Parent Makes Daughter Face $3,000 Credit Debt Consequences After She Goes On Spending Spree

Parenting is a constant dance between support and preparation. Parents nurture their children, but also strive to equip them with the tools they need to flourish as independent adults. Financial literacy stands tall among these crucial life skills.

This Reddit post resonates with a familiar challenge. A parent confronts a tough decision: their financially independent daughter, now drowning in credit card debt, seeks a financial rescue. The urge to provide immediate relief is powerful. However, the author recognizes a more valuable lesson in teaching their daughter financial responsibility.

More info: Reddit

Financial literacy is a skill parents diligently try to instill in their children

Image credits: Mikhail Nilov (not the actual photo)

The author’s daughter found herself drowning in credit card debt and expected her parent to bail her out

Image credits: Karolina Grabowska (not the actual photo)

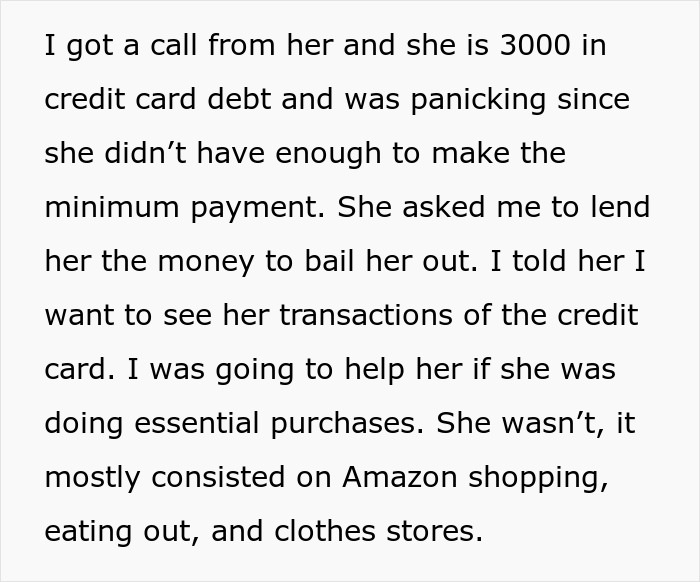

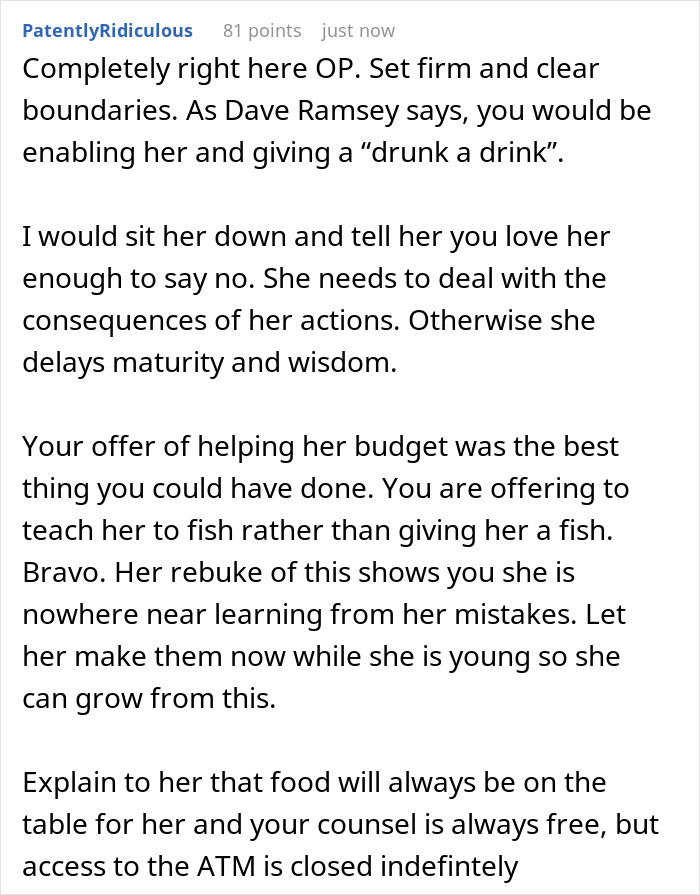

Image credits: Antique-Duty-9547

When the poster refused, she got pissed and called them a jerk

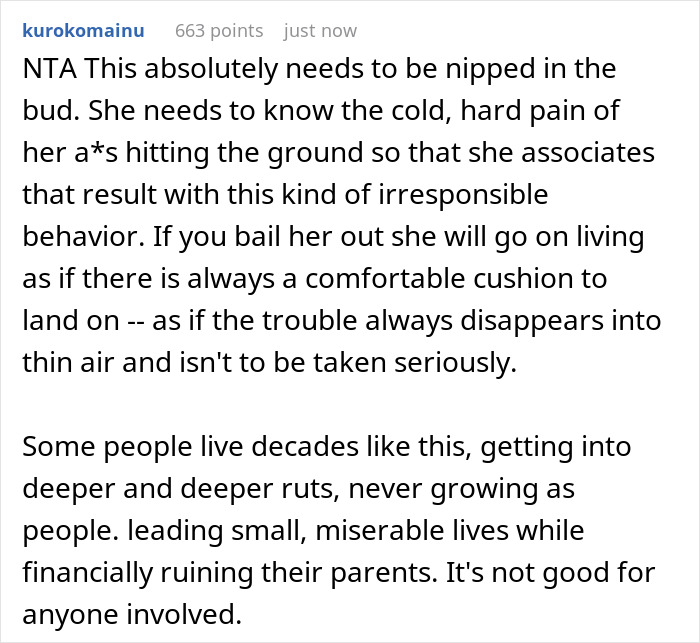

The Original Poster (OP) is facing a difficult situation after their 24-year-old daughter, who lives independently and has a good job, revealed she is $3,000 in credit card debt. The parent expressed concern about their daughter’s spending habits, which included frequent online shopping, eating out, and clothing purchases.

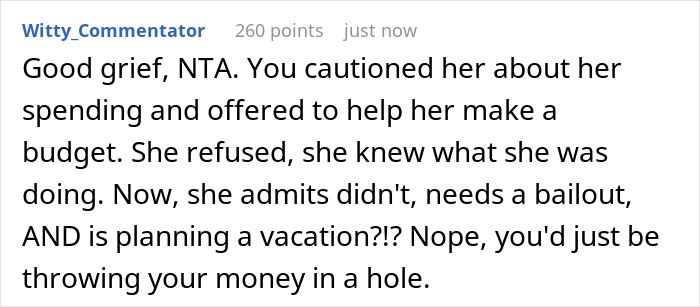

The situation escalated when the daughter, panicking about making the minimum payment, requested a loan from the poster to cover the debt. The author, however, conditioned their help on seeing the daughter’s credit card statements. The OP proposed an alternative solution: creating a budget together to tackle the debt. This suggestion, however, was met with frustration from the daughter, who reportedly called the parent a “jerk” for denying her a handout.

The parent acknowledged the difficulty of the situation. While they expressed a desire to help their daughter avoid hardship, they also felt it was important for her to learn from her choices. They emphasized the importance of financial responsibility as a life skill, suggesting that overcoming this challenge could be a valuable learning experience.

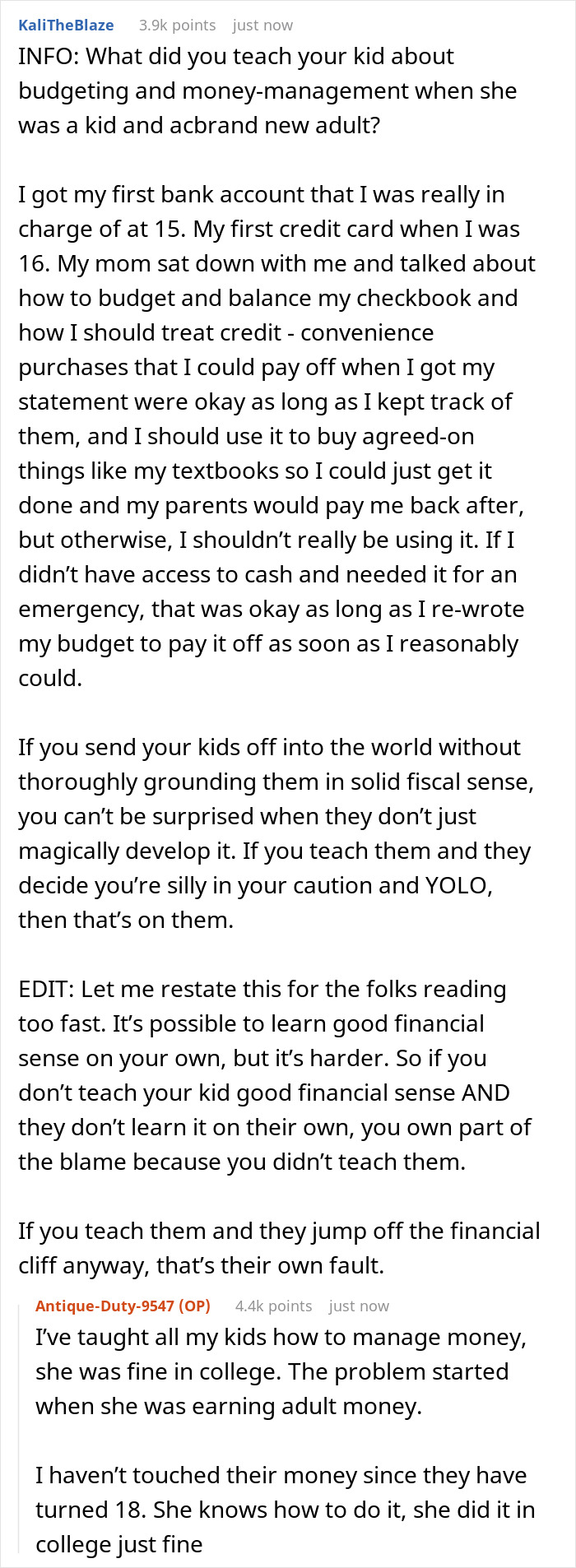

Commenters quickly pointed out the importance of teaching your kids how to manage money, which the OP quickly pointed out that they taught all their kids how to manage money, which the daughter in question did; however, this changed when she started earning her own money. This underscores a crucial point – financial literacy is an ongoing conversation, not a one-time lesson. One of the biggest challenges parents face is finding the right balance between offering support and allowing their children to learn from financial mistakes. A complete financial safety net can hinder opportunities for growth.

As InCharge wisely points out, there’s a difference between helping someone through a rough spot and feeling as if your generosity has opened a floodgate you need to close for the benefit of both parties.

Image credits: cottonbro studio (not the actual photo)

The danger we’re talking about is when help becomes a habit. Someone asking for a rare financial favor turns into someone who expects assistance whenever a bill needs paying. Dealing with financially irresponsible family members is never simply resolved by opening your checkbook. In fact, that should be down the list of steps you take when confronted with a request for financial assistance.

While the urge to bail out a struggling child is strong, enabling their financial missteps can have lasting consequences. In this case, rescuing the daughter from her $3,000 debt with a handout wouldn’t address the root cause of the problem – her overspending habits. It might provide temporary relief, but it wouldn’t equip her with the necessary skills to manage money responsibly in the future.

This situation presents a valuable opportunity for the daughter to learn from her mistakes. Working together to create a budget and tackling the debt head-on will not only alleviate the immediate pressure but also empower her with financial literacy. It’s a challenging but crucial lesson that will serve her well throughout her life.

But what are your thoughts on the situation. Did the parent strike the right balance? How can parents best navigate these financial challenges with their children? Let’s keep the conversation going!

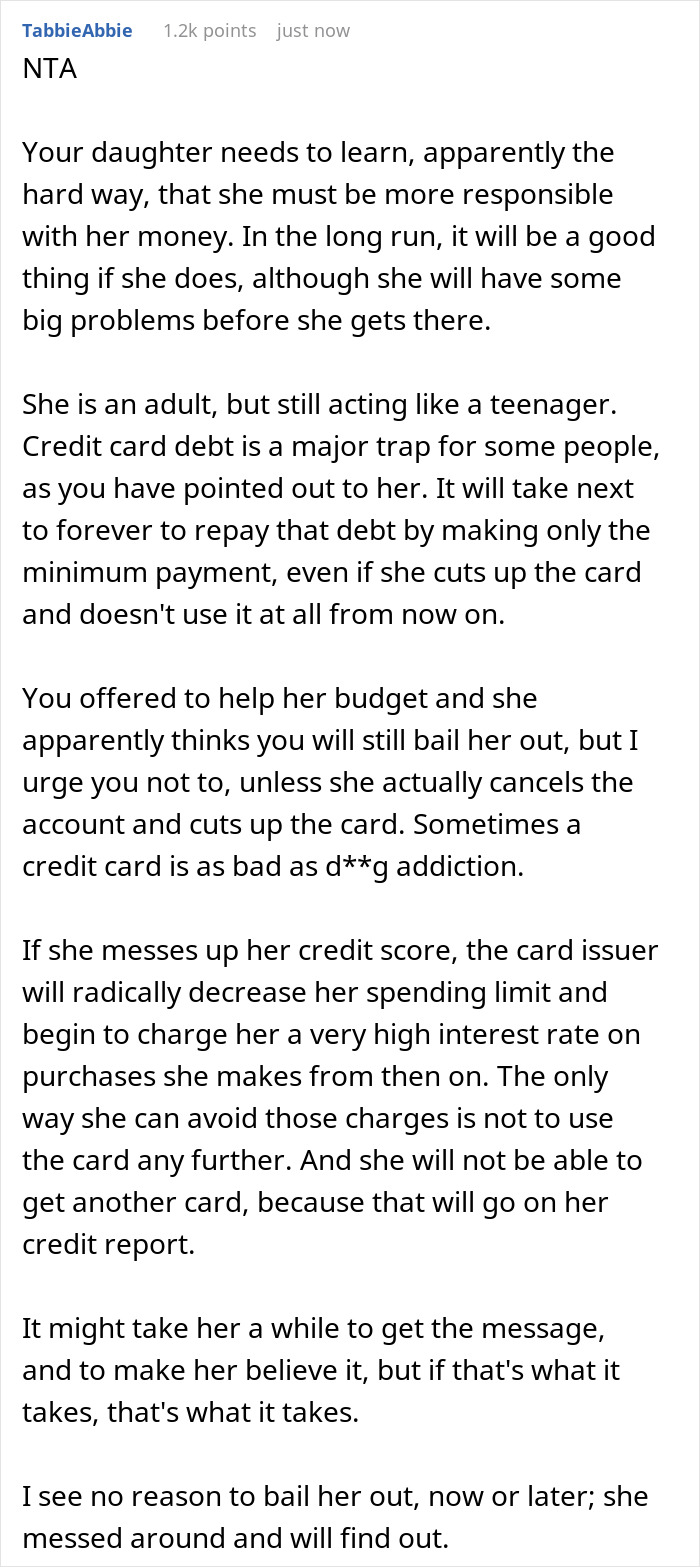

Commenters all shared a similar thought and expected the poster’s daughter to pay for it herself

Image credits: Alexandra Maria (not the actual photo)

Poll Question

Thanks! Check out the results:

You want me to help with this? Ok. Give me all your credit cards. You can have them back; when you've paid me back. Not before. Or? Well, homelessness is looking you dead in the eye.

Some stores will give you a temporary card to shop with just for the day or just look your account up so you can charge. So, this method of taking her cards won't work. My personal issue with CC debt was that I went to Consumer Credit Counseling. They took all my cards and put a stop on them. I paid them one lump sum and they paid the credit cards. It took about a year and a half but I was out of a $15,000.00 credit card debt and NEVER did it again.

Load More Replies...OP's daughter might think her mother's a jerk, but she also thinks she's living within her means. All that to say, OP shouldn't care what her daughter thinks since she's wrong. Her daughter is a moron.

I had serious debt problems when I was young. My parents were extremely house poor, and chose to keep that to themselves. They thought they were protecting us. I never saw them paying bills or even saving for a purchase. When I grew up, I quickly got lost in debt. I wish I'd had the sense to ask for/accept help when my debt was only $3000.

You want me to help with this? Ok. Give me all your credit cards. You can have them back; when you've paid me back. Not before. Or? Well, homelessness is looking you dead in the eye.

Some stores will give you a temporary card to shop with just for the day or just look your account up so you can charge. So, this method of taking her cards won't work. My personal issue with CC debt was that I went to Consumer Credit Counseling. They took all my cards and put a stop on them. I paid them one lump sum and they paid the credit cards. It took about a year and a half but I was out of a $15,000.00 credit card debt and NEVER did it again.

Load More Replies...OP's daughter might think her mother's a jerk, but she also thinks she's living within her means. All that to say, OP shouldn't care what her daughter thinks since she's wrong. Her daughter is a moron.

I had serious debt problems when I was young. My parents were extremely house poor, and chose to keep that to themselves. They thought they were protecting us. I never saw them paying bills or even saving for a purchase. When I grew up, I quickly got lost in debt. I wish I'd had the sense to ask for/accept help when my debt was only $3000.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

20

22