“Doesn’t Look Like We Can Avoid The Inevitable”: Hospital Worker Faces $5K Repayment Demand

We all face moments where things don’t go as planned, and sometimes those moments can be downright frustrating. Whether it’s a misunderstanding, a mistake, or just plain bad luck, life can throw us unexpected challenges that leave us scrambling for solutions.

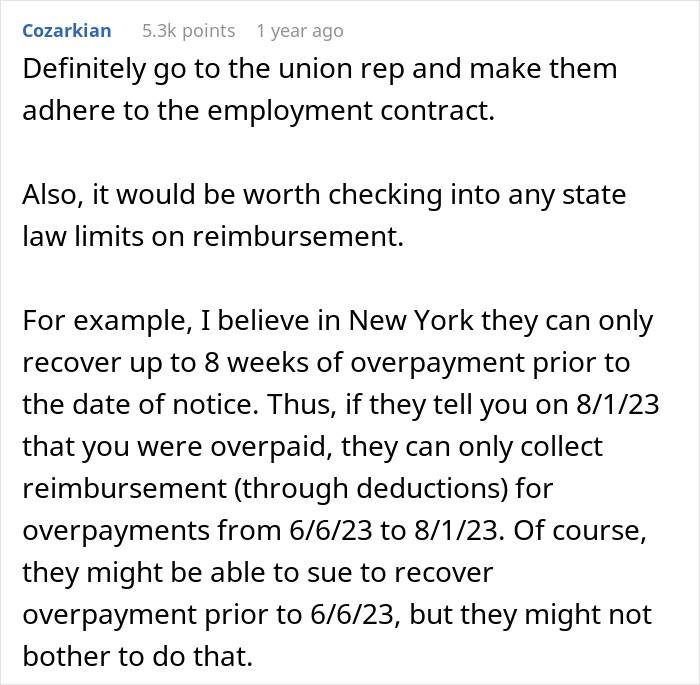

A person shared online how their girlfriend, a hospital worker, found herself in a tough spot after being told she owed $5,000 due to an overpayment error. Despite working hard and relying on her paycheck, the author’s girlfriend is now caught in a difficult position. Keep reading to find out how this story unfolds and what options she’s left with.

We might encounter unexpected challenges in life that can be deeply troubling

Image credits: Getty Images / unsplash (not the actual photo)

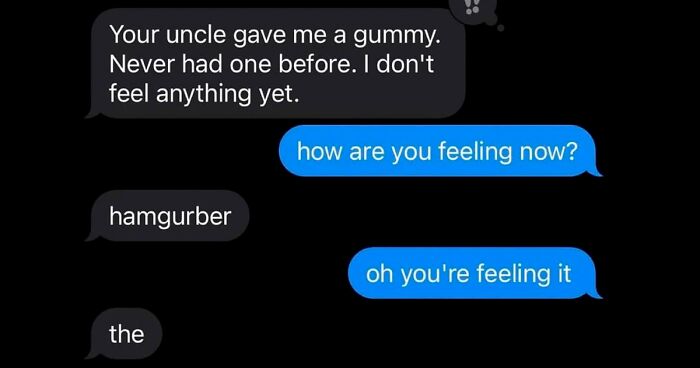

A person shared how their girlfriend is thinking about resigning from her job after a payroll error led to a $5,000 repayment demand

Image credits: Behnam Norouzi / unsplash (not the actual photo)

Image credits: Kateryna Hliznitsova / unsplash (not the actual photo)

Image credits: Mdg12d

Payroll mistakes can significantly affect employees

Mistakes can happen in any business, and payroll errors are no exception. These errors can create big problems, affecting both the company’s finances and the employees who rely on their paychecks. When such issues arise, they can cause significant stress and complications for everyone involved.

According to an EY report, companies with 250 to 10,000 employees were surveyed to understand the scope of payroll errors. The results were eye-opening. On average, businesses achieve only about 80.15% accuracy in their payment processes. That means a significant number of employees receive faulty salary payments.

When such mistakes occur, it takes companies about $291 to fix it. This includes both the direct costs, like correcting the error and processing refunds, and the indirect costs, such as the time spent dealing with the fallout and potential damage to employee trust.

The report highlights several types of payroll errors, with some being more common than others. When it comes to managing vacation and sick leave, mistakes happen more often than we’d like to think. On average, there are 721 mistakes for every 1,000 employees.

This could mean that your request for time off got lost or mixed up, or that someone’s sick leave wasn’t recorded correctly. Imagine planning a vacation and finding out that your vacation wasn’t approved, or being told you don’t have enough sick leave when you’ve been saving it up.

Image credits: Mohamed hamdi / unsplash (not the actual photo)

Payroll management is crucial because people depend on their paychecks to support their lives

Many employees rely on benefits like health insurance and retirement plans. Mistakes in handling these can mean you end up without the coverage you need or get the wrong benefits calculated. This can be really frustrating, especially when you’re counting on these perks for your health and future.

Similarly, time or attendance error is also a frequent payroll problem. When a company miscalculates the number of hours an employee has worked, it can lead to issues with how much they get reimbursed.

For instance, if you forget to clock in or out, it can lead to incorrect hours being recorded, which might affect your pay. You might get less salary compared to the hours you worked or more if you accidentally included extra hours.

There are times when such errors can happen due to technical glitches. If there are software or hardware issues with the timekeeping systems, it can also cause errors. A malfunctioning time clock might not record the exact time someone starts or ends their shift.

If there’s confusion about work schedules or if changes in the schedule aren’t communicated clearly, it can result in discrepancies. Just like in the case where the author’s girlfriend faced a $5,000 repayment demand due to a payroll error that went unnoticed for months.

She was left struggling to balance the unexpected financial burden, highlighting how crucial clear communication and accurate payroll management are for everyone’s peace of mind. What’s the most frustrating payroll error you’ve encountered at work?

Image credits: Ben Iwara / unsplash (not the actual photo)

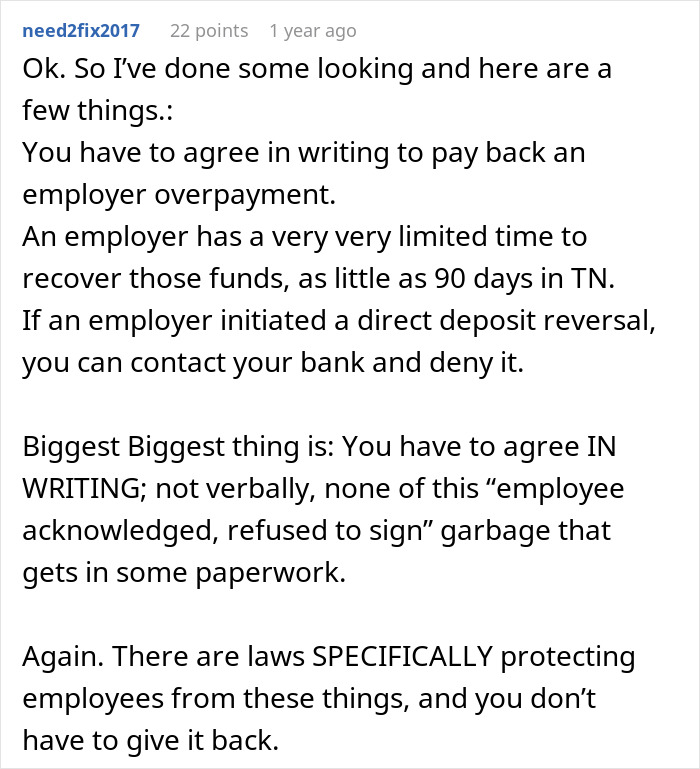

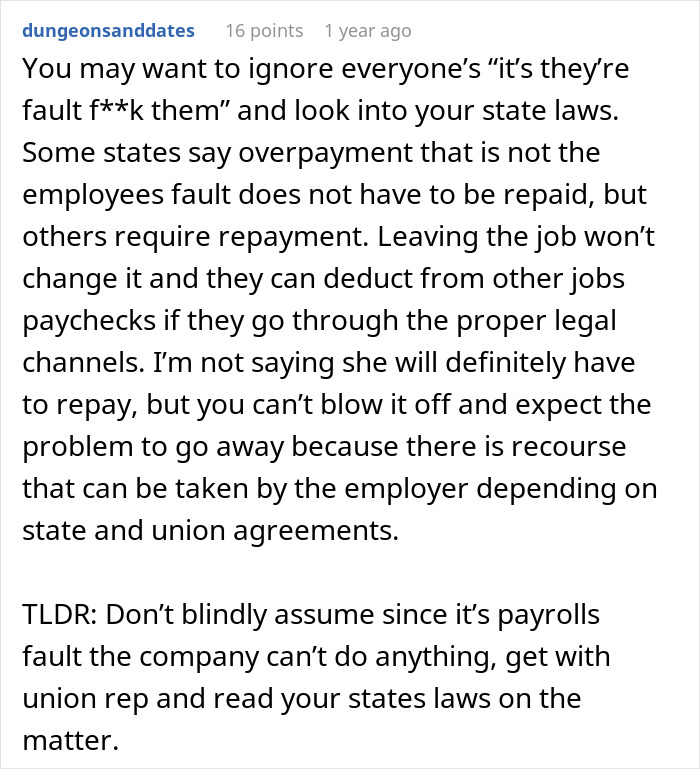

People online offered the author advice on how they could challenge the repayment terms

Poll Question

Thanks! Check out the results:

The only word that mattered in all of that was 'union.' Go to your union.

There may not be much they can do except, perhaps, ask for a longer timeline to repay but it’s worth it to ask.

Load More Replies...States and companies are very quick to get money back for their own mistakes. Very, very, very slow to reimburse wage theft.

She works for the state. Washington State deems any overpayment as a gift of public funds which is prohibited by law. By law, the hospital must reclaim those funds and has a short timeline to do that once the error is detected. If she worked for a private employer, if the employer did not detect the error within 90 days the funds don't need to be repaid.

The only word that mattered in all of that was 'union.' Go to your union.

There may not be much they can do except, perhaps, ask for a longer timeline to repay but it’s worth it to ask.

Load More Replies...States and companies are very quick to get money back for their own mistakes. Very, very, very slow to reimburse wage theft.

She works for the state. Washington State deems any overpayment as a gift of public funds which is prohibited by law. By law, the hospital must reclaim those funds and has a short timeline to do that once the error is detected. If she worked for a private employer, if the employer did not detect the error within 90 days the funds don't need to be repaid.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

30

22