35 People Share The Biggest “Money Mistakes” They’ve Made That Changed Their Life For The Worse

InterviewWhen you were a kid, did you ever play the game of “If I had a million dollars, here’s how I would spend it”? Casual conversations would ensue with your friends about mansion with spiral staircases, gorgeous homes on the beach in Hawaii, private jets that would fly in and out of your backyard and the ranches you planned to own and fill with exotic animals. Little did we know at the time that it takes a lot more than a million dollars to own those things, and that it’s much harder to accumulate funds than to lose them.

In the spirit of having a realistic view of money, Reddit users have recently been confessing the worst financial mistakes they’ve ever made, and we thought it might be useful to pass along their knowledge, if it'll help any of you pandas avoid making the same mistakes. From plunging themselves into debt with student loans to trusting that their spouses would be wise with money, we’ve gathered some of the most painful mistakes down below. Keep reading to also find interviews with Reddit user The_guy321, who sparked this conversation in the first place, financial advisor Michael Kitces, and Jen Smith, co-host of the Frugal Friends podcast.

Be sure to upvote any responses that hit home or that you’ll keep in mind for the future, and then feel free to share any financial faux pas that you’re guilty of in the comments below. Then, if you’re interested in checking out a Bored Panda article featuring tips that can help you save a little extra money, look no further than right here!

This post may include affiliate links.

43 years of buying and smoking cigarettes

43 years of buying and smoking cigarettes

For those still smoking here's some tips. First of all: Keep trying, even if you fail a few times, keep in mind that higher and difficult goals may require more than one attempt. I used zyban to quit and whereas it is not scientifically proven, I felt it made a difference. Try mindfulness to learn that you do not have to act upon all thoughts. Try to avoid situations in which you see other people smoking. Don't give up, you can do it too!! Oh also important: Do not think that now that you haven't smoked for a while, you can try one cigarette, because you can't. That is still addiction talking. You can do it! I am cheering for you!!

To hear what sparked this conversation in the first place, we reached out to Reddit user The_guy321. He told Bored Panda, "I recently have been focusing more on my financial health. I am nearly 38, and the weight of long term financial planning is setting in."

"I asked the question for two reasons. First, so I could learn from the collective mind that is Reddit on what to avoid. Second, entertainment value. Some of the answers had me laughing pretty good (hopefully with the commenter)." He added that, thankfully, he's never made any significant financial mistakes himself, but he does wish he had invested more earlier on.

Becoming a doctor. At the end of the day, it’s just a job. It wasn’t worth flushing my 20’s down the drain and accumulating a mountain of debt for this. I’m (finally) in a good spot in life now, but I don’t think the sacrifices I made to get here were worth it. Even from a less self-centered point of view, I don’t really do that much good for others with this job. Modern medicine is so much better at dragging out death than it is at improving life, and I’m tired of being a part of it.

Becoming a doctor. At the end of the day, it’s just a job. It wasn’t worth flushing my 20’s down the drain and accumulating a mountain of debt for this. I’m (finally) in a good spot in life now, but I don’t think the sacrifices I made to get here were worth it. Even from a less self-centered point of view, I don’t really do that much good for others with this job. Modern medicine is so much better at dragging out death than it is at improving life, and I’m tired of being a part of it.

A doctor told me, "Im trying to help you live longer." Woman, I have a chronic condition that puts me in pain every. Single. Day., will eventually cause one or more organs to fail and will be on my death certificate as contributing cause of death. That is my reality and I have learned to deal with it. For the love of God, can we stop trying to get me to live longer in agony and concentrate on quality of life instead of quantity. Thank You! This dr gets it!

We were also curious if The_guy321 learned anything from the responses to his post. "According to the comments, don't get married!" he shared. "I am too late to avoid that, but I have no complaints in making that decision."

He also shared a few tips for anyone who's recently made a financial faux pas or doesn't have the best track record managing their money. "Check out r/personalfinance on Reddit. Tons of great information and helpful people." Some of his top tips were, "Live within your means, avoid credit card debt, build up a 3-6 month emergency fund, then invest in index funds as early and as much as you can until you are nearing retirement age."

And if you make a mistake, don't beat yourself up about it. "Mistakes happen," The_guy321 told Bored Panda. "Learn from them, and move on. Dwelling on the negativity does no good."

Didn't contribute to my 401k for like 15 years. what a doof.

Didn't contribute to my 401k for like 15 years. what a doof.

CheesyComestibles added:

I just this year started a retirement account. Nobody taught me about this s**t. I'm 12 years into working. I could have had 12 years of gains, but instead got like 10 bucks interest in my savings account.

Why is money management not mandatory for high school graduation? I was taught nothing. I still know very little and trying to teach myself is like pulling teeth.

I never even had the option of a 401K. Pretty sure I'm going to work until I die.

Agreed to take over my ex gfs bills so that she could pay off her debts. 5 years and over $100,000 of my money later she was in more debt than when we started and cheating on me. Don't ever do this, just make her be an adult or dump her a*s. It's never worth it

Agreed to take over my ex gfs bills so that she could pay off her debts. 5 years and over $100,000 of my money later she was in more debt than when we started and cheating on me. Don't ever do this, just make her be an adult or dump her a*s. It's never worth it

No, you tried to be a good partner. You just kept doing it too long. You should set your limit and if nothing was changing.. then yes leave.

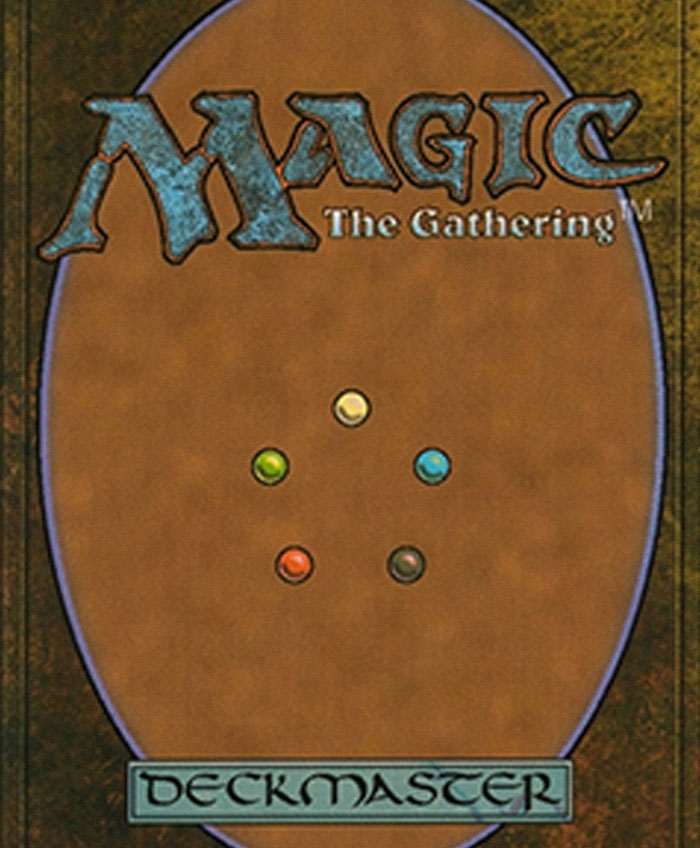

We also reached out to financial advisor Michael Kitces to gain more insight on this topic from an expert. Michael was kind enough to open up about some of the financial mistakes he made in the past that he's not particularly proud of. "I think the highlight is probably in my college years, back in the 1990s," he told Bored Panda. "I had been an avid player of Magic: The Gathering (in its early days!), and had a lot of the really rare unique cards from the early years."

"In 1999, I sold my Magic collection for $2,000 (back then, that was a lot of money!), so that I could put it into an online brokerage account to become a day-trader (the tech stock boom of the 1990s had a day-trading phenomenon similar to the Robinhood era of today!). Within 12 months, I had lost all $2,000," Michael confessed. "Nearly 25 years later, Magic The Gathering remains incredibly popular, and I was able to recently estimate that the cards would be worth well over $50,000 if I had just kept them instead of trying to day-trade stocks."

Getting married to the wrong partner.

People like to think about marriage as an emotional and physical commitment and tend to forget that it's a financial commitment as well.

If you get entangled with someone who has no clue how financial management works, you're in for a rollercoaster ride straight to hell.

can confirm. First girlfriend - I called off the marriage for this reason.

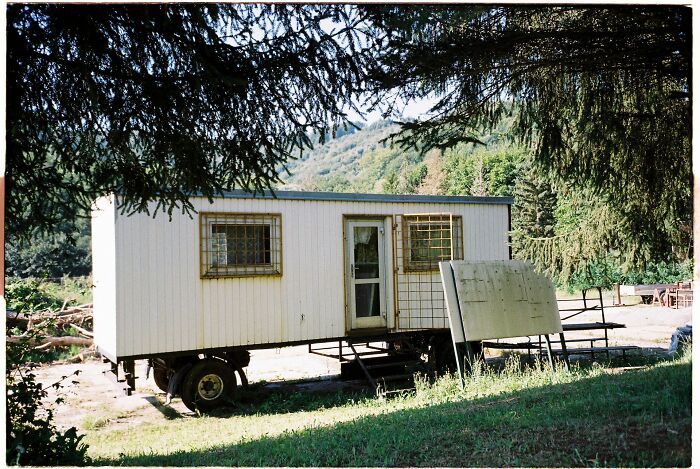

Bought a mobile home as a starter home. No one ever explained to me as a young adult the importance of investment and future planning. Mobile homes of course do not hold nor increase in value so you never build equity. It's akin to renting except you have to cover all your own repair costs too.

Bought a mobile home as a starter home. No one ever explained to me as a young adult the importance of investment and future planning. Mobile homes of course do not hold nor increase in value so you never build equity. It's akin to renting except you have to cover all your own repair costs too.

Terrible financial decision. Don't buy mobile homes kids. Just don't do it

Never buy a mobile home where you are renting the land. That is the biggest scam of them all. The homes are very expensive to move so you are at the whim of the landowners. There is a whole predatory investment class specifically for owning mobile home parks because the home owners are completely at the whim of the land owners.

If you've made some mistakes with your money, don't be too hard on yourself. Michael believes that this is an experience we all go through; sometimes, we just need to learn lessons the hard way. "This money stuff isn’t easy, it isn’t logical for a lot of us, and it has a lot of emotional ties," he told Bored Panda. "I don’t know how anyone will be able to fully learn how to overcome their impulses without some pain and hard lessons along the way."

"The faster/earlier we learn these lessons (the hard way), the more time we have to live a life with those lessons going forward! But the idea of 'you can have more wealth if only you didn’t make all those mistakes' may be literally true, but in practice, is an unrealistic idealistic dream. You can’t learn to build wealth without the learning that comes from mistakes along the way!"

Timeshare. I went to the seminar for a three nights stay at a beach resort. They got me. Phenomenal salesman, but they lie out of their asses. Spent thousands over a few years, only used the timeshare once, paid a lawyer to get us out of the contract (basically a mortgage). Now we’re free!

Timeshare. I went to the seminar for a three nights stay at a beach resort. They got me. Phenomenal salesman, but they lie out of their asses. Spent thousands over a few years, only used the timeshare once, paid a lawyer to get us out of the contract (basically a mortgage). Now we’re free!

My wife and I went to a seminar for holiday apartments and the salesman showed us photos of him and his "girlfriend" at a similar timeshare to the ones they were selling. He was about five foot four, scrawny, and unremarkable. She was six foot , stunning and clearly a posing model. I did my best to stifle my laughter but gave in when my wife, splutter laughed at the obvious set up photos. He got up said something about losing his focus and left us sitting in the room giggling like a pair of kids. We finished our coffee and left quietly soon after.

I co-signed a loan for my girlfriend at the time. I was 20 and in love. She bought the car, then put it in her mothers name, filled for bankruptcy, and went to live with the guy she was cheating on me with.

F**k you Christine. Thank you for teaching me at such a young age how s****y people actually are.

Michael also told Bored Panda that the two biggest mistakes he sees most often are, "Those who spend too much time worrying about what they’re spending without focusing enough on what they’re earning (it’s a lot easier to build wealth by learning to get a raise than trying to cut your expenses to the bone!), and making spending decisions based on the perceptions of others (the most self-destructive spending decisions I see are those who try to buy what other people buy [even if they can’t afford it themselves], or buying what you believe will make you look good in front of others [the 'keeping up with the Joneses' phenomenon]) instead of just trying to spend money on the things that bring you enjoyment. Marie-Kondo your spending!"

Credit card debt. Finally paid everything off when we sold/bought our next house and made the promise to never carry any credit card debt. And we haven't.

Credit card debt. Finally paid everything off when we sold/bought our next house and made the promise to never carry any credit card debt. And we haven't.

Spending money on in-app purchases for mobile games. Bonuses, upgrades, special features…all so I can loose interest in the game a year later. It’s flushing money down the toilet.

If a game gives you enjoyment, if it's not *too* much money I think that's a fine investment. There aren't too many games I've played "forever" (Sotn, yes, and Minecraft to name a few that I've played for many years).

And even after making some financial faux pas, Michael is confident that there's always time to bounce back. "Perhaps the greatest example to me is Warren Buffett," he told Bored Panda. "Warren’s net worth today is over $100 billion, making him one of the richest people in the world. But he was 60 years old before he ever became a billionaire in the first place; which means it took him 60 years to get the first $1B, and the past 30 years to get the other $99 billion."

"When you recognize that even one of the richest people in the world started his first business delivering newspapers at age 14, but accumulated 99% of his wealth only after he turned 60, it gives an appreciation of just how long it takes to build wealth (and how much we can make up for in the later years)!"

If you'd like to gain more financial wisdom from Michael, be sure to check out his website right here!

Kept my money in a bank ($ 150,000) because they were offering high interest rates in a country with questionable economic condition where i lived at the time. The entire system crashed and i can't access my money since 2019 while the bank keeps charging me monthly fees, slowly draining my savings. Welcome to Lebanon.

Kept my money in a bank ($ 150,000) because they were offering high interest rates in a country with questionable economic condition where i lived at the time. The entire system crashed and i can't access my money since 2019 while the bank keeps charging me monthly fees, slowly draining my savings. Welcome to Lebanon.

Going to college right out of high school. College is great if you know why you're there, but not for someone who isn't yet sure.

Going to college right out of high school. College is great if you know why you're there, but not for someone who isn't yet sure.

I can't speak for everyone but when I was fixing to graduate high school back in 2000-2001, everyone thought college was the next step because literally no one ever told us anything different. Parents, teachers, school guidance counselors, and the culture. EVERYTHING was about pushing kids into the college pipeline."

Wolfbeckett added:

I literally thought everyone working trades were living in poverty until I was in like my mid-twenties because no one ever brought it up unless it was to disparage the whole idea of working for a living.

If I had it to do over again, I would have dropped out of high school when I was 16 and started attending community college. IMO the last two years of highschool and the first two years of college cover the same material. My BA was an absolute breeze, but it cost way more than it should have. In retrospect, I should have done two years high school, two years community college, and two years university. I'd have been done a lot faster.

Big fat Indian wedding feeding nearly a 1000 judgmental semi-strangers I'll never hear from again!

Sorry I have zero sympathy for people who comply with cultural edicts. My own wedding had 80 people, and in Africa we also traditionally invite hundreds. F**k them. If you do not speak to a person every month, they do not deserve an invitation. Same for funerals. We don't bother in our family. We just burn and discard.

We also reached out to Jen Smith, co-host of the Frugal Friends podcast, to hear her thoughts on this topic. Jen shared with Bored Panda that her biggest financial mistake that she made in the past was maxing out her credit cards. "Thankfully they had low limits, $500 and $2,000, but I didn't have the self-control to not max them out. If the 'money' was available, I was going to spend it," she explained. "Once I maxed out both cards at the same time, I knew I needed to get rid of one. My way out was someone backing into my car in a parking lot. The damage was minor enough that I could still drive the car and use the insurance money to pay off the $2,000 card and cancel it. That dent was a constant reminder of that card."

As f**ked as it is, the financial expense is what got me to quit nicotine. I realized that I was spending $150 a month on disposable vapes and started comparing it to my other bills.

I was paying more for my unhealthy addiction than my car insurance, or my utilities. Kinda hard to justify when you look at it like that.

Yet some people still manage to justify it. Look, I don't care about people smoking, it's none of my business. But what absolutely infuriates me is if people complain about their money problems and that they don't have money for essentials... while they're spending a shitton of money on cigarettes.

Took a job way up North in Canada. Quit my old job, got rid of tons of stuff, had my dad help sell my house, etc. This was in 2019/early 2020 just before COVID hit big. I ended up hating the job up North; it was terrible. Went back home, somehow managed to get my old job back, but my house is gone and I can’t afford a new one in the current market. Stupid, idiotic decision on my part, and it keeps me up at night. I hate where I am in life right now. Stupid big expensive mistake that I’ll regret for the rest of my life.

Took a job way up North in Canada. Quit my old job, got rid of tons of stuff, had my dad help sell my house, etc. This was in 2019/early 2020 just before COVID hit big. I ended up hating the job up North; it was terrible. Went back home, somehow managed to get my old job back, but my house is gone and I can’t afford a new one in the current market. Stupid, idiotic decision on my part, and it keeps me up at night. I hate where I am in life right now. Stupid big expensive mistake that I’ll regret for the rest of my life.

If there's one thing I've learned, it's that you can push on through these things. COVID rocked me too. I'm down about 16 grand from where I was in 2020. Right now I have a little over $1000 in savings. It's rough, but I'm climbing my way back up again. $100 per week.

"Whether you learned about money from your parent, school, or nobody at all, everyone makes mistakes with money," Jen told Bored Panda. "And those mistakes teach you more about money than anyone in your life could. Count yourself lucky if you make mistakes when you're young because the stakes are usually lower and the fallout is much less expensive than money mistakes made later in life."

Sold my signed Banksy prints for a couple of grand to fund a new kitchen. Saw the same prints a couple of years later selling for £80,000.

Sold my signed Banksy prints for a couple of grand to fund a new kitchen. Saw the same prints a couple of years later selling for £80,000.

Blurgh. Just swallowed another mouthful of sick thinking about it (and they did a s**t job of the new kitchen floor).

At the height of the pandemic, I had a pretty severe "hidden" mental breakdown due to the trauma of isolation/quarentine and general terror over the whole thing. Combined with my own long-standing battle with Bipolar Disorder, I wound up withdrawing €4,000 from my savings account and going on a massively impulsive shopping spree.

At the height of the pandemic, I had a pretty severe "hidden" mental breakdown due to the trauma of isolation/quarentine and general terror over the whole thing. Combined with my own long-standing battle with Bipolar Disorder, I wound up withdrawing €4,000 from my savings account and going on a massively impulsive shopping spree.

Initially I told myself that the money was for a PC/laptop upgrade but as my mental health tanked the further the quarentine went on, I just kept spending in a desperate bid to feel something other than the crushing terror and uncertainty, chasing the fleeting dopamine hits that come from impulse purchases.

That was nearly 3 years ago and I'm still trying my damndest to build up my savings again. I hope I ever have another breakdown that bad as it was so embarassing when I eventually told my parents the full extent of the spree.

To add insult to injury, I also got an ill-advised Mohawk so I was both broke and (semi) bald.

Nowadays I've grown my hair out but I'm still struggling to recover my savings. Squirelling a away a few bob each week and hoping for the best. Thankfully, I'm on better medication now but yeah, things were bad for a while.

Oof I feel this one, I've been paying off debt for the past 6 years from reckless overspending when I was in a terrible place mental health wise (BPD, reckless and impulsive behaviour)

Jen also noted that getting into consumer debt is one of the most common financial errors for people to make. "When you're not making enough to afford the lifestyle social media is telling you you need, then people will use credit cards, student loans, or finance necessary things like cars to buy more stuff," she explained. "The only solution is to learn how to discern what it is you want from what advertisers and influencers are telling you to want."

"Nobody wants to believe they're easily influenced, but we all are," Jen added. "But when you know what you value, what your goals are worth to you, and what purchases truly make you happy, you can more easily say no to the things you don't really need or want."

Hate to admit it, but I got nailed by a crypto scam. So dumb.

Hate to admit it, but I got nailed by a crypto scam. So dumb.

Crypto is pure gambling, nothing else. Everyone who invests in Crypto should know this or already knows and still invest in hope of getting quick bucks. There is no shortcut to money ever, if there is one, its definitely a fraud or pure luck like lottery

When I turned 21, I gained full control over my inheritance account. It was how it was written in my grandparents will. At that time, it was only worth $15k.

When I turned 21, I gained full control over my inheritance account. It was how it was written in my grandparents will. At that time, it was only worth $15k.

It was the only time my financial advisor ever met with me. I said I wanted to invest all of it in AAPL.

I still remember the face he made in disgust. "Why would you want to invest in Apple?" I explained that I had just done a college paper on Steve Jobs and I truly believed that now that he was back in charge of the company, he'd turn the stock around. (valued around $1/share at the time, it has split many times since)

He convinced me to stay the course and keep the same investments my parents already had my brokerage invested in. At its peak, it grew to about $70k in value. (I still have the investment today). If I had invested in AAPL at that time like I wanted to, I'd have a cool 10M, and I could retire today.

Trust your gut people.

And if you've recently made any financial mistakes that are haunting you, don't be too hard on yourself. "Remember that you're not alone. No matter what mistake it is, someone before you has definitely made the same one," Jen told Bored Panda. "You may want to forget that it happened and move on as quickly as possible, but every mistake is an opportunity to learn and grow. Reflect on what triggered the choice, what you wanted to get out of it, and how it was a mistake, and consider how you'll handle similar situations differently in the future. Don't miss the opportunity to grow and do better."

If you'd like to hear more encouraging words from Jen about how to use your finances wisely, be sure to check out her podcast Frugal Friends right here! And if you're interested in some reading on the topic, you can find Jen's book The No-Spend Challenge Guide right here and her book Meal Planning on a Budget right here!

5 years ago I bought plane tickets for my ex to come and see me, he cancelled on me 3 days before saying his grandma was on her deathbed (she is currently still alive) I was 16 and I wasted 3 years worth of savings

5 years ago I bought plane tickets for my ex to come and see me, he cancelled on me 3 days before saying his grandma was on her deathbed (she is currently still alive) I was 16 and I wasted 3 years worth of savings

When you buy plane tickets check if they have a cancellation option and what the clauses are. Our airlines let you pay a little extra for a cancellation option so that you can cancel last minute if you have to.

Nearing the end of the dotcom boom (it hadn't busted yet) I had a about s**t ton of stock options to exercise. I was about to do it, when I heard that my Dad was entering the hospital for a cancer operation. I put the stock options exercise on hold for a week and went to be with my Dad (and Mom).

Nearing the end of the dotcom boom (it hadn't busted yet) I had a about s**t ton of stock options to exercise. I was about to do it, when I heard that my Dad was entering the hospital for a cancer operation. I put the stock options exercise on hold for a week and went to be with my Dad (and Mom).

While my Dad was in the hospital, my company released an earnings warning and our stock price got annihilated. When I did eventually exercise my options, I was down about $1,000,000 from where I was before my Dad entered the hospital.

For the record, my Dad is OK. And if faced with the same situation I would make the same decision. It might have been a big *money* mistake, but it was not a mistake.

I sincerely hope all of you pandas are in a secure place financially, but if you're looking to save a little bit more or start spending more wisely in this new year, I'm sure you can gain some knowledge from the responses on this list. Keep upvoting the answers that might spare you or someone else from making the same mistakes, and let us know in the comments any other financial lessons you've had to learn the hard way. Then, if you're interested in checking out another Bored Panda article that might help you save some extra cash, you can find that right here!

I paid for my ex-girlfriend's college tuition for three semesters as she 'just one semester left'-ed me for all three. That was AFTER she got a letter stating she was no longer eligible for the Pell Grant or further loans. So, the banks said, 'No more,' but I paid for another year and a half, while also paying all the household bills and supporting her kid.

We broke up, and she had the nerve to talk about what I supposedly OWE her.

i went to america for 10 days to visit a buddy of mine. cost me a fortune and i arrived to find he had been absorbed into his new girlfriend and was not the guy who left. Anytime he was away from her he was miserable and didnt want to do anything when he was with her all they wanted to do was have sex so they tried to get rid of me. massive waste of money and the loss of a friendship

i went to america for 10 days to visit a buddy of mine. cost me a fortune and i arrived to find he had been absorbed into his new girlfriend and was not the guy who left. Anytime he was away from her he was miserable and didnt want to do anything when he was with her all they wanted to do was have sex so they tried to get rid of me. massive waste of money and the loss of a friendship

Student loans

Student loans

For some this is the only way to get into college. I could never get a job in my chosen profession without a Bachelors degree, so there was no question about me going. In high school I made sure to get as many scholarships as I could to make sure my loan amount was as low as possible, but there was no way to avoid taking out a loan.

Not mine, but my dad's. He bought like $500 worth of collectable Star Trek dinner plates in the 80's thinking they'd be worth a ton of money in a few years. They're not.

Not mine, but my dad's. He bought like $500 worth of collectable Star Trek dinner plates in the 80's thinking they'd be worth a ton of money in a few years. They're not.

When I was younger I invested in beer and parties. Payoff was very bad.

Procrastination.

I have paid so many procrastination fees for late bills, and missed opportunities that the mind boggles.

thought i was just being a generous and kind person helping people out and never really expected them to pay me back. i was an IDIOT

That's ok, no one pays back. So either consider money you hand over to be a gift, or turn it around and ask them for money. That's what I do. If you have someone contact you and they're reluctant to start talking about what they really want, they really want money. So you steer the convo that way and start saying how broke you are etc etc. They will get the hint and go away.

Sports betting losses have cost me about a year's salary

I was not good at checking my company email inbox, nothing important came through there anyway (we mostly used Slack). And that is how I missed the deadline for my company’s IPO. They offered us stock at $10 and it opened at $40.

I was not good at checking my company email inbox, nothing important came through there anyway (we mostly used Slack). And that is how I missed the deadline for my company’s IPO. They offered us stock at $10 and it opened at $40.

Now I read my emails.

I discover bitcoin very early: I bought 100 of them at 63 cents a piece.

I discover bitcoin very early: I bought 100 of them at 63 cents a piece.

Sold the whole bunch for 300 dollars.

i.. never really bothered understanding all the crypto cash stuff so correct me if i’m wrong, but i’m guessing they sold it too early and could’ve sold it for a lot more later on? or the title of the article doesn’t apply to this one and they ended up making a profit?

Spending all my student loan refund checks instead of saving those f*****s to, oh, I don't know - PAY OFF MY STUDENT LOANS.

Spending all my student loan refund checks instead of saving those f*****s to, oh, I don't know - PAY OFF MY STUDENT LOANS.

This! And if they've put your loans on hold, pretend you have to pay them back now anyway --take your "payment" and save it in case you DO have to pay it back someday, or if you don't you'll have money to get on your feet when you graduate.

I invested $890 into a stock and it later became a little over 1.5 million dollars. I did not take the money out because I thought it would go up. I quit my job because I thought I was going to be rich. My stock crashed to worthless, I’m struggling to get by. I could’ve had a house, started a business. Now I have nothing

I invested $890 into a stock and it later became a little over 1.5 million dollars. I did not take the money out because I thought it would go up. I quit my job because I thought I was going to be rich. My stock crashed to worthless, I’m struggling to get by. I could’ve had a house, started a business. Now I have nothing

Sold my MTG collection in 1998. Almost full power9, 40 revised duals, all the playable cards from beta, legends etc. Sold them for $1000 and bought booze and meth.

Sold my MTG collection in 1998. Almost full power9, 40 revised duals, all the playable cards from beta, legends etc. Sold them for $1000 and bought booze and meth.

Would be able to pay for a house with those cards now.

same here, but I sold all mine to pay for a divorce.............worth it!

Bought a condo in July of 2007. The timing literally could not have been worse. Could have bought it for virtually half the price if I waited a year. Sold it just last year for less than I bought it (after inflation).

Bought a condo in July of 2007. The timing literally could not have been worse. Could have bought it for virtually half the price if I waited a year. Sold it just last year for less than I bought it (after inflation).

Spent $88,000 on Twitch in the past 2 years. Downvote me all you want. I have an addiction and I wanted to be real with you.

That’s rough…hopefully you can get to a better place!

Load More Replies...Never loan anyone anything without a safety. Never. Lending someone money for a car? Ok but the title will be in my name and you'll have insurance tied to it and we'll make a contract how the money has to be paid back and when you'll get the title. Loaning money for playing the stock market? Hell no.

Spent $88,000 on Twitch in the past 2 years. Downvote me all you want. I have an addiction and I wanted to be real with you.

That’s rough…hopefully you can get to a better place!

Load More Replies...Never loan anyone anything without a safety. Never. Lending someone money for a car? Ok but the title will be in my name and you'll have insurance tied to it and we'll make a contract how the money has to be paid back and when you'll get the title. Loaning money for playing the stock market? Hell no.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime