“We Can’t Afford Anything Else”: Woman Explains Why Young People Are Buying Lavish Items

While historically people often save more when times get tough, current younger generations are flipping that around.

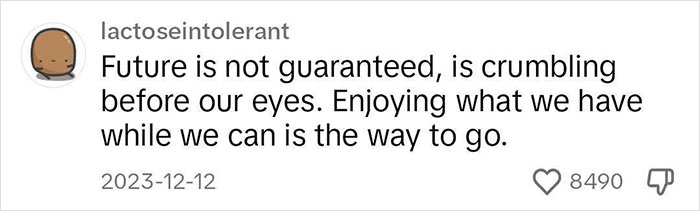

With a high cost of living, hefty student loan debt, and a tough labor market, many no longer believe they will ever afford a home or kids, so they are “doom spending” instead.

It’s defined as an act of spending money to cope with stress despite concerns about the economy and foreign affairs

According to a recent study conducted by Qualtrics on behalf of Intuit Credit Karma, more than a quarter of Americans (27%) engage in it, including 35% of Gen Z and 43% of millennials.

To give everyone interested a better understanding of the phenomenon, Maria Melchor, a NYC-based financial content creator, made a comprehensive video about it.

More info: FirstGenLiving.com | Instagram | TikTok

Personal finance expert and content creator Maria Melchor took it upon herself to explain the concept of “doom spending” to the internet

Image credits: firstgenliving

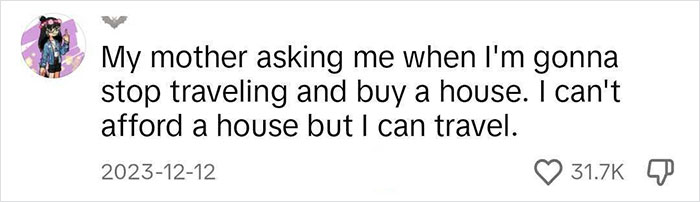

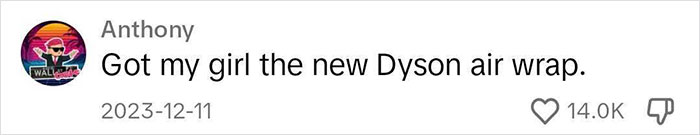

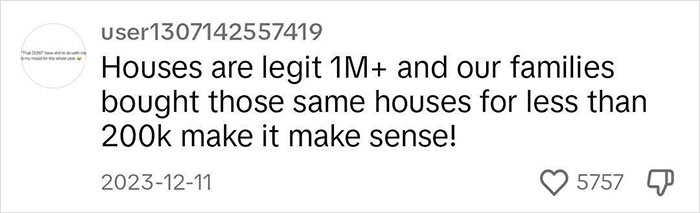

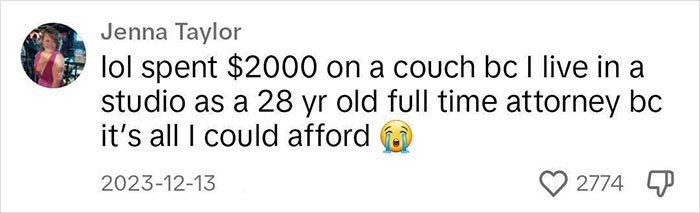

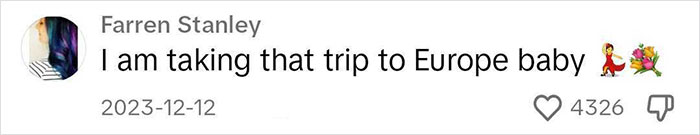

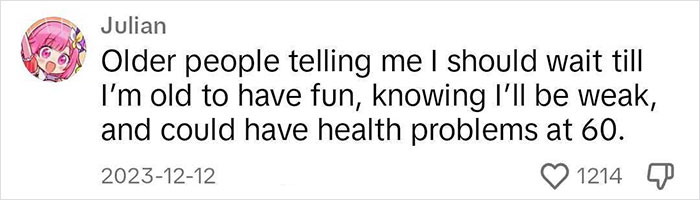

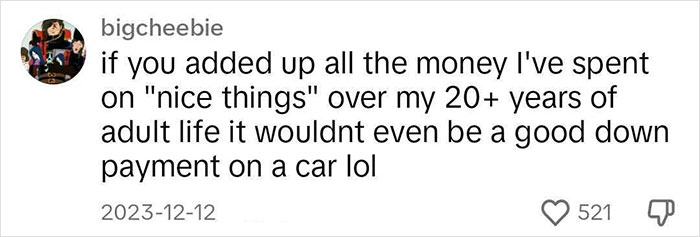

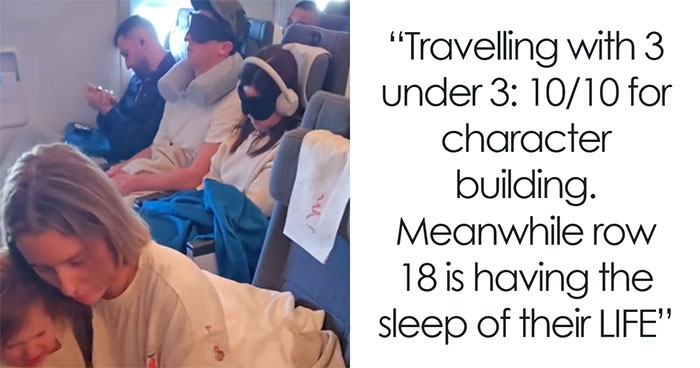

“When older people ask me how young people are affording nice things that they wouldn’t even buy for themselves, I tell them it’s because we can’t afford anything else. Homeownership or starting a family is so out of reach that we’re using that down payment or kid money on whatever it is we can afford.”

Image credits: firstgenliving

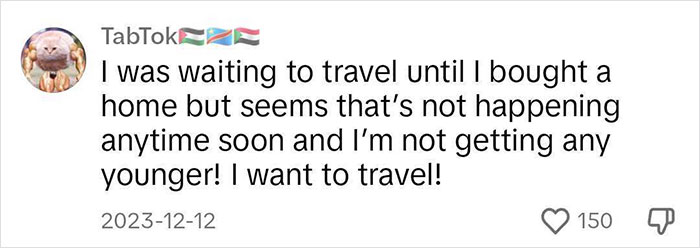

“That’ll bring us a semblance of the kind of adulthood we were promised when houses are a million dollars plus, and an older couple will likely outbid us anyway. We’re going to relinquish any lingering delusions about homeownership, and instead use that money to give our dogs the most enriched puppyhood they can have.”

Image credits: firstgenliving

Experts believe this practice is harming people’s well-being in the long run

The aforementioned Credit Karma study was conducted in November 2023, and it also discovered that in the six months leading up to it, half of Americans’ financial situation had worsened, with 42% reportedly struggling to afford enough food for themselves and/or their household, and another 56% living paycheck to paycheck.

During the same period, nearly one-third (32%) of Americans’ debt level had increased, mostly among millennials (38%) and Gen X (35%). Of those with debt, a quarter estimated they held more than $10,000 in debt – a significant amount, especially amid such high interest rates.

“Much like doom scrolling, we’re seeing people mindlessly shop to soothe concerns about the economy and foreign affairs, which could take a toll on their financial well-being,” said Courtney Alev, consumer financial advocate at Credit Karma.

Alev believes this is not a good practice. To keep yourself in check, she suggests doing an assessment of your finances to understand how much money you have coming in and out each month, as well as how much debt you owe. “This will help you make a plan for how you’re going to spend your money moving forward.”

“To get in the habit of better spending, consider using cash instead of cards until you get your spending in check. That way, you can limit your chances of overspending. Also, if your card information is stored online, you might consider deleting stored card information through your browser to make shopping online less frictionless,” Alev added.

Image credits: Karolina Grabowska (not the actual photo)

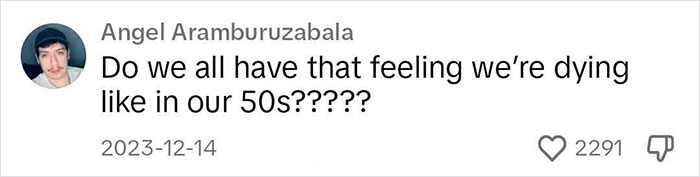

While doom spending may capture the economic zeitgeist of today, the habit isn’t new. Stephen Wu, an economics professor at Hamilton College in Clinton, New York, published a paper in 2004, explaining some people who feel luck and other outside factors play a significant role in their financial success are less likely to save.

He thinks that feelings of fatalism and counterintuitive spending habits have become more common in recent years, particularly after the pandemic and Great Recession. That’s when people began to realize that “a large part of their successes and failures were out of their control,” Wu said.

Melchor’s mini video lesson has since gone viral

@firstgenliving#zillennial#dink♬ original sound – Maria | FirstGenLiving

And it has ignited quite a heated discussion

Poll Question

Thanks! Check out the results:

“Denying yourself all pleasures won’t lift you out of poverty but it will make you want to kill yourself” - the most succinct explanation of this topic that I have ever seen.

Yup. Been there, done that. Will never say, why are they wasting their money on xxxx, because if you will never save enough to make a difference, there's no point saving

Load More Replies...I read that sales of frivolous items like lipstick actually went up in the Depression, rather than down, because people couldn’t afford the stuff they actually wanted, but they could afford lipstick and it was better than nothing. This isn’t new.

I think it depends where you live and the type of lifestyle you want to live. I live in the Midwest and there are affordable houses here. I own my own home, however if I lived on the east or west coast, I'd definitely not be able to afford even a studio apartment.

I found a fixer upper for 56k(on Zillow like at most 2 years ago). Like you can live in it, but it's definitely needing repairs. Not even a trailer/mobile home nor a modular. Friends, skills, tools and YouTube helped me transform my junk first house to pay for the next nice one.

Load More Replies...“Denying yourself all pleasures won’t lift you out of poverty but it will make you want to kill yourself” - the most succinct explanation of this topic that I have ever seen.

Yup. Been there, done that. Will never say, why are they wasting their money on xxxx, because if you will never save enough to make a difference, there's no point saving

Load More Replies...I read that sales of frivolous items like lipstick actually went up in the Depression, rather than down, because people couldn’t afford the stuff they actually wanted, but they could afford lipstick and it was better than nothing. This isn’t new.

I think it depends where you live and the type of lifestyle you want to live. I live in the Midwest and there are affordable houses here. I own my own home, however if I lived on the east or west coast, I'd definitely not be able to afford even a studio apartment.

I found a fixer upper for 56k(on Zillow like at most 2 years ago). Like you can live in it, but it's definitely needing repairs. Not even a trailer/mobile home nor a modular. Friends, skills, tools and YouTube helped me transform my junk first house to pay for the next nice one.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

-6

53