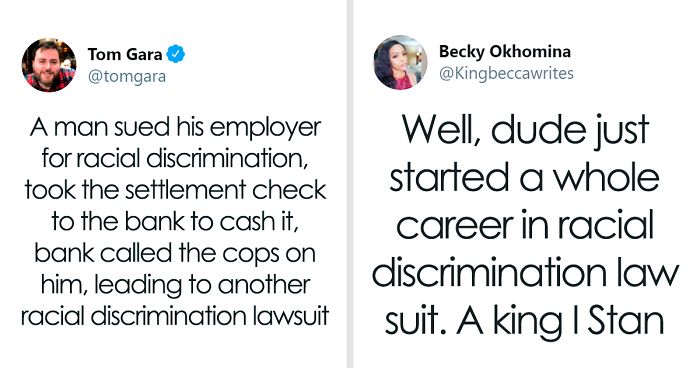

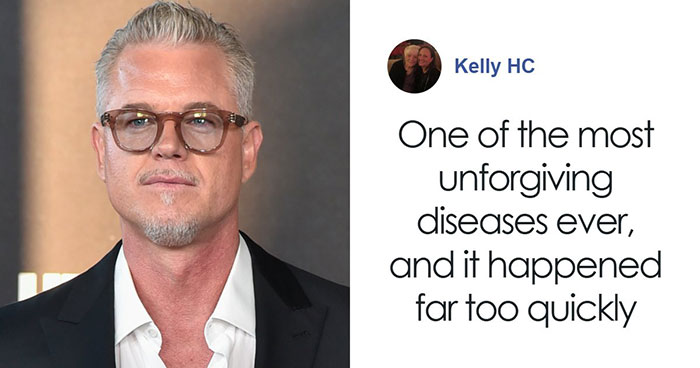

Black Man Goes To Deposit A Racial Discrimination Settlement Check, Faces Racism Again And Sues The Bank

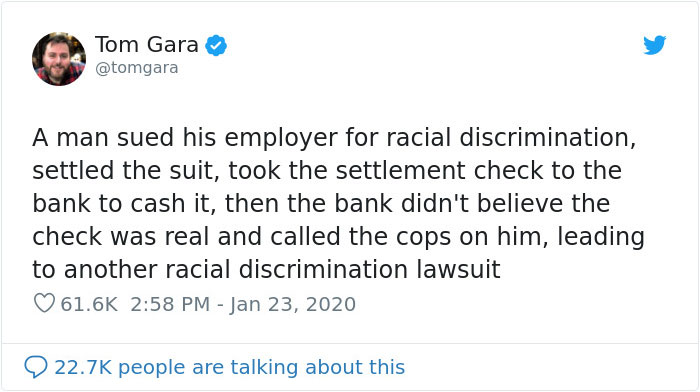

A Detroit resident who had just settled a racial discrimination lawsuit against his previous employer must have thought his legal troubles were over when he went to process the checks he received, but he didn’t expect to walk right into another case.

44-year-old Sauntore Thomas entered his local branch of TCF Bank, where he had been a customer for 2 years, with a series of checks that his lawyer had delivered to him that day. He reports that when he requested to open a savings account in which to deposit them and cash part of the money, the assistant manager who served him became suspicious, told him that she would have to “call them in,” and walked away to a back room, where she instead called the police to come to the bank and question him.

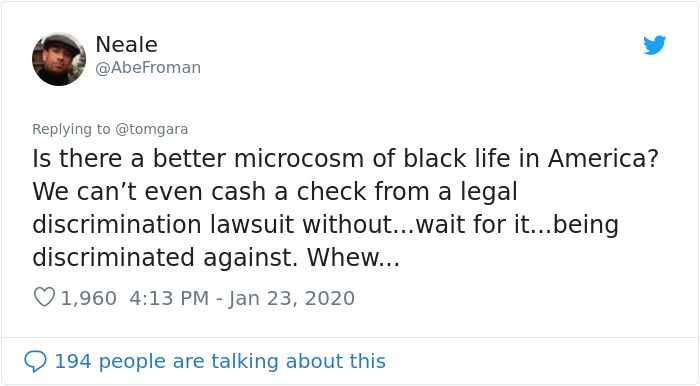

Thomas and his lawyer are appalled by the bank’s extreme actions and believe that the TCF spokesperson’s version of events doesn’t check out. What happened, they believe, is what has come to be called “banking while black,” a common racial profiling phenomenon in which bank workers treat black customers with excessive scrutiny.

This Detroit man ran into one racial discrimination case after another

Image credits: tomgara

Thomas told Buzzfeed News that during the confrontation, he made an effort not to become visibly upset, fearing that the situation could escalate similarly to cases in which black people have been violently restrained or killed by police. “I wanted to make sure I stayed as levelheaded as possible, because I wasn’t going to be the next person on the ground saying, ‘I can’t breathe.’”

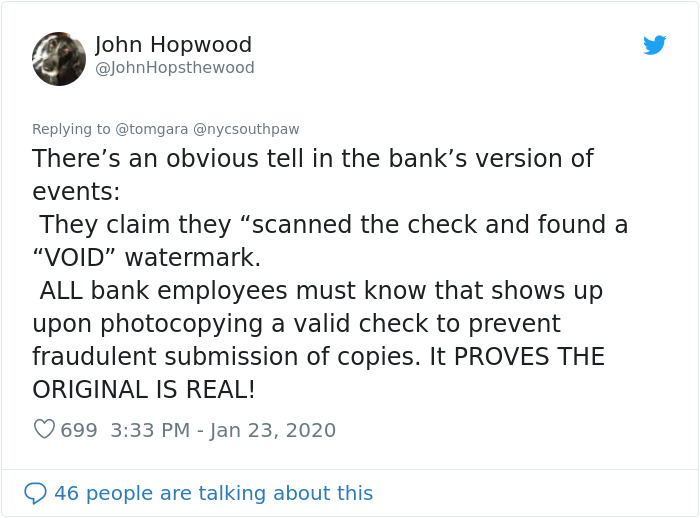

While banks often contact the owner of a large check before processing it, Thomas’ lawyer Deborah Gordon, who provided police and the bank with copies of the lawsuit while Thomas was at the bank being questioned by the police, does not think this is what the bank did before police were called. Tom Wennerberg, a spokesperson for the bank, claimed that the checks displayed void watermarks when scanned, and that the bank was unable to reach the issuing company (Thomas’ previous employer, Enterprise) for confirmation of the checks’ validity. Police, on the other hand, stated that the bank claimed its system did not recognize the checks as legitimate because they were printed differently than Enterprise’s payroll checks.

Thomas successfully deposited the checks with no issues at a different bank where he opened an account after closing his account with TCF and proceeded to buy a 2004 Dodge Durango, as he’d previously had no car and had to walk to work. Local police stated that investigation into TCF’s report of fraud was closed quickly as there was no indication that any crime took place. Thomas has now filed a lawsuit against the bank.

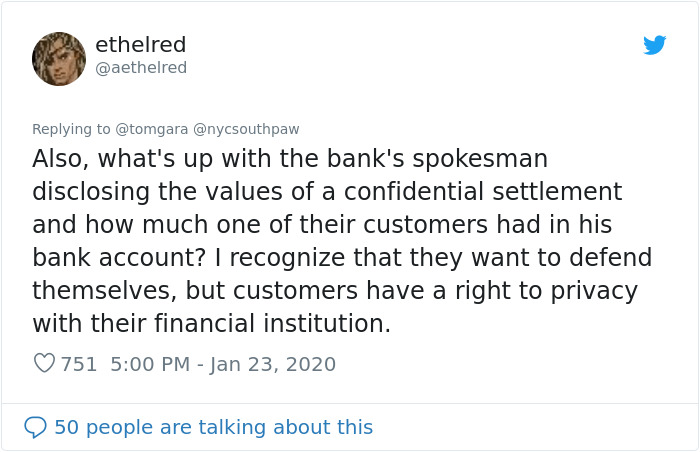

Wennerberg apologized for TCF’s actions, stating the bank’s stance against racism and discrimination, and maintaining that the call was made because of Thomas’ requests and the difficulty encountered in verifying the checks. He added that the assistant manager who called the police is also black.

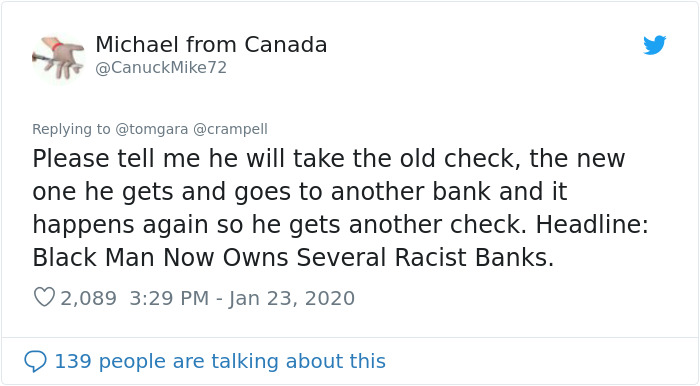

Commenters also aren’t buying the bank’s reasoning

Image credits: CanuckMike72

Image credits: 4everNeverTrump

Image credits: the_magic_m

Image credits: AbeFroman

Image credits: JohnHopsthewood

Image credits: speculawyer

Image credits: louis_staffer

Image credits: aethelred

Image credits: Kingbeccawrites

The US bank chain Wells Fargo has also come under fire a number of times for its staff subjecting black customers to unwarranted suspicion, identification checks and confiscations, and even police investigation for simply trying to cash or deposit checks. In 2019, the mayor of Mount Vernon, a town just to the north of New York City, even had police called on him by a Chase bank employee. He cited anti-black racial profiling as the cause of the incident.

56Kviews

Share on FacebookSlightly off topic, but: why do anyone anywhere in the world in the year 2020 use checks? With wire transfers (SEPA in Europe) there is not a single reason. It is safer, cheaper, and more convenient.

Hi Hans - run a small company with my husband and do still have some elderly customers that prefer cheques (which we don't as it's more hassle for us). They don't have computers or mobile phones (one doesn't even use an answer phone so he's a pain to get hold of) the highest level of tech in their home is usually the TV (some still CRT). These are people in their 70-90s. Most of our customers do pay by bank transfer and we do have some very clued up older people but there are just some who are worried or scared by technology. I have one customer who is in his 50s and he will pay by bank transfer but always does test sums of 1penny first because he once paid the wrong person because of a typo in the account number and they refused to return the money. The bank wouldn't help as it was his fault.

Load More Replies...It seems as though a lot of people commenting are misunderstanding the story. Yes banks do check to see if a check is legit for a large amount. What they don't do is call the cops on what is a legitimate check. So all the people claiming it is not racist for a bank to verify a large check can you answer two questions. 1) We know the check was legit, so why were the cops called for a legit check? 2) Is it logical to assume the bank never actually tried to verify the check like they claimed, since if they did it would have been verified and thus the bank is lying? Either way it sure sounds racist to me.

This is nuts. Like some who've commented I have worked in banking and this is NOT how you deal with someone opening accounts or paying in large cheques. If they're paying in a large amount you're nice to them and if it's a new account we did KYC (Know Your Customer) which is about avoiding money laundering. NONE of this involves immediately calling the cops, checks can be made without the customer even knowing about them. It lets you treat people with the respect they deserve whilst making sure you don't launder cash for criminals. This is flat out racism, poor guy!

Slightly off topic, but: why do anyone anywhere in the world in the year 2020 use checks? With wire transfers (SEPA in Europe) there is not a single reason. It is safer, cheaper, and more convenient.

Hi Hans - run a small company with my husband and do still have some elderly customers that prefer cheques (which we don't as it's more hassle for us). They don't have computers or mobile phones (one doesn't even use an answer phone so he's a pain to get hold of) the highest level of tech in their home is usually the TV (some still CRT). These are people in their 70-90s. Most of our customers do pay by bank transfer and we do have some very clued up older people but there are just some who are worried or scared by technology. I have one customer who is in his 50s and he will pay by bank transfer but always does test sums of 1penny first because he once paid the wrong person because of a typo in the account number and they refused to return the money. The bank wouldn't help as it was his fault.

Load More Replies...It seems as though a lot of people commenting are misunderstanding the story. Yes banks do check to see if a check is legit for a large amount. What they don't do is call the cops on what is a legitimate check. So all the people claiming it is not racist for a bank to verify a large check can you answer two questions. 1) We know the check was legit, so why were the cops called for a legit check? 2) Is it logical to assume the bank never actually tried to verify the check like they claimed, since if they did it would have been verified and thus the bank is lying? Either way it sure sounds racist to me.

This is nuts. Like some who've commented I have worked in banking and this is NOT how you deal with someone opening accounts or paying in large cheques. If they're paying in a large amount you're nice to them and if it's a new account we did KYC (Know Your Customer) which is about avoiding money laundering. NONE of this involves immediately calling the cops, checks can be made without the customer even knowing about them. It lets you treat people with the respect they deserve whilst making sure you don't launder cash for criminals. This is flat out racism, poor guy!

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

137

84