Did a Facebook or Instagram ad lead you to BillDoctor? With over 100 ads running across these platforms, it’s no surprise if that’s how you found them!

It’s always interesting how social media brings these companies to our attention, right?

But what exactly is BillDoctor, and how does it work? Let’s take a closer look and find out together.

What Is Bill Doctor?

From first looks, it appears to be a debt relief company, but according to their website, it is actually owned and operated by CPC Marketing, Inc. As a marketing company, Bill Doctor connects individuals seeking debt consolidation loans with potential lenders.

If you’re searching for a legitimate debt relief company to help you get out of debt quickly, it’s important to be cautious. Many companies market themselves as loan providers but in reality, they are not.

Difference Between Debt Consolidation and Debt Relief Programs:

It’s essential to understand the difference between debt consolidation loans and debt relief programs. Debt consolidation loans involve borrowing money to pay off multiple debts, simplifying your payments into one loan and comes with a lot of pitfalls. However, this approach still leaves you with debt that must be repaid, often with interest. On the other hand, debt relief programs, such as debt settlement or negotiation services, aim to reduce the total amount of debt you owe. These programs work directly with creditors to negotiate lower balances, providing a path to resolve your debt more affordably and efficiently.

Choosing the right option depends on your financial situation, goals, and comfort with different levels of risk and commitment.

CuraDebt has been helping individuals and small businesses nationwide for over 24 years, making the company and its team one of the oldest and most experienced in the debt relief industry.

CuraDebt provides a wide range of debt relief programs, including Debt Settlement Programs, Debt Negotiation Services, and other Personalized Debt Relief Solutions tailored to your unique financial situation.

Curadebt.com has an overall customer rating of 4.9 out of 5 stars from 262 reviews, indicating that most customers are generally satisfied with their experience. At CuraDebt, they also offer a free consultation to help you understand your options and find the best path forward.

More info: curadebt.com

History of Bill Doctor:

Image credits: web.archive.org

According to records from the Wayback Machine, Bill Doctor appears to have launched only recently, with its earliest traceable activity starting in 2023.

Despite its active presence on social media and advertising platforms, the company’s brief history raises questions about its experience and stability in the debt relief industry.

With such a short track record, it’s difficult to gauge the long-term effectiveness and reliability of their services. For those considering working with Bill Doctor, this limited history is an important factor to keep in mind, especially when compared to more established companies with decades of proven results in helping clients manage and resolve their debts.

However, on Bill Doctor website, they say we are doing work from 2022.

Reviews On Google:

Image credits: www.google.com

Instead of rummaging through the web looking for reassurance regarding opting for BillDoctor, take a look at all user opinions on BillDoctor from every consumer review platform within the first 3-4 pages of Google.

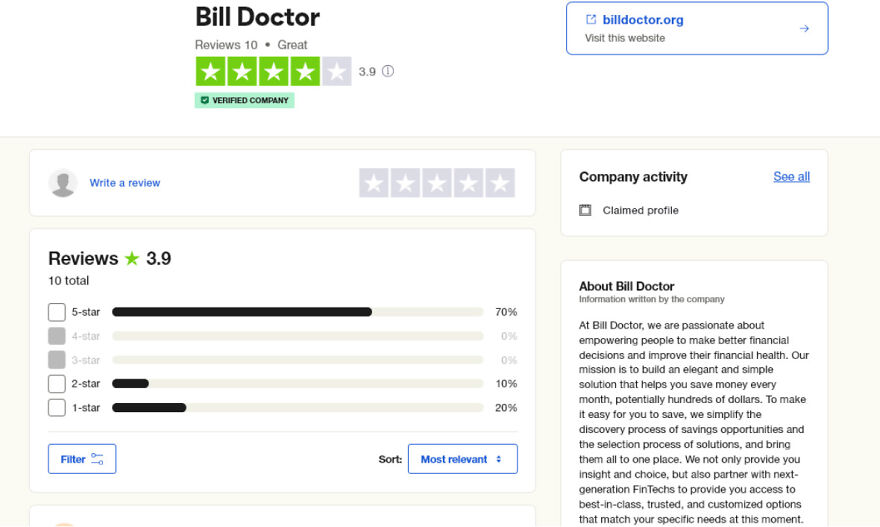

Bill Doctor Reviews On Trustpilot:

Image credits: www.trustpilot.com

Approximately 10 people have reviewed what it’s like entrusting BillDoctor with their financial situation and BillDoctor has received 3.9 out of 5.0 stars.

Many reviews have highlighted that Bill Doctor’s team was helpful and provided assistance without pressuring clients into signing up for their services.

However, not all feedback has been positive. Some customers felt that Bill Doctor lacked transparency in their communication and services, leaving them uncertain about the full terms and conditions of what was being offered.

Apparently, BillDoctor is not everyone’s cup of tea. You can take a look at more mixed Bill Doctor reviews on Trustpilot.

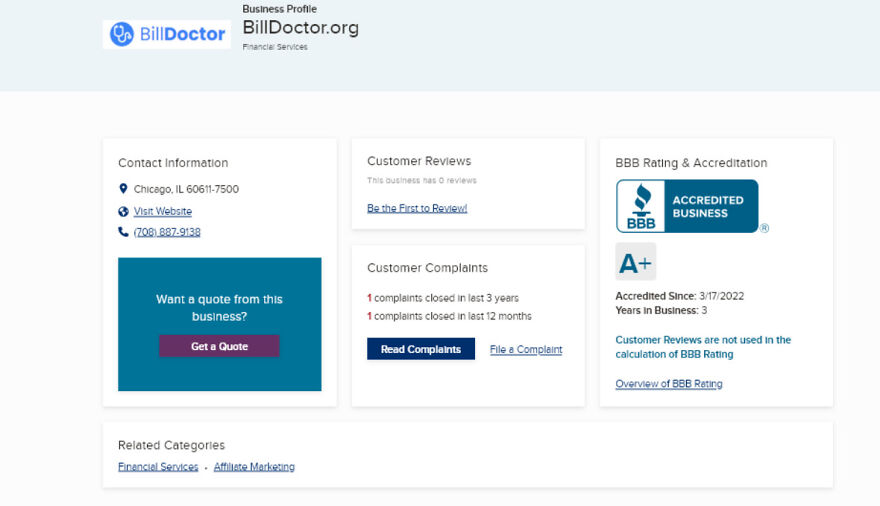

Bill Doctor BBB Reviews:

Image credits: www.bbb.org

Up until a few months ago, there were neither reviews nor complaints regarding BillDoctor on BBB and it had an “A” rating. However, today, BillDoctor has an improved, A+ rating on BBB.

While there are still no reviews, over the last two months, there have been two complaints filed against BillDoctor.

Let’s dive into the details of these complaints.

BBB Complaints:

A consumer took to the BBB for a complaint against the BillDoctor’s false advertising regarding the “Veterans Debt”. The complaint filed in February 2024.

On BBB’s website, you can see two complaints filed against the BillDoctor.

However, BBB has decided not to publicize the other complaint due to a probable violation of their publication standards.

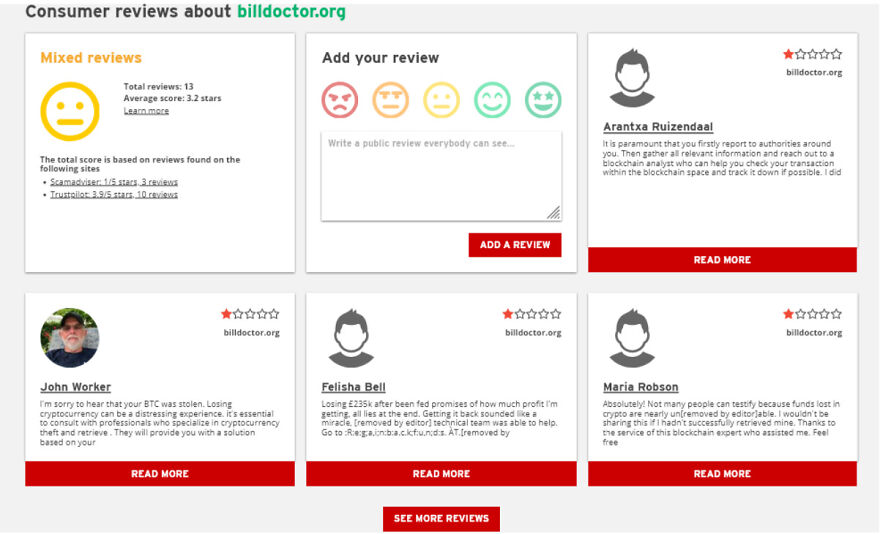

Bill Doctor On Scam Adviser:

Image credits: www.scamadviser.com

ScamAdviser has been analyzing this website since 2022 and their recently updated data shows BillDoctor with a 100% trust score and a 3.2 out of 5 star rating based on 13 reviews.

These ratings underscore the importance of carefully evaluating Bill Doctor and comparing it with other debt relief options before making a decision. If you are exploring debt relief solutions, consider reputable companies with more consistent positive feedback and proven track records in the industry. Always ensure the debt relief provider aligns with your financial goals and offers transparent, effective solutions. Many people prefer to try to get a debt consolidation loan before looking at options such as debt settlement and other debt relief programs.

However, if you’re looking for a well-established and reputable debt relief company, CuraDebt is worth considering.

Conclusion: Is Bill Doctor the Right Choice?

Bill Doctor has no control over the interest rates on the loans and how much credit score you should have to get the desired amount of loan approved. That depends entirely on the lender and BillDoctor including the rest of BillDoctor partnerships cannot influence the decision of the lenders.

Additionally, its marketing approach and connections to CPC Marketing, Inc. suggest that Bill Doctor primarily serves as a connector to lenders rather than offering direct debt relief solutions. For individuals truly seeking relief from debt, it’s important to work with a company that has a proven track record of success in the industry.

Companies like CuraDebt, with over 24 years of experience and a high level of customer satisfaction, provide a more transparent and trustworthy option. CuraDebt offers a range of debt relief programs, including debt settlement and negotiation services, which are designed to directly address and reduce your debt, helping you achieve financial freedom more efficiently.

Before committing to any debt relief company, it’s essential to do your research, read verified customer reviews, and consider a company’s longevity and reputation in the industry.

For a more reliable option, consider a consultation with a trusted company like CuraDebt, where you can explore personalized solutions tailored to your financial needs.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

-4

0