“He Stole One Of My Credit Cards”: Entitled Son Expects His Well-Off Boomer Parents To Support Him

In my previous posts, I have repeatedly written about the problems and difficulties of parenting when your child has just been born, or at most is a teenager. However, as it turns out, problems of various kinds do not leave parents alone even when their kid is in their twenties.

For example, this couple who already have three adult children, the youngest of whom clearly does not want to follow in the footsteps of his parents and siblings, working hard to reach wealth. Perhaps some mistake was made by the parents during his upbringing? Who knows? So let’s read this story from the user u/boomerindoubt and let’s try to figure everything out together.

The author of the post and his wife have three adult children

Image credits: Karolina Grabowska (not the actual photo)

The author admits that he and his spouse have been working hard throughout their entire lives and are now pretty well-off

Image credits: u/boomerindoubt

The elder children are very responsible, according to their dad, but the younger son is a true wastrel

Image credits: Pixabay (not the actual photo)

Image credits: u/boomerindoubt

The youngster used to spend money on booze and parties and several months ago even stole money from his dad’s card

Image credits: John Arano (not the actual photo)

Image credits: u/boomerindoubt

So the parents cut his funding off, and the guy managed to owe the bank $9k in just three months – and is now begging his parents to cover this debt

So, the Original Poster (OP) and his wife are boomers, according to themselves, in the sense that they are both already at a respectable age, and both have devoted a significant part of their lives to hard work in order to eventually achieve, if not wealth, then significant financial well-being. Well, to their credit, they achieved it.

The couple have three children, the youngest of whom is now 21 years old. They tried to give all three a decent education, and the older children successfully took advantage of this chance. At least, the dad claims that they are both very responsible, and we have no reason not to believe him.

But the youngest son – he, of course, studies in college, but is trying to use these years not so much to gain some knowledge and skills, but to party. The parents give their son money (the same as they gave to their older children), but he prefers to buy booze with this money, with all the ensuing consequences.

Moreover, recently, as the OP himself says, the son stole his credit card and charged a hefty amount of money to it, which he used to pay for drinks for a party. The guy swore that he simply mixed up the cards, but the father is sure that this is impossible – at least because they are of different colors (one is red, the other is blue).

So, the parents decided to deprive their son of financial support, leaving only money for education. He, of course, got immediately mad, literally cutting all ties with them, but three months later he suddenly showed up again, coming to his parents with another request.

As it turned out, during the time that he did not receive money from his parents, the guy managed to open a credit card at the bank and completely exhaust its limit. By the time of the conversation with the OP, the son already owed $9K, and now he was literally begging his parents to help him “for the last time.”

This time, the son claimed that he would now find a part-time job (previously he had indignantly rejected such offers), and for him this situation would become a priceless lesson for the rest of his life. The dad, being a pretty astute guy, understood perfectly well that this was unlikely to be true.

On the one hand, he felt sorry for his son; on the other, he realized that if he paid his debts today, the guy would, after some time, return to his former careless life. In addition, the OP and his wife, of course, are wealthy people – but shelling out 9 thousand in one payment also means a blow to the family budget for them… So the author decided to consult with netizens on this sensitive issue.

Image credits: Nicola Barts (not the actual photo)

In fact, the situation we described is not something out of the ordinary. At least, if we look at the statistics, we will see that 62% of adult children living at home don’t contribute to household expenses at all, according to CNBC, quoting the results of the poll conducted in 2022 by Savings.com.

Moreover, according to the same study, approximately half of parents whose adult children live with them provide at least some financial support to their offspring, forking out about $1,000 a month. And this does not take into account the fact that many parents also have to support their own parents…

“The situation for young adults today is much more bleak than for some previous generations,” The Hill quotes Christine Percheski, a sociologist at Northwestern University. “We are not covering as much of the cost for college as we did for previous generations. And young adults are facing a tough housing market that is not of their making.” Well, you can’t even argue here – and numerous stories about evil landlords are the best confirmation of this.

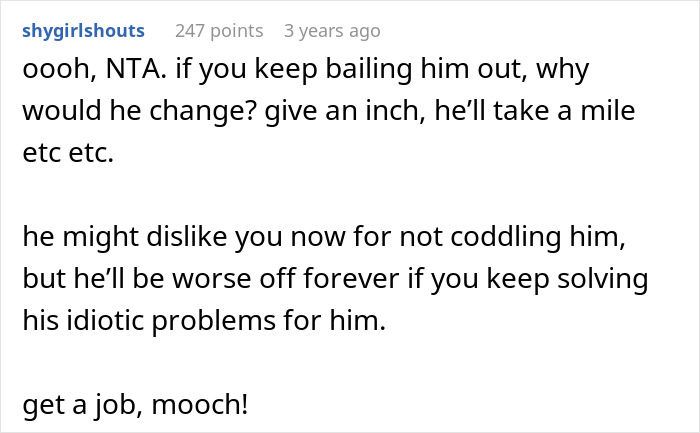

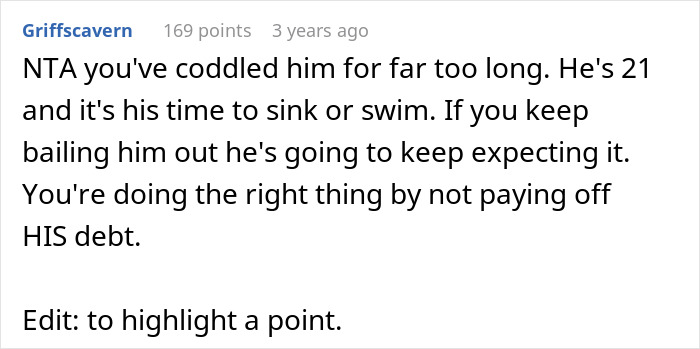

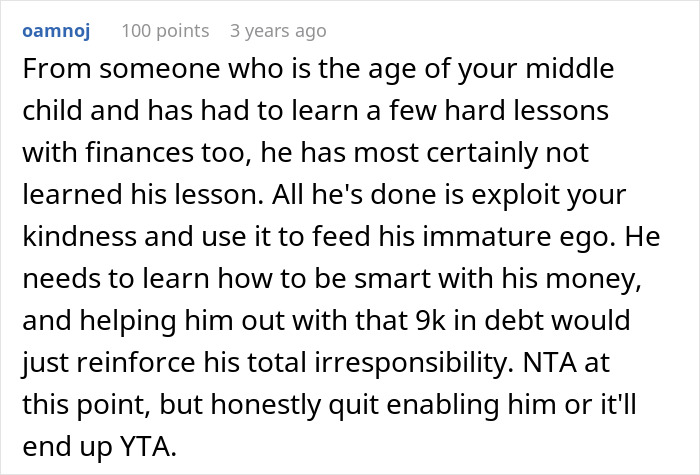

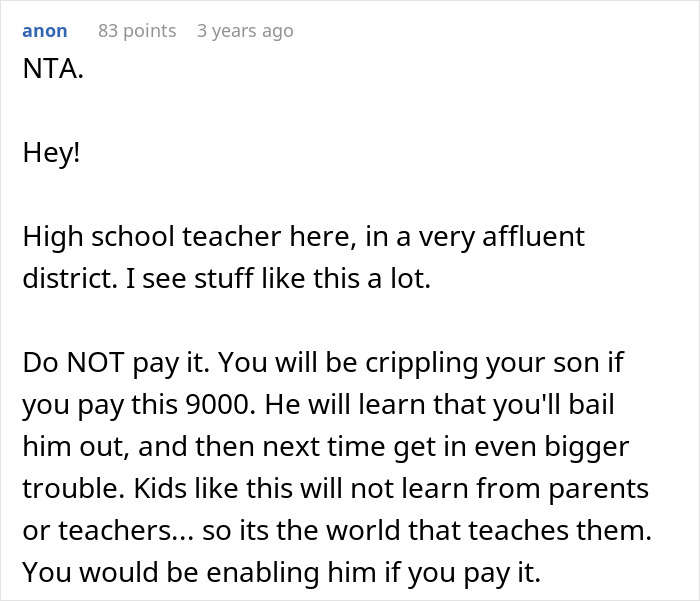

However, most commenters on the original post are sure that this time the parents really should teach their son a life lesson – even if it will lead him to problems in the short term. “$9K is nothing comparable to all the student loan debt you’ve let him avoid” – these are absolutely golden words from one of the people in the comments.

And people are also surprised how this guy managed to rack up as much as nine grand in debt in just three months. Looks like the author’s son really has a natural talent for spending money – even if it’s just parties and alcohol… “Good for you for paying his degree while you’re able, but you need to put your foot down on this one and nip it in the bud,” one commenter honestly wrote. So do you, our dear readers, agree with these opinions?

Many people in the comments mostly sided with the author, claiming that his son actually needs a proper life lesson here

MAN I wish these were my problems. How much money do they give him for him to be able to take out a $9,000 credit card on the first go? Most I could ever get is $500 and I don't understand how it's possible to rack up so much debt

I'm in my 40s and I can't get a $9000 limit. Granted I'm on disability so limited income, but still....

Load More Replies...I don't understand how a person with NO bills manages to spend 3k in a month.

Booze, drugs, parties, clothes, restaurants, dates, etc. Money can buy a lot of friendships.

Load More Replies...MAN I wish these were my problems. How much money do they give him for him to be able to take out a $9,000 credit card on the first go? Most I could ever get is $500 and I don't understand how it's possible to rack up so much debt

I'm in my 40s and I can't get a $9000 limit. Granted I'm on disability so limited income, but still....

Load More Replies...I don't understand how a person with NO bills manages to spend 3k in a month.

Booze, drugs, parties, clothes, restaurants, dates, etc. Money can buy a lot of friendships.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

88

44