway are typically the household's most significant unnecessary expenses. You'll be doing your wallet and waistline a tremendous favor by bagging your lunch.

My last job I kept getting stuff stolen, like containers and utensils. I'm down to 2 big soup spoons. I thought I was just losing them until I switched jobs and anything I take with me comes back home. I replaced so many stuff it was almost just worth it to eat take away.

Stay In And Socialize

You aren't required to spend all your money on margaritas and cosmos in a posh club to have fun with your pals. Instead, you can invite them over to play classic board games or have a movie night on the couch.

Slow Cook Your Meals

Making meals in a slow cooker will be just as quick and tasty as getting takeout. And it will cost much less in the long run! A homemade dinner will only cost you a few dollars instead of $10 or $15 for every meal. Choose wisely!

Give New Life To The Garments You Already Own

Consider browsing in your closet rather than going out and purchasing another pair of shoes that you'll only wear once and then forget about. Your wardrobe must have several pieces of clothing or footwear that are still trendy or returning to fashion. So organize your closet first and discover some of these hidden gems!

Buy A Car You Can Afford To Maintain

A car is probably one of the biggest purchases you'll ever make. In light of this, purchasing a car within your budget is paramount. Don't be hoodwinked by the car's bells and whistles. Before calling the dealer, decide what you can actually afford, both fuel consumption and maintenance-wise.

And don't rush to buy a car just for the sake of having a car. (Yes I am talking about myself) 😭

Watch The Register

You've probably seen the investigative programs that reveal the startling amount of mistakes that store scanners make. Being aware of this, closely check the cashier's display as they scan each item. Also, ensure that any sales and coupon reductions are applied.

Please be nice about it though. Sometimes it's a systems error or human error. Something might've scanned twice and the cashier didn't notice right away. It's not like they have the motive of making commission for a higher bill to matter for them to be ripping you off. Just alert them of the error and they can fix it for ya.

Fix Leaks

Your energy bill could be increasing due to cracks in your doors and windows. And unfortunately, they can't fix themselves. In addition to raising your power bills, leaking windows and doors can compromise the strength of your walls or result in mold growth. And we don't want that or the additional expenses it may create.

Quit Unhealthy And Costly Habits

Give up costly vices like drinking and smoking. It harms not just your health but also your bank account.

Coffee is my vice which in London can be nearly £4 each time. It all adds up so I bought a really good cup that doesn't leak and make my own.

Budget For The Holidays

As they fall on the same day every year, holidays and birthdays shouldn't ever come as a surprise. To avoid having to charge any expenses on a credit card during a major holiday, set aside money each month for these kinds of occasions.

There are people out there that can set money aside each month for anything? Hmmm must be nice.

Choose Energy-Efficient Bulbs

Even though energy-efficient light bulbs cost more, they are a wise investment. Compared to standard incandescent bulbs, LEDs and CFLs last far longer and consume significantly less electricity.

Across most of Europe at least old-fashioned incandescent bulbs are no longer available. The older generation "energy-saving" ones were often very poor, but modern LED bulbs are now pretty much universal and have come down in price, plus they usually last for many times the normal lifetime of older types.

DIY Gifts

Make your own gifts to save money, or give pals a "voucher" offering to care for their dog for a week or watch the kids while they're out for a date night. The people receiving them will undoubtedly appreciate these personalized and heartfelt presents.

Do Not Pay For Something You Can Get For Free

There are countless free resources on the internet and the world around you; you just need to know where to look. Learn about the garbage pickup schedule in your area to find free items. There should be designated days for heavy item trash pickup. You can take a trip to see what people are tossing away: bicycles in mint condition, wood furniture, TVs, and other items may be available. Just keep in mind that your car needs to be big enough to transport your haul home, and you might need assistance lifting heavier goods.

Take A Look In Your Pantry

Quite a few of us store a lot of food in our pantry yet keep buying more. And in fact, many do the same and keep heaps of food stashed away in their cabinets. However, while some stock up on non-perishable products "just in case," others forget they even have them. If you belong to the latter, make a list of your resources. Consider preparing a meal with what is already in the fridge or cupboard and consequently save money on your next grocery shopping trip.

We had some interesting meals when we only used food we already had in. Pagmag and muckment meals

Buy In Bulk

One of the frugal tricks that can reduce your shopping price is buying regularly used items, such as soap, paper towels, and toilet paper, in bulk. The cost per unit is typically lower when you purchase in larger quantities. Also, you won't have to go to the store as often!

Buy A Used Car

New cars are a complete waste since they start losing value the moment you drive them off the lot. Finding a nice used car might help you save a lot of money instead of buying a brand-new one. Instead of looking for something flashy, concentrate on dependability and quality. Also, don't forget to negotiate!

I’m not sure people who need tips on how to save money are buying new cars. If you don’t already drive a used car, you’re doing just fine financially.

Get To Know Your Mechanic

Find a reliable mechanic from a nearby business and stick with them. They will be familiar with your car and its history, which can save you a lot of money on diagnostic fees should parts fail. Additionally, you will receive significantly better maintenance discounts as a reward for your continued patronage.

Try A Virtual Workout

You can spend much less on fitness classes online than on a gym subscription. From yoga to Zumba to kickboxing, you can access them all for a lower price, or even better, for free!

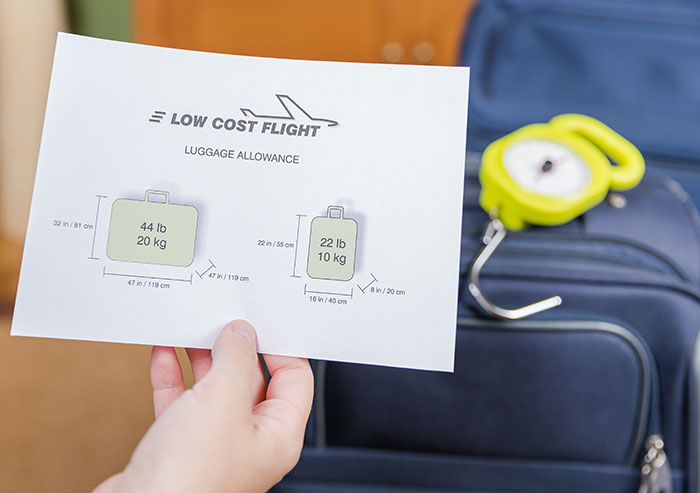

Wallet-Friendly Traveling

Traveling on a budget is one of the best frugal living tips. By visiting locations in the off-season, you can save a significant amount of money and still have a fantastic trip. Cutting back on eating out and choosing accommodations with kitchens to prepare your meals can also help you save a lot.

Fun For Free

Making a challenge fun is the best way to make it easier. Having fun for no cost is one of the best frugal tips. There are many free fun activities; visiting a park, having a picnic, or lighting a bonfire are just a few.

Visiting a park, at least in Florida, is not free. Most of the time it costs $2 to get in. That may not be expensive, but it still costs something, so I'm tired of seeing it pop up on "Fun things to do for free" lists.

Pay In Cash

Cash is more difficult to part with. Also, if you pay in cash, you won't be able to surpass your spending limit because you won't have the funds to do so, easy!

Make Lettuce Last Longer

Your lettuce will stay crisp and fresh with adequate air circulation and a small amount of moisture. The simplest (and most efficient) way to achieve this is to line a sturdy glass or plastic container with a few moistened paper towels, then scatter the greens on top of the paper towels. Lastly, put a matching lid on top and refrigerate.

Save Your Loose Change

Instead of tossing your spare change in a tip jar, save it so that at some point, you have money to treat yourself to that pumpkin latte pretty much guilt-free!

I wait until it's close to vacation time and usually have around $100.

Try A No-Spend Challenge

When something is presented as a challenge, it can be simpler to persist with it. Try a low-buy or no-spend year if you're unsure of where your money is going. Try a no-spend month, to begin with, and work your way up if a whole year intimidates you.

Reuse Grocery Store Bags

Particularly for smaller bins, grocery store bags function well as trash can liners. Also, if it's still in good condition, take the same bag on your next grocery shopping trip.

Start Budgeting

The key to your financial stability is setting up and following a budget. Budgeting may not be fun, but it is a vital part of the puzzle. You must prioritize what matters within your budget and ruthlessly eliminate what doesn't. Remember that occasionally treating yourself to something is perfectly fine. In fact, encouraged! Just make sure you have money set aside in advance for these purchases.

Look For The Best Insurance Offer

Your financial objectives may be seriously disrupted if you don't have proper insurance that fits your needs. Selecting the right plan is paramount. Once you have a better idea of the insurance you need, always compare insurance costs. You can save thousands by just doing so.

Not only check the cost of the policy but also the charges to insurance agents for arranging the contract

Avoid The Dryer

Forget about the dryer. The lint you see results from your clothing progressively disintegrating due to all the tumbling. Imagine what would happen with your hair if it had to endure all that tossing and spinning. Stick with the clothesline. Still, if you remain loyal to your dryer, make sure metal zippers are closed so they don't damage other clothing.

Air Your Soap

Firstly, store soap away from water because keeping it consistently wet will cause it to disintegrate more quickly. Another important thing - let the soap air dry. A bar of soap will last longer if you let the air dry out the moisture in it since it will become harder (and less likely to crumble).

Drive Less, Walk Or Ride A Bicycle More

You'll get more exercise throughout the day and spend less money on petrol if you walk or ride a bike whenever possible.

Excellent advice if you dont live in a place where it's winter weather 6 months out of the year and the grocery store and everything else aren't 10 miles away on average. We do have a large cyclist community but you don't typically see any of them out between November- at least March.

Have A Capsule Wardrobe

To look fashionable, you don't need to spend a lot of money on clothing each year. Maintaining a capsule wardrobe can cut your clothing costs by several hundred dollars a year (or even thousands). Everything will match, so you'll always look put together!

Have A Retirement Account

Retirement accounts are a valuable asset since they are intended to provide money when you stop working. You won't have any choice but to continue working past the "traditional" retirement age if you don't have a retirement plan, as Social Security is unlikely to supply you with a sufficient income.

With the way things are going for my generation (millenial) it seems inevitable that most of us will be working past the retirement age.

Read Grocery Ads Before You Shop

Popular products are often discounted in grocery stores as a tactic to entice you inside. They also use a lot of advertising to spread the word, including mailings to your home, inserts in local newspapers, or shopping directories. They are worthwhile to study every week. This is due to the weekly changes in what is on sale.

I use a phone app that carries all the latest flyers, which I check every week when the new ones come in, plus I shop at a store that has a low price guarantee; that way, if a competitor is advertising a lower price on something I need, I just show the flyer to the cashier, and they'll match the price.

Use Less Water

While scrubbing dishes, turn off the water. You might save 200 to 500 gallons of hot water each month, adding to significant monthly cost reductions.

Don’t Fall For Limits

When you notice signs that say "Limit six per customer," keep your wallet in your pocket. Stores are aware that customers will purchase more of a product if they believe there is a shortage, even when there usually isn't. Remember the beginning of Covid when people went so crazy about stocking up on toilet paper that even the prices went up? That's right.

It's 2023. My grandparents still have a walk-in closet filled to the ceiling with toilet paper.

Shop Alone

It's simple to become distracted and overlook what you're putting in your cart when you're with friends or family. Also, it is easier to linger in the shop longer than necessary when you are with someone. Go on your own so you can carefully monitor your list and stick to your spending limit.

Keep Your Hands Clean

Washing your hands frequently will help prevent catching all kinds of viruses and bacteria, saving you hundreds of dollars in medical expenses.

Not that I don't wash my hands, but I don't know what medical expenses are. Benefits of not living in a country where someone profits from people being sick.

Don't Save Your Credit Card Information Online

Clear your internet accounts off your credit card details. When you have to repeatedly input your card number, and expiration date, shopping and making purchases online becomes too much effort. This is one occasion when being lazy works in your (wallet's) favor.

Check Your Tires

Ensure that your tires are properly inflated. Your gas mileage decreases by 1% for each PSI under the recommended level of air pressure in your tires. And since most tires are five to ten PSI below the recommended level, that may add up to an increase in mileage of 5%.

Lighten Up Your Trunk

Your gas mileage is substantially impacted by the clutter you keep in your trunk or backseat. While getting rid of the weight of all those empty water bottles and fast food bags could save you roughly $40 a year, an extra 100 pounds in the car reduces fuel economy by about 2%.

Try Home Remedies First

If you feel a little under the weather or have a mild cough, natural treatments like honey and ginger may help you feel better. If you manage to heal without leaving your house, it will save you from paying for medication and petrol to get to the pharmacy.

Groom Your Dog At Home

The cost of pet grooming can add up, but you can cut costs significantly by doing it yourself at home with pet clippers.

Stick To The Food Basics

Stroll around the perimeter the next time you go to the grocery store. You'll find the essentials like bread, veggies, and meat. Avoid those middle aisles stocked with things we don't need and fancy packaging when you're trying to stretch your grocery budget.

Also, the stuff on the shelves that is eye level will be more expensive. Generally, the lower the shelf, the lower the price

Know What's Inside Your Fridge With A Sticky Note

When produce or dairy is concealed beneath other things in your fridge, it is simple to waste food. Making a simple list and sticking it on the refrigerator will help you remember what fresh foods are inside and when they need to be consumed.

Take Faster Showers

A typical showerhead uses around 2.5 gallons of water every minute, so taking shorter showers is an easy way to save money on your water bill.

Share Your Subscription With Friends Overseas

There is a restriction on how many screens you can have open at once on the same account. However, there is a workaround when the account users are in different countries! Hence, give your international pals who live in various time zones access to your Netflix account and split the bill!

Separate Your Bananas

Bananas continue to ripen after being harvested. Separating your bananas can help them stay fresh longer by slowing down the process. This is because bananas contain the plant hormone ethylene, produced by the banana itself. Because of it, the fruit continues to ripen and turns brown.

Maintain Your Shoes

Line the soles of your leather shoes to prevent the rubber from wearing down. Also, avoid wearing them back-to-back. Given a day off, leather shoes will survive longer because they are susceptible to moisture.

Wearing something less often will cause it to deteriorate slower... mind = blown...

Sign Up For Custom Rewards Programs

Many businesses provide rewards and discounts by racking up points on purchases, which can save one a lot of money. However, the catch is that you should be cautious when you receive member notifications about deals and sales since they could make you want to spend more money than you normally would.

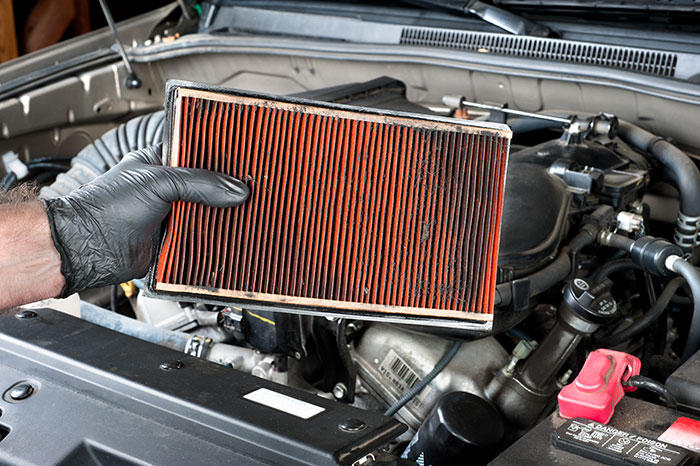

Care For Your Car

Every few months, clean or replace the air filter in your car because a clean air filter can improve gas mileage by up to 7% for every 10,000 miles, hence saving you money on gas.

DIY Air Freshener

Make your own air freshener with baking soda and your preferred essential oil to save spending money on pricey, fragrant aromatic sprays. It will smell just as good without the extra buckaroos.

Use an old spray bottle and fill with water, vinegar and fabric softener or essential oils. Costs pennies and works just as well as sprays you can buy. I use it to freshen up soft furnishings, clean up marks and spills, wipe down walls and doors, and keep on top of the dog smell.

Catch Matinees Instead

You can save money on tickets by watching movies during the day rather than at night. Also, don't be afraid to sneak in some nibbles to avoid overspending on expensive popcorn and diluted coke. Oh, come on, don't play a saint here; even cinema staff knows we all do it!

I almost never go to anything but matinees. Bought advanced tickets for Antman this Sat for my son and I for about $16 USD. We don't typically do snacks except the occasional popcorn. Definitely no drinks. It's already hard enough to sit through an entire movie without having to pee anyway ( thanks to my middle aged bladder).

Flip And Rotate Your Mattress

To extend the life of your mattress, rotate and flip it every three months. Also, you may consider regularly swapping couch cushions to prevent your family members' cheeks and backs from forming impressions.

Shop Second-Hand Stores For Kids' Clothes

If you have a baby and haven't explored the world of used children's clothing retailers, do so immediately. Some clothing items still have their tags attached or have barely been worn. Babies outgrow their clothes so quickly, so if you're shopping for one, it's very likely that you will find clothing that is still of excellent quality. Just give it a good wash first!

Don't Be Afraid To Negotiate

A long-standing tradition of being frugal is arguing and negotiating. Contrary to what salespeople and retail establishments would have you believe, almost everything is negotiable. One can successfully negotiate everything from a salary raise to discounts on brand-name products that aren't already discounted.

Upgrade Your Thermostat

Invest in a programmable thermostat to maintain the temperatures a little higher or lower during the day when no one is home.

Plan Out Your Cash Spend

Depending on your budget, withdraw a certain amount of money each week (or month). Other than being charged by the ATM every time you have to withdraw cash, you are more likely to stay within your spending limit because you will know exactly how much money you have left.

Automate Your Savings And Investments

You can save money quickly and effortlessly by using an automatic savings plan. Simply sign up for an automatic transfer of funds from your checking account to your savings account. Also, consider switching all of your bill payments to automatic.

And transfer any money left at the end of the month. Not so great if there's month left at the end of the money.

Get Coupon Savvy

Create a separate email account only for receiving printable in-store coupons, online coupon codes, daily specials, and other unique savings opportunities. Go through them once a week and choose the best to use on your next local supermarket trip.

Get A Part-Time Job

Getting a part-time job is a surefire way to speed up your savings. If you currently work a 9 to 5 job, consider looking into remote offers. However, finding something you are interested in is vital. Otherwise, it could be physically and mentally challenging to muster the energy to work after a long shift at your day job.

Downsize

Larger homes have their advantages. The costs of residing in a larger space, however, can mount. You pay for additional square footage and all the associated small expenses. To live more economically, think about decreasing your living area.

Skip The Salon

Although we all require some pampering and beauty treatments, you can save a ton of money by avoiding the salon whenever possible. Also, all the mani-pedi procedures can be easily done at home!

Have A Family Meeting To Review The Budget

You can benefit greatly from holding a weekly family business meeting to discuss your week and finances. It's ideal for establishing communication with your partner, organizing your week to prevent impromptu McDonald's drive-thrus, and a whole lot more. Having a talk with your family about the upcoming week will help everyone feel on the same page.

Extend The Life Of Your Razor

Shake off the excess water of your razor, dunk it in rubbing alcohol, and then leave it somewhere dry (do NOT leave it in the shower). In addition to cleaning the blade and preventing rust, this will extend its lifespan by many weeks!

Use old fashioned safety razors and shave soap and a brush. It costs Pennie’s compared to using name brand razor blades and shave cream and works just as well.

Look For Low-Cost Activities

Take advantage of free events held in your area. Local newspapers and websites frequently list free (or cheap entry) parks, museums, upcoming movie showings, sporting events, and other spots where people can congregate for a good time on a day (or night) out.

Use Money-Making Apps

Consider money-making apps to add extra cash to your pocket! You can sell stunning sunset photos you took on your smartphone, invest your spare change, or receive cashback and more. Just do your research and check the option that will suit you best.

Eat At Restaurants Where Kids Eat Free Or For A Discount

Browse family-friendly eateries where children can dine for nothing or for minimal cost. Finding such places only requires some research!

The people really being hit by the current financial nightmare already do this and more. And "go to matinees"... and what... skip work? There is a reason prices are higher out of working hours. This list just comes across as incredibly patronising and naive

There are matinee movies every day of the week. Check your local theater.

Load More Replies...The people really being hit by the current financial nightmare already do this and more. And "go to matinees"... and what... skip work? There is a reason prices are higher out of working hours. This list just comes across as incredibly patronising and naive

There are matinee movies every day of the week. Check your local theater.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

![“[Am I The Jerk] For Telling My Mom That It Was Very Obvious They Never Liked Me?”](https://www.boredpanda.com/blog/wp-content/uploads/2024/12/mom-relationship-drama-coverimage.jpg)