“Don’t Have Children You Can’t Fully Afford”: 40 People Share Their Most Controversial Money Tips

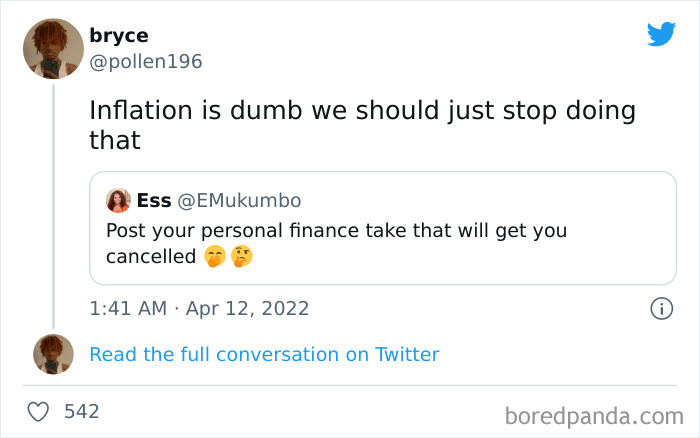

Esther Mukumbo is a mom from South Africa, trying to find her way toward financial independence. She has over 10 years of experience in Development Finance and Banking and is a director at a black women-owned investment company she co-founded called Malkia Invest.

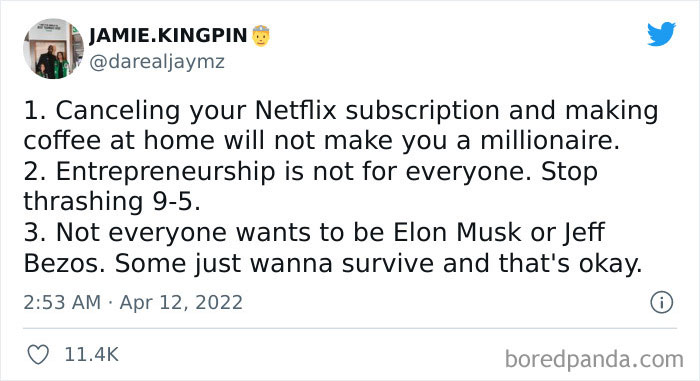

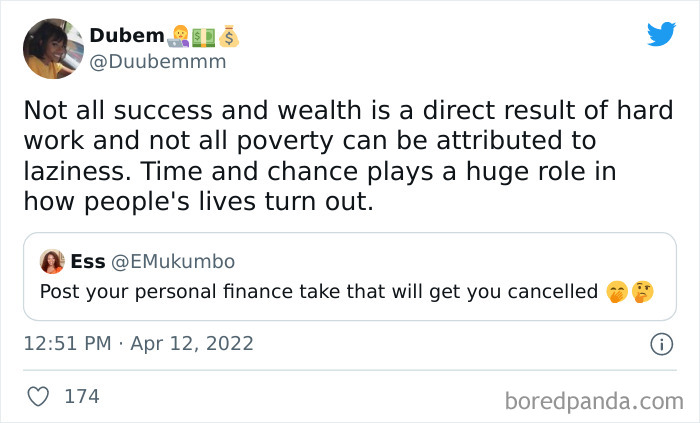

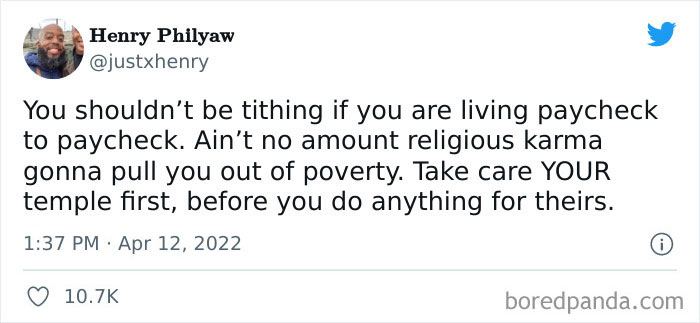

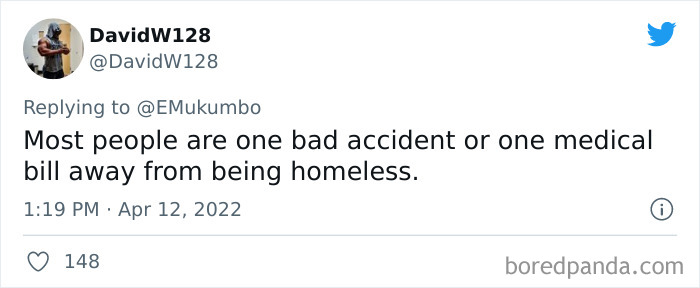

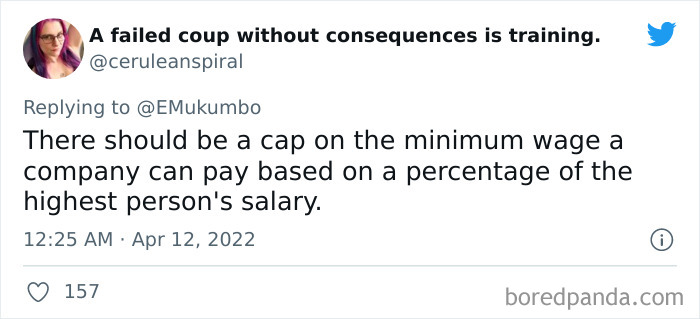

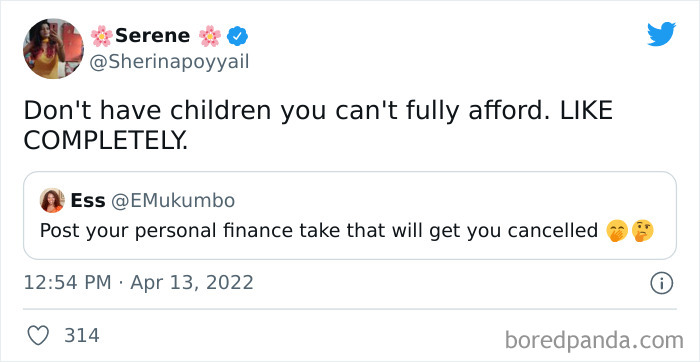

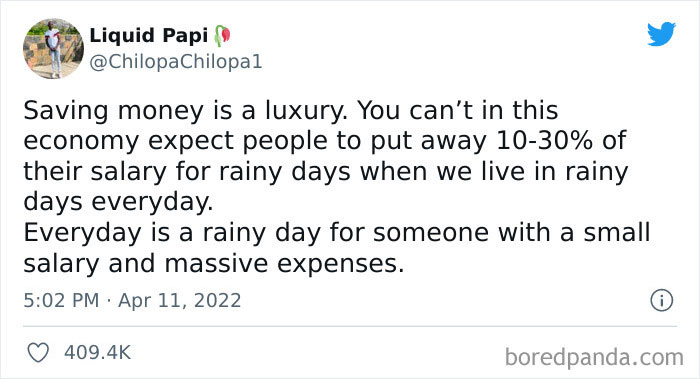

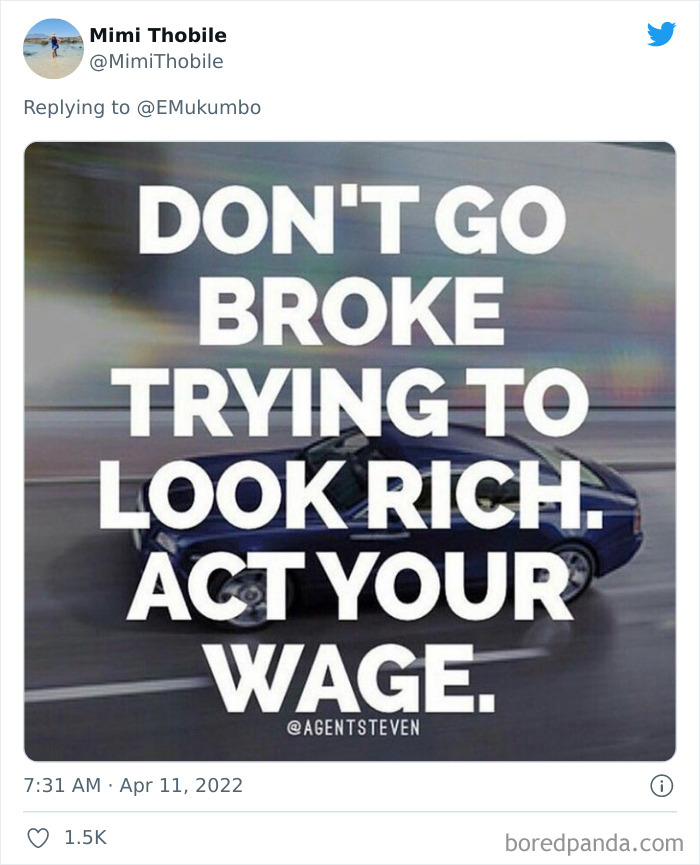

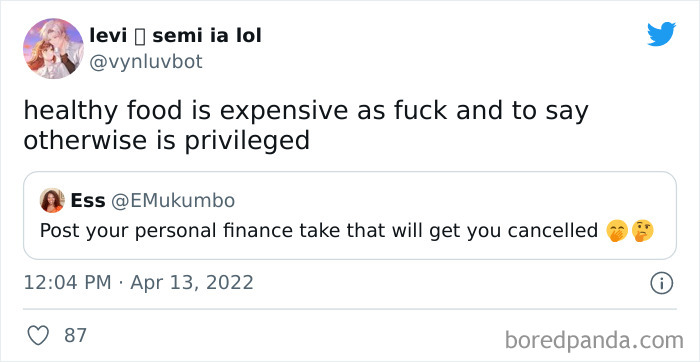

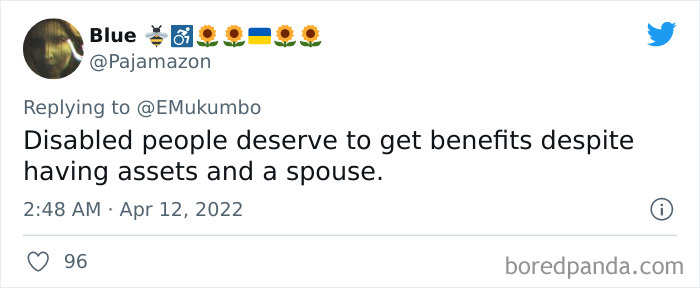

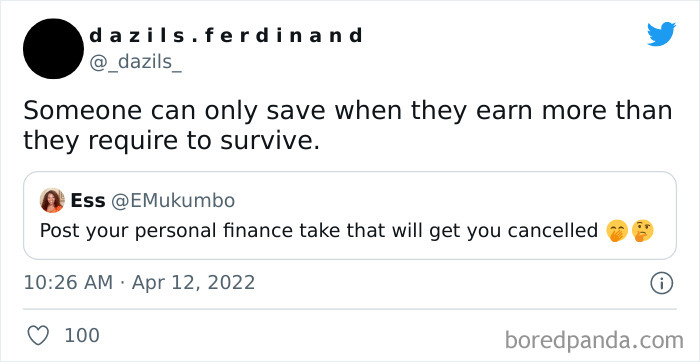

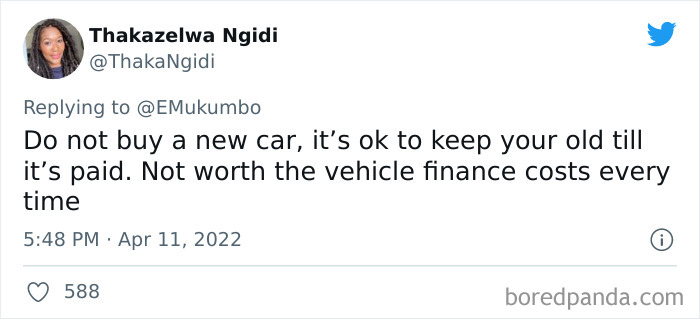

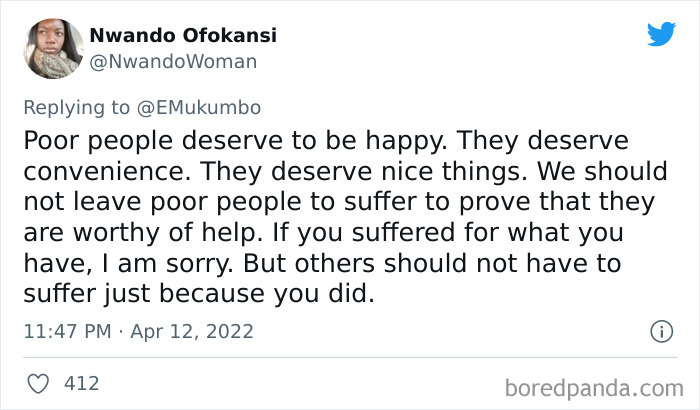

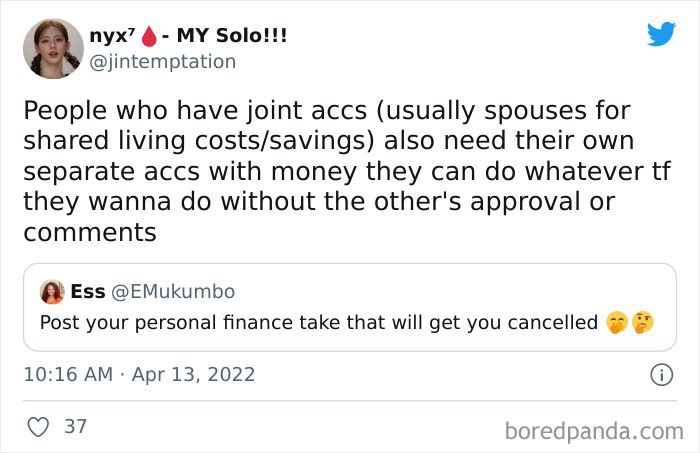

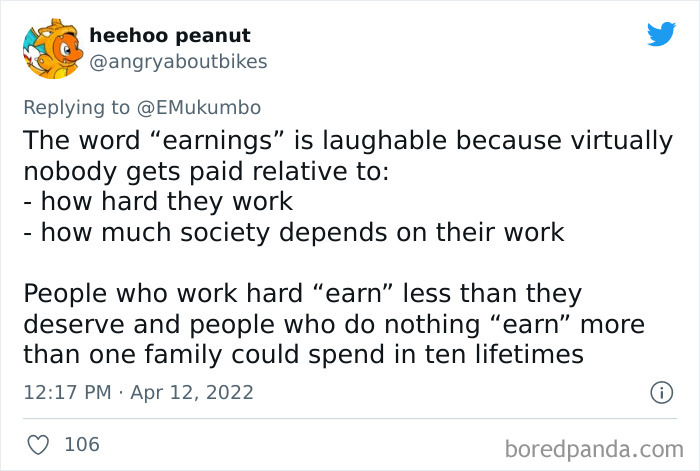

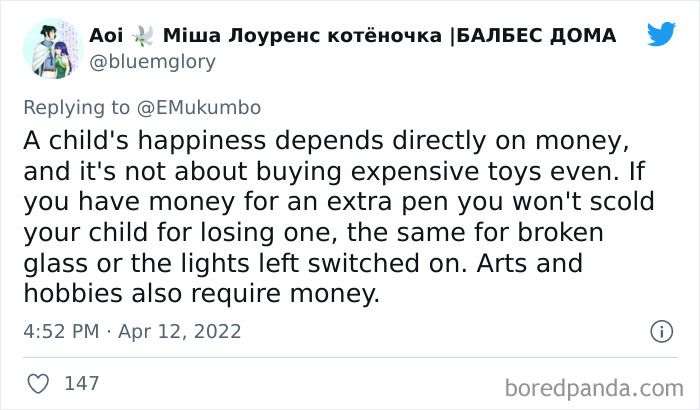

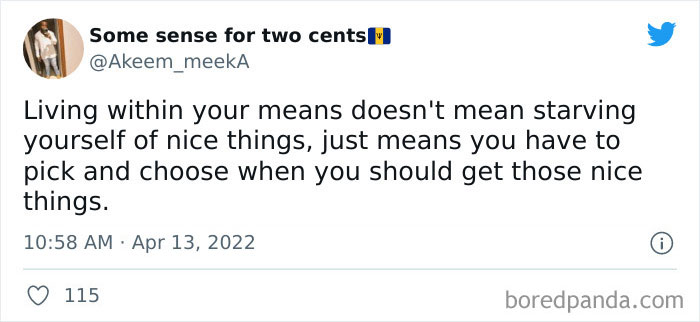

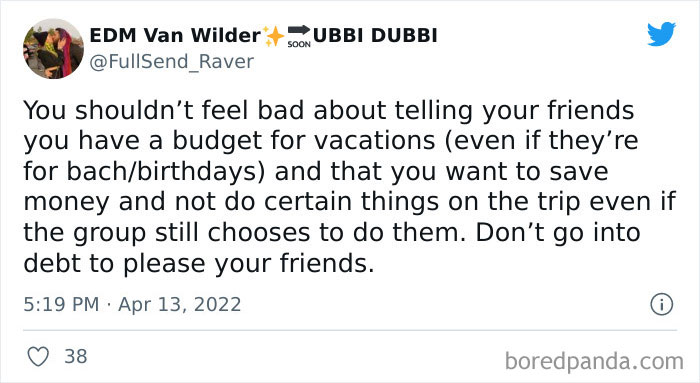

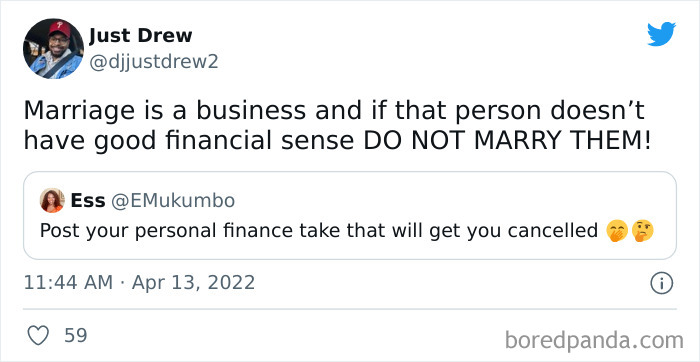

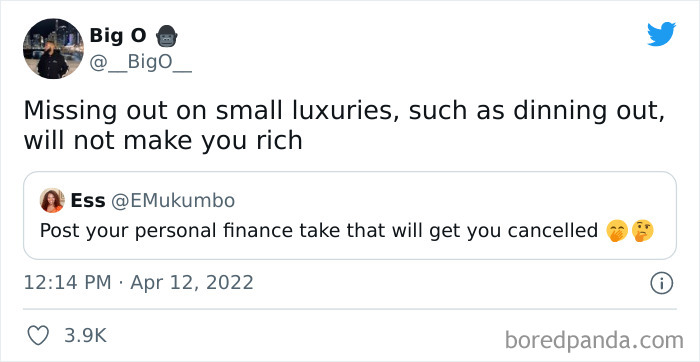

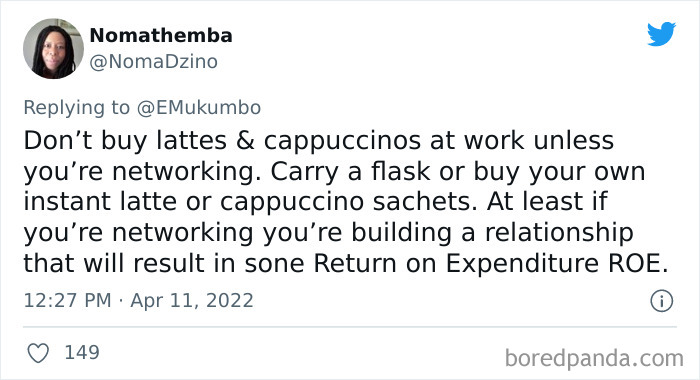

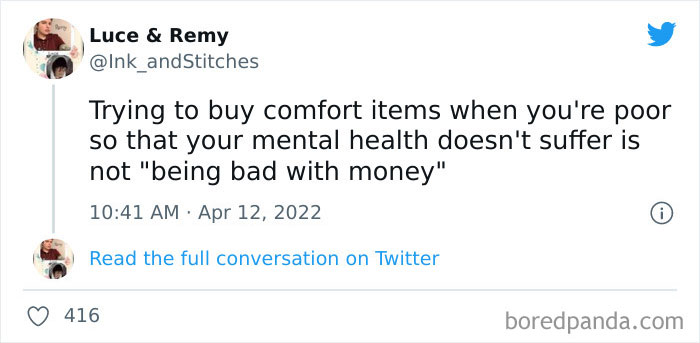

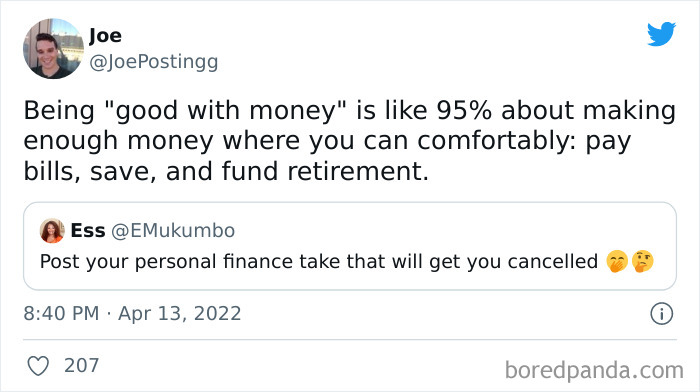

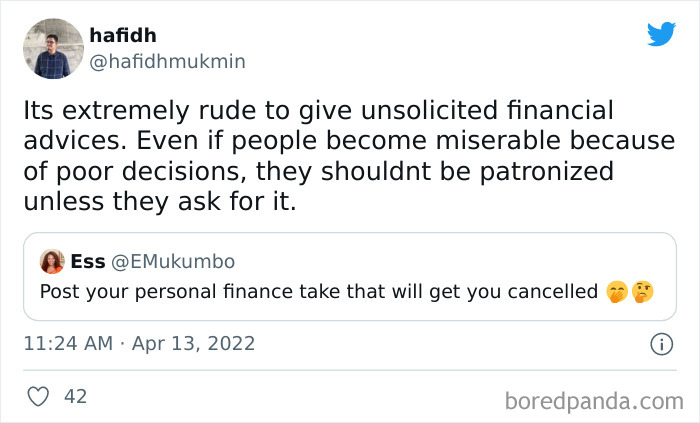

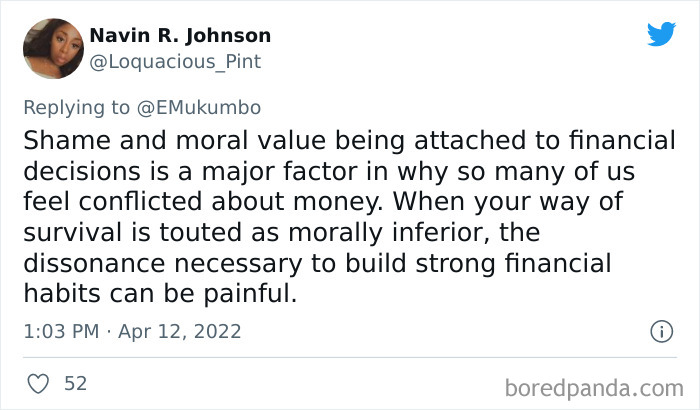

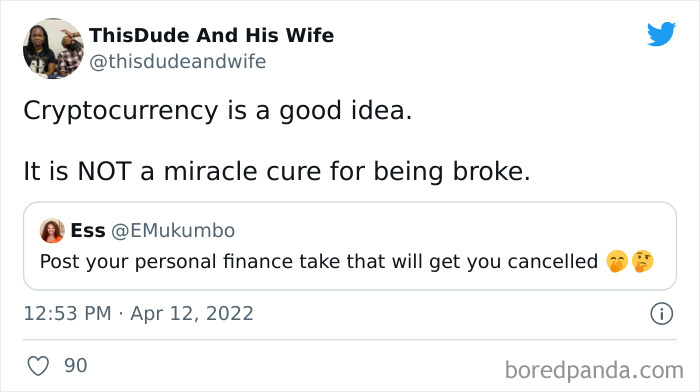

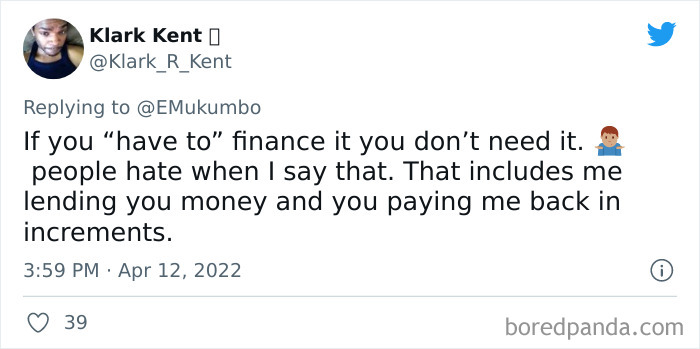

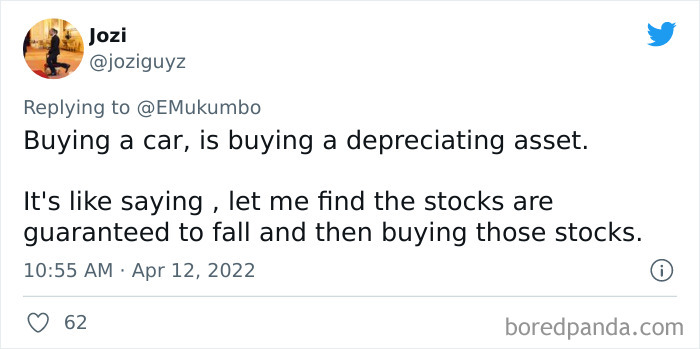

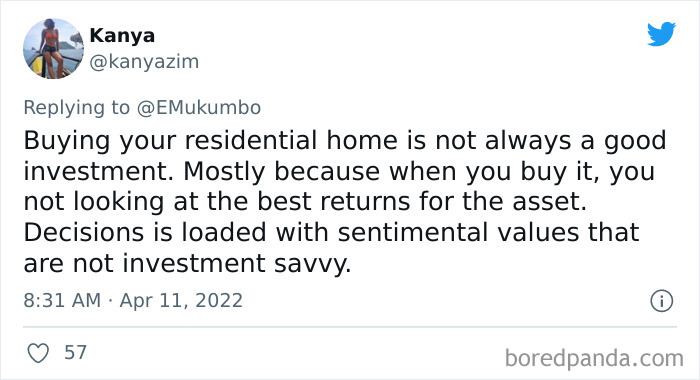

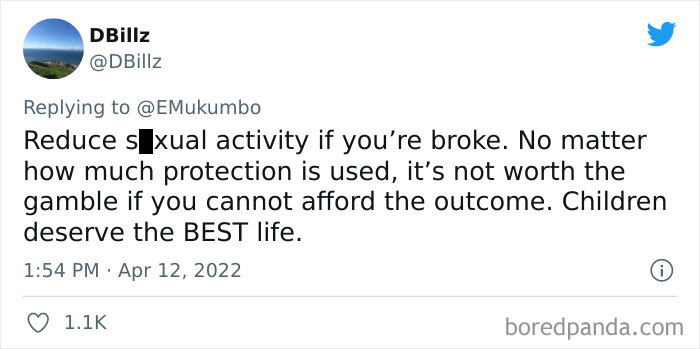

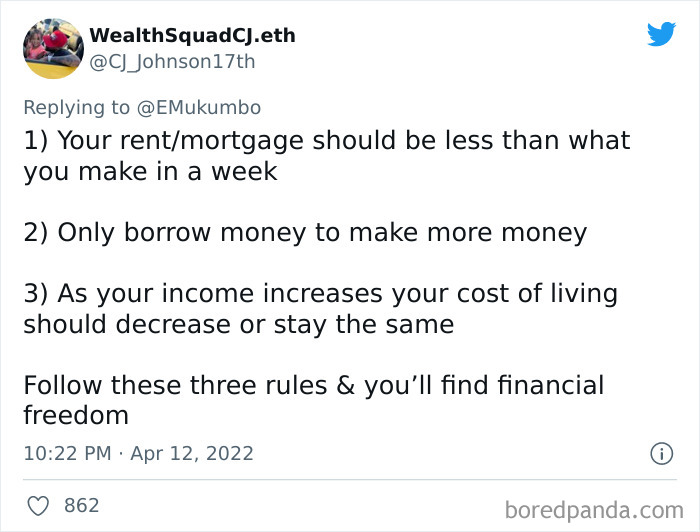

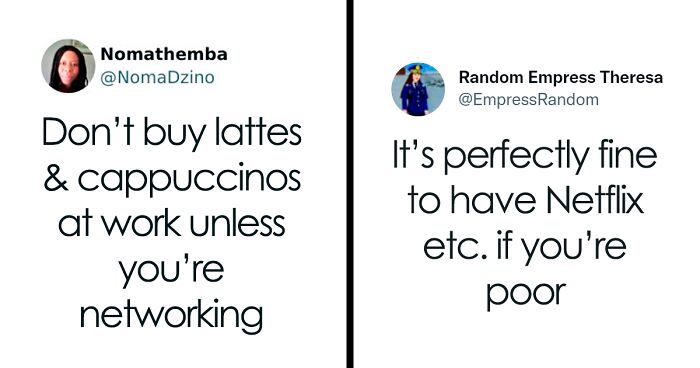

While trying to achieve her goals, Esther also regularly posts on social media and one of her latest tweets has gone viral. In it, the woman asked everyone to share their most controversial takes on personal finance, and people happily obliged.

This prompted an interesting discussion on money, a subject many often avoid in the real world, fearing making a fool of themselves or saying something that would trigger those around them. Yay the internet!

Image credits: EMukumbo

This post may include affiliate links.

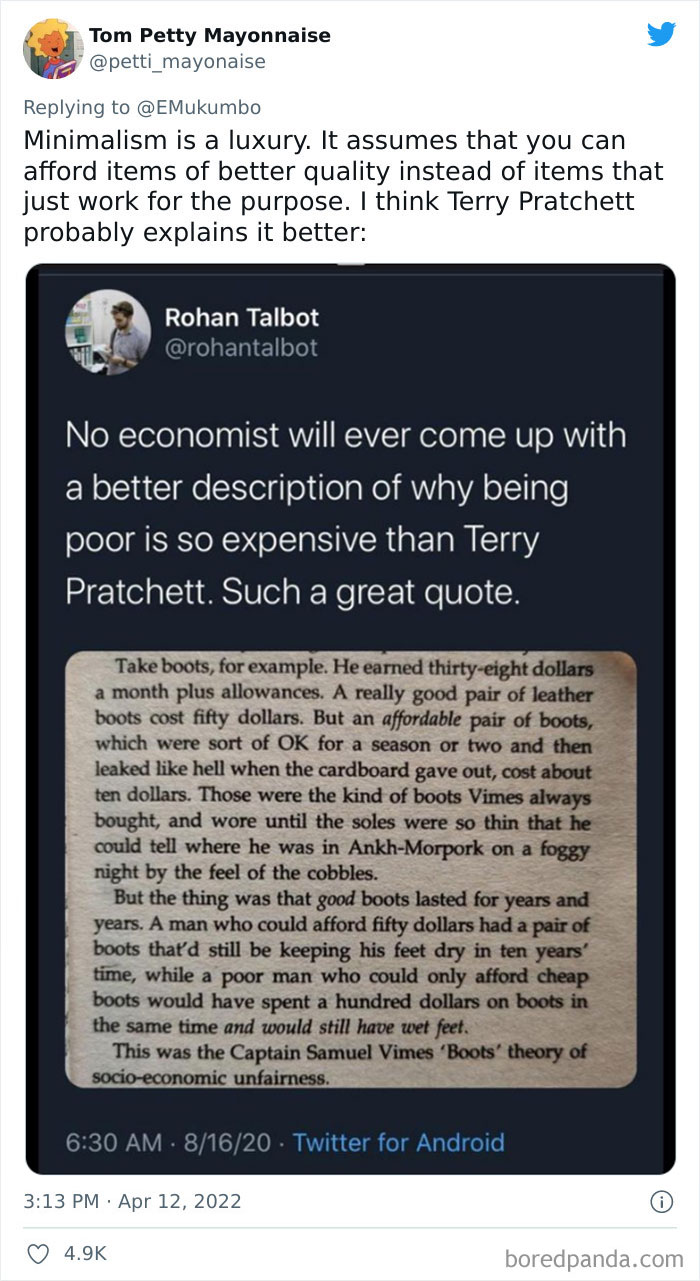

HA!!! HERE IT IS!!! The Terry Pratchett Sam Vimes Boots theory I mentioned before!

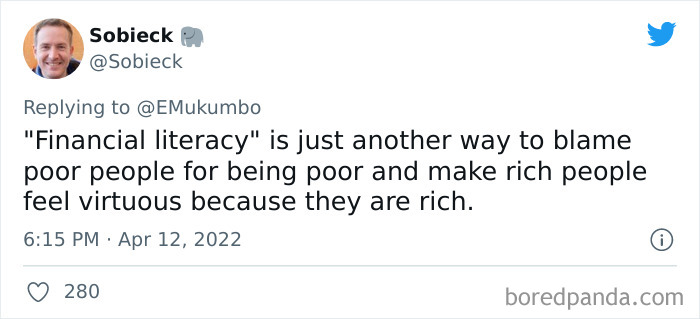

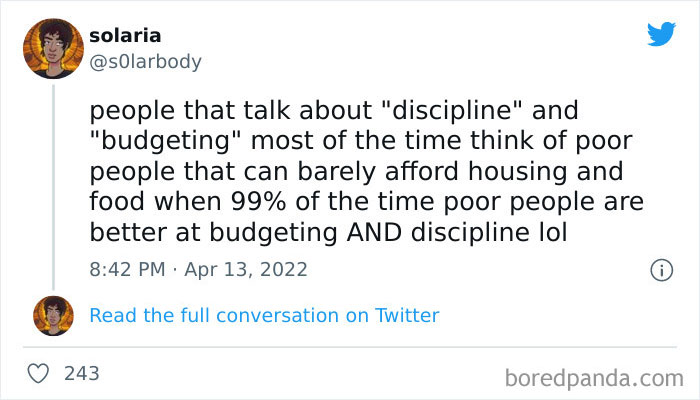

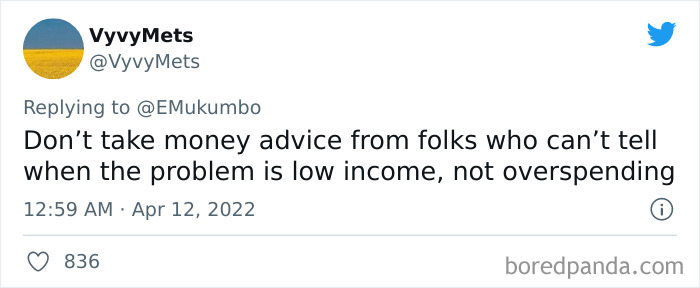

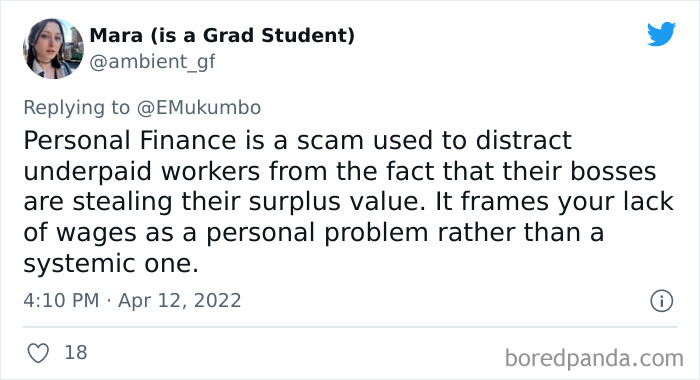

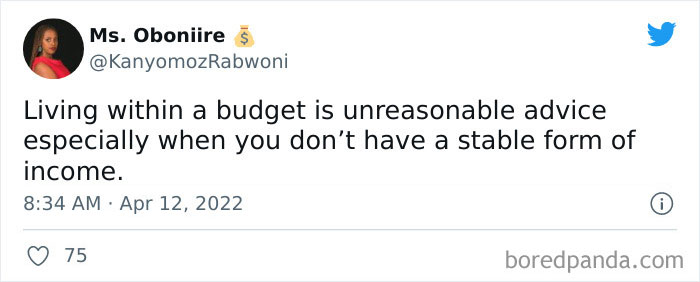

However, let's challenge this thread from a different perspective. Not because it's inherently wrong—it might allow us to get a better understanding of what these people are talking about. As Kristin Wong pointed out in The New York Times, traditional personal finance advice is often tossed around in blanket statements. While there's nothing wrong with the actual advice in theory, the way we deal with money in reality is often much more nuanced.

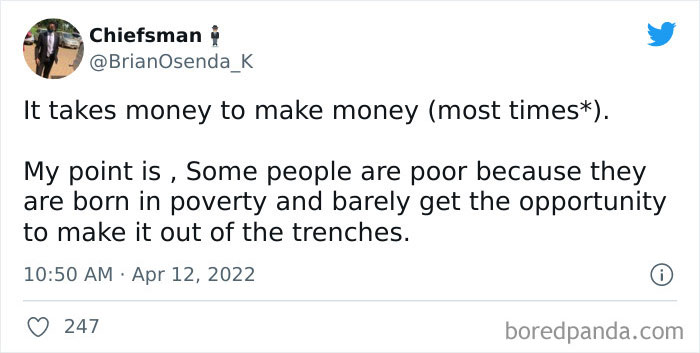

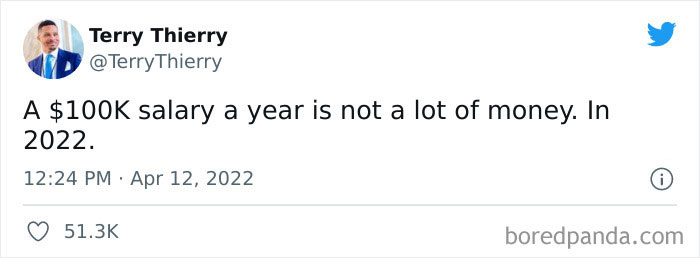

Consumer spending is increasing and unemployment rates have fallen, but wage growth has been slow, and income inequality is still very much a problem. With the situation changing so fast and drastically, what can we actually do about money?

How is this controversial? They absolutely should not exist. You don’t become a billionaire by paying people fair wages and a fair amount of tax. You become one by playing the system and cheating people out a liveable wage.

This is true. Terry Pratchett's Sam Vimes had a GREAT little commentary on that.... too darn true.

"I'm interested in the causes and consequences of inequality, particularly from a labor market perspective," Kate Bahn, director of labor market policy and an economist at the research organization Washington Center for Equitable Growth, told Wong. Dr. Bahn argued there's not enough emphasis on the larger structural barriers that make people's financial lives difficult. Personal finance might sometimes even further de-emphasize these barriers, she said.

There is, for example, a concept called labor monopsony, which is what happens when a single hiring entity gains control over the workforce.

"So employers will take advantage and pay workers less because there's nowhere else to go," Dr. Bahn said. "It's geographically remote areas where there may be only one big employer, and there's no other company to work for, so that company can pay whatever they want because workers can’t say, 'Screw this,' and go somewhere else."

Or better yet: Don't police how other people spend their money. Unless they ask you directly, it's literally none of your business. How would you like it if people commented and judged you on your purchases? Don't do it to others.

Get rid of religion, it is only about control and money. Controlling YOU and YOUR money.

Dr. Bahn's argument is that personal finance is necessary, but not quite sufficient. It's put forth as a solution when what we really need is policy, she said, and places priority on personal choice over issues that are ultimately out of most people's control.

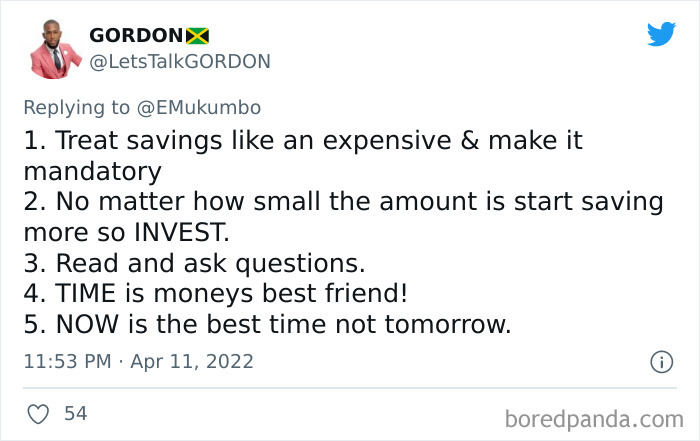

But there are still plenty of folks who think that personal finance remains helpful because it is a way to share information that many are discouraged from seeking. "People have criticized financial education, saying it doesn't work because people are still making mistakes," Billy Hensley, president and CEO at a private nonprofit, National Endowment for Financial Education, also told Wong. "Education can't help access jobs, but it can help people navigate the system as it exists."

You also can't buy in bulk, transport far for savings, or afford an annual subscription for discount stores or Prime.

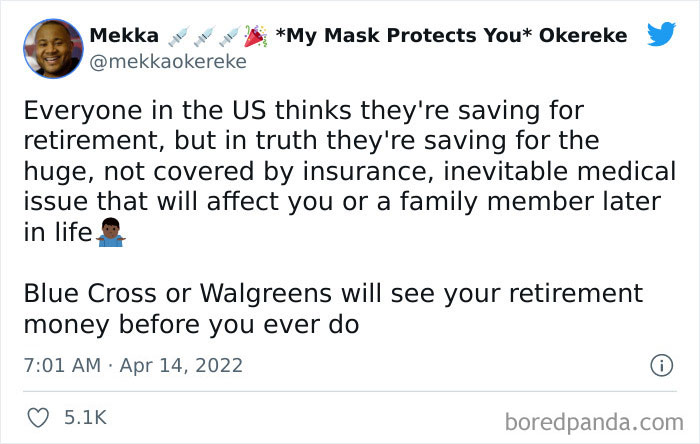

In... the USA... yes. I remember well the incredulous conversation I had when I was in my early 20s with an American friend. I laughed and asked him something like 'Ha ha.. yeah, sure, so what happens if you break your leg on vacation?" and he said "I dunno... pray... and beg?" - then I realized he was serious. And... the conversation got worse from there... it took me a WHILE to truly accept he wasn't exaggerating.

But when you think about it, how do you even measure the effectiveness of personal finance? After all, so much of it is... personal.

Rachel Schneider, a researcher and co-author of The Financial Diaries: How American Families Cope in a World of Uncertainty, tried to look at how people handle money in the real world. She and her co-author, Jonathan Morduch, a researcher and professor at N.Y.U., worked with over 200 families for a year, gathering information on every dollar that went in and out of their homes.

Our job offered " free 30 talk with a financial planner" He determined that I would have to put 1800 a month towards retirement to make the magical 1 million mark. That would have left me with $800 a month to live. And why do i need a million if i am living off 45,000 a year now ?

True. Very true. We don't own a car. There was a time we had to take the bus home from a big grocery haul. It was cheaper to get a ton of food all at once than spend bus/cab fare multiple times. So I'd be waddling down the block from the bus stop carrying 6 bags on each hand. Sometimes having to go back and forth up and down the block lol. Laundry day meant gathering up 3 large bags, putting them on the wagon and walking it all down to the laundromat. There was no car to just drive the kid to school. Rain, sun, ice and snow we had to walk her there and back, sometimes using the wagon or sled. Cleaning meant actually scrubbing and dusting, not using all that fancy stuff. We had slumlords so we had to do a lot of repairs ourselves or wait until a cheap, careless contractor came to do a temporary patch job. I was in way better shape back then than I am now lol.

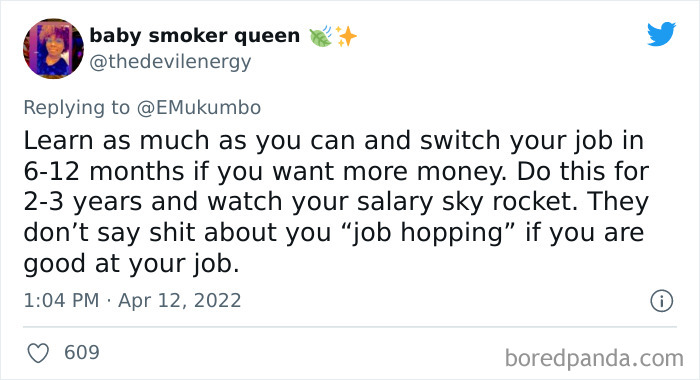

The people that work the hardest get paid the least. I worked my butt off in my early years (worked late, did extra) and it didn't pay off. My company went from a tenure/yrs of service promotion model to a college degree model.

When I was in college, I volunteered, teaching inner city ghetto kids in Chicago. Some of them were quite bright, and others quite not so. But nobody had ever taken the trouble to find out. Back in the mid-60's, had the bright ones been identified, and given proper educational opportunities, they might have flourished. But at this point, with evidence showing that the benefits of "Operation Head Start" rapidly attenuate when kids leave the program, it is pretty clear that the only "occupation" where hard work and effort are rewarded are in violent crime. You can't make much $ flipping burgers or shelving cans. But above some minimal effort, there seems to be little correlation between laziness and wealth as a whole, in the US. And while I did well financially, (academic medicine & private practice), I'm always haunted by the possibility that I "got in" because of affirmative action, depriving a more qualified candidate of the opportunity. Last name ends in a vowel.

Yeah, we're not the ones constantly hungover on our luxury yachts posting selfies. Many of us work two jobs just to pay basic costs.

No group is all anything. All generalities are incorrect. I don't think laziness is the biggest problem. I think two things are bigger causes. First, unrealistic expectations. I'm not saying that the system is fair, but it's not going to change overnight either. If you want a house and family, the odds are very, very slim without additional training of some kind. Second, people don't know how to budget their money. I blame our educational system for not preparing children for the real world.

Wow I’ve never seen more downvotes in my life. Every single one of your comments 😆 May be time to reevaluate!

Load More Replies..."A huge finding was the level of volatility people experience in their financial lives over the course of a year," Ms. Schneider explained.

Although she expected to find income volatility year to year, she was surprised to see how widely income varied within the year, too. A subject could be above the poverty line for the year overall, but that same person could fall below the poverty line in any given month.

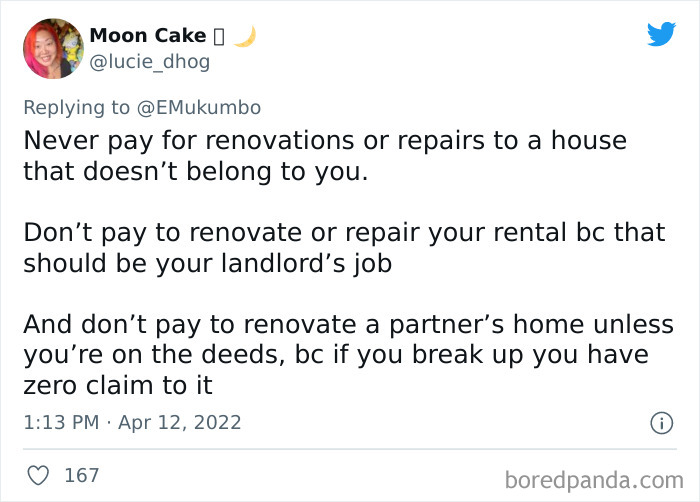

My mom has a serious problem with this. She's super finicky about interior/exterior appearances and every boyfriend she's moved in with, she's "helped" with redecorating and renovating. Each time I just shake my head and roll my eyes when she's not looking. Keep telling her to just stop and stop moving in with men just because she doesn't feel comfortable being a "single woman living on her own".

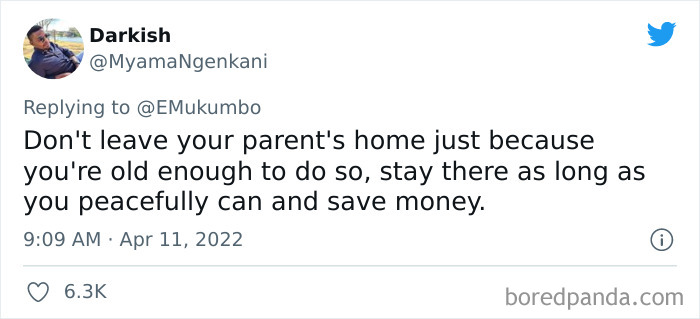

This is a personal matter between the family. There are some well-to-do parents who have no problems kicking their 18 year old to the curb without anything to survive on. And then there are the other parents, regardless of how well-off or not, who know how hard it is for the single, young folk to get by on their own and are okay with letting them remain at home to save money. It's no one else's business. You do you, people. If you're okay with your kids living at home, then that's you're business. If you want to kick them out of the nest, that's you're business.

"This has a huge impact on how people deal with money," Schneider said. "The economy has been growing and the unemployment rate is relatively low and declining, yet we’re not seeing that growth and prosperity getting distributed down to the bottom."

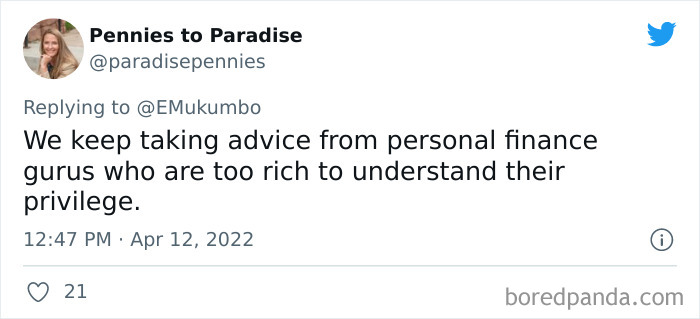

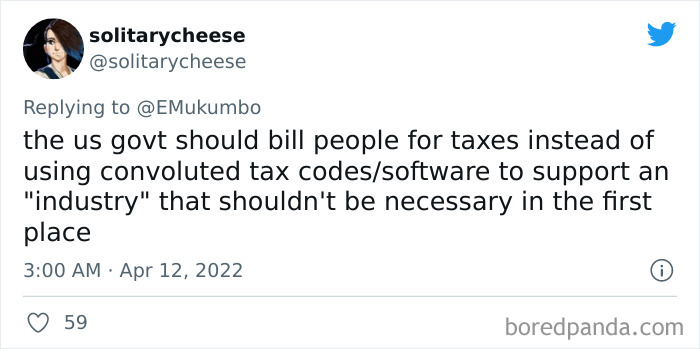

While Schneider agreed that financial education is necessary and can be useful, she also worried that overemphasizing it as a solution to financial challenges shifts responsibility away from our economy's major players (like banks that offer subprime predatory loans or companies that take advantage of workers).

Unless you have been in those shoes, you can't know how to advise someone on living in them.

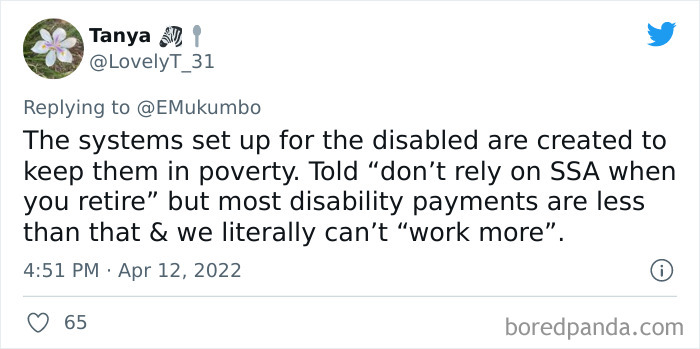

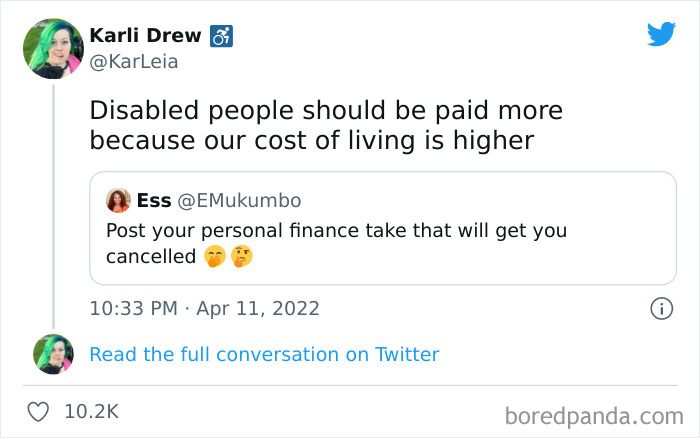

Disability benefits are there to cover the extra costs associated with having a disability/being disabled. Do you have to keep the heating on 3/4 of the year because of kidney failure, because there's a cost to that. Do you have to eat food without certain niche ingredients and therefore spend additional money covering the cost of that. I spend additional money each month on petrol so I can get to places because the bus isn't suitable. Disabilities cost more.

One thing that both proponents and critics of financial education seem to find common ground on, however, is that if we're going to help people navigate the current system, the way we talk about money has to evolve.

Financial education should not be telling a person to do this and in this exact way or you’re a failure. We need to humanize the topic and try to acknowledge the individual.

Anyway saving is a myth, that is NOT how rich people get rich. Source: I am in the 1% in my country, own 3 cars, paying off two properties, have two servants, private schooling, etc. How did I do it? Sheer luck, and playing the stock market with spare cash.

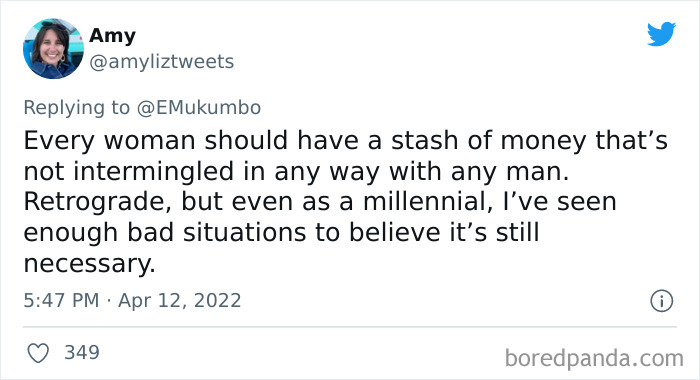

Ex-Credit Union manager here. If you're married, you should at least tell your spouse you have your own acct. Most honest couples disclose that ahead of time. AND don't ask anymore questions. If they can't accept that then they have issues that will probably ruin your relationship eventually anyhow. In the event of death the spouse is usually the beneficiary anyway.

This. I keep saying to people let's say "he is paid X" instead of "he earns X". Generally a person in management or above does not earn anything, they are more or less email forwarding devices that forward instructions between upper management and staff. That's not work.

a child's happiness depends on money I would feel better (and the people at school insulting me too) if I coul take a shower when I want instead of "water is expensive and we only have one hot water balloon-storage/day so we'll have to take turns : for a family of three max MAX is 1 shower every three days :(

I love my credit union. Still some fees but not nearly as bad as banks!

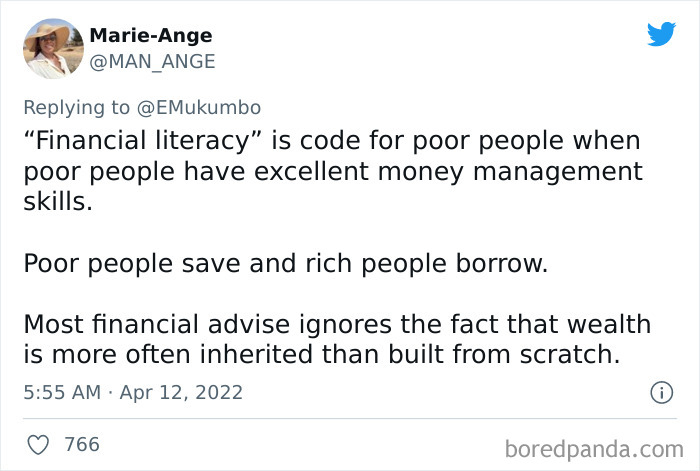

"Financial literacy" is code for rich people wanting to believe that poverty only happens due to personal faults and not systemic injustice.

Youtubers and other platformers get a lot of help from friends and family to advertise, and those who really did it themselves took a lot of sacrifices many of us aren't willing to risk. All these ones saying they quit their jobs to focus on their channel for a couple never tell you how they were able to do to that. Same with the ones saying they tried working one office job, quit and vowed to never work for someone again. HOW?

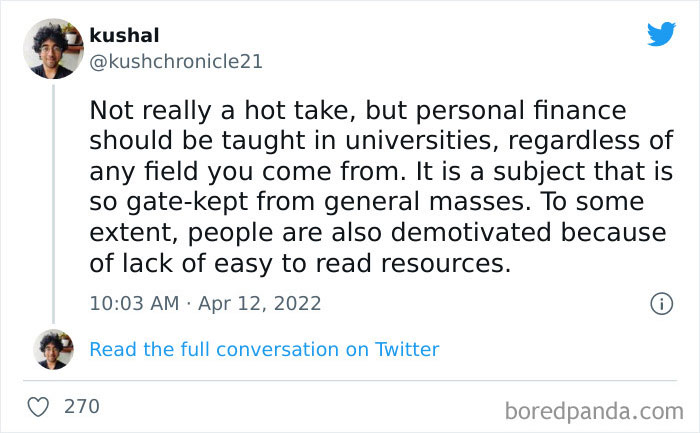

I think it should be taught in secondary school, as not everyone goes on to university

I never knew how true this was until a year ago. If I end up not being able to go back to work (currently on leave with a medical issue), I may or may not get social security benefits. They say that I can work, even if it's a job with less pay and less hours. How am I supposed to live on working 20 hours a week at $10 or $15 an hour?? If I don't find the right treatment, I'm poor no matter what.

If you have dyscalculia that is a very annoying statement to hear. It's not like we can't learn it just takes longer, and not a lot of people have the patience to take the time to teach it to someone with math dyslexia. It's frustrating and easier to just give up. But it's not that we're ignorant. We want this knowledge.

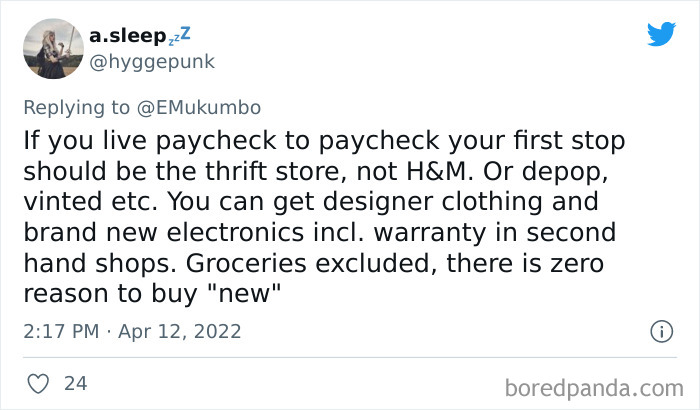

Charity shops are starting to have some pricier items these days though...I've found stuff in charity shops that would have been cheaper in H&M. This is irritating.

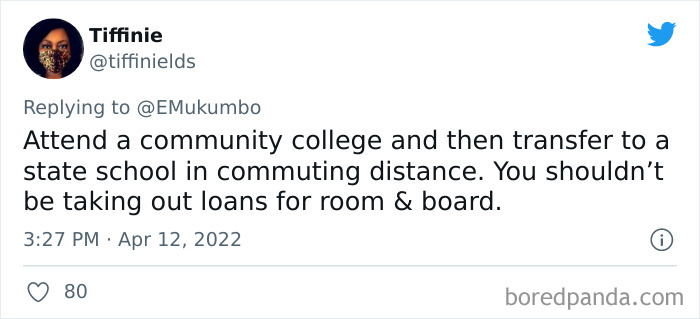

Absolutely - I have a PhD from Oxford and another one from Sydney. I've worked in and for several universities and one of the best editors I worked with taught at a community college in North America. A LOT of tenured professors at ivy league colleges are terrible teachers and not much good with undergraduates. Just because it's a more humble institution in terms of public profile, doesn't mean you won't get an excellent education there.

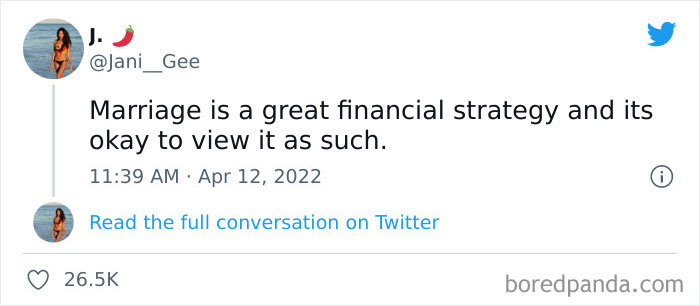

Where I am right now, divorce is the better strategy. I calculated it. If my husband and I divorced now we'd be financially better off, even living in 2 houses, because we would each be entitled to several types of rebates on taxes, rent and health care.

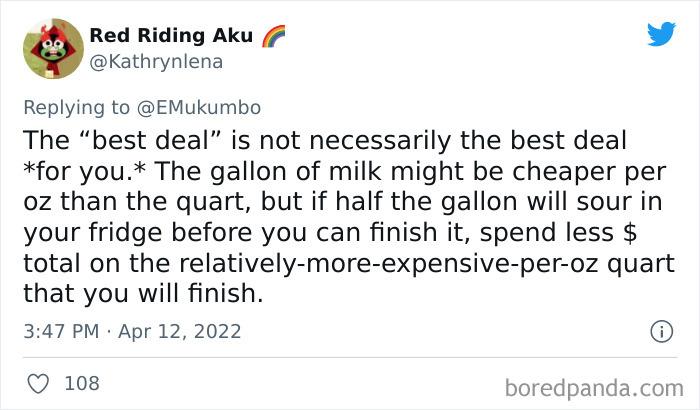

Weird, but this upsets me. I once asked my late dad to buy me one carrot when he went out for groceries. I only needed one carrot for a side dish. He brought back 1 kg of carrots because he thought they were cheaper at 99 cents than the single carrots at 1.59 per kg. I needed one carrot. 80 - 100 grams. Would have cost 16 cents or less. And WTF was I meant to do with the rest of the carrots? It's so annoying to me, it's such a waste of money and produce, don't buy stuff unless you can actually use it!

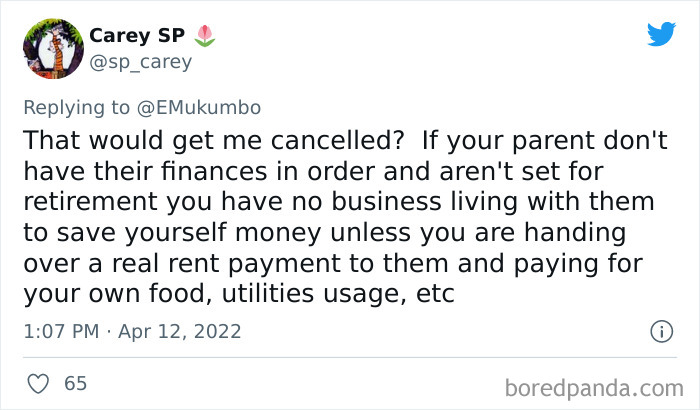

Yep... "... as you peacefully can"... that's key. I had to move out so that they'd stop holding it over me... ie: "You live here so you do this. We pay for your heat, electricity, so you can't do this, can't have that, we don't care if you're using your own paycheque, you live in our house so you can't." - ie: I couldn't buy a gecko, where I was paying for the food, the tank, the maintenance, the everything-to-care-for-it, because they didn't like lizards. Even though it was in my room so they did not have to see it... it was in their house. THEN they'd add on... that my choice of pet was 'causing all the bad luck' in the house - sooo yeah... out.

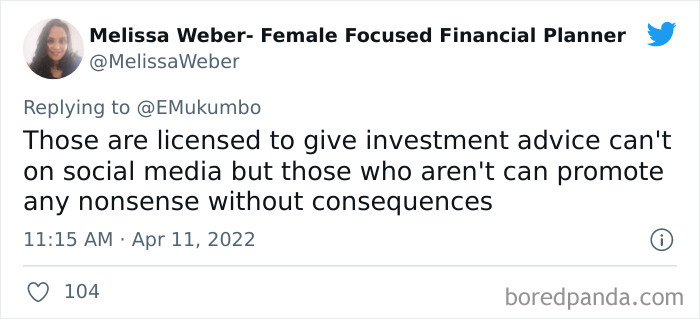

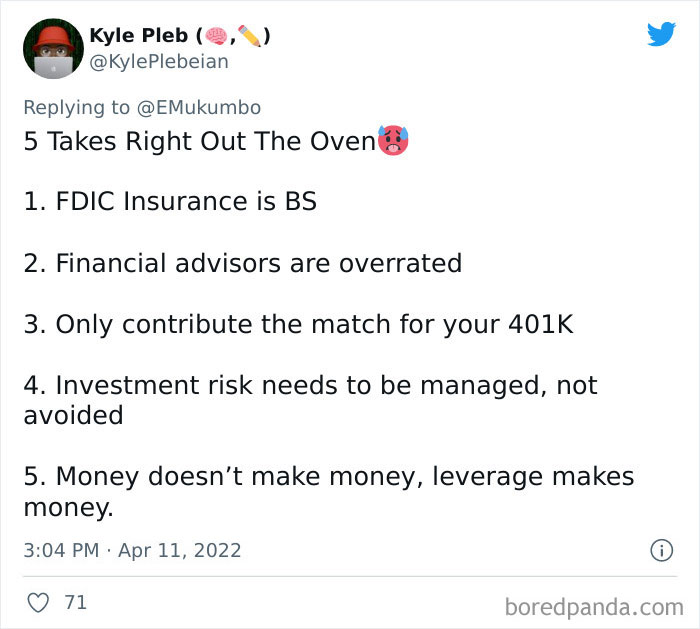

Whoa whoa whoa! So every financial guru/expert on YT and social media is not licensed? hmmmm......

Marriage is *partially* a business... and truthfully how you each view finances will have a massive impact on the sustainability of the marriage. The reason being that money matters. We don't live in a barter-based society. All-give-no-take on anything, repeated over years, will have an impact on the 'loooove'.

If you're defaulting on loans to take out loans to buy luxury comfort items it is being bad with money. If it's stopping at the diner down the street to get some mac and cheese and pie after a bad day- my heart is with you.

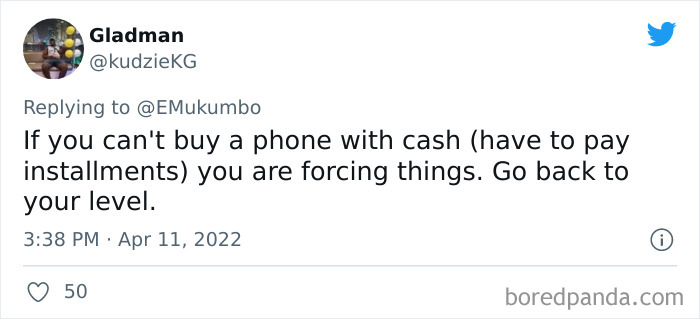

I used my last mobile until the back fell off and the battery was exposed. I couldn't afford to pay for a replacement outright. I pay $36 a month to pay mine off. I can afford that with my gigantic budget sheet.

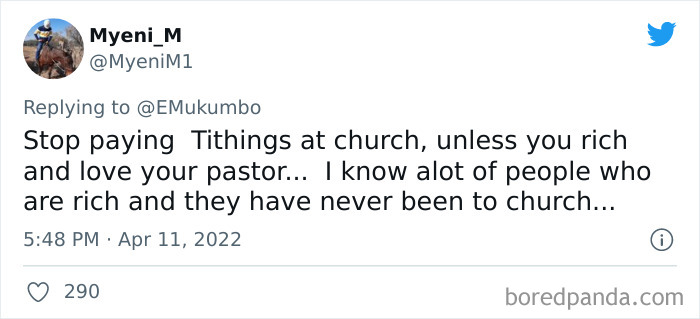

Tithes don't have to go to the church, but to any charitable endeavour. If your church says otherwise leave

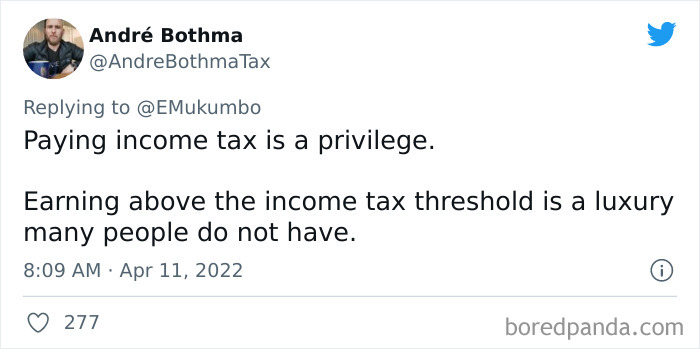

I can see from this guy's name that he is in SA (my country). Specifically that he's Afrikaans. And he's right. If you are paying income tax here, it means you have a full time job and can probably afford either a house or car, but not necessarily both. which puts you in the top 60%... the other 40% are unemployed.

Being good with money means spending $1500 taking a training course to learn a trade that will take you from minimum wage to $25/hr instead of spending it on a new phone. Being good with money means realizing that even if you're only spending $3 or $4 on something, if you're doing that every single day of the year, it adds up.

Before we moved in together, my husband and I made a spreadsheet of all income and bills, so we were able to split everything. We also talk about anything we do in the home, projects like renovation and redecorating, and split that. We are older, so no kids, any any excess is the person's.

I honestly think everyone should be using a debit card, so they can't spend money they don't have. A creditcard is basically a loan and can get you into massive trouble.

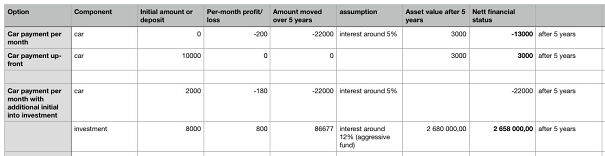

Nope. Put down a small deposit and pay the monthly. The rest of that money you saved up, put into an aggressive investment portfolio. Even if it's a "small" amount like $8000. Look at this. These calculations are based on approximate interest rates in our country on loans and aggressive investment portfolios. Option 1: Pay the car off over 5 years (usual approach). Result, you lose about 22k USD. Option 2. Pay the car cash up front (poor person approach). Result: you save about 3k USD. Option 3. Put a small deposit, pay the rest over 5 years, and take the rest of those savings and invest in a stock that outperforms your loan's interest rate. Result: 2.6 million USD after 5 years. Screen-Sho...41-png.jpg

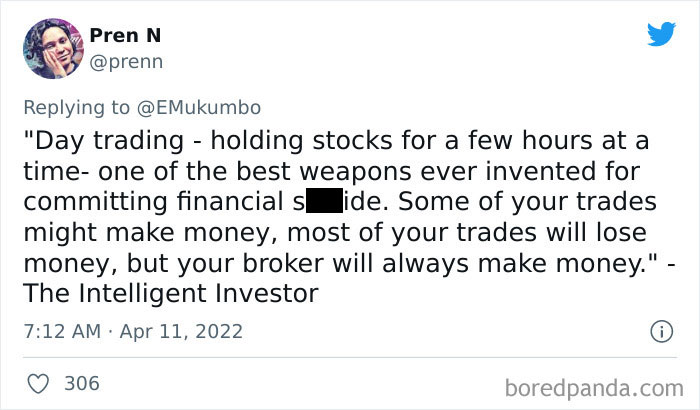

Not really true if you are the broker. Simple example: before the war started in Ukraine I bought US weapons stocks. Cynical, sorry. But it worked. I made about 20% after holding for 1.5 days.

nah, if you are penny pinching like that you are already poor. You should be looking at how to grow whatever money you have. What can you prioritise and where can you redirect funds to say a stock portfolio? Even a small one...

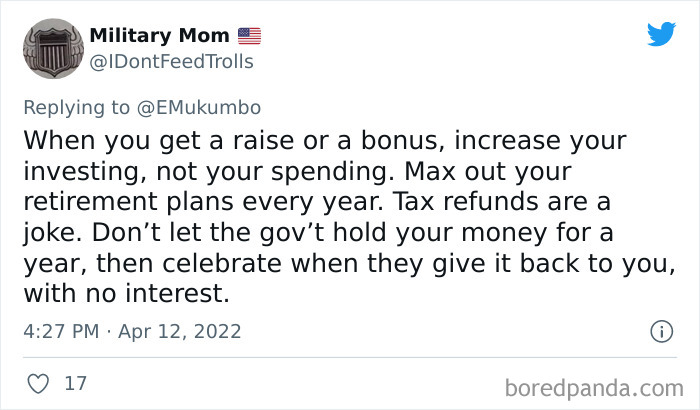

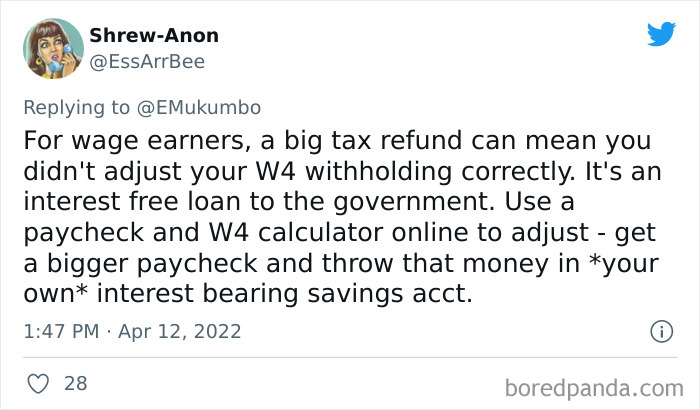

Yes! I've met so many people who see getting a huge refund as a good thing. To me it's bad. It means the government has been stealing my money for 12 months and finally gave it back (without paying me interest!). I'd much rather owe the government a small amount than have them owe me a big amount.

Long term, inflation has been under 2% for years. I do agree that dividends are not important when investing.

Inflation is a measure of how much less we can buy today with yesterday's money. It's not something we know how to control. No economist in the world can correctly and consistently predict inflation, or tell anyone exactly what should be done to increase or decrease inflation.

Living within a budget is never unreasonable. You know the bare minimum it costs to keep yourself afloat. Rent+gas+electric+water+ food. Everything else is a luxury. This is especially important if you don't have stable income...because until you cover those expenses, you shouldn't be spending on anything else. Likewise if you live alone, and your food budget is the same as your rent, that's not really sustainable. People have trouble seeing the difference between "want" and "need" you want to spend $200 a month on streaming services and internet, but you need to spend $200 on your electric bill for that to even be a consideration.

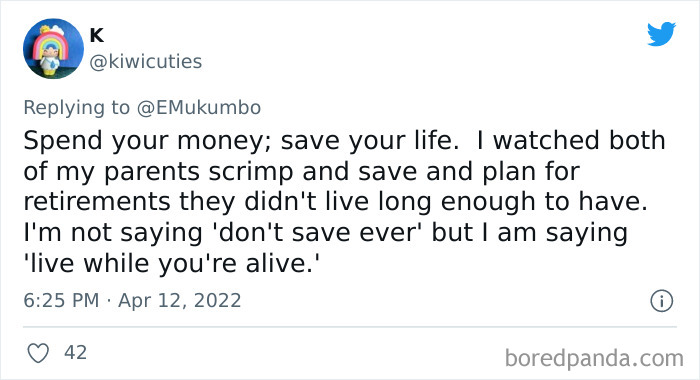

mmmm nahhh. This assumes you'll get a better phase of life etc. You do not know that.

with a name like "Audi sales exec" we really are going to trust you becasue you totally are not selling cars. LOL

Well if you're in a position to live with your parents that presumes that they own their own home. Which means it's probably paid off. Which means even if you have to pay them some rent and split utilities, it's going to be considerably LESS than the $1500-2500 you spent a month living alone pissing money away on rent. I've said this before in this thread, people don't acknowledge the difference between WANT and NEED very well. No one wants to move back in with their parents, but if it means you get to save $15,000-$30,000 over the course of a year or two, you need to consider the worth of doing so to be able to invest in owning a house.

If your mortgage overpayments allow an automatic mortgage holiday you can count this holiday towards that savings total, and the amount saved on mortgage interest is >>> amount of interest you will get in a savings account

Translation for non-africans. "Black tax" refers to your family asking you for money help if you are employed. It's called that because most black families have about 40% unemployment and hence the "family tax" is basically racialised. Few white families here are poor enough to have a family group / household that has to survive by borrowinig money from employed members.

Just because not being able to remember anything from high-school is her reality, doesn't mean it was mine. I would have appreciated those lessons very much!

When you need a reliable vehicle to get to work because you live in the country. Just save for it, right? 🤦

A roof over your head is an essential. If you can buy it you should.

Sex is one form of great entertainment poor people can afford! Condoms can be gotten for free btw

"Earn more money" gee, thanks! Now that's some practical advice. How do people come up with these pearls of wisdom /s

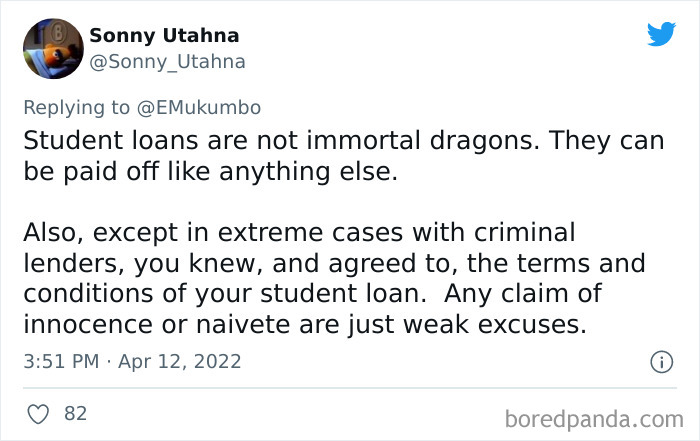

You're not responsible enough to legally drink alcohol, but we'll let you take out $100,000 in college loans. Any claim of of innocence or naivete is just a weak excuse.

Nobody asked to be born, Sunshine, including your parents. Get off your lazy ass and get a job.

Being poor is not a moral failing, but not giving a s#it about the poor is.

My financial advice to my fellow Americans: STOP voting against your own interests! If we would all do this then UNEARNED income wouldn't be taxed at a lower rate than earned income in this country.

Absolutely. I'd vote many time more UP if I could

Load More Replies...Other advice to not take from Twitter: who to vote for; whether to get vaccinated; whether the earth is flat; etc.

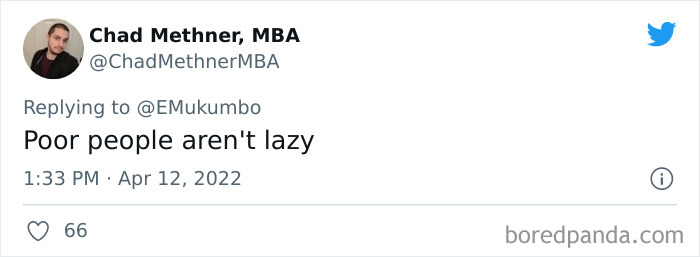

Load More Replies...Most poor people are doing everything they can to get out of poverty. You can actually do everything "right" and still be poor. All you need is bad luck. You cannot change what country you come from, wish parents you have, etcetera. And even if you start out well, an accident or a serious health problem can tank your economy for life.

Everyone should be able to live a normal life an have a family. Instead of shaming poor people for having kids we should change society so kids don’t grow up in poverty.

Poverty is actually avoidable if you graduate hs, always have a job, don’t have children until you’re married. Literally the formula that will make poverty disappear And your problems are not solved by trying to vote for the government to steal from “the wealthy”. Stop obsessing about “the wealthy” and focus on your wealth. Free healthcare is a lie. Pay your own medical expenses and be an adult.

My rule always was, if I have to wear Walmart shoes I'm damn sure not buying you a pair $250.00. I told my boys if they wanted them I would pay 50 and they had to earn the rest. Same thing with phones. But our kids didn't get a phone til the turned 13. These 9yr olds with the latest iPhone makes me cringe! I grew up poor.. I mean poor! It shows lol but my kids work there buts off now at 19.20 and 22! Proud momma!

If you are unskilled labor, it doesn’t how much money you make, eventually they will find a way to pay you or someone else less because there are no barriers to someone entering the job. Always have a skill and continually upgrade your skills to stay ahead of automation and cheaper incoming labor.

a justice system but the game ended. Attitudes after the game ended: the "rich" who all thought they were smarter and more deserving of everyone else. It was by f*cking chance (or the organizers) that they got the gold tokens. The poor understood that the game was rigged and were quite vocal about how it was rigged. Those who represented the middle class really thought they stood a chance of being the winner and were totally clueless as to what the game was all about. They were mostly bewildered at all the fuss made by the poor.

Played a "game" one time. Class was split into several teams of 5 people. Tokens were handed out "randomly". Different colors were worth different amounts. There were a very few gold tokens that were worth a lot more. The object of the game was be the person who ended up with the most points from their tokens. Scores were posted. Token handouts happened more than once. Takeaways from the game: In the two teams with the least scores (the poor) would race back to the others with their hands open. What have we got? Then one person was selected by the team to get all of the tokens for the team, the rest got 0. Those who got the golden tokens each stood alone, peeking at their hands. Those who thought they were still in the running to win, but really were not, each played their own hands but stayed with their teams. Cheating was rampant but those running the game said, we can't interfere, the game has not mechanism to deal with it. The "poor" were starting to talk about

Can we please stop using the term canceled please? No one gets canceled you get held accountable to the words you say or write. I'm not sorry your opinions are not viewed by the masses as acceptable and maybe just maybe your views are not acceptable are wrong.

What is true, and what is POPULAR often have no overlap. This little corner of the internet is a prime example of that. Say anything at all that 10 or more people don't LIKE and away you go. Doesn't matter if it's true, doesn't even matter if it's offensive. That's the problem that people have with "cancel culture" not being held accountable for your actions or words, but being held accountable for what some random stranger parses your words to mean or assumes to be true. There are countless examples over the past several years, the most recent example of course being Johnny Depp.

Load More Replies...So glad you shared! I'll be well on my way to my Caribbean retirement in no time with that advice!

Load More Replies...Being poor is not a moral failing, but not giving a s#it about the poor is.

My financial advice to my fellow Americans: STOP voting against your own interests! If we would all do this then UNEARNED income wouldn't be taxed at a lower rate than earned income in this country.

Absolutely. I'd vote many time more UP if I could

Load More Replies...Other advice to not take from Twitter: who to vote for; whether to get vaccinated; whether the earth is flat; etc.

Load More Replies...Most poor people are doing everything they can to get out of poverty. You can actually do everything "right" and still be poor. All you need is bad luck. You cannot change what country you come from, wish parents you have, etcetera. And even if you start out well, an accident or a serious health problem can tank your economy for life.

Everyone should be able to live a normal life an have a family. Instead of shaming poor people for having kids we should change society so kids don’t grow up in poverty.

Poverty is actually avoidable if you graduate hs, always have a job, don’t have children until you’re married. Literally the formula that will make poverty disappear And your problems are not solved by trying to vote for the government to steal from “the wealthy”. Stop obsessing about “the wealthy” and focus on your wealth. Free healthcare is a lie. Pay your own medical expenses and be an adult.

My rule always was, if I have to wear Walmart shoes I'm damn sure not buying you a pair $250.00. I told my boys if they wanted them I would pay 50 and they had to earn the rest. Same thing with phones. But our kids didn't get a phone til the turned 13. These 9yr olds with the latest iPhone makes me cringe! I grew up poor.. I mean poor! It shows lol but my kids work there buts off now at 19.20 and 22! Proud momma!

If you are unskilled labor, it doesn’t how much money you make, eventually they will find a way to pay you or someone else less because there are no barriers to someone entering the job. Always have a skill and continually upgrade your skills to stay ahead of automation and cheaper incoming labor.

a justice system but the game ended. Attitudes after the game ended: the "rich" who all thought they were smarter and more deserving of everyone else. It was by f*cking chance (or the organizers) that they got the gold tokens. The poor understood that the game was rigged and were quite vocal about how it was rigged. Those who represented the middle class really thought they stood a chance of being the winner and were totally clueless as to what the game was all about. They were mostly bewildered at all the fuss made by the poor.

Played a "game" one time. Class was split into several teams of 5 people. Tokens were handed out "randomly". Different colors were worth different amounts. There were a very few gold tokens that were worth a lot more. The object of the game was be the person who ended up with the most points from their tokens. Scores were posted. Token handouts happened more than once. Takeaways from the game: In the two teams with the least scores (the poor) would race back to the others with their hands open. What have we got? Then one person was selected by the team to get all of the tokens for the team, the rest got 0. Those who got the golden tokens each stood alone, peeking at their hands. Those who thought they were still in the running to win, but really were not, each played their own hands but stayed with their teams. Cheating was rampant but those running the game said, we can't interfere, the game has not mechanism to deal with it. The "poor" were starting to talk about

Can we please stop using the term canceled please? No one gets canceled you get held accountable to the words you say or write. I'm not sorry your opinions are not viewed by the masses as acceptable and maybe just maybe your views are not acceptable are wrong.

What is true, and what is POPULAR often have no overlap. This little corner of the internet is a prime example of that. Say anything at all that 10 or more people don't LIKE and away you go. Doesn't matter if it's true, doesn't even matter if it's offensive. That's the problem that people have with "cancel culture" not being held accountable for your actions or words, but being held accountable for what some random stranger parses your words to mean or assumes to be true. There are countless examples over the past several years, the most recent example of course being Johnny Depp.

Load More Replies...So glad you shared! I'll be well on my way to my Caribbean retirement in no time with that advice!

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime