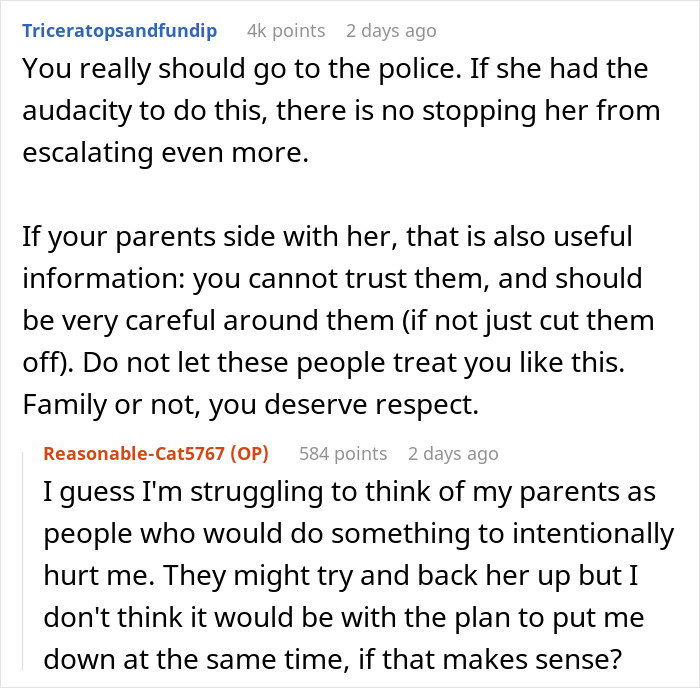

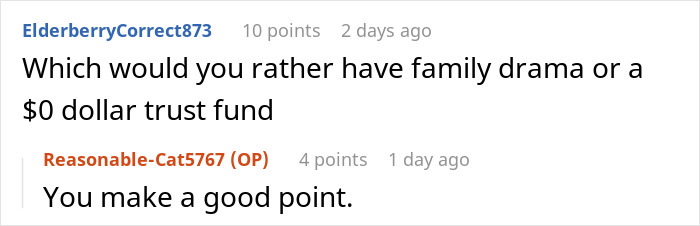

Woman Discovers Sister Faked Rehab Stay To Steal From Her Trust Fund: “I Am Livid”

Family and money are two things that can make life either incredibly fulfilling or deeply complicated. And when the two are at odds, it creates an explosive mix.

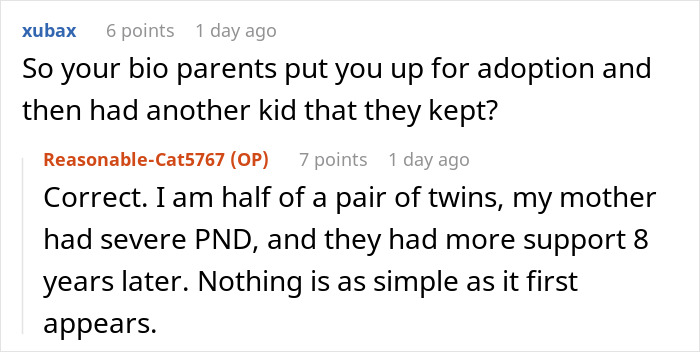

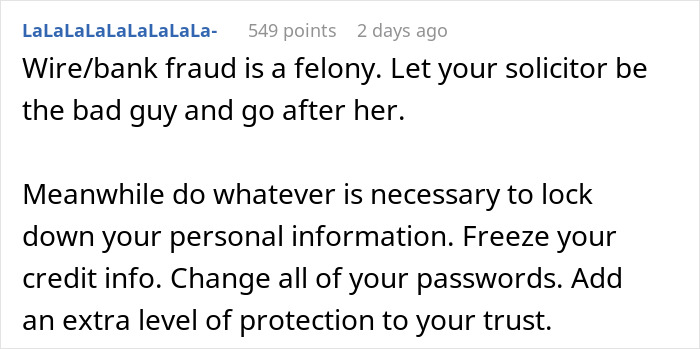

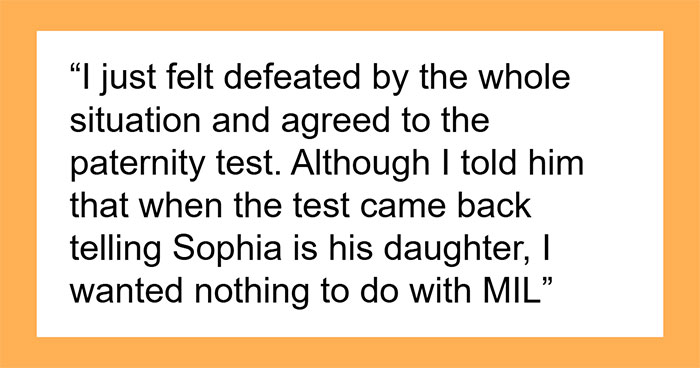

A troubled relationship had kept this Redditor and her sister apart for nearly ten years. But tensions flared recently, going from bad to worse when she found out her sibling had tried to take tens of thousands of pounds from her mental health trust fund. A shocking display of audacity, to say the least. Now, she’s grappling with the fallout and deciding what steps to take next.

The woman’s relationship with her sister had been troubled for years, leading to a decade of no contact

Image credits: MART PRODUCTION/Pexels (not the actual photo)

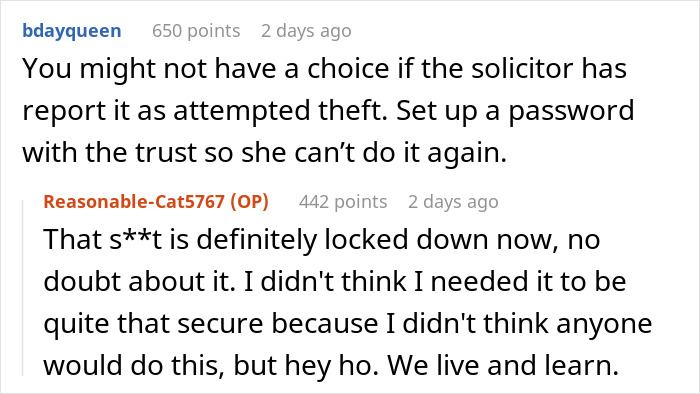

But recently, it went from bad to worse when she learned her sibling had tried to take thousands of pounds from her

Image credits: Mikhail Nilov/Pexels (not the actual photo)

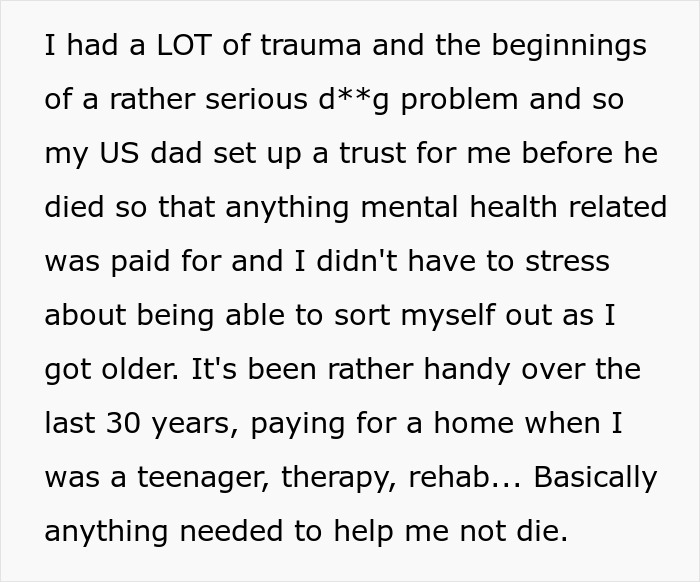

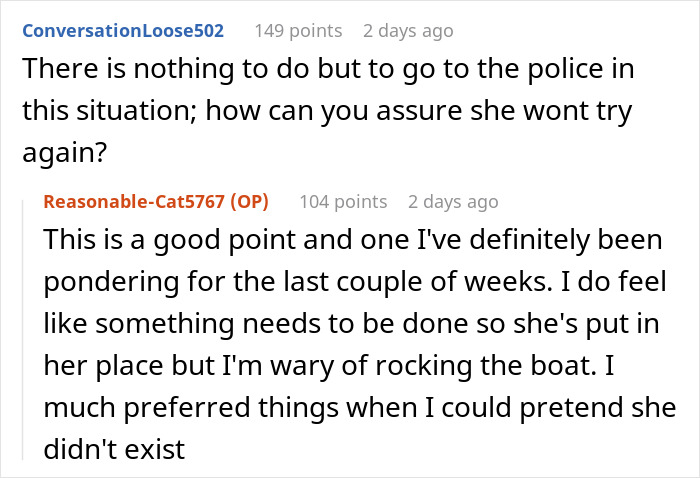

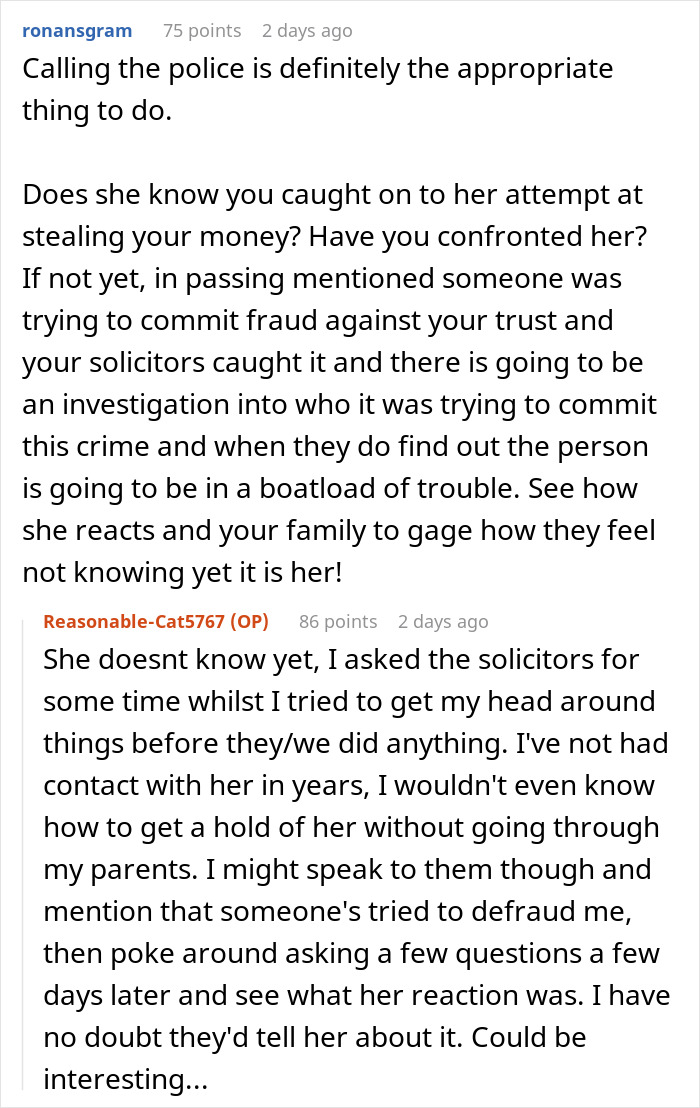

Image credits: Reasonable-Cat5767

Nearly 1 in 7 siblings fight about money

While siblings are known to fight about almost anything, arguments about money, as it turns out, are surprisingly rare. A 2017 report by Ameriprise Financial revealed that only 15 percent—or roughly 1 in 7—have financial disagreements. Most handle the topic without much drama, which might come as a relief to many families.

“The majority of siblings, about two-thirds, say they are talking about money,” Marcy Keckler, vice president of financial advice strategy for Ameriprise Financial, told CNBC. “They’re having conversations about money, and they’re going pretty smoothly.”

The downside is that when siblings do argue about money, parents are often caught in the middle. According to the report, 68% of these disputes involve them in some way. Common issues include disagreements over how parents distribute financial support to their adult children, how inheritance is divided after they pass, and differences in the level of care or financial help siblings provide to aging parents.

“There’s definitely a push-pull when it comes to this topic,” said Becky Krieger, a certified financial planner and senior director for wealth management teams at Accredited Investors Wealth Management at the time of the report, now a managing partner, in an interview with CNBC.

“I don’t think the parents want any conflict to surface regarding inequality,” she added. “But there are a lot of people who don’t want to talk about these subjects, either.”

Avoiding conversations about money might actually be at the root of the problem. A 2023 study from Carleton University in Ottawa, Canada, which surveyed nearly 500 people who were married or in serious commitments, found that addressing financial issues (as long as they’re small) can strengthen relationships.

“Married couples that were discussing, even in disagreement, mundane everyday expenses and spending reported more positive relationship outcomes,” noted the authors of the study Johanna Peetz, Zoe Meloff, and Courtney Royle.

Of course, finding out a family member secretly tried to steal from you is hardly a “small disagreement.” That’s a major breach of trust and far from healthy. But the takeaway here is clear: when it comes to family finances, it’s better to have open, honest conversations—even if they lead to minor squabbles—than to let resentment or secrecy fester.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

30

0