“We Practice Equity”: Couple Goes Viral After Sharing They Each Put 20% Of Their Incomes Towards Bills

Entering a serious relationship is not always rainbows and butterflies, especially if you decide to share a home; you’re no longer an independent, carefree soul, which means that all decision-making is now a joint responsibility.

Arguing over household chores, whether it’s a simple dishwashing request or a debate over who’s going to cover the next internet bill, is inevitable – which is why it’s vital to learn how to handle things reasonably.

Finance-related issues, for instance, are probably one of the most unpleasant topics that often pop up in relationships:

Perhaps you and your partner might prefer having a mutual account where you contribute toward bills and whatnot; or maybe you split things 50/50. However, sometimes it’s handy to reflect and see what works best, specifically if there’s an income difference.

More info: TikTok

Woman says she and her partner give the same percentage of their incomes toward bills instead of splitting them 50/50

Image credits: findingmimivlogs

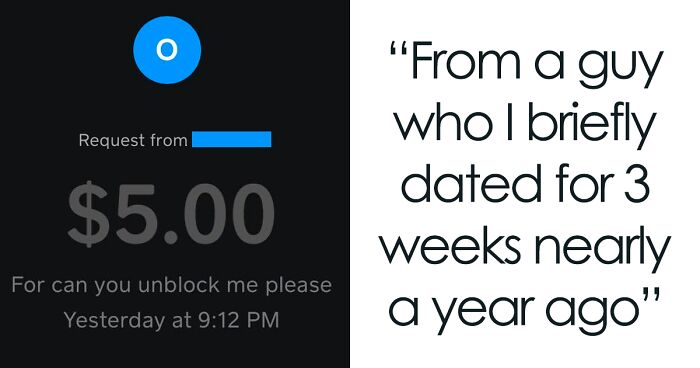

“We practice equity! This is just how we personally do it, but there are a lot of different ways that you can split your bills!” – this online user turned to TikTok to share that instead of using the usual 50/50 system for shared expenses, she and her partner both contribute the same percentage of their individual incomes. The video has managed to receive 776.9K views and 3390 comments discussing the idea.

The reason why the couple uses the percentage split method is because they practice equity

Image credits: findingmimivlogs

The woman began her video by sharing that she and her partner don’t split their bills 50/50 because they practice equity. She said that equity recognizes that each individual has contrasting resources and circumstances and as such, assigns opportunities needed to reach that equal outcome.

Image credits: findingmimivlogs

The couple acknowledges that there’s a salary difference between them, and because of that, the same percentage of each of their individual incomes goes toward shared expenses – in this case, bills. For instance, a hypothetical amount of 20% of the TikToker’s income is used, meaning that 20% of her partner’s income also gets put toward the monthly instalments.

They also recognize that circumstances change, and since the woman’s salary has significantly increased, the amount she contributes is higher

However, it doesn’t mean that her partner will pay more, as the 20% stayed the same for him

Image credits: findingmimivlogs

Moreover, the pair also understands that circumstances tend to change – and although the man’s income has been stable for the past two months, the TikToker’s wage has significantly increased, which indicates that the amount she contributes to bills will now be higher.

20% of her previous income is lower than 20% of her current income – however, it doesn’t mean that her partner will have to pay more, as his 20% remains the same.

Image credits: findingmimivlogs

Most will probably agree that finance-related conversations can be a sore spot, especially if the people in the relationship are on different salaries. Figuring out the best and perhaps fairest way to split shared household expenses can be such a headache; however, applying the percentage split method is a great way to contribute to your family’s fair-mindedness.

What do you think about this method? Is it fair? Or would you prefer to split your bills 50/50?

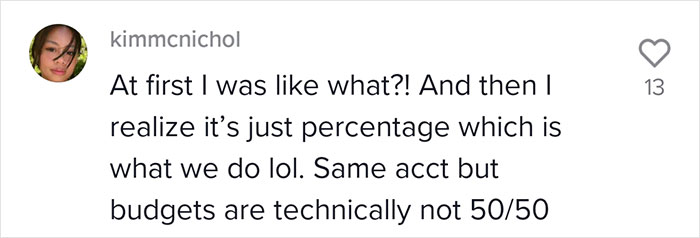

Fellow TikTok users shared their thoughts and opinions

3Kviews

Share on FacebookIf both parties agree that this is fair and equitable, then it's fair and equitable for them. Good for them! It works as long as the combined 20% is more than enough to cover expenses, and the 'slush fund' can be used as a de facto emergency/splurge fund.

I think the 20% was just a number - it could be 35% for all we know.

Load More Replies...Is this being touted as a new idea? My husband and I have done it this way for the last 17 years, ever since we first moved in together. We also accrue for future bills (the ones that occur annually, we accrue for on a monthly basis in advance so the money is already there) and have a slush fund for unexpected larger than usual bills. We split the credit card bill according to who bought what (so he pays for his own replacement keyboard after spilling a drink on it, and I pay for a new Switch game), and groceries are 50/50 since we eat approximately the same amount of the same food.

same for me and my husband. Our formula is; Total income, then take out personal necessary expenses, then from what is left work out a ratio of how much of the household expenses we each pay. Whatever we each have left over can go on savings and non essentials.

Load More Replies...I've heard the best is base the percentage on combined income. Combined income of 100K, one partner makes 40K, second one makes 60K then the percentage should be 40% and 60% respectively. Allows both to put in equally based on their income.

If both parties agree that this is fair and equitable, then it's fair and equitable for them. Good for them! It works as long as the combined 20% is more than enough to cover expenses, and the 'slush fund' can be used as a de facto emergency/splurge fund.

I think the 20% was just a number - it could be 35% for all we know.

Load More Replies...Is this being touted as a new idea? My husband and I have done it this way for the last 17 years, ever since we first moved in together. We also accrue for future bills (the ones that occur annually, we accrue for on a monthly basis in advance so the money is already there) and have a slush fund for unexpected larger than usual bills. We split the credit card bill according to who bought what (so he pays for his own replacement keyboard after spilling a drink on it, and I pay for a new Switch game), and groceries are 50/50 since we eat approximately the same amount of the same food.

same for me and my husband. Our formula is; Total income, then take out personal necessary expenses, then from what is left work out a ratio of how much of the household expenses we each pay. Whatever we each have left over can go on savings and non essentials.

Load More Replies...I've heard the best is base the percentage on combined income. Combined income of 100K, one partner makes 40K, second one makes 60K then the percentage should be 40% and 60% respectively. Allows both to put in equally based on their income.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

27

10