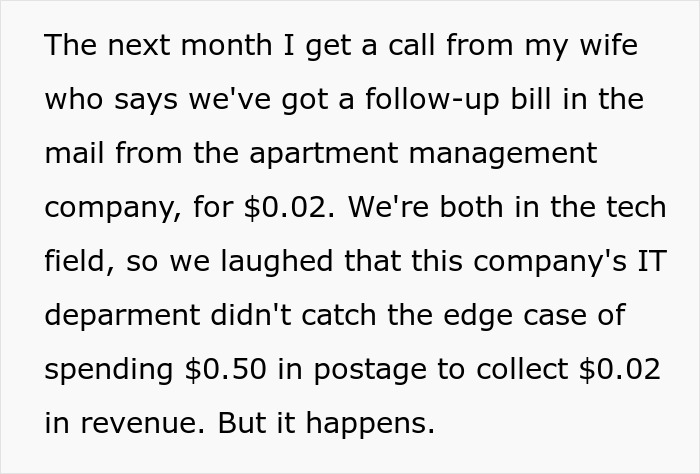

“Oh God, We Made A Mistake”: Apartment Manager Begs This Programmer To Stop Their Malicious Compliance

This story sounds like something Franz Kafka would write if he was alive in the 21st century. However, it really happened to Reddit user Lentesta.

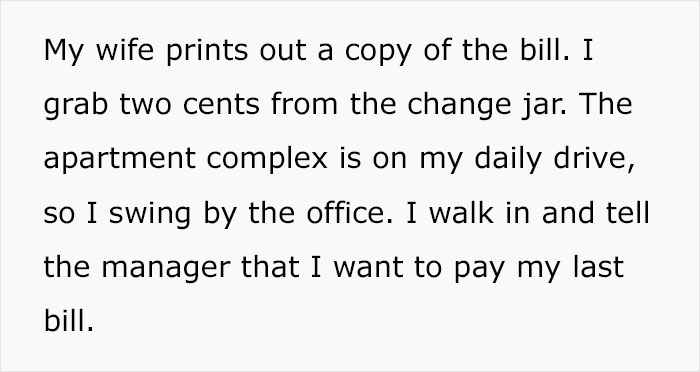

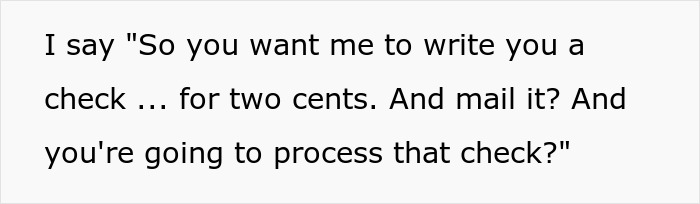

A little while ago, he got a letter from his former apartment manager, saying he still owed them $0.02. So the man saved up the money and dropped by to repay the debt in person, showing his deep remorse and willingness to repent.

However, the apartment manager obviously thought that the damage he had caused was too big to be forgiven so soon, and wanted to prolong his suffering; they refused to take cash for the bill.

Being a programmer, Lentesta devised a new plan in his quest for absolution, and when everything was said and done, he even told the subreddit ‘Malicious Compliance’ about it. Continue scrolling to see what he wrote.

This man tried to pay off his $0.02 debt in cash, but his former apartment manager wouldn’t accept it

Image credits: Jeff Weese (not the actual photo)

So he sent a $0.03 check and demanded a refund

Image credits: Ryutaro Tsukata (not the actual photo)

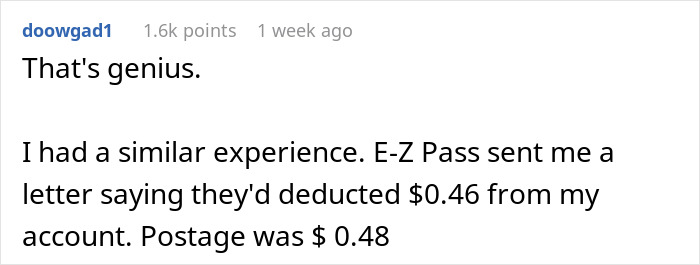

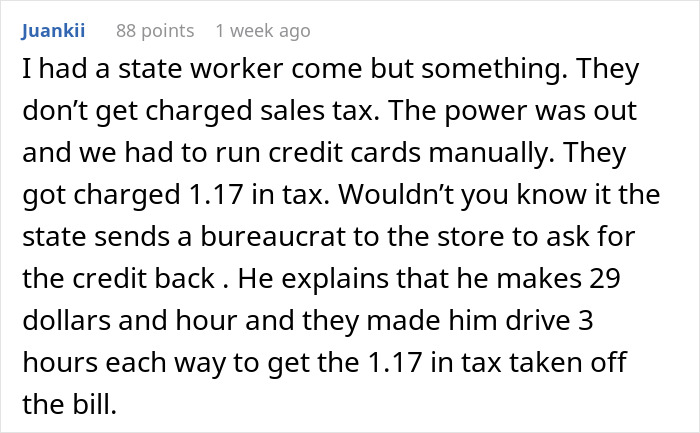

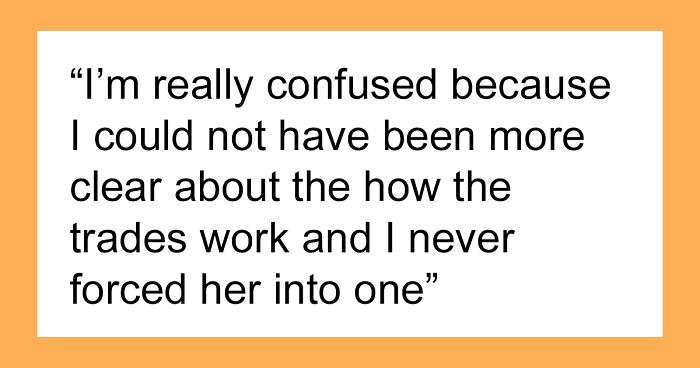

Image credits: lentesta

We managed to get in touch with Lentesta and he said he’s not sure why there was a $0.02 bill to begin with. “Perhaps I misread an amount like $0.08 as $0.06? It was never explained, and I didn’t research it,” the Redditor told Bored Panda.

But he hadn’t interacted with this specific employee before, so her attitude couldn’t have been payback for what Lentesta did to her in the past or anything like that. “All of my previous (and subsequent) interactions with the other staff were efficient and otherwise unremarkable,” he explained.

However, the Redditor said he understands “the safety reasons why apartment complexes have a ‘no cash accepted’ policy.”

In his case, “the security risk of accepting two cents in cash was nonexistent and circumventing the policy posed no significant administrative burden.”

“I fully expected the manager to say they’d just write it off, for us to wish each other well, and that to be the end of it.”

With debt cancellation, you’re no longer on the hook for the canceled amount and don’t have to worry about the lender coming after you in the future. But sometimes, your troubles don’t end there. You may need to report the canceled amount as income on your tax return.

This is because the IRS considers most forms of forgiven, canceled, or settled debt as income for tax purposes. Luckily, it is only when the amount of the canceled debt is more than $600 and that the lender is required to send you a 1099-C form.

If your forgiven debt is less than $600, you might not get a 1099-C, but you’ll still need to report it on your tax return.

While most canceled debts are considered taxable, there are a few exceptions to the rule. If you end up in a situation that fits one of these categories, you might still need to report the debt, but it won’t be counted toward your gross income:

- Bankruptcy. If your debt was discharged in bankruptcy, it’s not considered taxable income. The idea is that you’re already hurting financially, and requiring you to pay taxes could make things even more difficult;

- Insolvency. If you’re financially broke at the time of the cancelation—your liabilities exceed your assets—you may be able to exclude some or all of your canceled debt from your income on your tax return. The IRS determines how much you can exclude based on the extent of your financial insolvency;

- Gifts. If you borrowed money from your parents or a friend and they decided not to collect the full amount from you, that’s considered a gift for tax purposes;

- Tax-Deductible Interest. If you’ve had a business or mortgage loan canceled, where the interest was considered tax-deductible, you won’t need to report the interest portion of the forgiven amount as income. You will, however, still need to report the canceled principal amount;

- Certain Student Loans. If you’ve had your student loans forgiven in return for service in a specific field or career for a set period of time, the amount forgiven is not considered taxable income. The same goes if your student loans have been discharged due to death or permanent disability;

- Farm or Real Estate Debt. If your debt was attached to a farm or real estate business and you meet other eligibility requirements from the IRS, you may qualify for a special exclusion.

Which is quite relevant information when you consider that as of September 2022, US consumer debt is at $16.5 trillion, with the average American debt among consumers at $96,371.

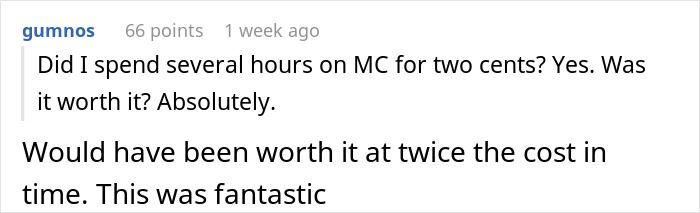

The original poster (OP) provided more details on the ridiculous situation in the comments

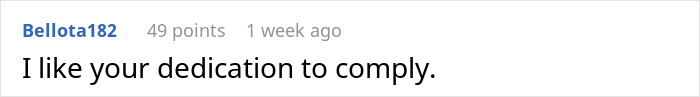

And people applauded the way he handled it

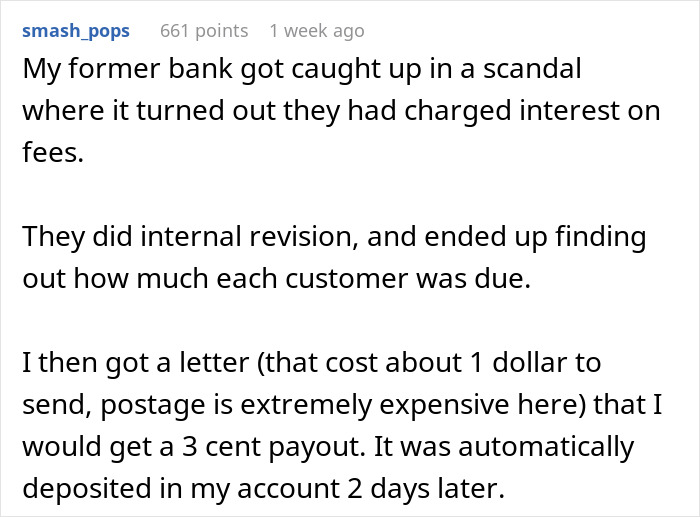

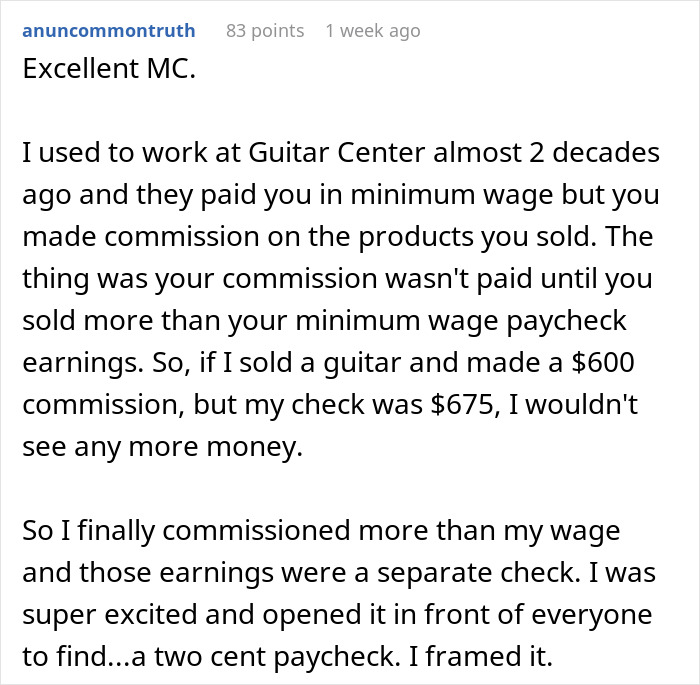

While many also shared similar stories of their own

When I paid the last installment of my student loan I thought that was it. Nope, got a bill for 1 cent. Called the bank, told them I was serious about my transferring a single cent, and did it. Next month, got a bill for 1 cent. So I called the agency that processed it, and the lady said I had to get out of the automated system and have a real person take it. The lowest denomination we had at the time was 5 cents, so I put a copy of the bill with 5 cents sellotaped to it in an envelope and mailed it. Next month I got a letter to confirm my loans were fully paid off. I sometimes joke that I paid off the last installment of my student loan 600%.

Many years ago I worked for a factory. Don'y remember the exact circumstance. Got paid weekly. Went into work one morning. Clock in, had to be on a monday, few minutes later clock out. Must have not work rest of the week. The following week got a?check for something like 32 cents. Maybe 28 cents. Don't remember the exact amount. Thought it was funny. Still end up cashing the check. Pretty sure cost them more to process the check and send it out then what it was the amount came to.

Years back kept getting a bill for $0.00. Some fraction of a penny ona spreadsheet somewhere; over roughly a year must've cost them many x more just in postage. When they started sending delinquent notices and threatening to send it to collections, I finally wrote and sent in a check for zero dollars and zero cents. Seemed to solve it; never got another notice.

When I paid the last installment of my student loan I thought that was it. Nope, got a bill for 1 cent. Called the bank, told them I was serious about my transferring a single cent, and did it. Next month, got a bill for 1 cent. So I called the agency that processed it, and the lady said I had to get out of the automated system and have a real person take it. The lowest denomination we had at the time was 5 cents, so I put a copy of the bill with 5 cents sellotaped to it in an envelope and mailed it. Next month I got a letter to confirm my loans were fully paid off. I sometimes joke that I paid off the last installment of my student loan 600%.

Many years ago I worked for a factory. Don'y remember the exact circumstance. Got paid weekly. Went into work one morning. Clock in, had to be on a monday, few minutes later clock out. Must have not work rest of the week. The following week got a?check for something like 32 cents. Maybe 28 cents. Don't remember the exact amount. Thought it was funny. Still end up cashing the check. Pretty sure cost them more to process the check and send it out then what it was the amount came to.

Years back kept getting a bill for $0.00. Some fraction of a penny ona spreadsheet somewhere; over roughly a year must've cost them many x more just in postage. When they started sending delinquent notices and threatening to send it to collections, I finally wrote and sent in a check for zero dollars and zero cents. Seemed to solve it; never got another notice.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

95

13