Buying a home is a huge accomplishment. Finally, you can put as many nails in the walls as you want without upsetting your landlord, and you can replace that ugly wallpaper with the paint color of your dreams! But owning a home also comes with many responsibilities, and it’s important to do everything you can to choose a house that won’t cause endless headaches.

Quora users have been detailing the most important things for first-time home buyers to be aware of, so we’ve gathered their best advice down below. Enjoy reading through, whether you’re planning to purchase your first home soon or you’re currently on your fifth, and be sure to upvote the knowledge that could save someone from buying a nightmare home!

This post may include affiliate links.

Don't ever buy anything with an HOA. (additional fee for living there) - you can never get rid of it, it can go up, and you can never truly pay off your property.

Don't ever buy anything with an HOA. (additional fee for living there) - you can never get rid of it, it can go up, and you can never truly pay off your property.

The HOA concept is essentially a forced "keep up with the Jones" authoritarian mentality. It originally was meant to give the neighborhood legal power to get a deadbeat homeowner who trashes his property to clean it up. They have evolved into a tool of harassment for power hungry Karen's with righteous attitudes.

Before buying your first home, you should know that you will probably need more money than you thought you would. Not necessarily to purchase the home, but to maintain it. Even if you purchase a brand new home with a warranty. Even little things like, Oh … I guess I will need to cut the grass now. I’ll need a lawn mower, and maybe a weed wacker. Maybe you have not taken into account that you will need to pay for all of your utilities and trash pick up. Maybe you had free wifi in your apartment, but now you will need to pay for it. There will be no more free maintenance guy to unclog your sink, or toilet. The list goes on, but you get the idea.

Before buying your first home, you should know that you will probably need more money than you thought you would. Not necessarily to purchase the home, but to maintain it. Even if you purchase a brand new home with a warranty. Even little things like, Oh … I guess I will need to cut the grass now. I’ll need a lawn mower, and maybe a weed wacker. Maybe you have not taken into account that you will need to pay for all of your utilities and trash pick up. Maybe you had free wifi in your apartment, but now you will need to pay for it. There will be no more free maintenance guy to unclog your sink, or toilet. The list goes on, but you get the idea.

All buyers should hire an home inspector who will take them through the house on a 4 hour inspection. The inspector should explain the major components of the home and produce a thorough report. Inspectors will also recommend a structural inspection if one is needed. At the same time, I recommend that buyers have a sewer scope inspection. If the inspector mentioned any roof defects, we will ask the seller to get their insurance agent out to see if it needs replaced (roofs can be replaced before the sale goes through). Lastly, along with inspection objection items the buyer asks the seller for, I always recommend buyers ask for an HVAC technician to inspect and repair as needed the Furnace, AC and hot water heater.

All buyers should hire an home inspector who will take them through the house on a 4 hour inspection. The inspector should explain the major components of the home and produce a thorough report. Inspectors will also recommend a structural inspection if one is needed. At the same time, I recommend that buyers have a sewer scope inspection. If the inspector mentioned any roof defects, we will ask the seller to get their insurance agent out to see if it needs replaced (roofs can be replaced before the sale goes through). Lastly, along with inspection objection items the buyer asks the seller for, I always recommend buyers ask for an HVAC technician to inspect and repair as needed the Furnace, AC and hot water heater.

One other note: Your real estate agent should care more about the buyer’s transaction than making the sale. I tell my buyers that if the inspection doesn’t go well or if the sellers won’t make necessary repairs, I will get them out of the transaction and we will find them another property. It’s all about advocating for the buyer.

My parents were about to buy a house, but hired an inspector at the last minute who found a lot of white mold in the basement

I've bought (and sold) a lot of homes (my mother says I buy homes like others buy shoes), and these are tips that have worked for me.

I've bought (and sold) a lot of homes (my mother says I buy homes like others buy shoes), and these are tips that have worked for me.

Buy a home you can easily afford. A lot of people buy homes at the top of their range, and that's a huge mistake for most...never be a paycheck away from foreclosure or struggling.

Find a house with bad aesthetics and fantastic "bones." Buy the house that looks decent on the outside but has internal superficial ugliness - gross paint, carpets, etc.. As long as the major systems are fantastic (plumbing, electrical, roofing, etc..), superficial things can be fixed and will add instant value.

Buy the cr*ppiest house in the nicest neighborhood you can. It will always sell for more than what you paid for it, if you put in some elbow grease.

Watch out for neighbors. When I sold real estate, I’d tell my clients to walk the neighborhood and talk to the old people. I’d have them call the cops and ask them about the neighborhood. Now, you can google streets, neighborhoods, log onto Facebook groups, etc.

Watch out for neighbors. When I sold real estate, I’d tell my clients to walk the neighborhood and talk to the old people. I’d have them call the cops and ask them about the neighborhood. Now, you can google streets, neighborhoods, log onto Facebook groups, etc.

One thing that never occurred to me until I bought my first place, kids playing out on the street at night. Obviously not like 11pm, but if there are kids riding around at 7 or 8. You know it's a relatively safe neighborhood.

A homeowners biggest enemy is water. So important there is no water leaking from the bathrooms or sink, flooding the foundation or basement, and no streams or drainage that will food the property.

A homeowners biggest enemy is water. So important there is no water leaking from the bathrooms or sink, flooding the foundation or basement, and no streams or drainage that will food the property.

Be sure to get a "fixed" interest rate with your mortgage...and have great credit. No matter what happens in the market, you'll be grateful.

Be sure to get a "fixed" interest rate with your mortgage...and have great credit. No matter what happens in the market, you'll be grateful.

Even if you don't have kids, consider the school district's reputation. It can impact your home's resale value and is a good indicator of the overall neighborhood quality.

Even if you don't have kids, consider the school district's reputation. It can impact your home's resale value and is a good indicator of the overall neighborhood quality.

Think about maintenance. A place with a huge backyard might *seem* awesome...until you are mowing all day every Saturday just to keep up. Things to consider - long driveways (plowing in winter), big back yards (mowing/trimming), etc...

Think about maintenance. A place with a huge backyard might *seem* awesome...until you are mowing all day every Saturday just to keep up. Things to consider - long driveways (plowing in winter), big back yards (mowing/trimming), etc...

I never would have even considered... the house I bought happens to be near a T intersection with a cul-de-sac on one branch. The snow plows go around the corner, back down into the cul-de-sac, then start plowing up the street and scoop EVERYTHING they dropped around the corner into the bottom of my driveway! I always have 2x sized pile as everyone else!

I'll keep this short and sweet. it's an old cliché but here goes, location, location, location. You can have a beautiful house, a pool, 3 car garage and a tennis court, new roof, up scale appliances. But if its in the wrong part of town, good luck on property value going up. Fat chance anyone will even come to your open house. You can pretty up a pig, but are going to kiss it.

I'll keep this short and sweet. it's an old cliché but here goes, location, location, location. You can have a beautiful house, a pool, 3 car garage and a tennis court, new roof, up scale appliances. But if its in the wrong part of town, good luck on property value going up. Fat chance anyone will even come to your open house. You can pretty up a pig, but are going to kiss it.

Location is the only thing you can't change about your house. I worked with a refugee family who had purchased a large, beautiful, modern house. I wondered how they could afford it, but didn't question it. Until the clinic called to say that all the kids had really bad asthma and ask if the adults in the home were smoking. Nope. There is a coal-fired power plant in the backyard of the house.

You can find this funny, but if more of a psychological guide: When you close on the house, you have to immediately do one thing before anything else - delete all of your redfin/zillow/whatever alerts. It is a law of the universe that right after buying your home, you will get an alert for your absolute dream home, and it will be listed at an amazing price.

You can find this funny, but if more of a psychological guide: When you close on the house, you have to immediately do one thing before anything else - delete all of your redfin/zillow/whatever alerts. It is a law of the universe that right after buying your home, you will get an alert for your absolute dream home, and it will be listed at an amazing price.

Property Taxes! You can purchase a lot more home in an area with reasonable property taxes unless your heart is set on downtown somewhere.

Property Taxes! You can purchase a lot more home in an area with reasonable property taxes unless your heart is set on downtown somewhere.

If you live in a no-income tax state, chances are your property taxes will be very high. They can be very high in states with income tax, too, for sure.

Crunch the numbers. Beyond the purchase price, factor in property taxes, homeowners association fees, and potential renovation costs. Make sure your dream home aligns with your financial reality.

Crunch the numbers. Beyond the purchase price, factor in property taxes, homeowners association fees, and potential renovation costs. Make sure your dream home aligns with your financial reality.

"homeowners association fees"? Never buy in a HOA! (Hell On Arrival)

Be careful about real estate agents making claims about the inexpensive cost of repairs and renovations. When searching for my home I would often neglect to tell agents my profession (Structural Engineer) and simply let them talk. More often then not I'd end up giving them enough rope to hang themselves, as they'd routinely drift into speaking about things well outside their expertise. Watch out when they start saying things like "it is really cheap to knock down this wall, that is just some drywall, cheap cheap cheap".

Be careful about real estate agents making claims about the inexpensive cost of repairs and renovations. When searching for my home I would often neglect to tell agents my profession (Structural Engineer) and simply let them talk. More often then not I'd end up giving them enough rope to hang themselves, as they'd routinely drift into speaking about things well outside their expertise. Watch out when they start saying things like "it is really cheap to knock down this wall, that is just some drywall, cheap cheap cheap".

We bought a house for our retirement in a small town near the mountains of NC. We discovered there is a shortage of trades workers here. Carpenters are super booked and will not return your calls for weeks. If they do, they will not be able to do the work for several months. The same with electricians. Plumbers you can only get if you have an emergency. Otherwise, wait three months. The average time to build a new home here is three years. Plus the contractor has to deal with his workers not showing up because it is some hunting season.

You can (almost) always sell your home and move. So don't worry about your "dream home" or "lifelong home". Statistically, you will end up selling and buying something else, eventually. However, that cuts both ways. Don't buy a house you hate just because you think you should get a "starter" house. Buy something that meets your needs and that you COULD stay in, if you need to. But also don't buy thinking you can never move and buy something else (bigger/smaller/different area/whatever).

You can (almost) always sell your home and move. So don't worry about your "dream home" or "lifelong home". Statistically, you will end up selling and buying something else, eventually. However, that cuts both ways. Don't buy a house you hate just because you think you should get a "starter" house. Buy something that meets your needs and that you COULD stay in, if you need to. But also don't buy thinking you can never move and buy something else (bigger/smaller/different area/whatever).

Make a list of all the things that you would like in a home. Be generous to yourself--everything you want. Now, one by one, eliminate everything you can live without. Be as brutal as you were generous.

Make a list of all the things that you would like in a home. Be generous to yourself--everything you want. Now, one by one, eliminate everything you can live without. Be as brutal as you were generous.

If you've done this honestly, you now have the Dealbreaker List. These are the absolutely must-have features. Keep this short list in mind as you see homes on the street or on a website, and share this list with your real estate agent. Hold your agent to this list; if they try to show you some property that does not have ALL your criteria, refuse to see it.

Have a solid six-month emergency fund before you buy a home. Not negotiable, in my opinion.

Have a solid six-month emergency fund before you buy a home. Not negotiable, in my opinion.

It's not so much just having the fund, but the possibility to replenish it after you needed it.

Check appliances. You’d be surprised how many people buy a house with a bad microwave, non-functioning ice maker on fridge, poorly-working dishwasher, etc.

Check appliances. You’d be surprised how many people buy a house with a bad microwave, non-functioning ice maker on fridge, poorly-working dishwasher, etc.

In the UK, Unless specifically mentioned these are not included in a house sale...

Know your market. Go to Zillow and see what houses have sold for in your area, before making an offer...know how competitive the market is, so you know how competitively to bid - how long do homes stay on the market? I've offered prices $100K less than ask and gotten homes, but also gotten homes by offering the asking price.

Know your market. Go to Zillow and see what houses have sold for in your area, before making an offer...know how competitive the market is, so you know how competitively to bid - how long do homes stay on the market? I've offered prices $100K less than ask and gotten homes, but also gotten homes by offering the asking price.

Look at the crime map for your area. There are beautiful cheap homes out there in neighborhoods you'd never want to live in. Don't be suckered in.

This is very outdated. Where my sister lives, houses are sold for at least 100k above asking price. It's insane. There is no bidding anymore, it's just putting a high price down and hoping someone else didn't put down an even higher price. Where I live, houses went up in value for several tens of thousands within the timespan of half a year. Buying a house it not a deal anymore, it's a race.

If the home has been freshly painted inside and out, be wary. Often, paint is used to cover water stains on the interior, and siding and trim decay on the exterior.

If the home has been freshly painted inside and out, be wary. Often, paint is used to cover water stains on the interior, and siding and trim decay on the exterior.

If the home has been renovated to any degree, ask to see the signed off permits. If the Seller is unable or unwilling to produce them, be very wary. The work may have been done by a DIYer who may know nothing about codes and good building practices.

Use your nose. If any room in the house smells musty, or if you detect an odor that shouldn’t be there, be very cautious.

If the house is pre-1965, be suspicious of the electrical system until it has been inspected by your home inspector.

The 1951 built house we purchased for our retirement home had a bad odor. But it was the only available house in our price range during the housing crunch two years ago so we bought it. The bad odor turned out to be two issues: the house had a basement with a rusted leaking drain pipe that the home inspector failed to find. Repairing that pipe and running a dehumidifier in the basement eliminated all musty basement odors. In the main floor the bad odor was from 70 year old paint on the ancient kitchen cabinets. We washed them down with white vinegar and let it set overnight. The odor was completely gone the next morning. We of course had a complete kitchen remodel done.

Do your due diligence. See a lot of properties before making a decision. Monitor what houses are listing for and what they are closing for. Don't bid the asking price unless the seller has set an unusually aggressive price. The only way you'll know if this is the case is if you track the market for at least few weeks/couple months.

Do your due diligence. See a lot of properties before making a decision. Monitor what houses are listing for and what they are closing for. Don't bid the asking price unless the seller has set an unusually aggressive price. The only way you'll know if this is the case is if you track the market for at least few weeks/couple months.

Ask the current owner for any info on the house which you may need. Who cuts their lawn? If there is a well, does anyone maintain it? Who services the pool? Who services the septic? When did they replace the roof? a/c? pool pump?

Ask the current owner for any info on the house which you may need. Who cuts their lawn? If there is a well, does anyone maintain it? Who services the pool? Who services the septic? When did they replace the roof? a/c? pool pump?

I did research about homes with pools as I am a lap swimmer and thought it would be great to have my own pool. They are extremely expensive to run and maintain. You can call the power company for any house you are considering buying and find out what the monthly electric usage is. The one with the pool had electric bills over $750 a month in the summer months to run the pump and filter and the automated cleaning robot. Plus the chemicals are expensive. They require a lot of work. The same with houses that have electric baseboard heating. Super high electric bills to heat with that design.

prior events

prior events

Things such as floods (in the last 10-15 years), infestations, any plants/farms or other industrial activity which happened in the area (including any demolished refineries); not sure if the proximity to the cemeteries is essential to you but you can look into this as well.

One of the things that I personally came across - which is kinda funny - is that one house we looked at (many years ago) was perfect: location, scenery, neighborhood. Just an eye candy.

Then we learned that there were serious problems with the ownership: previous owner "forgot" to sell the land which the house was built on.

Yeah.

So, there was a huge prolonged litigation happening at the time and the current owner "forgot" to tell us about it until we fell in love with the house and were about to enter into a contract, and that's when it came to light.

I am sure it's a one-off weird case, but just want to tell you about it, so ask as many questions that come into your mind as you possibly can, and make sure that you retain a lawyer that protects yours (and only yours) interests.

NEVER buy a house with someone you are NOT married to. This creates a very dangerous legal relationship (general partnership) that’s very difficult to undo w/o going to court and suing one another if one (ex) partner can’t buy out the other and the home can’t be sold to settle the obligation.

NEVER buy a house with someone you are NOT married to. This creates a very dangerous legal relationship (general partnership) that’s very difficult to undo w/o going to court and suing one another if one (ex) partner can’t buy out the other and the home can’t be sold to settle the obligation.

Open floor plan is still THE feature buyers want. Beyond that, an office space seems to be in high demand. At least one bathroom with a tub is important to people with children, but tubs in master bedrooms seem to have lost popularity. (Especially those huge “garden tubs" that used to be all the rage. Hardwood floors in the public spaces continue to be in demand.

Open floor plan is still THE feature buyers want. Beyond that, an office space seems to be in high demand. At least one bathroom with a tub is important to people with children, but tubs in master bedrooms seem to have lost popularity. (Especially those huge “garden tubs" that used to be all the rage. Hardwood floors in the public spaces continue to be in demand.

Walk in closets are in high demand here as many homes are older and don't have them. A bit of fenced yard is also a big asset as many have pets. A deck in back is always a plus.

Value: Are you getting your money's worth?

Value: Are you getting your money's worth?

Condition: Is the house well maintained? (An inspector will help you)

Market: You can't fight the market. Is the home in a market that is and will continue to be in demand or in a declining market?

Affordability: Do you have enough money for the down payment? Can you afford the mortgage, taxes, insurance, utilities and maintenance costs

Suitability? Can you see yourself living here for at least 5 years? (very hard to recoup upfront costs in less time)

Team: Do you have the right people helping / advising you? (Realtor / Mortgage Professional / Financial Advisor / Lawyer

I agree with everything Anthony wrote, but I do have an additional concern: what are you buying?

I agree with everything Anthony wrote, but I do have an additional concern: what are you buying?

Is this your “starter” home? If so, it’s important to find one that can relatively easily be improved upon, in an area with a solid school system (even if you don’t have kids yet). You want to make sure you can sell for more than you bought it for, to have money for the “step-up” home, and make it attractive to a young family.

Is this the home you will live in “forever”? If so, it’s important that it be convenient to your work. Also, consider how much acreage and interior space you have time and money to maintain. For instance, I love to garden. My “forever” home would have to have lots of space for me to devote to having a bigger area to plant. But some people would rather travel; in that case, their ideal home may have little or no land. How much interior space would depend upon how much you entertain guests, and how many children you have. Will you be hosting big family gatherings? Need 4 bedrooms or more?

Are you older, and/or have health concerns, like arthritis? You will need to think about accessibility. A one-level home or condo with easy parking will be essential. Think about room for ramps and grab bars. At least one large bathroom with an easy-access tub (or room for one) would be important. You’d be wise to have no door thresholds and have carpet as opposed to a hard floor surface. Another thought as to parking: even if you don’t drive, it is vital to have access to an area where a car/van/ambulance can easily reach you. Minutes count in an emergency; you don’t want EMT’s facing difficulty getting to you. The better accident-proof your home, the longer you can stay in it, and avoid expensive assisted living facilities.

If you are considering “flipping,” and are about to buy a property to fix up, think about all these considerations with your potential buyer in mind. Who will most be drawn to that house? A young family, retirees, executives? Do some research on schools, parks, commute times, gyms, elder services, area health care, etc.

Just a few ideas to get you thinking! Cheers!

If everything is brand new make sure it’s not a flip house ( bought and reselling in a short time) you’ll have a second appraisal requirement which is potentially an issue depending on listing price, amount of time between transactions and actual value of improvements made.

If everything is brand new make sure it’s not a flip house ( bought and reselling in a short time) you’ll have a second appraisal requirement which is potentially an issue depending on listing price, amount of time between transactions and actual value of improvements made.

Anticipate the future. Research local development plans, zoning regulations, and potential neighborhood changes to ensure your investment stands the test of time.

Anticipate the future. Research local development plans, zoning regulations, and potential neighborhood changes to ensure your investment stands the test of time.

Be thorough, you don’t have to use the inspector someone recommended. Call your friends and family who work in construction or related trades, have an inspection party… LOL Take a moisture meter, check that grounded outlets are installed as required by water sources are the real deal. Flush toilets, turn on all the faucets- check water pressure, how does the water smell? Check for leaking around or underneath every water source including behind the refrigerator. Basement walls, floor, ceiling is there something brand new in the middle of old? (Floor tiles, ceiling tiles, paint) Open everything- doors, windows, cabinets, checking for broken parts rigged up. Look under throw rugs!! Drive through the neighborhood morning, after school and evening to see the full picture. What types of vehicles are present? If you’re not a tea cup people or animal friendly person check out the yards in surrounding homes. Don’t get too wrapped up in the inside of the house unless you’re sold on the location. Pay attention to your gut instinct if something seems off it probably is look deeper now before you become the owner of a money pit. Everyone else can be in a hurry but it’s your $$ you set the pace to your comfort level. :-)

Be thorough, you don’t have to use the inspector someone recommended. Call your friends and family who work in construction or related trades, have an inspection party… LOL Take a moisture meter, check that grounded outlets are installed as required by water sources are the real deal. Flush toilets, turn on all the faucets- check water pressure, how does the water smell? Check for leaking around or underneath every water source including behind the refrigerator. Basement walls, floor, ceiling is there something brand new in the middle of old? (Floor tiles, ceiling tiles, paint) Open everything- doors, windows, cabinets, checking for broken parts rigged up. Look under throw rugs!! Drive through the neighborhood morning, after school and evening to see the full picture. What types of vehicles are present? If you’re not a tea cup people or animal friendly person check out the yards in surrounding homes. Don’t get too wrapped up in the inside of the house unless you’re sold on the location. Pay attention to your gut instinct if something seems off it probably is look deeper now before you become the owner of a money pit. Everyone else can be in a hurry but it’s your $$ you set the pace to your comfort level. :-)

Aside from finding your ideal first home, there are definitely a few people you want on your side to help get you there, and a good buyers’ agent can connect you to most of them.

First, you want the help of an EXPERIENCED and full-time buyers agent. Ask your friends, family, and co-workers who have previously bought who they’ve used and who they would recommend (and why!) Then be sure to check them out online to read reviews and see property history. If someone only has a few transactions a year, are they really going to be able to guide you properly? This agent, if experienced and FULL-TIME, should have established a great network of relevant professionals that he or she can recommend throughout the process. For example, which lenders have a great reputation of getting the job done easily and ON TIME, which attorneys or title companies are good, a home inspector that is respected and thorough yet isn’t going to get you scared about something like a missing GFCI, a reputable insurance Broker that can do the legwork for you…that sort of thing. Another important piece to the buyers’ agent is that this person should not be a salesperson…this person should guide you through the process of finding your perfect home (for now) and let YOU determine if it is the right one. There should be nothing “salesy” about it. You should be encouraged to recognize that, just like love, when it’s the right one…you’ll know it.

Buying a home will likely be the biggest purchase & challenging for first timer. After all, there are so many steps, tasks, and requirements, and you may be anxious about making an expensive mistake.

Before you begin looking, consider the type of residence that will serve your needs, what you can afford, how much financing you can secure, and who will help you conduct your search.

Here are things you need to know when buying your first home:

How's your financial health?

Which type of home will best suit your needs?

Which specific features do you want your ideal home to have?

How much mortgage do you qualify for?

Who will help you find a home and guide you through the purchase?

Buying a home is an emotional and time consuming effort. In addition, there is currently a tremendous shortage of inventory and because of low interest rates a high level of demand. Therefore, I advise my clients to be prepared to lose a home or two before they take ownership of one they will love.

Let’s look at this a bit deeper. It is emotional because looking at homes takes time that is juggled in among all other obligations. One can sometimes feel discouraged that the right home will never be found, or one can lose track of which home has which feature and very quickly feel overwhelmed. It could also be that the perfect home is found, an offer is written at the top of one’s budget, and the offer was beat out by someone else at a significant price premium. I have seen again and again Buyers who are deflated and emotionally raw after this experience. (I have experienced this myself several times). But, I am a firm believer that the right house will match with the right Buyer, and if an offer was lost that means it was not the right house and that was a learning opportunity.

To help reduce the emotional swings, to help ensure a Buyer and house match, I suggest to my clients that they research and decide on neighbourhoods first. When they tell me certain features they like to have around the home, such as close to transportation, parks, restaurants to walk to, or quiet streets lined with trees, I will suggest areas for them to explore. When we have decided areas to search in, our job has just become much easier.

Be sure you have frank conversations with your real estate agent about what you are looking for, what your motivations are, and how you live your life. This discussion often helps Buyers to realize features that they really want in a home that they had not thought about before because they are so used to living a certain way in the space they have. When moving to a new home, you have an opportunity to reinvent your lifestyle, so dream a little bit here and talk about how you would like to live in addition to how you currently live.

The next step is to decide features that a home MUST have. I suggest three to four “must-haves.” This list is so important because we make these features part of the search criteria so that we don’t even look at homes that do not have them. This will save the Buyers time and emotional struggle because they won’t “fall in love” with a home that doesn’t have a key feature and then dither over whether or not to buy it. Buyers should then have a list of four to six preferred items which they are willing to compromise on. When a home is found that has all the “must-haves” and most of the preferred items, it is the right home in an area they have already decided they would like to live in.

As to what to look for in a specific home, I come from a construction background and always nit-pick the details of tile installation, trim and mouldings, etc. I see these as tell-tale signs of the quality of the overall job. When attention was taken to make sure the trim is installed correctly or the tile work is well done, I have more confidence that what we cannot see behind the walls was also well done. Obviously, the reverse is true too. Look for signs of water intrusion, cracks in walls or foundations, and other structural issues. Cosmetic blemishes are easy and inexpensive to fix. Structural issues are a whole other matter. When these things are noted and the Buyer decides to go ahead on making the offer, then we make sure to ask our home inspector to take a look at them and give us advice.

Also be prepared on your first few home tours to find out more about what you do not want in a home than possibly finding the right home. You may decide to realign your “must-haves” and “preferreds” list after you have seen a number of homes that left you wondering, “What were they thinking!?” Or perhaps you have realized that you cannot get all of what you want in the budget range you have set.

Visiting open houses is a great way to begin this buying process. Use open houses as a way to begin the process of firming up what you definitely want in a home and what you definitely do not want. Keep in mind that, in most states, any agent hosting an open house legally represents the sellers, even if they are not the listing agent. According to the laws of the state they may or may not be able to give you advice, discuss other homes for sale in the area, etc. But all of them should be able to tell you the features and benefits of the home you are touring and discuss the surrounding neighbourhood. Before or after visiting the open house, walk or drive around and check it out. If you think it is an area you might consider living in, check it out at different times of the day.

Price and market history. Save your money. Or look just to purchase a rental home. If there is a positive cash flow then that makes sense.

Price and market history. Save your money. Or look just to purchase a rental home. If there is a positive cash flow then that makes sense.

Primary residence is a money down the drain.

Some things first time home buyers should check for on a house before buying

Property documents checklist.

The buyer should be clear about their needs.

The Buyer should be financially ready.

Use a trusted realtor.

These are some of the important points that need to be considered while buying a house. Sometimes the buyer does not keep these things in mind so hiring a team of expert real estate agents is required.

Before falling head over heels for that charming curb appeal, check the bones! A robust foundation and sound structural integrity are the cornerstones of a happy homeownership.

Don't let unexpected leaks rain on your parade. Assess the roof's condition, looking for signs of wear, age, or potential trouble. A solid roof is your shield against the elements.

Unwanted housemates? No thanks. Conduct a thorough pest inspection to ensure your dream home doesn't come with uninvited guests like termites, rodents, or other critters.

Drips, leaks, or water pressure woes can be major dampeners. Check faucets, inspect pipes, and give the plumbing a once-over to make sure everything flows smoothly.

Ensure the electrical system is up to code, with no faulty wiring or outdated components that could turn your dream home into a potential hazard.

Look for energy-efficient features like insulated windows, efficient HVAC systems, and sustainable appliances. It's good for the planet and your pocket.

Be absolutely sure that the city where you are buying will be your city of permanent residence.

Assess your job in terms of security and steadfastness. You will most likely go for a loan. You must be able to repay the loan.

There is no need to hurry to buy now. Save for the downpayment right now to reduce the loan. It is a myth that good property will be lost if you don’t buy now.

Expanding on the above point - do not go for a hefty loan with a 30-year tenure (because it reduces EMI). The longer you pay, the more interest you pay and the longer you are in debt. I always advise 15~20 years.

Check out resale properties. A good bargain can be had on resale - closer to your chosen area, bigger, etc.

Be wary of "helpful" friends and family. Just because your roommate's uncle is a real estate broker doesn't mean you should use him and trust his judgement on your buying decision. This can be a really expensive lesson to learn. The same is true of someone who is a lender, inspector, real estate lawyer, contractor etc. These people might be the right choice, but don't put your life in their hands. This is likely the biggest financial move of your life, so give it your full attention.

Small details matter.

Builders encourage you to splurge on flashy things like tile floors and stone countertops as a mark of “quality,” but those are things where they can make a lot of money on markup.

Where they really try to cut costs — to win on the overall price of the job — is on things that most people don't think of, because they aren't sexy or glamorous, and most non-builders are completely unaware of.

Framing lumber. Many builders use green lumber because it is cheaper. As it dries, it bend and twists in unpredictable ways. This results in wavy walls and popping nails. If it doesn't dry quickly, it can grow mold. Instead, specify kiln-dried lumber.

Cleaning during different building stages.

Sweep and vacuum the entire house after framing and rough utilities are installed, but before insulation and wallboard. This removes chips and dust that can harbor insects, and makes sealing holes and cracks easier.

Vacuum again immediately before painting. This removes dust remaining from the installation of wallboard, and prents the dust from getting on the wet paint.

Outlets and light switches.

Install more receptacle oulets than building codes require. In the US, the code requires that no portion of a usable wall be more than 6 feet from an outlet. That means that they can be 12 feet apart. That might not be enough! Think about how each room will be used. Work with your architect or electrician to decide where to put them, otherwise they will just guess.

Your builder will probably use the cheapest outlets and light switches available. (Actually, they get bids from electricians, who use the cheapest to give a lower bid.) A typical outlet costs less than a dollar, but if used in a “high use” area like a kitchen or bathroom, it will be worn out in five years. That's a fire hazard. Commercial quality outlets and switches will cost a few dollars more each, but will last many times longer. Specify commercial grade electrical devices throughout the house. It will cost a few hundred dollars more for the overall job, but you will have a much better result.

Ceiling lights. Ceiling lights are best installed in the visual center of the room, which may not be the physical center. Sometimes, the visual center lines up with the center of a window or doorway. Other times, it depends on how the room will be furnished. Again, work with your architect or electrician to figure out the visual center of the room, otherwise the electrician will just guess.

Lighting design. Most of the time, you end up with a ceiling light in the middle of the room. While that is adequate to keep you from injuring yourself in darkness and shadows, it often is less than ideal for task or mood lighting. Work with a lighting designer to have well-lit rooms without distracting shadows and glaring lights.

Wired networking. WiFi is all the rage, but for anything that is not mobile (like a printer or desktop PC), a wired connection will be the most reliable, and wiring it will leave more WiFi bandwidth for your mobile devices. Install a minimum of two wired (CAT6 or better) network drops in each room. Also install drops in strategic locations for ceiling-mounted wireless access points. (They can be powered over the network wire, so no power outlet is needed in those locations.) Better yet, install conduit to the jack locations so future connectivity methods can be easily installed.

Trim selection. MDF trim — basically, thick paper — is a popular choice for painted trim because it is inexpensive and easy to work with. But, compared to solid wood, it is more easily damaged (especially by water). Insist on solid wood window sills (at least) so that they won't be damaged from moisture from condensation or plants.

These are aspects of home building that most future homeowners are unaware of, but can make a difference in the quality and livability of the home.

Don’t forget to cross-check the necessary documents for the property. See if they are complete and correct. This is important for both short-term and long-term implications. I would suggest, if you are not familiar with this or if you don’t know how to be sure that the documents are clear, it’s good to consult a real estate expert to help you with this. It would certainly help you with your concern. In my case, there wasn’t a question about documentation, as I knew well about Lodha and its documentation processes. They were absolutely clear. I guess, it’s an advantage that you get when you buy a property from Grade A developers like Lodha Group.

The Golden Rule to Rule All Other Rules: Almost all the stress of building a home comes from unrealistic expectations.

Start with determining your budget and average costs per square foot in your area. So much strife between the builder and homeowner comes from not having a realistic grasp on your budget ceiling and how much it costs to build custom homes. If your architect/designer doesn’t have an idea of how much things cost, you had better consult with a contractor sooner during the design phase rather than later.

Think of how long you think it will take to design and build a home and double it.

Understand that you will never get everything correct. There will always, no mater how many times you design a custom home, be something that you later on realize you would have done differently.

Don’t be afraid to tell your architect/designer that you don’t like something. A lot of headaches are caused by people who are a) too nice to say they don’t care for something, or b) don’t really know what they want and are indecisive. We’re not drawing our house… we’re drawing your house. If your architect can’t handle that, find a new one. We do our best to listen and make educated guesses at what you’d like to see in a house, so knowing what you don’t like is as important as knowing what you do like.

Do your homework. Choose a style before you start the planning stage. During the building phase, when your contractor asks you to choose your appliances, do it quickly and give him an electronic copy of the list so he can refer to it. Don’t delay your own job making him wait for your selections. It’s hard enough to keep things efficient.

Don’t underestimate the amount of decisions you will be asked to make. Designing and building a custom home is 10,000 decisions. A contractor can make educated guesses, but if he’s not sure he has to not be afraid to ask you. If you act overwhelmed or get frustrated with the amount of questions being thrown at you, he’ll start to dread having to call you and will start making decisions without you that he probably should have asked. So make him feel like you’re happy he calls a lot.

Finally: The following rule applies to construction more than any other business in the world…

You can have it fast, you can have it quality, and you can have it cheap. But you can never have more than two of those at one time.

You make money when you buy a home, not when you sell it. In a housing market with record high price levels, this concept can be difficult to understand so I’ll explain with a simple example. It can help you avoid one of the biggest home buyer mistakes.

A property I currently own is in a cookie cutter neighborhood where all the homes are pretty much like one another. They share very similar square footage, lot size, and look pretty much the same. A neighbor and I purchased our homes exactly one day apart but he paid $39,000 more for the same home. So how does this happen?

For starters, many buyers (and sometimes lazy Realtors) overlook that getting a purchase offer approved is just the first step in the purchase process. As a buyer, you now have the opportunity to complete a home appraisal and inspection and negotiate credits or discounts if there are problems with the home (tip: virtually every home needs maintenance and updates that enable you to negotiate a credit). Simple tips such as these enable you to get the home for even less than the negotiated purchase price. The lower purchase price also means a lower monthly mortgage payment and other perks that add up over time.

More importantly, using these tips to negotiate a good purchase price buys you a lot of protection as a homeowner. You can now make needed or surprise repairs without overspending on the property and you also have a lot more equity if the housing market does take a downturn. Furthermore, if you decide to sell the property quickly, that equity you earned right away can help cover Realtor and other fees that can often dig into your profit margins. The buyer who paid $39,000 more for the property would not be able to do that as easily.

It’s true that you collect money when you sell a home but you earn it when you buy a home through smart negotiation that saves upfront fees and ongoing expenses during the time that you own the property. Happy buying.

Finalizing Floor Plan & Location of House.

Prepare the plan by utilizing your experience in staying houses of your choice . Finalize plan after discussing with your family members .

Maximum availability of Sunlight & Ventilation is the basic parameter to finalise location . Every year ,summer temperature is increasing gradually. So provide Windows of bigger size ( French Windows / windows up to roof level ). Give a ventilator above all doors ( windows touching roof level ) . If the door size is 1.2mx 2.4m , ventilator size can be 1.2m x 0.45m . Fix grill & mosquito mesh for ventilator.

Air Circulation in House .

While keeping all windows & doors open , every part of house should get ventilation . Hot air will go out through the ventilator & fresh air will come in through windows. Keep open the windows in day and night . Curtains, mosquito net & window grill will take care of the safety . If we are away from house, keep open one window/ ventilator in every room to have minimum air circulation. If we are closing all windows & ventilator trapped hot air inside will create cracks on wall .

Minimum two Windows for every room on opposite wall.

While planning house have an air duct/ open area in the central area of house to provide windows to get maximum cross ventilation.From all rooms we can give windows to

this area .

Architect & Construction Supervisor.

If you are having minimum information / knowledge about planning & house construction no need of an architect / work supervisor . Visit few house construction site , interact with house owner / contractor / skilled workers . If you have an Architect / engineer in your friends circle utilize their service.

Outsourcing Construction.

Give only labour contract & supply all materials to them .

Steel & Wood .

Use the reinforcement steel of SAIL, TATA-TISCON , Visakhapatnam steel plant, as they are making steel fro iron ore . Not to use any steel prepared in the re-rolling mills using scrap.

In market wood from Malaysia & African countries are available in different rate . These wood are not seasoned by immersing in water & cracks will develop any time . So use only Indian wood.

Cost-Effective Construction of House.

If you ate interested in this, use locally available natural materials to maximum extent.

Thanks for the A2A Kyle. Rather than regurgitate the same pre-printed and theoretical things that have been circulating for decades, I’m going to list the top 5 things my most recent buyer clients didn’t know or were unsure enough to ask me about.

The person who shows you the house becomes your agent.

This is not a hard and fast rule and generally doesn’t usually apply to attending an Open House. But sometimes a buyer says they may call the number on the sign on the property for a tour because there are no Open Houses and they don’t want to bother me for all the homes they may want to see that they are not seriously interested in buying. Then they think they can call me if and when they do want to buy the home. Even if the agent represents the seller, i.e. agent on the sign, that agent is usually entitled to both sides of the commission if you call them to come out and show you the house. Most often they still do not represent you as they already represent the seller BUT they get paid the buyer agent fee for NOT representing you in addition to the seller agent fee. Be mindful of this as it is often the lack of choosing their agent wisely that most buyers in hindsight regret. Choosing one by accident is not a good idea.

“How do I get my Earnest Money back?” when asked while writing an offer.

You should never make an offer while at the same time expecting to get your Earnest Money returned to you if you change your mind about buying the home. It is called “Earnest” money because it is the money you agree to give to the Seller showing how earnest you are about buying the home and that you pre-agree to forfeit to the seller if you change your mind. That IS what EARNEST MONEY is. The amount you agree to forfeit. Yes, there are ways to get your money back, but those are things that you pretty much can’t know at time of offer. New information is not just “new to you”. Contingencies where you can insist on the return of your Earnest Money are things that happen after the fact. The level of traffic out front did not change. The house did not get bigger or smaller or have fewer bedrooms or bathrooms. So you can’t ask for your Earnest money back because you decided you really needed four bedrooms instead of three or you really wanted a brand new home and not a resale home. It is really unfair for us to call it an “offer” because it is a binding contract if the seller accepts it without changes. Be careful when making an offer and know that it can unilaterally become a binding contract if the seller accepts that “offer”. There are lots of ifs, ands or buts on this…but KNOW that you should not be making offers frivolously with the idea that you will decide whether or not you want the house after the seller accepts your offer.

You are buying “AS-IS; WHERE IS”

Things people say when looking at a house. “I think I’ll cut down half of those trees and build a workshop/studio on the back of the yard.” “I think I’ll close off the downstairs and make this a duplex and rent out the lower level.” “I think I’ll put a second story on later, but for now this will do.” “There’s lots of land so we can add a few additional bedrooms later (septic)”. “We can knock out that wall…(wish I had a nickel), sometimes you can’t.

Even without an HOA, most local ordinances restrict how many trees you can cut down. This is especially true here in the Seattle Area. Yes, you see builders do it. But that doesn’t mean you can buy a house and clear all the trees out of the yard. Yes, you OWN it, but that doesn’t mean you can clear all of the trees on the property. Yes, there is a way to turn the lower level into a separate living space that you can rent out BUT that doesn’t mean the Single Family Home zoning will let you turn it into two dwellings and rent one of them out. Even if it is “a duplex”, be sure the ZONING is “duplex”. It could be an MIL or an ADU which means you must live in the property to utilize it as two and you can’t leave and rent them both out at

As any common man would say money is the key factor which you would need but that doesn’t seal the deal. As a customer you need to go through every detailing that makes you buy a perfect home and have a clear path in the journey of buying a home from scratch. The factors that you should ponder upon are:

1. Be Financially Disciplined to Build Down-Payment.

2. Stick to Your Budget.

3. Research on Your Dream Home.

4. Don't Just Save – Invest.

5. And Set Aside the Money for Future EMIs.

6. Prepare for Other Expenses.

7. Improve Your Credit Score.

8. Compare Home Loans.

1) Understand the area: Decide what areas best fit your lifestyle. If you're unfamiliar or new to the area your Realtor really comes in handy here. Area is more important than the house for a number of reasons including re-sale value, schools, proximity to work, family, & friends, etc.

2) Take note of the property condition: When touring homes, take note of any potential repairs or updates needed in the house (silently, don't point these things out to the homeowner at your showings). Good Realtors will do this for you automatically as well. Look past cosmetic changes (paint color, furniture, landscaping). Look for visible issues such as water damage (as well as the smell of moisture for that matter), condition of the A/C, water heater, & major appliances, condition of the roof, electric panel (mainly to be sure it isn't a model that is no longer up to code as many older units are considered fire hazards), age & condition of windows (replacing windows can be costly), & signs of termite damage (this typically looks like small piles of pellets). Keep in mind not all major problems are visible to the naked eye. If you see any of these issues, consider them a preliminary warning. Never assume you know what the issues are just by looking. Once you're in contract, always purchase a home inspection with a reputable inspector so you can identify the proper cures for any defects.

3) Know the true value of the home: Once you decide on a home you like, have your Realtor prepare a thorough market analysis on the property based on the comps & the repairs/updates you noted. These are the facts you will use to negotiate your offer with the Seller.

Selecting a home to purchase can be a stressful endeavor on many levels, both financially and emotionally. Based on my experience of guiding clients through the process, I recommend the following:

1. Visit the property at least 3 times prior to making an offer. This will allow you to be more objective each time you see the property. Also, make sure you vary your visiting times (day/night, weekday/weekend).

2. Look at other homes in the neighborhood in which you have a strong interest. This will give you leverage in negotiating a price on the home you want.

3. When you do make an offer, allow AT LEAST 10 days for an inspection contingency, preferably 14 days if the seller will allow it. During that time, inspect everything. Usually brokers are good at recommending reputable home inspectors. Also, get professionals specific to each trade to come and inspect the various components of the home (e.g., get a HVAC guy to come and look at the heating/cooling system, etc..g

4. Don't be afraid to ask the seller for credits for defects found.

5. Again, during the inspection period, go out to the property at all times of the day to get a feel for the neighborhood, neighbors, etc.

6. Most importantly, hire an attorney in your area who has experience in real estate transactions.

7. Know what you can afford: do your budget and make sure your mortgage payments won't break you every month.

That said, purchasing a home is an exciting event for you. Best of luck!

Are you buying to hold, build and sell or build and live in? These are the main questions. Then, consider, you make your money - to a large degree - when you buy. The price you pay and the deal you get will first be determined by your answer to the first questions. This will help determine how much is a good deal.Secondly, the location, potential increase in value, current market, zoning, cost of building what you want, resale in the lands location for finished product. Take one step at a time. Start with the basics to stay safe and smart.

Here are the top 10 things you should know when buying a house:

Budget and Affordability: Determine your budget and understand what you can comfortably afford. Consider your income, existing debts, down payment, and ongoing expenses like mortgage payments, property taxes, insurance, and maintenance costs.

Location: Evaluate the neighborhood, proximity to amenities (schools, hospitals, shopping centers), transportation options, crime rates, and future development plans. The location can significantly impact your quality of life and property value.

Property Inspection: Hire a professional home inspector to thoroughly evaluate the property's condition. They can identify potential issues or hidden problems that might require costly repairs in the future.

Financing Options: Research different mortgage lenders and loan options available to you. Compare interest rates, terms, and closing costs. Get pre-approved for a mortgage to strengthen your position during negotiations.

Homeownership Expenses: Understand the total cost of homeownership beyond the purchase price, including property taxes, homeowners association fees (if applicable), utilities, maintenance, and potential renovations.

Resale Value: Consider the potential for future resale value. Look at the housing market trends in the area, property appreciation rates, and factors that can positively or negatively impact the property's value over time.

Legal and Contractual Obligations: Review all legal documents carefully, including the sales contract, disclosure forms, and any contingencies. Seek legal advice if needed to ensure you understand your rights, obligations, and any potential risks.

Title Search: Conduct a thorough title search to ensure there are no outstanding liens, claims, or disputes on the property. This step ensures that you are buying a property with clear ownership rights.

Homeowners Insurance: Research and obtain homeowners insurance to protect your investment. Adequate coverage will safeguard against unexpected events like natural disasters, theft, or liability claims.

Future Plans: Consider your future plans and how the house aligns with them. Evaluate factors like the size of the property, number of bedrooms, potential for expansion, and the overall suitability for your long-term needs.

Rule number 1: You are investing your money, not simply purchasing a place to live.

Most people spend more time researching and picking out a car then they do in picking out a house and neighborhood.

Rule number 2: do your homework and never buy a home within the 500 year floodplain. Ever. It is not a bargain, it is a disaster waiting to happen.

Rule number 3: you may not be concerned that when your house is paid for that it might be worth less than you paid because you think “I’ll be living here until the day I die.” Actually, statistically, you’ll be selling in about eight years and the last thing you want to find out after eight years is that the house is only worth what you owe on it.

It is an investment, pure and simple. Secondarily, you’ll probably live there, so be sure it’s what you’re comfortable with. Not necessarily wildly in love with, but comfortably content.

Additionally, if you are planning to grow crops and/or livestock and will require pasture, be certain to know what water rights are connected to the land, both surface and ground water. Developed/improved water resources will improve the productivity of the land and appreciate its value.

I haven't seen anyone mention environmental issues in the previous answers. When buying land, think about the costs of environmental issues. The most obvious being (in development) density or coverage (impervious) on the site. Soil quality, which many mentioned, plays into density but it and the topography of the land itself, could increase development costs whether you're in New England blasting ledge, or Florida sinking piers on silty soil, the site work is an expense that you must know. Beyond that, even raw, virgin forest land can be contaminated if down gradient from a site with a spill. Farmland is often environmentally impacted. Remediation is an additional cost.

And finally, I'm not sure about the rest of the country but here in CT, the number one thing to know about land is Vernal Pools! Vernal pools can send you entire project askew, moving parking lots, buildings etc. to mitigate the impact on both the pools and their areas of safety. Wetlands in general have more impact on development potential and cultivation possibilities every year.

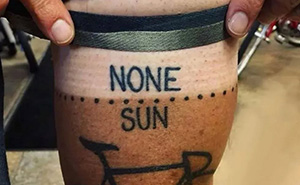

Lots of Sun. Lots of air. And if possible, as close to a perennial source of water, as possible. All of this reads pretty romantic, I know, in this age when you can barely get a few square feet of sky and a handful of stars... in a structure jutting into the sky...

But if you can, get as many windows and doors open in the East. Especially, of all your bedrooms. Do your checks in summers, if you are in India or in the Northern hemisphere near the tropics.

- Water in basement is problematic; some moisture is normal but excessive amounts indicate serious issues.

- Basements resembling swimming pools should be deemed worthless; purchasing such a property is a scam.

- Properties with significant water issues should be demolished rather than sold.

- Presence of mold or musty smells should be avoided; they are health hazards and may signal larger problems.

- Hot water heater and/or furnace over 10 years old is concerning; while replacement is manageable, it can be expensive.

- Any signs of leaking pipes should be avoided; they indicate potential underlying issues.

I'm sure there's lots more. But these are just some things I looked for or experienced during and after my home buying process.

Right agent & right lender if you need a loan. You choose wisely in those two areas and you are virtually assured of success.

1. Right agent: way to many buyers don’t pay much attention to what agent they use because the sellers pay the commission. You need to recognize that you are hiring your agent to guide you whether you are paying them directly or not. And choose unwisely you could overpay, get into a bad property, pull the trigger too early, etc… A good agent will tell you what’s wrong with properties, know the market, be recognized by other area agents, advise you to see plenty of places before you buy. Don’t settle on one till you find the right one, even if your mom loves the agent who helped them buy 30 years ago.

2. Right lender: many communities have nuances and quirks that only a local lender would know about. Being able to address these issues is often the difference between offer accepted and rejected, or having a deal blow up in process. If you do #1 above properly they will be able to make recommendations.

Best all-around tip: Don't do it. Seriously. Buying a house almost never makes sense financially, and owning a house is a lot of work.

Right, I know, your real estate agent has asked the usual question, Why throw away money on rent when you could buy? That might make sense if you could buy the house for cash, but you probably can't. You'll need a loan, so you'll just change from throwing away money on rent to throwing away money on interest payments.

But there's the tax deduction for mortgage interest, too, right? Well, yes, but in order to claim it, you have to give up your standard deduction, which is currently over $12,000 for a married couple filing jointly. If you buy a house for $300,000 with a 30-year, 4.5% mortgage loan and 20% down, your first year's interest is less than $11,000. You're better off keeping your standard deduction!

And what about that 20% down payment? You're looking at $60,000 in cash, up front, right now, plus closing costs that might be in the neighborhood of $5,000 to $10,000. If you were to invest that money in stocks instead, you'd expect it to just about double in the next ten years to around $130,000 (based on historical returns, and taking the low end of the range of closing costs). In real estate, you'd be lucky to get 2% or 3% per year, so you'd be looking at a gain of maybe $85,000. During that time, you paid in another $49,000 of principal, so your real net gain is about $36,000. Closing costs when you sell will come to $30,000 - $35,000, so there you go.

Cellars/basements are vastly under-rated spaces.

If you can build it in from the start, and local geography allows, a cellar is a great way to increase the size of your house without going too high, or too big, both of which may be restricted by zoning etc. It can replace your foundations.

It is soundproofed by earth -good for noisy hobbies, or a cinema room- you don’t want windows there!

It is naturally temperature stable- no need for air conditioning

Provides lots of storage, it is a good place for utilities

In some areas, a storm cellar is useful

If you have a sloping site, a drive in basement/garage is an easy way to level the site

Other bits.

Ducting for cables is future-proofing, and easy.

Isolation valves on water and heating systems will make your life easier, and cost next to nothing

If you want high end materials, choose timeless classics that won’t go out of fashion. The room I’m in right now has a decent wooden floor that is 100 years old, and still looks good.

If you can design you layout to work with the sun for heating, or with natural shade for cooling, you’ll save lots of energy and effort.

Decent external shutters are good for noise, heat, shade, security and weather proofing!

Following are the important points to be noted while planning for own flat

Your convinience to travel to the office.

Your spouse convinence to tral to his/her office.

Your childs convenience to go to school.

Convinence to travel to market during normal days and in case of urgency.

Convinence to travel to hospital in case of emergency.

Would suggest if your are trying to buy a house other than the area you are living in first try it with rental hiuse in the new area where you are planing to buy house look at your convinence and then decide to buy.

You have to check the credibility of seller viz whether he has complete the project on time, has he kept up his promise, you have to check this from the market and not the seller.

You then check for the loan which you would receive for your income.

Sources for down paymenr viz savings, savings in the form of PF savings receivable from freinds and relatives etc.

Then you have to keep certain funds for your emergency purpose if reqd. Try to have 10% of the house value has the builder is bound to come with changes demanding you with excess cost.

Whether you are purchasing ready to occupy house or under construction property since under construction property might cost higher as it may include GST. Also you have to pay rent for under construction period for the house you are living in.

Whether you are going to opt for small buildet or big one, has for big one the cost is also higher and you have to pay higher maintenance cost after possesion.

Check with your lawyer for the credibility of documents also check Encumberence Certificate for 25 years.

Decide the bank in which you are going to take loan based on interest, processing fee documentation charges etc.

Last but not the least have some money in your packet for house warming ceremony.

Best of luck for your new house

They forgot about the part that you should have bought the house in 1993? 🙃

We bought ours in 2007... it was still a good time then.

Load More Replies...They forgot about the part that you should have bought the house in 1993? 🙃

We bought ours in 2007... it was still a good time then.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime