30 Surprisingly Easy Frugal Changes That Helped People Reach Their Financial Goals

InterviewSaving money often sounds easier than it is, even if you have disposable income once the bills are paid. That’s because nowadays, there are so many things that scream ‘buy me’ and the process of buying itself has never been easier – just a few clicks and your cart is paid off.

But what if we postpone paying for the cart and review the things we have in it after a while? Maybe even delete an item or two that we don’t actually need? Reviewing and scaling down the shopping cart was one of the tips netizens of Reddit’s ‘Frugal’ community shared after one of them asked about the easiest frugal changes people have made that helped them save money.

Today, we’d like to shed some light on their tips and tricks that might inspire you to make some frugal changes in life, too. So scroll down to find them on the list below—where you will also find Bored Panda’s interview with the netizen who started the thread, u/Peliquin—and go dust off that piggy bank.

This post may include affiliate links.

Put things in the Amazon cart but don't buy right away. Come back a few days later and realize I don't NEED that, remove. Repeat.

Put things in the Amazon cart but don't buy right away. Come back a few days later and realize I don't NEED that, remove. Repeat.

Done that.. it has worked somewhat but have items which i dont regret... books mostly

I often met up with friends at restaurants, just by default, and that got really expensive, even when they weren't that special. I started volunteering ideas of just meeting for dessert (instead of a drink and meal), going for a hike, or just meeting at a park to sit and chat. The whole point was to just be together, so no one really paid attention to the switch and they were actually a little glad to not have to plan the outings themselves. My budget is happy about it!

I often met up with friends at restaurants, just by default, and that got really expensive, even when they weren't that special. I started volunteering ideas of just meeting for dessert (instead of a drink and meal), going for a hike, or just meeting at a park to sit and chat. The whole point was to just be together, so no one really paid attention to the switch and they were actually a little glad to not have to plan the outings themselves. My budget is happy about it!

Restaurants are too loud to enjoy chatting with friends. They want people to shut up and eat but what they got was my me waving goodbye.

Got rid of sodas. With the prices increasing, and sodas leading to health issues down the road I definitely will save more than just money in the long run.

Got rid of sodas. With the prices increasing, and sodas leading to health issues down the road I definitely will save more than just money in the long run.

I drink a pop maybe 2 or 3 times per year and let me tell you when you are not used to them they are so unbelievably sweet! Like too sweet, I can only drink a small glass or half a can and I'm done.

Changing your lifestyle or old habits is not that easy, so going from barely setting any money aside to putting half of your paycheck into savings probably wouldn’t be, either. But the frugal changes redditors discussed in the thread were far from extreme; maybe even something many of us would manage doing. And even baby steps still count as moving in the direction of a more frugal lifestyle and a smaller hole in the wallet.

Finally got a library card and connected to my Kindle via Libby. I haven't bought a single book, ebook or physical, all year.

Finally got a library card and connected to my Kindle via Libby. I haven't bought a single book, ebook or physical, all year.

Not a change this year, but one that all my friends have been shocked by as I've slowly converted them over time! Your local library is your best resource for a lot of things, but especially accessing books, audiobooks, magazines, manga, graphic novels, music, television shows, movies, and so on and so forth. Language learning apps? Many libraries (like mine!) have free subscriptions for their users. Doing genealogy? Tons of free resources, including, often, Ancestry.com. My library has several apps like Libby, Kanopy, and Hoopla. Free online classes, free sessions with lawyers and job search professionals, free internet, hotspots, board games, yard games, video games, puzzles.....

Not a change this year, but one that all my friends have been shocked by as I've slowly converted them over time! Your local library is your best resource for a lot of things, but especially accessing books, audiobooks, magazines, manga, graphic novels, music, television shows, movies, and so on and so forth. Language learning apps? Many libraries (like mine!) have free subscriptions for their users. Doing genealogy? Tons of free resources, including, often, Ancestry.com. My library has several apps like Libby, Kanopy, and Hoopla. Free online classes, free sessions with lawyers and job search professionals, free internet, hotspots, board games, yard games, video games, puzzles.....

Also, many libraries have seed libraries and 'library of things' --> anything from science-y or artsy kits to car/house/etc repair.

In an interview with Bored Panda, the redditor who started the thread, ‘Peliquin’, also emphasized the significance of seemingly minor change. “I often see frugal tips being out of reach for people who are just beginning a frugal journey,” they noted. “People don't go from drinking 3-4 sodas a day to drinking only tap water easily. Downshifting to fewer sodas, or an at home soda maker isn't necessarily pure frugality, but it's an easy step.”

Starting to cook my own meals more and not eating in restaurants.

Starting to cook my own meals more and not eating in restaurants.

Every time you cook a meal, you make it better. I’m at the point now where food served in restaurants isn’t good enough for me.

Go YouTube!

I created a gift bin. Whenever I see a great deal online or in a thrift store, bin store etc. I buy things and store them in my gift bin.

I created a gift bin. Whenever I see a great deal online or in a thrift store, bin store etc. I buy things and store them in my gift bin.

I always have nice gifts handy for kids, family members. I’m ready for Christmas

For example, we are going to a birthday next week and I have 2 brand new boxes of nice legos that I got for very cheap back in January. The kid will be happy with gifts and we only have to worry about wrapping it.

I'd like to add, making your own cute, but simple, gift cards. I bought watercolor pens and a 50pk of cardstock and envelopes for $25 a few years back. Saves me $2-$6 at least a couple times a month. I have a massive Irish family, so it does add up. Bonus; I'm now revered as an artist for my silly doodles paired with dumb jokes.

Stopped using DoorDash etc and started using frozen chicken strips and tater tots when I need a quick fix.

Stopped using DoorDash etc and started using frozen chicken strips and tater tots when I need a quick fix.

OMG... F**k food delivery apps. By the time I checkout, a $10 burrito is $23. And, literally, half the time something goes wrong: like missing items, half the food is spilled in the bag, hot food is cold, cold food is warm, it's missing sauces and dressings. I'm not gonna agree that frozen tater tots serve the same purpose, but I too have sworn off food delivery apps and just gotten over my aversion to eating out by myself in my sweats and headphones.

Peliquin shared that they joined the ‘Frugal’ community because they had seen a good frugal gardening tip there and thought that it might be a good place to learn a few tricks. “I can't really think of something I've picked up, but I do think that being in this subreddit has made me think in more dimensions about how to use common items in more ways,” they said.

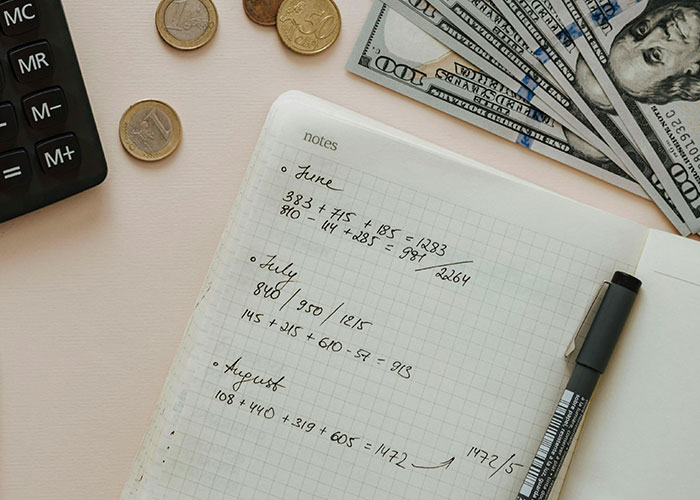

Writing down every expense in an actual budgeting notebook. I've tried budgeting apps on/off for years and never stuck with them. Having an actual notebook where I physically write all of my expenditures has made me way more frugal in every aspect of my life. Something about writing it & seeing it made me want to stop spending it!

Writing down every expense in an actual budgeting notebook. I've tried budgeting apps on/off for years and never stuck with them. Having an actual notebook where I physically write all of my expenditures has made me way more frugal in every aspect of my life. Something about writing it & seeing it made me want to stop spending it!

I have been using a budget book for over 20years. It is good to see where your money actually went, and make you think twice over your expenditure. It also allows you to stay within that month's salary and not dip into access funds in your current account

Quitting a 2 pack a day smoking habit. $500/mo.!!

Quitting a 2 pack a day smoking habit. $500/mo.!!

Started shopping at the discount grocery store. Ours has lots of things that are nearing or just past sell by dates, and I was nervous things might not be good. Haven't had a single issue and we're literally saving hundreds per month on groceries.

Started shopping at the discount grocery store. Ours has lots of things that are nearing or just past sell by dates, and I was nervous things might not be good. Haven't had a single issue and we're literally saving hundreds per month on groceries.

Sadly in Canada Loblaws has bought all the cheap grocery store chains and harmonized up the prices. Record all time high profits while claiming inflation/supply chain issues are responsible. You have to really shop around here to find cheap groceries. We had a nation-wide boycott and they reduced prices for a few months, but they've been edging them back up

The redditor admitted that as useful as some tips shared on r/Frugal are, not all of the netizens’ answers to their thread were equally helpful. “I thought that a lot of people just shared their top favorite frugal tip whether or not it was easy to implement. I really had to hunt to find stuff that was more what I was looking for,” they told Bored Panda.

“I think people can [benefit from threads as this one], but I think what people need is more like some sort of six-month frugality boot camp. I wrote a post about that a few years ago, and I wish I could get more people to have read it. It's what I personally did when I was finally making enough money to make real choices, and it has kept me pretty well ahead of all spending.”

Cancelled cable, no one was watching ‘regular’ TV, kept prime and Hulu. No one in the house has noticed.

Cancelled cable, no one was watching ‘regular’ TV, kept prime and Hulu. No one in the house has noticed.

We cancelled cable tv when I realized that tv nowadays really stinks, and all the old good shows are on Tubi, Pluto, etc, for free.

One morning when I had some downtime, I went through my email and unsubscribed from basically any email list I was a part of. Wayfair, H&M, Home Depot etc etc. All of it. Not only has this completely cleared up my inbox, I no longer get tempted by sale days, coupon codes etc. It has helped curb impulse spending immensely!

One morning when I had some downtime, I went through my email and unsubscribed from basically any email list I was a part of. Wayfair, H&M, Home Depot etc etc. All of it. Not only has this completely cleared up my inbox, I no longer get tempted by sale days, coupon codes etc. It has helped curb impulse spending immensely!

Drinking. I like a glass of wine or two with dinner or after. Doing it every night is expensive and unhealthy. I have started to replace it with drinking hot tea at night. I’ve never been a tea drinker but it’s fun to explore different options and it’s starting to grow on me a bit.

Drinking. I like a glass of wine or two with dinner or after. Doing it every night is expensive and unhealthy. I have started to replace it with drinking hot tea at night. I’ve never been a tea drinker but it’s fun to explore different options and it’s starting to grow on me a bit.

I learned to make my fancy coffee at home. I used a cheap espresso machine we had to make sure i would stay in the habit and after a couple weeks i bought a used nicer model and have made my fancy coffee at home since. I dont have to sacrifice taste for frugality. The $250 i spent on the nice espresso machine has easily been "earned" back not going to coffee shops.

I learned to make my fancy coffee at home. I used a cheap espresso machine we had to make sure i would stay in the habit and after a couple weeks i bought a used nicer model and have made my fancy coffee at home since. I dont have to sacrifice taste for frugality. The $250 i spent on the nice espresso machine has easily been "earned" back not going to coffee shops.

this is always interesting to me - I buy in coffee shops only when travelling. People actually use them regularly :D

Turned 40 and decided to quit dying my hair. I’m over a year in and have not only saved money, but my hair is the healthiest it’s ever been! I also like my natural gray sparkle!

Turned 40 and decided to quit dying my hair. I’m over a year in and have not only saved money, but my hair is the healthiest it’s ever been! I also like my natural gray sparkle!

Gave my wife 2 choices. Stop dying your own hair to save$$ and go to a proper salon or go gray. She has the most beautiful gray hair on the planet!

I have started to go through all drawers, cabinets wardrobes etc having a clear out. Not only have I discovered things I'd forgotten and organised things in such a way that I know how much of everything that I have, but it's illustrated to me where I was making impulse purchases that I regreted. That's helped me stop repeating those same mistakes. For example, I am done with eyeshadow, I've never really "got" how to do it, I end up looking awful and I've chucked the lot out, it wasn't a matter of finding the "right palette", it's just not for me!

I have started to go through all drawers, cabinets wardrobes etc having a clear out. Not only have I discovered things I'd forgotten and organised things in such a way that I know how much of everything that I have, but it's illustrated to me where I was making impulse purchases that I regreted. That's helped me stop repeating those same mistakes. For example, I am done with eyeshadow, I've never really "got" how to do it, I end up looking awful and I've chucked the lot out, it wasn't a matter of finding the "right palette", it's just not for me!

I love this attitude and wish I had it. It's difficult to throw things out if you've come from a financially unstable background. I earn the money to buy something, you're bloody right I want to keep it. So I've adopted a "one in, one out" system. If I'm going to buy something I have to donate, sell or throw out something first. And I have to do the "out" before the "in". I can't count the number of times it's helped me realise I don't need something, I just want it.

I moved somewhere with an Aldi nearby and my grocery budget is about half of what it used to be.

I moved somewhere with an Aldi nearby and my grocery budget is about half of what it used to be.

I want to upvote this 100 times. Aldi is the best grocery chain. My *only* qualm is planning to buy in bulk when there are special times (I.e. like last week during German week because those frozen potatoes are amazing)

Not this year but during the pandemic... we only ordered from restaurants that let us come and pick up the order. No food delivery services whatsoever. Once we slowed down our eating out from "once a week" to "once a month or two", we started spending way less on takeout.

Not this year but during the pandemic... we only ordered from restaurants that let us come and pick up the order. No food delivery services whatsoever. Once we slowed down our eating out from "once a week" to "once a month or two", we started spending way less on takeout.

also giving up alcohol when my husband needed major surgery. The doctors recommended to not drink 2 weeks before and 2 weeks after... and we just never made it back into a liquor store. Going on 8 months of total sobriety now!

Yeah. Just not buying booze for a month at a time really helps. I went from 2 bottles of whiskey and about 12 beers per month to just none. That saves me over $75/month and I really don't miss it

Same, with a little variation. I just switched to the cheapest drinks at the store. That way I can buy twice as much, it sucks 10 times worse, and I'm hung over all the time! ... wait, I don't think I'm doing this right...

Load More Replies...  Meal Prep!

Meal Prep!

I prep 5 oatmeal breakfasts, 5 chicken pasta and sauce meals and 5 chicken, rice and black bean meals.

This saves me so much money and time!

I mix in fruit cups for breakfast and lunch. I usually go with pineapple or mandarin oranges. I eat way healthier and I’m saving money.

If, like a dog, you don't mind eating the same thing day in day out ...

Doubled my 401k contributions. Less extra money burning a hole in my pocket.

Doubled my 401k contributions. Less extra money burning a hole in my pocket.

Espresso machine. I was buying a 7 dollar Starbucks drink daily. Now it costs about 25 cents for the same thing.

Espresso machine. I was buying a 7 dollar Starbucks drink daily. Now it costs about 25 cents for the same thing.

Buying bone-in chicken thighs for $0.99/ lb instead of boneless/skinless for over $3/lb. Also bought a cheap boning knife ($10) and YouTube'd how to remove the bone. It's surprisingly easy. Then you keep the bones for stock. Takes me about 15 mins to process about 10 pounds of meat.

Buying bone-in chicken thighs for $0.99/ lb instead of boneless/skinless for over $3/lb. Also bought a cheap boning knife ($10) and YouTube'd how to remove the bone. It's surprisingly easy. Then you keep the bones for stock. Takes me about 15 mins to process about 10 pounds of meat.

Switching auto and home insurance. Our auto went down by two-thirds and our home by half. I don’t even want to think of the money we overpaid over the years.

Switching auto and home insurance. Our auto went down by two-thirds and our home by half. I don’t even want to think of the money we overpaid over the years.

Speaking as a former property restoration technician, don't go for the cheap insurance. Get a bundle from a good company with a good reputation. The best I've ever seen is State Farm. They would pay us to go out and help people unpack, rearrange furniture, anything to make their clients happy. The worst is Dejardains. They would make us itemize every single thing on the claim. Measuring and documenting every single piece of clothing, getting the serial and model number off of every single piece of Tupperware to use up every single penny of a client's deductible and then fighting the clients on a claim. Research the company's reputation, pick one that's been around forever, then stick with them and they will look after you.

I started cutting my own hair. As a guy, paying $50-60 a month for something that only looks good for probably 2 weeks is not ideal. I'll only pay that if I have a special event like a wedding or if I'm going on a memorable trip (once or twice a year). Otherwise, I'll just cut it at home and spend $0.

I started cutting my own hair. As a guy, paying $50-60 a month for something that only looks good for probably 2 weeks is not ideal. I'll only pay that if I have a special event like a wedding or if I'm going on a memorable trip (once or twice a year). Otherwise, I'll just cut it at home and spend $0.

I've been cutting my husband's hair for 25 years, now. Unfortunately, he doesn't own the skill to reciprocate, and I dare not do it to myself.

The only real change that we made was not ordering take out so much. We were ordering 3-4 times a week and going out about once a week. Now we are ordering out once ever other week and not dining out. It’s saving my family of 4 about $1000 a month. Honestly, I miss being able to have all the dining options, but due to certain circumstances we can no longer afford such luxuries.

The only real change that we made was not ordering take out so much. We were ordering 3-4 times a week and going out about once a week. Now we are ordering out once ever other week and not dining out. It’s saving my family of 4 about $1000 a month. Honestly, I miss being able to have all the dining options, but due to certain circumstances we can no longer afford such luxuries.

"all the dining options" ... cook it yourself. It even tastes better because it's fresh and hasn't spent 30 minutes in an isolated box and gone soggy.

Went on a "no-buy." Sounds nuts but gamifying making do with my existing wardrobe, decor, cooking utensils, gardening tool etc has made it so easy. And it simplifies the process of figuring out whether a purchase is worth the money because it DOESNT MATTER- I'm not allowed to buy it anyway.

Went on a "no-buy." Sounds nuts but gamifying making do with my existing wardrobe, decor, cooking utensils, gardening tool etc has made it so easy. And it simplifies the process of figuring out whether a purchase is worth the money because it DOESNT MATTER- I'm not allowed to buy it anyway.

I did a no buy month and wondered if I would make it through but wound up breezing through it and found it so helpful and easy I am committing to a year.

I love this, and would have loved it even more if they would have explained what a "no buy" is.

Online thrifting for toddler clothes. They are outrageously expensive and the tots grow out of them in a year or less.

Online thrifting for toddler clothes. They are outrageously expensive and the tots grow out of them in a year or less.

Back in the day, if someone in the neighborhood or family just had a baby, especially if it was their first, someone always had a huge box of all the basics, plus some dressy stuff, to ease the expense of buying everything, that was loaned to the new parents. Not the stuff that gets worn out, but the stuff that’s really durable and good quality that can be passed on to someone new. When they were done with it, they’d store it until the next set of new parents needed it. There were always boxes like that making the rounds of every couple in the neighborhood or family.

Setting a budget. I grew up poor and no one taught me about money. I’ve just been winging it my whole life. This year my husband and I sat down to have a come to Jesus and figure out *where was all our money going?*

Setting a budget. I grew up poor and no one taught me about money. I’ve just been winging it my whole life. This year my husband and I sat down to have a come to Jesus and figure out *where was all our money going?*

We just sort of divided our money up into different accounts because we can’t be trusted. The main account is only for bills and gas and groceries, but I only spend a set amount a month on groceries. Then each of us has a fun account that we add money to each pay period. That’s the only money we have to blow. Then there is a family fun money. If we want to buy pizza or go to the movie it comes from there.

It completely changed my relationship ship to money, and I thought I was frugal. I was a single mom who raised two kids on one income before o got married. I was not good with money. I was good with stretching the last few dollars after I wasted all my money.

Money is like toilet paper. Learn to use the full roll like you use the last 3 feet 🤓🤓

NOT renewing Prime.

NOT renewing Prime.

I'm old, from a waste-not-want-not era, so I know how to turn leftovers into something tasty. A useful skill to avoid food waste. I also mostly cook from scratch, but always have some staples in the cupboard (beans, lentils, diced tomatoes, corn, tuna) that can be turned into à meal in a pinch.

You need money to save money. Twice a year, the coffee I like goes on sale for $6.99 instead of the regular price of $10.99. I would buy 2 cases (24 cans), which lasted me until the next sale. The 2 lights rule. I live alone and there's no reason to have 2 lights on in the house, but it sometimes happens. There's no excuse for 3 lights on, ever. My electric usage averages $20 a month (before tax and transportation). To save money, I make meals for under (used to be $1 but with inflation) $3. That means eating a lot of leftovers (pasta, soup, stew) and on buying on sale surprises. I only cook for me, so its easier in some ways, but not in others (BJ's and Costco are not cost effective). Challenge yourself to lower utility and grocery bills by trying to decrease your bill 10 or 15% a month - they're the only bills that aren't fixed.

One of mine has an upfront cost: Bought a freezer. I now buy meat on sale and in bulk. I worked in the food industry before medically retiring and am a bit picky about my meats. So I will go without until that ground beef, steak, roast, bacon, shellfish, or fish is on sale... then I buy three. During the holidays when ham and turkey are on sale for ⅓ of the price, I buy three. I now have a full freezer that I work down and replenish during sales.

Sam's Club. And I'm moving into an apartment with an actual functional kitchen. It's twice the price but I'll be able to properly cook. Worth it.

My biggies are: No spontaneous purchases, everything goes in the cart for 3 days Make my lunches & diners Grow my own weed

I'm old, from a waste-not-want-not era, so I know how to turn leftovers into something tasty. A useful skill to avoid food waste. I also mostly cook from scratch, but always have some staples in the cupboard (beans, lentils, diced tomatoes, corn, tuna) that can be turned into à meal in a pinch.

You need money to save money. Twice a year, the coffee I like goes on sale for $6.99 instead of the regular price of $10.99. I would buy 2 cases (24 cans), which lasted me until the next sale. The 2 lights rule. I live alone and there's no reason to have 2 lights on in the house, but it sometimes happens. There's no excuse for 3 lights on, ever. My electric usage averages $20 a month (before tax and transportation). To save money, I make meals for under (used to be $1 but with inflation) $3. That means eating a lot of leftovers (pasta, soup, stew) and on buying on sale surprises. I only cook for me, so its easier in some ways, but not in others (BJ's and Costco are not cost effective). Challenge yourself to lower utility and grocery bills by trying to decrease your bill 10 or 15% a month - they're the only bills that aren't fixed.

One of mine has an upfront cost: Bought a freezer. I now buy meat on sale and in bulk. I worked in the food industry before medically retiring and am a bit picky about my meats. So I will go without until that ground beef, steak, roast, bacon, shellfish, or fish is on sale... then I buy three. During the holidays when ham and turkey are on sale for ⅓ of the price, I buy three. I now have a full freezer that I work down and replenish during sales.

Sam's Club. And I'm moving into an apartment with an actual functional kitchen. It's twice the price but I'll be able to properly cook. Worth it.

My biggies are: No spontaneous purchases, everything goes in the cart for 3 days Make my lunches & diners Grow my own weed

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime