“Nearly 3.5k Total Reviews”: Car Dealership Tries To Bait And Switch The Wrong Customer

Car dealers are not, generally, known as paragons of honesty and integrity. Like veteran emergency surgeons, you’ll lose an arm and a leg in the blink of an eye. While you will end up with a car, the costs often outweigh the benefits.

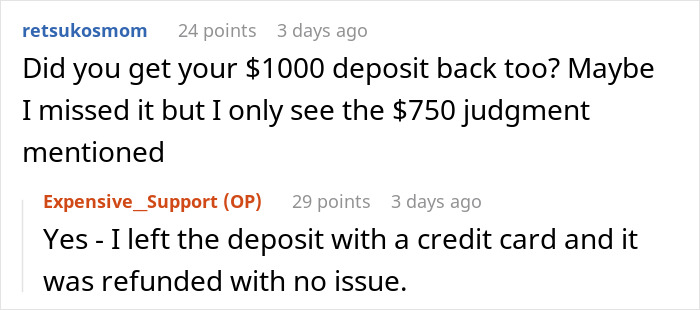

A netizen ended up losing a few hundred dollars in travel fees due to a duplicitous car dealership that was trying to pull off a bait and switch. So they decided to spend a few moments every day for years getting back at them. We reached out to OP via Reddit and will update the story when they get back to us.

Some businesses employ all sorts of dishonest tactics to make a sale

Image credits: Pixabay/Pexels (not the actual photo)

So one would-be customer got back at a car dealership that attempted a bait and switch

Image credits: JÉSHOOTS/Pexels (not the actual photo)

Image credits: mstandret/ Envato elements (not the actual photo)

OP decided to take matters into his own hands

Image credits: LinkedIn Sales Navigator/Pexels (not the actual photo)

Image credits: Expensive__Support

Certain business people see lying and manipulation as a normal part of their jobs

Image credits: Anders Kristensen/Pexels (not the actual photo)

Hearing the words “a car dealership tried something shady” has the same sort of feeling as “a bear does its business in the woods.” While, of course, there are honest car dealers everywhere, it’s ultimately a position where a salesperson has to move a rapidly depreciating item that most people take out loans to afford.

Unfortunately, for many people, a car is both a necessity and a status symbol. This means that most people go into a car dealership ready to walk away with at least something, a fact that car dealers are well aware of. Indeed, OP sort of put themselves in a similar position, by flying with a one-way ticket to a dealership and informing them about this information. While it does look like the dealership was planning to do a bait and switch anyway, this was just the icing on the cake.

Fortunately, OP had done their research and was willing to back out of a bad deal. Some salespeople (and just regular humans around money) tend to adopt a strategy where they try to coax a person out of their money. From “looking after it” to using the sunk cost fallacy, this is how many people end up with cars they neither like, nor can afford.

OP’s strategy, while long in execution, appears to be very effective

Image credits: cottonbro studio/Pexels (not the actual photo)

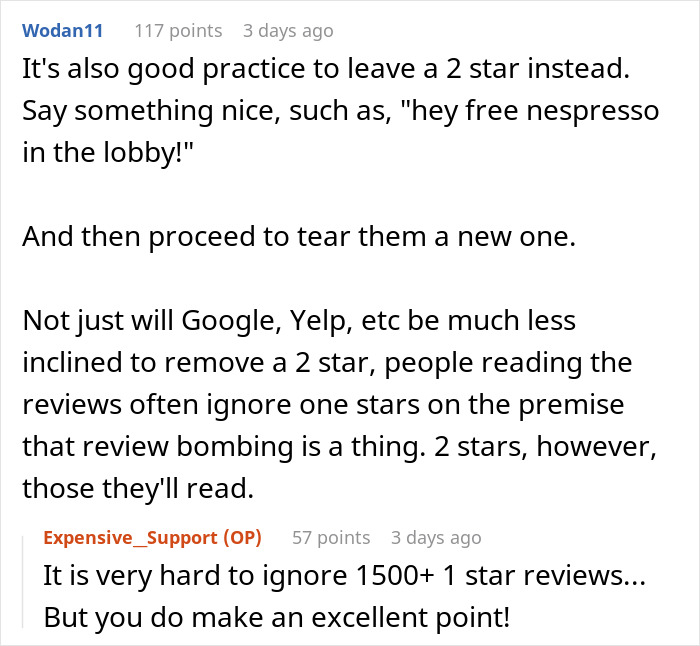

The real crux of the story is not a car dealership attempting to swindle a customer, that’s a practice as old as cars themselves. Instead, the draw and appeal of this tale is exactly how OP went about getting their revenge. A bad review is often the last refuge of an angry customer, but OP decided to take the long view.

After all, had they left a single, one-star review, the average would have barely shifted. But by launching a massive, consistent war of attrition against the dealership’s page was another game entirely. Indeed, there is a chance that OP has written more one-star reviews than the dealership has even sold cars.

Bad reviews are a good way to warn customers

Image credits: Keira Burton/Pexels (not the actual photo)

Not that this business deserves any real sympathy. According to OP, they took years to even pay them back for the travel expenses, and, no doubt, they have pulled similar stunts on other, unwary customers in the past. Of course, they also told OP exactly what to do, so OP, at worst, was just guilty of malicious compliance.

For those who have also been on the receiving end of horrible business practices, a bad review can be a moment of closure and a way to warn folks against suffering a similar fate. Indeed, we often pick what businesses to frequent based, almost entirely, on other user’s reviews. This isn’t always a reflection of how well or poorly a business operates, but, by and large, it’s a good indicator. OP shares some details of their process in the comments section (which can be found below) for those who are also itching to get back at a company that has wronged them.

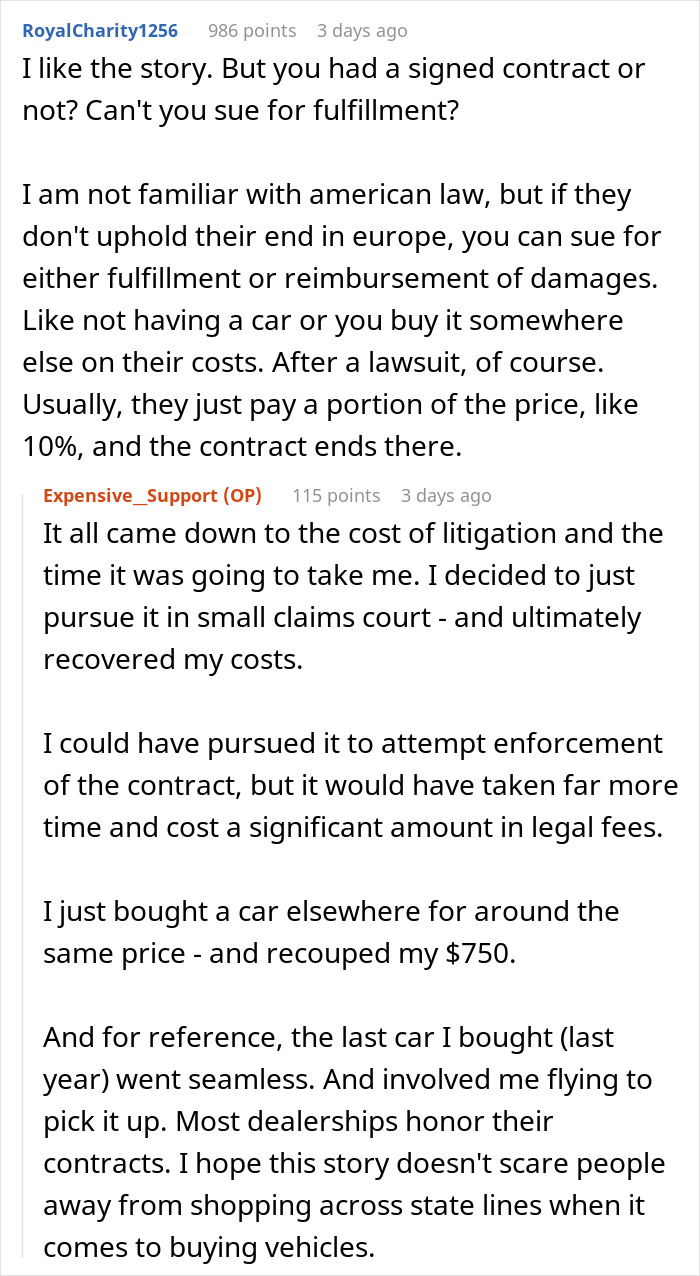

Some readers wanted more details

Commenters found his revenge hilarious and gave some suggestions

Poll Question

Thanks! Check out the results:

Explore more of these tags

I had negotiated the purchase of a new vehicle, 100% online. They saw pictures of my car that was going to be used as a trade-in. Drove to another state to complete the deal and the GM came over to me and wanted to re-negotiate the trade in value. I said nope, picked up my stuff and was getting ready to leave. He changed his mind and would honor the commitment his sales staff had made. They were complete jerks with everything after that and it took a few days to straighten out. They then had the audacity to request a 5 star review. I answered their email with a LOL gif.

Just imagine being able too casually buy a new car every 4 years or so...

My secretary does that on minimum wage. She’s just got insanely good credit and gets cheaper vehicles on 4- year terms, never paying for than she can easily afford per month. Once it’s paid off, she trades it in for a new one and rolls the equity into the new loan. Interesting way to live, that’s for sure, and I don’t think I could do it, but she makes it work for her!

Load More Replies...I had negotiated the purchase of a new vehicle, 100% online. They saw pictures of my car that was going to be used as a trade-in. Drove to another state to complete the deal and the GM came over to me and wanted to re-negotiate the trade in value. I said nope, picked up my stuff and was getting ready to leave. He changed his mind and would honor the commitment his sales staff had made. They were complete jerks with everything after that and it took a few days to straighten out. They then had the audacity to request a 5 star review. I answered their email with a LOL gif.

Just imagine being able too casually buy a new car every 4 years or so...

My secretary does that on minimum wage. She’s just got insanely good credit and gets cheaper vehicles on 4- year terms, never paying for than she can easily afford per month. Once it’s paid off, she trades it in for a new one and rolls the equity into the new loan. Interesting way to live, that’s for sure, and I don’t think I could do it, but she makes it work for her!

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

25

7