Managing money and kids is a difficult task, particularly when the children are old enough to think they know how to make decisions. After all, investing, college funds, all quite boring in the face of instant gratification.

A man turned to the internet for advice after a marital disagreement on how he used his son’s “lottery winnings.” After going through a round of lottery tickets as a family, the one his son took won a considerable amount of money. So OP invested it and it ended up paying off. However, some believe he should just give the entire sum to the kid.

It’s questionable to give a teen a huge sum of money without any supervision

Image credits: Iain Watson (not the actual photo)

So one father was second-guessing his choice to invest the money his son “won”

Image credits: Julia M Cameron (not the actual photo)

Image credits: Mikhail Nilov (not the actual photo)

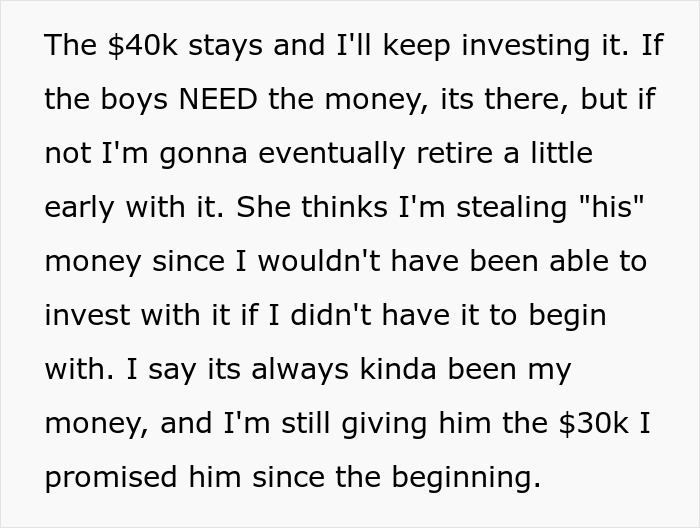

Image credits: FinancialSecretary9

Working out who owns what in a family can be difficult

Image credits: Anna Shvets (not the actual photo)

This story manages to cover a very interesting combination of ethical questions. First and foremost, how does ownership work in a family? Obviously, nearly anything a parent buys for a child is, legally, the parent’s property, since most kids don’t have their own income. This is doubly true for something like a lottery ticket, which only the purchasing adult could redeem in the first place.

This is perhaps why many did side with OP. Having different family members scratch off the ticket is fun, but OP, who is legally an adult and bought it, has to be the one to pick up the money. Nevertheless, most parents tend to avoid playing the “Do you know who actually owns things?” card unless it’s absolutely necessary.

First and foremost, it can really drive a wedge between the child and the parent. It’s not like it’s the kid’s fault they don’t have income and this just exacerbates the usual juvenile frustration with not having all the rights and privileges of an adult. As many parents know, it’s even worse when the child in question, like in this story, is a teen.

A college fund is a big deal in the US

Image credits: Pixabay (not the actual photo)

On the other hand, there are some obvious and less obvious reasons for the father to hold onto most of the cash. First and foremost, a college fund is legitimately the main way many young adults avoid being in debt until much later in life. The average annual cost at a private institution in the US was $33,500 in 2017. This was seven years ago, so you can bet your bottom dollar that it’s higher now.

As shocking as it sounds, the entirety of these lottery winnings wouldn’t cover the entire four-year degree, depending on where this young man aimed to go. However, seeing as it’s been invested well, that money has been grown effectively. A college fund is no small deal, it can and will give this young adult a headstart in life which he will only truly understand when discussing people’s college debt a decade later and realizing how lucky he was.

All in all, this money can be a teaching moment for the son

Image credits: Vika Glitter (not the actual photo)

There is also a “hidden” downside of just handing over the money. OP has more than one kid. Anyone with siblings will be well aware that your brother or sister winning the lottery might be the worst thing possible. The jealousy, FOMO, gloating, etc, might cause a lot of inter-familial strain that OP was quite clever about avoiding. Indeed, by spending some of it upfront, he negated the usual downside of investing, the lack of instant gratification.

Of course, the real question is what should he have done with the earnings from investing it. All in all, holding on to them is by no means bad. He quite generously offered to manage the money for his son for free, something that he will struggle to find later in life. It’s also a good way to

OP answered some questions in the comments section

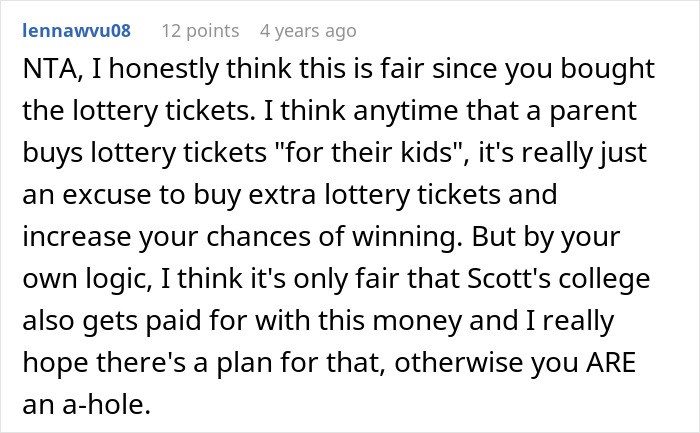

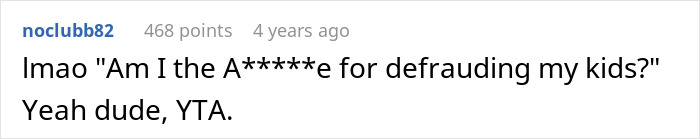

A few readers sided with the father

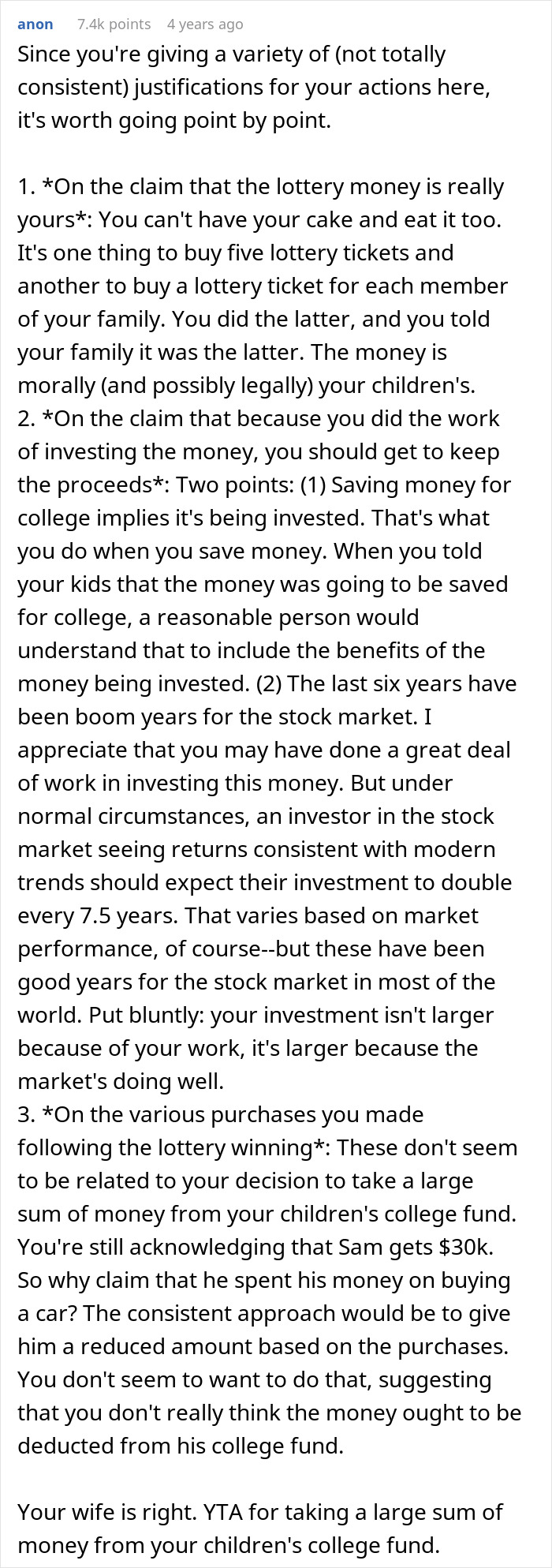

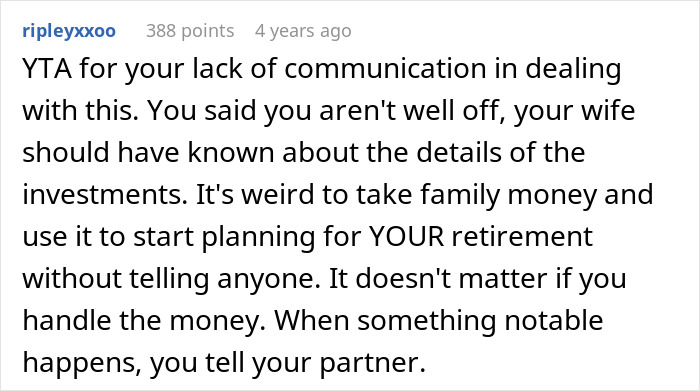

Some thought he was in the wrong

Poll Question

Thanks! Check out the results:

Explore more of these tags

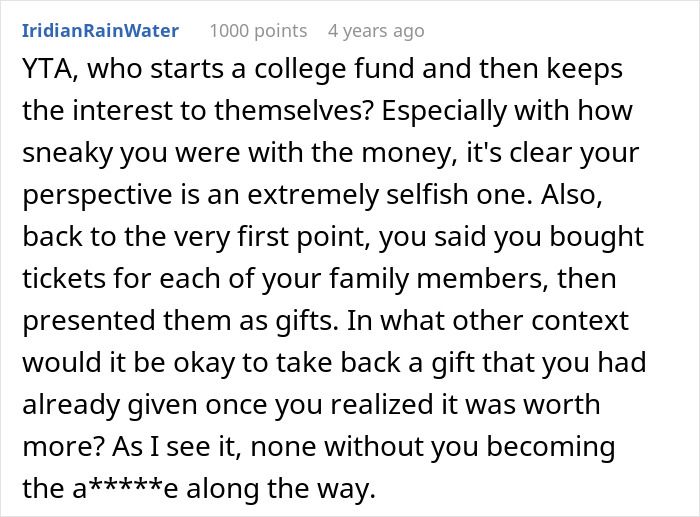

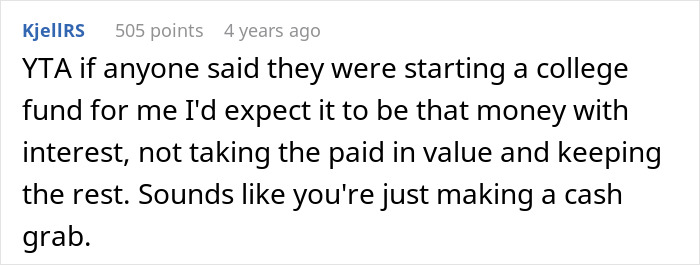

YTA. Sam’s money is being risked but he doesn’t get to share in the gains. If Op has lost it all investing, would he have made it up? If Op wanted a share of the money, that should have been the deal from the beginning.

We are missing too much info here for that judgment. Average interest on savings is only a couple percent at most. If he truly almost doubled the money, that was some heavy investing. Actually kind of impressive.

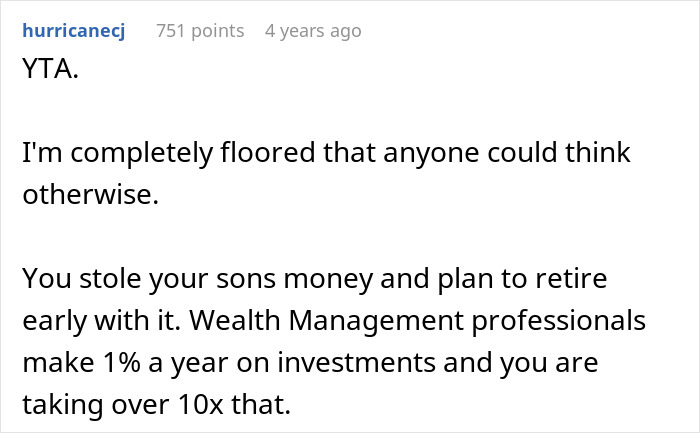

Load More Replies...If you’re a money manager you take a small percentage of the base amount as payment, maybe a bit of the interest. This yahoo sounds like he thinks if he grows the money, he gets the money. This is the kind of money handling that child stars emancipate themselves from their parents for.

The kid didn't earn the money though. It wasjust a lottery ticket dad bought.

Load More Replies...I know a family that had the same kind of windfall. The kids - who were actually fully adult - each got $25K. One was already heavily in debt, so that 25K went to pay that off so they wouldn't be stuck swimming in debt and interest for years to come. That's fine - a good way to spend the money, Not fun - but necessary. The other ones blew through their shares in less than a year - trips, stuff, taking friends out. Nothing left and noting to show for it. OP did great. He invested well and not only did his family get a dream vacation (for her) a car and a college education, they also got a healthy safety net. OP's wife? Total a$$h*le. The only thing OP did wrong was how he phrased that the interest was *his*, when he meant the interest was not his son's - it's a nuance that matters.

I'd say they did well with handling the windfall financially. But they did poorly handling it socially. The up front decision should have been $25k for each son's education + $10k for family fun - then put that in three segregated investment accounts to avoid this type of sore feelings later.

Load More Replies...How to teach your kids the valuable lesson in that anybody and everybody, even a parent, can screw you over for their own gain. AH

The kid has more money (5 grand more) than he was expecting. How did he get screwed?

Load More Replies...The dad is the one who bought all of the tickets. No one asked him to. He randomly assigned tickets to his family. In my opinion the money should be shared to the benefit of the entire family. The father is doing a good job managing the money and making it grow. Give both brothers equal amounts for college from the fund. Why should one brother benefit more than the other. The family is poor and the parents deserve to benefit from the money as well---without the father buying the ticket, no one would have any money at all.

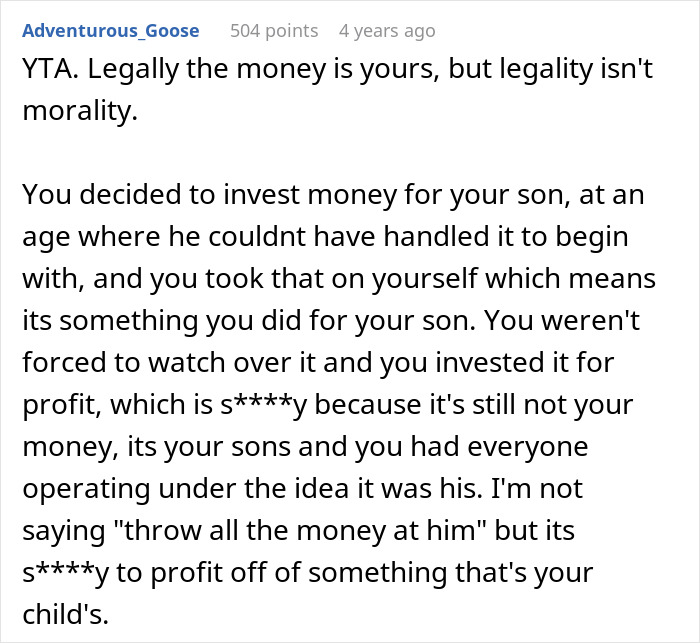

The moment the dad gifted the tickets to his sons, it became the sons' possessions. Also, I don't see anything about anyone in the family - particularly the son - consenting or even being aware of the arrangement that the dad has done. Not to mention his decision to take the gains for HIMSELF, not even for the family, which is a huge AH move.

Load More Replies...when i turned 16, i was gifted $600. i wisely decided not to spend it, and asked my mom to put it in her bank account and hold it for me. some time later (probably months) i finally decided to spend some of it, and asked my mom for my money. i was shocked and upset to learn that i had no money, my mother had spent it. i was SO mad for so long, but as i grew up i realized she needed it for bills and kept our water running and our fridge full. i wish my mom had told me she needed it, because i would have readily agreed, but the shock of just finding out the money was gone was a blow to our relationship at the time. based on knowing how it feels to have your parent just take your money, i say YTA.

Your situation sucks, but its not the same. You guys sound like you werent ..."well off" and it was only $600.. the op had 60k. If you want returns you dont put your money in a savings account, maybe some for use in emergencies and long term goals. But if your looking to GROW your money you invest it. Hes actually setting them up better in the long run. The two situations dont compare. Sorry..and i hope you forgive your mom because even though it was your 600, bills paid saved you all from debt to some degree im sure. (Unless your mom DIDNT spend it on bills, food ect.)

Load More Replies...Think everyone is missing that he started with 60K, not 30K. I assume 30k for each kid so "sharing" the money this way without investing it, him and his wife already were not getting anything. But since he invested it and it grew, he thinks that additional 40k should go to him. People are also forgetting that he's not planning to pull that money out all together. He'll likely give the kid what he needs when he needs it and the rest will CONTINUE to grow over the years. If this is the case, and he only plans to take 40k no matter how much more it grows and then eventually split it between the kids, then I don't see the issue. He’ll need to keep track of what he’s already given each kid as he gives it to ensure that the rest is still split evenly in the end. But By the time both kids are done with college they could have a down payment on a house as well. Also the kid is fine with it so I assume he understands there's more to it than what's posted here. I don't see the issue

The money is going to continue to grow. He says "if the boys NEED the extra money, it is there" otherwise he plans to ensure they graduate from college debt free or mostly debt free, and again, that money will still be growing. I don't think the dad is being selfish at all, I think he's being smart. And I think maybe the way he tells the story comes off worse than what the situation actually is

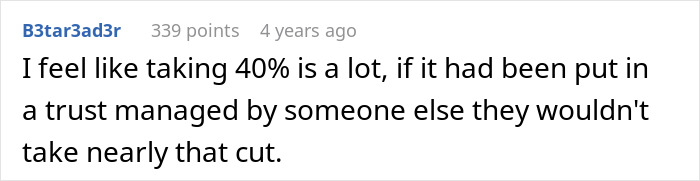

Load More Replies...Definitely he's the ash sole. FORTY PERCENT? Investment managers take only 10%. Taking 10K would have been arguable, taking more is theft.

The number of YTA votes speaks volumes about why most household finances are in such a poor state. Money is fungible - one dollar is interchangeable for another dollar. That's why you can think of this as all dad's money, or all the sons' money. Views based on these extreme starting points are nearly always wrong. The fairest baseline for interpreting this is if you divide the $60k equally - each family member gets $15k. Kids spent $5k (game + car) dropping their shares to $12.5k, mom spent $5k on vacation dropping her share to $10k. Dad invested the remainder ($50k) and doubled it to $100k. So mom's share is doubled to $20k. Kids' share is now $25k each. And most importantly, dad's $15k gets doubled to $30k. So of the $100k in the bank, $30k of it is his. Add a appropriate management fee for him and it's probably closer to $35k of it being his. Although is reasoning is flawed, dad is NTA. In fact he's an angel because he's still willing to give up most of his share to his kids if they need it.

So you'd be okay with your financial advisor investing your money without you knowing it and then keeping the earnings for himself? Got it. But in the real world, that's called stealing and they can go to prison for that.

Load More Replies...YTA. Sam’s money is being risked but he doesn’t get to share in the gains. If Op has lost it all investing, would he have made it up? If Op wanted a share of the money, that should have been the deal from the beginning.

We are missing too much info here for that judgment. Average interest on savings is only a couple percent at most. If he truly almost doubled the money, that was some heavy investing. Actually kind of impressive.

Load More Replies...If you’re a money manager you take a small percentage of the base amount as payment, maybe a bit of the interest. This yahoo sounds like he thinks if he grows the money, he gets the money. This is the kind of money handling that child stars emancipate themselves from their parents for.

The kid didn't earn the money though. It wasjust a lottery ticket dad bought.

Load More Replies...I know a family that had the same kind of windfall. The kids - who were actually fully adult - each got $25K. One was already heavily in debt, so that 25K went to pay that off so they wouldn't be stuck swimming in debt and interest for years to come. That's fine - a good way to spend the money, Not fun - but necessary. The other ones blew through their shares in less than a year - trips, stuff, taking friends out. Nothing left and noting to show for it. OP did great. He invested well and not only did his family get a dream vacation (for her) a car and a college education, they also got a healthy safety net. OP's wife? Total a$$h*le. The only thing OP did wrong was how he phrased that the interest was *his*, when he meant the interest was not his son's - it's a nuance that matters.

I'd say they did well with handling the windfall financially. But they did poorly handling it socially. The up front decision should have been $25k for each son's education + $10k for family fun - then put that in three segregated investment accounts to avoid this type of sore feelings later.

Load More Replies...How to teach your kids the valuable lesson in that anybody and everybody, even a parent, can screw you over for their own gain. AH

The kid has more money (5 grand more) than he was expecting. How did he get screwed?

Load More Replies...The dad is the one who bought all of the tickets. No one asked him to. He randomly assigned tickets to his family. In my opinion the money should be shared to the benefit of the entire family. The father is doing a good job managing the money and making it grow. Give both brothers equal amounts for college from the fund. Why should one brother benefit more than the other. The family is poor and the parents deserve to benefit from the money as well---without the father buying the ticket, no one would have any money at all.

The moment the dad gifted the tickets to his sons, it became the sons' possessions. Also, I don't see anything about anyone in the family - particularly the son - consenting or even being aware of the arrangement that the dad has done. Not to mention his decision to take the gains for HIMSELF, not even for the family, which is a huge AH move.

Load More Replies...when i turned 16, i was gifted $600. i wisely decided not to spend it, and asked my mom to put it in her bank account and hold it for me. some time later (probably months) i finally decided to spend some of it, and asked my mom for my money. i was shocked and upset to learn that i had no money, my mother had spent it. i was SO mad for so long, but as i grew up i realized she needed it for bills and kept our water running and our fridge full. i wish my mom had told me she needed it, because i would have readily agreed, but the shock of just finding out the money was gone was a blow to our relationship at the time. based on knowing how it feels to have your parent just take your money, i say YTA.

Your situation sucks, but its not the same. You guys sound like you werent ..."well off" and it was only $600.. the op had 60k. If you want returns you dont put your money in a savings account, maybe some for use in emergencies and long term goals. But if your looking to GROW your money you invest it. Hes actually setting them up better in the long run. The two situations dont compare. Sorry..and i hope you forgive your mom because even though it was your 600, bills paid saved you all from debt to some degree im sure. (Unless your mom DIDNT spend it on bills, food ect.)

Load More Replies...Think everyone is missing that he started with 60K, not 30K. I assume 30k for each kid so "sharing" the money this way without investing it, him and his wife already were not getting anything. But since he invested it and it grew, he thinks that additional 40k should go to him. People are also forgetting that he's not planning to pull that money out all together. He'll likely give the kid what he needs when he needs it and the rest will CONTINUE to grow over the years. If this is the case, and he only plans to take 40k no matter how much more it grows and then eventually split it between the kids, then I don't see the issue. He’ll need to keep track of what he’s already given each kid as he gives it to ensure that the rest is still split evenly in the end. But By the time both kids are done with college they could have a down payment on a house as well. Also the kid is fine with it so I assume he understands there's more to it than what's posted here. I don't see the issue

The money is going to continue to grow. He says "if the boys NEED the extra money, it is there" otherwise he plans to ensure they graduate from college debt free or mostly debt free, and again, that money will still be growing. I don't think the dad is being selfish at all, I think he's being smart. And I think maybe the way he tells the story comes off worse than what the situation actually is

Load More Replies...Definitely he's the ash sole. FORTY PERCENT? Investment managers take only 10%. Taking 10K would have been arguable, taking more is theft.

The number of YTA votes speaks volumes about why most household finances are in such a poor state. Money is fungible - one dollar is interchangeable for another dollar. That's why you can think of this as all dad's money, or all the sons' money. Views based on these extreme starting points are nearly always wrong. The fairest baseline for interpreting this is if you divide the $60k equally - each family member gets $15k. Kids spent $5k (game + car) dropping their shares to $12.5k, mom spent $5k on vacation dropping her share to $10k. Dad invested the remainder ($50k) and doubled it to $100k. So mom's share is doubled to $20k. Kids' share is now $25k each. And most importantly, dad's $15k gets doubled to $30k. So of the $100k in the bank, $30k of it is his. Add a appropriate management fee for him and it's probably closer to $35k of it being his. Although is reasoning is flawed, dad is NTA. In fact he's an angel because he's still willing to give up most of his share to his kids if they need it.

So you'd be okay with your financial advisor investing your money without you knowing it and then keeping the earnings for himself? Got it. But in the real world, that's called stealing and they can go to prison for that.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

40

147