Wife Loses It When Hubby’s Mom Advises They Cut Back On Things During Financial Crisis

Money just might be able to buy happiness, but it sure does also know how to stress-test a relationship. And at the heart of it all lies a crucial question: When things get tough, how much sacrifice is too much?

When today’s Original Poster (OP) turned to his mom—a veteran of single-income household management—her practical advice clashed with his wife’s preferences, igniting a reaction that’s less about dollars and more about principles. And yes, things escalated fast.

More info: Reddit

Forget “for better or worse”; if you’re spending too much on takeout and refuse to cut back on it to save money, it’s definitely worse!

Image credits: MART PRODUCTION / Pexels (not the actual photo)

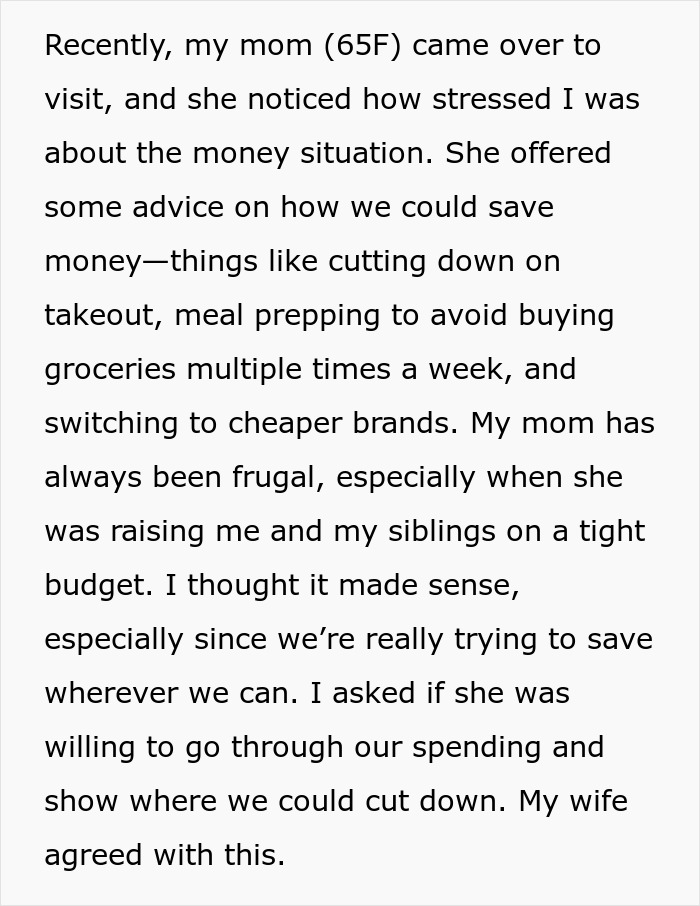

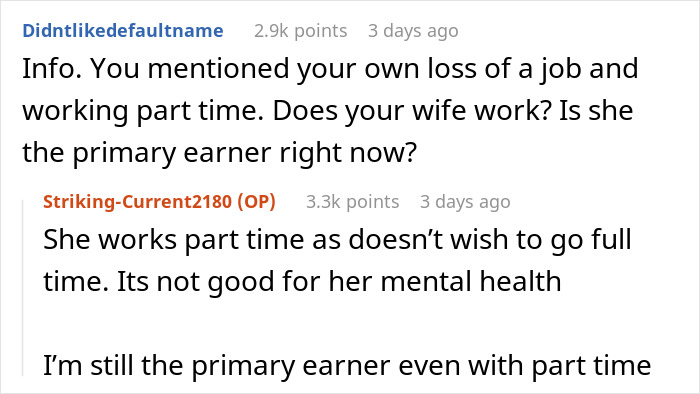

The author and his wife are in a bit of a financial crisis and decided to ask his mother to suggest a few ways they can cut down on spending

Image credits: Striking-Current2180

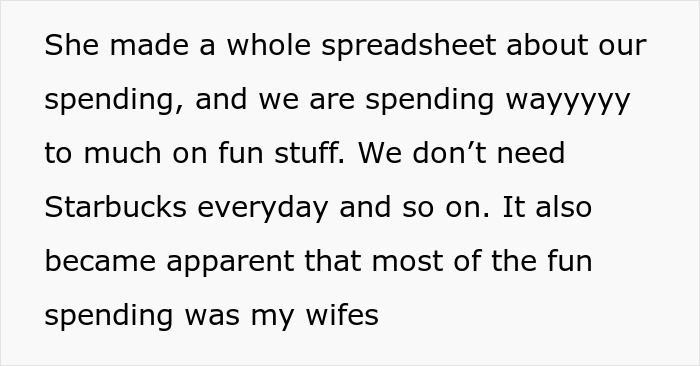

Image credits: Mikhail Nilov / Pexels (not the actual photo)

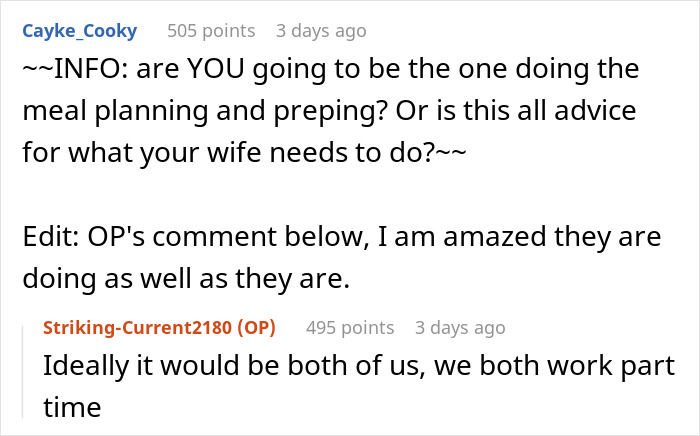

His mother revealed they’ve been spending on many irrelevant things, but his wife did not take that well

Image credits: Striking-Current2180

Image credits: Mikhail Nilov / Pexels (not the actual photo)

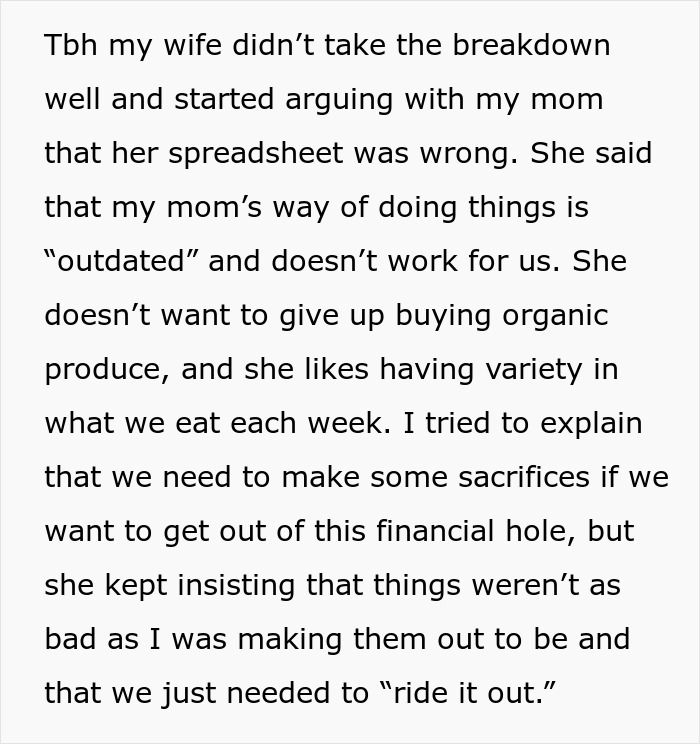

The wife went on to say that her mother-in-law was wrong about their spending and insisted that she couldn’t cut back her spending on takeout

Image credits: Striking-Current2180

The husband got frustrated and told his wife she was rather wrong, and now, she’s upset with him for siding with his mom

For the couple, the challenges started when the husband lost his full-time job and began working at a part-time job that didn’t match his previous earnings. With bills piling up, they had to dip into their savings to stay afloat.

Enter his 65-year-old mom, who, after noticing his stress, offered advice from her years of experience raising three kids on a shoestring budget. Her suggestions included cutting out daily coffee runs, sticking to meal prepping, and swapping expensive brands for cheaper alternatives.

Seeing that his mom would be very helpful in this case, the OP invited his mom to dig deeper into their spending habits and his wife was on board with this.

The OP’s mom created a detailed breakdown of their expenses, revealing that a lot of their money was being spent on “fun” things and that most of it came from the wife’s spending. This revelation didn’t go over well.

His wife challenged the spreadsheet, arguing that the OP’s mother’s way of doing things was simply outdated. She stood her ground, stating that maintaining their quality of life with organic food and occasional indulgences wasn’t up for negotiation.

This led to an argument between the couple, and it reached a breaking point when the husband lost his patience after his wife refused to cut back on takeout and criticized his mom’s budgeting advice. In frustration, the OP told his wife that she was wrong, and defended his mom.

His wife was upset by his words, accusing him of being a jerk for siding with his mom. Since then, she’s barely spoken to him.

Image credits: Karolina Kaboompics / Pexels (not the actual photo)

According to First Alliance, conflicting financial goals can be a major red flag in relationships. This disconnect makes it difficult for couples to work toward financial goals. They advise couples to have open conversations about their goals and find a balance between individual wants and needs to overcome such challenges.

Unfortunately, many people aren’t able to distinguish between needs and wants. However, Bankrate explains that the key to differentiating wants and needs is assessing whether an expense is essential for survival or simply enhances comfort and lifestyle.

Needs would include “debt obligations, healthcare, housing, transportation, utilities, groceries,” while wants, on the other hand, would include things like “entertainment, dining out, travel, leisure activities, and non-essential purchases like gadgets, snacks, [and] designer clothing.”

To prioritize effectively, Bankrate suggests creating a clear list of essential expenses versus unrestricted spending. This can help couples navigate tight budgets and work toward financial goals without unnecessary friction.

While it may seem natural to turn to friends or family for financial advice, Yahoo Finance notes that turning to family and friends can be helpful; however, limited experience or perspective can lead to poor decisions, especially in tough economic times.

Instead, they recommend seeking advice from certified financial planners or fiduciaries whose expertise aligns with your unique situation.

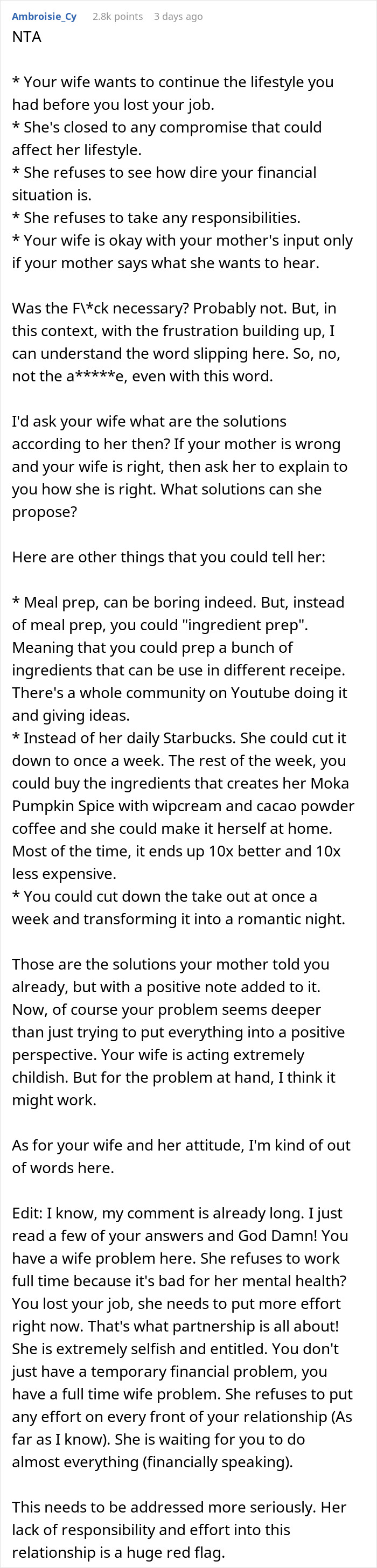

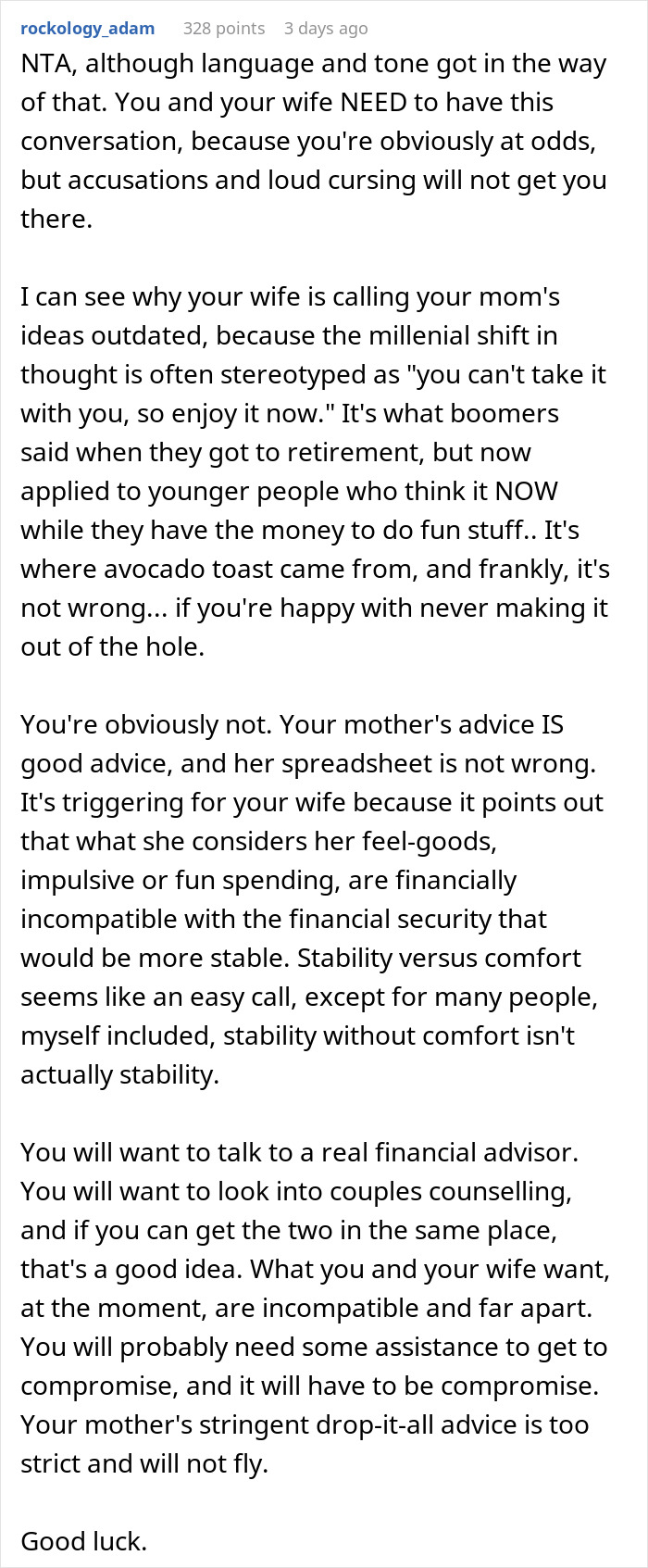

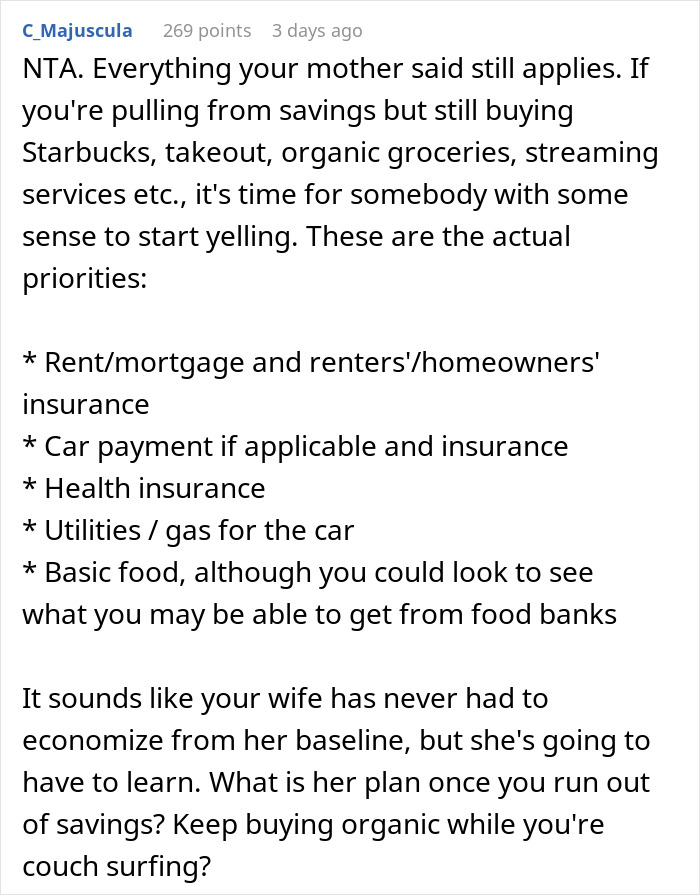

The majority of commenters sided with the husband, emphasizing that his wife was being unreasonable for prioritizing things like Starbucks over the family’s financial well-being.

Many pointed out that the financial suggestions his mother offered are still relevant, underscoring how small expenses can add up and hurt financial stability.

Who do you think is in the wrong here: the husband for being harsh, or the wife for not taking the financial situation seriously? Please, let us know your thoughts!

He turned to netizens to find out if he was wrong for saying his wife was wrong, but their overall sentiments show that he isn’t

Poll Question

What approach would you take if you were in a similar financial predicament?

Fully cut down on non-essential expenses

Moderate spending while maintaining quality of life

Seek external financial advice

Discuss and compromise with my partner

How do adults not realize that takeout is the very first thing you cut when you have no money but more time to cook? Seriously... takeout and to go coffee were the things I cut when I was on a budget.

These are the things I buy sparingly even though I am not on a budget. It's a luxury, not an everyday thing.

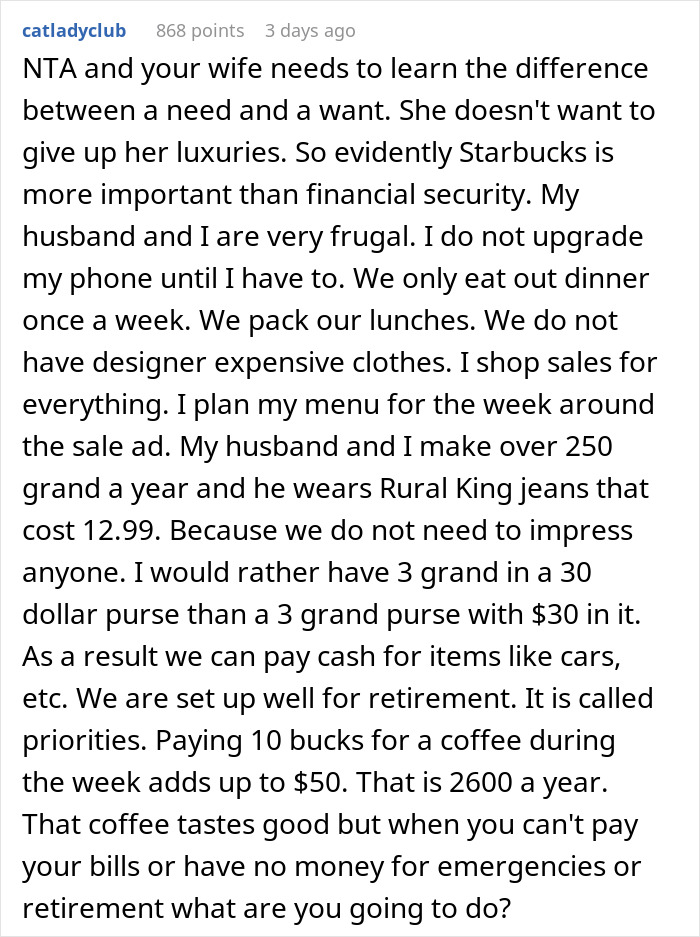

Load More Replies...Funny how the wife can't work full time because of mental health issues but those issues aren't affected by spending money they don't have on luxuries.

A person who works part time but but has Starbucks and takeout every day? What is she, a teenager who lives at home and pays no rent? I'm at the other end of the mortgage tunnel with an income, and I still couldn't justify living like that!

How do adults not realize that takeout is the very first thing you cut when you have no money but more time to cook? Seriously... takeout and to go coffee were the things I cut when I was on a budget.

These are the things I buy sparingly even though I am not on a budget. It's a luxury, not an everyday thing.

Load More Replies...Funny how the wife can't work full time because of mental health issues but those issues aren't affected by spending money they don't have on luxuries.

A person who works part time but but has Starbucks and takeout every day? What is she, a teenager who lives at home and pays no rent? I'm at the other end of the mortgage tunnel with an income, and I still couldn't justify living like that!

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

40

67